How to Take Payments Over the Phone A UK Business Guide

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

For a huge number of UK businesses, taking payments over the phone is just part of the daily routine. It's a quick, direct way to get things done. But let's be honest, asking a customer to read out their card details feels a bit... outdated, doesn't it? In today's world, that old method is neither secure nor does it inspire much confidence.

The game has changed. We now rely on secure payment gateways and clever tech like DTMF suppression to keep sensitive data locked down and stay on the right side of the rules.

Why Secure Phone Payments Are Non-Negotiable

Whether you're a local tradesperson or a massive contact centre, taking card payments by phone is often essential. It’s an immediate, human-led way to finalise a sale, collect a fee, or clear an outstanding balance. The problem is, there's a real tension between this convenience and how clued-up customers are about data security these days.

Data breaches are constantly in the news. So, asking someone to rattle off their full card number, expiry date, and CVV over a recorded phone line is a massive red flag for them. It's not just risky; it can instantly erode trust and saddle your business with a huge compliance headache under the Payment Card Industry Data Security Standard (PCI DSS).

The Modern Consumer Expectation

People are used to slick, secure digital payments. They tap their phones, use contactless cards, and buy online with a single click. This has totally rewired their expectations. Any payment process that feels even slightly insecure is going to set off alarm bells.

A clunky or unnerving phone payment experience doesn't just put one sale at risk—it can do real damage to your brand's reputation.

The numbers back this up. The UK is firmly a card-first, cash-light society. UK Finance reports that debit cards were used for 26.1 billion transactions, making up around half of all payments. At the same time, contactless payments hit 18.9 billion, meaning nearly four in ten payments were contactless. This digital-first mindset directly shapes how comfortable people feel about sharing financial details verbally.

More Than Just a Transaction

A secure phone payment process isn't just a nice-to-have feature anymore; it’s a cornerstone of customer trust and business integrity. Get it right, and you're showing a clear commitment to protecting customer data, which is a powerful way to build loyalty.

The goal is to make the payment process disappear into the background. It should be so seamless and secure that the customer doesn't even have to think about the safety of their information.

This is exactly what modern solutions are built for. They let you take payments efficiently without sensitive card details ever entering your systems. This approach not only protects your customer's information but also drastically simplifies the maze of PCI DSS compliance, turning a potential liability into a genuine competitive edge.

Navigating Your Security and Compliance Obligations

When you take a payment over the phone, you’re handling far more than just a transaction. You're being entrusted with your customer’s sensitive financial data, and that comes with serious responsibility. This isn't just about good business practice; it's a strict legal requirement governed by the Payment Card Industry Data Security Standard (PCI DSS).

Getting this right is not about ticking boxes on a form. It's the absolute foundation of customer trust and the only thing protecting your business's reputation from the catastrophic fallout of a data breach. The fines for non-compliance are steep, but the damage to your brand can be permanent.

The Problem with Old-School Phone Payments

For years, the standard way to take a phone payment was simple: an agent would listen as a customer read out their full 16-digit card number, expiry date, and three-digit security code. The agent would then key this directly into a payment terminal or virtual system. While common, this practice is a compliance nightmare.

The moment your staff members hear or see this sensitive card data, your entire contact centre is pulled into what’s known as PCI DSS scope. This instantly includes:

- Your people: Every single agent, manager, or IT person who could potentially access that data.

- Your technology: The agent's desktop PC, your phone system (PBX), call recording software, and even the network switches and routers.

- Your processes: How data is handled, stored (even for a second), and transmitted across your network.

Suddenly, you're facing an enormously complex and expensive challenge. You have to prove that every one of these components is secure, which means costly annual audits, penetration testing, and constant monitoring. It's a technical and procedural maze that can bleed time and money.

A Smarter Strategy: PCI DSS Scope Reduction

Fortunately, there’s a much better way. Instead of trying to bolt security onto every corner of your operation, the goal should be scope reduction. You design your payment process so that sensitive card data never enters your environment in the first place.

