A Guide to Merchant Payment Processing and Costs

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

At its heart, merchant payment processing is the system that lets your business accept electronic payments—like credit and debit cards—and ensures that money makes its way securely into your bank account. It's the financial plumbing that connects your customer, their bank, and your business, all in the blink of an eye.

How Merchant Payment Processing Really Works

Ever wondered what actually happens in those few seconds between a customer tapping their card and the "Approved" message flashing up? It's a lightning-fast, high-stakes relay race involving several key players. Forget the dry, technical definitions for a moment; it's much easier to understand if you think of it as a well-oiled machine with distinct, moving parts.

The whole process kicks off the moment a customer hands over their card, whether in person, online, or over the phone. That single action triggers a complex chain of communication that verifies the payment and starts moving the money.

The Key Players in the Process

To really get to grips with how payments work, you need to know the cast of characters. Every single transaction involves a financial dance between a few core entities, each with a crucial role to play in making sure the payment is secure, authorised, and settled correctly.

To make this clearer, here’s a quick rundown of who does what.

Key Players in Every Card Transaction

| Player | Role in the Payment Journey | Real-World Analogy |

|---|---|---|

| The Payment Gateway | This is the secure front door. It captures the customer's card details—whether through a chip-and-PIN machine, a web checkout page, or an agent's terminal—and encrypts them for safe travel. | The secure postbox where you drop off a sensitive letter. |

| The Payment Processor | The central communications hub. It takes the encrypted information from the gateway and routes it to the correct card network (like Visa or Mastercard) and onwards to the customer's bank. | The postal service sorting office that directs the letter to the right destination. |

| The Issuing Bank | This is simply the customer's own bank (the one that issued their card). It checks if the customer has enough funds or credit and sends back a "yes" or "no" message. | The recipient of the letter who reads it and decides how to reply. |

| The Acquiring Bank | This is your business's bank (the one that acquires the funds for you). It receives the approval and the funds, eventually depositing them into your merchant account. | Your own postbox, where you receive the final, approved reply. |

Each player has a distinct job, but they all work together seamlessly to make the magic happen.

