Pay by bank app: A Quick Guide to Modern, Secure Payments

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

A pay by bank app lets your customers pay you directly from their bank account, using their own trusted mobile banking app to approve the transaction. It's a fast, secure alternative to card payments that completely sidesteps the need to share sensitive card numbers, all made possible by open banking.

Why Pay By Bank Is a Game-Changer for Customer Payments

The way we pay is definitely changing. For years, the go-to method for any remote payment, especially in places like contact centres, has been the humble credit or debit card. We’re all familiar with it, but let’s be honest, it’s a process riddled with problems for everyone involved.

Every card-not-present payment introduces friction. A customer has to read out a long card number, expiry date, and security code over the phone or painstakingly type it all into a web form. It's a clumsy process, prone to human error, and a common cause of failed payments and frustrated customers.

The Old Way Is Broken

Beyond the sheer inconvenience, traditional card payments are a security and compliance minefield. Every single time card data is spoken, typed, or even momentarily stored, it creates a weak spot for fraudsters to attack.

This risk forces businesses into the incredibly complex and expensive world of PCI DSS compliance. It means putting rigid controls in place to protect data, and for contact centres, it often leads to clunky "pause and resume" recording systems that are far from foolproof.

This is where the pay by bank app comes in. It's not just a minor tweak; it’s a fundamental shift in how payments are handled. We're moving away from a model of sharing sensitive data to one of simply authorising a direct transfer.

Think of it like this: instead of giving a merchant the keys to your financial house (your card details), you're just telling your bank to send a specific amount of money on your behalf, just this once. That simple change completely flips the security dynamic on its head.

A Modern Fix for Modern Headaches

This shift is happening now because two powerful forces have aligned: the maturity of open banking technology and the massive consumer trust in mobile banking apps. People are already comfortable managing their money on their phones, using biometrics like a fingerprint or face scan to log in. Pay by bank simply taps into this existing trust and security.

Throughout this guide, we’ll break down:

- How It Works: The mechanics of how open banking APIs create that secure payment link.

- The Security Payoff: Why this method slashes fraud risk and shrinks your PCI scope.

- Getting It Done: How to integrate a pay by bank solution into your own workflows.

Let’s dive into the technology and see why it’s quickly becoming the go-to solution for businesses that value both security and a smooth customer experience.

How a Pay By Bank App Actually Works

To really get what makes a pay by bank app so effective, you need to look at what’s happening behind the curtain. Forget the clunky, multi-step process of card payments. Instead, picture a secure, digital tunnel running directly from your customer’s bank to yours. There are no middlemen to slow things down or introduce risk.

The whole thing is built on the foundation of Open Banking. Think of Open Banking APIs (Application Programming Interfaces) as highly secure digital bouncers. They don’t see or store your customer's login details; they just let a customer grant temporary, one-time permission for a specific payment to happen.

