Your Guide to Merchant Acquirer Banks and Payment Processing

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

At its most basic, a merchant acquirer bank is the financial institution that plugs your business into the world of card payments. They set up your merchant account and act as the essential middleman between you, the major card networks like Visa and Mastercard, and the bank that issued your customer's card.

Simply put, they’re the reason you get paid.

The Role of a Merchant Acquirer Bank in Your Business

Think of your merchant acquirer as the air traffic control for your sales. When a customer taps their card or enters their details online, a flurry of messages has to zip between different financial systems in a matter of seconds. The acquirer directs all this traffic, making sure the payment data gets where it needs to go, safely and securely.

Without an acquirer, your business is effectively cut off from the global payments network. They are the foundational partner that makes modern commerce tick.

Your Financial Gatekeeper

But an acquirer does a lot more than just shuffle money around. They act as your sponsor or gatekeeper within the card payments system. Before they’ll even let you take a single payment, they run a series of underwriting checks to make sure your business is legitimate and financially sound. This is a crucial step that protects the integrity of the whole system.

Once you’re approved, the acquirer sets you up with a merchant account. This isn't your normal business bank account; it's a special account where the money from your card sales pools before it's settled into your main account.

The Three Core Functions

Behind every single transaction, your acquirer is performing three critical jobs:

- Transaction Authorisation: When a payment is initiated, the acquirer takes that request from your terminal or website and sends it through the card scheme (like Visa) to the customer's bank to get a simple 'yes' or 'no'.

- Settlement and Funding: After the sale is approved, the acquirer pulls the money from the customer's bank and drops it into your merchant account. This process is known as settlement.

- Risk Management: Your acquirer is on the hook for a certain amount of financial risk. They manage this by keeping an eye out for fraud, helping you navigate chargeback disputes, and making sure you’re following all the PCI DSS security rules.

A merchant acquirer bank is more than just a service provider—it's a financial partner. It vouches for your business, handles the complex flow of funds, and connects you to the card payment ecosystem. For any business taking card payments, they are completely non-negotiable.

Getting your head around this relationship is the first step to truly owning your payment strategy. For businesses looking to fine-tune their setup, exploring dedicated merchant services solutions can offer tighter control and security, particularly for sales where the customer isn't physically present, like in a contact centre. This knowledge helps you pick the right partners and build a payment infrastructure you can rely on.

The Key Players in Every Card Transaction

To really get to grips with what a merchant acquirer bank does for your business, you first need a clear picture of everyone involved when a customer pays by card. Think of it like a play with a cast of four main characters.

Imagine a customer, Sarah, calls your contact centre to pay an invoice. That simple phone call sets off a chain reaction, a high-speed, secure dance between four distinct players to get the money from her account to yours.

Let's follow the journey.

The Cardholder and the Merchant

The whole process starts with the two people who actually want to do business:

The Cardholder: This is your customer, Sarah. She holds the card and gives you permission to charge it for a specific amount. She's the one kicking everything off.

The Merchant: This is you. You've sold a product or service and need to get paid.

This is the bit we all see, but behind the scenes, two powerful financial institutions are about to get involved to make the payment happen.

The Issuing Bank: The Customer's Bank

The issuing bank (or issuer) is simply the bank that gave Sarah her credit or debit card. We're talking about the big high-street names like Barclays, HSBC, or Lloyds. They have a direct relationship with Sarah, manage her account, set her credit limit, and send her a bill every month.

When you try to take a payment, the issuer's job is to answer one crucial question almost instantly: "Should we approve this?" To decide, it runs a lightning-fast check on a few key things:

- Does Sarah have enough money or available credit?

- Has the card been reported lost or stolen?

- Does this payment look unusual or potentially fraudulent?

The issuer carries all the risk on the customer's side of the fence. If a fraudster uses Sarah's card, the issuer is the one who has to cover the loss initially, which is why their security checks are so tight.

The Merchant Acquirer Bank: Your Bank

And here's where your merchant acquirer bank comes in. As we've covered, this is your bank in the payment process. Its main relationship is with you, the merchant. The acquirer gives you the special merchant account you need to take card payments and acts as your gateway to the global card networks like Visa and Mastercard.

