How to Securely Pay Over the Phone A Complete Guide

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

When you pay over the phone, you’re simply giving a business your credit or debit card details during a call to complete a purchase. This might involve talking to a live agent or punching your details into an automated system (an IVR) using your phone's keypad.

Why Bother With Phone Payments Anymore?

In a world full of one-click checkouts and digital wallets, it’s tempting to write off phone payments as a thing of the past. But for many businesses and their customers, this channel isn't just relevant—it's absolutely essential. The real power of paying by phone comes down to two simple things: accessibility and the human touch.

Think about customers who aren't comfortable with new technology, or someone who needs to talk through a complicated bill before they hand over their money. For them, speaking to a real person provides the confidence that everything is being handled correctly. That direct, human conversation builds a level of trust that a cold, impersonal web form just can't match.

The Human Element in High-Value Transactions

Some transactions are more than just a quick online purchase; they carry real weight and often involve a bit of back-and-forth.

Consider these common scenarios:

- Renewing an insurance policy: A customer will almost certainly have questions about their coverage before they commit to another year.

- Setting up a payment plan: Arranging a custom schedule for a large utility bill isn't something that fits neatly into a standard online checkout. It requires a proper conversation.

- Making a charitable donation: A potential donor often feels more connected and inspired to give when they can speak to a passionate representative from the organisation.

In these cases, the conversation is just as important as the payment itself. The ability to ask questions, clarify details, and get immediate verbal confirmation is a level of service that purely digital channels struggle to replicate.

A Critical Channel with Big Risks

Even with the digital boom, taking payments over the phone is a crucial lifeline for countless UK businesses. It’s particularly common in regulated industries like utilities and insurance, where it still makes up a huge chunk of all transactions. While card payments dominated in 2023, voice-based collections held their ground, proving their lasting importance for companies and consumers alike.

The real challenge isn't whether you should offer phone payments. It's how you can do it without exposing your business to the massive risks of fraud and compliance failures. Getting this wrong can lead to crippling financial penalties and do irreparable damage to your brand.

This guide is built to solve that exact problem. We’ll walk you through the practical steps and technical setups needed to accept phone payments securely and efficiently. By understanding the benefits of secure phone payments and compliance, you can protect your customers, shrink your PCI DSS scope, and keep this vital revenue stream flowing with complete confidence.

Choosing Your Secure Phone Payment Architecture

Deciding how you’ll take payments over the phone isn't just a tech problem to solve; it's a strategic move that shapes your customer experience, operational load, and overall risk profile. The architecture you pick dictates how card data moves—or more importantly, how it doesn't move—through your contact centre. This single decision has a massive impact on your PCI DSS obligations and your vulnerability to fraud.

There are really three main ways to tackle this, each offering a different mix of agent involvement, automation, and security. Getting to grips with them is the first step in figuring out what makes sense for your customers and your business.

