A Guide to Alternative Payment Methods for Modern Business

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

When someone talks about an "alternative payment method," what do they really mean? Simply put, it's any way a customer can pay that isn't cash or a major credit or debit card. This includes things we see every day, like digital wallets (think Apple Pay and Google Pay), direct bank transfers, and the increasingly popular Buy Now, Pay Later services.

These aren't just niche options anymore; for many, they're the new normal.

Why Traditional Payments Are Falling Behind

The familiar swipe of a credit card is starting to feel a bit dated, isn't it? We live in a world that’s digital-first, where speed and convenience aren't just nice-to-haves—they're the bare minimum. This shift means that businesses sticking only to traditional payment methods are getting left behind.

Think of it this way: offering only card payments today is like a shop in the 1990s that would only accept cheques. Sure, it worked for some, but it completely missed the point for a growing number of people who had already moved on to something better and faster.

What Today's Customers Expect

Modern customers have their entire financial world in their pocket. They expect paying a bill over the phone or setting up a subscription to be instant and effortless. Any little bit of friction, like having to dig out a wallet and read a 16-digit card number aloud, can be enough to make them give up.

This is especially true for younger generations. Digital wallets are already a huge part of UK e-commerce, with PayPal alone accounting for 20% of online transactions. The contactless wave is undeniable, with payments hitting 18.9 billion in 2024. And with a massive 78% of 16-24-year-olds using mobile payments in 2023, it's clear where things are headed. You can find more details in the UK's top online payment statistics for 2025.

The Hurdles for Regulated Industries

This new reality creates specific problems for any organisation that deals with sensitive information.

- Contact centres: For years, agents have taken card details over the phone, a practice riddled with PCI DSS compliance headaches and fraud risks.

- Insurance firms: Collecting premiums or paying out claims needs to be rock-solid and secure, protecting everyone involved.

- Housing associations: Taking rent payments requires a flexible approach that works for different tenants while keeping cash flow predictable.

For these kinds of organisations, this isn't just about making things easy for customers. It's about fundamental operational security. Directly handling card data opens them up to a world of complex compliance rules and the ever-present danger of a data breach.

It’s obvious that alternative payment methods are no longer optional. They provide a clear way forward, helping businesses meet customers where they are while also cutting down on the risks and red tape that come with old-school, card-not-present payments. This guide will walk you through how to bring your payment systems up to date, creating a more secure, efficient, and customer-friendly operation.

Understanding the Core Types of Alternative Payments

To get a real handle on alternative payment methods, we need to look past the buzzwords and see how they actually function in the real world. Each one offers a different spin on how we pay, solving a unique problem that traditional cards just can't. Think of it less like a list and more like a toolkit for building a better, smoother payment experience for your customers.

