What Is a Bank Reference Number and Why Does It Matter?

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think of a bank reference number as the unique tracking code for your money. Just like a parcel number follows a package from the warehouse to your doorstep, this string of digits follows a financial transaction from the sender all the way to the recipient.

It’s the critical piece of information that makes sure your payment lands in the right place and gets matched to the correct invoice or account. Without it, financial tracking would be a messy, confusing, and highly error-prone headache.

The Role of a Bank Reference Number Explained

Remember the last time you bought something online? That confirmation email came with an order number, didn't it? It’s what you and the seller both use to pinpoint that specific purchase out of thousands. A bank reference number does the exact same job, but for money. It’s the single piece of data that connects a payment to its purpose.

This identifier is absolutely fundamental for creating a clean and clear audit trail. When a customer pays an invoice, the reference number they include—often the invoice number itself—is the crucial link. It tells the business’s finance team exactly which debt has been paid off, paving the way for smooth and often automated account reconciliation.

Why This Identifier Is So Important

At its core, a bank reference number provides two things: clarity and context. It answers the simple but vital question, "What is this payment for?" This straightforward function prevents a whole host of problems, from funds being applied to the wrong account to long, drawn-out customer service calls.

For any business juggling more than a handful of payments, trying to match them using just a name or the amount paid is a recipe for disaster.

A well-managed bank reference number system is the bedrock of efficient financial operations. It turns what could be a confusing flood of anonymous payments into a tidy, organised, and easily searchable record of every transaction.

Let's break down its core jobs:

- Payment Matching: It directly ties an incoming payment to a specific invoice, customer account, or order. No more guesswork.

- Dispute Resolution: If a customer ever questions a payment, the reference number lets your support team find that exact transaction in seconds.

- Financial Auditing: It creates an unambiguous record, making life much easier for accountants trying to verify financial statements and prove compliance.

Ultimately, this string of characters brings order to the otherwise chaotic flow of money. While it’s slightly different from a general payment reference, it plays a similarly vital role in the world of finance.