When your agent types Sarah’s card details into your system, the request doesn’t go directly to her bank. Instead, it’s sent to your acquirer. The acquirer then packages it up and sends it down the right channels—through the card network—to Sarah's issuing bank to get a yes or no.

The easiest way to keep it straight is to remember this: The issuing bank issues the card to the customer. The merchant acquirer helps the merchant acquire the money from the sale.

Getting this distinction right is crucial. They are both banks, but they sit on opposite sides of the table. They have completely different jobs, manage different risks, and have different priorities. It's a common point of confusion, but understanding it makes everything from reading your fee statements to sorting out payment problems much, much easier.

To make their separate roles crystal clear, let's put them side-by-side.

Merchant Acquirer vs Issuing Bank: Key Differences

This table breaks down who does what in a typical card transaction. While both are banks, they serve completely different masters and have very different responsibilities.

| Aspect | Merchant Acquirer Bank | Issuing Bank |

|---|---|---|

| Primary Relationship | Serves the merchant (your business) | Serves the cardholder (your customer) |

| Main Responsibility | Routes transaction requests, settles funds into your merchant account, and manages your connection to card networks. | Issues payment cards, authorises or declines transactions, and manages the cardholder's account and credit. |

| Risk Focus | Manages merchant-side risk, including chargeback ratios, compliance, and potential for merchant fraud. | Manages cardholder-side risk, including credit defaults and fraudulent use of the card. |

| In a Dispute | Notifies you of a chargeback and facilitates the representment process if you decide to challenge it. | Initiates the chargeback on behalf of the cardholder and makes the final decision on the dispute's outcome. |

As you can see, they are two sides of the same coin. The acquirer is your partner in payments, fighting your corner, while the issuer is there to protect the cardholder. Both are essential for the system to work.

How Your Payments Are Actually Processed

Ever wonder what really happens when a customer taps their card? It feels instant, but behind that simple tap is a whirlwind of digital activity. This isn't just a straightforward money transfer; it's a high-speed conversation between several banks, with your merchant acquirer bank acting as the master coordinator.

Let's pull back the curtain on this four-step journey. Understanding this process makes it clear why there's a short gap between making a sale and seeing the money in your account. It shows you exactly where your funds are at every moment.

