Discover PCI levels of compliance: A Clear Guide to PCI Thresholds

Get Compliance Consultation

Ensure your payment processing meets UK regulations with Paytia's compliance experts.

Trying to get your head around PCI DSS requirements can feel a bit like deciphering a completely new language. But here's the good news: PCI compliance isn’t one single, monolithic mountain to climb. It’s actually a tiered system, and where you fit in depends on how many card transactions your business processes each year.

Figuring out the different PCI levels of compliance is the first, and most important, step towards getting a handle on your security responsibilities.

Finding Your Place on the Compliance Map

Think of PCI compliance a bit like vehicle licensing. You don't need the same licence to ride a moped as you do to drive a 44-tonne lorry. It’s the same principle here. A small local shop processing a few dozen card payments a week has very different security validation needs compared to a massive online retailer that handles millions. This risk-based approach keeps the security measures proportionate to the potential threat.

The Payment Card Industry Data Security Standard (PCI DSS) groups businesses into four main tiers, known as Merchant Levels 1, 2, 3, and 4. Your specific level is decided almost entirely by your annual transaction volume, and that level dictates exactly what you need to do to prove you're compliant.

Why Your Transaction Volume Matters

The logic is pretty straightforward: the more cardholder data you handle, the bigger the risk if something goes wrong. This makes you a more attractive target for cybercriminals. As you move up the levels, from 4 to 1, the validation and reporting requirements naturally become more stringent. This framework is designed to help you pinpoint your exact obligations, turning what looks like a complicated rulebook into a clear, actionable checklist.

For example, businesses that accept payments over the phone face their own unique set of challenges. If that's you, our guide explains the key UK regulations for taking credit card payments over the phone and how they fit into the bigger PCI DSS picture.

By identifying your merchant level right from the start, you can navigate the requirements with confidence, avoid wasting time on tasks that don't apply to you, and focus your energy on the security controls that truly matter for your business. It's all about finding your spot on the compliance map so you can chart a clear path forward.

In the next sections, we’ll break down each of these levels, look at the specific transaction thresholds, and detail the exact validation methods required for each one—from simple self-assessment questionnaires to full-blown formal audits.

What Are the Four PCI Merchant Levels?

To get a handle on your compliance responsibilities, the first step is figuring out which of the four PCI merchant levels your business fits into. The whole system is based on one simple metric: how many card transactions you process each year. Think of it as a risk-based tier system – the more card payments you handle, the stricter the rules become.

The logic here is pretty straightforward. A business processing millions of transactions is a much bigger target for criminals than a small local shop. A breach there could be catastrophic, so the validation requirements are naturally tougher. Each level has its own set of hoops to jump through to prove you're keeping customer data safe.