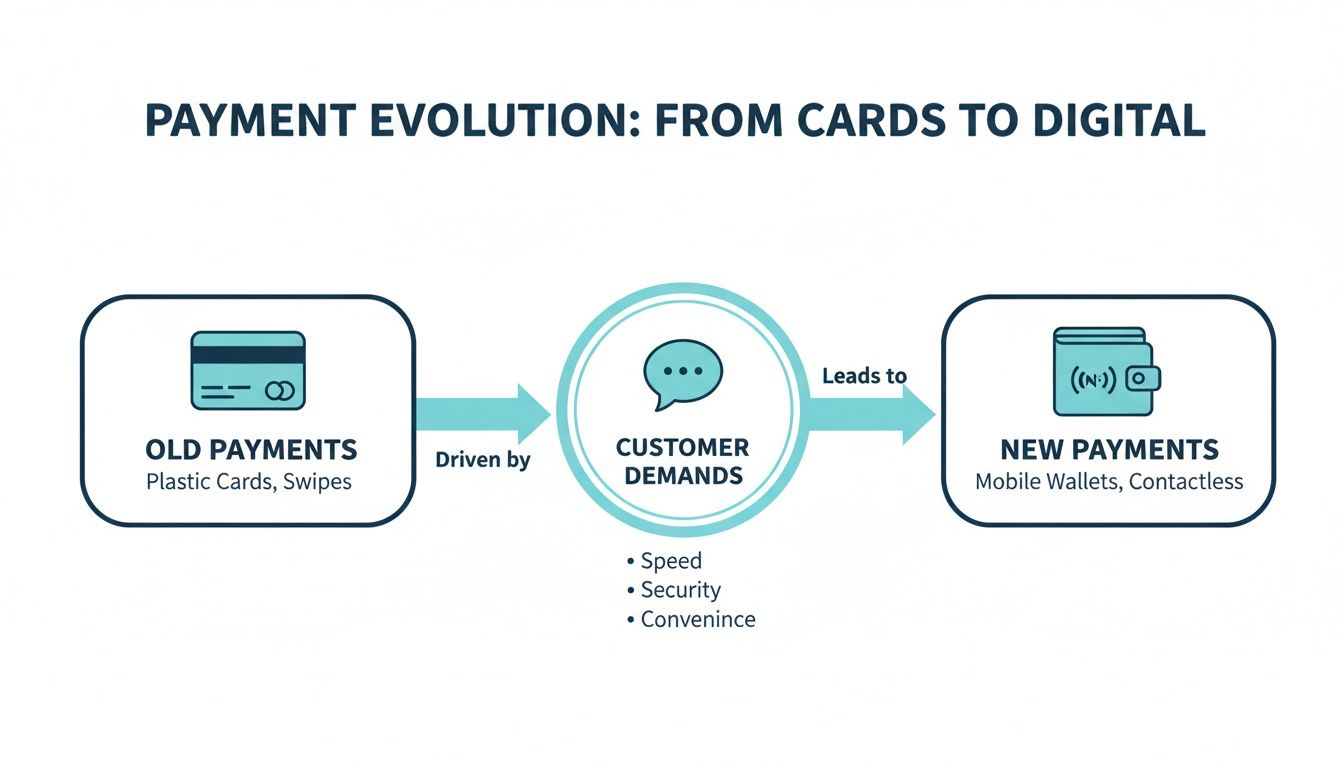

The whole reason we're even talking about this is because customer expectations have shifted. People now demand speed, convenience, and watertight security—things older systems often struggle with.

This diagram says it all, really. It shows a clear line from the plastic in our wallets to the apps on our phones, and it's customer demand that’s pulling us forward. Let's break down the most important tools in this new payment toolkit.

Digital Wallets: Your Physical Wallet, But Smarter

A digital wallet (or e-wallet) is pretty much what it says on the tin: a secure, digital home for your payment details. It holds your credit cards, debit cards, and bank info, letting you pay with a quick tap or a click instead of typing out the same numbers over and over again.

When someone pays with Apple Pay or Google Pay, for instance, they're using something called tokenization. It’s a clever bit of tech that swaps your actual, sensitive card details for a unique, single-use code for that specific transaction. This is a massive leap forward for security. Even if a company’s data was breached, the stolen tokens would be completely useless to a fraudster.

Digital wallets have become the most trusted payment method globally. Their mix of sheer convenience and powerful security has made them a firm favourite, with experts predicting 58% of UK consumers will be using them by 2030.

This blend of ease and safety is precisely why they've taken over in e-commerce and in-app payments.

Bank Transfers and Open Banking: The Direct Connection

Bank transfers are simple: money moves directly from a customer's bank account to yours. The old way of doing this could be clunky and slow, but modern systems built on Open Banking have completely changed the game.

Think of Open Banking as a secure digital handshake between your systems and the customer's bank. With their clear permission, your payment provider can talk directly to their bank, creating a seamless and incredibly secure payment journey. The customer simply authorises the payment from inside their own trusted banking app. If you're looking to understand these direct payment options better, learning about the https://www.paytia.com/solutions/pay-by-bank is a brilliant place to start.

This approach is especially useful for:

- High-value transactions that might hit credit card limits.

- Cutting down on processing fees by sidestepping the card networks.

- Slashing fraud risk, since the payment is authenticated directly by the bank.

To help you decide, here’s a quick comparison of the most common methods and where they shine.

Comparing Popular Alternative Payment Methods

Use this table to quickly compare the key features of each payment method and identify which is best suited for different business scenarios.

| Payment Method | Best For | Typical Use Case | Key Benefit |

|---|---|---|---|

| Digital Wallets | E-commerce, in-person retail, and in-app purchases. | A customer paying for coffee with their phone or checking out online. | Speed, convenience, and enhanced security through tokenization. |

| Bank Transfers (Open Banking) | High-value B2C and B2B transactions. | Paying a deposit on a car or settling a large supplier invoice. | Lower fees, no card limits, and extremely low fraud risk. |

| Buy Now, Pay Later | Retailers selling higher-priced goods to younger demographics. | Splitting the cost of a new laptop or sofa into several payments. | Increases conversion rates and average order value. |

| Direct Debit | Subscription services, memberships, and regular bill payments. | Monthly gym fees, software subscriptions, or utility bills. | Predictable revenue, reduced admin, and fewer failed payments. |

Each method clearly has its own strengths, making the right choice dependent on what you sell and who you sell to.

