What Is a Payment Service Provider? (what is payment service provider)

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

A Payment Service Provider (PSP) is a third-party company that helps you accept all sorts of payments through a single, neat connection. Think of them as your all-in-one financial partner, handling everything from the moment a customer pays until the money lands safely in your business account.

What Is a Payment Service Provider in Simple Terms?

Imagine your business is a high-end stereo system. To play music from different sources—a turntable, a streaming service, a phone—you'd traditionally need separate amplifiers, cables, and inputs for each one. That setup quickly becomes complex, expensive, and a real headache to manage.

A payment service provider is like a modern, smart receiver that unifies everything. It has all the necessary connections built-in, letting you plug any "payment device" in and have it just work.

Instead of trying to build separate relationships with multiple credit card schemes (like Visa and Mastercard), digital wallets (like Apple Pay), and various banks, you just partner with one company. That single relationship opens the door to the entire, often fragmented, world of payments.

The All-in-One Payment Partner

A PSP takes care of the entire payment lifecycle for a business, bundling several critical jobs into one service. This integrated approach massively simplifies your operations, especially if you take payments through different channels—online, in-person, or over the phone in a contact centre.

Let's break down the core functions of a PSP and what they mean for your day-to-day business.

Core Functions of a Payment Service Provider

This table shows how a PSP bundles multiple complex roles into a single, efficient service.

| Function | What It Does for Your Business | Key Benefit |

|---|---|---|

| Payment Processing | Manages the technical routing of transaction data between the customer, your business, and the banks involved. | Ensures payments are authorised and settled quickly and reliably without you needing to manage the technical plumbing. |

| Merchant Account Provision | Provides the special bank account required to accept credit and debit card payments, often as part of their service package. | Removes the need to apply for a separate merchant account from a bank, which can be a slow and complex process. |

| Payment Gateway Services | Securely captures and transmits payment information from where it's entered (like a website or a phone call). | Protects sensitive customer data at the point of entry and ensures it gets to the processor without being compromised. |

| Security & Compliance | Handles complex security rules like PCI DSS, using tools like tokenisation and encryption to protect data and prevent fraud. | Dramatically reduces your security risk and the heavy burden of achieving and maintaining PCI compliance yourself. |

By acting as a single point of contact, a PSP saves you from negotiating contracts, integrating technology, and managing security with dozens of different financial institutions. The entire model is built for efficiency.

For example, when a customer in a call centre gives their card details over the phone, the PSP’s system can securely capture that information, process the payment, and confirm the transaction in seconds. Crucially, your business never has to directly handle or store the sensitive card data, which slashes your security risk and compliance headaches. This is what makes a payment service provider such an essential partner for modern business.

Understanding The Payment Processing Ecosystem

To really get what a payment service provider does, it helps to see where it fits in the wider world of payments. When a customer pays you, the money goes on a journey involving several key players, and honestly, their roles can seem confusingly similar. Untangling them is the first step to appreciating the efficiency a PSP brings to the table.

A good way to picture this is to think of the process like a bustling restaurant kitchen during a busy dinner service. Each person has a distinct, vital role in getting the "meal" (your payment) from the customer to your business's bank account.

The Payment Service Provider (PSP) is the Head Chef. They don't just cook one part of the meal; they orchestrate the entire operation from start to finish. The Head Chef makes sure all the different stations work together seamlessly, from taking the order to plating the final dish and settling the bill.

Distinguishing The Key Players

Within this ecosystem, four main roles work in sequence to make a transaction happen. A PSP often bundles these services, but they are functionally distinct. Understanding their individual jobs makes the value of an all-in-one solution crystal clear.

Payment Gateway: This is your restaurant's friendly waiter. Their job is to take the customer's "order" (their payment details) securely and deliver it to the kitchen. They don't cook the food, but they are the crucial, customer-facing link that gets the whole process started.

Payment Processor: Think of this as the talented line cook. Once the waiter delivers the order, the processor gets to work, "cooking" the transaction. They connect to the card networks and banks, handling the technical steps of authorisation and validation.

