Bank to bank payments with

identity verification

Stop losing money to expensive card processing fees. Pay by bank delivers 70% cost savings with instant bank-to-bank transfers that customers trust more than sharing card details.

Watch Demo Video

See how our solution works in action

Trusted by 10,000+ world-class brands and their business of all sizes

Pay by Bank - Secure Direct Bank Payment Solutions

Enable instant bank-to-bank transfers with advanced security and compliance. Direct bank account payments without traditional payment processing fees.

Save £900+ Monthly on Processing Fees

Stop paying 2.9% + 30p per transaction. Pay by bank costs just 0.5% + £1.00 per transaction. For £50k monthly volume, save over £10,800 annually.

Instant Money in Your Account

No more 2-3 day waiting periods. Bank transfers settle instantly with real-time confirmation. Improve cash flow and reduce payment delays.

Customers Trust Their Banks More

89% of customers prefer direct bank payments over sharing card details. Increase conversion rates with familiar, trusted banking experience.

Bank-Grade Security Included

Customers authenticate using their own bank's multi-factor security. No sensitive payment data on your systems. PSD2 compliant by default.

Setup in Under 10 Minutes

Simple API integration connects you to all major UK banks instantly. No complex merchant accounts or lengthy approval processes required.

Reduce Failed Payments by 40%

Direct bank authentication eliminates declined cards, expired dates, and insufficient funds issues. Higher success rates mean more revenue.

"Pay by bank transformed our customer experience. The direct bank transfers are instant and customers trust it more than sharing card details. We've reduced processing costs by 65% while increasing conversion rates."

Ian Hames

Head of Sales, UK Retail Sales Company

See Pay by Bank in Action

Watch how customers securely authenticate and complete bank payments using their trusted banking apps

Desktop Authentication

A demonstration showing customers using their desktop computer or MAC to identify themselves and verify payment requests inside their mobile banking app.

Mobile Authentication

A demonstration showing customers using their mobile phone to identify themselves and verify payment requests inside their mobile banking app.

Secure ID Verification with Paytia Fena

Both demonstrations show how customers authenticate using their existing bank security systems. No new passwords or payment details required - customers use their trusted banking app for secure verification.

