A Guide to Credit Card Cell Phone Processing in the UK

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Credit card cell phone processing is simply the way businesses take card payments using a mobile phone. This can be done with a physical card reader, a payment app, or through secure phone call technology. It's completely changed the game, allowing everyone from a sole trader on the go to a massive contact centre to take payments securely, anywhere they need to.

Understanding Credit Card Phone Payments

Let's be honest, staring at complex payment regulations can feel a bit much. So, let's break down what processing card payments on a phone actually means in simple, practical terms.

Think of it as the natural evolution from the old-school, fixed cash register to a flexible payment tool that fits in your pocket. This isn't just a simple tech upgrade; it’s a fundamental shift for modern UK businesses, especially those running contact centres or with teams working out in the field.

The technology itself comes in a few different flavours. You've got the simple card readers that plug into a smartphone, all the way up to advanced, agent-assisted solutions built for busy call centres. The real driver behind all this? Changing customer expectations. People now want the same seamless experience paying over the phone as they get when they tap their card in a shop.

Why Mobile Processing Is Now Essential

This technology has quickly gone from a "nice-to-have" to a vital business function for a few key reasons:

- Boosting Cash Flow: You can capture payments immediately, which means less waiting around for money to come in and better financial stability.

- Enhancing Customer Trust: Using a secure, professional payment method shows your customers you take their data security seriously.

- Streamlining Operations: It slots payments directly into your existing workflows, whether your team is on the road or taking calls in an office.

This move to mobile has completely reshaped how businesses handle card data. The growth in people paying via smartphones has been huge; UK Finance data shows that cards made up around 64% of all UK payments in 2024. As we all get more used to frictionless transactions, we expect the same speed and ease when paying over a phone call. This has created a real need for secure, agent-assisted solutions. You can dig into the details in the UK Finance Payment Markets summary.

The ability to process a payment securely during a live conversation removes friction, prevents abandoned sales, and solidifies customer commitment at the peak moment of interest.

At the end of the day, credit card cell phone processing relies on a whole network of financial institutions working in harmony. The transaction itself is managed by a payment service provider, which acts as the crucial middleman between your business, the customer's bank, and your bank. If that's a new term for you, our guide explains in detail what a payment service provider is and how they work. This unseen infrastructure is what makes secure, instant mobile payments possible.

Comparing the Five Main Mobile Payment Methods

Figuring out how to take card payments on a mobile phone can feel like you’re staring at an endless menu. With so many options, each with its own quirks and benefits, it’s easy to get lost. The trick is to match the method to what your business actually needs, focusing on security, customer experience, and keeping the compliance auditors happy.

Let's cut through the noise and compare the five main ways your business can process card payments using a mobile. We’ll break down each approach, from simple hardware add-ons to sophisticated software, helping you pick the right tool for the job.