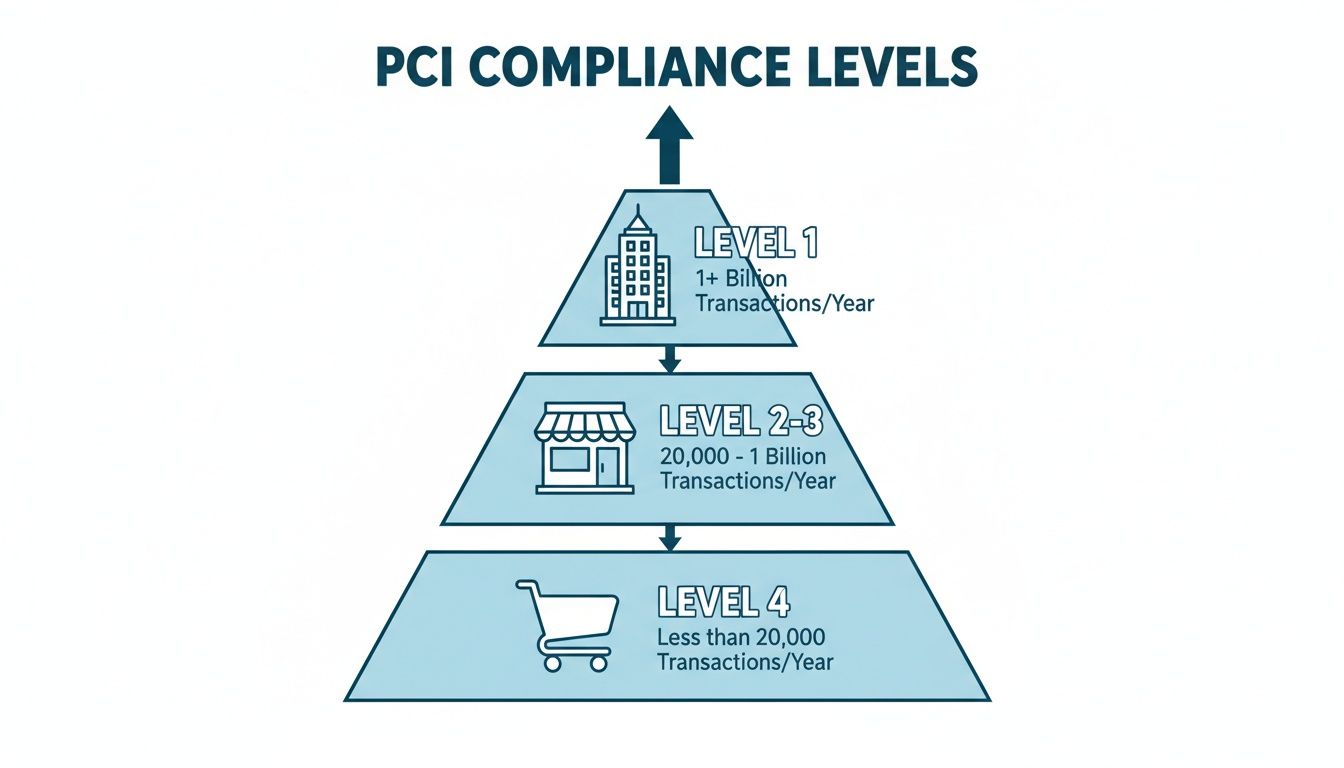

This pyramid gives you a quick visual breakdown of how the levels are structured. You’ll see that Level 1 sits at the top, reserved for the largest global players, while the vast majority of businesses fall into the base.

As you can see, most businesses are at Level 4, but the organisations at the peak of the pyramid are the ones facing the most intense scrutiny from the payment card industry.

Level 1 Merchants

This is the top tier, the most demanding of all PCI compliance levels. If your business processes over six million card transactions a year, across all your payment channels, you’re in this bracket. The sheer volume of cardholder data you’re responsible for puts you in the highest-risk category.

Because of this heightened risk, you can’t just tick a few boxes yourself. Level 1 merchants must bring in the experts for a formal, on-site audit every single year, conducted by a Qualified Security Assessor (QSA). The outcome of this deep dive is a document called a Report on Compliance (ROC), which meticulously verifies that you’re meeting every single PCI DSS requirement. It’s a serious undertaking.

Level 2 Merchants

Dropping down a notch, we have Level 2. This is for businesses that process between one and six million card transactions annually. The compliance burden here is a little lighter than for Level 1, but it’s still a significant commitment.

Instead of that full external audit, Level 2 merchants can typically validate their compliance using an annual Self-Assessment Questionnaire (SAQ). But that's not all. You’ll also need to submit a signed Attestation of Compliance (AOC) and arrange for quarterly network vulnerability scans performed by an Approved Scanning Vendor (ASV).

Level 3 Merchants

This level is typically where you’ll find many mid-sized e-commerce businesses. Specifically, Level 3 applies to merchants processing between 20,000 and one million e-commerce transactions per year. In the UK, the card brands have set these clear thresholds to define exactly what’s expected. You can find a detailed breakdown of these UK-specific levels over at securious.co.uk.

Validation for this group usually involves completing the right SAQ for your payment setup and potentially undergoing quarterly ASV scans, especially if you have public-facing IP addresses involved in the payment process.

Key Takeaway: While the major card brands like Visa and Mastercard set the global standards, it’s actually your acquiring bank (the one that processes your payments) that officially determines your merchant level. They are the ones who will tell you exactly what you need to do to prove your compliance.

