What Is a Digital Wallet and How It Works

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think of a digital wallet as the modern-day equivalent of that worn leather wallet you’ve carried around for years. Instead of being stuffed with physical cards and paper, it’s a secure app on your smartphone or smartwatch that holds digital copies of everything you need—debit and credit cards, loyalty cards, event tickets, you name it. It completely changes the game for how you pay, making every transaction faster, safer, and far more convenient.

So, What Exactly Is a Digital Wallet?

Remember fumbling through your physical wallet, searching for the right card while a queue builds up behind you? A digital wallet eliminates that chaos entirely. It organises all your payment and loyalty cards into one tidy, secure place on your phone. When it's time to pay, you just tap your device. Simple as that.

This shift towards convenience is anything but small. The UK digital wallet market is exploding, currently valued at USD 0.06 billion but projected to hit USD 0.20 billion by 2033. That’s a compound annual growth rate of 14.40%, a clear sign that people are ditching plastic for the security and simplicity of tapping to pay. You can get a deeper dive into these trends from IMARC Group's comprehensive report.

At its heart, a digital wallet isn't just a payment app. It’s a secure vault for your financial credentials and personal information, designed to smooth out daily life, from grabbing a coffee to boarding a flight.

A Look Inside a Digital Wallet

So, what can you actually keep in one of these things? While payment cards are the headline act, modern wallets are designed to be much more. They’re a central part of the growing world of alternative payment methods that give you more choice beyond traditional banks.

To help paint a clearer picture, this table breaks down the key features.

Digital Wallet Key Features at a Glance

| Component | Function | Example |

|---|---|---|

| Payment Information | Stores encrypted debit and credit card details for quick, secure payments. | Apple Pay, Google Wallet, Samsung Pay |

| Loyalty & Membership | Digitises physical loyalty cards so you never miss out on points or rewards. | Storing your Tesco Clubcard or Nectar card. |

| Tickets & Passes | Keeps event tickets, boarding passes, and travel cards in one accessible spot. | A digital train ticket or concert e-ticket. |

| Digital Keys & IDs | Acts as a secure holder for digital hotel keys, car keys, and even IDs. | Unlocking your hotel room with your phone. |

As you can see, a digital wallet is designed to consolidate all the essentials. Your smartphone becomes the single, secure hub for payments, identification, and access. It’s not just about decluttering your pockets; it’s about making everyday interactions seamless and secure.

The Technology Behind Your Tap to Pay

That split-second tap of your phone or smartwatch at a payment terminal feels like magic, but it’s powered by some seriously clever tech working in perfect harmony. When you understand what’s happening behind the scenes, you start to see why a digital wallet is often safer and more convenient than pulling out a physical card.

The most common piece of the puzzle for in-person payments is Near Field Communication (NFC). Think of it as a secret, short-range radio handshake between your device and the payment reader. When you hold your phone close to the terminal, the NFC chips in both devices recognise each other, establishing a secure, low-power connection to swap payment information.

This connection only works over a tiny distance—we're talking a few centimetres. That’s a built-in security feature, making it nearly impossible for criminals to intercept the signal or for you to pay for someone else’s coffee by accident.

How Tokenization Protects Your Real Card Details

While NFC handles the handshake, another technology called tokenization is the real hero protecting your sensitive data. Tokenization is like giving your credit card a digital disguise for every single purchase you make. Instead of your actual 16-digit card number being sent to the merchant, your digital wallet provides a unique, one-time-use code, or "token."

This token is just a randomly generated string of numbers that stands in for your card for that one transaction. If the merchant ever suffers a data breach, all the hackers get is a pile of useless, expired tokens—not your real card details. Your actual account number stays safely encrypted, never even touching the merchant’s system.

In essence, tokenization ensures your primary account number is never transmitted or stored during a payment. It replaces sensitive data with a non-sensitive equivalent, drastically reducing the risk of fraud.