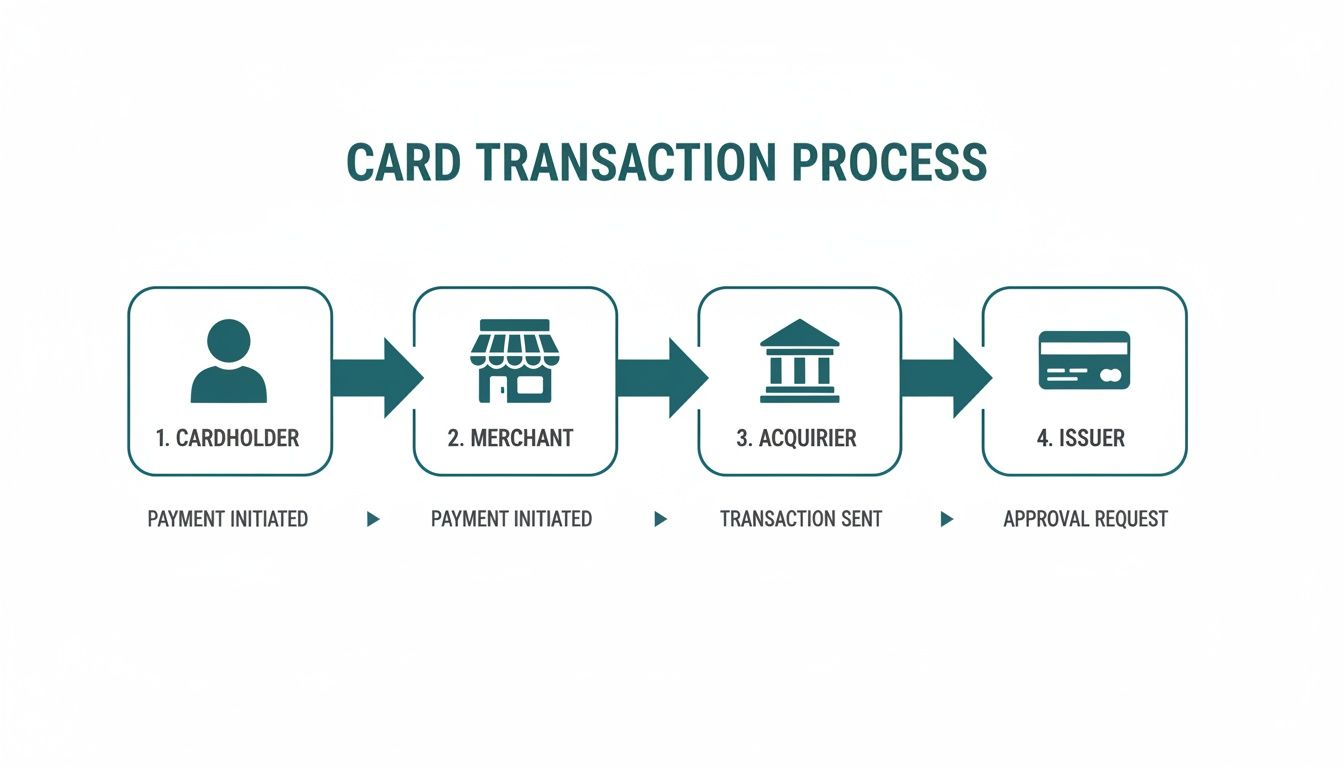

This flow chart maps out the key players and the path a payment takes from the customer's card right through to their bank.

As you can see, the merchant acquirer is the central hub. It takes the payment request from you and handles all the communication with the card schemes (like Visa or Mastercard) and the customer's bank.

Stage 1: The Authorisation Request

It all starts the second your customer provides their card details, whether they're tapping a terminal, typing them online, or reading them out over the phone. This first step, authorisation, is all about getting a rapid-fire "yes" or "no" from the customer's bank.

Here’s how that split-second sequence plays out:

- Your payment terminal or website checkout captures the card details and sale amount.

- This information zips securely over to your merchant acquirer bank.

- The acquirer instantly routes the request to the correct card scheme (e.g., Visa).

- The card scheme passes it on to the cardholder's own bank (the issuer).

- The issuing bank performs a quick check: are the funds available? Is the card valid? Any fraud flags? It then sends back an approval or decline code.

- This response travels all the way back down the line, and in a matter of seconds, your terminal flashes "Approved" or "Declined."

It's important to realise that no money has moved yet. An authorisation is simply a promise from the customer's bank that the funds are available and have been ring-fenced for this transaction.

Stage 2: The Clearing Process

As you go about your day, you'll collect a whole batch of these authorised payments. At the end of the day, your point-of-sale system or online gateway bundles them all up and sends a single file to your merchant acquirer. This is known as the clearing process.

You can think of it like submitting your weekly timesheet. Instead of logging every single task individually, you send a consolidated report of all your work. The acquirer does the same thing, sorting all your transactions and forwarding them to the relevant card schemes to officially start the money-moving process.

Stage 3: The Settlement of Funds

With the transaction data cleared, the card schemes step in to manage the settlement. This is where the money actually starts moving between the banks. The schemes act as the go-between, instructing all the different issuing banks to transfer the funds for your approved sales over to your merchant acquirer bank.

This inter-bank transfer is the critical, behind-the-scenes step that brings all your day's takings from potentially thousands of different customer banks into one place: your acquirer's account.

Key Takeaway: Authorisation is a promise to pay, clearing is the paperwork, and settlement is the actual movement of money between the banks. Each stage is a necessary step leading to the final goal: getting paid.

Stage 4: The Final Funding

Now for the part you’ve been waiting for: funding. Once your merchant acquirer has received the settled funds from all the issuing banks, it deducts its agreed-upon fees (often called the Merchant Service Charge).

