What Is Payment Reference: what is payment reference and why it matters

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

A payment reference is a unique code that ties a payment to a specific invoice, customer, or sale. You can think of it as a tracking number for your money. It’s the one thing that guarantees when funds arrive, a business knows exactly who they’re from and what they’re for. Without it, matching payments becomes a frustrating and time-consuming puzzle.

What a Payment Reference Is and Why It Matters

Ever sent a parcel without putting the recipient's name on it? The courier knows it's reached the right building, but nobody inside has a clue who it’s for. A payment without a reference creates the exact same headache for a company’s finance team; the money has hit the bank, but its purpose is a complete mystery.

This simple string of characters is the unsung hero of the accounts department. It acts as a bridge between the customer paying and the business getting paid, turning what would be an anonymous deposit into a clearly identified transaction. For any business, this is absolutely fundamental for keeping the books organised and accurate.

The Core Function of a Payment Reference

At its heart, a payment reference solves the problem of attribution. When a company is dealing with dozens, or even thousands, of payments every single day, just looking at the sender's name isn’t enough. The reference number gives them a clear, unique identifier that their systems can instantly recognise and match up.

This direct link is vital for several key business functions:

- Automated Reconciliation: It lets accounting software automatically match incoming cash to outstanding invoices, slashing the amount of manual work needed.

- Improved Cash Flow: When payments are allocated quickly, a business gets a much more accurate, real-time picture of its financial health.

- Enhanced Customer Service: If a customer rings up with a query, an agent can use the reference to find the transaction in seconds, leading to a much faster resolution.

- Clear Audit Trails: It creates an unambiguous record, which makes life a lot simpler during financial audits and compliance checks.

Essentially, the reference number brings order to the chaos of daily transactions. It’s the key that unlocks efficient accounting and makes sure every pound is accounted for properly. The journey a payment takes can be complex, often going through a what is a payment service provider to be processed securely. A clear reference ensures that at the end of that journey, the payment lands exactly where it belongs in the company’s books.

A missing or incorrect payment reference is one of the most common reasons for accounting delays. It can turn a two-second automated task into a two-hour manual investigation for a finance professional, highlighting just how crucial it is in day-to-day operations.

Breaking Down Common Payment Reference Formats

Let's be clear: not all payment references are created equal. While they all share the same core job—linking a payment to its purpose—their structure can look wildly different from one business to the next. Getting your head around these different formats is the first step to building a system that actually works for you, not against you.

Some businesses keep things simple, using a basic sequential numbering system. Think INV-1001, INV-1002, and INV-1003. For smaller outfits, this is often more than enough. It’s easy to set up and straightforward for everyone involved.

But as a business scales, its referencing needs tend to get a bit more complex. A smarter, alphanumeric format can embed useful data right into the reference itself, saving your finance team a ton of time when it comes to reconciliation.

Information-Rich Reference Structures

Many organisations now generate dynamic references that carry their own context. This clever approach turns the reference from a simple tag into a useful piece of data that can kickstart automated processes.

A few common examples you’ve probably seen:

- Customer or Account ID: A utility company might use something like

9876543-JUN24, neatly combining the customer's account number with the billing month. - Order or Booking Number: An e-commerce store will almost always use the order number, like

ORD-54321, creating a direct, unbreakable link to that specific purchase. - Policy or Claim Number: In the insurance world, you might see a reference like

POL-A4B6C8-PREMIUM, instantly identifying both the policy and the type of payment.

