A Guide to Contact Center IVR for Seamless Customer Interactions

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think of a modern contact centre IVR as the digital front door to your business. It's the first voice your customers hear, intelligently greeting them and figuring out what they need without anyone having to lift a finger. Forget those frustrating, robotic menus from years ago; today’s Interactive Voice Response systems are sharp, efficient digital receptionists, on duty 24/7. They can instantly solve simple queries or route more complex issues to the perfect agent.

What Is a Modern Contact Centre IVR

At its heart, a contact centre IVR is an automated phone system that talks to callers, collects information, and sends them to the right place. But its role has grown far beyond simple call routing. Now, it's a strategic asset for managing the entire customer journey, right from that first "hello."

Here's a good way to think about it. A traditional IVR was like a basic building directory with a limited set of buttons, forcing you down a rigid, pre-set path. A modern IVR is much more like a human concierge. It listens to your request in plain English and guides you directly where you need to go, whether that’s a self-service payment portal or a specialist on the team.

The Evolution from Menus to Conversations

The biggest leap in IVR technology has been the move from clunky keypad entries—those Dual-Tone Multi-Frequency (DTMF) beeps—to genuine conversational AI. This has completely changed the game, turning a frustrating process into something smooth and natural. In UK contact centres, research shows that advanced IVRs with natural language processing let callers simply state their needs, routing them instantly without forcing them through complicated menus. You can learn more about how technology is adapting in our latest look at call centre trends.

This shift is all about two key functions:

- Empowering Customers: It gives them immediate, round-the-clock access to self-service. They can check an order, pay a bill, or book an appointment, all on their own terms.

- Supporting Agents: It handles the repetitive, high-volume stuff. This frees up your human agents to focus on the high-value conversations—the complex problems or empathetic moments where their skills really shine.

A well-designed IVR doesn't create a barrier between you and your customers; it builds a more efficient bridge. By automating the routine, it makes human interactions more meaningful and impactful.

Ultimately, a modern contact centre IVR changes the whole dynamic of that first point of contact. It's no longer just a necessary evil. It's now a powerful tool for boosting operational efficiency, securing sensitive actions like payments, and delivering a far better customer experience from the moment someone dials your number.

