Recurring PaymentPlans

Automate your subscription billing: Create and manage recurring payment plans with Paytia's flexible scheduling system. Set up subscription billing through agent-assisted telephone calls or send secure online forms to customers for self-service plan activation and management.

Automated Payment Collection

Made easy with flexible scheduling

Key Benefits

Why businesses choose Paytia for recurring payment plan collection

Agent-Assisted Setup

Our team helps you configure recurring payment plans with optimal schedules, amounts, and customer communication workflows tailored to your business needs.

Customer-Actionable Links

Send secure payment links to customers for self-service recurring plan setup. Customers can configure their own schedules, amounts, and payment preferences online.

Flexible Scheduling

Configure daily, weekly, monthly, or yearly recurring patterns. Set custom intervals, end dates, and subscription amounts with full currency support.

Dual Collection Methods

Accept recurring payments through live telephone calls with agent assistance or via secure online forms. Perfect for businesses requiring personal service and automated collection.

How Recurring Payment Plans Work

Two flexible methods for setting up and managing recurring payment schedules

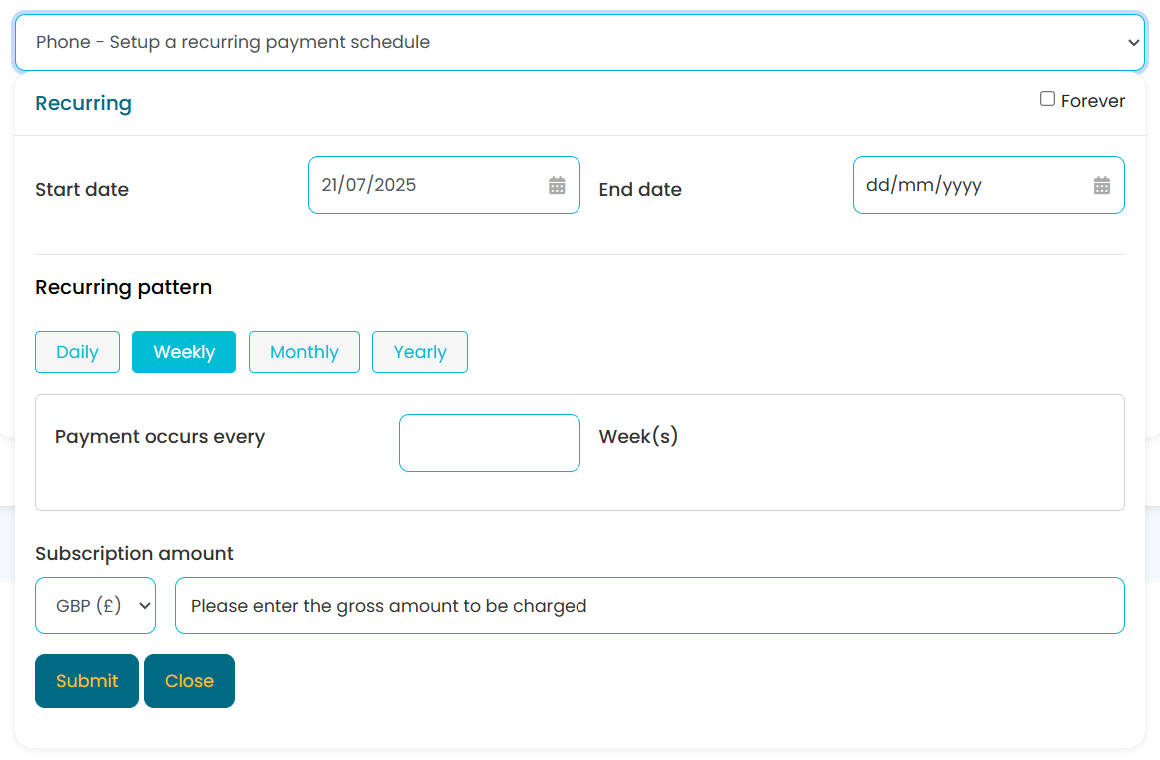

Agent-Assisted Telephone Setup

Your agents can set up recurring payment schedules during live phone calls with customers. Configure start dates, recurring patterns, payment intervals, and subscription amounts directly in the call flow.