Using modern payment technologies, you can build a secure wall between your business and the very data you’re trying to protect. This strategy can slash your PCI DSS assessment and management burden by up to 90-95%. It frees up your team to focus on what they do best: looking after customers. It’s a complete game-changer, shifting your posture from reactive defence to proactive prevention.

By keeping payment card data completely out of your systems and away from your agents, you are fundamentally removing the risk. If you don't have the data, you can't lose it, and your compliance obligations become drastically simpler.

This proactive approach also speaks directly to the growing anxiety customers have about sharing their financial information. A Mintel study found that 59% of UK consumers are more worried about security when paying online or remotely than in-store. That fear is only amplified when a customer is asked to read their card details aloud to a stranger on a recorded phone line.

How Modern Technology Reduces Your Scope

Secure payment platforms are designed specifically to solve this problem. They act as a secure bridge, connecting your customer, your phone system, and your payment gateway, ensuring card details are captured without ever touching your infrastructure.

Here are the key technologies that make this possible:

DTMF (Dual-Tone Multi-Frequency) Suppression: This clever tech lets customers enter their card details using their telephone keypad. The tones are masked (or 'suppressed'), so your agent never hears them and, crucially, your call recording system never captures the sensitive digits.

Channel Separation: The payment process is smoothly diverted to a secure, isolated digital channel, completely separate from the voice conversation with the agent. Your agent stays on the line to help the customer, but they are firewalled from the actual data entry.

Tokenisation: Once the payment goes through, the sensitive card data is swapped for a unique, non-sensitive "token." This token can be safely stored and used for future transactions, like recurring payments or refunds, without you ever needing to handle the actual card number again.

By adopting these methods, you effectively "de-scope" your agents, your call recordings, and your wider IT environment from the most difficult PCI DSS controls. You can learn more about how these changes align with the latest compliance standards by reviewing the upcoming telephone payment requirements for PCI DSS 4.0.1. Ultimately, this isn't just about compliance; it's about building a smarter, safer, and more trustworthy business.

Choosing the Right Technology for Phone Payments

Understanding your security obligations is one thing, but putting them into practice requires the right tools. Picking the right technology is probably the most important decision you'll make when figuring out how to take phone payments securely.

The good news? Modern solutions are designed to be both powerful and surprisingly straightforward. They can slot right into your existing workflows without causing a massive headache.

The whole point of any secure phone payment tech is to stop sensitive card details from ever touching your business environment. That's the secret to shrinking your PCI DSS scope and, most importantly, protecting your customers. Let's break down the main technologies that get the job done.

Core Security Technologies Explained

Think of these as the essential building blocks for any secure phone payment system. They work together to build a protective wall around your agents, your call recordings, and your IT systems, making sure card details stay invisible and out of reach.

DTMF Suppression: This is a clever bit of tech that lets customers punch in their card details using their phone’s keypad. As they press the keys, those familiar DTMF tones are masked or replaced with a flat tone. Your agent can stay on the line to help out, but they can't hear the numbers being entered. Crucially, your call recording system won't capture them either.

Channel Separation: This technique smoothly diverts the payment part of the call into a separate, secure digital channel. The voice conversation with your agent keeps going on one channel, while the card data entry happens on another, completely isolated one. The agent is effectively firewalled from the transaction, unable to see or hear a thing.

Tokenisation: Once your payment gateway successfully processes a payment, the actual card number gets swapped for a unique, non-sensitive identifier called a token. You can safely store this token in your CRM or billing system. It lets you process future payments—like recurring subscriptions or refunds—without ever needing to store or ask for the customer's real card details again. It's the ultimate 'have your cake and eat it' solution for secure repeat billing.

These technologies are often bundled together into a single platform, working seamlessly in the background. Your main decision is about how your customers and agents will actually use this technology.