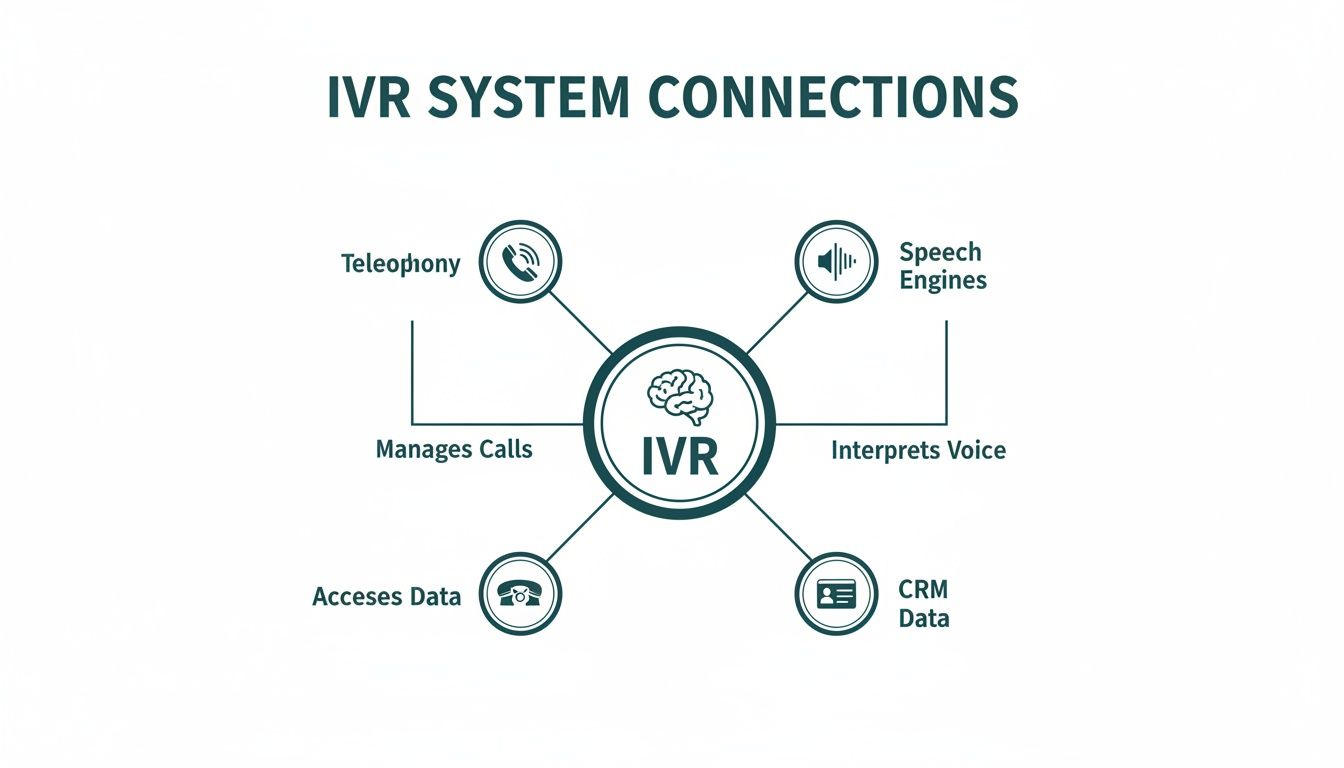

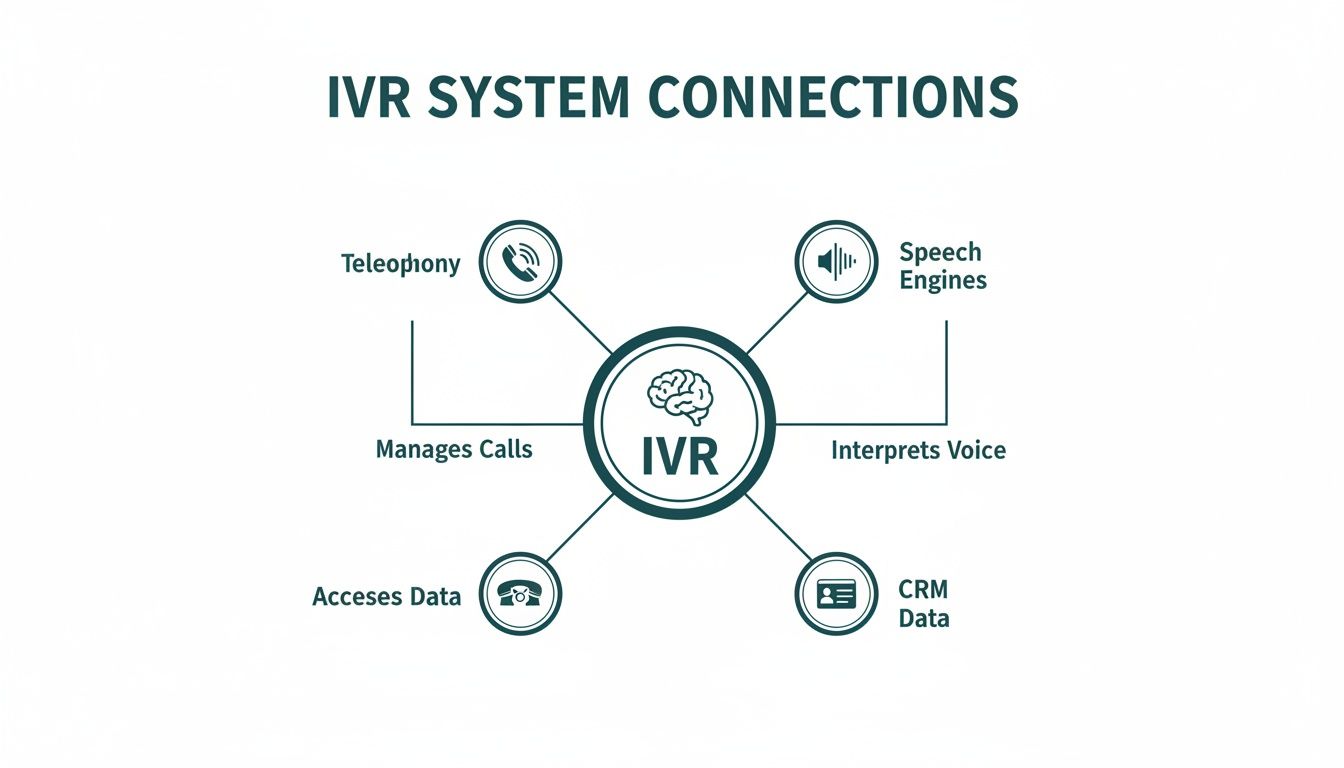

How IVR Technology Connects Your Business Systems

To really get what a modern contact centre IVR can do, it helps to look under the bonnet and see how all the pieces fit together. Think of it like a perfectly run restaurant kitchen during a busy Saturday night. Every part has a job, and they all have to communicate flawlessly to create a great experience for the customer.

First up, you have the telephony interface. This is your front-of-house staff, taking the initial order. It’s the technical gateway connecting the public phone network to your internal systems, handling the raw audio and call signalling.

Then you have the IVR application itself, which is the head chef running the show. This is the core logic that orchestrates the entire operation. It executes the call flows you’ve designed, knows which questions to ask, and decides where to send the caller based on their answers.

Working right alongside the head chef are the specialist cooks—the speech engines. These include:

- Text-to-Speech (TTS): This is the voice of your IVR, converting your written scripts into natural-sounding spoken words.

- Automatic Speech Recognition (ASR): This engine is the listener, translating a caller's spoken words into text the IVR application can work with.

These parts handle the basic mechanics of a call, but the real magic of a modern IVR comes from its ability to connect with your other business systems. This is where it goes from being a simple call routing tool to a central hub for customer interaction.

Weaving Together Your Customer Data

The most powerful connection for a contact centre IVR is with your Customer Relationship Management (CRM) system. The moment a call comes in, the IVR can do a quick "data dip" into your CRM using the caller's phone number.

This simple integration instantly turns a generic call into a personal conversation. Instead of a bland, "Hello, welcome," the IVR can greet a returning customer with something like, "Hi, Sarah. Are you calling about your recent order?" That small touch makes the customer feel seen and valued.