Acquiring Bank: The acquiring bank is the restaurant manager. This institution, also known as a merchant acquirer, manages the restaurant's finances. It takes the approved payment from the customer's bank and deposits it into your business account, settling the final bill. Our guide on the role of a merchant acquirer bank explains this relationship in more detail.

A PSP acts as the single point of contact that manages all these other players on your behalf. Instead of you having to hire a waiter, a line cook, and a manager separately, the Head Chef (PSP) provides an entire, fully-staffed kitchen team under one roof.

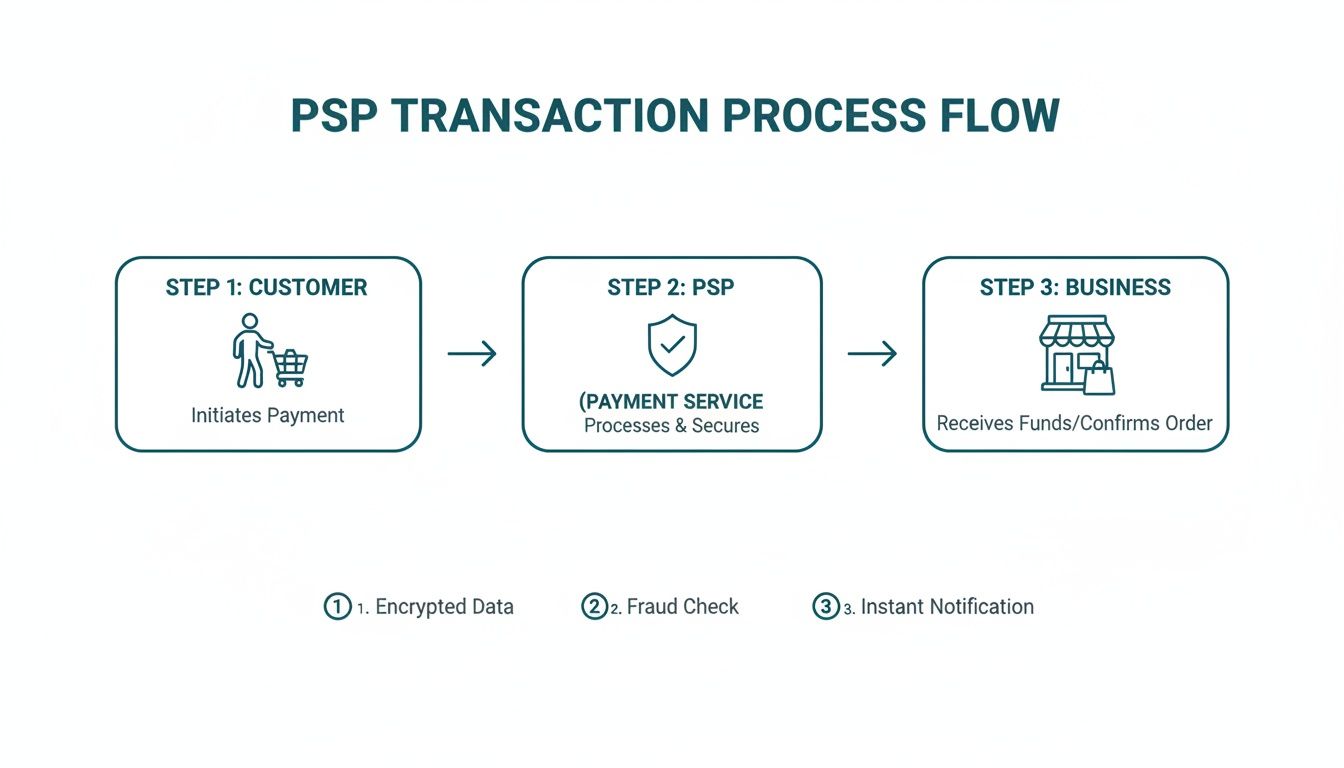

This flowchart shows the simplified journey a payment takes when a PSP is involved, highlighting its central role.