- Real-time setup during customer calls

- Daily, weekly, monthly, or yearly patterns

- Immediate payment authorization and scheduling

- Forever option or custom end dates

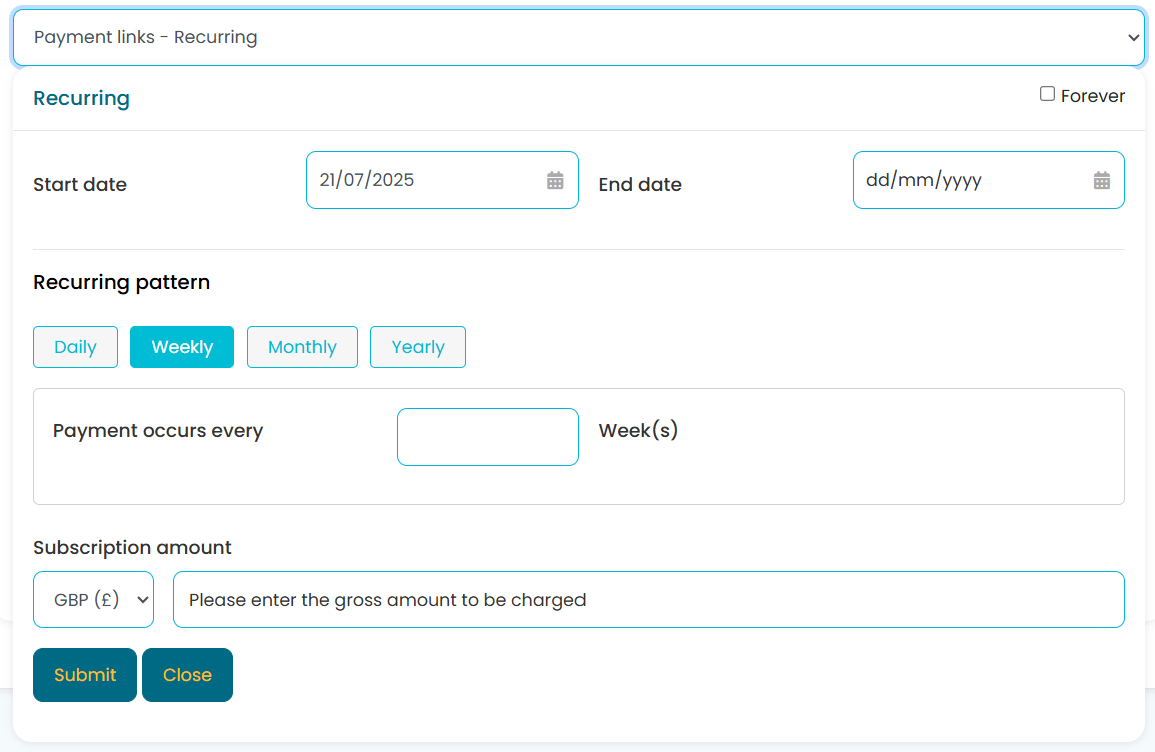

Customer-Actionable Online Forms

Create secure payment links that customers can use to set up their own recurring payment plans. Business users configure the framework, then customers complete the setup at their convenience.

- Self-service customer activation

- Secure payment link distribution

- Complete online plan management

- Reduces administrative overhead

Business Use Cases for Recurring Payment Plans

How businesses across industries use Paytia's recurring payment collection

Subscription Services

Software companies, streaming services, and SaaS providers use recurring plans for monthly and annual subscriptions with automatic renewal.

- • Monthly software licenses

- • Annual service renewals

- • Tiered pricing plans

- • Trial-to-paid conversions

Healthcare & Insurance

Medical practices and insurance providers collect monthly premiums, co-pays, and payment plan installments through automated billing.

- • Insurance premium collection

- • Medical payment plans

- • Monthly co-pay billing

- • Healthcare subscription services

Utilities & Services

Utility companies, telecom providers, and service businesses automate monthly billing cycles and payment collection.

- • Utility bill automation

- • Telecom service billing

- • Maintenance contracts

- • Property management fees

Education & Training

Educational institutions and training providers collect tuition payments, course fees, and certification renewals on recurring schedules.

- • Monthly tuition payments

- • Course payment plans

- • Certification renewals

- • Training program fees

Membership Organizations

Clubs, associations, and membership-based businesses automate dues collection and membership renewals with flexible scheduling.

- • Annual membership dues

- • Monthly club fees

- • Professional association renewals

- • Gym and fitness memberships

Professional Services

Legal firms, accounting practices, and consulting businesses use recurring billing for retainers, monthly services, and ongoing engagements.

- • Legal retainer payments

- • Accounting service fees

- • Consulting retainers

- • Professional service contracts

Complete Implementation Guide for Recurring Payment Plans

Step-by-step guide to implementing automated recurring payment collection for your business

Setting Up Agent-Assisted Recurring Payment Plans

Agent-assisted recurring payment plans allow your customer service team to set up automated payment schedules during live telephone conversations. This method is particularly effective for businesses that require personal interaction and immediate customer service support. The process combines the efficiency of automated billing with the trust-building benefits of human interaction.

Step 1: Configure Payment Schedule Framework

Before agents can set up recurring payments, your business needs to establish the framework for payment schedules. This includes defining available recurring patterns (daily, weekly, monthly, yearly), setting minimum and maximum payment amounts, establishing currency options, and configuring end date parameters. The system supports both fixed-term and ongoing ("forever") payment plans, giving businesses flexibility to accommodate different customer needs and business models.