Buy Now, Pay Later: A Modern Take on Layaway

Buy Now, Pay Later (BNPL) services like Klarna or Clearpay give customers the freedom to buy something straight away and pay for it in interest-free instalments. It’s a flexible, modern twist on credit that has become incredibly popular, particularly with younger shoppers.

For a business, it's a win-win. You get the full payment from the BNPL provider immediately, and they handle the collections from the customer. All the financial risk is lifted from your shoulders, while your customers get a more manageable way to afford what they want.

Direct Debits: The Power of Automation

For any business dealing with recurring payments—subscriptions, memberships, regular bills—Direct Debit is the gold standard. A customer gives you a one-off authorisation, and you can then collect agreed-upon payments directly from their bank account on schedule.

It's a true "set-it-and-forget-it" system. You get predictable, stable revenue, and your customers don't have to worry about manual payments. Crucially, it almost eliminates the problem of failed payments from expired or cancelled cards, which is a constant headache when relying on recurring card charges. For any business wanting to get its finances in order, exploring how supplier payment automation can revolutionise operations is a logical next step.

How Open Banking Is Redefining Secure Transactions

Of all the new ways to pay, Open Banking really is in a league of its own. It’s not just a minor update to how we handle money; it’s a complete rethink. Think of it as a super-secure, permission-based tunnel that connects a customer’s bank account directly to a business, cutting out the traditional card networks entirely.

It’s like giving a trusted friend a special key that only opens one specific door for a single visit, instead of handing over your entire bunch of keys. The customer gives their approval for a payment directly inside their own banking app—an environment they already use and trust. That one-time approval is all that’s needed. No sensitive card numbers or security codes are ever shared with the business.

This direct link is what makes Open Banking so powerful, especially for any business where rock-solid security and identity checks are non-negotiable. It’s a smarter, safer way to get paid.

The Power of Identity Verified Pay by Bank

The real game-changer here is something called ‘Identity Verified Pay by Bank’. Because the payment is started and approved from within the customer's own bank account, their identity is essentially confirmed by the bank itself during the transaction. This adds a powerful layer of authentication that card payments just can't compete with.

For businesses processing insurance claims, collecting charity donations, or handling any high-value payment, this is a massive win. It significantly cuts down the risk of fraud, chargebacks, and payments made with stolen details, because the transaction is locked to a verified bank account holder.

By tying the payment directly to a customer’s authenticated bank session, Open Banking confirms that the person paying is who they claim to be. This built-in verification is a huge leap forward for transaction security.

This robust identity check is exactly why regulators and security-focused organisations are championing this method. It offers a level of certainty that’s almost impossible to get with traditional card payments, where details can be easily stolen and used by fraudsters.

A Look at the Customer Journey

From the customer's point of view, the whole process is refreshingly simple and feels completely secure. It gets rid of that nagging worry people have about reading their card details out over the phone or typing them into a website.

Here’s a quick rundown of how a typical payment works:

- Initiation: The business sends the customer a secure payment link via SMS, email, or even web chat.

- Selection: They tap the link and are shown a list of banks. They just pick theirs.

- Authentication: They’re then whisked away to their own mobile banking app or online portal. Here, they log in just like they always do—with a fingerprint, Face ID, or their usual password.

- Approval: The payment details are already filled in for them to check. With one final tap, they approve the transaction.

- Confirmation: They are sent straight back to the business's confirmation page. Payment complete.

Throughout this entire flow, the customer never enters their bank login details or card numbers anywhere but their own trusted banking app. It’s a smooth, friction-free experience that builds confidence.

Simplifying PCI DSS Compliance

One of the biggest wins for businesses, particularly contact centres, is how Open Banking completely changes the game for PCI DSS compliance. Because no card data is ever handled, sent, or stored by your systems, the transaction falls entirely outside the scope of PCI DSS.