Agent-Assisted vs. Automated IVR Payments

When it comes to actually capturing the card details, you’ve got two main paths: have an agent guide the customer through it, or let an automated system handle everything. The best choice really boils down to your business model, call volume, and what your customers prefer.

An agent-assisted payment journey keeps the human touch front and centre. The customer stays on the line with your agent, who can answer questions and offer support while the customer uses their keypad to securely enter their details. This is perfect for complex sales, sorting out account queries, or any situation where a bit of reassurance goes a long long way.

On the other hand, an Interactive Voice Response (IVR) system offers a fully automated, self-service option. Customers can call in anytime—day or night—to make a payment without ever speaking to a person. This is ideal for straightforward, high-volume transactions like paying a utility bill, topping up an account, or settling an invoice. For a deeper dive into designing these automated journeys, our guide on IVR payment flows has some great insights.

Choosing between agent-assisted and IVR isn't an either/or decision. Many businesses find a hybrid approach gives them the most flexibility. Customers can self-serve for simple payments, but agents are there for the more complex stuff.

To help you weigh it up, let's look at how the primary methods for taking secure payments over the phone stack up.

Comparing Phone Payment Capture Methods

This table breaks down the main approaches, highlighting where each one shines.

| Method | How It Works | Best For | Key Benefit |

|---|---|---|---|

| Agent-Assisted | An agent stays on the line while the customer uses their keypad to enter card details via a secure, masked channel. | High-value sales, complex transactions, debt collection, and situations needing customer reassurance. | Provides a personal touch and immediate support, which can be vital for closing sales or resolving issues. |

| Automated IVR | A fully automated system guides the customer through the payment process using voice prompts, without any agent involvement. | Routine bill payments, account top-ups, out-of-hours transactions, and high-volume, simple payments. | Available 24/7 and dramatically reduces the workload on your agents, freeing them up for more valuable conversations. |

Ultimately, the goal is to make the payment process seamless for the customer while being iron-clad secure for your business.

Integrating with Your Existing Systems

A secure payment solution shouldn't be an island. To be truly effective, it needs to play nicely with the tools you already use every day. We're talking about your telephony system, your payment gateway, and your Customer Relationship Management (CRM) software.

Your phone system is the starting point, whether it's a traditional PBX or a modern cloud-based platform. The payment solution has to intercept the call audio to do its DTMF suppression or channel separation magic. If you're looking to get your communications setup right for taking payments, checking out a guide on the best VoIP phone system for small business can be a huge help.

Next, the solution acts as a secure bridge to your chosen payment gateway (like Stripe, Worldpay, or Adyen), sending the encrypted card data for authorisation.

Finally, it should talk back to your CRM, updating the customer's record with the payment status and that all-important secure token for future use. This creates a neat, closed-loop system that’s both efficient and incredibly secure.

Building a Secure and Seamless Payment Journey

Theory is one thing, but putting it into practice is what really counts. This is where we get into the nuts and bolts of building a payment process that feels completely seamless to your customer while being iron-clad secure for your business. The aim here is to make the payment a natural part of the conversation, not an awkward, clunky interruption.

For a truly polished experience, your phone payment process should slot neatly into your broader omnichannel customer service strategy. A customer shouldn't feel a jarring difference whether they're paying via a link you've texted them, an automated IVR, or with an agent on the line. It all needs to feel like one consistent, trustworthy brand experience.

The core technologies that make this possible are surprisingly straightforward when you break them down.

