3DS2 Authentication Guide 2026

Get 3DS2 Integration Help

Implement 3DS2 authentication with Paytia's secure payment solutions.

Think of 3D Secure as the digital equivalent of a bank asking for your PIN at an ATM. It’s that extra security check to prove you really are who you say you are when buying something online. This crucial security layer protects both you and the merchant from the headache of online fraud.

What Is 3D Secure Authentication

At its heart, 3D Secure (3DS) is a security protocol built to stop fraud in online credit and debit card payments. It adds a vital step where your identity is verified by the card networks themselves, like Visa (Visa Secure) and Mastercard (Mastercard Identity Check).

This process is like a digital handshake between everyone involved, making sure the person typing in the card details is the actual owner. It was designed specifically to fight Card-Not-Present (CNP) fraud—the all-too-common scenario where a criminal uses stolen card details to make purchases. The fact that the global 3D Secure market was valued at $1.10 billion in 2022 tells you just how essential it has become in modern commerce.

The Three Domains of Security

So, what does the “3D” actually stand for? It’s not about graphics; it refers to the three distinct domains, or parties, that work together during the authentication check. Understanding these roles is the key to seeing how it all fits together.

- The Issuer Domain: This is simply the bank that issued your credit or debit card. They’re responsible for checking that you are, in fact, you.

- The Acquirer Domain: This is the merchant’s side of the equation—their business bank and payment processor. They are the ones requesting the security check to make sure the sale is legitimate.

- The Interoperability Domain: This is the clever bit of infrastructure, run by the card scheme (like Visa or Mastercard), that securely connects the other two domains. Think of it as a secure courier, passing messages between the merchant and your bank.

By linking these three domains, 3D Secure creates a closed loop of verification. It’s like having the customer, the shop, and the bank's security guard all in the same room confirming the purchase is valid before any money changes hands.

This table shows the clear difference between a standard online payment and one protected by 3D Secure.

Standard vs 3D Secure Authenticated Payments

| Feature | Standard Card Payment | 3D Secure Authenticated Payment |

|---|---|---|

| Verification Method | Relies on card details (number, expiry, CVV) | Adds a layer of authentication with the cardholder's bank |

| Data Exchange | Basic transaction data sent to the payment gateway | Rich data is shared between merchant, issuer, and acquirer |

| Authentication Step | None beyond basic card info | Cardholder identity is verified via a challenge (e.g., OTP) or frictionless flow |

| Liability for Fraud | Typically rests with the merchant | Shifts from the merchant to the card-issuing bank |

| Fraud Risk | Higher, as it relies on static, stolen information | Significantly lower due to dynamic identity verification |

As you can see, 3D Secure introduces a robust verification process that makes every transaction safer.

How It Protects Businesses and Customers

This collaborative security model offers a win-win. For customers, it’s an extra shield, making it much harder for thieves to use stolen card details for unauthorised purchases. It gives you peace of mind that your bank is actively double-checking things behind the scenes.

For merchants, the main benefit is a powerful protection called liability shift. When a transaction is successfully authenticated using 3D Secure, the financial responsibility for any fraudulent chargebacks typically moves from the merchant to the card-issuing bank. This dramatically cuts the financial risk of taking payments online and helps build a more trustworthy e-commerce environment for everyone.