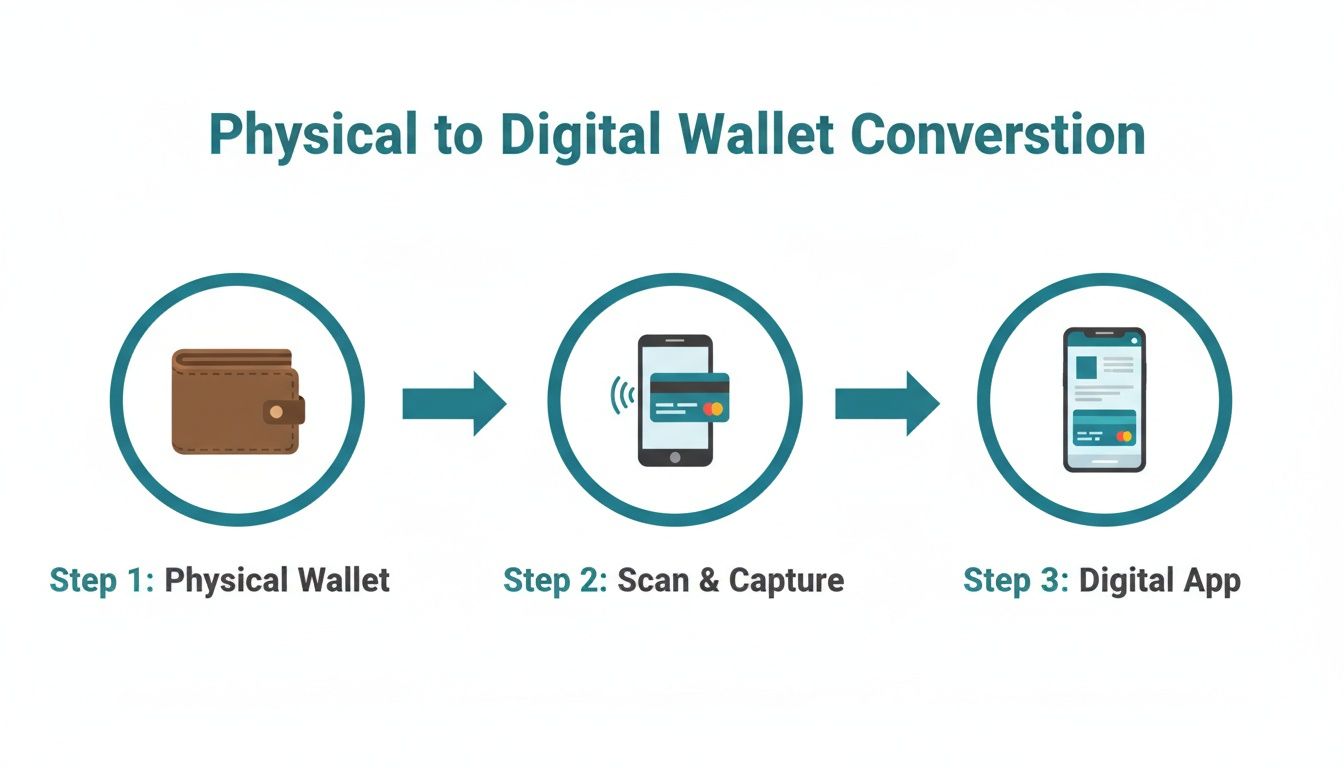

Getting your physical card into this secure digital form is incredibly simple. You just scan it, and the app does the rest, as this flow shows.

That simple, three-step process—physical wallet to scanned card to secure app—is what makes mobile payments so convenient and secure.

The Role of QR Codes in Digital Payments

Beyond tapping, another technology has become hugely popular, especially for online payments, in-app purchases, and certain in-store setups: the Quick Response (QR) code. A QR code is basically a super-powered, two-dimensional barcode that can store a ton of information, including a link to kick off a payment.