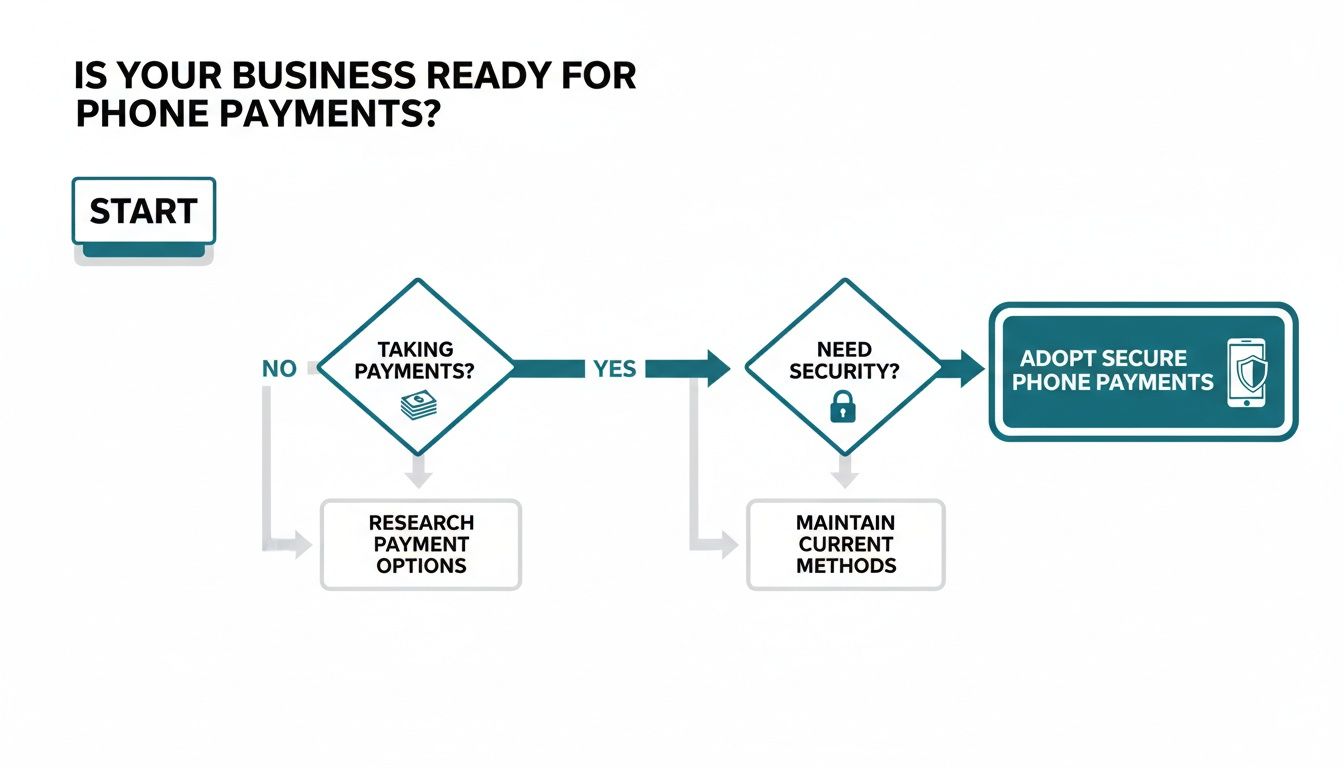

This decision tree can help you visualise whether your business is ready to adopt a secure phone payment solution.

As the visual shows, if you're taking payments and need to protect that data, a secure, dedicated solution is the only real path forward.

Comparison of Mobile Credit Card Processing Methods

To make sense of the options, it helps to see them side-by-side. The table below breaks down the five key methods, showing how they work, where they shine, and—crucially—how they impact your PCI DSS compliance burden.

| Processing Method | How It Works | Best For | PCI DSS Scope Impact | Customer Experience |

|---|---|---|---|---|

| Mobile Card Reader | A small device connects to a phone via Bluetooth, accepting tap or chip payments. | Face-to-face sales like markets, mobile tradespeople, and pop-up shops. | High (if card data passes through the mobile device's software). | Quick and familiar for in-person transactions. |

| Virtual Terminal | An agent manually keys the customer's card details into a secure webpage on their phone. | Basic phone orders where simplicity is valued over security. | Very High (the agent, their device, and your network are all in scope). | Can feel slow and intrusive for the customer. |

| DTMF Masking | The customer enters their card numbers using their phone's keypad; the tones are hidden. | Busy contact centres, insurance claims, and service bookings. | Very Low (sensitive data completely bypasses your systems). | Secure and seamless; the agent stays on the line to help. |

| Secure Payment Links | An agent sends a unique link; the customer pays on their own device. | Web chat support, chasing invoices, or self-service payments. | Minimal (the transaction happens entirely on the customer's device). | Modern and empowers the customer to pay in their own time. |

| Open Banking | The customer authorises a direct bank transfer using their own mobile banking app. | High-value payments, recurring bills, or security-conscious customers. | None (no card data is ever handled or transmitted). | Extremely secure but requires the customer to be comfortable with their banking app. |

Each method solves a different problem. A mobile card reader is perfect for a market stall but useless for a call centre. A virtual terminal might seem easy, but it opens a can of worms for compliance. The key is understanding these trade-offs before you commit.

