Alternative payments methods: A Practical Guide for UK Businesses

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Alternative payment methods are, simply put, any way a customer can pay you that doesn't involve cash or a major credit card. This isn't just a niche category anymore; it's a huge shift towards faster, more convenient, and more secure transactions, all driven by customers who now live and breathe digital.

Why Businesses Are Looking Beyond Card Payments

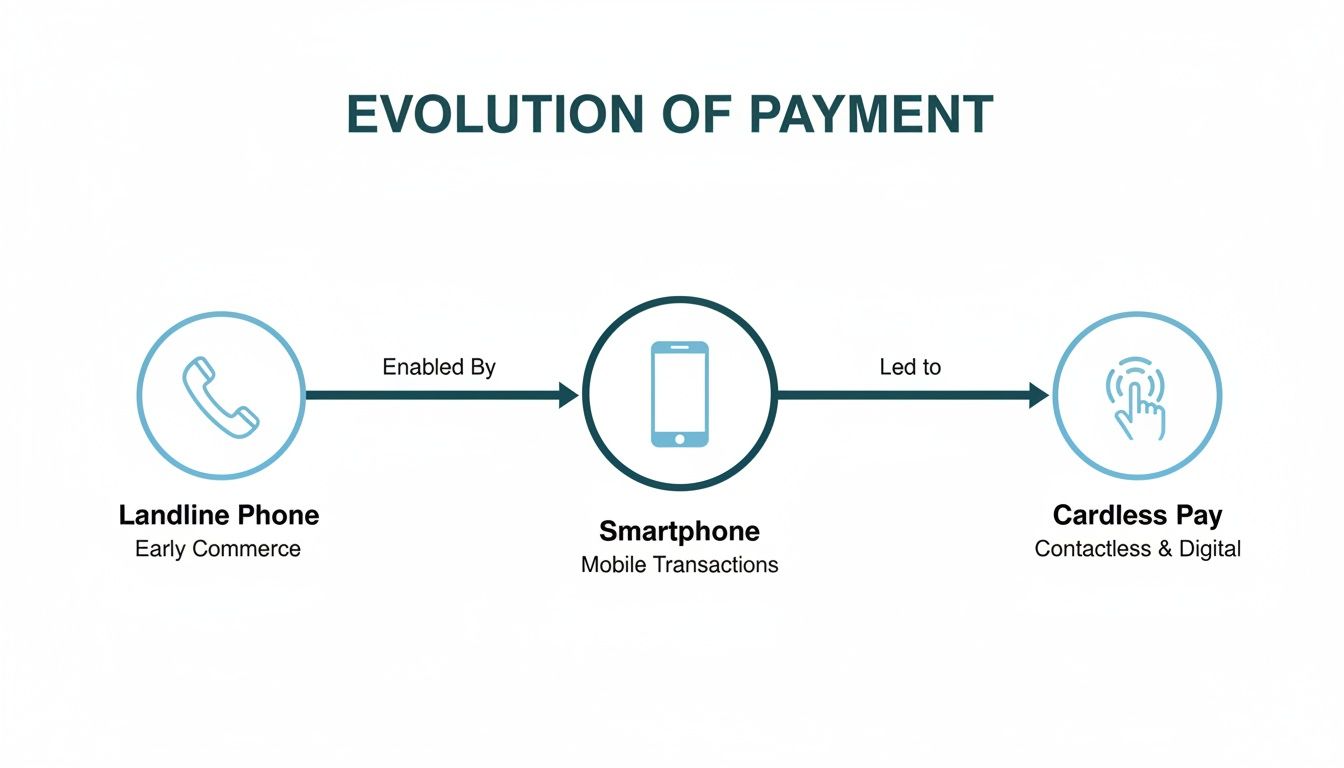

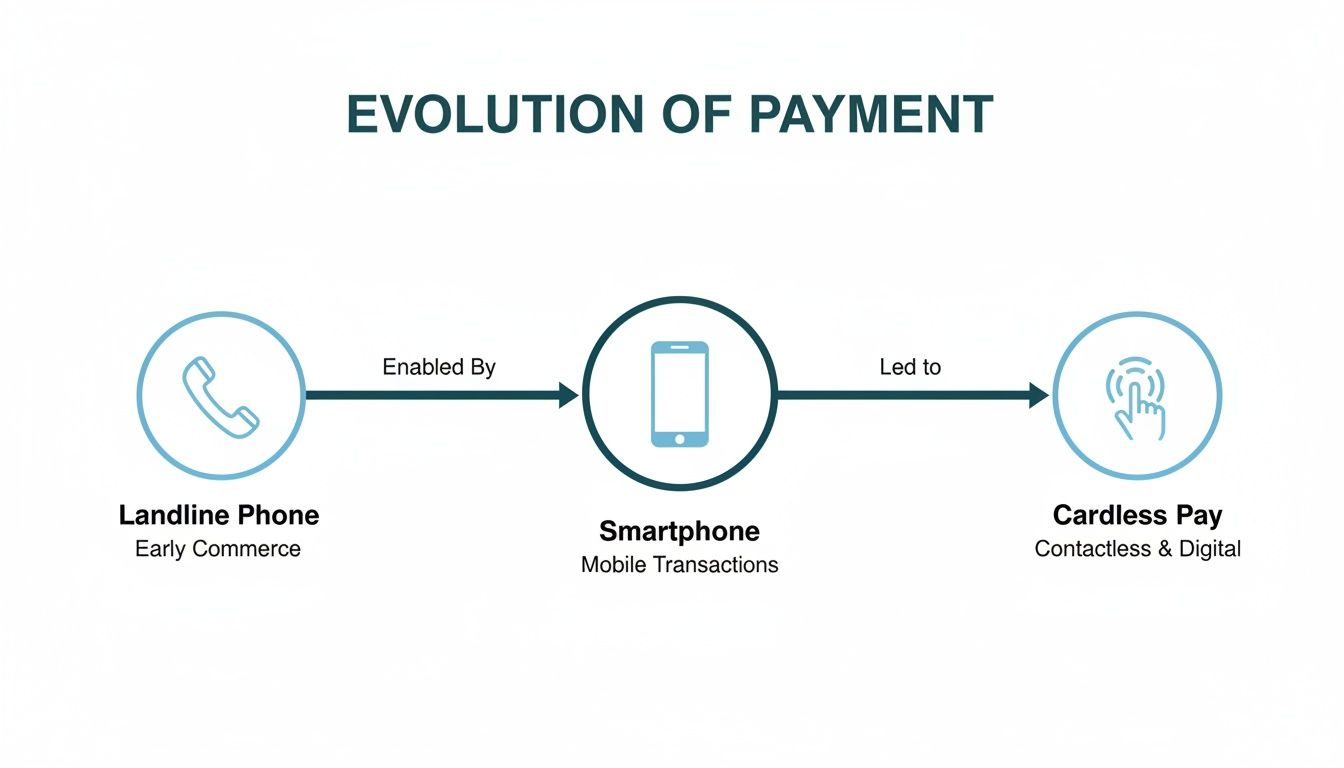

Think about it this way: the landline phone in your house used to work perfectly well for making calls. But would you ever trade your smartphone for one today? Of course not. The leap from traditional card payments to alternative methods is just like that. Swiping a card is familiar, sure, but it’s quickly becoming the landline in a world that runs on the speed and smarts of a smartphone.

This change isn't about chasing the latest tech fad. It's about meeting people where they are. Customers today expect the simplicity of one-click checkouts, the speed of instant bank transfers, and the ease of paying with their mobile wallet. Forcing them to manually punch in 16 digits, an expiry date, and a CVV feels clunky and outdated—like asking them to find a payphone. That friction is a real problem. In fact, research shows that a staggering 56% of consumers will ditch a purchase for good if their favourite payment option isn't there.

The True Cost of Sticking to the Old Ways

Ignoring this shift is about more than just one lost sale. When a customer lands on your payment page and doesn't see the familiar logos they trust—like Apple Pay, PayPal, or their bank's own "Pay by Bank" option—their confidence takes a hit. That moment of hesitation is often all it takes to trigger cart abandonment, a headache for any business selling online or over the phone.

For businesses with contact centres, this is a critical point. Relying solely on taking card numbers over the phone creates unnecessary friction and security risks. The longer an agent and customer spend reading out and confirming card details, the higher the risk of a dropped call, a typo, or a failed payment.