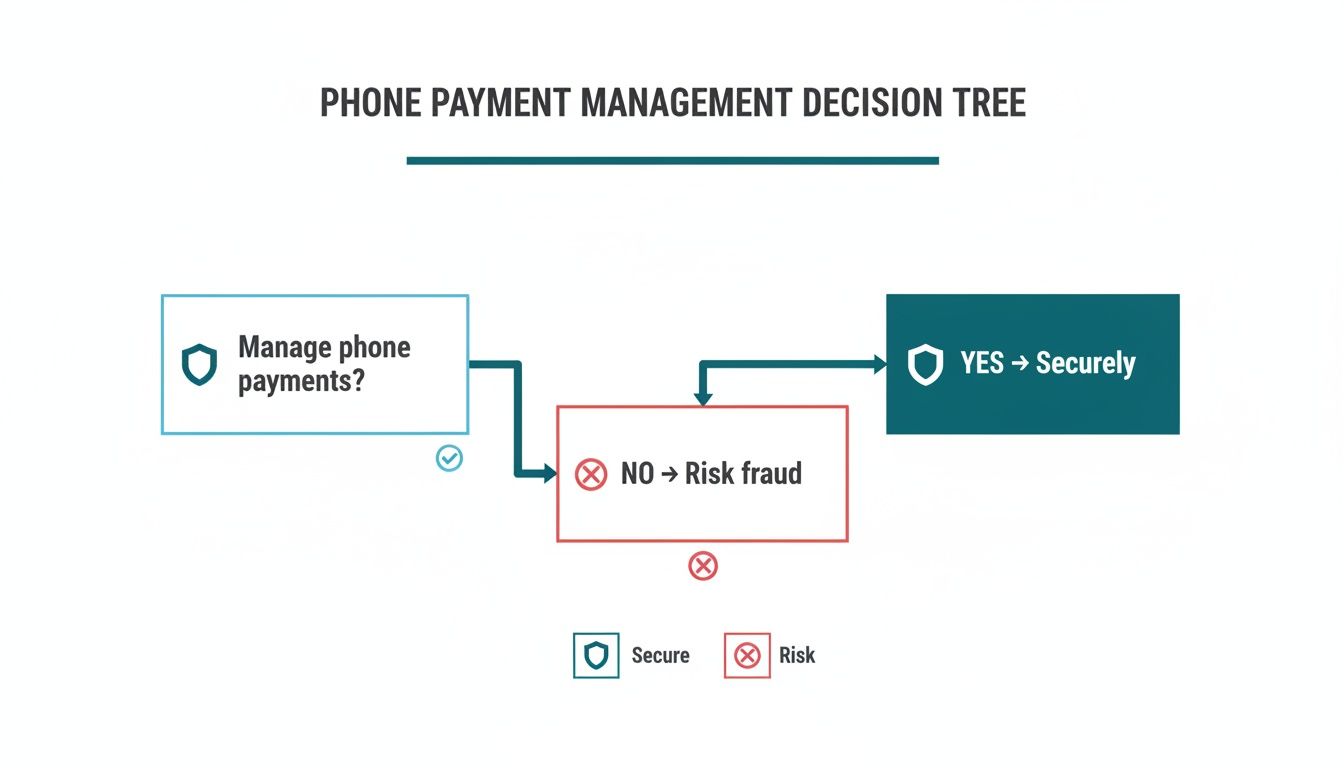

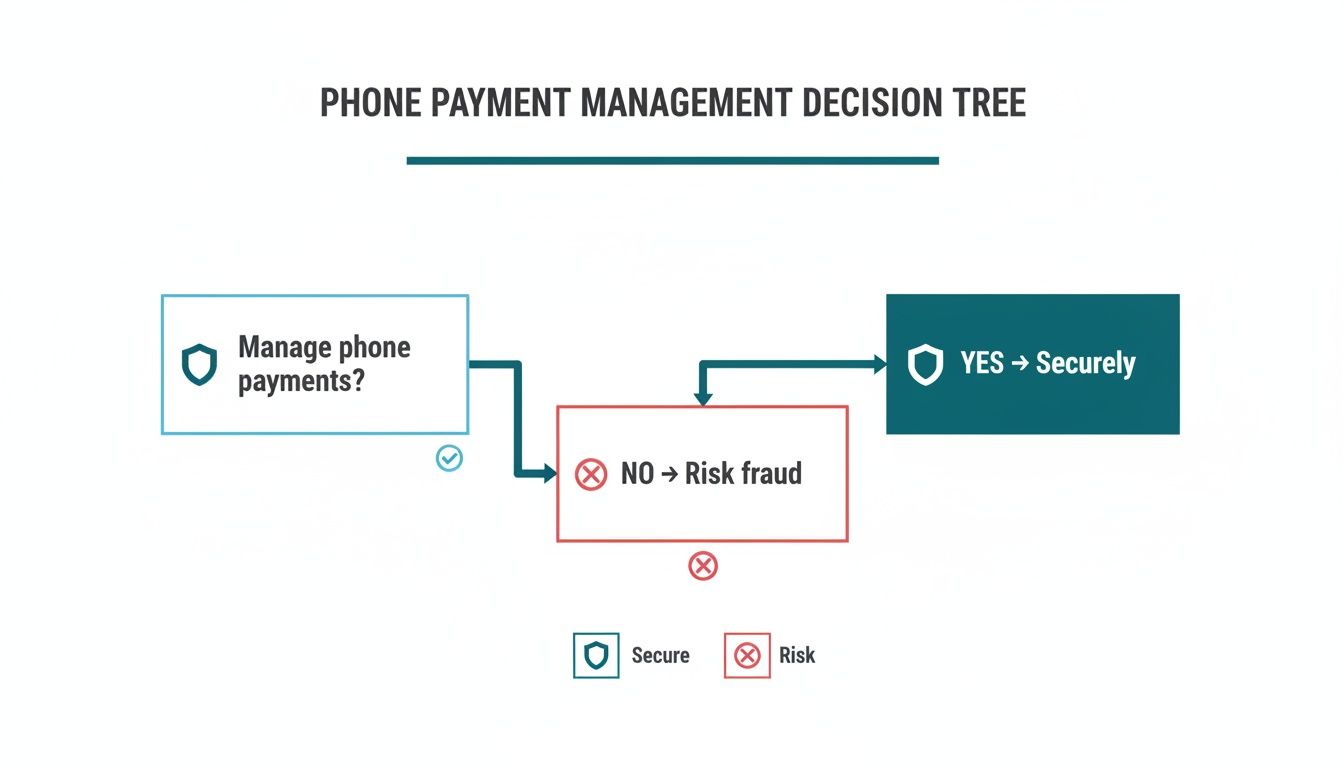

At its core, the choice is simple: either you proactively manage phone payments with a secure process, or you accept the financial and reputational risks of doing nothing.

Ignoring the problem isn’t a neutral stance. It’s an active decision to expose your organisation to serious harm.

Agent-Assisted Payments with DTMF Suppression

For many contact centres, this is the natural first step towards securing phone payments without a complete operational overhaul. The agent stays on the line with the customer for the entire transaction, offering that human touch and guiding them when needed.

Here’s how it works: when it's time to pay, the customer taps their card details into their telephone keypad. This is where the clever bit comes in. DTMF (Dual-Tone Multi-Frequency) suppression technology intercepts these keypad tones. The agent just hears flat, masked beeps, while the sensitive card data is sent straight to the payment gateway, completely bypassing your systems.

This approach is a great fit for:

- Complex or high-value transactions where a customer might need some reassurance.

- Organisations moving away from insecure methods, as it feels very familiar to agents.

- Service-heavy environments like insurance renewals or travel bookings, where the conversation is just as important as the transaction.

The biggest win with DTMF suppression is that sensitive cardholder data—the long card number, expiry date, and CVC—never even touches your contact centre environment. It's kept out of call recordings, off agent desktops, and away from your network. That’s the absolute foundation of reducing your PCI DSS scope.

Automated IVR Self-Service Payments

If your business handles a high volume of predictable, routine payments, an automated Interactive Voice Response (IVR) system is a game-changer. This setup lets customers call in and settle their accounts 24/7 without ever needing to speak to a person. The IVR guides them to enter their account and payment details using their phone’s keypad.

Think of utility companies or subscription services. Customers often just want to pay their monthly bill quickly and move on. An IVR makes that happen. The whole thing is automated, secure, and can handle huge volumes without breaking a sweat.

An IVR payment system really shines when your goal is to:

- Offer around-the-clock payment options for ultimate customer convenience.

- Free up your agents from repetitive payment tasks so they can focus on more complex queries.

- Slash operational costs by automating thousands of simple transactions.

Hybrid Models Using Secure Payment Links

The third option is a smart blend of a real-time conversation and a modern digital payment experience. In this hybrid model, the agent can send a secure payment link directly to the customer's mobile via SMS or email while they're still on the phone together.