1. Mobile Card Readers

This is probably the most familiar method. We’re talking about those little portable devices that connect to a smartphone or tablet via Bluetooth. They effectively turn a standard mobile into a point-of-sale (POS) terminal.

Think of the card reader at your local coffee van or craft fair. The owner types the amount into an app on their phone, and you tap or insert your card into the reader. It’s a brilliant solution for any business taking payments face-to-face.

But for businesses that handle payments over the phone, like contact centres or any service provider scheduling appointments remotely, this method just doesn't work. It’s impractical and insecure because it demands the customer be physically present.

2. Virtual Terminals

A virtual terminal is basically a secure webpage that lets you manually type in a customer's credit card details. An employee logs into the terminal through a web browser on their phone or computer, while the customer reads their card information aloud.

It’s a step up from scribbling down card numbers on a notepad, but it throws open the doors to some major security and compliance risks. Your agent hears and sees the sensitive card data. This immediately brings your staff, their devices, and potentially your entire network into the scope of PCI DSS. That means a much bigger compliance headache and a higher risk of a data breach.

3. DTMF Masking and Secure IVR

Now we're getting into smarter solutions. DTMF (Dual-Tone Multi-Frequency) masking is purpose-built for taking payments during a live phone call. When it’s time to pay, the customer simply uses their phone's keypad to enter their card numbers.

The magic is that the tones are masked or replaced with a flat tone, so your agent can’t hear the sensitive numbers. The data is routed directly to the payment processor, completely bypassing your agent, your phone systems, and your call recordings. This dramatically shrinks your PCI DSS scope and protects customer data.

DTMF masking empowers an agent to guide a customer through a payment without ever hearing or seeing the card details. It’s the perfect blend of human assistance and robust data security.

For businesses like contact centres, insurance companies, and housing associations, this is often the gold standard. It creates a smooth, agent-assisted experience while locking down security. Solutions like Paytia offer a complete platform for secure agent-assisted mobile payments, keeping your operations compliant and your customers safe.

4. Secure Payment Links

Another popular method for remote payments is the secure payment link. Your agent can generate a unique link and send it directly to the customer via SMS, email, or a web chat message during a conversation.

The customer clicks the link, which opens a secure, branded payment page on their own device. They enter their card details themselves, and your agent gets a real-time notification once the payment is done. This self-service approach removes your business from the process of handling card data entirely.

This method provides a fantastic customer experience, letting people pay using their own device in a way that feels familiar and secure. It's particularly useful for collecting outstanding balances or confirming bookings after a call has ended.

5. Open Banking and Pay-by-Bank

Open Banking is a newer player in the UK but is growing incredibly fast. Instead of using card details, it allows customers to pay directly from their bank account by securely authorising the payment through their own mobile banking app.

When it’s time to pay, the customer gets a request and is prompted to approve the transaction in their bank's app, often using biometrics like a fingerprint or Face ID. This is incredibly secure because no card details are ever shared. It also massively reduces the risk of chargebacks, as the customer’s own bank authenticates the payment.

Navigating PCI DSS Compliance for Phone Payments

Taking payments over the phone opens up a fantastic channel to serve your customers, but it comes with a serious responsibility: security. This is where the Payment Card Industry Data Security Standard (PCI DSS) steps in. Don't think of it as just a mountain of complicated rules; it's the digital equivalent of a bank vault, built specifically to protect your customers' sensitive card details.

For any business that uses credit card cell phone processing, getting to grips with these standards isn't just a good idea—it's absolutely essential. Getting it wrong can lead to painful consequences, including eye-watering fines, losing your ability to take card payments altogether, and the kind of reputational damage that can take years to repair. A single data breach can shatter the trust you've worked so hard to build.

This is more relevant than ever as UK consumer habits have shifted decisively towards mobile. People manage their lives on their phones, and their expectations for security during a phone or chat payment are sky-high. With 57% of UK adults now using a mobile wallet and cards making up around 64% of all UK transactions, the phone is undeniably a core payment channel. Solutions that keep card details completely separate from your staff and systems align perfectly with how people already use their devices for secure transactions.