The visualisation makes it clear: the PSP sits right between the customer and the business, simplifying the entire flow.

Comparing Roles in the Payment Ecosystem

Let's put these roles side-by-side to make their differences crystal clear and see how the restaurant analogy holds up.

| Entity | Primary Role | Key Responsibility | Restaurant Analogy |

|---|---|---|---|

| Payment Gateway | Secure Data Capture | Transmits encrypted payment details from the point of sale (e.g., website, phone) to the processor. | The Waiter taking the customer's order. |

| Payment Processor | Transaction Execution | Communicates with card networks (Visa, Mastercard) and banks to approve or decline the transaction. | The Line Cook preparing the meal. |

| Acquiring Bank | Financial Settlement | Receives the funds from the customer’s bank and deposits them into the business’s merchant account. | The Restaurant Manager handling the money. |

| Payment Service Provider | Orchestration & Simplification | Bundles all the above services, providing a single integration for payment acceptance and management. | The Head Chef running the entire kitchen. |

The evolution of this ecosystem has seen new types of players emerge, especially in the UK. The rise of electronic money institutions (EMIs) as key payment service providers has reshaped the landscape, safeguarding €17 billion in funds in 2022.

This growth shows PSPs moving into agile roles once held by traditional banks. This makes them ideal for contact centres in sectors like retail and healthcare that need secure, real-time payment solutions. Ultimately, this all-in-one model is designed for one primary purpose: to make your life easier.

How PSPs Handle Security and PCI DSS Compliance

When you accept a payment, you're not just handling money; you're handling your customer's trust. Security isn't just another feature for a payment service provider—it's the absolute foundation of their entire operation. A single slip-up can have devastating consequences for a business's reputation and its bottom line.

This is why PSPs pour enormous resources into building a fortress of security measures, designed to protect both you and your customers. They manage the complex, often intimidating world of payment security so you don't have to become an expert yourself. Their main job is to take sensitive cardholder data completely off your hands, removing it from your business environment altogether.

Unpacking Key Security Concepts

To really get how a PSP protects transactions, we need to look at a few core technologies they use. These might sound technical, but their purpose is incredibly simple: to make valuable data completely useless to criminals.

End-to-End Encryption (E2EE): Think of this like sending a message in a locked box that only the recipient has the key to. The moment a customer types in their card details, that data is scrambled into an unreadable code. It stays scrambled until it reaches the secure processing network. Even if a hacker managed to intercept it, all they’d have is gibberish.

Tokenisation: This is where the casino chip analogy really clicks. Imagine you give a casino cashier £100 and get a chip in return. Inside that casino, the chip is worth £100. But if a thief steals it and tries to use it at the local supermarket, it's just a worthless piece of plastic. Tokenisation does the same thing with card numbers. The PSP swaps the real card number (the PAN) for a unique, non-sensitive placeholder called a "token." This token is perfect for things like recurring billing or refunds within the PSP's secure system, but it holds zero value to an outsider.

These two technologies work hand-in-hand to make sure real, sensitive cardholder data never even touches your business systems, drastically cutting down your risk.

The Critical Role of PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of non-negotiable security rules for any organisation that accepts, processes, stores, or sends credit card information. Getting compliant—and staying compliant—can be a complicated, expensive, and time-consuming headache.

This is arguably one of the biggest benefits a PSP brings to the table. By using a PCI DSS Level 1 certified provider, you essentially outsource the hardest parts of compliance. Because their systems are the ones handling all the sensitive data, your own business's "PCI scope"—the parts of your network and operations subject to PCI DSS rules—shrinks massively.

A payment service provider acts as a security shield, absorbing the complexity of PCI DSS compliance. By ensuring sensitive data bypasses your environment, they can help reduce your compliance scope by up to 90-95%, saving significant time, money, and resources.