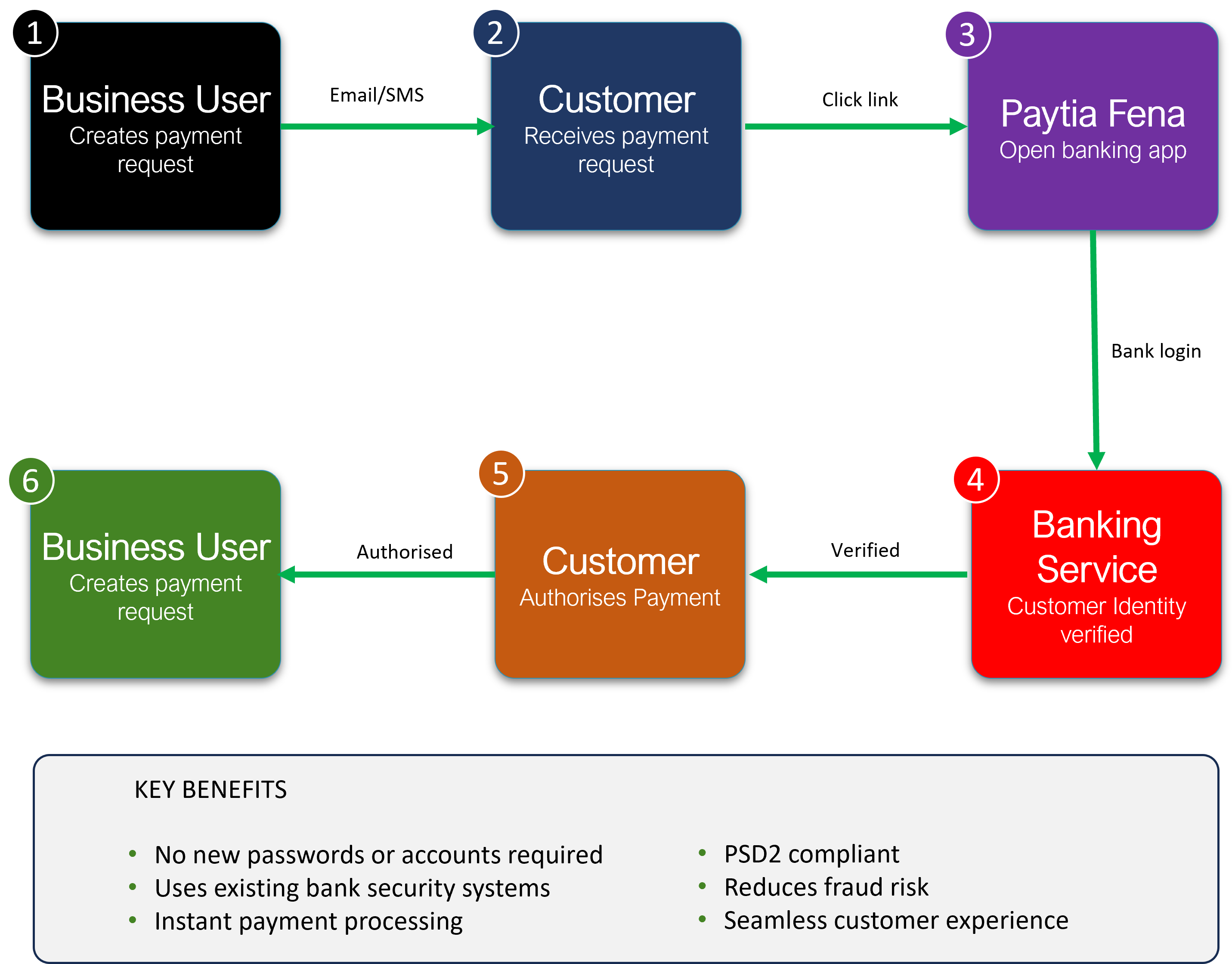

How the Secure Payment Process Works

Follow the 6-step process that ensures secure, bank-grade authentication using your customer's existing banking credentials.

Step-by-Step Process

Your business user creates the request for payment and sends it to your customer by email or SMS message

Your customer clicks the received link button in their email or mobile messages

The bank payment service takes over and correctly opens the mobile banking app (mobile) or desktop internet bank login page (desktop)

Your customer logs into their banking app, verifying their identity

Your customer sees the request for payment presented by their bank and confirms they accept the payment request

Money transfer is initiated and your business receives the agreed payment

Pay by Bank: Reduce Processing Costs by 70% with Instant Bank Transfers

Transform Your Payment Processing with Direct Bank Transfers

💰 Calculate Your Cost Savings

• Traditional payment processing: 2.9% + 30p per transaction

• Pay by bank processing: 0.5% flat rate + £1.00 per transaction

• Monthly processing volume of £50,000 (100 transactions) saves £900+ per month

• Annual savings: £10,800+ in reduced processing costs

• Plus instant settlement - no 2-3 day waiting periods

- ✓ Connect with all major UK banks via Open Banking

- ✓ 70% lower processing costs than traditional methods

- ✓ 10-minute setup with secure API integration

- ✓ Bank-grade security with PSD2 compliance included

Direct Bank Transfers - The Future of Payment Processing

Traditional payment processing is expensive and complex. Pay by bank eliminates intermediaries by connecting directly to customer bank accounts through secure Open Banking APIs.

Customers authenticate with their own bank using familiar online banking credentials. Payments are instant, secure, and cost-effective for both you and your customers.

Result: Reduce processing costs by 70% while improving customer trust and satisfaction.

Pay by Bank Features:

- ✓ Instant bank-to-bank transfers via Open Banking

- ✓ Connect with all major UK banks via Secure Open Banking

- ✓ Real-time payment confirmation and settlement

- ✓ Recurring payments and subscription billing

- ✓ Advanced fraud detection and prevention

- ✓ Complete transaction reporting and analytics

- ✓ PSD2 compliant with bank-grade security

Transform your payment processing with secure, instant bank transfers. Customers prefer banking with institutions they trust.

Integrated Open Banking API

Connect with all major UK banks through our secure user interface and Service. Setup takes just 10 minutes.

Customer Authenticates with Bank

Customers use familiar online banking credentials to authenticate directly with their bank. No sharing of sensitive financial information required.

Instant Bank Transfer

Direct bank-to-bank transfer is processed instantly with real-time confirmation. Funds settle immediately with complete transaction tracking.

