What Is An AOC Explained for Payments and Contact Centres

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Ever stumbled across the acronym 'AOC' and felt a bit lost? You're definitely not the only one. In the world of business and tech, pinning down what an AOC is can be tricky because the same three letters mean wildly different things depending on the context.

While it might bring to mind a US politician, a fancy French wine, or even a new type of computer, its meaning in telecommunications is very specific—and crucial for anyone managing costs.

Untangling The Acronym AOC For Your Business

If you're running a contact centre or dealing with business phone systems, the definition you need to know is Advice of Charge. It’s a telecoms feature that gives you real-time information on how much a phone call is costing, either during the call or right after it ends.

Think of it as a running taxi meter for your phone conversations. It provides immediate, clear visibility into your communication spend, preventing any nasty surprises on your monthly bill.

This guide is focused squarely on that definition and what it means for modern businesses. We'll cut through the confusion of the other meanings to give you the practical knowledge you need. Getting to grips with Advice of Charge is the first step in a much bigger conversation about operational efficiency and, more importantly, securely taking payments over the phone.

What We're Talking About (And What We're Not)

Just to make sure you're in the right place, let's quickly clear up the different uses of AOC. This table will confirm the focus of our guide.

Common Meanings of the Acronym AOC

| Acronym | Full Term | Industry or Context | Is This Article About It? |

|---|---|---|---|

| AOC | Advice of Charge | Telecommunications & Payments | Yes, this is our focus |

| AOC | Alexandria Ocasio-Cortez | US Politics | No |

| AOC | Appellation d'Origine Contrôlée | French Wine & Food Certification | No |

| AOC | Analog Optical Computer | Advanced Computing Research | No |

Now that we're on the same page, we can dive in. Our goal is to explore how this simple, foundational concept of call cost awareness has evolved. We'll connect it directly to the critical challenge facing businesses today: taking secure card payments in their contact centres and creating efficient, trustworthy revenue channels.

What Advice of Charge Actually Means for Calls

Let's break down what ‘Advice of Charge’ or AOC really is. At its heart, AOC is a classic telecoms feature that tells you the cost of a phone call while it's happening. Think of it like a taxi meter for your phone line—it keeps a running tally of the cost as you talk, not just a surprise bill at the end.

This idea comes from the old days of traditional phone networks, where it gave businesses a simple way to watch their spending in real time. For any company juggling a high volume of calls, knowing exactly what each minute costs is the first step towards getting control of your operational budget.

The Three Flavours of AOC

Advice of Charge isn't a one-size-fits-all solution. It traditionally comes in three main varieties, each designed to deliver cost information at a different point in the call.

- AOC-S (Start): This gives you the cost information right at the start of the call. It’s like a pre-paid meter telling you the price per minute before you even say hello.

- AOC-D (During): This type sends cost updates periodically during the conversation. This is the closest thing to that taxi meter ticking up, showing you a running total as the call goes on.

- AOC-E (End): Finally, this version gives you the total cost of the call right at the end. It's a final summary for your records the second you hang up.

Getting to grips with these AOC types shows how businesses used to manage call expenses. While modern VoIP and contact centre platforms handle this differently now, the fundamental need for cost transparency has never gone away.

This foundational concept is still incredibly relevant today. When your agents are handling complex customer queries, perhaps guiding them through a payment process, every single second has a direct cost.

The link between how long a call takes and how much it costs is precisely where the old-school principle of AOC finds its modern-day value. To see how you can make these interactions more efficient, check out our in-depth IVR payment flow guide.

Why Cost Awareness Is Crucial for Modern Contact Centres

The core idea behind Advice of Charge—cost transparency—is more vital than ever for today’s businesses. Pinning down the cost per interaction isn’t just an operational footnote; it's a strategic necessity. This is especially true when customers pick up the phone, often a premium and expensive channel, to sort out important issues.