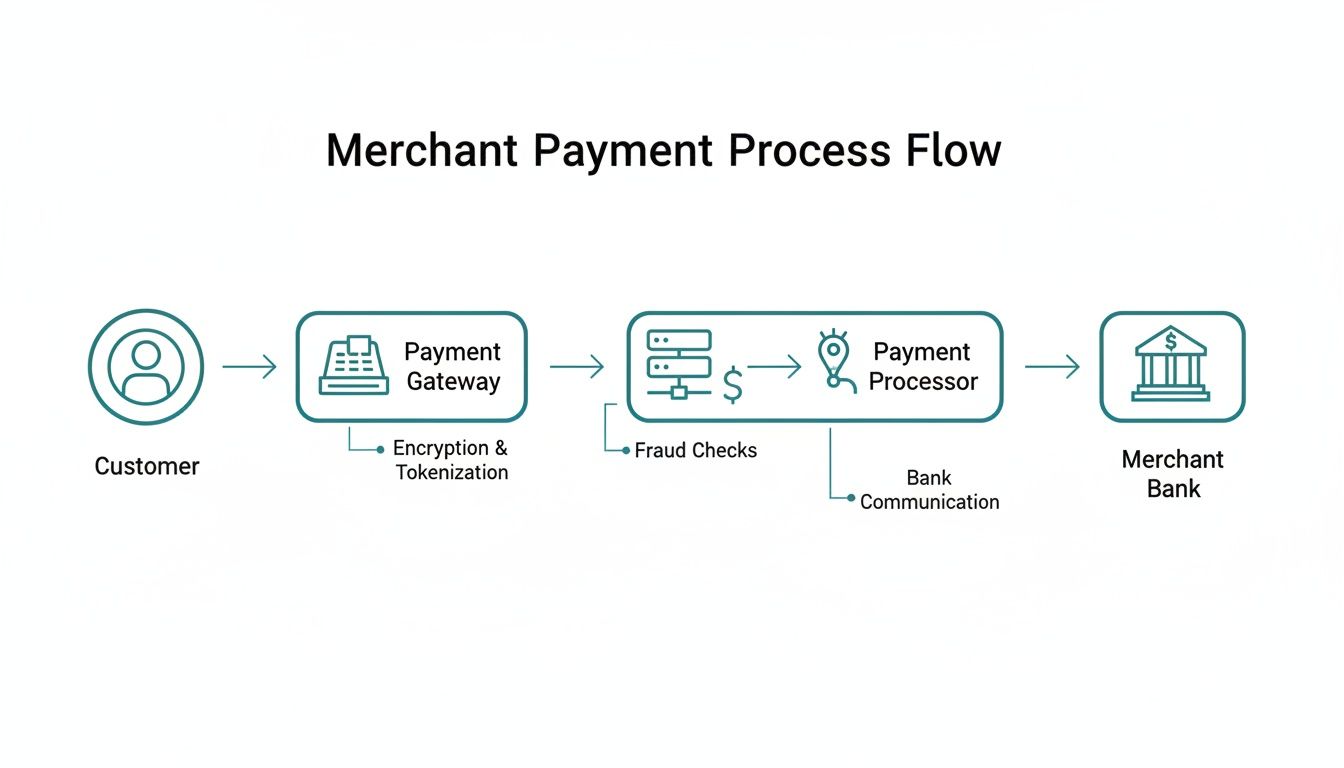

This flow chart gives you a bird's-eye view of how these different parties interact during a typical transaction.

As you can see, it’s a linear, secure path. Data flows from the customer to the gateway, is managed by the processor, and finally finds its home in your merchant bank account.

Key Takeaway: The entire authorisation dance—from the customer's tap to the approval message on the screen—takes just two to three seconds. The actual money transfer, known as settlement, typically follows within 1-3 business days.

Getting your head around this basic workflow is the first real step toward making smarter decisions about your payment systems. For a deeper dive into the nuts and bolts of getting paid online, resources explaining how to accept payments on a website can be incredibly useful. When you know what each component does, you're in a much better position to troubleshoot problems, compare different providers, and ultimately keep your costs under control.

The Core Technologies Behind Secure Payment Capture

Now that we've met the players involved in a transaction, let's get into the tech that makes secure merchant payment processing a reality. These aren't just fancy add-ons; they are the absolute essentials for protecting customer data, building trust, and keeping your business safe from a disastrous data breach. They are the bedrock of any modern, secure payment system.

First up, and arguably most important, is a clever concept called tokenization.

What Is Payment Tokenization?

Imagine tokenization as a high-end cloakroom. You hand over your valuable coat—the customer's sensitive card details—and you get a simple paper ticket back. That ticket, the token, is worthless to anyone else. But for the attendant, it’s the key to finding your specific coat.

It’s the exact same principle in the payments world. A token is a randomly generated, non-sensitive string of numbers and letters that stands in for the actual card number, or Primary Account Number (PAN).

Your business systems only ever touch this meaningless token. The real card data is locked away inside a secure, PCI DSS-compliant digital vault managed by your payment partner. What this means is that even if your systems were breached, thieves would only find a pile of useless tokens.

By swapping sensitive data for non-sensitive placeholders, tokenization dramatically cuts the risk of data theft. It's one of the most powerful tools for reducing the scope of your business's PCI DSS compliance obligations.

This tech is the foundation for securely handling things like recurring billing, saving customer profiles for one-click checkouts, and processing refunds—all without re-exposing sensitive card information. It gives you flexibility without sacrificing security.

Securing Payments in Contact Centres

While tokenization is great for protecting data once you have it, what about capturing it in the first place? This is a huge challenge in contact centres, which have traditionally been a weak link when it comes to payment security. An agent hearing card details over the phone or, even worse, having them captured on call recordings is a massive compliance and security nightmare.

This is where another brilliant piece of technology comes in: DTMF suppression.

DTMF stands for Dual-Tone Multi-Frequency—those are the unique sounds each key makes when you press it on your phone keypad. Without any protection, those tones can be recorded and easily converted back into the card number, expiry date, and CVC.

How DTMF Suppression Works

DTMF suppression (or masking) technology cleverly intercepts these keypad tones before they ever get to your agent or your call recording system. The customer keys in their card details, but your agent just hears a flat, single tone. The actual tones are captured securely by the payment platform and sent straight to the processor, completely bypassing your own IT environment.