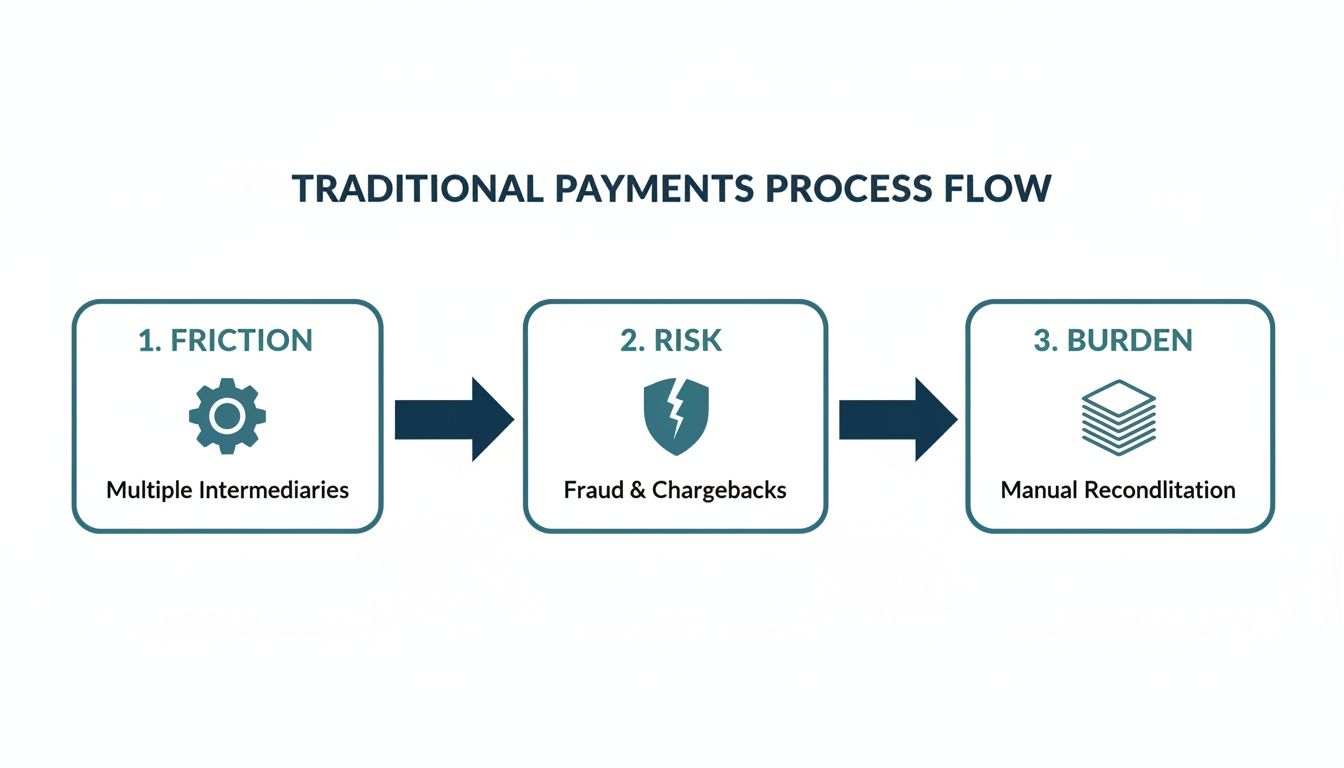

It’s an elegant solution that completely sidesteps the old payment rails, which are often weighed down by friction, fraud risk, and manual reconciliation headaches.

The image above gives you a clear picture of the pain points in legacy payment systems—all things that Pay by Bank was designed to fix. Now, let’s walk through the streamlined journey your customer gets instead.

The Customer Journey Step-by-Step

The real magic here is simplicity. The process leans on the security customers already know and trust: their own banking app. From start to finish, the experience feels smooth and familiar.

Receiving the Payment Request: It all starts when your customer gets a payment request. This is usually a secure link sent over SMS or email, or perhaps shown on-screen after a chat with one of your contact centre agents.

Seamless Redirection: Clicking that link securely and automatically opens their own mobile banking app or online banking portal. Instantly, they’re in a familiar, trusted space.

Bank-Level Authentication: Next, they authorise the payment using the high-level security they use every day—biometrics like a fingerprint or facial recognition, or their unique banking passcode. This isn't some third-party login; it’s their bank’s own robust Strong Customer Authentication (SCA).

Confirming the Details: The banking app then shows them all the pre-filled payment details: your business’s name as the payee and the exact amount due. This completely eliminates the risk of someone mistyping an account number or payment value.

Final Authorisation: With all the details confirmed, the customer gives their final approval for that single transaction. A simple tap is all it takes to push the payment directly from their account to yours.

Instant Confirmation: Right away, the customer is sent back to a success screen confirming the payment went through. The whole process is often done in under a minute. You can see this smooth flow for yourself by watching our Pay by Bank demo video.

Moving Money, Not Data

This modern approach fundamentally changes the game on security. No sensitive card numbers, expiry dates, or CVC codes are ever shared, transmitted, or stored. The system is designed to move money, not expose data.

This distinction is critical. Traditional payments rely on sharing credentials (card details) that can be stolen and misused. A pay by bank app transaction is simply an instruction, authorised by the customer from inside their bank's secure perimeter, to push funds to a merchant.