Level 4 Merchants

Finally, we arrive at Level 4, which covers the vast majority of small businesses. If you process fewer than 20,000 e-commerce transactions per year, or up to one million transactions through other channels (like in-person or over the phone), this is you.

Just like Levels 2 and 3, validation is handled through an annual SAQ. The specific questionnaire you'll need to fill out depends entirely on how you take card payments. For some, quarterly ASV scans might also be required.

PCI DSS Merchant Compliance Levels at a Glance

To make this a bit easier to digest, here’s a simple table summarising the four merchant levels and their core requirements.

| Merchant Level | Annual Transaction Volume (All Channels) | E-commerce Transaction Threshold | Primary Validation Method |

|---|---|---|---|

| Level 1 | Over 6 million | N/A | Annual Report on Compliance (ROC) by a QSA |

| Level 2 | 1 to 6 million | N/A | Annual Self-Assessment Questionnaire (SAQ) & AOC |

| Level 3 | Under 1 million | 20,000 to 1 million | Annual Self-Assessment Questionnaire (SAQ) |

| Level 4 | Under 1 million | Fewer than 20,000 | Annual Self-Assessment Questionnaire (SAQ) |

Remember, this table is a general guide. Your acquiring bank will always have the final say on your specific obligations based on their risk assessment of your business.

Decoding Your Validation and Reporting Requirements

Once you've figured out which PCI level you fall into, the next question is simple: what do you actually need to do? Proving you're compliant isn’t just about ticking boxes; it involves specific documents and validation methods. This isn't just paperwork—it’s the concrete proof your acquiring bank needs to see.

Think of it like getting a vehicle MOT. A small family car and a heavy goods vehicle both need to prove they're roadworthy, but the tests they undergo are vastly different. In the same way, a Level 1 merchant’s validation process is far more intense than a Level 4 business’s self-check.

The Two Paths of Validation: ROC vs. SAQ

For the largest businesses, validation is a formal, hands-on process.

- Report on Compliance (ROC): This is the most thorough validation method, strictly for Level 1 merchants. It’s a comprehensive, on-site audit performed by an independent Qualified Security Assessor (QSA). The QSA meticulously examines every aspect of your security controls and documents their findings in the ROC.

For most other businesses (Levels 2, 3, and 4), the process is a guided self-evaluation.

- Self-Assessment Questionnaire (SAQ): This is a tool merchants and service providers use to report on their PCI DSS self-assessment. There isn't just one SAQ, though. There are several types, each tailored to different payment scenarios. For example, a business that fully outsources its payment processing (SAQ A) has far fewer requirements to verify than one that handles card data on its own servers (SAQ D).

The key difference is external versus internal validation. A ROC is an independent audit by a third-party expert, while an SAQ is your organisation’s declaration that you have met the necessary security requirements.

Understanding Key Compliance Acronyms

Beyond the main validation documents, a few other key terms and reports pop up. Getting your head around these helps complete the picture of your reporting duties.

An Attestation of Compliance (AOC) is a form you submit alongside your ROC or SAQ. It’s essentially your formal declaration, signed by an executive, confirming that the information you've provided is accurate and that your business is compliant. It's the official sign-off on all your hard work.

Another critical component is the Approved Scanning Vendor (ASV). This is a company certified by the PCI Security Standards Council to conduct external vulnerability scans. If your business has any external-facing IP addresses in your payment environment, you'll almost certainly need to undergo quarterly network scans by an ASV to check for security holes.

Navigating PCI DSS means knowing how to effectively validate and report on your controls, especially in modern, dynamic environments. This often involves addressing and mitigating cloud computing security risks as part of your overall strategy.

Ultimately, these elements—the ROC or SAQ, the AOC, and any required ASV scans—form the complete package of proof you submit to your acquiring bank. It’s how you demonstrate your commitment to protecting cardholder data.

How PCI Compliance Levels Play Out in the Real World

All these rules and levels can feel a bit abstract, so let's bring them to life. By looking at a few everyday business scenarios, you can see exactly how transaction volume shapes what a company actually has to do to stay compliant. It’s all about turning the theory into practical, real-world actions.

Think of it as a story for each business type. We’ll connect the dots between the number of payments they handle and the specific security hoops they need to jump through each year.