The Power of PCI Scope Reduction

The smartest way to tackle compliance is through PCI scope reduction. Think of your "scope" as everything and everyone in your business that touches, stores, or transmits cardholder data. The bigger that scope, the more complex, expensive, and stressful your PCI DSS audit will be.

The goal is to shrink that scope down to the bare minimum.

It’s like protecting a valuable package. You could build a massive fortress around your entire office (a huge, expensive scope), or you could simply place the package in a secure, third-party locker service that handles all the security for you (a tiny, manageable scope). The second option is obviously simpler, cheaper, and safer.

Technologies like DTMF masking and tokenisation are your secure locker service.

- DTMF Masking: This clever tech stops your agents and call recordings from ever capturing the sensitive tones a customer makes when typing their card details on their phone keypad.

- Tokenisation: Instead of storing the actual card number, this process replaces it with a unique, non-sensitive "token." You can use this token for future payments without ever exposing the real card data.

By putting these tools in place, you effectively remove your agents, phone systems, and call recordings from PCI DSS scope. This dramatically simplifies your compliance burden.

Understanding PCI DSS Certification Levels

Not all security certifications are created equal. PCI DSS has different validation levels, depending on how many transactions a business handles each year. The highest and most demanding of all is Level 1.

A service provider with a Level 1 PCI DSS certification goes through punishingly rigorous annual audits by an independent Qualified Security Assessor (QSA). This certification is the ultimate proof that their systems, processes, and security controls meet the highest possible standard for protecting card data.

When you work with a Level 1 certified provider like Paytia, you're building your payment security on a foundation of proven, audited trust. It offloads a huge chunk of the security responsibility from your shoulders. A good PCI DSS compliance checklist can help you map out the specific requirements you need to cover.

Finally, whenever mobile devices are involved, it's vital to think about every potential weakness. Strong compliance means being aware of the built-in risks of different communication channels, which includes understanding SMS security risks if text messages are part of how you talk to customers. Choosing the right secure processing method from the start is the key to building a compliant and trustworthy operation.

Implementing Your Secure Payment System

Knowing the theory is one thing, but taking action is where you’ll see the real change in your business. Rolling out a secure system for credit card cell phone processing is far more than just a tech upgrade. It's a strategic move that shields your customers, your reputation, and ultimately, your profits. A well-thought-out launch plan makes the transition smooth and builds trust from the get-go.

The aim here is to weave secure payments into the natural flow of a customer conversation. That means your new payment solution needs to play nicely with the tools your team already relies on, whether that’s your CRM or your VoIP phone system. The right platform should feel like a seamless part of your existing setup, not some clunky, bolted-on afterthought.

Modern, secure platforms are built for this very purpose. They’re designed to be intuitive, which drastically cuts down on training time. When your agents no longer need to see, hear, or write down sensitive card numbers, their job gets a whole lot simpler. They become guides for the customer, not guardians of their data, which removes a massive amount of risk and stress.

Your Step-by-Step Implementation Checklist

A bit of structure goes a long way in preventing headaches and ensuring a successful launch. Think of this checklist as your roadmap, guiding you from the first look at your current setup to the final go-live.

1. Assess Your Current Needs and Risks

Before you even look at a single vendor, take an honest look at how you operate today. How are you taking payments right now? Where are the weak spots? You need to pinpoint every channel where you accept card details—over the phone, in a web chat, maybe even on a video call. This initial review will give you a crystal-clear picture of what you actually need.

2. Evaluate Technical Requirements and Integrations

Next, it's time to look at your tech stack. Any payment solution you choose must work with your phone system (PBX/VoIP), contact centre software, and CRM. Look for pre-built integrations or a solid API that can automate tasks, like automatically marking an invoice as paid in your CRM the second a transaction is complete.