By connecting to your CRM, the IVR stops treating callers like strangers. It leverages existing data to anticipate needs, streamline verification, and create a journey that feels both personal and efficient.

This link gives the IVR access to a goldmine of information, such as:

- Account history and previous interactions.

- Recent purchases or open support tickets.

- Customer status (e.g., VIP, new client).

Armed with this context, the IVR can route calls far more intelligently, sending a high-value client straight to a senior account manager while guiding a new customer to the right onboarding team.

The Critical Link to Payment Systems

Another absolutely vital integration is with your payment gateways. This connection is what lets a contact centre IVR securely handle financial transactions without any human involvement—a total game-changer for efficiency and PCI compliance.

When a customer needs to pay a bill, the IVR application establishes a secure link to your payment processor. The caller then enters their card details using their phone’s keypad. Those tones (DTMF) are captured directly by the secure payment system, completely bypassing your contact centre environment.

This direct line is the key to shrinking your PCI DSS compliance scope. Since your agents and call recording systems never hear or touch the sensitive card data, the risk of a breach plummets. You can learn more about how a payment gateway API integration builds these secure, automated financial workflows.

Ultimately, these integrations are what elevate an IVR from a simple menu into a dynamic, intelligent part of your business operations.

Securing Payments and Achieving PCI DSS Compliance

When a customer gets ready to pay over the phone, it’s a make-or-break moment for the sale. It's also a huge security risk for your business. The second you handle sensitive card details directly, you’re exposing your entire contact centre to the tough requirements of the Payment Card Industry Data Security Standard (PCI DSS).