This isn’t just a small adjustment; it’s a total overhaul of your compliance workload. The huge responsibility of protecting sensitive cardholder data is lifted because that data never even touches your environment. For any organisation wrestling with the cost and complexity of PCI DSS certification, this is a massive incentive.

The adoption rates certainly reflect its appeal. In the UK, open banking has emerged as a game-changer among alternative payment methods, boasting over 15 million active users as of July 2025. This surge is part of a wider move towards real-time, secure transactions. Meanwhile, Faster Payments hit 5.6 billion transactions in 2024, overtaking cash to become the UK's second most-used method. You can discover more insights about alternative payment methods in the UK at Noda.live.

Bolstering Security and Slashing Compliance Headaches

When we talk about alternative payment methods, convenience usually steals the spotlight. But the real game-changer, especially for businesses handling sensitive customer data, is what’s happening behind the scenes: a massive leap forward in security and compliance.

These modern payment systems are built from the ground up to protect data. Their core principle is simple but incredibly powerful: they keep sensitive card and bank details completely out of your business environment. When a customer pays with a digital wallet or through an Open Banking transfer, you never see, hear, or touch their full credentials. That single shift fundamentally strengthens your entire security posture.

The Magic of Tokenization

A key technology making this possible is tokenization. Think of it as creating a secret, one-time-use code for every transaction. Instead of transmitting a customer's actual credit card details, the system swaps them for a unique, randomly generated token.

This token is just a stand-in, a placeholder that’s only valid for that single purchase. If a fraudster were to intercept it, it would be completely useless to them. It's like giving a valet a key that only starts your car once, instead of handing over your entire keychain. This makes data breaches far less catastrophic because no reusable financial information is ever exposed.

For businesses, particularly contact centres, this is a monumental shift. Tokenization is a cornerstone of modern payment security, effectively neutralising the value of stolen data and protecting both the customer and the merchant from the fallout of a breach.

This approach is a world away from traditional card-not-present transactions, where sensitive data often had to be stored or transmitted, creating a tempting target for cybercriminals.

Transforming PCI DSS Compliance

Anyone who accepts card payments knows the headache of Payment Card Industry Data Security Standard (PCI DSS) compliance. The rules are complex, the audits are stressful, and the penalties for non-compliance are severe. This is where alternative payment methods deliver one of their biggest wins.

Imagine an agent in your contact centre taking card details over the phone. Suddenly, that entire conversation, the agent’s screen, the call recording, and even your CRM system can fall within the scope of PCI DSS. Securing all of that is a constant, expensive battle.

Now, picture this instead: the agent sends the customer a secure payment link via SMS. The customer taps the link and pays on their own device using Apple Pay or their banking app.

What just happened?

- The agent never saw, heard, or handled any card data.

- The payment information never entered your company’s network.

- The transaction was handled entirely within a secure, PCI-compliant payment gateway.

This simple change can slash your PCI DSS scope by up to 95%. The compliance burden shrinks dramatically, shifting from your entire infrastructure to simply managing the relationship with your payment provider. It frees you up to focus on your business, not on navigating a maze of security controls. To get a better grasp on the requirements, our detailed PCI DSS compliance checklist provides an excellent overview.

End-to-End Encryption Comes as Standard

Another crucial security feature baked into most alternative payment solutions is end-to-end encryption. It ensures that from the moment a customer enters their details to the second it reaches the payment processor, the data is completely scrambled and unreadable.

Think of it like sending a valuable item in a locked box where only the recipient has the key. Even if someone manages to intercept the package, they can’t get inside. That’s exactly what encryption does for payment data.

This protection works across all channels, whether it's an agent-assisted payment over the phone or a self-service transaction via an automated IVR system. It guarantees that information stays private and secure from start to finish, building customer trust and giving your organisation peace of mind. By adopting these methods, you aren't just modernising how you take payments—you're building a more resilient, secure, and compliant business from the inside out.

Weaving Secure Payments into Your Contact Centre

Bringing alternative payment methods into your contact centre doesn’t mean you have to rip up your existing processes and start again. Far from it. The best strategies are designed to weave these modern, secure options directly into your current workflows, making what your agents already do even better. The goal is simple: make payments safer and easier for everyone involved, without causing a massive headache.

Think of it as giving your team a new set of powerful tools. Instead of the old, risky practice of asking for card numbers over the phone, agents can now guide customers toward secure, self-service channels. This move puts both your team and your customers in control, boosting efficiency and building trust with every single interaction.