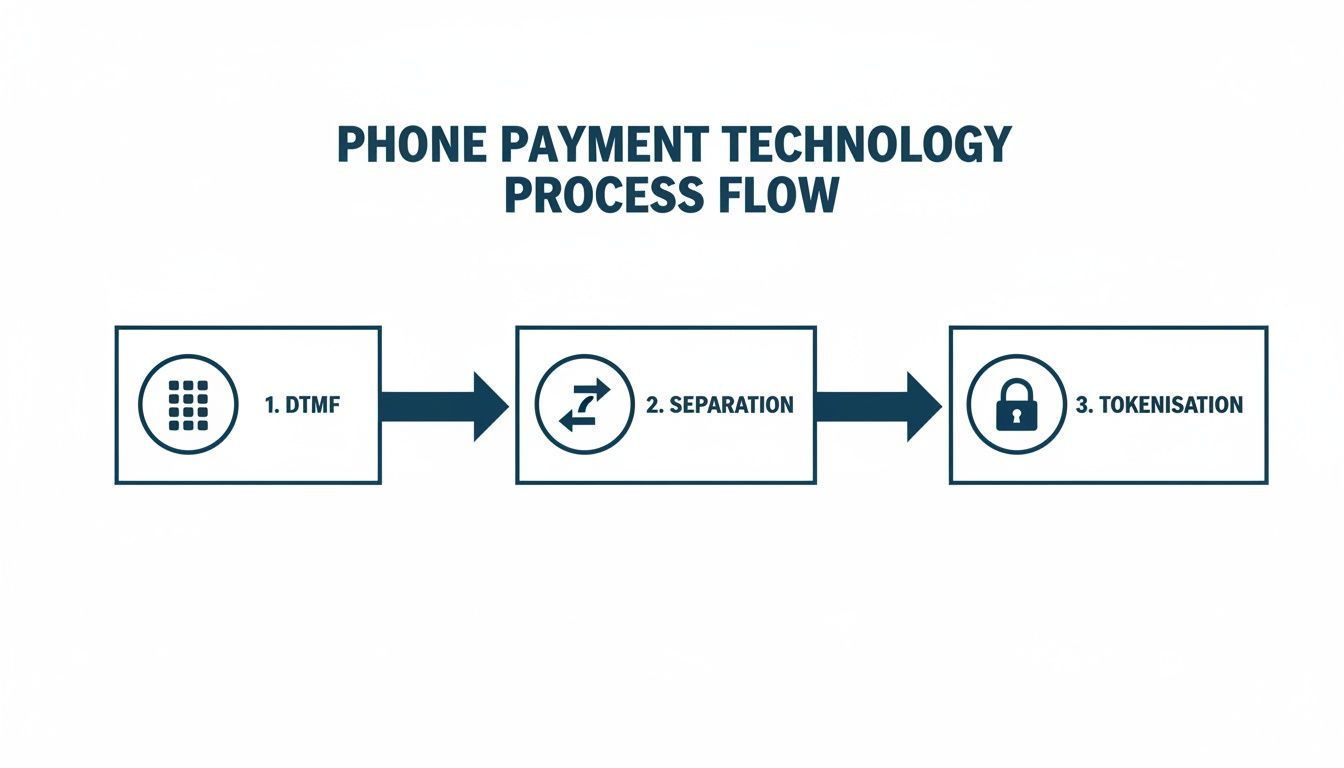

This diagram shows how DTMF masking, channel separation, and tokenisation work in concert. They create a protective bubble around the payment details, ensuring that sensitive cardholder data never even touches your company's environment.

Nailing the Agent-Assisted Experience

When an agent is personally guiding a customer through a payment, that handover needs to be smooth. A clumsy transition can instantly create friction and anxiety, undoing all the good work and rapport built up during the call. The script your team uses is just as vital as the technology behind it.

Forget abrupt, demanding language like, "Right, I need your card details now." Your agents need to be armed with phrasing that’s both professional and reassuring.

A Better Agent Transition Script

"Okay, I can get that sorted for you. To take your payment securely, I'm going to hand you over to our automated payment line to enter your card details. Don't worry, I'll stay on the line with you the whole time in case you need any help. For your security, I won't be able to hear or see the numbers you type in. Just let me know when you're all done."

This simple script is incredibly effective. It tells the customer exactly what's happening, confirms the agent isn't abandoning them, and—most importantly—frames the entire process as a step taken for their security. It turns a procedural necessity into a moment that actually builds trust.