A single slip-up, like a card number getting picked up by a call recording or jotted down by an agent, is all it takes to cause a data breach. The aftermath isn’t just heavy fines; it’s the kind of brand damage that can be impossible to repair.

This is exactly where a secure contact centre IVR steps up. It stops being a simple call-routing tool and becomes a core part of your security and compliance framework, built specifically to handle payments without letting sensitive data anywhere near your internal systems.

As this diagram shows, a modern IVR sits at the centre of your operations, connecting your phone lines, speech recognition, and CRM to manage customer interactions securely and smartly.

The image really brings to life how these integrations let the IVR pull information from different places, creating a smooth and intelligent journey for the customer from beginning to end.

Building a Secure Digital Tunnel for Payments

So, how does a secure IVR actually protect payment data? Think of it as creating a ‘secure digital tunnel’. When a customer is ready to pay, the agent can stay on the line to help them, but the payment itself is diverted through this private tunnel.

The customer simply enters their card numbers using their phone’s keypad. The IVR uses clever tech like DTMF (Dual-Tone Multi-Frequency) masking to grab these tones before they ever get to your agent or your call recording system. Instead of the usual beeps, the agent just hears a flat, monotonous sound, making it impossible to figure out the numbers.

At the same time, the IVR opens a direct, encrypted line to your payment gateway to process the transaction. This is often called channel separation.

This secure tunnel effectively puts a wall around your entire contact centre environment—your people, your call recorders, and your network—separating them completely from the payment. The sensitive data travels through the tunnel straight to the payment processor, never once touching your systems.

It’s this architectural separation that dramatically cuts down your compliance headache.

Slashing Your PCI DSS Scope

For any business that takes card payments, getting and staying PCI DSS compliant can be an expensive, all-consuming task. The ‘scope’ of compliance covers all the people, processes, and tech in your business that store, process, or transmit cardholder data.

The bigger your scope, the more systems you have to lock down, the tougher the audits, and the higher the costs. By using a secure IVR for payments, you effectively lift your entire contact centre out of that scope.

Here’s what that looks like in the real world:

- Simpler Audits: Auditors don't need to pore over your call recording systems, agent desktops, or network infrastructure, because card data never enters that environment in the first place.

- Lower Compliance Costs: The price tag for annual audits, penetration testing, and securing a wide range of systems can drop significantly—often by as much as 90-95%.

- Massively Reduced Breach Risk: When the most valuable data isn't in your systems, you suddenly become a much less interesting target for cybercriminals.

You can get a deeper understanding by exploring the core PCI DSS requirements to see how this technology tackles them head-on.

Comparing Payment IVR Approaches

It's important to know that not all IVR payment solutions are built the same. The level of security and the impact on your PCI DSS scope can differ wildly.

Let's break down the key differences between a standard approach and a truly secure one.

Standard IVR vs Secure Payment IVR for PCI DSS Compliance

| Feature | Standard IVR | Secure Payment IVR (e.g., Paytia) | PCI DSS Impact |

|---|---|---|---|

| Data Handling | Card data may pass through business systems before reaching the payment gateway. | Card data is diverted and sent directly to the payment gateway, bypassing internal systems. | Secure IVR drastically reduces scope by keeping card data out of your environment. |

| Agent Involvement | Agents may still hear or see card details, keeping them and their workstations in scope. | Agents are completely isolated from the payment data via DTMF masking and channel separation. | De-scopes agents and their equipment, simplifying compliance and training. |

| Call Recordings | Card details can be accidentally captured in recordings, creating a major compliance failure. | DTMF suppression ensures no sensitive tones are ever stored in audio logs. | Eliminates the risk of card data contamination in call recordings. |

In the end, putting a secure payment function inside your contact centre IVR is one of the smartest moves you can make to protect your customers and your business. It turns a high-risk process into a secure, compliant, and trustworthy interaction that builds customer confidence right when it matters most.