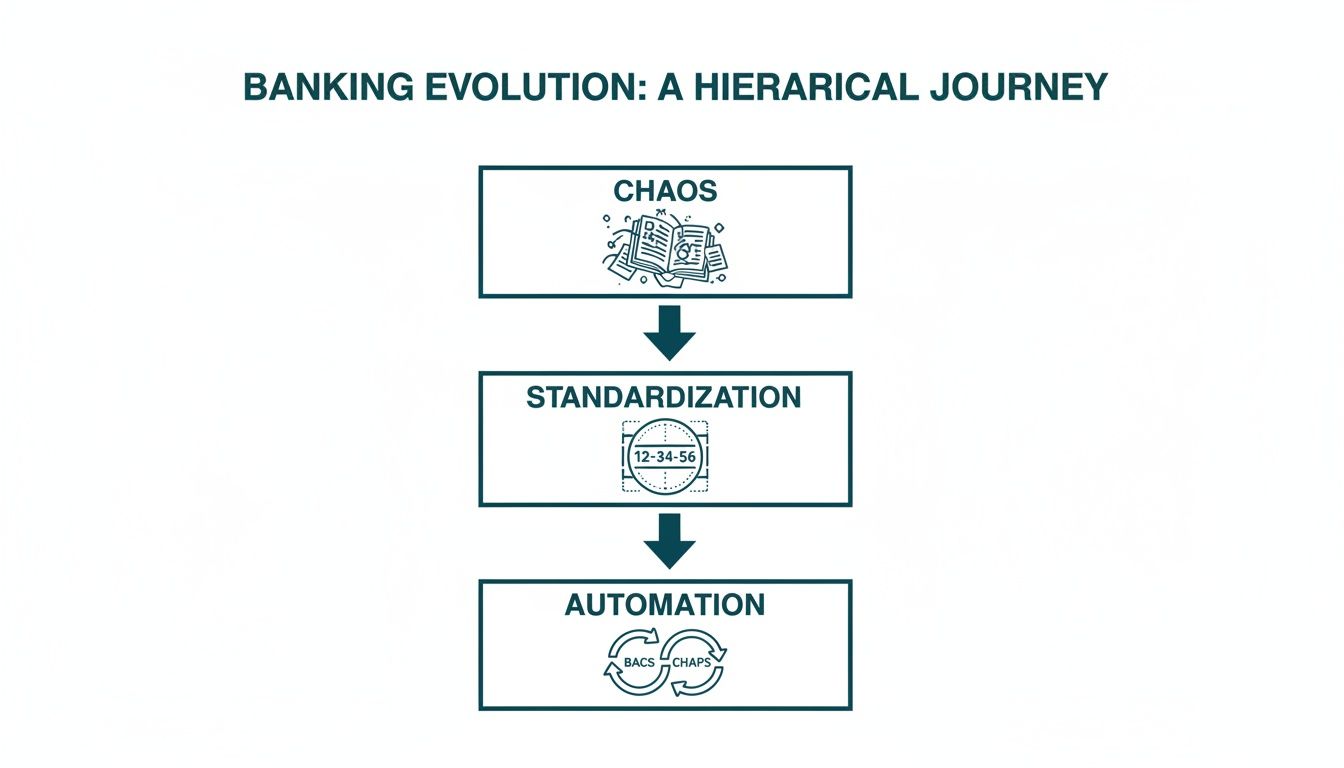

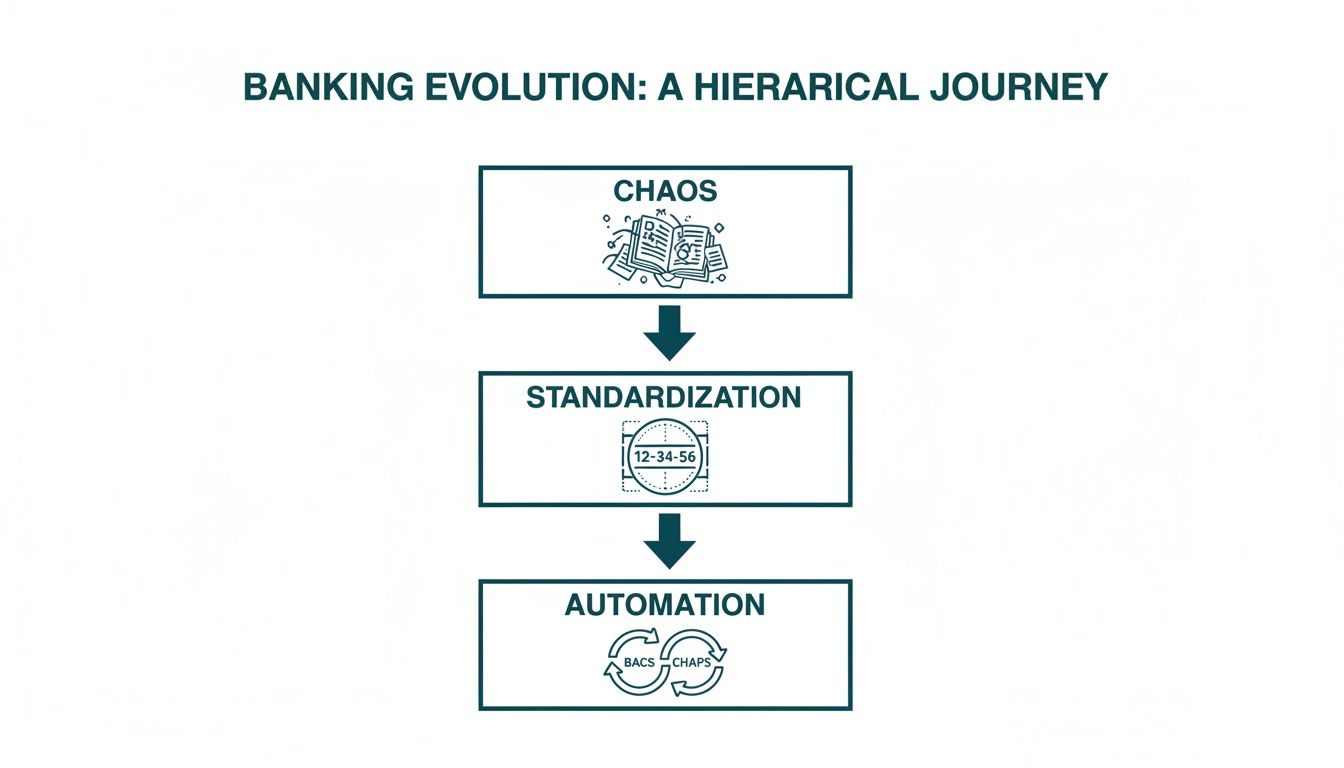

How Standardized References Transformed Banking

Before the structured systems we rely on today, banking was a chaotic affair. Think handwritten ledgers, where tracking a payment depended on a vague description, a name that could easily be misspelled, or the sharp memory of a bank clerk. This wasn't just slow; it was dangerously prone to human error. Matching a payment to an invoice felt more like detective work than accounting.

This lack of a common language for transactions created bottlenecks, drove up costs, and chipped away at trust. For banking to grow up and support a modern economy, it needed a radical overhaul. The industry had to move away from messy, manual bookkeeping toward a system built on simplicity and structure. The answer was a standardized identifier: the bank reference number.

The Dawn of Automated Banking

The real shift kicked off in the mid-20th century as banks started drowning in a sea of cheques and transfers. The old ways just couldn't cope. Recognising the looming crisis, the UK banking industry took a huge step toward automation by introducing sort codes.

Starting in 1957, the staggered rollout of these six-digit codes began replacing the inconsistent identifiers used by London's clearing banks. This standard was a game-changer for routing payments in a booming post-war economy and slashed the manual sorting errors that had plagued the system. You can explore more about the history of this foundational system and how it shaped UK finance.

This wasn't just about a new format; it was a fundamental change in how money was tracked. By giving each bank branch a unique, predictable code, the system created a reliable pathway for every transaction. It laid the essential groundwork for the automated payment networks that are now the backbone of our financial world.

Paving the Way for Modern Payment Networks