This old-school process doesn't just hurt the customer experience; it blows up your security and compliance burden. The moment you handle sensitive card data—even verbally—your operation falls squarely under the strict rules of the Payment Card Industry Data Security Standard (PCI DSS). That’s a heavy, costly, and complex responsibility to carry.

Adapting to How People Want to Pay

The good news? Embracing alternative payment methods isn't the massive technical overhaul it used to be. It's about strategically adding the choices your customers already use and trust. For any business taking payments remotely, like a contact centre, this is absolutely crucial. By integrating a solution that supports a variety of modern payment methods, you can:

- Build Customer Trust: Offering familiar, secure options shows you care about their convenience and security.

- Cut Down on Abandoned Sales: A smoother, quicker checkout means more completed transactions. It's that simple.

- Shrink Your Security Burden: Modern platforms can handle these payments without sensitive data ever entering your environment, which can dramatically reduce your PCI DSS scope.

This guide will walk you through the most important alternative payment methods for UK businesses, showing you how to adapt securely and keep your customers happy.

The Landscape of Alternative Payments in the UK

To really get your head around alternative payment methods, you need to appreciate just how many options are available to UK businesses today. This isn't about finding a single replacement for card payments. It's about a whole ecosystem of choices, each built for a different job—from slick e-commerce checkouts to rock-solid recurring billing.

The UK's payment scene has changed dramatically over the last ten years. Contactless payments, in particular, have completely reshaped how we buy things, soaring from just 53% adoption in 2017 to 91% by 2022-23. Mobile wallets have also taken off, jumping from 14% use in 2017 to 39% in 2022-23. The generational shift is undeniable: a massive 78% of UK consumers aged 16-24 now regularly use mobile payment services. You can discover more insights on the UK's payment evolution from Airwallex.

This visual charts the journey from the clunky, phone-based commerce of the past to the instant, card-free world we live in now.

It’s clear how technology has pushed customer expectations forward, demanding faster, simpler, and more secure ways to pay. Let’s break down the key players leading this charge.

Comparing Popular Alternative Payment Methods

To make sense of the options, it helps to see them side-by-side. This table gives a quick glance at how the most common methods stack up for UK businesses.

| Payment Method | How It Works | Best For | Key Business Benefit |

|---|---|---|---|

| Digital Wallets | Stores card details on a device (e.g., Apple Pay, Google Pay). Customers pay with a tap or biometric scan. | Fast online checkout, in-person contactless payments. | Reduced Cart Abandonment: Makes paying incredibly quick and easy. |

| Open Banking | Customers authorise payment directly from their bank account via their own banking app. No card details are shared. | High-value transactions, businesses wanting to cut fees and fraud risk. | Lower Fees & No Chargebacks: Bypasses card networks, reducing costs and risk. |

| Direct Debit | Businesses "pull" agreed payments from a customer's bank account on a schedule after a one-time mandate is set up. | Subscriptions, memberships, recurring bills. | Predictable Cash Flow: Automates collections and eliminates late payments. |

| Buy Now, Pay Later | A third party (e.g., Klarna) pays the business upfront, while the customer pays back in interest-free instalments. | Retail, especially for higher-priced items. | Increased Sales & Order Value: Removes the immediate cost barrier for customers. |

| Payment Links | A secure URL is sent to the customer (via SMS, chat, email). They click to a payment page to complete the transaction. | Contact centres, remote sales, invoicing. | Enhanced Security & PCI Scope Reduction: Keeps sensitive data out of your systems. |

Each method solves a different problem, and the right choice often depends on your specific business model and customer base. Now, let's explore these in a bit more detail.

Digital Wallets: The Frictionless Checkout Experience

Digital wallets like Apple Pay, Google Pay, and PayPal are probably the most familiar alternatives. Think of a digital wallet as a secure vault on your customer’s phone or computer that holds their card details.

When it's time to pay, they don't have to hunt for their card and type in all the numbers. Instead, they just authorise the payment with a fingerprint, face scan, or password. The wallet handles the rest, transmitting the payment info using tokenization—a process that swaps the real card details for a secure, one-time code.