The customer simply clicks the link, which opens a secure, branded payment page right on their device. From there, they can type in their card details or use a digital wallet like Apple Pay or Google Pay. The agent often gets a real-time status update on their own screen and can confirm the payment has gone through successfully.

This is a particularly strong approach for:

- Customers who are perfectly happy with digital payments but called for a specific reason.

- Businesses that want to offer a wider range of payment choices, including popular digital wallets.

- Situations where it helps to see a summary, like reviewing an order before finalising the payment.

Comparison of Phone Payment Architectures

To make the choice clearer, here’s a breakdown of how these three architectures stack up against each other. Each has its strengths, and the "best" one really depends on your specific operational needs and customer preferences.

| Architecture Type | How It Works | Best For | PCI-DSS Scope Reduction | Customer Experience |

|---|---|---|---|---|

| Agent-Assisted (DTMF) | Agent stays on the line while the customer enters card details via keypad. Tones are masked from the agent and recordings. | Complex/high-value sales, service-led interactions, first step to securing payments. | Very High: Card data bypasses the entire contact centre environment. | Personal and reassuring, guided by a live agent. Feels traditional and secure. |

| IVR Self-Service | Customer calls an automated line, follows voice prompts, and enters payment details via keypad without an agent. | High-volume, routine payments like bills, fines, or subscription renewals. | Highest: No human involvement. Data goes directly from the customer to the payment gateway. | Fast and efficient for simple tasks. Available 24/7, but lacks a human touch. |

| Hybrid (Payment Links) | Agent sends a payment link via SMS/email during the call. Customer completes payment on their own device. | Customers comfortable with digital channels, offering digital wallet options. | Very High: Payment happens outside the voice channel and agent's desktop. | Modern and flexible, offers choice (card, Apple Pay, etc.). Seamlessly bridges voice and digital. |

Ultimately, there's no single right answer. Each of these models offers a secure and compliant way to handle payments over the phone. The best fit hinges on your customer base, the nature of your transactions, and your business priorities. In fact, many larger organisations find that implementing a mix of these solutions gives them the flexibility to meet every customer's needs.

Implementing Essential Security and Compliance Controls

When you start accepting payments over the phone, you’re suddenly dealing with two massive challenges: iron-clad security and rigid compliance. Get this wrong, and it’s not just a technical headache; you’re risking customer trust and your reputation.

The absolute cornerstone of a secure system is making sure sensitive cardholder data—the full card number, the CVC—never even touches your contact centre environment. I’m not talking about just adding a few more firewalls. This is about completely rethinking your payment workflow to isolate and protect that data from the second a customer starts typing it in. The real goal here is to build a secure bubble around the transaction, keeping your agents, your call recordings, and your internal networks completely out of scope for PCI DSS.

Frankly, the stakes have never been higher. Security breaches in UK phone payments are on the rise, creating a compliance nightmare for contact centres. UK Finance reported a shocking 15% jump in card-not-present fraud from voice channels in 2022. That’s costing businesses an incredible £1.2 billion every single year.

This risk is only made worse by old habits, like agents still asking for full card details verbally—a huge problem when you consider the 75.5 billion off-net mobile call minutes where these payment conversations often happen.

Core Technologies for Bulletproof Security

To properly de-risk your contact centre, you need a defence built on a few key technologies. These aren't just buzzwords; they are proven controls that work together to intercept and shield payment data before it ever becomes a liability.

DTMF (Dual-Tone Multi-Frequency) Suppression: This is the foundation. When a customer uses their telephone keypad to enter their card number, DTMF suppression grabs those tones and masks them with a single, flat beep. Your agent stays on the line to help, but they never hear or see the actual digits.

Channel Separation: This is a simple but powerful idea: the voice conversation and the payment data travel on separate, isolated paths. The agent's conversation carries on as normal, but the DTMF tones holding the card data are rerouted straight to a secure payment platform, completely bypassing your own telephony systems.