Designing a Painless IVR Payment Flow

For customers who prefer self-service, your Interactive Voice Response (IVR) design is make-or-break. A long, confusing IVR is a guaranteed recipe for hang-ups and lost payments. Keep it simple, clear, and direct.

Your goal is to get the caller from A to B with the least possible effort.

- Welcome & Identify: Start with a quick greeting and ask for an identifier. "Please enter your 8-digit account number, followed by the hash key."

- Confirm: Always repeat the key detail back. "Thank you. I've found the account for Mrs Smith. If this is correct, press 1."

- State the Amount: Be crystal clear about what they're paying. "The outstanding balance is £55.20. To pay this now, press 1."

- Card Entry: Guide them step-by-step. Prompt for the long card number, expiry date (specify MMYY format), and the 3-digit CVV from the back.

- Final Check: Before processing, confirm the last four card digits and the amount one last time.

- Confirmation & Receipt: Instantly confirm the payment was successful and offer to send a receipt via SMS or email.

This logical structure reduces the mental effort for the customer, making them far more likely to complete the transaction without frustration.

Handling Recurring Payments and Refunds Securely

Often, the customer relationship doesn't end with a single payment. You'll likely deal with subscriptions, repeat billing, or the need to process refunds. This is where tokenisation becomes your most powerful ally.

After the first successful payment, your payment gateway swaps the customer's raw card details for a secure, non-sensitive "token." Think of it as a unique, randomised alias for their card. You can safely store this token in your CRM or billing system.

By using tokenisation, you can process future payments—like a monthly subscription or an annual renewal—without ever asking for the customer's card details again. It completely removes the risk and PCI DSS burden of storing sensitive data.

This same token is used to process refunds just as securely. A housing association can refund a rent overpayment, or an insurance company can process a claim payout, all without ever re-exposing the original card number. It’s a clean, compliant, and highly efficient process.

The move towards these modern methods isn't just a compliance exercise; it's a commercial necessity. UK Finance data shows that of the 48.8 billion payments made, over eight in ten were electronic, not cash. The mobile payments market is set to grow at a blistering 38.3% compound annual rate through 2030, with payments made via mobile browsers being the largest chunk of that revenue. This shift shows a clear customer demand for secure, digital-first payment options.

Best Practices for Building Customer Trust

Getting your secure payment system up and running is a huge win, but it’s really just the starting line. The long-term game is all about maintaining a process that isn’t just effective and compliant, but one that actively builds customer trust with every single transaction.

Your customers need to feel, without a doubt, that their sensitive information is safe with you. Just having the right tech isn't enough; you have to show them you’re committed to their security. This is how you turn a compliance headache into a powerful statement about your brand's integrity.

Consistent Monitoring and Auditing

Once you're live, your payment platform’s dashboard is your new best friend. You need to be in there regularly, keeping an eye on key metrics to spot friction points before they become real problems. Don't wait for complaints to start rolling in.

Here are the key performance indicators you should be watching like a hawk:

- Transaction Success Rates: If this number suddenly drops, it could signal a technical glitch with your gateway or a confusing step in the payment flow that’s causing people to give up.

- Call and Transaction Durations: Are payments taking longer than they should? This might point to an inefficient IVR menu or agents who need a bit more coaching on how to guide customers smoothly.

- Abandonment Rates: Pay close attention to where customers are dropping off. If a lot of people hang up right when it's time to enter their card details, the instructions might be unclear, or worse, they don't feel the process is secure.

By regularly auditing these numbers, you can fine-tune your payment journey based on what people are actually doing, not just on what you think they’re doing. It’s this constant cycle of improvement that keeps the experience seamless.

This kind of hands-on management is fundamental to building trust. It demonstrates that you care not just about security, but about the customer's time and experience. For a deeper look at this, exploring the connection between customer trust, payment security, and revenue shows just how intertwined these elements really are.