Business Benefit: The number one advantage here is slashing checkout friction. Turning a tedious data-entry chore into a single tap can make a huge difference to your cart abandonment rates and push conversions up.

Open Banking: The Secure Digital Handshake

Open Banking, often called 'Pay by Bank', lets customers pay you directly from their bank account. It’s like a secure, digital handshake between your business and the customer's bank, with the customer giving the nod of approval.

When a customer chooses this option, they’re sent to their own online banking app to authorise the payment. They use the same login details and security they always do, like their fingerprint or face ID. Once approved, the funds move straight from their account to yours. This method completely bypasses the traditional card networks.

That’s a big deal for a few reasons:

- Lower Transaction Fees: Without the card schemes taking their cut, the cost per transaction is often much lower.

- Instant Settlement: Money can land in your account almost instantly, rather than the days it can take for card payments to clear. Hello, better cash flow.

- Reduced Fraud and Chargebacks: Because the customer authenticates directly with their bank, the risk of fraudulent chargebacks is practically zero.

Direct Debit: The Engine of Recurring Revenue

For any business built on recurring payments—subscriptions, memberships, regular instalments—Direct Debit is an absolute workhorse. It gives you permission to pull agreed-upon amounts from a customer's bank account on a set schedule.

It’s this "pull" mechanism that makes it so powerful. After a one-time setup of a Direct Debit Mandate, the entire process is automated. This gives you unparalleled reliability for your revenue stream.

Business Benefit: Direct Debit delivers incredible cash flow stability. It automates your collections, wiping out the headache of late payments, expired cards, and chasing customers every month.

Buy Now, Pay Later: Flexible Credit at the Checkout

Buy Now, Pay Later (BNPL) services like Klarna and Clearpay have exploded in popularity, especially in retail. They give customers the choice to get an item now but spread the cost over several interest-free instalments.

For you, the business, it’s beautifully simple. The BNPL provider pays you the full amount upfront (minus their fee). They then take on the job, and the risk, of collecting the instalments from the customer.

This flexibility is a brilliant way to boost sales, especially for bigger-ticket items.

- It lifts your average order value by making larger purchases feel more manageable.

- It appeals to younger customers who often prefer it over traditional credit cards.

- It improves conversion rates by removing price as an immediate hurdle.

Payment Links: The Versatile Payment Tool

Payment Links are one of the most adaptable tools in the modern payment kit. It’s a unique, secure URL you can send to a customer through pretty much any channel—email, SMS, web chat, or even as a QR code.

When the customer clicks the link, they land on a secure payment page. There, they can pay using whatever method they prefer, be it a card, a digital wallet, or Open Banking.

This is a game-changer for contact centres. Instead of asking a customer to read their card details out loud over the phone, an agent can simply send a secure link. The customer pays privately and safely on their own device, and your systems never have to touch sensitive card data. This simple step can massively reduce your PCI DSS compliance scope and build huge trust.

How Digital Wallets Are Winning the Checkout

Of all the alternative payment methods out there, digital wallets like PayPal, Apple Pay, and Google Pay have become the undisputed champions of the online checkout. They deliver that seamless, one-tap experience modern customers don't just prefer—they now expect it as standard. For businesses, this translates directly into fewer abandoned carts and a much smoother customer journey.

Digital wallets have cemented their place as the go-to payment method for UK e-commerce, and their dominance is only set to grow. By 2025, they are projected to command a whopping 58% of the e-commerce market share. Mobile wallet adoption, in particular, is soaring, having jumped by 45% in the last year alone, with younger demographics leading the charge. If you’re managing remote payments, supporting digital wallets isn't just a good idea; it’s a necessity.

The Power of Tokenization Explained

The secret ingredient that makes digital wallets both simple and incredibly secure is a technology called tokenization.

Think of it like a valet key for your car. You hand over a key that can only start the ignition and lock the doors—it can’t open the boot or the glove compartment. Your original key, with full access, stays safely with you.

Tokenization does something very similar with payment data. When a customer adds their card to a digital wallet, the service works with the bank to swap the real 16-digit card number for a unique, randomly generated code called a 'token'. This token is what gets passed along during a transaction.