End-to-End Encryption (E2EE): From the moment the customer’s keypad tones are captured until they hit the payment gateway, that data has to be encrypted. E2EE ensures that even if someone managed to intercept the data, it would be completely unreadable and useless.

Tokenization: After a successful transaction, the payment platform swaps the sensitive card number (the PAN) for a unique, non-sensitive identifier called a "token." This token can be safely stored in your CRM to handle things like recurring payments or refunds, all without ever keeping the actual card details on file.

When you combine these controls, you create an environment where cardholder data is essentially invisible to your entire organisation. It never shows up on an agent's screen, never gets saved in call logs, and never crosses your internal network. This is how you achieve a radical reduction in your PCI DSS scope.

The Power of Drastically Reducing PCI DSS Scope

Let’s be honest, achieving and maintaining PCI DSS compliance can be an operational nightmare. The audits are expensive, long, and complicated, pulling in massive effort from IT, security, and operations teams. A vital piece of this puzzle involves [achieving PCI DSS compliance and ISO certifications](http://redchip.com.ph/ISO and PCI DSS.html), which really sets the standard for managing information security properly.

But when you stop card data from ever entering your environment, you effectively take that entire environment out of the PCI audit scope. For most contact centres, we’re talking about a scope reduction of over 90%.

That translates into very real business benefits:

- Simpler Audits: Instead of checking hundreds of controls across your whole network, your audit focuses almost entirely on your third-party payment provider's compliance.

- Lower Costs: The money you spend on annual audits, penetration tests, and maintaining secure infrastructure drops dramatically.

- Reduced Risk: Your organisation is no longer a juicy target for data thieves, because you simply don't hold the data they're after.

If you want to get into the nuts and bolts of how the technology works, you can learn more about what DTMF masking is and see how it operates in a live contact centre. It's the engine that makes all of this possible.

Ultimately, putting these controls in place isn't just about ticking a compliance box. It’s about building a fundamentally safer, more resilient payment operation that protects your customers, your brand, and your business.

Your Integration and Deployment Playbook

Switching to a new, secure way to pay over the phone can feel like a huge undertaking. It's easy to get bogged down in the details. But with a solid playbook, you can break it down into manageable steps. Success here isn’t just about the tech—it's about getting your people, processes, and platforms all moving in the same direction right from the start.

This journey begins well before you install a single piece of software. The first, and arguably most important, phase is getting enthusiastic buy-in from across the business. This means pulling your IT, compliance, and operations teams into the discussion from day one. Each group brings a vital perspective to the table.

Your IT team is going to be focused on technical feasibility, security protocols, and what resources they need to commit. The compliance folks will be zeroed in on how this solution impacts your PCI DSS scope and data protection obligations. And your operations team? They need to know how the new workflow will affect agents and the customer experience. Getting everyone aligned early on saves a world of headaches later.

The Technical Integration Phase

Once you have the green light internally, the real technical work can kick off. As you build out your playbook, starting with a good understanding of system integration principles is key to making sure everything runs smoothly. A modern secure payment solution is designed to plug into what you already have, not force a complete overhaul.

You'll typically be looking at three primary integration points:

- Telephony (PBX/VoIP): This is the big one. The payment solution has to talk to your phone system to intercept DTMF tones or manage call flows for things like IVR payments.

- Customer Relationship Management (CRM): Linking the payment platform to your CRM is a game-changer for your agents. It creates a unified desktop where they can start a payment and see its status in real-time, all without leaving the customer's record. No more tedious manual entry.

- Payment Gateways: Your chosen solution acts as a secure go-between for you and your payment gateway. This connection is essential for actually processing the transaction and making sure the money settles correctly. For a deeper dive, check out our guide on payment gateway API integration which gets into the technical nuts and bolts.

This phase is all about close collaboration between your IT team and the provider's technical experts. Clear communication and a shared project plan aren't just nice-to-haves; they're absolutely essential for a smooth rollout.