Establishing a simple, structured identifier like the sort code was the critical first step. It created the operational foundation needed to launch groundbreaking systems that completely changed how money moves.

Without that initial standard, high-volume payment networks would have been impossible. These early reference systems allowed banks to:

- Automate Sorting: Machines could finally read and route cheques and payment instructions without needing a human to intervene.

- Increase Processing Speed: Transaction volumes scaled from thousands to millions per day.

- Reduce Errors: The risk of sending funds to the wrong place or crediting the wrong account dropped dramatically.

The bank reference number wasn't just an administrative tweak; it was the key that unlocked financial automation. It transformed payment processing from an art reliant on manual skill into a science based on logic and precision.

This history shows why handling a bank reference number with care is so important today. It’s not about being tidy for the sake of it; it’s about upholding a system designed for accuracy, speed, and trust. Every time a correct reference is used, it reinforces the integrity of a financial ecosystem that took decades to build—a system that now supports modern marvels like Bacs and CHAPS, processing billions of transactions flawlessly every year.

Finding the Right Reference Number for Your Transaction

Not all reference numbers are created equal. Using the wrong one can feel like sending a payment into a financial black hole, leaving both you and the recipient wondering where the money went.

Think of them like different parts of an address. A postcode gets a letter to the right neighbourhood, but you need the full street address to make sure it reaches the correct house. It’s the same with payments. Businesses use a variety of codes for very specific reasons, and knowing which one to use is absolutely critical.