The real card number is never transmitted or stored on the merchant’s systems. It’s like using a disposable credit card number for every single purchase. If a data breach were to happen, the thieves would only get a useless, single-use token, not the customer's actual card details.

This process adds a powerful layer of security, making every payment far safer for both the customer and your business.

Why Younger Consumers Drive Adoption

The rapid shift towards digital wallets is heavily influenced by who’s doing the buying. Younger consumers, who’ve grown up with smartphones as their primary window to the world, value speed and simplicity above all else. For them, punching in card details feels clunky and outdated.

They expect a frictionless experience where a purchase is completed with a quick fingerprint or face scan. This preference has a direct impact on business outcomes:

- Reduced Friction: A one-tap payment process drastically lowers the effort needed to complete a sale, which is a proven way to boost conversion rates.

- Increased Trust: Well-known brands like Apple Pay and PayPal provide an immediate sense of security, reassuring customers that their data is in safe hands.

- Future-Proofing Your Business: By catering to the habits of the next generation of consumers, you ensure your business stays relevant and competitive.

Digital Wallets in Contact Centres

The benefits aren’t just for online shops. In a contact centre, digital wallets offer a secure and efficient way to handle payments over the phone. Instead of asking a customer to read out their card details, an agent can trigger a payment request that pops up as a notification on the customer's smartphone.

The customer then authorises the payment securely using their digital wallet, without ever saying their sensitive information out loud. This method keeps payment data completely out of call recordings and away from the agent's screen, dramatically simplifying PCI DSS compliance and building customer trust.

To dive deeper into how this technology works, you can read our guide on what is a digital wallet.

The Quiet Revolution of Open Banking Payments

Among the many alternative payment methods reshaping UK commerce, Open Banking really stands out. Often called ‘Pay by Bank’, this isn’t just another payment option on a checkout page; it’s a fundamental rewiring of how money moves from a customer to a business.

Think of it as creating a direct, highly secure tunnel between your customer’s bank account and yours. It completely cuts out the traditional card networks.

This approach is what many in the industry are calling a ‘quiet revolution’ in account-to-account (A2A) payments. And it’s not just a niche idea—as of July 2025, over 15 million UK users had adopted Open Banking, showing just how quickly it’s becoming mainstream.

The whole system works by using bank-grade security to let customers pay you straight from their account, tapping into a growing demand for faster, more transparent payment experiences.

How Open Banking Works in Practice

Let’s use a real-world example. Imagine a housing association that needs to collect a large rent payment. Traditionally, this might mean a risky card payment over the phone or a slow Bacs transfer that takes days to clear.

With Open Banking, the entire process is transformed.

- Initiate Payment: The housing officer sends the tenant a secure payment link. Simple.

- Authenticate Securely: The tenant clicks the link, which prompts them to select their bank. From there, they’re securely redirected to their own mobile banking app—an environment they know and trust.

- Approve with Biometrics: Inside their familiar banking app, they see the pre-filled payment details and approve the transaction using their fingerprint or Face ID.

- Confirm Instantly: The funds move directly from their account to the housing association’s, with both parties getting an instant confirmation.

Notice what’s missing? At no point are card numbers or sensitive details shared with the business. The whole transaction is shielded by the customer’s own bank security—the same robust protection they rely on every day.

This digital handshake is powerful because it leverages the trust and security already built into the UK’s banking infrastructure. It’s not some third-party app asking for details; it’s the customer’s own bank facilitating a direct, authenticated payment.

The Tangible Business Benefits

Adopting Open Banking isn’t just about convenience. It delivers three standout advantages that directly impact your bottom line and make your operations more efficient, offering concrete financial and security wins over card payments.

- Significantly Lower Fees: By bypassing card networks like Visa and Mastercard, you dodge all the associated interchange and scheme fees. This can lead to transaction costs that are up to 80% lower than traditional card payments—a huge saving, especially on high-value purchases.

- Instant Payment Settlement: Unlike card payments that can take days to clear, Open Banking funds often land in your account almost instantly. This dramatically improves cash flow and gives you much faster access to your revenue.

- Near-Elimination of Chargebacks: Because every single payment is authenticated by the customer directly within their banking app (a process known as Strong Customer Authentication), the risk of fraudulent chargebacks is virtually eliminated. This gets rid of a major source of revenue loss and administrative headaches.