This consumer-friendly process couldn’t be better timed. Mobile banking adoption in the UK has skyrocketed, with a clear majority of bank account holders now actively using their phones for banking. This comfort and familiarity is exactly why pay by bank app payments feel so natural and trustworthy to customers.

By working with the tools customers already use and trust every single day, the pay by bank app gets rid of friction and builds confidence. It turns what could be a point of frustration into a seamless, secure interaction.

The Security Advantages Over Card Payments

When it comes to adopting a new way to get paid, security is always front and centre. This is where Pay by Bank apps really shine, drawing a sharp contrast with the risks baked into traditional card payments—especially for remote or "card-not-present" (CNP) sales.

For years, the go-to method for taking a payment over the phone has been asking a customer to read out their 16-digit card number, expiry date, and CVC. It’s a practice riddled with risk. That sensitive data is spoken aloud, heard by an agent, and often travels through various internal systems, creating far too many weak points for fraud.

Pay by Bank completely sidesteps this outdated process. Because the customer authorises the payment from inside their own secure banking app, sensitive details are never shared with your business or your agents. The entire risky exercise of sending reusable card numbers back and forth simply disappears.

Built-in Strong Customer Authentication

One of the biggest security wins with open banking payments is the native Strong Customer Authentication (SCA). This isn't some clunky add-on; it's the high-grade, multi-factor security that banks have invested millions in perfecting and that customers already know and trust.

When a customer goes to approve a payment, they are using their bank’s own verification methods, which will always involve at least two of the following:

- Knowledge: Something only they know (like a password or PIN).

- Possession: Something only they have (their mobile phone).

- Inherence: Something unique to them (a fingerprint or facial scan).

This biometric layer makes transactions incredibly secure. After all, it’s much harder for a fraudster to fake a fingerprint than it is to steal and reuse a card number. To see how modern payment solutions leverage these kinds of advanced security measures, it’s worth exploring different strategies to enhance fintech app security.

One-Time Tokens Versus Reusable Data

Another massive security upgrade is how the payment information itself is handled. A traditional card payment is like giving someone a key that can be used to unlock your account over and over again. A Pay by Bank transaction is fundamentally different.

It uses a secure, one-time token for each individual payment. Think of it as a single-use digital ticket. Once the payment is made, that token is useless and cannot be used again, making it worthless to criminals even if they managed to intercept it. This shift from static, reusable card details to dynamic, single-use tokens is a huge leap forward.

By removing the need to handle, transmit, or store any card details, you are not just adding a layer of security—you are fundamentally removing the source of the risk itself. This proactive approach is far more effective than reactive fraud detection measures.

When we put the two methods side-by-side, the security differences become crystal clear.

Comparing Pay By Bank App and Traditional Card Payments

This table highlights the key differences in security, compliance, and user experience between pay by bank app transactions and traditional card payments made remotely.

| Feature | Pay By Bank App | Traditional Card Payment (CNP) |

|---|---|---|

| Data Exposure | Zero. Card details never leave the bank's app. | High. 16-digit PAN, expiry, and CVC are spoken and transmitted. |

| Authentication | SCA built-in (e.g., biometrics, PIN). | Weak. Often relies only on data printed on the card. |

| Fraud Risk | Very low. Single-use tokens and SCA. | High. Prone to CNP fraud and data interception. |

| PCI DSS Scope | Dramatically reduced. No card data enters your systems. | Full scope. Agents, networks, and recordings are all included. |

Ultimately, the comparison shows that Pay by Bank is not just another payment option; it’s a foundational shift towards a more secure and streamlined way of doing business.

A New Era for PCI DSS Compliance

For any business taking card payments, PCI DSS (Payment Card Industry Data Security Standard) compliance is a constant operational headache and a significant cost. The scope of your PCI audit is dictated by where and how cardholder data touches your organisation.

When you take card details over the phone, your agents, call recordings, and internal networks all fall squarely within the scope of PCI DSS. This means expensive audits, complicated security controls, and the ever-present worry of a data breach.