You’ll see a mix of identifiers out there. Some are tied to a single transaction, like an invoice number. Others identify a person or company, such as a customer account ID. Then there are the internal system references that banks use purely for their own tracking. The key is knowing how to tell them apart so you can confidently find and use the correct bank reference number every single time.

Where to Look for Reference Numbers

Often, the biggest challenge is just finding the right number in the first place. Luckily, they tend to show up in the same predictable places across different financial documents. Knowing where to look can save you a ton of time and prevent frustrating payment errors.

You'll almost always find these identifiers in a few key locations:

- On Invoices: This is the most common spot. The invoice number is usually the preferred reference for paying a bill.

- In Payment Instructions: When a company asks for payment, they will nearly always tell you exactly what number to use in the reference field.

- On Bank Statements: Details from previous transactions on your statement will show the reference you used for past payments.

- Within Online Banking Portals: Payment confirmation screens and transaction histories are great places to find the details for recurring payments.

The journey to our modern, organised banking system wasn't straightforward. We've moved from chaotic manual ledgers to the standardised, automated systems we rely on today, and reference numbers were a huge part of that evolution.

This standardisation is what made reliable tracking possible and ultimately paved the way for the automated finance tools we use today.

Decoding Different Reference Types

To cut through the confusion, it helps to understand the main categories of reference numbers you'll come across. Each one has a distinct job in the payment chain, making sure money gets routed and allocated correctly. Some codes are meant for public use between you and the recipient, while others are purely for the bank's internal processing.

For businesses dealing with a high volume of transactions, sorting through these numbers manually is a non-starter. Many rely on sophisticated tools like bank statement converter software to automatically pull out and categorise these numbers, turning a painstaking task into an automated one.

To help your team quickly identify the right number, we've put together a simple table outlining the common types you'll encounter and where to find them.

Common Bank Reference Numbers and Their Locations

| Reference Type | Common Format | Where to Find It | Primary Use Case |

|---|---|---|---|

| Invoice Number | Alphanumeric (e.g., INV-12345) | On the invoice document from a supplier or vendor. | Linking a payment directly to a specific product or service. |

| Customer ID | Numeric or Alphanumeric (e.g., CUST-9876) | Welcome emails, account portals, utility bills. | Identifying a customer for recurring payments or subscriptions. |

| Payment Reference | Alphanumeric (e.g., PAY-ABC123) | Payment confirmation screens, remittance advice. | A unique code for a one-off payment, often online. |

| Transaction ID | Long Alphanumeric String | Bank statements, payment gateway receipts. | Internal tracking for banks and payment processors. |

Using this table as a quick reference can help minimise errors and ensure that every payment is applied correctly the first time.

The most effective way to eliminate payment confusion is to treat the reference field with the same importance as the payment amount and sort code. An incorrect reference can cause just as many problems as a mistyped digit in an account number.

For day-to-day clarity, let’s break down the three you’ll see most often:

- Invoice or Bill Number: This is transaction-specific and ties your payment directly to a particular sale. It's the most common reference requested by businesses.

- Customer or Account ID: This is a permanent number assigned to you by a company. It's typically used for recurring payments like utility bills or subscriptions where the amount might change but the payer stays the same.

- Payment Reference: This is a more generic term that could mean either of the above, or it might be a unique code generated for a single online payment.

The golden rule is to always double-check which specific number the recipient has requested. When in doubt, the invoice number is almost always the safest bet.

How Businesses Use Reference Numbers Every Day

A bank reference number is so much more than just a string of digits on a statement; it's the operational heartbeat of a company's financial workflow. In the real world, these codes are the indispensable tools that turn a chaotic flood of incoming payments into organised, actionable data. For any business, they are the key to efficiency, accuracy, and quick problem-solving.

Their most vital role is in automated payment reconciliation. Just imagine a business with thousands of customers paying invoices each month. Without a unique identifier, the finance team would face the impossible task of manually matching each payment to the right account, relying on vague clues like the payment amount or the sender’s name. It's a recipe for errors and countless wasted hours.