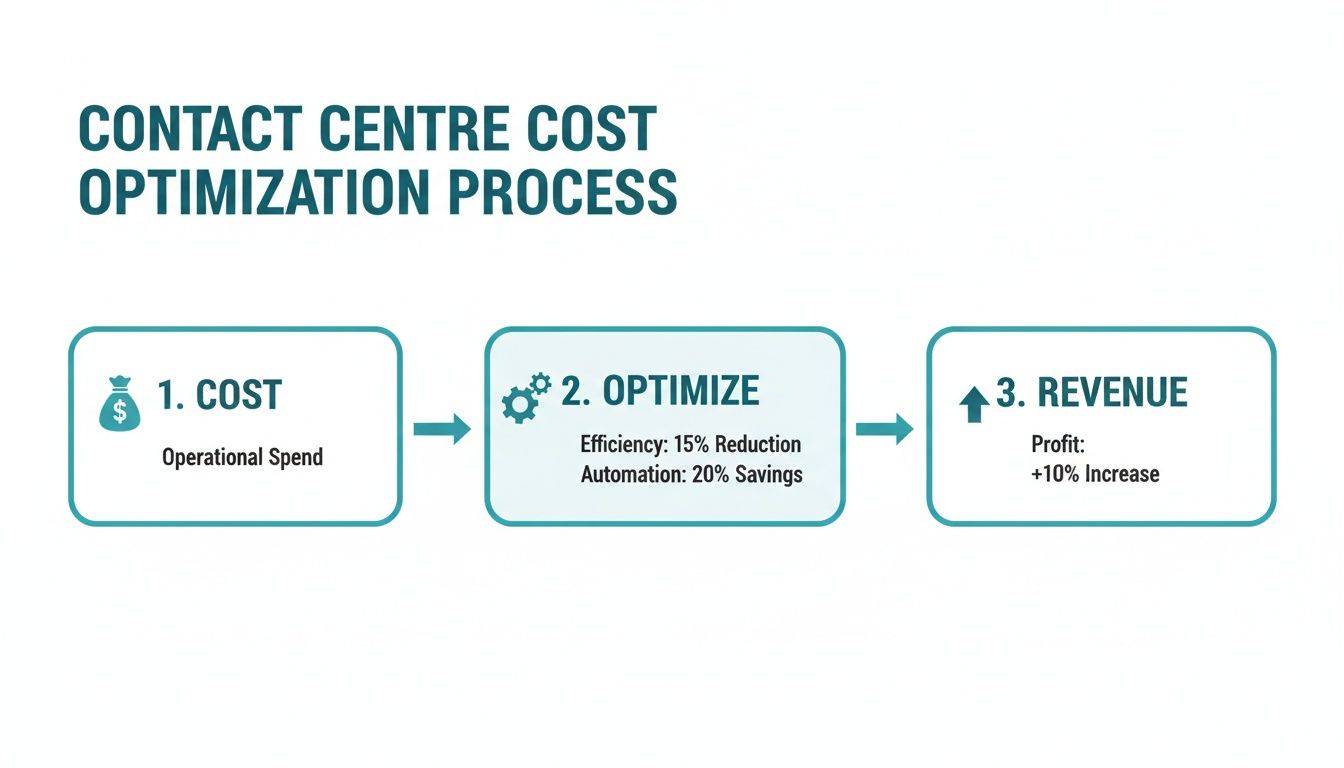

When managers have a firm grip on call-related expenses, they can start making much smarter decisions. It gives them the data they need to optimise agent workflows, justify new technology investments, and clearly show the value their teams are bringing to the table. This simple shift in perspective can transform a contact centre from a cost line on a spreadsheet into a recognised hub for customer satisfaction and revenue.

In the UK, this financial clarity is paramount. The call centre market has ballooned to an estimated £3.2 billion in revenue and supports around 170,000 frontline agent jobs. As call volumes and customer expectations climb, that growth only amplifies the need for razor-sharp operational efficiency. You can dive deeper into the data on the UK contact centre industry on IBISWorld.com.