This is especially vital for businesses with contact centres. Taking payments over the phone is a high-risk activity, as agents and call recordings can be exposed to card numbers. A PSP with secure phone payment technology ensures this data is captured without ever entering your call centre's environment, solving a massive compliance headache. You can learn more about the different requirements by exploring the various PCI levels of compliance in our detailed guide.

Of course, using a PSP doesn't mean you can forget about security altogether. To complement the robust security offered by your provider, it’s smart to regularly conduct a comprehensive website security audit to spot and fix potential weak points in your own systems. A proactive approach is always the best strategy for protecting customer data and maintaining trust.

Exploring Core Features and Services from a PSP

A modern payment service provider does far more than just shuttle money from a customer’s bank to yours. The real magic is in the suite of services wrapped around that core function. These tools are built to solve real-world business problems—from cracking new international markets and automating billing to fighting fraud and smoothing out your cash flow.

Think of a basic payment processor as a simple delivery van; it gets the job done, but that’s about it. A full-service PSP, on the other hand, is like your own dedicated logistics company. It doesn’t just deliver the package; it handles international customs, manages subscription deliveries, tracks everything in real-time, and even provides insurance against loss. It’s a strategic asset, not just a line item on your expenses.

These value-added services are what turn a payment system from a necessary evil into a powerful engine for growth.

Going Global with Multi-Currency Support

For any business with eyes on customers beyond its own borders, accepting international payments is an absolute must. A top-tier PSP makes this surprisingly simple by offering robust multi-currency support.

This feature lets you show prices and accept payments in a customer's local currency. A UK-based online shop, for example, can sell a £50 item to someone in the United States for $65, and the PSP handles all the currency conversion and settlement behind the scenes. This might seem like a small touch, but it has a huge impact on customer confidence. It gets rid of the guesswork around exchange rates and foreign transaction fees that so often leads to abandoned carts.

Automating Revenue with Recurring Billing

The subscription economy is here to stay, but trying to manage recurring payments by hand is a recipe for headaches and lost revenue. This is where a PSP's recurring billing or subscription management tools become absolute game-changers.

These systems let you automatically charge customers on a set schedule—be it weekly, monthly, or annually.

- For a Software-as-a-Service (SaaS) company: This means uninterrupted access for users and that all-important predictable monthly recurring revenue (MRR).

- For a local gym: It automates membership fee collection, freeing up staff to help members instead of chasing payments.

- For a charity: It simplifies managing regular monthly donations from dedicated supporters.

Better still, these tools often come with features like automated retries for failed payments and card-updater services, which helps cut down on the number of customers you lose to something as simple as an expired card.

By automating the entire billing cycle, businesses can slash administrative overhead, create consistent cash flow, and keep customers happy. It turns a manual, error-prone chore into a reliable, hands-off revenue stream.

Enhancing Flexibility with Payment Links

Not every sale happens on a website checkout page. PSPs offer payment links (or Pay-by-Link) to give you incredible flexibility in how and where you get paid. A payment link is just a unique, secure URL you can send to a customer through email, SMS, web chat, or even a direct message on social media.

When the customer clicks it, they’re taken to a secure, branded payment page to finalise their purchase. This is perfect for taking deposits for appointments, settling invoices, or even selling products directly through Instagram without needing a full e-commerce site. It’s a simple but powerful tool for selling across multiple channels.

While these features streamline operations, they also help tackle a persistent headache for UK businesses: late payments. Payment service providers in the UK underpin a financial system handling record volumes, with UK Finance reporting 48.8 billion total payments in 2024. Despite this, a recent survey found that a staggering 90% of UK firms faced late payments averaging 32 days. PSP features like recurring plans and automated payment reminders are crucial tools that help businesses fight back against this problem and improve their financial stability. You can dig into the full report on UK payment market trends on UK Finance.

Integrating a PSP into Your Business Workflow

A fancy payment service provider is useless if it doesn't slot neatly into your existing operations. When you're choosing a PSP, you're not just buying a list of features; you're finding a partner whose tech can talk seamlessly with the tools you already use every single day. The real goal is to create one unified system where taking a payment feels like a natural part of your workflow, not some clunky, disconnected chore.