Exploring Real-World Benefits and IVR Use Cases

Beyond the technical diagrams and security protocols, what’s the real story? What tangible value can a modern contact centre IVR actually deliver? The answer is a lot more than just call routing. When done right, an IVR becomes a strategic asset that delivers measurable wins in three key areas: cutting costs, delighting customers, and making your agents’ lives easier.

Think of it this way: implementing an IVR isn’t about building walls around your human agents; it’s about building smarter pathways for your customers. By automating the routine, high-volume stuff, you create a far more efficient and satisfying experience for everyone.

This approach is becoming non-negotiable as customer expectations continue to climb. Despite the rise of digital channels, recent research from UK contact centres reveals that 70% of customers still want to speak to a real person for specific situations. This doesn’t make the IVR irrelevant—it clarifies its job. Its primary role is to manage queues and knock out simple queries upfront, freeing up your agents for the conversations where they truly make a difference. You can see more on what UK customers really want from contact centre interactions in 2025.

Reducing Operational Costs with Smart Automation

One of the first things you’ll notice is the impact on your bottom line. Every single call that gets fully resolved without human help is a direct cost saving. Scale that across thousands of interactions, and the financial argument becomes impossible to ignore.

Here are a few powerful examples where automation pays for itself:

- Automated Bill Payments: Instead of an agent spending five minutes processing a payment, the IVR can handle the entire transaction securely. This doesn't just save time and money; it shrinks your PCI DSS scope, as we've already covered.

- Order and Account Status Checks: Questions like "Where’s my delivery?" or "What’s my account balance?" are perfect for an IVR. The system can do a quick data dip into your CRM or order management platform to give an instant, accurate answer.

- Information Broadcast: Use the IVR as your frontline announcer for frequently asked questions—things like business hours, office locations, or updates on service outages.

By automating these predictable, repetitive tasks, you're not just saving money. You're reallocating your most valuable resource—your agents' time—towards more complex and revenue-generating activities.

Elevating the Customer Experience with Self-Service

Today's customers crave convenience and control. A well-designed IVR delivers both by offering powerful self-service options that are available 24/7, long after your human agents have clocked out. This empowers customers to get things done on their own schedule.

A fantastic example is self-service appointment scheduling. A caller can interact with the IVR to find available slots, book a new appointment, or even reschedule an existing one—all without ever needing to speak to a receptionist. For the customer, it’s a seamless experience. For your business, it’s a massive efficiency win. For a deeper dive, take a look at how this technology is changing customer interactions in contact centres.

Boosting Agent Productivity and Job Satisfaction

This might be the most underrated benefit of a great contact centre IVR: its positive impact on your team. When the IVR siphons off all the mundane, repetitive queries, it completely changes the role of a contact centre agent. They’re no longer stuck answering the same basic questions all day long.

Instead, they get to be genuine problem-solvers. The calls that get through to them are the ones that actually need a human touch—complex troubleshooting, calming down a frustrated customer, or offering in-depth product advice.

This shift has two powerful effects:

- Increased Productivity: Agents spend their time on high-value interactions, resolving more complex issues per shift.

- Higher Job Satisfaction: Tackling more meaningful work leads to happier, more engaged employees and lower staff turnover—a critical metric for any contact centre.

Ultimately, the IVR and your agents become a powerful partnership. The technology handles the predictable, and the people manage the exceptional. This synergy is the hallmark of a truly modern and efficient customer service operation.

Your Actionable IVR Implementation Checklist

Starting a contact centre IVR project, whether from scratch or as a major overhaul, can feel daunting. But if you have a clear plan, you can get from concept to a successful launch without hitting the usual snags. This checklist breaks the whole process down into logical, manageable stages.

Think of this as the architectural blueprint for your IVR. You wouldn't build a house without one, and the same thinking applies here. Each step is a foundation for the next, making sure the final system is solid, functional, and actually does the job you need it to do.

Phase 1: Define Your Goals and Journeys

Before you even think about writing a script or picking a vendor, you need to know what success looks like. Why are you doing this? Answering that question right at the start gives the entire project a clear direction and a benchmark for its value down the line.