For regulated industries, platforms like Paytia take this a step further by offering an Identity Verified Pay by Bank solution. This adds another layer of security, ensuring the person making the payment is who they claim to be, helping you meet tough compliance and Know Your Customer (KYC) requirements with ease.

Implementing Secure Payments in Your Contact Centre

Embracing a wider array of payment methods is one thing. Actually implementing them securely in a busy contact centre is a whole different ball game.

For decades, the standard was clumsy and risky: customers would simply read their card numbers out loud over the phone. Not only is this process painfully slow and riddled with human error, but it also throws your entire operation into the deep end of PCI DSS compliance.

The moment sensitive payment data enters your environment—whether it's spoken by a customer, typed into a chat window, or keyed into your systems—your organisation is officially within PCI DSS scope. This means you're on the hook for applying strict, expensive controls to your networks, call recordings, and agent desktops.

Thankfully, there’s a much smarter way to handle this.

Shrinking Your PCI Scope with Tokenization

The real secret to secure remote payments is making sure sensitive data never touches your systems in the first place. This isn't magic; it's achieved through proven technologies like tokenization and channel separation.

Think of it like this: your business has a high-security vault for storing money, but it's managed by a specialist third party. When a customer pays, their funds go straight into this ultra-secure vault. You get a receipt—a unique token—that confirms the payment and can even be used for future transactions, but you never physically handle the cash.

That’s exactly how modern payment platforms operate. The customer enters their details into a secure interface owned by a PCI DSS Level 1 certified provider, like Paytia. Your business only ever receives a token, completely removing toxic payment data from your environment and shrinking your PCI DSS scope by as much as 90%.

This shift does more than just slash compliance costs. It builds incredible trust with your customers by demonstrating just how seriously you take the security of their data.

Proven Models for Secure Remote Payments

Modern platforms provide several battle-tested ways to capture alternative payments without ever exposing your agents or systems to sensitive info. Each model is tailored for a specific communication channel, creating a smooth experience for both your customers and your team.

- Payment Links via Web Chat and Email: An agent can generate a unique, secure payment link in real-time and send it to the customer via chat, SMS, or email. The customer simply clicks the link, which opens a secure payment page on their own device, and completes the transaction using their preferred method—be it a digital wallet, Open Banking, or a card.

- Automated IVR Payments: For 24/7 self-service, customers can call an Interactive Voice Response (IVR) system to make payments. They use their telephone keypad to enter details securely, while DTMF suppression technology masks the tones so no sensitive data is ever captured in call recordings. This is a brilliant option for paying routine bills or renewing subscriptions.

- Agent-Assisted Phone Payments: During a call, the agent can transfer the customer to a secure, automated system to enter their card details. The agent stays on the line to offer help, but they are completely shielded from hearing or seeing the sensitive information. This gives you the perfect blend of human support and robust security. You can find a detailed breakdown of how to securely pay over the phone in our complete guide.

Unifying Payments for a Better Experience

To truly lock down payments in your contact centre, you should consider innovative methods like secure QR code payment solutions like Paytia's Scan To Call QR Code Generator that completely remove sensitive data from your environment. The most effective strategy, however, is to use a unified platform that centralises all these channels.

A platform like Paytia acts as a single, secure gateway for capturing payments across phone, chat, email, and self-service portals. This approach simplifies your operations, cuts down on training, and gives you a consolidated view of every transaction.

By eliminating sensitive data from call recordings, agent screens, and your CRM, you don't just tick a compliance box—you create a safer, more trustworthy payment experience for everyone involved.

Building the Right Payment Strategy for Your Business

Choosing the right mix of payment methods isn't about jumping on every new trend. It's about building a smart, focused strategy that actually fits your customers and how your business works on the ground. The real goal is to handpick a selection that makes customers happier and your internal teams more efficient.

Start by getting to know your customer base. Are they mainly younger shoppers who now expect the slick speed of a digital wallet at checkout? Or are you managing subscriptions where the sheer reliability of Direct Debit is what really matters? Nailing these preferences is the first step to cutting out friction and earning genuine loyalty.