Switching to a Pay by Bank app solution changes everything. Because card data never enters your environment, you can slash your PCI DSS scope—often by as much as 90-95%. This isn’t just about saving money on compliance. It’s about freeing up your team, simplifying your operations, and gaining genuine peace of mind. It's a strategic move that fortifies your security from the ground up.

Real-World Use Cases For Your Industry

The real power of a pay by bank app isn't in the technology itself, but in what it solves. This isn't just another tech upgrade; it's a practical fix for some of the oldest headaches in business. By taking sensitive card data completely out of your hands, it tackles deep-rooted problems with security, customer experience, and day-to-day efficiency.

Let's look at a few real-world scenarios where this is making a difference, turning clunky payment processes into something smooth, simple, and secure.

Transforming Contact Centre Payments

Contact centres are the heart of customer interaction, but they're also a massive weak point for payment security. For years, the standard has been asking a customer to read out their card details over the phone. It’s slow, it’s awkward, and it’s a compliance nightmare under PCI DSS.

A pay by bank app completely flips this script. Instead of the agent typing in card numbers, they simply trigger a secure payment link and send it to the customer by SMS or email right there on the call. The customer taps the link and approves the payment on their own phone, using their bank app's built-in security like a fingerprint or face scan.

This small change in workflow delivers huge wins:

- Drastically Reduces PCI Scope: Card data never even touches your contact centre. That means the cost and complexity of staying PCI DSS compliant drops through the floor.

- Boosts Security: The risk of fraud from staff or from compromised call recordings just disappears.

- Improves Customer Trust: Customers feel far more comfortable knowing they don’t have to speak their card details out loud to a stranger.

With over half the adult population in the UK now using mobile wallets, it’s clear that customers are ready and willing to pay this way. It’s no longer a niche preference; it's a mainstream expectation.

Streamlining Utilities and Bill Payments

For any utility company, chasing down countless one-off bill payments is a constant drag on resources. Dealing with expired cards, chasing late payments, and manually reconciling bank transfers—it all eats up time and hurts cash flow.

A pay by bank solution cleans up this entire process. You can embed a payment link right into a digital invoice or send it out in a payment reminder. The customer can then pay their gas, electricity, or water bill in a couple of taps, without ever having to dig out a card or manually type in account numbers and references.

This is about more than just convenience. It's about payment certainty. Because the money moves directly from the customer's bank via the UK's Faster Payments network, the funds settle almost instantly. This massively cuts down on failed payments and the administrative headache that comes with them.

Securing Patient Payments in Healthcare

In healthcare, confidentiality is everything. When it's time to settle an invoice for a consultation or treatment, clinics need a way to take payment that protects patient privacy and guarantees the funds will arrive promptly.

Asking for card details over the phone feels invasive, especially when discussing sensitive health matters. A pay by bank app provides a discreet and far more secure way forward. The provider sends a link, and the patient pays through their own trusted banking app. The whole transaction is private, protected by bank-grade security, and reinforces the critical trust between a patient and their provider.

Protecting High-Value Retail Transactions

When you're selling high-value goods like luxury items or bespoke furniture, the stakes are much higher. A single fraudulent transaction or a chargeback can wipe out your profit margin. Card-Not-Present (CNP) fraud is a constant threat, where criminals use stolen card details for big-ticket online or phone purchases.

Pay by bank payments are a game-changer here. Because the payment is authenticated directly by the customer's bank using Strong Customer Authentication (SCA), the chance of fraud is almost zero. Better yet, because it's an irrevocable bank transfer, the risk of chargebacks that plagues card payments is gone. This gives retailers the confidence to accept high-value remote payments without constantly looking over their shoulder.

These are just a few examples of how a pay by bank app can be put to work solving specific industry challenges. You can explore a wider range of secure payment solutions for different industries to see how the technology can be tailored to what you do.

How to Implement a Pay by Bank App Solution

Switching to a pay by bank app solution might sound like a huge IT project, but it’s really about smart integration, not a complete system overhaul. The magic is in the Application Programming Interfaces (APIs). Think of them as secure bridges that connect the payment service to the business software you already use.