Proactively Communicating Your Security Measures

You can't just assume customers know how secure your process is. You have to tell them, clearly and confidently. This isn't about bragging; it’s about offering reassurance at the most critical moment of their interaction with you.

Train your agents to frame the security measures as a direct benefit to the customer. When it’s time for payment, a simple script can make all the difference. Something like, "For your security, I'm now passing you to our fully encrypted, automated system to enter your details. I can't hear or see the numbers you enter, ensuring your data remains completely private."

That small bit of language transforms a routine step into a powerful trust-building statement.

Avoiding Common Operational Pitfalls

Even with the best technology in the world, simple operational mistakes can completely undermine trust and create a terrible experience. Knowing the common tripwires is the first step to avoiding them.

- Insufficient Agent Training: Your team has to be rock-solid confident in the payment process. If an agent sounds hesitant or fumbles a customer's security question, that customer's confidence evaporates instantly.

- A Confusing IVR Flow: Nobody likes a robotic voice rattling off a dozen confusing options. A clunky automated system is a fast track to high abandonment rates and a damaged brand perception.

- Inconsistent Messaging: The security promises you make on your website or in marketing materials must match the actual phone experience perfectly. Any disconnect feels jarring and immediately raises red flags for the customer.

By staying focused on these long-term strategies, you'll maintain a phone payment system that isn't just secure and compliant—it will be a constant reminder that you have your customers' backs.

Common Questions Answered

Even with the best plan in place, a few practical questions always pop up when you're setting up secure phone payments. Let's tackle some of the most common ones we hear from UK businesses.

Is It Actually Legal to Take Card Payments Over the Phone?

Yes, it's perfectly legal to take card payments over the phone here in the UK. But—and this is a big but—it’s a tightly regulated activity. You are legally required to comply with the Payment Card Industry Data Security Standard (PCI DSS) to keep your customers' card details safe.

Ignoring these standards isn't an option. It can lead to eye-watering fines, but perhaps more damaging is the complete erosion of customer trust. Using PCI DSS-compliant technology is a foundational part of taking payments safely and legally.

How Can I Take Payments Without a Physical Card Machine?

You definitely don't need a clunky, old-school countertop machine for phone payments anymore. Modern businesses have shifted to much more flexible and secure software-based solutions.

The two main approaches you'll see are:

- Virtual Terminals: Think of this as a secure webpage where you or your agent can manually type in a customer's card details to run a transaction.

- Secure Payment Platforms: This is the smarter way. These platforms integrate with your phone system, letting customers key in their details using their telephone keypad. This completely bypasses your agents and call recordings.

The goal is always to choose a method that stops sensitive card data from ever touching your own systems. A good virtual terminal is one option, but a DTMF masking solution is far better, keeping you compliant while delivering a smooth experience for your customer.

What's the Absolute Safest Way to Take a Phone Payment?

Hands down, the safest method is one that completely removes your business from the process of handling sensitive card data. Technologies like DTMF suppression (sometimes called masking) and channel separation are the gold standard for this.

Here’s how it works: the customer uses their phone's keypad to enter their card numbers. The tones are masked, so your agent can’t hear them, and more importantly, your call recording software never captures them. This move dramatically shrinks your PCI DSS scope and virtually eliminates the risk of an internal data breach.

Do I Have to Tell Customers the Call Is Being Recorded for Payments?

Yes, you absolutely should. Transparency is everything when it comes to building trust. You should always let customers know that calls are being recorded right at the start of the conversation.

When it's time to take the payment, it's also a great idea to explain how you're protecting them. For example, an agent could say something like, "For your security, I'm now going to pass you to our automated system to enter your card details. I won't be able to see or hear any of the numbers you enter." This offers powerful reassurance and shows you’re serious about their privacy.

Ready to make your phone payments simple and secure? Paytia provides a PCI DSS Level 1 certified platform that keeps sensitive data out of your environment, reducing compliance costs and building customer trust. Learn more and book a demo with our team.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.