Step 2: Agent Training and Interface Familiarization

Customer service agents require comprehensive training on the recurring payment setup interface. The training should cover how to navigate the payment scheduling screen, explain recurring pattern options to customers, calculate payment dates and amounts, handle customer questions about billing cycles, and manage special scenarios like holidays or billing date adjustments. Agents also need to understand the legal and compliance aspects of recurring billing, including how to properly obtain customer consent and explain cancellation policies.

Step 3: Live Call Implementation Process

During customer calls, agents follow a structured process to set up recurring payments. This begins with confirming the customer's identity and payment authorization, followed by explaining the recurring payment options available. The agent then accesses the recurring payment setup screen, enters the start date (which can be immediate or scheduled for the future), selects the appropriate recurring pattern based on customer preference, configures payment intervals and amounts, and sets end dates if applicable. Throughout this process, the agent maintains clear communication with the customer, explaining each step and confirming details before finalizing the setup.

Step 4: Payment Authorization and Confirmation

Once the payment schedule is configured, the system processes the initial payment authorization to validate the payment method and ensure sufficient funds or credit availability. The customer receives immediate confirmation of the recurring payment setup, including details about payment amounts, billing dates, and how to manage or cancel the plan. This confirmation process builds customer confidence and reduces future disputes or chargebacks related to unexpected charges.

Implementing Customer-Actionable Online Payment Links

Customer-actionable online payment links represent the self-service approach to recurring payment plan setup. This method reduces administrative overhead for businesses while giving customers the flexibility to configure their payment preferences on their own schedule. The process involves creating secure, customizable payment forms that customers can access through unique links.

Business User Configuration Process

Business users begin by accessing the payment link creation interface, where they configure the basic parameters for the recurring payment plan. This includes setting the available recurring patterns (daily, weekly, monthly, yearly), defining payment amount ranges or fixed amounts, establishing currency options, and configuring customer communication preferences. The system allows businesses to pre-populate certain fields while leaving others open for customer customization, striking the right balance between business requirements and customer flexibility.

Link Generation and Distribution

Once the payment plan framework is configured, the system generates a unique, secure payment link that can be distributed to customers through various channels. These links can be sent via email, text message, included in customer portals, or embedded in website pages. Each link is encrypted and includes security tokens to prevent unauthorized access or tampering. The links can be configured with expiration dates to maintain security and ensure timely customer response.

Customer Self-Service Experience

When customers access their payment link, they encounter an intuitive interface that guides them through the recurring payment setup process. The form presents the available options clearly, allows customers to select their preferred payment schedule, enter their payment information securely, review and confirm all details before submission, and receive immediate confirmation of their recurring payment plan. The interface is designed to be user-friendly and accessible across all devices, ensuring customers can complete the setup process regardless of their technical expertise or device preferences.

Ongoing Plan Management

After initial setup, customers can access their recurring payment plans through secure customer portals or management links. This self-service capability allows customers to view upcoming payment dates, modify payment amounts within allowed parameters, update payment methods, pause or resume payment plans, and cancel subscriptions according to business policies. This level of customer control reduces support requests and improves customer satisfaction while maintaining business operational efficiency.

Advanced Configuration Options and Business Benefits

Flexible Scheduling Patterns

Paytia's recurring payment system supports sophisticated scheduling patterns that accommodate diverse business needs. Daily recurring payments work well for micro-payment models or daily service fees. Weekly patterns suit businesses with weekly service cycles or subscription models. Monthly billing remains the most common pattern for subscription services, utilities, and membership organizations. Yearly patterns support annual subscriptions, insurance premiums, and membership renewals. Additionally, the system supports custom intervals, allowing businesses to configure payments every two weeks, quarterly, or any other interval that matches their business model.

Currency and Pricing Flexibility

The platform supports multiple currencies, enabling businesses to collect recurring payments from international customers in their preferred currency. This feature is essential for businesses operating in global markets or serving diverse customer bases. The system automatically handles currency conversion, applies appropriate exchange rates, and manages currency-specific payment processing requirements. Businesses can set different pricing tiers for different markets while maintaining consistent payment collection processes.

Integration with Business Systems

Successful recurring payment implementation requires seamless integration with existing business systems including customer relationship management (CRM) platforms, accounting software, billing systems, and customer communication tools. Paytia's platform provides APIs and integration tools that connect with popular business software, ensuring that recurring payment data flows seamlessly into existing business processes. This integration eliminates manual data entry, reduces errors, and provides comprehensive visibility into customer payment patterns and business cash flow.

Compliance and Security Considerations

Recurring payment collection must comply with various regulations including PCI DSS for payment security, GDPR for data protection, and industry-specific requirements. Paytia's platform maintains PCI DSS Level 1 compliance, implements advanced encryption for all payment data, provides audit trails for all transactions, supports customer consent management, and includes tools for handling customer disputes and chargebacks. These security and compliance features protect both businesses and customers while ensuring sustainable payment collection operations.

Frequently Asked Questions

Everything you need to know about Recurring Payment Plans

Ready to Implement Recurring Payment Plans?

Start collecting recurring payments automatically with Paytia's comprehensive payment plan solutions.