Beyond Cost Tracking to Value Creation

Knowing your costs is only half the story. The real win comes when you turn that awareness into action, boosting both efficiency and profitability without ever letting the customer experience suffer. This is where modern tools really make their mark.

To keep a handle on costs while managing calls effectively, businesses are turning to comprehensive call management solutions that help streamline day-to-day operations. These platforms give agents the tools to handle calls more efficiently, cutting down on unnecessary talk time while actually improving the quality of service.

A clear view of costs enables a powerful transition: from merely handling service calls to actively creating secure and efficient revenue opportunities on every interaction.

When an agent understands that every minute has a measurable financial impact, they’re better equipped to guide conversations toward a resolution. This is never more true than when a call involves a payment. An efficient call doesn’t just save the company money on the spot; it leads to faster payment collection, which improves cash flow and cuts out the need for costly follow-ups down the line.

Ultimately, cost awareness is the foundation for building a more resilient and profitable contact centre.

From Advising Costs to Securely Processing Payments

While the classic 'Advice of Charge' gives us a handle on call costs, a much bigger challenge pops up the second a payment enters the conversation. Customer habits have created a tricky situation for contact centres. British consumers still overwhelmingly prefer a human touch, with 42% wanting to speak to a live agent, especially for sensitive topics.

That preference gets even stronger when money is involved. A solid 52% of people feel more comfortable giving their payment details to a person rather than an automated system. It's a clear signal of trust in that person-to-person connection.

This reality forces a strategic shift—from simply managing costs to actively and safely generating revenue.

You can see the evolution here: tracking costs is just the start. The real goal is to optimise how you work and turn that customer interaction into a secure source of revenue.

The Modern Challenge: PCI DSS Compliance

This customer trust creates a massive PCI DSS compliance headache. Old-school AOC was only ever built to advise on a charge, not securely process one. It offers zero protection for sensitive cardholder data like the long card number or the CVC code, leaving your business wide open to risk.

When a customer reads their card details over the phone, that data can easily end up in call recordings, flash across an agent's screen, or even get scribbled on a notepad. Each of those moments is a major compliance failure and a potential data breach waiting to happen.

This is where the conversation has to change. To give customers the human interaction they want while keeping their data safe, you need technology built for this exact problem. Modern solutions use tools like DTMF suppression and end-to-end encryption to completely fence off sensitive data from your environment. To see how this works in practice, our guide on how to safely accept card payments over the phone breaks down the practical steps.

To take efficiency and security even further, looking into workflow automation for small business can be a game-changer. By bringing in these modern tools, you can meet customer expectations for a personal touch without ever letting their payment details put your business at risk.

Turning Service Calls Into Secure Revenue Channels

How do you flip the script on your contact centre, turning it from a necessary expense into a secure and efficient revenue engine? The secret is giving your teams the right tools to take payments directly on customer service calls. This isn't just a nice-to-have anymore; it's a fundamental part of a modern business.

The pressure is mounting for both in-house teams and outsourcers to prove their value in hard numbers. These days, clients want their partners to demonstrate a clear return on investment. They're asking for outcomes like a 10% drop in the cost-to-serve, 25% fewer avoidable calls, and real improvements in customer satisfaction—all while capturing revenue. You can get the full story on these changing expectations in the latest contact centre outsourcing report.

This means going far beyond the old idea of just giving an 'Advice of Charge' and instead, securely processing payments in the moment.

From Cost Centre to Profit Centre

Think about a couple of everyday situations where this change really comes to life. An insurance agent can take a policy renewal payment on the very first call. A housing association can collect overdue rent without ever having to send a follow-up letter.

In both examples, a secure payment solution transforms a standard service interaction into an instant opportunity to capture revenue. This simple shift creates powerful ripple effects across the entire business.

- Better Cash Flow: Money is collected on the spot, cutting out delays and boosting the company's financial health.

- Less Manual Work: Agents aren't stuck scheduling callbacks or handing off payment tasks to another department, which frees up their time for more valuable work.