This simple process achieves several critical things:

- Agents never hear or see sensitive card numbers, removing the human element of risk.

- Call recordings contain no audible card data, so they remain secure and compliant.

- Your phone systems and network are kept out of PCI DSS scope, which makes audits far less painful.

It’s a win-win. The customer has a smooth experience, using their keypad as they normally would, while your agent can stay on the line to help and confirm the payment was successful. It's an elegant fix for a problem that has plagued contact centres for years.

Both tokenization and DTMF suppression are vital parts of a strong payment security strategy. They work hand-in-hand to protect data from the moment of capture right through to storage and future use. To see how these are often packaged together, it's worth exploring how a modern payment gateway API integration works, as it's typically the hub for implementing these security measures.

Getting to Grips with PCI DSS Compliance and Cutting Costs

If your business takes card payments, then the Payment Card Industry Data Security Standard (PCI DSS) isn't just a recommendation—it's the bedrock of secure payment processing. Think of it as the global rulebook for protecting customer card details. Getting this wrong can lead to eye-watering fines, having your payment facilities withdrawn, and a reputation hit that’s hard to recover from.

For many, managing PCI DSS feels like trying to solve an impossibly complex puzzle. The requirements are deeply technical, the audits can be a huge drain on resources, and the stakes are incredibly high. But there's a brilliantly simple strategy to cut through the complexity: de-scoping.

The Smart Way to De-Scope Your Environment

So, what is de-scoping? It’s the process of strategically removing your systems, people, and processes from any direct contact with sensitive card data. The logic is beautifully straightforward: if cardholder information never touches your environment, that environment no longer falls under the heavy scrutiny of PCI DSS rules.

This single move can shrink your compliance burden by an astonishing 90-95%.

It works by using secure payment platforms that handle the data capture for you. Instead of a customer reading their card details out over the phone, or an agent typing them into your CRM, the information is entered directly into a secure, isolated system. Your business only ever sees a non-sensitive token, which means the risk is taken completely off your hands.

Tackling High-Risk Areas Like Your Contact Centre

Contact centres are a classic example of a high-risk payment environment. Without the right controls, every single phone call is a potential security weak point.

Here are a few of the biggest risks in a typical contact centre:

- Agent Exposure: When agents can hear or see full card numbers, it creates a massive opportunity for both deliberate fraud and accidental data leaks.

- Insecure Call Recordings: Recording calls for quality checks is standard practice, but capturing card details in those recordings creates a toxic data goldmine for criminals.

- Vulnerable Systems: An agent’s computer, your phone network, and CRM systems can all become part of your PCI scope if they ever process or store card data.

Modern secure payment platforms are designed to shut down these threats completely. By using clever technology like DTMF suppression and secure payment links, they ensure sensitive data bypasses your contact centre infrastructure entirely. You can learn more about how to protect your payment channels by exploring these PCI DSS solutions, which are built to reduce your compliance footprint.

Key Insight: A truly effective compliance strategy isn’t just about passing an audit. It’s about fundamentally designing risk out of your day-to-day operations. De-scoping does exactly that by making sure sensitive data never even enters your ecosystem.

This approach doesn’t just make you more secure; it also saves a significant amount of money by cutting down the time and expense spent on audits and compliance admin.

Slashing Costs and Clearing Hurdles

For businesses in the UK, controlling costs has never been more critical. According to a recent survey, high transaction fees are the number one headache for UK merchants. An incredible 72% of businesses said fees were damaging their cash flow and profits in the merchant payment processing space.

Compliance challenges weren't far behind, cited by 66% of businesses as a major burden. By implementing a platform that de-scopes your environment, you're directly solving that second massive pain point. You can dig into more of these findings in the 2025 Merchant Survey by The Payments Association.

Reducing your PCI scope delivers real, tangible savings:

- Lower Audit Costs: A smaller, simpler scope means your audit is quicker and far less expensive.

- Reduced Security Overhead: You no longer need to spend a fortune securing systems that don’t handle sensitive data.

- Eliminated Non-Compliance Fees: You can wave goodbye to the steep monthly penalties that processors often charge for failing to prove your compliance.

By making the strategic choice to remove your business from the flow of raw card data, you turn PCI DSS from a daunting obstacle into a simple, manageable part of doing business. It frees you up to focus your time and money on what really matters—growing your company and looking after your customers.