This API-first approach lets you embed payment features directly into your team's daily tools. Whether that’s your CRM, billing software, or even your contact centre’s phone system, the idea is to place the payment workflow exactly where it makes sense. It creates a much smoother journey for both your agents and your customers.

What’s great about this is its flexibility. There's no single, rigid way to set things up; you get to tailor the payment journey to fit how you actually talk to your customers.

Choosing Your Implementation Model

How you offer the payment option can change dramatically depending on your business. Each method is designed to be as frictionless and secure as possible, whether it's an agent guiding the customer or a fully automated process.

Here are a few popular integration flows:

- Live Agent Assistance: An agent on a call can generate a payment request with a single click inside their CRM. A secure link is immediately sent to the customer’s phone via SMS or email. They can complete the payment on their own device while still talking to the agent.

- Automated IVR Systems: For 24/7 self-service, you can build the payment workflow right into your Interactive Voice Response (IVR) system. After a customer verifies their account, the IVR can automatically send a payment link to their phone.

- Web Chat and Messaging: If a customer is chatting with an agent or a bot, the payment link can be dropped directly into the conversation. The entire experience stays in one place.

The core idea behind all these models is the same: your systems kick off the request, but the actual payment authorisation happens securely within the customer’s own trusted banking app. This separation is what makes the process so secure and dramatically simplifies your compliance headaches.

When you're mapping out your solution, it helps to have a grasp of mobile application design fundamentals. Looking into the key factors for Android app development can offer some really useful insights for building a solid, user-friendly payment system, making sure the customer-facing part is as slick as possible.

Essential Backend Features for Success

A smooth customer journey is only half the story. A successful implementation needs powerful backend features to make the whole system work for your business. These are the tools that are crucial for managing payments efficiently, staying compliant, and getting a complete financial picture.

Tokenization for Recurring Payments

One-off payments are just the start. For any kind of subscription or payment plan, tokenization is non-negotiable. After a customer authorises their first payment using the pay by bank app, the system creates a secure token. This token is a placeholder for their bank details, letting you set up recurring direct debits without asking the customer to approve every single transaction.

Detailed Audit Controls and Reporting

You absolutely need robust reporting. Your payment platform must give you detailed audit logs for every transaction, tracking each step from the initial request to the final settlement. This is vital for a few reasons:

- Reconciliation: Makes it easy to match payments to customer accounts.

- Compliance: Gives you a clear, auditable trail for any regulatory checks.

- Dispute Resolution: Lets you quickly pull up a payment’s history to solve customer queries.

A well-planned pay by bank app is much more than a new way to get paid—it’s a strategic upgrade to your entire operational toolkit. To see how this could work for your business, check out our detailed guide on Paytia’s Pay by Bank solutions and see how you can integrate it into your specific workflows.

Your Roadmap to Adopting Pay by Bank

Making the move to a pay by bank app isn't just a tech project; it's a strategic shift. To get it right, you need a clear, phased approach that considers your processes, your partners, and your people. It all starts with taking an honest look at how you get paid today.

First, map out your current payment journey from start to finish. Where does the friction creep in for your customers? Where are the security weak spots? If your agents are still taking card numbers over the phone or you're holding onto sensitive data for longer than you should, those are your starting points. Pinpointing these specific pains builds a powerful business case for making a change.

This initial review is crucial. It turns the conversation from "we need new technology" into "we need to solve these real-world problems," like cutting down on fraud or making PCI DSS audits less of a headache.

Selecting the Right Technology Partner

Once you know what you need, picking the right partner is the single most important decision you'll make. Not all providers are the same, and the best ones act more like a guide than a simple vendor. Your evaluation needs to be thorough, focusing on a few critical areas.

Look for a partner with deep, proven experience in secure payments, backed by a platform that is PCI DSS Level 1 certified. This is non-negotiable. It’s the foundation of your entire security and compliance strategy.

But don't stop at certifications. Dig into their integration capabilities. A great partner will have robust APIs and a solid track record of connecting with different telephony and CRM systems. Ask to see case studies that mirror your industry and operational setup.