It all starts with understanding the different ways a PSP can be set up. Each method strikes a different balance between control, speed, and security, letting you pick the path that makes the most sense for your technical know-how and how your business runs.

Choosing Your Integration Path

Fundamentally, there are two main ways to connect a PSP to your business. Each is designed for a different kind of setup.

Hosted Payment Pages: This is the simplest and quickest route. Your PSP gives you a secure, ready-made webpage, and you just send your customers there to pay. Because the PSP hosts the page and handles all the sensitive card data, it massively reduces your PCI DSS compliance headache. It’s perfect for businesses without a big team of developers or anyone who just needs to get up and running fast.

API-Based Integration: For businesses that want total control over the look and feel of their checkout, an Application Programming Interface (API) is the answer. An API acts as a bridge, letting your own systems "talk" directly to the PSP's platform. This means you can build a completely custom payment flow right inside your own website, app, or software. It definitely requires more technical skill, but it gives you ultimate flexibility. For a deeper dive, check out our guide on payment gateway API integration.

The right choice really boils down to your priorities. Do you value speed and simplicity above all else, or is a deeply customised, branded journey more important?

Connecting with Core Business Systems

True integration is about more than just your website. A versatile PSP should plug into the software that runs your entire business, making things more efficient and getting rid of tedious manual tasks.

For example, connecting your PSP with core platforms like Microsoft Dynamics 365 is a game-changer. When payment data flows automatically into your Customer Relationship Management (CRM) or Enterprise Resource Planning (ERP) system, you get a 360-degree view of every customer. You can see everything from their first enquiry right through to the final payment.

A well-integrated PSP transforms a payment from a simple financial transaction into a rich source of business intelligence. It updates customer records, reconciles accounts, and makes reporting a breeze—all automatically.

Unifying Payments Across All Channels

In today's omnichannel world, customers expect to pay wherever they interact with you—on your website, over the phone, or even through a web chat. A properly integrated PSP brings all these channels together, delivering a consistent and secure experience no matter where the transaction happens.

This is especially vital for contact centres. PSPs that connect directly with PBX/VoIP telephony systems let agents take secure phone payments in real-time without ever seeing or hearing sensitive card details. This kind of connectivity has fuelled the incredible growth of mobile payments in the UK, a market expected to be worth £6.92 billion by 2030. As PSPs make it simple to accept Apple Pay and Google Pay, they also make it essential to secure other channels like phone calls, shrinking your PCI scope without piling on extra training.

This unified approach means every single transaction, regardless of the channel, is secure, efficient, and perfectly woven into the fabric of your business.

How to Choose the Right Payment Service Provider

Picking the right payment service provider is one of the biggest calls you’ll make for your business. This isn’t just about moving money from A to B; it’s a decision that touches your revenue, customer happiness, and operational security. You’re looking for a genuine partner who helps you grow and keeps you safe.

It's tempting to just look at the headline transaction fee, but that's a mistake. The cheapest option often ends up being the most expensive when you factor in hidden charges, poor support, or security gaps. You need to look at the whole picture and find a PSP that aligns with where your business is heading, not just where it is today.

Evaluate the Fee Structure

First things first, you need to get your head around how they charge. The pricing model will hit your bottom line directly, so it's vital to know exactly what you’re paying for.

You’ll typically come across two main models:

- Flat-Rate Pricing: This is the simple, no-fuss option. You pay a set percentage plus a fixed fee for every transaction (for example, 2.9% + 30p). It’s predictable and easy to forecast, which is why it’s a favourite for smaller businesses and startups.

- Interchange-Plus Pricing: This model is more transparent but also a bit more complex. It separates the non-negotiable interchange fee (which goes to the customer's bank) from the PSP’s markup. It can be trickier to predict your monthly costs, but it often works out cheaper for businesses with a healthy transaction volume.

Whatever the model, always ask for a complete breakdown of every single potential charge. That includes monthly fees, chargeback penalties, and anything extra they might bill you for.