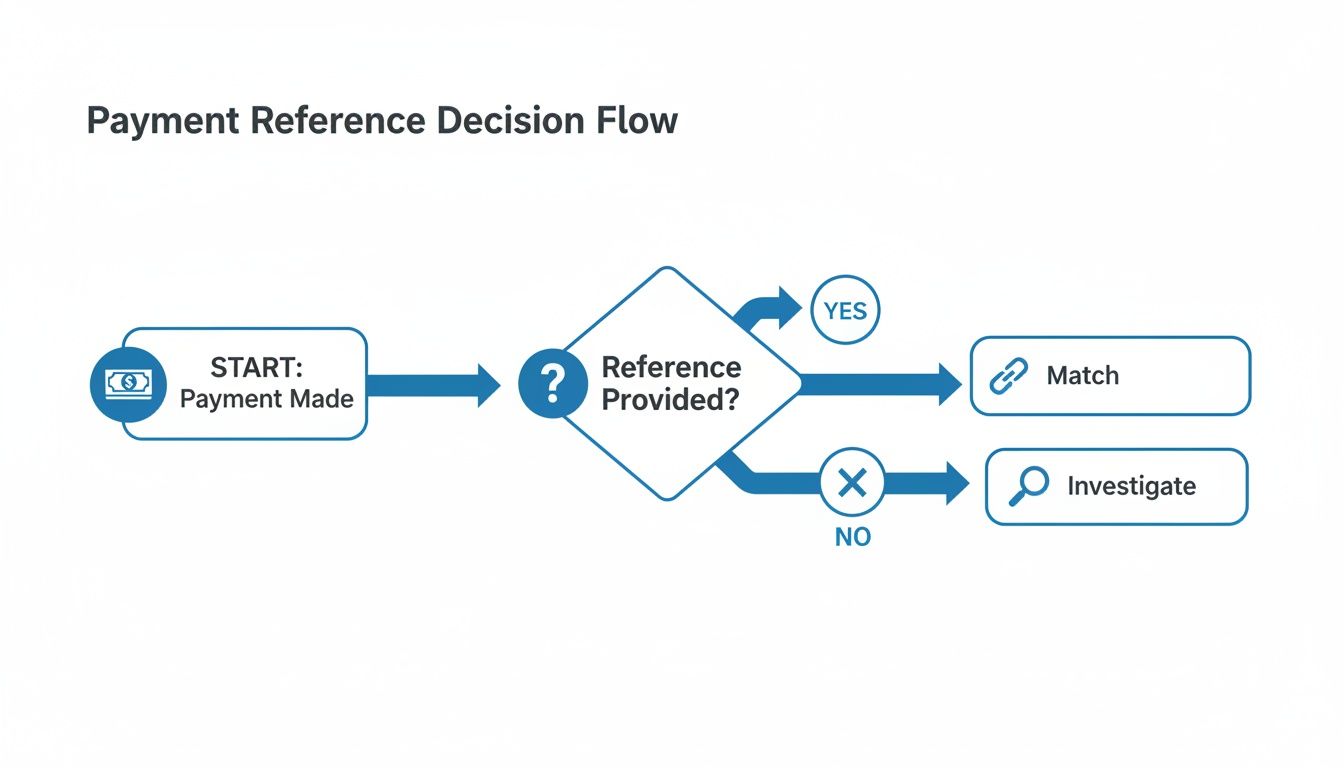

This simple flowchart shows just how critical that little string of characters is. Get it right, and everything flows smoothly. Get it wrong, and you’ve got a problem.

As you can see, a correct reference means an instant, efficient match. But when it's missing or wrong, it triggers a manual investigation that drains time and resources.

Choosing the Right Format for Your Business

So, what's the perfect format? It really depends on your operations, how many transactions you handle, and what your accounting systems can cope with. A simple numeric system is clean but gives you zero context. On the other hand, a complex alphanumeric one packs in data but runs the risk of customers typing it in wrong.

The best payment reference system is one that balances operational detail with customer simplicity. It should be logical enough for your systems to parse automatically but clear enough that a customer can easily identify and use it.

To help you figure out what might work best, we've put together a quick comparison of the most common structures out there.

Comparing Common Payment Reference Formats

This table breaks down the characteristics, benefits, and typical use cases of different payment reference structures to help you choose the right format for your needs.

| Format Type | Structure Example | Primary Benefit | Common Use Case |

|---|---|---|---|

| Numeric Sequential | 10245 |

Simplicity and ease of generation. | Small businesses, freelance invoices. |

| Alphanumeric (Date-based) | CLT451-202407 |

Embeds a timestamp for easy sorting. | Subscription services, monthly retainers. |

| Alphanumeric (Customer ID) | ACCT-98765-PAY |

Directly ties payment to a customer account. | Utilities, local councils, membership clubs. |

| Alphanumeric (Order-based) | WEB-ORD-A55B3 |

Links payment to a specific sale or order. | E-commerce, retail, ticketing services. |

Ultimately, you’re aiming for a reference that is both unique and meaningful. It needs to be distinct enough to avoid any confusion, while carrying just enough information to make your financial admin run like clockwork. The right system reduces manual headaches and boosts accuracy across the board.

The Critical Role of References in Financial Reconciliation

So, we've covered what a payment reference is. Now let’s get into why it’s so incredibly important for the health of your business.

Picture this: you’re running a huge event and need to match hundreds of guests to their name tags, but none of the tags has a name on it. Total chaos, right? That’s exactly what your accounts department faces every day without clear payment references.

These simple codes are the very backbone of an orderly accounting process. They act as an automated bridge, instantly linking the money that hits your bank account to the correct customer or outstanding invoice in your books. No guesswork needed.

The High Cost of Missing References

When a reference is wrong or, even worse, missing entirely, the knock-on effects can be painful. The money arrives, sure, but it gets dumped into an unallocated cash account—a sort of financial limbo.