This isn’t just about looking modern; it’s about fundamentally strengthening your security, which is non-negotiable for any business today.

Empowering Agents with Secure Payment Links

One of the most straightforward and effective tools you can deploy is the secure payment link. Whether an agent is on the phone, in a web chat, or even messaging on social media, they can generate a unique, single-use payment link and send it straight to the customer.

The customer gets the link on their device—usually their smartphone—and a simple tap takes them to a secure payment page. From there, they can pick how they want to pay, whether that’s with Apple Pay, Google Pay, or via an Open Banking transfer. The whole transaction happens on their device, completely siloed from the agent’s screen and your company’s network.

This method is incredibly flexible. For instance:

- A housing association agent can fire off a link to a tenant during a call to clear an overdue rent payment on the spot.

- An insurance firm can use a link to take a policy excess payment while wrapping up a claim.

- A charity fundraiser can text a link to a supporter who has just pledged a donation over the phone.

This simple workflow is a game-changer for compliance. By making sure agents never see, hear, or handle sensitive payment details, you drastically reduce your PCI DSS scope and slash your fraud risk.

Offering 24/7 Self-Service with Automated IVR

Let’s be honest, for many routine payments, customers don’t even need to speak to a person. An Automated Interactive Voice Response (IVR) system lets them make secure payments over the phone, 24/7, without any human intervention.

Think of it as your own secure, automated cashier. A customer calls, follows a simple menu, and enters their payment details using their phone’s keypad. Modern IVR payment systems use DTMF masking technology, which cleverly hides the tones as they’re pressed. This means the details are never exposed in call recordings or to any agent who might be listening in.

This is perfect for high-volume, predictable payments. A utility company, for example, can let thousands of customers pay their monthly bills whenever it suits them, freeing up agents to tackle more complex problems. It’s a win-win: you cut operational costs and give customers an instant, always-on payment option. To get a feel for all the tech involved, have a look at our complete guide to call centre payment security solutions.

Creating a Seamless Experience with API Integrations

If you want to take your payment process to the next level, Application Programming Interfaces (APIs) are the way to go. APIs let you hook your payment platform directly into your other critical business systems, like your Customer Relationship Management (CRM) software.

This creates a single, unified view of the customer. When an agent is on a call, they can see the customer’s entire payment history and account status right there in the CRM they use all day long. From that same screen, they can kick off a payment request that automatically sends a secure link or directs the customer to the IVR.

Once the payment is sorted, the confirmation pings straight back to the CRM, updating the customer's record in real time. This gets rid of manual data entry, cuts down on human error, and gives both the agent and the customer a slick, professional experience. This kind of connected approach is what truly builds an efficient and watertight contact centre payment system.

Choosing the Right Payment Mix for Your Business

Picking the right blend of alternative payment methods isn’t a game of collecting every shiny new option. It’s about being strategic. The goal is to create a payment setup that’s so smooth your customers barely notice it, but that works relentlessly behind the scenes for you.

First things first, get to know your customers. Who are they, and how do they actually like to pay? Are you dealing with a younger crowd that lives and breathes on their phones, expecting the instant gratification of Apple Pay? Or are your sales typically high-value, where the security of Open Banking is a must-have? Nailing down these basics is your starting point.

Your Decision-Making Checklist

To build a payment strategy that genuinely works, you need a framework. Think about how each payment option solves a specific problem for your business or makes life easier for your customers. A smart approach usually means offering a curated mix of methods for different situations.

Use this checklist to figure out what fits your business best:

- Customer Demographics: Are your customers mobile-first? It's worth remembering that 58% of UK consumers are expected to be using digital wallets by 2030. If your audience is tech-forward, this is a trend you can't ignore.

- Transaction Type: Are you taking one-off payments, or is it all about subscriptions? For recurring bills, Direct Debit is often a better bet than card payments, as you won't have to deal with the headache of failed payments from expired cards.

- Value and Risk: Do you handle big-ticket transactions or work in an industry prone to fraud? Something like Identity Verified Pay by Bank provides a layer of security that traditional cards simply can't offer.

- Operational Efficiency: How much time is your team sinking into chasing payments or navigating compliance paperwork? Secure payment links and automated IVR systems can free up a huge amount of admin time.

As you build out your payment mix, don't forget the practical integrations that make a real difference, like Discover how our platform can transform your payment security.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.