What's left is then deposited directly into your business bank account.

The whole cycle, from the customer's tap to your bank deposit, usually takes 1-3 business days. The exact timing comes down to your specific agreement with your merchant acquirer, and this explains that natural delay between making a sale and having the cash on hand.

In this whole journey, the payment gateway is the secure messenger. It’s the technology that encrypts the initial payment request and sends it safely from your systems to the acquirer. For businesses that want to build a truly seamless and secure payment experience, getting the details of a payment gateway API integration right is absolutely essential.

What You're Really Paying For: A Plain-English Guide to Merchant Acquirer Fees

Taking card payments is a must for any modern business, but it doesn't come for free. If you've ever looked at your payment processing statement and felt completely baffled, you're not alone. Getting to grips with what your merchant acquirer bank is charging you is the first step to making sure you're getting a fair deal.

These fees aren't just pulled out of thin air. Each one pays for a specific part of the complex journey a transaction takes from your customer's card to your bank account.

The headline number you'll see is the Merchant Service Charge (MSC). This is the total percentage you pay on every single transaction, but it’s actually made up of three smaller, distinct costs. Think of it like a concert ticket price – part of it goes to the artist, part to the venue, and part to the ticket agent.

Let's pull back the curtain and see exactly where your money is going.

The Three Slices of the Fee Pie

The Merchant Service Charge isn't a single fee; it's a bundle that covers all the key players who make a card payment happen. Breaking it down shows you who gets what.

Here are the three core components:

Interchange Fees: This is the big one, usually accounting for 70-80% of your total cost. This slice of the pie goes from your acquirer straight to your customer's bank (the 'issuer'). It covers their costs for authorising the payment, the risk of fraud, and the convenience of offering credit. These rates are set in stone by the card schemes like Visa and Mastercard, so they’re non-negotiable.

Scheme Fees: A much smaller fee that goes directly to the card schemes themselves—Visa, Mastercard, and the like. This pays for the use of their vast, secure networks that connect all the banks together. Just like interchange, these are fixed and you can't negotiate them.

The Acquirer's Markup: This is the only part of the fee your acquirer actually keeps. It’s what they charge you for providing the merchant account, processing the transaction, moving the money into your bank, and offering support when you need it. This is the one and only part of the MSC where you have some wiggle room to negotiate.

How Acquirers Package Their Prices

Merchant acquirers present these fees in a few different ways, and the model you're on can dramatically change what you pay each month.

Interchange-Plus Pricing: This is by far the most transparent option. Your acquirer shows you the exact interchange and scheme fees for each transaction and then adds their markup on top. You can see precisely what they're making, which puts you in a much stronger negotiating position.

Tiered Pricing: This model bundles transactions into different categories like 'Qualified' or 'Non-Qualified', each with a different rate. It sounds simple, but it’s often murky. The acquirer decides which transactions fit into which tier, making your costs unpredictable and often higher than they need to be.

Flat-Rate Pricing: The simplest model of all. You pay one single percentage and maybe a small fixed fee for every transaction, no matter what card is used. It's easy to understand, but if you process a lot of low-cost debit cards, you'll almost certainly end up overpaying.

Choosing a pricing model isn’t just about finding the lowest number. It’s about clarity and control. Interchange-plus gives you a true picture of your costs, helping you make smarter decisions for your business.

Don't Forget the Hidden Extras

On top of the main transaction fees, you need to keep an eye out for other charges that can sneak onto your bill. Always read the small print in your contract for things like:

- Terminal Rental: A monthly fee for leasing your physical card machine.

- Payment Gateway Fee: A charge for the software that connects your website or phone system to the payment network.

- Chargeback Fee: A penalty you have to pay every time a customer disputes a transaction.

- PCI Compliance Fee: A fee for services to help you meet security standards, or worse, a penalty for failing to do so.

In the UK, the old guard of merchant acquirers still holds a massive 71% market share. This shows just how established they are in handling payments for everyone from high-street shops to large contact centres. Understanding how they structure their fees is crucial. If you're interested in the wider market, you can learn more about the UK's digital payment market dynamics on MerchantSavvy.co.uk.

