How Does Open Banking Work An Essential Guide

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Open banking is simply a secure way for you to grant trusted financial apps access to your banking information. Think of it as giving a regulated third party a special, temporary key to view specific data—without ever sharing your login details. The whole system is built on bank-level security and is designed to put you firmly in control of your financial life.

What Is Open Banking and Why Does It Matter?

At its heart, open banking isn't a product or a specific bank. It's a regulated framework that requires traditional banks to share customer data—only with the customer's explicit consent—through secure digital channels called Application Programming Interfaces (APIs). This was mandated in the UK by the Competition and Markets Authority (CMA) and is backed by legislation like the second Payment Services Directive (PSD2).

The main goal was to break down the data silos that the major banks have held for decades. By opening things up, regulators wanted to spark more competition and fresh ideas in the financial services industry. This framework empowers you, the customer, to use your own financial data to find better products and services.

The Driving Force Behind Financial Innovation

Before open banking, your financial data was effectively locked away with your bank. If you wanted to use a budgeting app, you might have had to share your actual banking username and password. This risky practice, known as "screen scraping," is precisely what open banking was designed to replace with a secure, consent-driven process.

This shift has paved the way for a whole new generation of financial tools and services, including:

- Smarter Budgeting Apps: These tools can analyse your spending across multiple accounts to give you a complete financial picture.

- Faster Loan Approvals: Lenders can instantly and securely verify your income and financial history, dramatically speeding up credit decisions.

- Seamless Account-to-Account (A2A) Payments: This allows you to pay for goods and services directly from your bank account, bypassing traditional card networks entirely. If you want to dive deeper into payment options, you can explore various alternative payment methods that are shaking up the industry.

A Rapidly Growing Ecosystem

The adoption and economic impact of open banking in the UK have been nothing short of remarkable. The UK open banking market is projected to grow from USD 1.15 billion in 2025 to USD 4.37 billion by 2034, fuelled by a strong compound annual growth rate. This isn't just theory; it shows how both consumers and businesses are genuinely embracing the technology.

As of January 2024, 13% of digitally active UK consumers and 18% of small businesses were already using open banking services, demonstrating its broad appeal and practical value. You can find more details in this UK open banking market report.

In essence, open banking works by putting you in the driver's seat of your financial data. You decide who gets access, what information they can see, and for how long, all within a highly secure and regulated environment.

This control fosters a more competitive marketplace where fintech companies and even traditional banks must create better, more personalised products to win your business. From streamlined identity verification to more secure payment methods, open banking is fundamentally changing how we interact with our money.

Understanding the Mechanics of Open Banking

To really get what's happening with open banking, it helps to look under the bonnet. The whole system is a carefully managed dance between different parties, each playing a specific part and communicating through secure digital channels. It’s less like handing someone your house keys and more like sending a highly vetted, insured courier with a specific request that only you can approve.

At its heart, the process involves three key players:

The Payment Service User (PSU): This is you—the customer, whether an individual or a business, who owns the bank account. The most important thing to remember is that the PSU is always in control and must give explicit consent for anything to happen.

The Account Servicing Payment Service Provider (ASPSP): This is just the official, slightly clunky term for your bank or financial institution. They're the gatekeepers of your data and are responsible for maintaining the secure gateway to it.

The Third-Party Provider (TPP): This is the regulated fintech company or app offering the service. TPPs generally come in two main flavours: Payment Initiation Service Providers (PISPs), which kick off payments, and Account Information Service Providers (AISPs), which access account data to offer things like budgeting tools or financial dashboards.

The Secure Digital Messengers Known as APIs

The magic that connects all these players is the Application Programming Interface (API). Think of an API as a secure digital waiter in a restaurant.

You (the PSU) tell the waiter (the TPP) what you want—let's say, to pay a bill. The waiter takes your order to the kitchen (your bank, the ASPSP) through a very specific, secure ordering system.

The kitchen then confirms the order directly with you before they start cooking. Crucially, the waiter never actually enters the kitchen, never sees the recipes (your login details), and can only pass authorised messages back and forth. This setup guarantees your credentials are never exposed to the third-party app.