The Evolution from 3DS1 to 3DS2

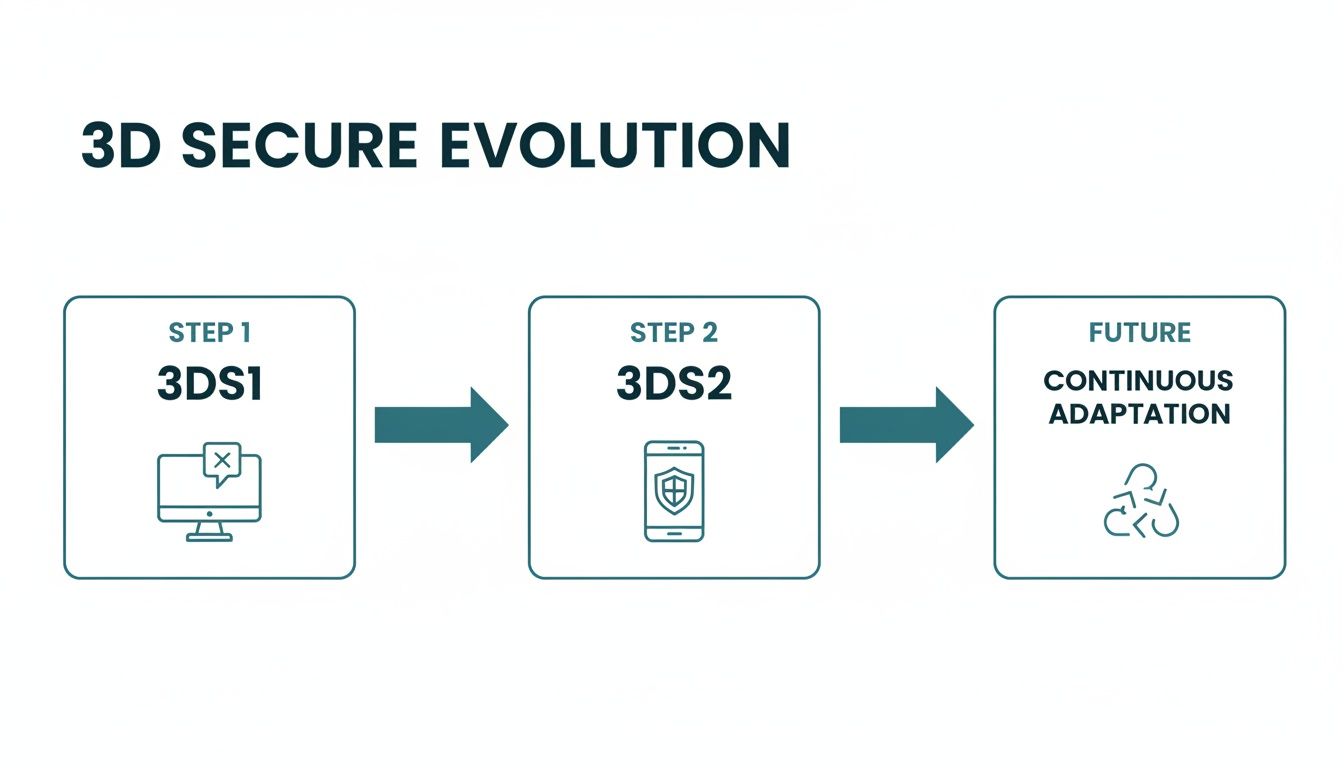

The story of 3D Secure authentication is one of moving from a well-intentioned but often clumsy security measure to the smarter, more customer-friendly system we have today. The original version, 3DS1, was a genuine attempt to tackle the growing problem of online fraud.

However, if you’ve ever been abruptly redirected to a clunky, bank-branded pop-up window during checkout, asking for a password you barely remember setting up, you’ve experienced 3DS1 firsthand. It wasn't exactly a smooth experience.

This sudden redirect was a massive point of friction. It interrupted the checkout flow, looked suspicious to many shoppers, and was terribly optimised for the growing wave of mobile commerce. The result? High cart abandonment. Businesses were losing sales not over price or product, but because the final security step was just too much hassle.

The Need for a Smarter Approach

It was crystal clear that a new solution was needed—one that could provide rock-solid security without torpedoing the customer experience. The world was going mobile, and payment security had to catch up. This pressure is what drove the development of 3D Secure 2 (3DS2).

3DS2 was rebuilt from the ground up, designed specifically for how we pay now—online and on our phones. Its main goal was to make the authentication process as invisible as possible, creating what we now call the frictionless flow.

Think of 3DS1 as a security guard who stops and questions every single person entering a building, no matter who they are. 3DS2 is the upgraded, smarter guard who recognises the regulars and waves them through, only stopping an unfamiliar face for a quick ID check.