When you scan a merchant’s QR code with your phone’s camera, it usually does one of two things:

- Initiates a Payment: The code opens your wallet app or a secure webpage, already filled in with the merchant’s details and the amount owed. You just have to authorise it with your fingerprint, face, or PIN.

- Presents Your Details: Sometimes it works the other way around. Your wallet generates a unique QR code on your screen, which the merchant scans to grab your payment token and complete the sale.

This flexibility makes QR codes a fantastic tool for businesses that don’t have NFC-enabled terminals. Pulling all these different technologies into a smooth system is a key task for any business. If you're curious about the deeper technical side, our guide on payment gateway API integration is a great place to start.

Together, NFC, tokenization, and QR codes form the technological backbone of modern digital wallets. They deliver the speed, convenience, and rock-solid security that have made tapping to pay a global standard.

Exploring the Different Flavours of Digital Wallets

Just like physical wallets, digital ones aren't one-size-fits-all. You might prefer a slim card holder, while someone else needs a chunky billfold. Digital wallets are much the same, coming in different forms to suit different habits and needs.

Figuring out the main categories helps clarify where they all fit. The lines can sometimes get a bit blurry, but wallets generally fall into a few key groups. Some are baked right into your smartphone, while others are extensions of your bank or a specific payment service you use online. This variety is what makes them so useful, offering a solid fit for almost any situation.

And people are definitely finding their fit. Mobile wallet use in the UK has shot up, showing just how much trust and convenience they now offer. A study from UK Finance revealed that around 57% of UK adults are now using mobile wallets for purchases both online and in-store. That’s a huge jump from 42% not long ago, cementing their place as a major player in how we pay.

Universal Wallets Built Into Your Device

These are the wallets that come ready-to-go on most new smartphones and smartwatches, making them incredibly easy to start using. You can think of them as the default, all-purpose wallet that’s part of your device’s operating system.

- Apple Pay: Found on iPhones, Apple Watches, and other Apple gear, it uses NFC for tap-and-go payments in shops and provides a simple one-click checkout for online and in-app buys.

- Google Wallet (formerly Google Pay): This is the Android equivalent, giving you tap-to-pay, ticket storage, and loyalty card management across a huge range of smartphones.

- Samsung Wallet (formerly Samsung Pay): While it works like the others, Samsung Wallet has a clever trick up its sleeve called Magnetic Secure Transmission (MST). This lets it work with older magnetic stripe card readers, giving it an edge on compatibility in some places.

These "xPay" wallets, as they're sometimes called, are the kings of in-store convenience. In fact, a whopping 80% of Apple Pay's transaction volume happens via NFC. Their appeal is simple: they're fast, easy, and tied directly into your device's security, like Face ID or fingerprint scanning.

Bank-Specific and Payment Gateway Wallets

Moving beyond the built-in options, many banks and payment companies offer their own wallets. These are designed to either integrate more deeply with your bank accounts or create a dedicated bubble for certain types of payments.

Bank-specific wallets are often part of your main mobile banking app. They let you manage your accounts, see your spending, and make payments from one central hub—a neat, unified experience.

Payment gateway wallets, like PayPal, work a bit differently. They act as a middleman between your bank and the shop. You can load money into your PayPal account or link your cards, then use your PayPal login to pay on millions of websites. This is a massive favourite for e-commerce because it adds a layer of buyer protection and means you don’t have to hand over your card details to every single online store.

Key Takeaway: While the universal wallets focus on slick, tap-to-pay convenience, bank and gateway wallets offer either a single view of your finances or a secure, self-contained way to pay online.

Specialised Cryptocurrency Wallets

Finally, we have a unique and fast-growing category built just for digital currencies like Bitcoin and Ethereum. Crypto wallets are a different beast altogether. They don't hold money in the traditional sense; instead, they securely store the private keys that prove you own your digital assets and let you authorise transactions on the blockchain.