Piloting and Training for Success

Before you flip the switch for everyone, running a controlled pilot programme is a must. This isn't just a final tech check. It's your first real chance to see how the new process works in the wild and gather feedback from both agents and customers.

Pick a small, representative group of agents to be your pilot team. These agents will become your internal champions, and their hands-on feedback on the new workflow is invaluable. Keep a close eye on metrics like average call handling time, payment success rates, and any hiccups customers experience along the way.

A common mistake is to treat agent training as a simple software tutorial. Effective training must focus on the ‘why’ behind the change—explaining how the new system protects both the customer and the business.

Your training sessions need to be comprehensive and interactive. Use role-playing to walk agents through different scenarios, from a simple, successful payment to handling a declined card. Make sure they have simple, clear language to explain the new, secure process to customers. When agents are confident, customers feel more at ease.

Planning the Full-Scale Rollout

With a successful pilot in the bag and your training materials fine-tuned, you're ready for the main event. A phased rollout is almost always the smartest approach. You could start with a single team or department before expanding it across the entire contact centre.

This staggered method lets you manage the change without overwhelming your support resources. As you roll out and even after you're fully live, keep the feedback channels wide open. Regular check-ins with team leaders and agents will help you spot any new issues and find ways to keep making the process better. By following this playbook, you'll ensure your move to secure phone payments is not just a technical success, but a strategic win for the whole business.

Optimising Operations and Measuring Success

Getting your secure system to pay over the phone up and running is a huge step, but it’s really just the beginning. The real magic happens when you shift your mindset from deployment to continuous optimisation. This is about more than just processing payments; it’s about digging into the data, tweaking your workflows, and proving the system is actually delivering a return on investment.

Without solid metrics, you're essentially flying blind. You can't spot where things are slowing down, nor can you show the positive impact on your bottom line. The goal is to create a feedback loop where performance data directly informs how you operate, leading to happier customers and healthier financials.

This focus is more important than ever. While secure phone payments are taking off in UK contact centres, voice is still a critical channel for high-stakes transactions like insurance claims or utility bills, making up about 8-10% of these interactions. And while cash payments have seen a surprising resurgence after a decade of decline, cards are still king.

Phone payments act as a vital bridge, especially for customers who aren't glued to their mobile wallets. In fact, only 38% of people aged 35-44 are registered for mobile wallet alternatives, compared to 54% of 16-24 year-olds. You can get a better sense of the UK mobile payments market and where it's heading from recent industry analysis.

Key Performance Indicators to Track

To get a real handle on performance, you need to be tracking the right Key Performance Indicators (KPIs). These numbers give you a clear, honest look at both how efficiently your team is working and how satisfied your customers are.

Your KPI dashboard should absolutely include:

- Payment Success Rate: This is your bread and butter. What percentage of payments go through successfully on the first attempt? A low rate here could point to anything from a dodgy payment gateway integration to confusing instructions for the customer.

- Average Handling Time (AHT) for Payment Calls: How long is an agent tied up processing a single payment? A well-integrated, secure system should slash this number by getting rid of manual data entry and clunky processes.

- First Call Resolution (FCR) for Payments: Is the customer’s payment issue sorted in one go? A high FCR is one of the best signs of an efficient process and a great customer experience.

- Agent Utilisation: With automated IVR or payment link options handling the simple stuff, your agents should have more time for complex, valuable conversations. Tracking this helps you quantify just how much time you’re giving back to your team.

Tracking these KPIs isn't just about generating reports to file away. It's about using the data to ask tough questions. If AHT is creeping up, is it a training issue? If success rates dip at a certain time of day, is there a problem with a specific card issuer?

An Operational Checklist for Ongoing Management

Optimisation isn't a "set it and forget it" task. It requires a structured, consistent approach. A simple operational checklist ensures nothing falls through the cracks and keeps your team in a constant state of improvement.

Think of it as embedding a rhythm of review and refinement into your daily operations.

Weekly Team Huddles

- Get the team together and pull up the KPI dashboards.