Scrutinise Security and Compliance

When it comes to security, your chosen PSP needs to be a fortress. There are no two ways about it. Level 1 PCI DSS certification is the absolute minimum you should accept—it’s the highest security standard in the industry and proves they meet tough requirements for protecting card data.

When you hand over your payment processing, you're entrusting that provider with your customers' data and your company's reputation. Look for clear proof of their security credentials, including support for tokenisation, end-to-end encryption, and solid fraud detection tools.

This is especially critical if you take payments in high-risk environments, like a busy contact centre. A provider that can actually take your operations out of the scope of PCI DSS isn’t just another vendor; they’re a crucial risk management partner.

Check Integration and Support

A great PSP should fit into your existing tech stack like a glove. Make sure they offer smooth integrations with your e-commerce platform, CRM, and any other software you rely on day-to-day. If you have specific needs, like taking payments over the phone through a PBX or VoIP system, double-check they have proven experience and the right technology to handle it.

Finally, never underestimate the value of good old-fashioned customer support. When things go wrong—and they sometimes do—you need a partner who answers the phone and knows how to fix the problem. Check their support hours, see how you can contact them, and read online reviews to get a feel for their service quality before you sign on the dotted line.

Common Questions About Payment Service Providers

It’s completely normal to have a few questions when you're getting to grips with payment service providers. As we've walked through the basics, let's tackle some of the most common things that businesses ask when they’re weighing up their options. Think of this as a quick FAQ to cement what we've covered.

What Is the Main Difference Between a PSP and a Merchant Account?

Think of a merchant account as a special kind of bank account that a business must have to accept card payments. In the old days, you had to apply for one directly from a bank, which was often a slow, painful process bogged down in paperwork and underwriting checks.

A PSP completely changes the game. It essentially bundles everything you need—the merchant account, payment gateway, and processing services—into one neat package. When you sign up with a PSP, you get the whole setup in one go, letting you start taking payments far more quickly and with much less hassle.

Are My Transactions Fully Secure if I Use a PSP?

Partnering with a reputable PSP is one of the biggest security upgrades you can make for your business. They are mandated to maintain the highest level of PCI DSS compliance and use sophisticated tools like tokenisation and encryption to lock down sensitive data. This takes a massive security and compliance weight off your shoulders.

But it’s important to remember that security is a partnership. Your own business practices still play a crucial role. For instance, if you take payments over the phone, it’s vital to use a secure solution that stops card details from ever entering your call recordings or appearing on your agents' screens. This is key to maintaining that end-to-end security and shrinking your own compliance footprint.

Using a PSP is the most significant step you can take towards securing your payment process. However, your own internal procedures for handling customer interactions must complement the security measures your provider puts in place.

Can a Small Business Use a Payment Service Provider?

Absolutely. In fact, PSPs are often the perfect solution for small businesses and start-ups. They were designed to tear down the traditional barriers—like high costs and complexity—that once made it so difficult for smaller companies to accept card payments.

PSPs usually offer simple, predictable pricing and a quick setup, so you don't have to get into complicated negotiations with acquiring banks. Many provide tools that work straight out of the box, such as:

- Hosted payment pages for getting an e-commerce site up and running fast.

- Payment links you can send to customers via email or SMS.

- Virtual terminals for taking card payments over the phone.

These features empower even the smallest of businesses to offer a professional, secure payment experience right from day one.

How Do PSPs Manage International Payments?

Today’s PSPs are built for a global economy. They make selling internationally feel surprisingly simple by supporting dozens of currencies and a whole host of popular local payment methods from across the world.

They take care of all the tricky stuff—like currency conversion, cross-border settlements, and navigating different international banking regulations—for you. This means your business can sell to customers just about anywhere without the headache of setting up separate bank accounts or payment systems in every single country.

Ready to secure your phone and digital payments while dramatically reducing your PCI DSS scope? Paytia's Secureflow platform offers a suite of tools designed for contact centres and modern businesses. Explore our solutions at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.