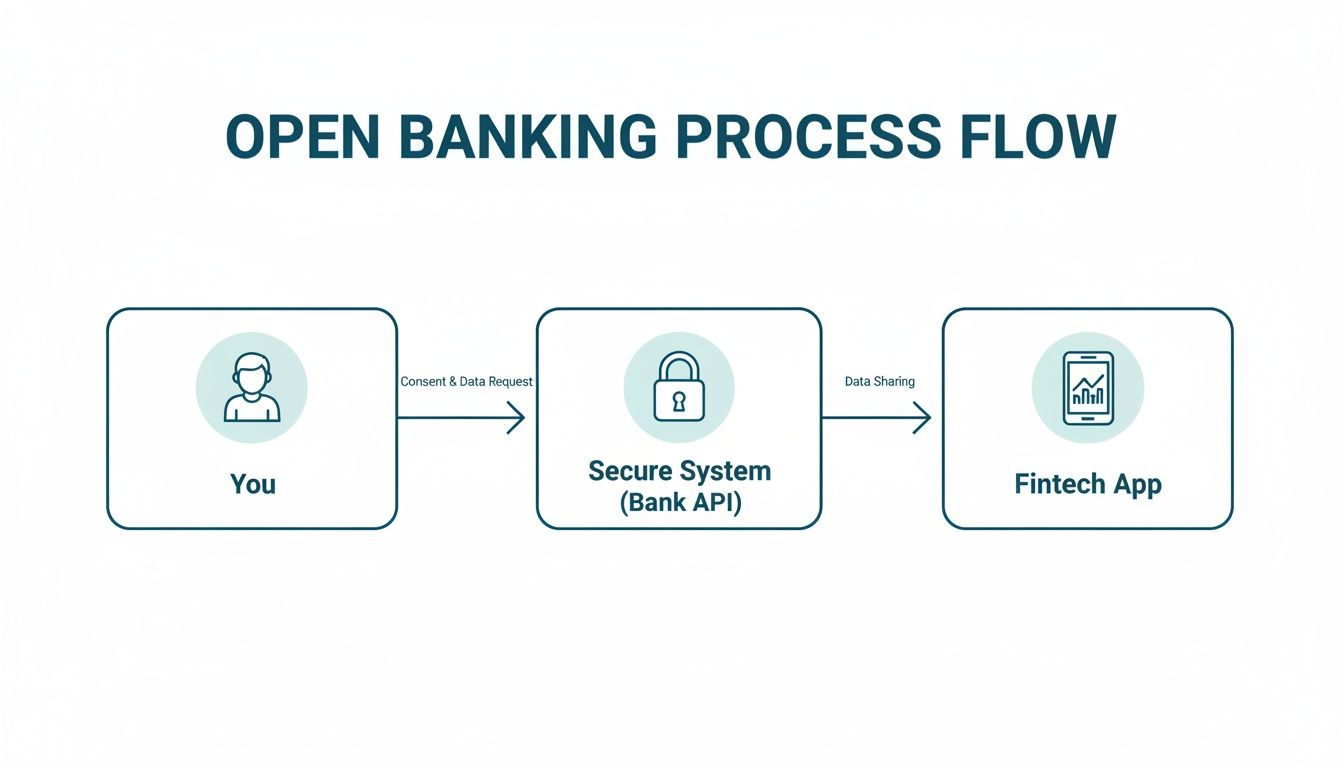

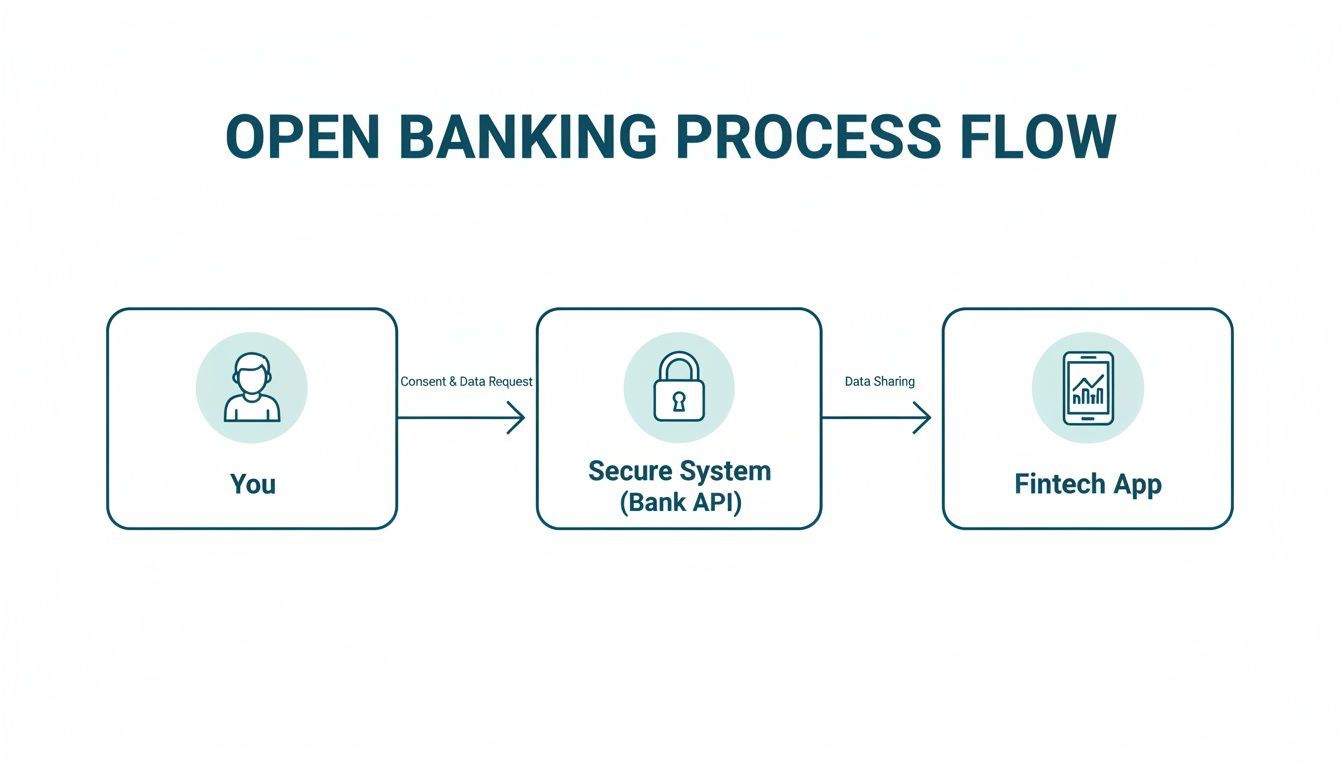

The flow chart below shows just how this secure interaction between the customer, the bank's system, and the fintech app works in practice.

As the visual makes clear, the customer always kicks off the action. It's then processed through a secure, regulated channel before any information reaches the third-party app, keeping sensitive details locked down.

A Practical Example: A Pay by Bank Transaction

Let's walk through a typical open banking payment, a scenario we see all the time in contact centres.

Imagine a customer, Sarah, needs to pay an invoice over the phone. She's speaking with a customer service agent who is using a platform like Paytia. Instead of asking Sarah to read out her card details, the agent triggers a 'Pay by Bank' request.

Initiation: The agent sends Sarah a secure payment link, usually via SMS or email. This link takes her to an open banking service run by a regulated TPP.

Consent: Sarah clicks the link and lands on a clear, simple consent screen. It shows the exact payment amount and who she's paying. She then selects her bank from a list of trusted institutions.

Authentication: This is the most critical step. Sarah is redirected away from the third-party environment and straight to her own familiar banking app or online portal. Here, she logs in just as she always does—using her password, fingerprint, or Face ID. This secure process is known as Strong Customer Authentication (SCA).

Because the authentication happens directly with her bank, Sarah never shares her login details with the TPP or the business she is paying. Her credentials remain completely private and secure.

Authorisation: Once she's logged in, her bank presents the transaction details for a final check. She sees the amount and the payee's name one last time and confirms the payment with a single tap.

Confirmation: Her bank instantly fires a secure, encrypted confirmation back to the TPP through the API. The TPP then alerts the business's system that the payment has gone through. On the phone, the agent sees a real-time confirmation on their screen, and Sarah's invoice is marked as paid.

This whole sequence is over in moments, creating a seamless and incredibly secure experience. Not only does this protect Sarah's data, but it also gives the business instant, guaranteed payment confirmation, completely wiping out the chargeback risk that comes with card payments. It’s a perfect illustration of how open banking works to build a safer, faster, and more efficient payment world for everyone.

The Security Framework That Powers Open Banking

When you’re dealing with financial data, trust is everything. So, the big question is always the same: is open banking actually safe?

The short answer is yes. The entire system is built on bank-grade security, watertight regulation, and authentication methods designed to protect everyone involved.