A partner’s reliability and support are just as important as the technology itself. Ensure they offer strong service-level agreements (SLAs) and responsive support to help you navigate implementation and troubleshoot any issues that arise.

Crafting Your Rollout and Measuring Success

With a partner on board, your attention can turn to implementation. A successful launch is about more than flipping a switch; it requires careful planning to get both your team and your customers ready for the new way of doing things.

Your rollout plan should include:

- Comprehensive Agent Training: Your team needs to do more than just learn the new system. They need to understand the why behind it so they can explain the security and convenience benefits to customers with confidence.

- Clear Customer Communication: Get your messaging sorted early. Simple, clear communications that introduce the new payment option and highlight its benefits will make all the difference.

- Phased Go-Live: Don't go for a big bang launch. Consider rolling out the new system to a smaller team or a specific customer segment first. This lets you iron out any kinks before going live across the board.

To prove the switch was worth it, you have to define what success looks like from day one. Set up key metrics to track your progress and demonstrate a clear return on investment.

These metrics should include:

- Transaction Success Rates: A healthy increase here is a great sign that the new process is smoother and more reliable.

- Incidents of Fraud: A significant drop is one of the main reasons to adopt a pay by bank app in the first place.

- Customer Satisfaction Scores: Keep a close eye on feedback related to the payment experience.

- PCI DSS Audit Costs: Track how much you're saving in compliance overheads over time.

This data-driven approach lets you quantify the benefits and build on your success. The UK's Faster Payments System, which powers these bank transfers, is already one of the country's most used payment methods, so you're tapping into a clear consumer preference. For more insight into these trends, check out the latest UK Finance Payment Markets Report.

Frequently Asked Questions About Pay By Bank

It's natural to have questions when a new way of handling payments comes along. Getting to grips with how a pay by bank app actually works is the first step to seeing why it’s a game-changer for you and your customers. Let's tackle some of the most common queries head-on.

Is This the Same as a Manual Bank Transfer?

Not at all, and this is where the magic lies. We’ve all experienced the clunky process of a manual transfer: leaving the website, logging into our bank, and painstakingly typing in a sort code, account number, and reference—all while hoping we don't make a mistake. It’s slow, tedious, and a common source of payment errors.

A pay by bank app scraps that entire manual process. It uses open banking to do the heavy lifting, pre-filling all the payment details with perfect accuracy. The customer is simply guided to their own trusted banking app to approve the payment with a tap. It’s quicker, feels much smoother, and virtually guarantees the money goes to the right place.

How Secure Are These Payments for My Customers?

Payments made this way are incredibly secure, piggybacking on the robust, multi-layered security already built into your customer's banking app. This always includes Strong Customer Authentication (SCA), which usually means using a fingerprint or face scan to confirm it’s really them.

The real security win here is that no sensitive card or account data is ever shared with you, the merchant. The customer authorises the payment from inside their bank's digital fortress, so their details are never exposed.

Think about it: this is miles more secure than asking a customer to read out their card number over the phone or type it into a web form, which are prime targets for fraudsters.

What if a Customer Does Not Have Their Banking App?

That's a fair question, but modern payment systems are designed with this in mind. If a customer initiates a payment on their desktop or simply doesn’t have the mobile app installed, the flow doesn’t just stop.

Instead, the system will smoothly redirect them to their bank's familiar online login portal. They can then authorise the payment securely in a web browser, just as they would when checking their balance. The core open banking security principles remain the same, ensuring a consistent and safe experience no matter the device.

How Quickly Do Businesses Receive the Funds?

In the UK, funds sent via a pay by bank app usually land in your account almost instantly. This is because the payment travels on the Faster Payments Service (FPS), the same 24/7 network that powers everyday bank-to-bank transfers.

This near-instant settlement is a massive leap forward from card payments, which often take days to clear. Getting your money faster dramatically improves business cash flow and makes reconciliation a whole lot simpler. No more waiting and wondering when the funds will finally arrive.

Ready to transform your payment security and customer experience? Paytia provides a PCI DSS Level 1 certified platform that makes adopting pay by bank simple and seamless. Learn how Paytia can modernise your payments today.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.