This new, risk-based approach completely changed the game, moving from an active, in-your-face verification to a passive, background analysis.

This screenshot shows a typical 3DS1 verification page—a common sight that often caused confusion and frustration for online shoppers.

The pop-up window, often with inconsistent branding, would disrupt the user's journey and directly contribute to lost sales for merchants.

How 3DS2 Creates a Seamless Experience

The magic behind 3DS2's frictionless flow is all about data. Where 3DS1 only looked at a few basic details, 3DS2 can securely share over 100 different data elements between the merchant and the customer's bank to assess the risk.

This rich data paints a detailed picture, helping the bank make a highly accurate decision in milliseconds. Key data points often include:

- Device Information: Is the customer using a recognised phone or laptop?

- Transaction History: Does this purchase fit their usual spending habits?

- IP Address and Geolocation: Is the payment coming from a familiar location?

- Browser Details: Things like language, time zone, and screen resolution help build a digital fingerprint.

By analysing this wealth of information quietly in the background, the card issuer can approve the vast majority of legitimate transactions without ever interrupting the customer. This intelligent risk analysis is the heart of modern 3D Secure authentication; it delivers security that works with the user, not against them.

For those interested in the financial protections offered, you can learn more about how the 3DS2 liability shift benefits merchants in our detailed guide. This evolution not only boosts conversion rates but also builds customer trust by providing a secure yet effortless checkout process.

How 3D Secure Authentication Actually Works

To really get what 3D Secure authentication is doing, you have to look under the bonnet. The whole process is over in milliseconds, but behind the scenes, a pretty sophisticated sequence of events makes sure every payment is verified and legitimate.

Think of it like a highly secure courier service. Its only job is to get a payment request safely from the merchant to the customer's bank and back again, without any hiccups. This all happens thanks to a few key players working in perfect harmony.

The diagram below really captures the jump from the clunky pop-ups we all remember from 3DS1 to the slick, data-driven approach of its successor, 3DS2.

As you can see, the whole point of the evolution was to make the experience better, especially on mobile, by pushing the security checks into the background where they belong.

The Key Players in the Process

Let's follow a single transaction to see how it works. We need to meet the main components of the 3D Secure system first. Each has a specific job to do, routing the authentication request to the right place and getting a clear, trusted answer.

- Merchant Plug-In (MPI): This is the starting line. When a customer clicks "pay," the merchant's e-commerce platform or payment gateway fires up the MPI, which bundles up all the transaction details and sends them off for checking.

- Directory Server (DS): This is the central sorting office, run by the big card schemes like Visa or Mastercard. Its job is to look at the request from the MPI, check the card number, and route it to the correct bank.

- Access Control Server (ACS): This is the final stop and the brain of the whole operation. It’s run by the customer's own bank—the one that issued the card. The ACS is what analyses all the data and makes the final call on whether the transaction looks genuine.

You could think of the Directory Server as a postal sorting office that knows exactly which bank’s security team (the Access Control Server) needs to inspect the package. The ACS then effectively opens the package, checks everything against its records, and gives the final thumbs up or down.

The Frictionless Flow in Action

The holy grail for 3DS2 is the frictionless flow. This is where authentication happens so smoothly that the customer doesn't even know it’s there. In fact, over 90% of 3DS2 transactions go down this seamless path.

Here’s a step-by-step look at what’s happening in those few milliseconds:

- A customer enters their card details on your site and hits the pay button.

- Your MPI sends a request to the Directory Server packed with over 100 data points—things like device ID, IP address, shipping details, and even purchase history.

- The DS instantly forwards this rich data packet to the customer’s bank and its Access Control Server.

- The ACS analyses all that data. If it all looks consistent with the customer's usual behaviour, it gives the transaction an immediate green light.

- That approval zips straight back through the DS to you, the merchant, and the purchase is complete.

This whole dance happens completely out of sight, securing the transaction without adding a single extra step for the customer. For anyone integrating this, understanding how a payment gateway API integration facilitates this data exchange is crucial for a smooth setup.