Integrating Payments into Your Omnichannel Strategy

Your customers don’t think in channels. They see one brand, one conversation. They might start a query on your website’s live chat, follow up with a phone call, and expect to settle their bill through a link sent to their phone—all without hitting a single snag. This is the reality of an omnichannel world, and your merchant payment processing has to be built for it.

When your payment systems are disjointed, you create friction. Think about a customer calling to pay an outstanding bill. If your phone agent can’t see the notes from a previous web chat or can't instantly send a secure payment link, the experience falls apart. It’s not just frustrating for the customer; it’s a recipe for operational headaches and lost revenue.

Unifying Payments Across Customer Touchpoints

The real goal here is to deliver a consistent, secure payment experience no matter how a customer gets in touch. This means weaving your payment platform directly into the communication tools your teams already live in day-to-day.

A genuinely unified system should let you:

- Take secure payments over the phone using tech like DTMF masking, which keeps sensitive card details out of earshot of agents and away from call recordings.

- Send secure payment links via web chat or SMS, giving customers the power to pay on their own device without having to read card numbers out loud.

- Integrate with video tools like Zoom, so a face-to-face consultation can flow straight into a secure, immediate payment.

- Connect directly with your CRM, ensuring every payment is automatically logged against the right customer record for a full 360-degree view.

To get this right, you need to think bigger than just the transaction. It starts with understanding the complete omnichannel customer experience, which provides the blueprint for a payment system that actually meets people where they are.

Real-World Scenarios in Action

Let’s step away from the theory for a moment and see what this looks like in the real world.

Picture this: a customer is using web chat to sort out a billing query. The agent confirms the outstanding balance and, with one click inside their chat console, generates a secure payment link. The customer gets it instantly, opens it on their phone, and enters their details on a secure page. The payment goes through, the agent gets a real-time confirmation, and the CRM is updated. The entire issue is resolved in minutes.

Key Takeaway: An omnichannel payment strategy isn’t about offering every channel under the sun. It's about making sure the channels you do offer are seamlessly connected, creating a single, logical experience for both your customers and your staff.

This simple shift turns the payment from a clunky final hurdle into a natural, integrated part of the conversation.

Future-Proofing Your Payment Strategy

Customer payment habits are always on the move. Just look at the upcoming contactless payment changes in the UK. With new £100 limits on the horizon, experts predict tap-and-go could soon make up 60-80% of all card transactions. This shift shows why it's so important for payment systems to link in-person point-of-sale data with CRM and analytics tools—much like platforms such as Paytia already do for remote channels like PBX/VoIP and Zoom.

As these trends pick up speed, UK payment gateways must deliver unified experiences where a journey can start on one channel and finish on another, all while keeping PCI compliance costs under control. By choosing a flexible, integrated payment platform, you're not just solving today's problems. You’re building a foundation that can adapt to new behaviours and technologies as they appear, keeping your business efficient, secure, and ready for whatever comes next.

Choosing the Right Payment Processing Partner

Picking a partner for your merchant payment processing is a massive decision, and it goes way beyond just finding the lowest rate. Think of it less like a simple purchase and more like a long-term strategic partnership. It’s a choice that will have a real, tangible impact on your security, your customer's experience, and ultimately, your bottom line.

It’s easy to get bogged down by providers all shouting about low fees and quick setups. But the real goal is to look past the flashy headline numbers and dig into the criteria that actually matter for your business.

A cheap provider who leaves you exposed to compliance nightmares or vanishes when you need support will cost you far more than you ever saved on transaction fees. You're not just buying a service; you're investing in the security and stability of your revenue stream.

Core Non-Negotiable Criteria

Before you even glance at a pricing sheet, there are a few absolute deal-breakers. These are the foundational pillars of any secure, reliable payment solution. If a provider can't tick these boxes, walk away.

Your evaluation has to start with these must-haves:

- PCI DSS Level 1 Certification: This is the gold standard, the highest level of security validation in the payment card industry. It means their systems have been through the wringer with rigorous independent audits. Honestly, don't even consider a partner without it.