Pay by Bank Pricing Plans

Choose the plan that fits your business needs

Essentials

Ideal for growing businesses seeking cost-effective bank transfer processing

Includes:

- Fena Secure Open Banking connector included

- Connect with all major UK banks

- Instant, authorised, bank-to-bank transfers

- Real-time payment confirmation

- Advanced fraud detection

- Recurring payment support

- Customer bank account tokenization

- Comprehensive reporting & analytics

- Send Bank payment links by SMS

- Send Bank payment links by Email

Not included:

- Send using your own email server, from your own business domain

- Secure Code link protection

- Add your business logo

- Add expiry times to your links sent

- Enhanced webhook integration

- Premium API service

- Dedicated account manager

- White-label customization

- SLA guarantees

- Enterprise-grade security

Enterprise

Enterprise-grade solution with comprehensive Open Banking integration for high-volume bank transfer processing

Includes:

- All Professional features included

- Send using your own email server, from your own business domain

- Secure Code link protection

- Add your business logo

- Add expiry times to your links sent

- Enhanced webhook integration

- Premium API service

- Dedicated account manager

- White-label customization

- SLA guarantees

- Enterprise-grade security

Supported UK Banks

Connect with all major UK banks through our secure Open Banking integration. Customers can pay directly from their trusted banking institutions.

| Bank Name | Support Type | Settlement Time | Status |

|---|---|---|---|

| Bank of Scotland | Personal & Business | Instant | ✓ Active |

| Barclays | Personal & Business | Instant | ✓ Active |

| Chase Bank | Personal | Instant | ✓ Active |

| First Direct | Personal | Instant | ✓ Active |

| Halifax | Personal | Instant | ✓ Active |

| HSBC | Personal & Business | Instant | ✓ Active |

| Lloyds Bank | Personal & Business | Instant | ✓ Active |

| Mettle | Business | Instant | ✓ Active |

| Monzo | Personal & Business | Instant | ✓ Active |

| NatWest | Personal & Business | Instant | ✓ Active |

| Nationwide | Personal & Business | Instant | ✓ Active |

| Revolut | Personal & Business | Instant | ✓ Active |

| Royal Bank of Scotland | Personal & Business | Instant | ✓ Active |

| Santander | Personal & Business | Instant | ✓ Active |

| Starling Bank | Personal & Business | Instant | ✓ Active |

| TSB | Personal | Instant | ✓ Active |

| Tide | Business | Instant | ✓ Active |

| Ulster Bank | Personal & Business | Instant | ✓ Active |

| Virgin Money | Personal & Business | Instant | ✓ Active |

Uptime

Secure transactions

Reduction in fraud

ROI for businesses

Frequently Asked Questions

Download Our Free Guide

Learn how to implement pay by bank solutions for your business with our comprehensive guide on Open Banking integration.

Pay by Bank Overview

Complete guide to implementing secure bank-to-bank payment acceptance

- What are bank-to-bank payments and how they work

- Zero data handling - eliminate PCI compliance burden

- Three payment methods: phone, online, and recurring

- Cost comparisons and real business savings examples

- Implementation steps and technical requirements

PDF format, 4 pages

Complete Pay by Bank Solutions

Open Banking API Integration

Our Open Banking integration connects directly with all major UK banks to provide secure bank-to-bank transfers. The Open Banking platform handles all authentication while maintaining PSD2 compliance and security standards.

- • Secure Open Banking API connections

- • Real-time bank transfer capabilities

- • Multi-bank payment platform support

- • Advanced Open Banking security features

Professional Bank Transfer Services

Complete bank transfer solution designed for businesses requiring secure direct payments. Our bank transfer processor handles transactions efficiently with comprehensive banking services support.

- • High-volume bank transfer capabilities

- • Secure direct payment systems

- • Professional bank transfer services

- • Enterprise banking solutions

Account to Account Payment Processing

Advanced account to account payment technology with comprehensive security measures. Our direct debit solution supports all major UK banks with full regulatory compliance.

- • PSD2-compliant account to account payments

- • Secure bank account verification

- • Instant account to account transfers

- • Real-time payment confirmation

Instant Payment Solutions

Full-service instant payment platform with integrated banking capabilities. Our instant payment services support businesses with complete direct transfer infrastructure.

- • Complete instant payment package

- • Secure bank authentication portal

- • Banking services with Open Banking integration

- • Professional instant payment support

Direct Banking System Integration

Our direct banking system seamlessly integrates with existing business infrastructure to provide comprehensive bank transfer solutions. The banking system supports all major UK banks while maintaining PSD2 security and compliance standards.

Bank Authentication Portal

Secure bank authentication portal with real-time verification capabilities for trusted transactions

Open Banking Solutions

Comprehensive Open Banking solutions supporting all major UK banks and building societies

Instant Transfer Processing

Specialized instant transfer processing with secure bank-to-bank connectivity and real-time confirmation

Ready to Reduce Processing Costs by 70%?

Join hundreds of businesses saving thousands with secure, instant bank transfers. Transform your payment processing today.