Streamlining Accounts Receivable

The bank reference number, which is usually the invoice number, acts as a digital bridge. When a customer includes it in their payment, accounting software can instantly read the code and match the incoming funds to the outstanding invoice. This single action automatically closes the loop, marking the bill as paid without any human intervention.

This automation is what allows a business to scale. It cuts down on manual data entry, minimises the risk of human error, and frees up finance professionals to focus on strategic tasks rather than playing detective with bank statements. For businesses managing high volumes of transactions, this efficiency isn't a luxury; it's a necessity.

Resolving Disputes and Powering Automation

Beyond day-to-day accounting, reference numbers are crucial for customer service and resolving disputes. When a customer calls with a query about a payment, the reference number lets a support agent pinpoint the exact transaction in seconds. That speed and accuracy are essential for maintaining good customer relationships and sorting out issues on the first call.

A unique reference number provides an indisputable audit trail for every single transaction. It acts as the single source of truth that both the business and the customer can rely on, turning potential conflicts into simple verifications.

These identifiers also power automated systems. Think of high-volume e-commerce or subscription services. The reference number ensures that when a payment lands, it's correctly allocated, triggering the right actions—whether that’s dispatching an order or renewing a service. You can learn more about how modern payment systems like Pay by Bank use these principles for seamless transactions.

The sheer scale of payments tied to reference numbers in the UK is staggering. In 2023 alone, Direct Debit volumes topped 4.8 billion, covering everything from household bills to business collections. These figures show how reference numbers are the silent heroes preventing chaos in a system handling trillions of pounds every year.

And finally, for tracking and reconciliation, businesses often use efficient receipt generation tools that incorporate these reference numbers, simplifying record-keeping for both the company and its customers.

Keeping Reference Numbers Secure and Compliant

When you’re handling financial data, even something as simple as a bank reference number, you’re taking on a serious responsibility. While the reference itself might not seem as sensitive as a credit card number, it almost always travels with other personal and payment information. That proximity puts it squarely in the crosshairs of data protection laws that no business can afford to ignore.

Get it wrong, and you're exposed. We're talking about everything from reputation-damaging data breaches and internal fraud to simple human error. One slip-up could mean payments go astray, customer data gets compromised, or you’re hit with painful fines from regulators.

Navigating the Regulatory Landscape

For any organisation touching payment details, two frameworks are absolutely critical: the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR). Both demand strict, provable controls over how you collect, store, and use customer data.

- PCI DSS: This is the global benchmark for protecting cardholder data. If a bank reference number is captured as part of a card transaction, your entire process for handling that interaction falls under its scope.

- GDPR: This regulation protects the personal data of everyone in the EU and UK. A reference number that can be tied back to a customer’s name or account is absolutely considered personal data and must be managed with care.

Meeting these standards isn't just about ticking a compliance box—it's about earning and keeping customer trust. With data breaches making headlines almost daily, people are more cautious than ever about who they share their information with. A secure process is a powerful way to show you take their privacy seriously.

The Role of Secure Payment Technology

This is where modern secure payment platforms completely change the game. Instead of letting sensitive data ever touch your own systems, they use clever technology to keep it completely separate. This dramatically shrinks your compliance headaches and your risk exposure—a process often called "de-scoping."

The whole point of modern payment security is simple: stop sensitive data from ever entering your environment. If you create a secure, isolated channel for capturing payments, you remove the risk at the source.

Two key pieces of tech make this possible:

- Tokenization: This replaces sensitive data (like a card number) with a unique, non-sensitive stand-in called a "token." You can safely store and use this token for things like repeat billing without ever exposing the original card details.

- End-to-End Encryption: From the moment a customer types it in, their data is scrambled. It stays that way until it reaches the secure payment processor, making it completely useless to anyone who might intercept it.