Managing Risk and PCI Compliance with Your Acquirer

Your relationship with a merchant acquirer bank goes much deeper than just processing payments. They are, in essence, your primary partner in managing financial risk. Think of them as the gatekeepers of the payments ecosystem. Because they’re financially on the hook for the merchants they bring into the fold, they have a serious stake in making sure your business is secure and run responsibly.

This gatekeeper role kicks in right from the start. When you apply for a merchant account, the acquirer puts your business under the microscope in a process called underwriting. They’ll examine everything from your business model and trading history to your financial stability, all to be sure you’re a legitimate operation that can fulfil orders and handle any potential disputes.

The Challenge of Chargebacks

One of the biggest headaches for any acquirer—and for you—is the chargeback. This is what happens when a customer disputes a transaction with their bank, which then yanks the money back from your account. While it’s a vital tool for protecting consumers, a high rate of chargebacks can be a huge red flag for your acquirer, signalling everything from operational issues to poor security.

Chargebacks usually boil down to a few common causes:

- True Fraud: A classic case of stolen card details being used for an unauthorised purchase.

- Merchant Error: Simple mistakes like billing twice, charging the wrong amount, or failing to deliver the goods.

- Friendly Fraud: This is when a genuine customer disputes a legitimate charge, either because they’re confused or, sometimes, because they’re trying to get something for free.

A flood of chargebacks doesn’t just hit your bottom line through lost revenue and penalty fees; it chips away at your reputation with your acquirer. If your chargeback ratio creeps over the thresholds set by the card schemes (usually around 1%), you could find yourself in a monitoring programme, facing higher fees, or even having your merchant account shut down entirely.

The Bedrock of Security: PCI DSS Compliance

To keep the entire payment system safe from data breaches, every merchant acquirer bank insists on strict adherence to the Payment Card Industry Data Security Standard (PCI DSS). This isn't just a friendly suggestion; it's a non-negotiable part of your contract if you want to accept, process, store, or transmit cardholder data.

PCI DSS is the official rulebook for keeping sensitive payment information safe. Your acquirer is the enforcer, and it’s their job to make sure you follow those rules to the letter. Get it wrong, and you could be looking at crippling fines or losing your ability to take card payments altogether.

What’s required of you will vary depending on how many transactions you process and exactly how you handle card data. It's crucial to understand the different https://www.paytia.com/resources/blog/pci-levels-of-compliance, as this will define your security responsibilities. For businesses like contact centres, where agents might take sensitive card details over the phone, the compliance burden can feel especially heavy.

Reducing Your Risk and Compliance Burden

So, what’s the best way to manage chargeback risk and your PCI DSS obligations? Stop the sensitive data from ever entering your systems in the first place. This is where modern payment security platforms really shine.

Technologies that secure payment channels, like DTMF masking or encrypted payment links, can shrink your risk profile dramatically. When your agents, your IT systems, and even your call recordings never come into contact with raw card numbers, you effectively reduce your PCI scope. Alongside this, mastering application security best practices is key to protecting payment data and upholding the PCI compliance your acquirer enforces.

Taking this kind of proactive approach sends a clear message to your merchant acquirer bank: you are a low-risk, responsible partner. By proving you have solid controls in place to protect card data, you not only make your own compliance journey simpler but also build a stronger, more trusted relationship with the institution that makes it possible for you to get paid.

How to Choose the Right Merchant Acquirer Bank

Choosing a merchant acquirer bank is one of those foundational business decisions that can make or break your operations. It directly affects your cash flow, customer experience, and bottom line. Think of it less like picking a supplier and more like finding a long-term business partner.

The first port of call should always be the fee structure. A good partner will be completely upfront about what you’re paying for. Look for a clear pricing model like Interchange-plus, which separates the card scheme fees from the acquirer’s margin, and be wary of complex tiered pricing that can obscure the true cost.

Don't just skim the contract, either. Dig into the fine print for hidden fees, lengthy lock-in periods, or hefty early termination penalties. Your agreement should give you room to grow, not tie you down.