Next, look at what you’re actually selling. For high-value payments, the tiny fees and solid security of Open Banking make a compelling case, pretty much wiping out the risk of chargebacks. But for smaller, more frequent purchases, you can’t beat the one-tap simplicity of a mobile wallet.

Curating Your Payment Mix

A well-thought-out payment strategy solves specific business problems. There is no one-size-fits-all answer here; the best approach is always a deliberate blend of options tailored to your unique workflows.

- For E-commerce: You’ll want to prioritise digital wallets like Apple Pay and Google Pay to slash those frustratingly high cart abandonment rates.

- For Subscriptions: Implementing Direct Debit is a game-changer for automating revenue and bringing stability to your cash flow.

- For High-Value Remote Sales: Using Open Banking through a secure payment link keeps your transaction costs down and fraud risk to a minimum.

To build an effective payment strategy, businesses must evaluate comprehensive POS system solutions that can support the adoption of new payment technologies and enhance customer experience. This integration is key to a seamless operation.

The most successful payment strategies aren’t just about adding more options. They are about adding the right options and unifying them on a single, secure platform. This simplifies management, reduces compliance burdens, and creates a consistent customer journey.

Let's recap the core benefits. Alternative payments mean lower costs by sidestepping traditional card networks, much better security through tech like tokenization, and a vastly improved customer experience. A platform like Paytia pulls all these benefits together, letting you accept a whole range of payment types securely while dramatically shrinking your PCI DSS scope.

This strategic approach does more than just modernise your checkout; it future-proofs your business. By taking a hard look at your current processes and embracing a flexible payment solution, you can meet customer expectations today and be ready for whatever comes next.

Got Questions About Alternative Payments? We've Got Answers

Stepping into the world of alternative payments can feel like learning a new language. Don't worry, it's simpler than it looks. Here are some quick, straightforward answers to the questions we hear most often.

What's the Real Difference Between a Digital Wallet and a Mobile Wallet?

It's easy to get these two mixed up, as people often use the terms interchangeably. Think of it this way: a digital wallet is the main category, covering any software that holds your payment information. A mobile wallet is just one specific type of digital wallet that lives on your phone—think Apple Pay or Google Pay.

The important thing is that both use a security feature called tokenization. Instead of sending your real card number, they create a unique, one-time code for the transaction. This makes them a much safer way to handle payments, especially online or over the phone.

How Do Alternative Payments Actually Help with Our PCI DSS Scope?

This is a big one. Alternative payment methods can dramatically reduce your PCI DSS scope by making sure sensitive card data never even touches your company's systems. When a customer pays using a secure link or an automated phone system, they're entering their details directly into a certified payment provider's environment, completely bypassing yours.

This one simple change means your agents never see, hear, or handle the card numbers. That massively simplifies your compliance checklist and cuts down on associated costs.

It all boils down to a simple idea: you can't be held responsible for protecting data you never have in the first place. By offloading the payment capture to a secure platform, you shift the bulk of the compliance headache away from your team.

Is Open Banking Really as Safe as a Traditional Card Payment?

Absolutely. In fact, many experts consider it even more secure. Open Banking payments rely on your own bank's security systems, which already include things like fingerprint ID, facial recognition, and other multi-factor authentication steps you use every day.

Because the payment creates a direct, authorised link from one bank account to another, there's no need to share card numbers with the business you're paying. This slashes the risk of those numbers being exposed in a data breach and helps prevent fraudulent chargebacks.

Which Alternative Payment Method Is the Right Fit for My Business?

There's no single "best" option—it really comes down to who your customers are and how you operate.

- E-commerce businesses often find digital wallets are a game-changer for reducing abandoned shopping carts.

- Subscription-based companies love the reliability of Direct Debit for steady, recurring income.

- For high-value, one-off transactions, Open Banking is fantastic because of its low costs and rock-solid security.

Most of the time, the smartest approach is to offer a curated mix of payment methods. That way, you cater to what your customers prefer while meeting your own business needs.

Ready to build a secure, flexible payment strategy that gives your customers the choices they expect? Paytia brings a wide range of alternative payment methods together on a single platform, all while shrinking your PCI DSS scope. See how our solutions can get your business ready for the future by visiting https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.