- A Smoother Customer Experience: Customers get to sort their issue and pay their bill in one seamless conversation, which is a huge win for satisfaction.

By weaving secure payment technology directly into the call flow, businesses can hit modern efficiency targets, tighten up security, and massively improve the customer journey—all at once.

The Technology That Makes It Happen

Making this shift safely means using specific tools built to protect sensitive information. Modern platforms offer a whole suite of options that empower agents while keeping your business compliant with tough standards like PCI DSS.

The key technologies include:

- Automated IVR Payments: Letting customers pay through a self-service menu before they even connect with an agent.

- Secure Payment Links: Sent by SMS or email during a call, allowing customers to complete the payment on their own device.

- Agent-Assisted Secure Payments: Using DTMF masking to hide the keypad tones as a customer types in their card details, so the agent never sees, hears, or handles the sensitive info.

Putting these tools in place is the foundation. For a deeper dive into the operational side of things, check out our guide covering the best practices for agent-assisted payments. When you adopt these methods, you turn every service call into a secure, efficient, and profitable interaction.

Answering Your Questions About AOC and Call Payments

Let's pull all these threads together and tackle the questions that pop up when you connect a legacy idea like Advice of Charge with the very modern need for secure payments. This isn't just theory; these are the practical things you'll want to know for your own contact centre.

Our goal here is to give you the confidence to make smart decisions about the tech and processes you use every day. Let's get into the specifics.

Is Advice of Charge Still Relevant with Modern VoIP Systems?

While the old AOC protocol itself is a relic of ISDN networks, the idea behind it—knowing what a call costs—is more important than ever. In today's world of VoIP and cloud contact centres, that function has just evolved. It now lives inside sophisticated analytics dashboards and Call Detail Records (CDRs).

These modern tools give you a much richer picture than AOC ever could, breaking down everything from talk time and wait time to resolution rates. So, while the tech has moved on, the business need for cost visibility that AOC first addressed is still a cornerstone of running an efficient operation.

How Do Secure Payment Solutions Affect an Agent's Workflow?

Good secure payment tools are designed to feel almost invisible to the agent. They stay on the line with the customer, keeping that human connection alive, but they are completely firewalled from the actual payment details.

When it's time to pay, the customer simply uses their telephone keypad. This is where the magic happens: DTMF masking technology silences or scrambles the tones, so the agent can't hear, see, or record the card numbers. This takes a huge weight off the agent's shoulders. They no longer have to handle toxic data, which also means you don't need expensive 'clean room' environments to stay compliant.

The key takeaway is that agents can focus on customer service, not on handling sensitive data. This improves both security and the overall customer experience by keeping the interaction smooth and personal.

Can Secure Payment Systems Integrate with Our Existing CRM?

Absolutely. In fact, they're built for it. Leading secure payment platforms come with robust APIs and pre-built connectors that are designed to play nicely with the major CRM, billing, and telephony systems you’re already using.

This integration allows for the automatic tokenisation of payment details, linking a secure, non-sensitive token back to the right customer record in your CRM. The biggest win? This whole process happens without dragging your core business systems into the scope of PCI DSS, which dramatically simplifies your compliance headache and secures your entire operation.

What Is the Main Difference Between AOC and PCI Compliance?

Think of it this way: AOC is about cost awareness, while PCI DSS compliance is all about data security. Advice of Charge tells you how much a phone call is costing your business, helping you keep an eye on your expenses.

PCI DSS, on the other hand, is a mandatory set of strict security rules designed to protect card details during a transaction. An AOC system helps you manage your budget, but it does nothing to secure a payment. Secure payment solutions are built specifically to solve the PCI DSS challenge, making sure that when you take a payment on a call, it's done in a way that protects both your customer and your business from fraud and data breaches.

Transform your service calls into secure revenue channels with Paytia. Our platform makes it easy to accept card payments over the phone, through web chat, or via payment links, all while keeping your business fully PCI DSS compliant. Discover how Paytia can secure your payments today.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.