These wallets come in two main forms. There are software-based "hot wallets" that live on your computer or phone for quick access, and hardware-based "cold wallets"—physical devices that keep your keys completely offline for maximum security. If you're diving into this world, getting a handle on the basics of blockchain development can really help you understand how these wallets operate. Their job isn't just about payments; it's about securely managing your assets in a decentralised world.

How Digital Wallets Keep Your Money Safe

Handing over your physical credit card probably feels second nature. The idea of storing those same details on your phone, however, can feel a bit strange at first.

In reality, digital wallets are built with multiple, overlapping layers of security that often make them a much safer way to pay than using a traditional plastic card. These protections work in concert to shield your financial information every step of the way.

The first and most obvious line of defence is biometric authentication. Before a payment can even begin, your digital wallet needs you to prove you’re really you. This means using something completely unique, like your fingerprint (Touch ID) or your face (Face ID).

This simple check is incredibly effective. Even if someone steals your phone, your wallet remains locked tight. A thief can’t just pick it up and go on a spending spree, unlike a physical card that can be used by anyone who finds it.

The Power of Tokenization Revisited

Beyond your personal biometrics, the real engine protecting your card details is tokenization. As we touched on earlier, this process is like a digital bodyguard. It creates a unique, single-use code—a "token"—for every transaction you make.

This is a complete game-changer for payment security. When you use a physical card, your actual 16-digit card number (your Primary Account Number or PAN) is sent to the merchant and can even be stored in their systems. If that merchant ever suffers a data breach, your details are exposed.

With a digital wallet, all a hacker would find is a pile of useless, expired tokens. Each token is tied to one specific purchase and can't be reused, making the stolen data completely worthless. This single feature massively cuts down the risk of card-cloning and online fraud.

Tokenization transforms your sensitive payment information into a non-sensitive equivalent. It ensures that your actual card number is never exposed, creating a secure barrier between your account and the merchant’s systems.

This high level of security is a major reason for the rapid adoption of digital payment methods. The UK digital payments market is a prime example, currently valued at USD 11.7 billion and projected to soar to USD 43.7 billion by 2034. You can explore more about this market expansion from Straits Research.

Adhering to Strict Industry Standards

This robust security framework isn't just a collection of good ideas; it's governed by strict industry rules. All digital wallet transactions must comply with the Payment Card Industry Data Security Standard (PCI DSS). This is the global benchmark for any organisation that handles card payments, setting the rules to ensure everyone maintains a secure environment.

PCI DSS compliance involves a long list of requirements, including:

- Strong access control measures to ensure only authorised people can access sensitive data.

- Regularly monitoring and testing networks to find and fix security weaknesses.

- Implementing robust encryption to protect cardholder data when it's being sent and when it's being stored.

For businesses, accepting digital wallet payments means working with payment processors that are fully PCI compliant. This is non-negotiable. It not only protects your customers but also shields your business from the huge fines and reputational damage that follow a data breach.

Many businesses use specialised payment platforms to keep phone payments and other transactions secure and compliant, effectively taking their own systems out of PCI DSS scope. These platforms often add extra layers of security, such as 3-D Secure authentication, to double-check a customer's identity.

Putting Digital Wallets to Work for Your Business

While your customers are happily tapping away to pay for their coffee, the real power of digital wallets for your business goes way beyond the till. For any company, embracing these payment methods isn't just about keeping up with trends—it's a smart, strategic move to tighten security, streamline operations, and give customers the slick experience they now expect.

The numbers don't lie. Global spending via digital wallets hit an eye-watering $41.0 trillion in 2024. That's a massive clue about how a huge chunk of your customers prefer to handle their money. Integrating these options is more than just adding another button to your checkout; it's a chance to fundamentally improve how you handle every single transaction.

The benefits are especially powerful in industries where payments are taken remotely. From busy contact centres to bustling e-commerce sites, digital wallets offer a robust way to make payments secure, compliant, and refreshingly simple.