Kick things off by setting clear, specific business goals. Are you trying to cut down call handling times, boost first-contact resolution, or automate payments to bring down your PCI DSS compliance costs? Get specific.

Next, it's time to put yourself in your customers' shoes. Map out the most common reasons they phone you. Look for the high-volume, low-complexity queries that are perfect candidates for automation.

- Find Top Call Drivers: Dig into your call logs. Are most people calling to check an account balance, track an order, or make a payment?

- Visualise the Ideal Path: For each of those reasons, draw out the perfect journey from the customer's point of view. What’s the fastest, most intuitive way for them to get what they need?

- Keep It Simple: The main goal here is to make getting around your IVR completely effortless. Put the most frequent queries right at the top of your menu.

Phase 2: Design an Intuitive Call Flow

Once your customer journeys are mapped out, you can start designing the call flow—the menus and prompts that guide your callers. This is where a lot of IVR projects go wrong. A system that's too complex, confusing, or long-winded just creates frustrated customers who hang up.

The name of the game is clarity. Every single prompt should be short and to the point.

Always give callers a clear way out. One of the biggest frustrations is feeling trapped in a menu loop. An easy-to-find option like "press 0 to speak with an agent" is absolutely essential for a good customer experience.

Here are the key things that make a call flow work well:

- Craft a Welcoming Greeting: The first thing a caller hears sets the tone. It needs to be brief, professional, and confirm they’ve dialled the right number.

- Limit Menu Options: Never give a caller more than four or five choices in one menu. Too many options just lead to confusion and mistakes.

- Use "Destination First" Language: Structure your prompts like this: "For sales, press 1" instead of "Press 1 for sales." It’s a small tweak, but it matches how people naturally process information.

- Invest in High-Quality Audio: Whether you hire a professional voice artist or use a modern text-to-speech engine, make sure the audio is clear, natural, and easy to understand.

Phase 3: Select Technology and Test Rigorously

With a solid design in hand, you can find the right technology partner. You'll want a solution that integrates smoothly with your existing systems, especially your CRM and payment gateway. A platform with a user-friendly, no-code visual builder is also a huge plus, as it lets non-technical staff make changes later on.

Testing is the final, make-or-break stage before you go live, and it’s one that often gets rushed. Thorough testing is the only way to find design flaws and technical glitches before your customers do.

- Simulate Real Scenarios: Get your team to pretend they are customers and try out every possible path. Test all the edge cases, like what happens when someone enters an invalid account number or doesn't make a choice at all.

- Involve Real Users: Bring in a small group of employees or even loyal customers for User Acceptance Testing (UAT). Their fresh eyes are invaluable for spotting confusing prompts or awkward navigation that you might have missed.

- Measure and Iterate: Keep an eye on key metrics during testing, like call completion rates and where people are dropping off. Use this feedback to fine-tune your IVR before its official launch.

How to Measure Success and Avoid Common Pitfalls

Getting your contact centre IVR live is just the first step. The real work begins now, turning it from a simple call-routing tool into a genuine asset for your business and your customers.

Success isn't a one-and-done deal. It requires you to constantly measure performance, listen to what the data is telling you, and refine the experience. Think of your IVR as a dynamic system that needs regular tuning, not a static menu you can set and forget. This proactive approach is what separates a frustrating IVR from one that truly improves efficiency and keeps customers happy.

Key Performance Indicators to Track

To get a clear picture of how your IVR is performing, you need to keep a close eye on a few core metrics. These numbers tell the story of your customer interactions, highlighting what’s working well and what needs a bit of attention.

Three of the most important KPIs are:

- Containment Rate: This is the big one. It’s the percentage of calls that are fully handled within the IVR, without ever needing to speak to a live agent. A high containment rate is a brilliant sign that your self-service options are hitting the mark.

- Call Abandonment Rate: This tracks how many people hang up while they’re still in the IVR menu. If this number starts to creep up, it’s a red flag that your menus are too confusing, the prompts are too long, or the journey is just plain frustrating.