Evaluating Technology and Support

Once you're happy with the commercials, it's time to look at the technology. How well does their payment gateway or processing platform play with your existing systems? If you run a contact centre, for instance, a clunky integration with your CRM will create constant friction for your agents and a disjointed experience for your customers.

And what happens when things go wrong? Because at some point, they will. The quality of customer and technical support is a huge differentiator. You need a team you can get hold of quickly—people who know what they're talking about and can solve your problem without passing you from pillar to post. It's worth giving their support lines a test call before you sign anything.

A great merchant acquirer should feel like an extension of your team. Their technology should empower your operations, and their support should provide confidence that you can resolve issues quickly and efficiently.

Weighing Stability Against Innovation

The acquiring market is a tale of two cities right now. In the UK, the big, established players still hold a massive 71% of the market share. Yet, nimble fintech challengers are winning over 80% of new merchants, especially SMEs, by offering smarter tech and better service. You can read more about the UK payments business on Fintech Wrap Up.

This leaves you with a critical choice. Do you go with the perceived safety of a household name, or do you partner with an innovator that’s more agile? The right merchant acquirer bank for your business will strike the perfect balance between proven reliability and the kind of forward-thinking features that can truly help you get ahead.

Your Merchant Acquirer Questions, Answered

Even after getting the hang of how the payment world fits together, you're bound to have a few practical questions. Let's tackle some of the most common ones that businesses ask when dealing with a merchant acquirer bank.

What's the Real Difference Between an Acquirer and a Payment Gateway?

This one trips up a lot of people, but the distinction is actually quite simple once you see how they work together.

Think of your merchant acquirer as the actual bank in the transaction. It's the financial institution that provides your merchant account, underwrites the financial risk, and ultimately moves the money from your customer’s card issuer into your business bank account. The acquirer is all about the money.

A payment gateway, on the other hand, is the secure piece of technology that acts like a digital courier. Its job is to safely grab the payment details from your website or payment terminal and securely pass them along to the acquirer. The gateway is all about the secure data transfer.

In a nutshell: The gateway is the secure messenger, and the acquirer is the bank that manages the funds. You need both to get paid.

Can I Switch My Merchant Acquirer Bank?

Yes, absolutely. In fact, it's good business practice to review your acquiring relationship every so often to make sure you’re still getting the best deal and service for your needs.

But before you jump ship, you need to dig out your current contract and read the fine print. Most agreements have strict notice periods or hefty early termination fees that can catch you out if you’re not careful.

When you're shopping around for a new provider, don't just get dazzled by low headline rates. Look deeper. Consider the quality of their customer support, how easily their tech integrates with your systems, and whether their solutions can help you simplify your PCI DSS compliance. A great merchant acquirer bank acts like a partner in your business, not just a faceless processor.

How Can I Tell if My Acquirer's Fees Are Fair?

Figuring out what's "fair" really depends on your business. Your sales volume, average transaction size, and risk profile all play a huge part. A good rate for a busy high-street shop won't be the same for a small contact centre taking occasional payments.

The most honest and transparent pricing model you'll find is called Interchange-plus. This model clearly separates the fixed interchange and scheme fees (which nobody can change) from the acquirer's own markup. This way, you can see exactly what their slice of the pie is.

To get a proper feel for whether a deal is fair, you need to do your homework:

- Get a few quotes: Always compare detailed proposals from at least three different acquirers.

- Ask for a full fee schedule: A simple blended rate can hide all sorts of extra charges. Insist on seeing a complete breakdown of every possible fee.

- Get a statement analysis: Ask any potential new acquirer to go through one of your current statements and show you exactly, line by line, where they can save you money.

Putting in this effort up front is the best way to make sure you end up with a deal that's both competitive and completely transparent.

At Paytia, we know that wrestling with payment security and compliance can be a headache. Our solutions are built to work perfectly with whatever merchant acquirer you choose, helping you massively reduce your PCI DSS scope and keep your customers' sensitive data safe on every single transaction. Learn more about how Paytia can secure your payments.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.