Transforming Contact Centre Payments

Contact centres have always struggled with a major security headache: how do you take a card payment over the phone without exposing customer data to huge risks? The old-school method of an agent taking down card numbers verbally is a minefield of PCI DSS compliance issues and a magnet for fraud.

This is exactly where digital wallets, combined with modern payment tech, provide a brilliant solution.

Instead of asking for sensitive card details, your agent can simply send a secure payment link to the customer's mobile via SMS or email. The customer taps the link, chooses their go-to wallet like Apple Pay or Google Pay, and authorises the payment on their own phone using their face or fingerprint.

This approach is known as channel separation, and it's a genuine game-changer. The sensitive card details are tokenized and processed entirely on the customer’s device, completely bypassing your agent and your internal systems. The payment data never even touches your environment.

The knock-on effect on your security and compliance is massive. By making sure your agents and call recordings never see, hear, or touch payment details, you can dramatically shrink your PCI DSS scope. This not only slashes the risk of a data breach but also cuts down the cost and hassle of staying compliant.

Reducing E-commerce Cart Abandonment

For anyone selling online, the checkout is where you either make the sale or lose it. A clunky, long-winded payment form is one of the biggest reasons people abandon their shopping carts. Every single field a customer has to fill in is another opportunity for them to give up and go elsewhere.

Digital wallets kill this problem with one-click payments. When a customer chooses to pay with Apple Pay or PayPal, their billing and shipping info is filled in automatically and securely. No more fumbling to type in a 16-digit card number, expiry date, and CVV code.

This ridiculously smooth experience has a direct impact on your conversion rates. By removing all that friction at the most critical point in the journey, businesses see a huge drop in abandoned carts. It turns a chore into a seamless, single-tap action—and that’s exactly what today's online shoppers want.

Key benefits for e-commerce include:

- Faster Checkouts: Slashes the time to buy from minutes down to seconds.

- Increased Conversions: Stops customers from dropping off at the final hurdle.

- Enhanced Security: Tokenization keeps both you and your customer safe from fraud.

The Role of Secure Payment Platforms

Of course, making all this happen takes more than a basic payment gateway. You need a secure payment platform built to handle the entire transaction while keeping sensitive data completely separate from your business.

Think of these platforms as a secure bridge connecting you, your customer, and your payment processor, but without ever letting raw card data onto your side. They provide the tools you need—like secure payment links and smart telephony integrations—to make channel separation a reality.

By using a platform like this, you can confidently take digital wallet payments anywhere, whether it’s over the phone, through web chat, or even via an automated IVR system. It’s an approach that lets you offer the modern payment options customers love while holding yourself to the highest standards of security and PCI compliance. In short, it’s how you future-proof your entire payment setup.

Putting Secure Wallet Payments into Practice

Deciding to accept digital wallet payments is a smart move, but a successful launch demands more than just flipping a switch. It’s about building a secure, efficient, and compliant payment ecosystem from the ground up—one that protects both your customers and your business.

The first step is often finding a payment processor that supports popular wallets like Apple Pay and Google Wallet. But that's just the table stakes. The real work lies in weaving this new payment method into your existing operations, whether it’s your CRM, e-commerce platform, or even your telephony system for handling phone orders.

Building on a Secure Foundation

The absolute cornerstone of any implementation is securing the entire transaction, from the moment a customer pays to the final settlement. This is where the concept of channel separation becomes crucial. The aim is simple: make sure sensitive payment data, even the tokenised information from a digital wallet, never touches your business environment.

For any business adding wallet payments, a secure and well-planned fintech payment integration is non-negotiable. This means using solutions that carve out a secure, isolated pathway for the transaction to travel directly from the customer to the payment gateway, bypassing your internal systems entirely.

When you use a secure payment platform, you effectively remove your business operations from the scope of PCI DSS compliance. This includes your agents, call recordings, and internal networks. The result? A drastically reduced security burden and a much lower risk of a costly data breach.