The Challenge Flow: When More Proof Is Needed

So, what happens if the ACS isn't 100% convinced? If a transaction seems a bit out of the ordinary—maybe the customer is using a new device, shipping to a new address, or making an unusually large purchase—it triggers a challenge flow.

This is just a polite way of asking for a little more proof that the cardholder is who they say they are. Instead of an instant approval, the ACS will prompt the customer for an extra piece of information.

The most common challenges you’ll see are:

- Entering a one-time password (OTP) that’s just been sent to their phone.

- Tapping to approve the payment within their mobile banking app.

- Using a biometric identifier like a quick fingerprint or facial scan.

Once the customer provides that extra bit of proof, the transaction is approved and sails through. This challenge step is the very heart of Strong Customer Authentication (SCA), making sure that even higher-risk payments are buttoned up tight.

UK merchants, in particular, have seen huge benefits from this, with the country accounting for 30% of Europe's entire 3DS demand. By 2024, an impressive 65% of merchants globally had adopted 3DS2, with UK success rates setting the benchmark for the rest of the world.

How 3DS Plugs Directly into SCA Compliance

Understanding 3D Secure is one thing. Realising its central role in modern payment rules is what elevates it from a 'nice-to-have' security feature to an absolute business necessity. For any merchant in the UK and Europe, 3D Secure 2 (3DS2) isn't just a good idea; it's the main piece of tech that makes compliance with Strong Customer Authentication (SCA) possible.

SCA is the regulatory muscle that came out of the Second Payment Services Directive (PSD2). Its goal is straightforward: make online payments safer by demanding more proof of identity. Think of it as a digital doorman who needs to see at least two forms of ID before letting a payment go through.

This isn't an optional extra. The UK fully enforced SCA by the end of 2020, which meant almost every online transaction had to pass this higher security check. By January 2021, card issuers started flat-out rejecting payments that weren't authenticated with 3DS2, forcing the industry to adapt quickly. This is where modern solutions like tokenisation and robust encryption also play a part, helping businesses meet these tough standards and slash their PCI-DSS scope by as much as 90-95%. You can see how the market has evolved in response to these regulations in this 3D Secure market report.

The Three Pillars of Strong Customer Authentication

The rules of SCA are very specific. They demand that authentication is proven using at least two out of three separate factors. This is precisely where the 3DS2 "challenge" flow lines up perfectly with the law.

The three factors are:

- Knowledge: Something only the user knows (like a password or PIN).

- Possession: Something only the user has (like their phone for receiving a one-time code).

- Inherence: Something the user is (like a fingerprint, face scan, or voiceprint).

When a customer faces a 3DS2 challenge, they are explicitly asked to provide proof from two of these categories. A classic example is approving a purchase in a banking app on your phone (Possession) by scanning your fingerprint (Inherence). This simple action ticks two boxes and satisfies the SCA mandate, making 3DS2 the default tool for compliance.

The Power of the Liability Shift

Beyond just ticking a compliance box, using 3DS correctly brings a huge benefit for merchants: the liability shift. This is a powerful financial protection that flips the script on who pays for fraudulent chargebacks.

Normally, if a customer claims a transaction was fraud, the merchant is on the hook for the loss. For businesses handling lots of payments, this can quickly add up to a serious financial headache.

With liability shift, if a payment is properly authenticated through 3D Secure but later turns out to be fraudulent, the financial responsibility "shifts" from you, the merchant, to the bank that issued the card. This gives every business a massive incentive to get their authentication right.

This single feature completely changes the risk game for online commerce. It means that by taking the right steps to confirm your customer's identity, you’re not just protecting them—you're protecting your own revenue from the most common types of online fraud. For a deeper dive into how security protocols like 3D Secure fit into the bigger picture, a complete guide to fintech software development can show how these measures are woven into the very fabric of modern financial systems.