The National Supermarket Chain: Level 1

First up, picture a massive national supermarket chain. We're talking hundreds of stores across the UK, a sprawling e-commerce site, and a busy home delivery service. They're easily processing well over six million card transactions a year.

That colossal volume puts them squarely in Level 1. For them, a simple self-assessment won't cut it. They must bring in the experts for a rigorous, on-site audit every single year, conducted by a Qualified Security Assessor (QSA). The end result is a formal Report on Compliance (ROC). This is the most intense validation process there is, and for good reason—the sheer amount of cardholder data they handle represents a huge risk.

The Growing Online Fashion Brand: Level 2

Now, let's switch to a trendy online fashion brand that's really taken off. It’s pulling in around 1.5 million transactions annually through its popular website. This volume slots them into the Level 2 category.

While they get to skip the full on-site audit that a Level 1 merchant endures, their compliance journey is still a serious undertaking. They need to fill out an annual Self-Assessment Questionnaire (SAQ)—likely one of the more detailed versions—and submit an Attestation of Compliance (AOC). On top of that, they have to hire an Approved Scanning Vendor (ASV) to run quarterly network vulnerability scans, probing their systems for any security weaknesses.

Each business’s journey is unique, but the principle is constant: higher transaction volume means more stringent validation. The goal is to match the level of scrutiny to the level of risk.

The Local Restaurant with Online Orders: Level 3

Think about your favourite local restaurant that started taking online orders for takeaways. It processes about 50,000 e-commerce transactions a year through its website, which places it firmly in Level 3.

Here, the compliance path gets much more straightforward. The restaurant's main job is to complete the right annual SAQ, which all depends on how its website payment system is set up. For instance, if they use a payment gateway that redirects customers to a secure, third-party page to enter their card details, they can likely use the much shorter and simpler SAQ A. This massively reduces their workload, but knowing the consequences of PCI non-compliance is still vital, even for smaller operations.

The Independent Gift Shop: Level 4

Finally, let’s imagine a charming little gift shop in a local village. The owner has a single card terminal on the counter for face-to-face sales and processes fewer than 20,000 transactions a year. This business is a classic Level 4—the most common tier of all.

For the shop owner, the primary task is completing an annual SAQ. Depending on their specific card machine and how it’s connected, this could be a relatively simple questionnaire. It’s a process designed to be manageable for even the smallest of businesses, ensuring everyone does their part to protect customer data.

The True Cost of Getting PCI Compliance Wrong

Thinking about the different pci levels of compliance might seem like just another box-ticking exercise, but getting it wrong is far more than a simple admin headache. It's a massive business risk with serious financial and reputational consequences that can send shockwaves through your entire company.

Ignoring PCI DSS requirements isn't a strategy; it's a high-stakes gamble. The immediate penalties from card brands are bad enough, but the damage from a breach can be catastrophic, as we’ve seen in large-scale credit and debit card data breaches where millions of records are exposed.

Financial Penalties and Hidden Costs

The most direct consequence of non-compliance is the hefty fines imposed by the payment card brands. These aren't just a slap on the wrist; they are designed to hurt.

For UK businesses, these penalties can run from £5,000 to £100,000 per month, depending on how long you've been non-compliant and how serious the issue is. And that's just the start. If you suffer a data breach, you'll also be on the hook for forensic investigations, credit monitoring for affected customers, and the cost of reissuing every single compromised card.

But the real danger often lies beyond the card brand penalties.

In the UK, a PCI-related data breach that exposes personal customer information also falls under the Data Protection Act 2018 (GDPR). This can trigger separate, and often much larger, regulatory fines that can reach up to £17.5 million or 4% of your global annual turnover—whichever is higher.

That means a single security slip-up could leave you facing two sets of crippling financial penalties. To understand more about how these costs are calculated, it's worth reading the comprehensive UK guidance on non-compliance penalties.

The Damage to Customer Trust

Beyond the immediate financial hit, the long-term reputational damage can be even more devastating. Trust is the cornerstone of any customer relationship, and a data breach shatters it in an instant.

Losing customer confidence leads to churn, bad press, and a tarnished brand image that can take years, if ever, to rebuild. Investing in robust security and maintaining PCI compliance isn't just about avoiding fines; it’s about protecting your bottom line and preserving the trust you've worked so hard to build.

