Secure IVR Payment Solutions

Automated, PCI-compliant phone payments that reduce costs and enhance security. Transform your phone payment process with our secure, automated IVR solutions.

Transform Your Phone Payment Process

IVR payment solutions automate telephone payments, allowing customers to pay 24/7 without agent assistance. The system uses voice prompts and touchtone inputs to guide customers through a secure payment process, significantly reducing operational costs while enhancing security and compliance.

For businesses using 3CX phone systems, our IVR payment solutions integrate directly with your existing telephony infrastructure, providing automated payment collection that works seamlessly with your current setup while maintaining full PCI compliance.

Automated Payment Collection

Enable customers to make payments at any time without agent assistance, reducing staffing costs while maintaining service quality.

Enhanced Compliance

Reduce PCI DSS scope with our secure payment architecture, eliminating card data from your call center environment.

Seamless Integration

Integrates with your existing telephony system, CRM, payment processors, and other business systems for streamlined operations.

Scalable Architecture

Handles unlimited call volumes with consistent performance, adapting to seasonal fluctuations without service degradation.

How IVR Payment Solutions Work

Secure, automated payment processing that protects sensitive card data

Customer Initiates Payment

Customer calls your payment line and is guided through an automated payment process.

Secure Data Collection

DTMF masking secures card entry, ensuring card details never reach your environment.

Payment Processing

Transaction is securely processed, and confirmation is provided to the customer.

Key Features

Comprehensive capabilities that streamline phone payments

24/7 Payment Availability

Allow customers to make payments any time of day or night, even outside business hours.

DTMF Masking Technology

Secure card entry with dual-tone multi-frequency masking that protects sensitive data.

Flexible Payment Options

Support for credit cards, debit cards, and other payment methods to accommodate customer preferences.

Real-time Reporting

Comprehensive dashboard with transaction data, success rates, and payment analytics.

Multi-language Support

Provide payment services in multiple languages to accommodate diverse customer bases.

Customizable Call Flows

Tailor the payment process to match your brand voice and specific business requirements.

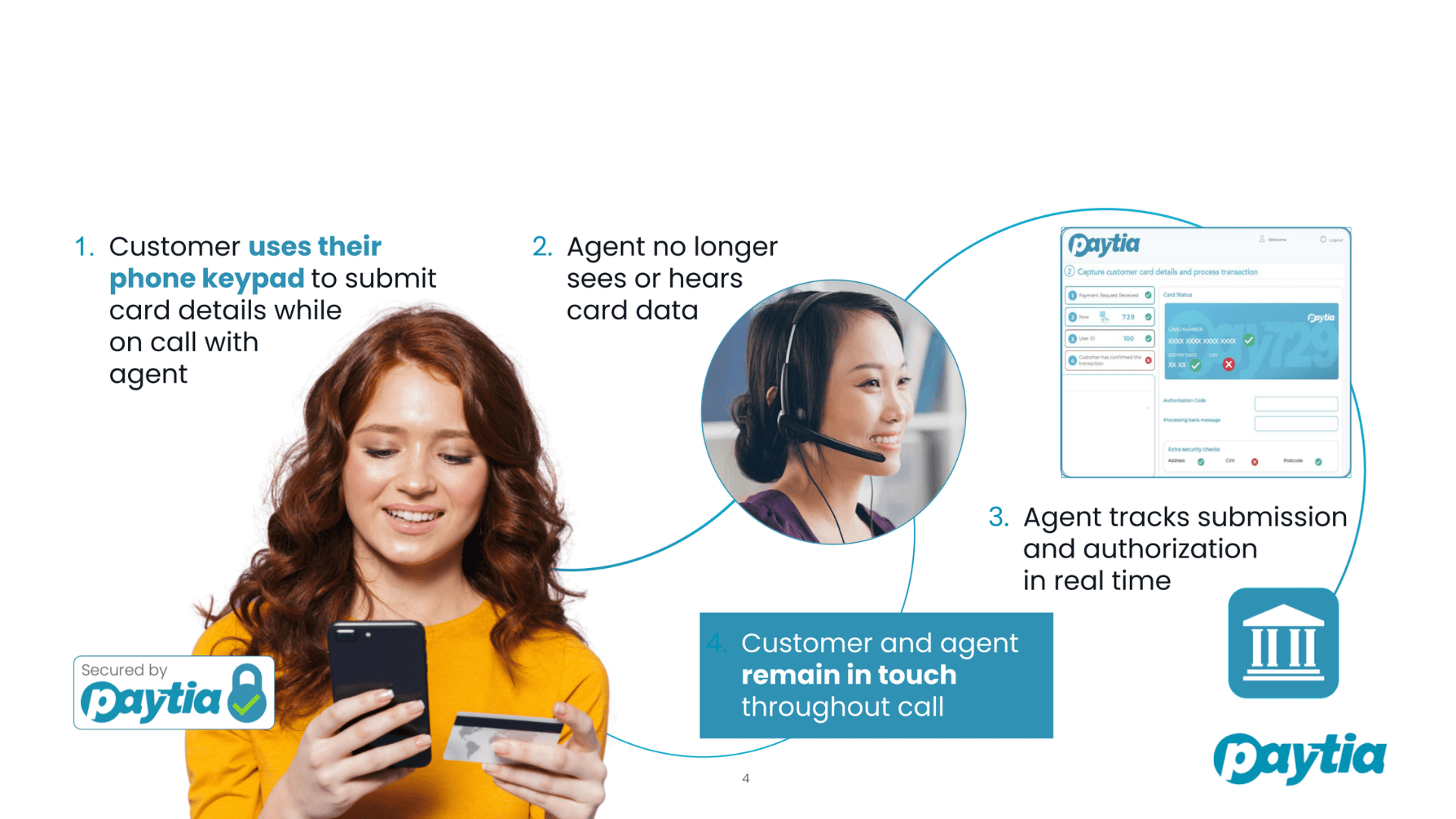

Agent-Assisted Option

Optional hybrid model where agents can assist customers but are removed during card data entry.

Payment Confirmation

Multiple confirmation options including voice, email, and SMS notifications.

Seamless Integrations

Connect with CRM, ERP, billing systems, and payment processors for streamlined operations.

Simplify PCI DSS Compliance

Reduce compliance scope and complexity with our secure architecture

PCI DSS Level 1

Our solutions are built on infrastructure that meets the highest level of PCI compliance standards, ensuring maximum security for your customers' payment data.

Reduce compliance scope to SAQ A

Eliminate card data from your environment

Reduce compliance audit costs by 87%

Simplified annual assessment process

Compliance Comparison

| Requirement | Without Paytia | With Paytia IVR |

|---|---|---|

| PCI Self-Assessment | SAQ D (329 questions) | SAQ A (22 questions) |

| Network Security | Extensive Requirements | Minimal Requirements |

| Call Recording Restrictions | Complex & Risky | No Restrictions |

| Staff Training Requirements | Extensive | Minimal |

Frequently Asked Questions

Common questions about our IVR payment solutions

Ready to Transform Your Phone Payments?

Join hundreds of organizations that have simplified compliance, reduced costs, and improved security with Paytia's IVR payment solutions.