A Step-by-Step Guide to a Smooth Rollout

A structured approach ensures you don't miss any critical details. While every business is unique, a solid plan will generally follow these key stages:

- Map Your Current Setup: First, take stock. Identify every touchpoint where you accept payments—over the phone, on your website, via chat—and trace the existing data flow. This will immediately highlight any security vulnerabilities.

- Choose a Compliant Partner: Select a payment platform that not only supports digital wallets but also offers features like secure payment links and telephony integration. These tools are the building blocks of channel separation.

- Integrate with Your Core Systems: Work with your provider to link the payment platform to your CRM or other business software. The goal is to automate workflows and sync data seamlessly without ever bringing sensitive information into your environment.

- Train Your Team: Get your staff up to speed on the new, secure process. The best systems make this easy, as agents simply trigger a payment link instead of handling any card data themselves, which means training is often minimal.

Following this method transforms your payment process from a potential liability into a secure, streamlined asset for your business.

Got Questions About Digital Wallets?

Even as digital wallets become second nature for tapping to pay, a few common questions always seem to surface. Digging into the details of their security, what they mean for compliance, and how they differ from other payment apps is key to understanding their real value. Let’s tackle some of the most frequent queries head-on.

These answers should help clear things up and show you exactly where digital wallets fit in the bigger payments picture.

Are Digital Wallets Actually Safer Than Physical Cards?

Yes, and by a significant margin. When you compare them, a digital wallet is much safer than carrying a physical card around. It all comes down to two clever bits of tech working in tandem to keep your details locked down.

First up is biometric authentication. Think of this as the bouncer at the door. To even open your wallet, you need to prove it’s you with a fingerprint or face scan. This simple step means that even if someone steals your phone, they can’t get anywhere near your payment cards.

Then there’s tokenization, which makes sure your real card number is never actually shared during a transaction. Instead, the wallet sends a unique, one-time-use code—a token—to the merchant. If that retailer ever gets hacked, all the criminals will find is a pile of useless, expired tokens, not your financial data.

Contrast that with a physical card. If you lose it or it gets stolen, whoever finds it can start using it immediately, especially online. Digital wallets slam that security door shut.

Can My Business Stay PCI Compliant if We Take Wallet Payments by Phone?

Absolutely. In fact, it often makes achieving and maintaining compliance a whole lot simpler. The trick is to use a secure payment platform that relies on channel separation.

Here’s how it works: instead of your agent asking for card details over the phone, they send a secure payment link straight to the customer's mobile.

The customer taps the link, chooses their favourite digital wallet (like Apple Pay or Google Pay), and authorises the payment on their own device. The entire transaction, complete with all that tokenized data, completely bypasses your company's systems. Because your agents never see, hear, or handle any sensitive payment information, you can massively shrink your PCI DSS scope. That makes compliance easier and much more affordable.

What’s the Difference Between a Digital Wallet and a P2P App?

It’s easy to see why people mix them up, but their core jobs are quite different. It helps to think of it like this:

- A Digital Wallet (e.g., Google Wallet, Apple Pay) is built to be a direct replacement for the wallet in your pocket. Its main purpose is to securely hold your payment cards so you can quickly and safely pay businesses, whether you're in a shop or buying something online.

- A Peer-to-Peer (P2P) Payment App (e.g., Venmo, Cash App) is designed specifically for sending money to other people. It’s all about personal transfers—splitting the dinner bill with friends or paying someone back for concert tickets.

Some apps are starting to blur the lines by offering features from both worlds, but the fundamental distinction holds true. Digital wallets are for commerce; P2P apps are for personal transfers.

At Paytia, we specialise in creating secure, PCI-compliant payment experiences that let businesses harness the power of digital wallets, especially in contact centres. Our channel separation technology ensures your operations stay out of scope, protecting both your customers and your bottom line. Discover how Paytia can secure your remote payments.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.