This isn't a free-for-all where your data is suddenly up for grabs. A better analogy is a high-security building. Every visitor needs verified credentials, they have to pass through multiple checkpoints, and they're only granted access to a specific room for a set period. Security isn't an add-on; it's baked into the very foundation of how open banking works.

The Regulatory Gatekeepers

Here in the UK, the open banking world is watched over by some serious regulators. The main one is the Financial Conduct Authority (FCA), which acts as the official gatekeeper. Before any company can even think about becoming a Third-Party Provider (TPP), it has to go through a rigorous authorisation process with them.

The FCA scrutinises everything—from a company's financial health and data security practices to its internal controls and even who’s running the show. Only the firms that meet these demanding standards get a licence and are added to the official Open Banking Directory. It’s your guarantee that any app or service you connect with is legitimate, trustworthy, and held to the same high standards as your own bank.

PSD2 and Strong Customer Authentication

The whole security framework is propped up by a piece of legislation called the second Payment Services Directive (PSD2). One of its most important rules is the mandate for Strong Customer Authentication (SCA), a multi-layered security measure designed to stamp out fraud.

SCA demands that any digital payment or account access request must be verified using at least two of these three factors:

- Knowledge: Something only you know (like a password or PIN).

- Possession: Something only you have (like your mobile phone, often confirmed with a one-time code).

- Inherence: Something you are (like your fingerprint or face ID).

This is exactly why, when you use an open banking service, you’re always sent back to your own banking app to approve the request. You log in with your familiar biometrics or password, which satisfies the SCA requirement in a secure environment that your bank controls completely.

By making SCA mandatory, regulators have made it incredibly difficult for fraudsters to make unauthorised payments. The third-party app never sees, touches, or stores your banking login details, breaking a critical link in the fraud chain.

This is a world away from older, riskier methods like screen scraping, where you literally handed over your username and password to a third party. Open banking’s API-driven model, paired with SCA, has made that practice obsolete.

Built-In Data Protection and Consent

Beyond authentication, data privacy is at the heart of the system. When you give your consent to an open banking service, you are always in the driver’s seat. The process is explicit, meaning you have to actively approve exactly what data is being shared, who it’s being shared with, and for how long.

Consent isn't a blank cheque. For account information services, access typically has to be re-authorised every 90 days, forcing a regular check-in where you confirm who can see your data. For initiating payments, consent is given one transaction at a time. This granular control means you never have to worry about a company having permanent, unchecked access to your financial life. It's this transparent, customer-first approach to consent that builds the trust needed to make the entire system work.

The Tangible Benefits for UK Businesses

Understanding the theory of open banking is one thing, but seeing its real-world impact is where it all clicks. For UK businesses—especially those taking payments through contact centres or remote teams—this regulated framework delivers powerful, concrete advantages. It turns payments from a point of friction into a source of efficiency and trust.

These aren't just minor tweaks; they represent a fundamental shift in how money moves. Businesses can finally step away from clunky, outdated processes that are slow, expensive, and wide open to fraud.

Dramatically Lower Transaction Costs

Traditional card payments come with a long chain of intermediaries. You have acquiring banks, card schemes like Visa or Mastercard, and payment processors, and every single one takes a slice of the transaction. These fees, usually a percentage of the sale, add up fast and eat directly into your profit margins.

Open banking payments, often called Account-to-Account (A2A) payments, completely change the game. By creating a direct, secure line between the customer's bank and the business's account, it cuts out most of these expensive middlemen.

The result? A significantly lower cost per transaction. Instead of a percentage-based fee, many A2A payments have a small, fixed fee, making it an incredibly cost-effective option, particularly for high-value sales. This direct model also brings another powerful financial benefit.

Because the funds are pushed directly from the customer's bank with their explicit, authenticated approval, the risk of chargebacks is virtually eliminated. This removes a major source of revenue loss and administrative headaches for businesses.

This isn’t just a niche concept; it's a rapidly growing movement. The UK's open banking initiative, driven by the Competition and Markets Authority (CMA) since 2018, has seen phenomenal growth. In 2023, Open Banking Limited reported 130 million open banking payments, a huge jump from 68 million in 2022. By July 2025, over 15.16 million users were actively using these services, proving just how much trust people have in the system. You can dig into more of these open banking trends and statistics to see the full picture.