This forces your finance team to turn into detectives. They have to drop what they’re doing and spend precious hours digging through records, trying to figure out where the money came from and what it was for.

This manual sleuthing isn't just a drain on time; it's expensive and risky.

- Delayed Cash Flow: Money that hasn’t been allocated can’t be officially recognised. This gives you a skewed, inaccurate picture of your real cash position.

- Increased Operational Costs: Every hour your team spends chasing mystery payments is an hour they can't spend on valuable financial analysis that actually grows the business.

- Poor Customer Experience: Nothing sours a relationship faster than sending a late payment notice to a customer who has already paid. It causes frustration and seriously damages their trust in you.

For a clearer picture, it’s worth brushing up on understanding bank reconciliations, a fundamental process that is almost completely crippled without accurate reference data.

Fuelling Automated Reconciliation

Modern accounting software and ERP systems are built for automation. They’re designed to pull in bank feeds and automatically match payments to invoices, often churning through thousands of transactions in minutes with zero human input.

But this entire high-powered engine grinds to a halt without one crucial piece of fuel: the payment reference.

An automated reconciliation system is only as smart as the data it receives. A correct payment reference allows for 99% or higher auto-matching rates, whereas missing references drop this figure to near zero, forcing every transaction into a manual review queue.

This dependency really shines a light on the true value of a well-oiled referencing system. It directly impacts your bottom line by making you more efficient, improving the accuracy of your financial reports, and freeing up your finance team to focus on growth instead of grunt work.

Properly managing this data is a key part of any robust process, something we explore further in our guide to payment validation.

In short, a good payment reference isn't just an admin detail; it's a critical asset for any healthy, efficient business.

How Smart Referencing Enhances Security and Prevents Fraud

Beyond just tidying up your accounts, that humble payment reference plays a massive part in your security and anti-fraud strategy. Think of it this way: using a generic reference like PAYMENT is like leaving your front door unlocked. Anyone could wander in. But a unique, non-guessable reference acts as a specific key for each transaction, adding a surprisingly powerful layer of protection.

This is a game-changer for preventing payment misapplication—where funds get accidentally or even maliciously applied to the wrong account. With a unique reference, the chances of this happening plummet. If a payment arrives with a reference that doesn't exist or doesn't match an outstanding balance, it can be immediately flagged for investigation instead of being processed incorrectly.

Creating a Bulletproof Audit Trail

A strong payment reference is the backbone of a robust audit trail. It forges a clear, traceable link from an initial invoice or order, through the payment itself, all the way to the final entry in your financial ledger. This end-to-end visibility isn't just good practice; it's an absolute necessity for financial transparency and accountability.

This detailed trail is your best friend when you need to:

- Verify Transactions: Quickly confirm that every payment received corresponds to a legitimate sale or service.

- Resolve Disputes: When a customer questions a charge, you can instantly pull up the entire transaction history just by using the reference.

- Support Audits: Give auditors clear, undeniable evidence for every single financial entry, making their job (and yours) much easier.

Without this, trying to trace the source of funds becomes a frustrating, often inconclusive exercise, leaving the business exposed to both internal and external fraud.

A strong audit trail, anchored by unique payment references, is a business's first line of defence. It transforms your financial records from a simple list of numbers into a verifiable story of every transaction.

Upholding Compliance in Secure Workflows

For any business in a regulated industry, especially those handling card payments, security is non-negotiable. One of the biggest challenges is making sure all transaction data is handled within a PCI DSS compliant workflow. This is where the partnership between a payment reference and a secure payment platform truly shines.

Modern systems can generate or carry a unique what is payment reference code securely throughout the entire payment journey. This means the reference is fundamentally tied to the transaction without ever exposing sensitive cardholder data like the full card number or CVC.

For a contact centre, this is huge. It allows an agent to process a payment tied to a specific customer account, with the reference acting as the secure link while the actual payment details stay encrypted and out of scope. That single capability is essential for proving compliance and, most importantly, protecting customer trust.

Best Practices for Capturing References in Contact Centres

In the fast-paced world of a contact centre, capturing a payment reference correctly is where theory smacks into reality. Human error is an ever-present risk, and a single mistyped character can throw the entire reconciliation process off course, creating a headache for both your finance and customer service teams. Getting it right the first time isn't a luxury; it's essential.

This is especially true in the UK, where the move to digital payments has gathered serious momentum. With cash payments in retail dropping from 62% in 2006 to just 40% by 2016, the need for rock-solid electronic referencing has never been more critical for keeping the books balanced.

Empowering Agents with Clear Processes

Your agents are on the front line of payment capture. Vague instructions just won't cut it—they lead to inconsistent data. Equipping them with simple, repeatable techniques is the key to success.