- Seamless Integration Capabilities: The last thing you want is another clunky, standalone system. The solution has to play nicely with the tools your team already relies on, like your phone system (VoIP/PBX), CRM, and other contact centre software. Poor integration just creates headaches, manual work, and a disjointed experience for everyone.

- Expert and Responsive Support: When something goes wrong with payments, you need real help, fast. Look for a partner who gives you access to genuine experts who understand the nitty-gritty of payment tech and compliance—not just a generic call centre script.

Key Features That Deliver Real Value

Once you've confirmed the non-negotiables are in place, you can start looking at the features that will genuinely make a difference to your operations. Don’t get distracted by a long list of bells and whistles; focus on the tools that solve your specific challenges.

A great platform will offer practical, high-value tools like these:

- Automated IVR Payments: An Interactive Voice Response (IVR) system is a game-changer. It lets customers pay their bills over the phone 24/7, without ever needing to speak to one of your agents. This frees up your team, cuts down call times, and gives customers a super-convenient way to pay on their own schedule.

- Robust Recurring Billing Systems: If your business runs on subscriptions or payment plans, you need a solid automated recurring billing engine. It should securely handle everything from storing payment details (using tokenisation) to managing the entire billing cycle without anyone needing to lift a finger.

A true payment partner does more than just move money. They provide the tools and expertise to de-scope your environment, automate manual tasks, and secure every customer touchpoint, turning payments from a cost centre into a strategic asset.

Before you sign on the dotted line, you have to get a clear picture of all the terms and potential hidden fees. For more on this, our guide on what to watch for when signing up for payment processing is a must-read. It can save you from some common and costly mistakes.

Payment Partner Evaluation Checklist

When you're comparing providers, it helps to have a structured way to evaluate them side-by-side. The table below outlines the key criteria to consider, why they're so important, and the specific questions you should be asking to get the answers you need.

| Feature/Criteria | Why It Matters | Questions to Ask |

|---|---|---|

| PCI DSS Scope Reduction | This is the biggest security and cost-saving win. A good partner actively removes your systems from handling sensitive card data. | "How exactly does your technology remove our contact centre and call recordings from PCI scope?" |

| Processor Agnosticism | Avoids vendor lock-in. You want the freedom to change your acquiring bank without having to rip out your entire payment setup. | "Is your platform independent of the payment processor? Can we switch acquirers in the future without any disruption?" |

| Integration Support | A smooth implementation is critical. You need a partner who will actively help you connect their solution to your existing tech stack. | "What does your implementation process involve? Will we get a dedicated technical contact to guide us?" |

| Support Model | When issues arise, you need quick access to knowledgeable experts, not just a ticketing system. | "What are your support SLAs? Who will we be speaking to—a first-line agent or a technical specialist?" |

| Transparent Pricing | Hidden fees for things like setup, support, or PCI compliance can quickly inflate your costs. Clarity is key. | "Can you provide a full breakdown of all fees, including any monthly, annual, or one-off charges? What isn't included?" |

| Omnichannel Capability | Customers expect to pay how they want. A partner that supports phone, web, and other channels offers a better experience and future-proofs your setup. | "Beyond phone payments, what other channels (e.g., SMS Pay-by-Link, email) does your platform support?" |

Using a checklist like this ensures you're making a decision based on a complete picture, not just the headline transaction rate. It helps you find a partner who will genuinely support your business's security and growth for the long haul.

Critical Questions to Ask Potential Vendors

To really separate the genuine partners from the simple resellers, you need to go into your conversations armed with some pointed questions. A good provider will welcome this level of detail; a weak one will get defensive.

Here are three key questions to get you started:

- On Security and De-Scoping: "Can you walk me through, step-by-step, how your platform takes our contact centre and call recordings out of PCI DSS scope? What specific technologies, like DTMF suppression, are you using to make that happen?"

- On Implementation and Support: "What does your implementation actually look like? Are we assigned a dedicated technical contact who can help us integrate this with our phone system and CRM?"

- On Flexibility and Agnosticism: "Is your platform 'processor agnostic'? In other words, if we decide to change our acquiring bank down the road, can we do that without having to tear everything out and start over?"

Listen carefully to their answers. A true partner will give you clear, confident, and detailed responses. They'll sound less like a salesperson and more like a consultant, focused on helping you build a more secure and efficient way to handle payments. That's how you know you've found the right one.