3. Plan the Integration and Workflow

Get granular here. Map out the entire payment journey from your agent's point of view. When do they initiate the payment during the call? What do they see on their screen? A documented workflow ensures every agent handles payments the exact same way, every single time, giving your customers a consistent and professional experience.

4. Manage the Rollout and Staff Training

Don’t try to boil the ocean. A phased rollout is nearly always the best bet. Start with a small pilot team to test the system in the real world. This lets you collect feedback and smooth out any wrinkles before everyone else starts using it. And because the best systems are so intuitive, training can focus on the simple new process rather than a long list of complicated security rules.

Fostering a Security-First Culture

At the end of the day, technology is only half the battle. Your implementation plan has to include building a culture where security is second nature. This means helping your team understand why these new steps are so critical for protecting both your customers and the company.

A successful implementation isn't just about installing software. It's about embedding security into your company's DNA, making safe payment handling an automatic, ingrained behaviour for every member of your team.

Beyond the payment process itself, your overall business security needs to be solid. A secure IT foundation supports everything else you do. This can include everything from network firewalls to physical security. For some businesses, this might mean bringing in specialists. If you’re looking into wider security upgrades, you can find great resources on topics like finding the right security system supplier to make sure your entire operation is buttoned up. By taking a comprehensive, security-first approach, you’re setting your business up for safe, compliant growth.

Choosing the Right Payment Vendor for Your Business

Picking a partner for your credit card cell phone processing is one of the most critical decisions you'll make for your business. It’s about so much more than just finding the lowest transaction fee.

Think of it as hiring a specialist security team for your customers' most sensitive data. You need a partner that fits your business perfectly, striking the right balance between iron-clad security, smart functionality, and long-term value. Making the right call starts with asking the right questions—because a flashy sales pitch is one thing, but proven, audited security is what truly matters.

Your Vendor Evaluation Checklist

Before you even think about signing a contract, run any potential partner through this essential checklist. Every point here ties directly back to a tangible business outcome, from boosting your collection rates to fortifying your defences against fraud.

Are they PCI DSS Level 1 certified? This is your absolute baseline. Level 1 is the highest security standard, demanding gruelling annual audits. It's the ultimate proof that a vendor can be trusted to handle huge volumes of card data securely. No certificate, no deal.

Does the platform cover all your channels? Your customers reach you through phone calls, web chat, video, and SMS. Your payment solution has to meet them where they are, offering a seamless and secure experience every single time, no matter the channel.

How will they shrink your PCI DSS scope? The best platforms, like Paytia, are engineered to keep sensitive card data completely out of your environment. Ask them to explain exactly how their tech (like DTMF masking or tokenisation) cuts down your compliance workload. This isn't just a feature; it's a massive saving in time and money.

What are its integration capabilities? A payment tool that doesn’t talk to your other systems just creates more work. You need a vendor that plugs straight into your existing CRM, VoIP phone system, and other core business tools. This is how you automate workflows and kill off manual data entry for good.

A truly valuable payment partner doesn't just process transactions; they actively reduce your risk. By removing sensitive data from your systems, they simplify your compliance, protect your reputation, and let you focus on serving your customers.

Connecting Features to Business Growth

Getting your head around the technical features is only half the battle. The real goal is to connect those features to tangible business results.

For example, a platform that offers automated payment reminders can have a direct, positive impact on your collection rates by chasing up overdue invoices on your behalf. Likewise, the emergence of Open Banking and bank-verified payments provides a powerful new shield against fraud. This method confirms payments directly with the customer's bank, which all but eliminates chargeback risks and gives you certainty for high-value sales.

The UK digital payments market is on the verge of a massive expansion, with a laser focus on mobile-first experiences. Forecasts show the market surging from USD 11.7 billion in 2025 to USD 43.7 billion by 2034. As people increasingly run their financial lives from their phones, they'll expect secure and simple payment options over calls and chats.

This trend, paired with high consumer expectations for reliability, builds a powerful case for adopting a secure, multi-channel payment platform. You can dig into the full analysis of UK digital payment market trends to see the data for yourself. By choosing the right vendor now, you’re setting your business up to meet these evolving demands securely and efficiently.