A Major Reduction in Payment Fraud

Payment fraud is a constant threat for any business taking remote payments. Card-not-present (CNP) fraud, where criminals use stolen card details online or over the phone, is a particularly nasty and persistent problem.

This is where open banking’s built-in security becomes a game-changer. Every single transaction requires Strong Customer Authentication (SCA), which happens directly within the customer's own trusted banking app.

Here’s why that is so important for security:

- No Shared Card Details: The customer never has to read their 16-digit card number, expiry date, or CVC code aloud or type it into a web chat. This sensitive data is never exposed, which means it can't be stolen or intercepted.

- Bank-Verified Identity: The payment is authenticated using the customer’s secure banking login, often with biometrics like a fingerprint or Face ID. This confirms the identity of the person making the payment with a level of certainty that card details just can't match.

- Reduced PCI DSS Scope: For your business, keeping sensitive cardholder data out of your systems significantly reduces your PCI DSS compliance burden. That means less time, money, and resources spent on complex audits.

By using the bank’s own security measures, businesses can drastically cut their exposure to fraud and build a much safer payment process from the ground up.

An Improved Customer Payment Experience

Finally, the whole process is faster, smoother, and just feels better for the customer. Gone are the days of laboriously reading out card numbers, correcting mistakes, and feeling anxious about sharing sensitive info over the phone.

With an open banking solution like Paytia’s Identity Verified Pay by Bank, the process is simple. An agent sends a secure link, and the customer completes the payment in a few taps within their own banking app. It’s quick, intuitive, and feels far more secure.

This effortless experience doesn't just speed up payment times; it builds real customer trust. When a customer knows their financial details are safe, their confidence in your business grows, leading to stronger relationships and better loyalty.

Putting Open Banking Into Practice with Secureflow

The theory behind open banking is great, but it’s seeing it in action that really brings the value home. For any business with a contact centre or remote team, switching from clunky, insecure card-not-present payments to a smooth, bank-verified process is a game-changer. This is exactly where Paytia’s Secureflow platform comes in.

Let’s picture a common scenario. An agent is on the phone with a customer who needs to pay an outstanding bill. The old way meant asking for sensitive card details over the call, a process riddled with risk and PCI DSS compliance headaches. With Secureflow’s Identity Verified Pay by Bank feature, that whole interaction changes.

A Seamless and Secure Agent-Led Journey

The entire flow is designed to be effortless for both the agent and the customer, with security built in from the very start.

Initiate the Payment: The agent simply clicks a button in their interface. This generates a unique, secure payment link for the exact amount owed, which is then sent directly to the customer's mobile via SMS or to their email.

Customer Authentication: The customer taps the link and is guided to a secure portal to select their bank. From there, they’re instantly and securely redirected to their own, familiar mobile banking app or online login page.

Bank-Verified Authorisation: Now in their own banking environment, the customer logs in just as they always do—using their password, PIN, fingerprint, or Face ID. Their bank presents the payment details for one final check, and they authorise the transaction with a single tap.

That final step is what makes this so powerful. The customer’s identity is confirmed by the bank itself, providing a layer of security and assurance that’s simply unmatched. At no point do the agent or the business’s systems ever see or handle sensitive financial data.

Instant Confirmation and Reduced Scope

As soon as the customer approves the payment, their bank sends an immediate confirmation back through the secure open banking API. This confirmation pops up in real-time on the agent’s screen, letting them know the payment was successful.

The whole thing happens without any card numbers, expiry dates, or CVC codes ever being spoken or transmitted over the call. This immediately and drastically reduces a business's PCI DSS compliance scope, saving a huge amount of time, cost, and administrative effort.

This isn’t just a niche trend; it’s happening right now. Account-to-account (A2A) payments powered by open banking are quickly becoming mainstream in the UK. In 2023, the system handled 130 million payments, a massive jump from 68 million in 2022. That momentum exploded with a 70% jump to 14.5 million payments in January 2024 alone. More recently, FCA data shows that by July 2025, usage had soared to 2.04 billion service interactions among 15.16 million users, cementing its place as a key payment method. You can dig into the numbers yourself with these UK open banking statistics from the FCA.

Building Confidence and Shutting Down Fraud

The benefits go well beyond just efficiency. The real strength of this method is the bank-verified identity. Traditional card payments rely on static information that can be stolen and misused. An open banking payment, on the other hand, is authenticated by the one institution that knows the customer best—their own bank.