Your Merchant Payment Processing Questions Answered

Stepping into the world of merchant payment processing can often feel like you’re trying to decipher a completely new language. To cut through the jargon, let's tackle some of the most common questions that pop up when businesses are setting up or improving their payment systems.

What Is the Difference Between a Payment Gateway and a Processor?

This is easily one of the most frequent points of confusion, but a simple analogy makes it crystal clear. Imagine your payment system is a retail shop with a secure till at the front and a trusted delivery service out the back.

The payment gateway is your shop's till. It’s the customer-facing part—the secure checkout page on your website, the terminal in a shop, or the interface an agent uses to capture card details. Its main job is to securely encrypt this sensitive information and pass the 'order' safely on to the next stage.

The payment processor is the behind-the-scenes delivery service. It takes that encrypted order and does all the heavy lifting. It communicates with the card networks (like Visa or Mastercard) and the customer's bank to get the transaction approved and start the process of moving the money into your account.

While some companies bundle these services together, they are two distinct and vital functions. The gateway is the secure front door; the processor is the engine room that makes it all work.

How Can My Business Effectively Reduce Its PCI DSS Scope?

The single most effective way to simplify your PCI DSS obligations is to make sure sensitive cardholder data never even touches your systems. This strategy, known as de-scoping, can literally remove 90-95% of the compliance requirements you're responsible for.

It works by using technology that captures payment details in an isolated, compliant environment that’s completely separate from your own network, agents, and call recordings.

Here are the most common and effective ways to do it:

- Secure Payment Links: You send a link to the customer via SMS, email, or web chat. They enter their card details on their own device, keeping that sensitive data far away from your agent's screen and your network.

- DTMF Masking for Phone Payments: This clever tech intercepts the keypad tones (DTMF) a customer enters when paying over the phone. Your agent only hears a flat, monotone sound, while the actual numbers are routed directly and securely to the payment platform. Crucially, this keeps card details out of your call recordings.

- Dedicated IVR Systems: An automated Interactive Voice Response system lets customers pay 24/7 without ever speaking to an agent. The entire transaction happens within a secure, PCI DSS-certified environment.

Because your agent's computer, your CRM, and your call recordings never come into contact with the raw card numbers, they are removed from the scope of a PCI audit. This saves a phenomenal amount of time, money, and stress.

Can I Switch Payment Processors Without Causing Business Disruption?

Yes, you absolutely can—but there's a catch. You need to be using what's known as a "processor-agnostic" secure payment platform. This is a crucial feature that prevents you from getting locked in with one vendor and gives your business genuine long-term flexibility.

Think of these platforms as a secure, independent layer sitting between your day-to-day operations and the various payment processors that handle the back-end transactions. Your team keeps using the same familiar interface for taking payments, and your customers get the same smooth experience they always have.

Key Insight: Being processor-agnostic means you can shop around for better transaction rates or switch to a provider with superior service whenever you want. This freedom ensures you are never held hostage by a single vendor's ecosystem or pricing.

The ability to swap out the underlying processor without disrupting your front-end operations is a powerful advantage. It allows you to adapt your financial partnerships as your business needs change over time.

What Are Chargebacks and How Can I Minimise Them?

A chargeback is essentially a forced refund. It happens when a customer disputes a charge on their statement, and their bank initiates a reversal of the transaction. For merchants, they’re a serious headache because you lose the original revenue from the sale and get hit with extra administrative fees from your processor.

Minimising chargebacks really comes down to a few core best practices. First off, make sure your billing descriptors—the company name that appears on a customer's bank statement—are crystal clear and easy to recognise. A vague or confusing descriptor is one of the most common reasons genuine customers accidentally dispute a charge they don't remember making.

On top of that, excellent customer service and clear communication go a long way. For payments taken remotely, it’s also about having a solid audit trail. Using a method like a customer-completed secure payment link provides much stronger proof that the cardholder authorised the transaction, especially when compared to a payment where an agent manually keyed in the details. This evidence can be invaluable if you ever need to fight a fraudulent chargeback claim.

Ready to simplify your payments and slash your PCI scope? Paytia provides the secure, flexible, and processor-agnostic platform you need to take payments safely across any channel, from phone calls to web chat.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.