How to Simplify Your Compliance and Reduce Scope

Trying to get your head around the different PCI compliance levels can feel like a mammoth task. But there's a powerful strategy that makes the whole thing far more manageable: scope reduction.

The concept is beautifully simple. If sensitive cardholder data never even touches your systems, your compliance footprint shrinks dramatically.

This isn't just some clever technical workaround; it's a strategic business decision. It's about minimising risk, cutting costs, and saving a huge amount of time. By bringing in modern payment technologies, you can effectively build a protective bubble around your business environment.

Descoping Your Contact Centre

For any business that takes payments over the phone, the contact centre is a massive source of PCI scope. Think about it: your agents and call recording systems are directly exposed to sensitive payment card numbers, which puts a heavy compliance burden on your entire infrastructure.

The good news is you can pull this entire environment out of scope using specific technologies. Take DTMF (Dual-Tone Multi-Frequency) masking as an example. This lets customers tap in their card details on their telephone keypad. Those tones are intercepted and masked before they ever get to your agent or your call recording systems.

The result? The sensitive data never even enters your environment.

This approach brings some serious benefits to the table:

- Simpler SAQs: Descoping can be the difference between wrestling with a complex SAQ D and breezing through a much simpler questionnaire like SAQ A.

- Lower Costs: With fewer systems in scope, the time and money you spend on audits and vulnerability scans will drop significantly.

- Better Security: The safest way to protect data is to not have it in the first place. This fundamentally lowers your risk of a breach.

By preventing cardholder data from ever entering your network, you're not just ticking a box. You are fundamentally changing your business's risk profile. Suddenly, PCI compliance stops being a defensive chore and becomes a proactive advantage.

This method is genuinely one of the most effective ways to simplify the whole PCI validation process. It’s all about working smarter, not harder, to achieve solid security. You can find out more about how modern payment capture solutions simplify PCI DSS compliance and see how you can reduce the burden on your team.

Got Questions About PCI Compliance Levels? We've Got Answers.

We’ve dug deep into the different PCI levels of compliance, but it’s natural for a few questions to still be floating around. Here are some quick, straightforward answers to the ones we hear most often.

If I Use a Third-Party Processor, Am I Automatically Compliant?

This is a common misconception. While using a compliant processor like Stripe is a massive step in the right direction and drastically shrinks your PCI scope, it doesn’t get you off the hook entirely. You're still on the line for your own bit of the compliance puzzle.

Think of it this way: the processor handles the heavy lifting, but you still need to prove your own environment is secure. This almost always means completing a Self-Assessment Questionnaire (SAQ) each year. The exact one you’ll need, like the much simpler SAQ A, hinges on how you’ve integrated their payment services.

How Do I Figure Out My Official PCI Level?

Your acquiring bank—the financial institution that provides your merchant account—is the ultimate authority here. They determine your official PCI level based on the number of card transactions you process over a year, following the thresholds set by the major card brands like Visa and Mastercard.

The only surefire way to know your level is to ask them. Just get in touch with your acquiring bank or payment processor. They’ll tell you exactly what your level is and which validation documents you need to get sorted.

Remember: Your acquiring bank has the final word on your compliance level and what you need to do. Don't rely on online calculators or general guides; always go straight to the source.

What Happens if My Business Grows and I Jump Up a Level?

First off, congratulations! But yes, if your transaction volume climbs and pushes you into a higher PCI level, your validation requirements will get tougher. For instance, moving from Level 4 to Level 3 could mean switching to a more detailed SAQ or facing new scanning requirements.

Your acquirer keeps an eye on your transaction volumes, so they’ll let you know when you've crossed a threshold. It's always a good idea to stay ahead of the game, though. If you see significant growth on the horizon, have a chat with them early. It’ll give you plenty of time to prepare for what’s next.

Ready to drastically reduce your PCI scope and simplify compliance? Paytia secures your phone and digital payments, preventing sensitive data from ever touching your systems. Discover how Paytia can protect your business and your customers.

Ready to Simplify Compliance?

Get expert guidance on UK payment regulations and PCI DSS compliance. Contact us today.