- Scripted Confirmation: Give your agents clear, concise scripts to nail down the reference. A simple, "Could you please read that reference back to me one more time?" is often all it takes to catch most errors before they happen.

- Phonetic Alphabet: For those tricky alphanumeric codes, train agents to use the NATO phonetic alphabet (Alpha, Bravo, Charlie). It’s a classic for a reason and completely removes the confusion between similar-sounding letters like 'B' and 'P' or 'M' and 'N'.

- System Integration: The gold standard is having the reference field baked directly into the agent's CRM or payment screen. This stops them from scribbling it down on a sticky note first, which slashes the risk of transcription errors when they key it in later.

For a broader look at the environment where these practices make a difference, it's worth exploring different approaches for optimizing contact center operations.

Leveraging Automation to Eliminate Human Error

While training your team is a must, the most powerful strategy is to design human error out of the process entirely. Modern payment technology can automate reference capture, guaranteeing 100% accuracy on every single transaction.

By automating reference capture, a business can transform a key point of failure into a source of operational strength. The goal is to make the correct reference the default, not the exception.

This kind of automation usually comes in one of two flavours:

- Pulling from a Customer Record: When an agent kicks off a payment, a secure platform can automatically grab the right invoice or account number from your CRM and attach it to the transaction. The agent never even has to ask for it, let alone type it.

- Generating on the Fly: Alternatively, the system can create a unique, one-time payment reference for that specific call and embed it directly into the transaction data, all behind the scenes.

These automated workflows are a core part of secure solutions designed to accept card payments over the phone, as they lock down data integrity while protecting sensitive information. By putting these practices into play, you’re not just making reconciliation easier—you’re making the entire payment process faster and smoother for your customers.

Common Questions About Payment References

Even when you've got the basics down, payment references can still throw a spanner in the works. We get it. That's why we've put together answers to the most common questions that trip people up. Think of this as your go-to guide for those slightly tricky, real-world scenarios.

What Happens If a Customer Uses the Wrong Reference?

When a customer gets the payment reference wrong, it kicks off a whole chain of frustrating problems. The money does arrive in your bank account, that's the good news. The bad news? It shows up as a mystery payment.

Because your systems can't match it to an invoice or customer account, the payment just sits there, unallocated. This forces your finance team to play detective, manually digging through records to connect the dots. This whole process delays your cash flow and skews your financial reporting. For the customer, it can mean getting unnecessary late payment reminders or even having their service cut off—all while they genuinely believe they've paid. A wrong reference is a lose-lose situation.

Is a Payment Reference Different from a Transaction ID?

Yes, they're completely different, though they're often confused. They both relate to the same payment, but they answer different questions.

- A payment reference is the code you create. Its job is to explain the 'why' behind the payment—like

INV-9876for a specific invoice. It’s purely for your own internal bookkeeping, helping you reconcile who paid for what. - A transaction ID is generated by the bank or payment processor. It's a unique identifier that tracks the 'how' and 'when' of the payment's journey through the financial system. It acts as the official receipt, proving the funds have moved.

It’s a bit like returning a library book. The payment reference is the book's title, telling you which specific item was returned. The transaction ID is the time-stamped receipt from the return slot, proving it was handed back. You need both to have the full story.

How Technology Improves Payment Reference Management

Technology completely overhauls how you handle payment references, taking it from a manual, error-prone task to a slick, automated process. Modern accounting platforms, CRMs, and payment systems can all talk to each other to make sure the right reference is used every single time.

For instance, your invoicing software can automatically generate a unique reference for every bill you send out. When it's time for a customer to pay—especially in a contact centre—an integrated payment solution can pull that exact reference from their record and attach it to the transaction. This completely removes the risk of an agent mistyping it. This kind of automation doesn't just guarantee accuracy; it speeds up reconciliation, boosts security, and creates a clean data trail from sale to settlement.

Are There Specific Rules for Payment References in the UK?

While there isn't one single law in the UK that dictates the exact format of a payment reference, you can't just make them up as you go along. Their structure is heavily shaped by the rules of the payment schemes themselves.

Systems like Bacs and Faster Payments have their own technical requirements for the reference field. This includes character limits (usually 18 characters) and restrictions on which characters you can use. If your reference is too long, it will get cut off, making it useless. Beyond that, broader regulations like the Payment Services Regulations (PSRs) and anti-money laundering (AML) rules require businesses to maintain a crystal-clear audit trail. This makes using accurate, consistent payment references a non-negotiable part of staying compliant.

Ready to eliminate reference errors and secure your payment process? Paytia's Secureflow platform automates reference capture within a PCI DSS compliant workflow, ensuring every payment is matched correctly and securely. Discover how to streamline your operations at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.