Using 3D Secure in Omnichannel Payments

While 3D Secure authentication was born in the world of online shopping carts, its real power today extends far beyond a website’s "buy now" button. Customers now expect to pay securely and easily whether they're on a phone call, in a web chat, or messaging your business.

This immediately raises a critical question: how do you apply a screen-based security tool to a voice-based channel like a contact centre? The answer isn’t to force old methods to work but to bridge these channels with modern payment solutions that create a secure, hybrid journey.

Blending Human Interaction with Digital Security

Picture a customer on the phone with a contact centre agent, ready to pay a bill or finalise a purchase. In the past, this meant the customer had to read their card numbers aloud—a process riddled with risk, creating a massive PCI DSS compliance headache and exposing sensitive data.

Modern systems flip this outdated process on its head. The agent never needs to hear or handle any card details. Instead, they simply trigger a secure payment process right from their desktop.

This is where the magic happens. The agent sends a secure payment link directly to the customer’s mobile phone via SMS or to their email. The customer then opens that link on their own trusted device, entering their payment details and completing the 3D Secure authentication in a private, secure web environment.

This simple but incredibly effective workflow solves several key problems all at once.

The Hybrid Payment Journey Explained

This omnichannel approach cleverly separates the conversation from the sensitive payment process. It’s a concept known as channel separation, and it ensures cardholder data never even enters the contact centre's environment, drastically reducing PCI DSS scope and risk.

Here’s a breakdown of how it works in practice:

- The Conversation: The agent and customer discuss the order or payment on a phone call, video chat, or web chat.

- The Secure Handoff: The agent initiates a payment request, sending a unique, single-use link to the customer's device.

- The Private Authentication: The customer clicks the link, which opens a secure payment page. Here, they complete the transaction, including any 3DS challenge, entirely on their own screen.

- The Confirmation: The agent gets a real-time notification that the payment was successful, allowing them to wrap up the call professionally without ever touching sensitive data.

Securing Recurring Payments with Tokenization

This process also works perfectly with tokenization. During that first secure transaction, the customer's card details are captured by the payment gateway and swapped for a unique, non-sensitive token.

This token can then be used for all future recurring payments or subscriptions without your systems ever needing to store the raw card number. Combining a secure payment link for the initial setup and tokenization for subsequent charges gives you a complete, compliant solution for the entire customer payment lifecycle. Businesses can learn more about setting up these user-friendly flows by exploring options for secure web payments that integrate these technologies.

The results speak for themselves. In the UK, the rollout of 3DS 2.0 has been a game-changer for fraud reduction, especially with SCA requirements now governing around 80% of transactions. For instance, transactions using Visa Secure show fraud rates a staggering 70% lower than non-3DS payments. For any business processing remote payments, it's clear that 3DS is now a cornerstone of modern economic crime prevention. You can learn more about how 3DS has impacted the UK payment landscape on Fortune Business Insights.

Best Practices for a Smooth Authentication Experience

Putting 3D Secure authentication in place is more than just a technical tick-box exercise. It's about designing a payment journey that feels both safe and completely painless for your customers. Nailing this balance is absolutely vital for keeping conversions high and earning long-term trust.

The real trick is to stop thinking about just having 3DS, and start thinking about how to use it smartly.

By far, the most powerful strategy is to send as much rich, high-quality data as you can with every single transaction. Think of it as giving the customer’s bank a detailed, trustworthy story about the purchase they're trying to make. When an issuing bank gets a full picture—things like device ID, shipping address, and the customer's purchase history—its risk engine is far more likely to give the payment an immediate green light, skipping a challenge that might just cause the customer to give up.

Keep an Eye on Your Flows and Tweak as You Go

You can't fix what you don't measure. Diving into your payment data regularly is the only way to spot and smooth out the rough patches in your authentication process.

- Track Your Authorisation Rates: Keep a close watch on your approval and decline rates. If you see a sudden drop, it could be a red flag for an issue with the data you're sending, or perhaps a problem with a specific bank.

- Analyse Decline Codes: A declined payment isn't just a lost sale; it's a clue. Dig into the specific decline codes from your payment gateway. They tell you why a transaction failed, giving you the breadcrumbs you need to fix the root cause.