- Customer Satisfaction (CSAT) Scores: A quick post-call survey—like asking, "On a scale of 1-5, how was your experience today?"—gives you direct feedback from the source. This is invaluable for understanding the why behind your other numbers.

Think of these metrics as your IVR's health check. A high containment rate with a low abandonment rate and positive CSAT scores means your system is in great shape. If one of these numbers is off, it’s an early warning sign that something needs attention.

Avoiding Common IVR Pitfalls

Even with the best intentions, it's surprisingly easy to fall into common traps that turn a helpful IVR into a customer's worst nightmare. Steering clear of these is crucial for maintaining a positive experience.

Let's be honest, a huge driver for IVR investment is saving money. With the average inbound call in a UK contact centre costing £6.25, it's significantly more expensive than digital channels. You can find more insights on UK contact centre operational costs on ccma.org.uk. But while cost optimisation is a perfectly valid goal, it should never come at the expense of the customer experience.

Here are the most frequent mistakes to avoid:

- Overly Complex Menus: Don't give callers decision fatigue. Stick to no more than four or five options in any single menu. Anything more just leads to confusion and people giving up.

- No Escape Hatch: Always, always provide a clear and easy way to reach a human, usually by pressing '0'. Trapping customers in an endless automated loop is the fastest way to destroy goodwill.

- Poor Voice Recognition: If you’re using conversational AI, make sure it’s properly tuned to understand a wide range of accents and dialects. There’s nothing more infuriating than having to repeat yourself over and over to a machine.

- Dead-End Call Flows: Every single path in your IVR must lead to a resolution. Whether that's completing a task or getting transferred to the right agent, make sure no route leaves a customer stranded.

Common Questions About Contact Centre IVR

Even with the best plan in the world, a few questions always pop up when you’re getting a contact centre IVR off the ground. Let’s tackle some of the most common ones I hear from teams making the switch.

How Long Does It Realistically Take to Implement an IVR?

The honest answer? It depends entirely on what you need it to do. If you're looking for a basic system that just routes calls to the right department, you could be up and running in a matter of weeks. It’s pretty straightforward.

But if you’re aiming for something more sophisticated – say, an IVR that talks to your CRM and securely handles customer payments – that's a bigger project. You'll need to factor in proper design, build, and rigorous testing, which usually takes a couple of months to get right.

The biggest mistake I see is teams rushing the planning and testing phases to hit a deadline. It almost always backfires, leading to a clunky customer experience and expensive fixes later on. A little patience upfront saves a lot of headaches.

Can an IVR Genuinely Make Customers Happier?

Absolutely, but only if it's designed with them in mind, not just for the business's convenience. A good IVR wins customers over by offering 24/7 self-service for simple tasks – like checking a balance or tracking a delivery – which people genuinely appreciate.

The trick is to make it intuitive and quick. Most importantly, there must always be an obvious, easy "escape hatch" for a customer to speak with a human agent when their problem gets complicated. That’s non-negotiable.

How Do I Actually Measure the ROI of My IVR?

Measuring the return on your investment isn't just about fluffy metrics; it comes down to hard numbers from cost savings and efficiency boosts.

- Call Deflection: This is your starting point. Count how many calls are fully handled within the IVR without ever needing an agent. In the UK, the average inbound call costs £6.25 to handle, so every single call your IVR resolves on its own is a direct saving.

- Agent Productivity: Are your agents now spending their time on more complex, valuable conversations instead of just resetting passwords? That shift from high-volume, low-value work is a massive win for productivity and morale.

- Reduced PCI Scope Costs: If you’re taking payments through your IVR, don't forget to calculate the money saved from simpler compliance audits and cutting down the overheads that come with PCI DSS.

When you track these clear, tangible metrics, you can build a powerful business case that proves the ongoing value your contact centre IVR delivers.

Take the complexity and risk out of phone payments with Paytia. Our secure IVR solutions de-scope your contact centre from PCI DSS, reduce compliance costs, and build customer trust. Discover a smarter way to handle payments at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.