Bank reference numbers, especially sort codes, have been the backbone of the UK's high-value payment system for decades, powering CHAPS since its launch in 1984. In the 2025 financial year, CHAPS handled an average of 210,483 settlements every single day. For support teams using a solution like Paytia's secure IVR or web chat, these references unlock Pay by Bank transactions that can slash PCI scope by 90-95% and put payment chasing on autopilot. You can discover more about these payment and settlement statistics from the Bank of England.

By adopting these technologies, you can capture payments and reference details without the data ever passing through your own network, call recordings, or agent desktops. It’s a powerful approach that not only builds huge customer trust but makes achieving and maintaining compliance a whole lot simpler.

Streamlining Payments with Secure Technology

Going beyond just ticking compliance boxes, the right secure technology can completely overhaul your payment workflows. It’s about transforming a clunky, high-risk process into something smooth and efficient for both your team and your customers. This is where you swap out manual headaches for intelligent automation.

Think about the traditional way a contact centre agent takes a payment. It often involved asking for sensitive card details and a bank reference number over a recorded phone line. It's a slow, insecure method that's just begging for human error. Modern payment solutions sidestep this risk entirely by offloading the entire process to secure, automated channels.

Automating the Collection Process

Today’s technology can handle the whole transaction without any sensitive data ever crossing your threshold. This move not only locks down your security but also massively improves the customer experience by giving people convenient, self-service options they actually prefer.

Some of the key automated features include:

- Secure IVR Systems: Customers can punch in their payment details and reference numbers using their telephone keypad, 24/7, without ever speaking to an agent. This frees up your people to handle more complex customer issues.

- Secure Payment Links: Your agents can instantly send a unique payment link via SMS or web chat. The customer then completes the purchase on their own device within a secure, isolated environment.

This level of automation does more than just shield data; it makes your entire operation more robust. To see how these systems work under the bonnet, you can learn more about how a payment gateway API integration provides the technical foundation.

Adopting secure payment technology isn't just a defensive play against compliance risks. It's a proactive strategy to drive efficiency, slash costly mistakes, and build a seamless payment journey that earns customer trust.

Ultimately, these tools turn a high-stakes manual chore into a reliable, automated function. Instead of your agents burning valuable time on repetitive payment tasks, they can get back to what they do best: providing fantastic service. It’s a shift that streamlines operations, cuts overheads, and builds a foundation of trust with every transaction.

Your Top Questions About Bank Reference Numbers

When you're dealing with payments, it’s the small details that can make a big difference. The bank reference number is one of those details that often trips people up, yet it's absolutely vital for making sure your money gets where it needs to go without a hitch. Let's clear up a couple of the most common questions we hear.

What Happens If I Forget the Reference Number?

Forgetting to add a reference number can throw a serious spanner in the works. Without that unique code, the recipient’s finance team has to play detective, trying to match your payment based on nothing more than the amount and your name.

This manual guesswork is slow and frustrating for everyone. Your payment could end up sitting in a holding account for days, or worse, get accidentally credited to the wrong customer. That often leads to awkward follow-up calls and can even disrupt the services you’re paying for. Always, always double-check the reference is there before you hit send.

Is a Bank Reference Number the Same as a Transaction ID?

That’s a great question, and the simple answer is no—they do two very different jobs. Think of a bank reference number as a label you attach to the payment (like an invoice number) so the person receiving it knows exactly what it's for. It’s a code that means something to both of you.

A Transaction ID, on the other hand, is a long, random string of characters the bank generates for its own records. It’s purely for internal tracking, helping them trace the payment as it moves through their system. It’s useful if there’s a technical problem, but it tells the recipient nothing about why you sent the money.

Here’s a simple way to think about it: the reference number is the "memo" you’d write on an old-school cheque. The Transaction ID is the bank's internal stamp on the back of it. Both are important, but they answer completely different questions.

Ready to make your payment processes simpler and more secure? Paytia's solutions automate how you collect payments and their reference numbers, cutting down on compliance headaches and freeing up your team to focus on what matters. Find out how Paytia can transform your payment workflows.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.