This gives you a much higher degree of certainty that the person making the payment is the legitimate account holder. It slams the door on common fraud tactics, builds stronger customer confidence, and ensures your payments are not only faster but fundamentally more secure. To see how this all comes together, you can read more about Paytia’s integrated Secureflow platform.

Answering Your Key Questions About Open Banking

As open banking starts showing up everywhere, it’s only natural for businesses to have questions. Stepping away from the payment methods we’ve all used for decades can feel like a big leap, but getting the facts straight can bring a lot of clarity and confidence.

This section cuts through the noise to tackle the most common queries we hear about how open banking actually works. We'll give you straightforward answers to help you decide if it’s right for your business.

Let’s get into the key questions probably on your mind.

Is Open Banking Truly Secure?

This is usually the first question people ask, and for good reason. The answer is a resounding yes. The entire system was built from the ground up with bank-level security and strict regulation at its core. Unlike card payments where sensitive details like the 16-digit card number are shared, open banking keeps your most critical data completely private.

Every single payment is protected by Strong Customer Authentication (SCA), a multi-factor security protocol required by law. This isn't something the business handles; it all happens directly within the customer's own trusted banking app or online portal.

Because the authentication happens in the bank’s secure space, the customer’s login details, passwords, and PINs are never exposed to the third-party app or the business getting paid. It’s a closed loop designed to lock fraudsters out.

On top of that, any company offering open banking services in the UK must be authorised and regulated by the Financial Conduct Authority (FCA). This isn't just a simple registration. It’s a deep vetting process that ensures only trustworthy, compliant, and financially stable companies can even participate. This adds a powerful layer of oversight and protection for everyone.

Do I Have to Share All My Financial Data?

Absolutely not. This is one of the biggest misconceptions. A core principle of open banking is granular, user-led consent. You are always in the driver's seat, deciding exactly what data is shared, who it's shared with, and for how long. The system is specifically designed to prevent the kind of broad, unchecked access to your financial life that people worry about.

When a customer starts an open banking journey, the consent screen they see will clearly spell out what's being requested.

- For Payments: Consent is given for one transaction at a time. The customer approves a single payment for a specific amount to a specific business. There's no ongoing access. It’s a one-and-done approval.

- For Account Information: If a service needs to see account data (like a budgeting app, for example), the customer has to explicitly approve it. This consent isn't permanent and has to be re-authorised, usually every 90 days.

This model of explicit, time-limited consent means data sharing is always intentional and transparent. The customer holds all the keys and can revoke access at any time through their own bank’s dashboard.

How Is This Different from Screen Scraping?

This is a crucial point to understand. Screen scraping was the old, insecure way of doing things, where customers had to hand over their actual bank login username and password to a third-party app. That app would then log in pretending to be them, literally "scrape" the data off the screen, and store it. It was incredibly risky, involving sharing the most sensitive credentials you have.

Open banking was created specifically to make screen scraping a thing of the past. Here’s a simple breakdown of the difference:

| Feature | Screen Scraping | Open Banking (APIs) |

|---|---|---|

| Credentials | User shares their actual login/password. | Credentials are never shared with the third party. |

| Authentication | Handled by the third party, creating a huge risk. | Handled directly and securely by the user's own bank. |

| Data Access | Often grabbed all available data from the screen. | Strictly limited to specific data points the user approves. |

| Regulation | Largely unregulated and actively discouraged by banks. | Highly regulated by the FCA and government directives. |

In short, open banking uses secure, purpose-built connections called Application Programming Interfaces (APIs). Think of an API as a controlled, protected gateway that allows for very specific requests, rather than just handing over the keys to the front door. It’s a fundamentally safer, more transparent, and regulated approach.

How Can My Business Start Using Open Banking Payments?

Getting started is much simpler than most people think. You don’t need to become a regulated financial entity or build a complex banking integration from the ground up. The easiest route is to partner with an authorised provider that has already done all the heavy lifting.

Platforms like Paytia’s Secureflow have these capabilities built right in, ready to be integrated into your existing workflows. A good solution provider handles all the regulatory compliance, technical plumbing with the banks, and security protocols for you. This lets you offer secure, Identity Verified Pay by Bank options to your customers almost immediately, without needing a team of developers or compliance experts.

By integrating a solution like Paytia, your business can immediately start taking faster, more secure, and lower-cost payments, all while slashing your PCI DSS compliance burden and building customer trust. Find out more at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.