- Slice and Dice Your Data: Look at how you're performing across different countries, card types, and even transaction values. This can uncover patterns, like a certain bank being a bit more sensitive to challenges, which lets you fine-tune your approach for them.

A seamless and secure online payment experience also relies on implementing comprehensive website security best practices. While 3D Secure protects the transaction, the overall security of your digital environment is what builds complete customer confidence from start to finish.

Talk to Your Customers Clearly

When a challenge step is simply unavoidable, clear communication changes everything. Let's be honest, many customers still aren't familiar with the 3D Secure authentication dance, and a sudden pop-up asking for a code can feel jarring or even suspicious if it's not handled well.

Give your customers a heads-up by explaining why they're being asked for an extra step. A simple message on your checkout page, something like, "For your security, your bank may ask you to verify this payment," can manage expectations and lower the anxiety.

This small touch turns a potential point of friction into a moment of reassurance. It shows you're taking their security seriously and leads to a much smoother, and more successful, transaction.

Frequently Asked Questions About 3D Secure

To wrap things up, let's tackle some of the most common questions businesses and their customers have about 3D Secure authentication. Getting these answers straight helps clarify its role in everyday transactions and reinforces why it's such a vital part of modern commerce.

Is 3D Secure Authentication Mandatory in the UK?

For the vast majority of online and remote electronic payments, the answer is yes. In the UK, using 3D Secure is effectively mandatory because of the Strong Customer Authentication (SCA) regulations under PSD2.

Since 3D Secure 2 (3DS2) is the main method banks and payment providers use to comply with these rules, any transaction that skips it is almost certain to be declined by the customer's bank. While some low-risk or specific recurring payments might get an exemption, applying 3DS is the standard for compliant and successful transactions.

Can 3D Secure Be Used for Phone Payments?

Not directly over a traditional voice call. These Mail Order/Telephone Order (MOTO) transactions are considered out of scope for SCA. However, you can absolutely integrate 3D Secure authentication into a phone interaction by using a modern, omnichannel payment flow.

For example, an agent can send a customer a secure payment link via SMS or email while they're on the call. The customer simply opens the link on their device and completes the payment in a secure browser, which triggers the 3DS process. This keeps the transaction secure, compliant, and completely out of your contact centre’s scope.

This hybrid approach blends the personal touch of an agent-led conversation with the robust, automated security of 3D Secure. Crucially, it ensures payment data never even enters the agent's environment, protecting both the customer and the business.

What Is the Difference Between a Frictionless and Challenge Flow?

A frictionless flow is the ideal outcome with 3DS2. This is when the customer's bank can approve the transaction instantly using background data—like device info, location, and purchase history—without the customer having to lift a finger.

A challenge flow happens when the bank needs a bit more proof. The customer is then 'challenged' to verify they are who they say they are, usually by entering a one-time code sent to their phone or using a biometric like a fingerprint. The whole point of 3DS2 is to make the frictionless flow happen as often as possible to keep things smooth for the customer.

Does Using 3D Secure Protect Me from All Chargebacks?

No, but it gives you incredibly powerful protection against fraud-related chargebacks thanks to the liability shift. If a transaction is authenticated with 3D Secure and a customer later claims it was fraudulent, the financial liability typically shifts from you (the merchant) to the card-issuing bank.

However, it won't protect you from chargebacks for other reasons, like disputes over product quality or non-delivery. Think of it as a critical tool against fraud, not a blanket guarantee against all disputes.

At Paytia, we specialise in integrating secure, compliant payment solutions into your existing workflows, including omnichannel 3D Secure authentication for contact centres. Our Secureflow platform ensures you can accept payments safely across voice, chat, and digital channels while drastically reducing your PCI DSS scope. Discover how we can help you build trust and improve your payment success rates at https://www.paytia.com.

Ready to Implement 3DS2?

Get expert help implementing 3DS2 authentication. Contact Paytia today.