- Talk about any weird spikes or dips from the past week.

- Ask your agents directly: What’s working? What's a pain point? Their front-line feedback is gold.

Monthly Performance Reviews

- This is your chance to go deeper into the data. Look at success rates by agent, payment type, or even time of day.

- Listen to a few call recordings (the non-sensitive bits, of course) to hear how the payment process is actually being handled. Is it smooth? Awkward?

- Pinpoint opportunities for a bit of extra coaching for an agent or a small tweak to the process.

Quarterly System Health Checks

- Get your IT team and your solution provider in a room (virtual or otherwise). Review system performance, integration stability, and uptime reports.

- Make sure all your software is up-to-date and that you’re actually using any new features that have been rolled out.

- Revisit your security protocols. Double-check that your PCI DSS scope reduction is still valid and properly documented.

By making these practices a regular part of how you work, your payment system evolves from a simple tool into a genuine strategic asset. You’ll not only maintain a secure and compliant setup but also drive real improvements in efficiency, cost, and the overall customer journey.

Frequently Asked Questions About Taking Payments Over the Phone

Even with the best strategy in place, questions always crop up when you’re rolling out a new way to pay over the phone. We’ve been there. So, we've gathered some of the most common queries we hear from enterprise teams and answered them directly, based on our experience in the field.

Think of this as a quick reference to clear up any lingering doubts about the tech, the compliance, or the day-to-day operations.

How Does DTMF Suppression Actually Work?

DTMF (Dual-Tone Multi-Frequency) suppression is a clever bit of technology that intercepts the tones a customer presses on their keypad before they ever reach your agent or your call recording system.

When a customer starts typing in their card number, a secure platform grabs those tones directly and masks them. All your agent hears is a flat, monotonal sound—a simple beep—to confirm an entry was made. The sensitive data itself is immediately whisked away to the payment gateway through a fully encrypted channel.

The result? That sensitive card data never even touches your contact centre environment. It stays off agent desktops and out of your network, which is hands-down the most effective move you can make to shrink your PCI-DSS scope.

Can We Plug a Secure Payment System into Our Existing CRM?

Yes, absolutely. In fact, you should insist on it. Modern secure payment platforms are built from the ground up to integrate with major CRMs, ERPs, and of course, the leading PBX, VoIP, and CCaaS telephony systems.

This kind of integration is what stitches everything together into a seamless workflow. Your agent can trigger a payment request right from the customer’s record in your CRM, and the transaction status gets updated automatically the second it’s done. This completely gets rid of manual data entry, which is a huge source of human error and a real drag on efficiency.

What's the Difference Between PCI Scope Reduction and Being Compliant?

This is a really important distinction, and it’s one that often causes confusion. Being PCI compliant means your organisation ticks all the necessary boxes required by the Payment Card Industry Data Security Standard (PCI DSS). It's an ongoing, active commitment.

Scope reduction, on the other hand, is about strategically shrinking the parts of your business that handle or have access to cardholder data. By using tech like DTMF suppression, you stop that sensitive data from ever entering your infrastructure in the first place. This can slash the number of PCI DSS controls you need to prove you're meeting each year, cutting the cost, complexity, and time spent on your annual audit by as much as 95%.

How Does an Automated IVR Payment System Help the Customer?

An automated IVR payment system gives your customers the ability to pay whenever they want, 24/7. They don't have to wait in a queue or call back during business hours. That kind of convenience is a massive win for customer satisfaction.

It also offers a completely private and secure way to pay, as customers are interacting directly with an automated system, not a person. For many, this builds a huge amount of trust. And on your side, it frees up your skilled agents from taking routine payment calls, letting them focus on sorting out more complex customer problems where they can add real value.

Ready to secure your phone payments and slash your PCI DSS scope? The Paytia Secureflow platform offers a comprehensive suite of tools, from agent-assisted DTMF suppression to fully automated IVR and secure payment links. Discover how we can protect your business and delight your customers at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.