Where Do You Go From Here?

This guide has shown that modern credit card cell phone processing is about much more than just convenience. It’s really about building trust with your customers, guaranteeing rock-solid security, and running a smarter, more efficient business.

If you take only one thing away from this, let it be this: choose a payment method that actively shrinks your PCI DSS scope and protects sensitive customer data by its very design. It’s time to leave risky old habits behind, like scribbling card numbers on paper or punching them into insecure systems. The future is secure, compliant technology that makes those vulnerabilities a thing of the past.

Your goal should be to make secure payment handling an automatic, ingrained behaviour for every member of your team, supported by technology that makes compliance the path of least resistance.

Taking Confident Action

You now have a clear roadmap to figure out what you need and select the right tools for the job. As you look at your options, keep these three things front and centre:

- PCI DSS Scope Reduction: This has to be your top priority. Getting card data out of your environment saves time, slashes costs, and massively minimises your risk.

- Omnichannel Support: Make sure your chosen partner can handle payments securely everywhere you do business, whether that’s over the phone, through web chat, or any other channel.

- Seamless Integration: The right platform should slot neatly into the CRM and phone systems you already use, automating your workflow without causing headaches for your team.

This is your call to action. It’s time to secure your payment processes, protect the reputation you’ve worked so hard to build, and give your customers the seamless, trustworthy experience they expect. You now have the knowledge to move forward with confidence.

Frequently Asked Questions

As you get closer to choosing a way to handle phone payments, a few common questions tend to pop up. We've gathered the most frequent ones here to help you nail down your strategy and move forward with confidence.

Can We Legally Add a Surcharge for Credit Card Payments?

Yes, for the most part, businesses in the UK can add a surcharge to cover the cost of processing a credit card payment. However, there are strict rules. You are absolutely not allowed to charge a customer more than the transaction actually costs you to process – it can't be a profit-making exercise.

Crucially, you have to be completely upfront about it. The fee must be clearly communicated to the customer before they commit to the payment. No surprises.

What's Genuinely the Most Secure Way to Take a Payment Over the Phone?

The most secure methods are always the ones that prevent sensitive card details from ever entering your business environment in the first place. It's a concept known as 'PCI scope reduction', and it's the gold standard.

- DTMF Masking: This is widely seen as the best approach for live agent calls. Your customer taps their card numbers into their phone keypad, but the tones are scrambled. This means neither your agent nor your call recordings can ever capture the actual data.

- Open Banking (Pay-by-Bank): This method is incredibly secure because no card details are shared at all. The customer simply authorises the payment directly from their own banking app, which is already a fortress of security.

With both of these, you sidestep the risk entirely by ensuring sensitive data never touches your systems. That's the ultimate goal for top-tier security and easy compliance.

How Much Should We Expect to Pay in Processing Fees?

Processing fees can be all over the map, but in the UK they typically land somewhere between 1.5% and 3.5% of the transaction's value. This fee isn't just one charge; it’s a cocktail of different costs: the interchange fee (which goes to the customer's bank), the scheme fee (for networks like Visa or Mastercard), and whatever your processor adds on top for their service.

Your final rate will hinge on a few things:

- The card type (debit cards are usually cheaper to process than credit cards).

- Your sales volume (more transactions can sometimes give you leverage for better rates).

- The payment method itself (phone payments are 'card-not-present', which can sometimes carry higher fees due to a perceived risk of fraud).

The real secret is finding a provider who is transparent with their pricing. Steer clear of vendors who nickel-and-dime you with hidden extras like setup fees, monthly minimums, or penalties for not being PCI compliant. These can quickly bloat your costs.

Choosing a partner with a simple, clear fee structure means you can actually predict your expenses and won't get a nasty shock when your statement arrives.

At Paytia, we’re firm believers that robust security shouldn’t be complicated. Our PCI DSS Level 1 certified platform uses clever technology like DTMF masking to take your systems completely out of scope, protecting your customers’ data and your company's good name. See how easy it is to roll out secure, compliant payments across all your channels at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.