Understanding are bank transfers instant: what speeds mean for your cash flow

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

So, are bank transfers instant? The simple answer is: mostly, but not always.

In the UK, many bank transfers feel immediate thanks to the Faster Payments Service (FPS), which processes most everyday transactions in a matter of seconds, 24/7. However, whether a payment truly arrives the moment you hit ‘send’ depends on several moving parts.

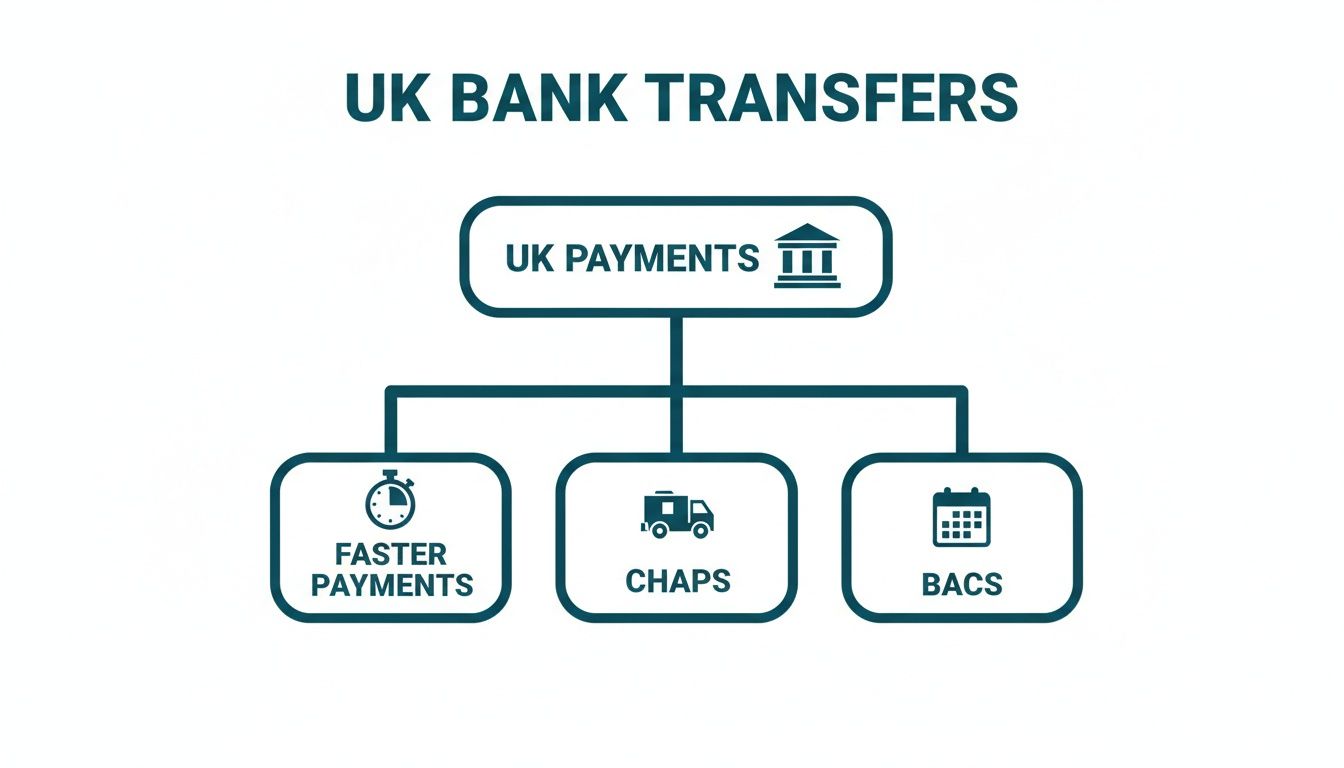

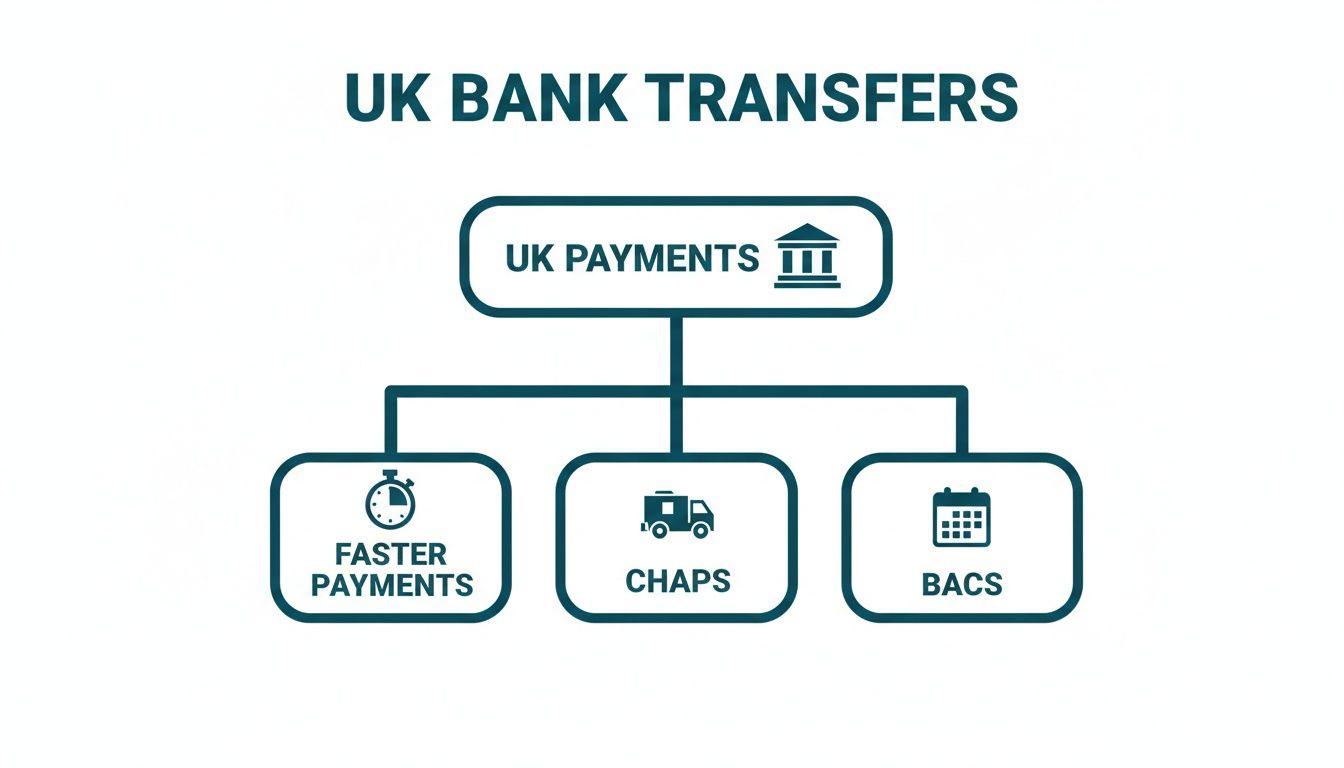

Understanding the UK’s Payment Speeds

The speed of a bank transfer is determined by the system, or 'payment rail', it travels on. Think of these rails like different delivery services for your money. A small payment to a friend is like a high-speed motorcycle courier, arriving almost instantly. In contrast, a large business-to-business payment might travel on a more robust, scheduled service, taking a bit longer to get there securely.

For any business that relies on predictable cash flow, understanding these systems is key. It helps you manage your own finances and, just as importantly, your customers' expectations. The UK has three main payment rails, and each one serves a very distinct purpose.

The Three Core UK Payment Systems

- Faster Payments Service (FPS): This is the workhorse for most personal and small business online banking. It’s built for speed and convenience, handling the vast majority of day-to-day transfers up to £1 million.

- CHAPS (Clearing House Automated Payment System): Reserved for high-value, time-sensitive payments, CHAPS offers a same-day guarantee for transactions with no upper limit. It's the secure, armoured truck of the payment world.

- BACS (Bankers' Automated Clearing System): This is the system for bulk, non-urgent payments like payroll and Direct Debits. It’s reliable and cost-effective but operates on a predictable three-day cycle.

A key takeaway is that the purpose of the payment often dictates its speed. While FPS makes many transfers feel instant, the banking system uses different methods for different needs, balancing speed, security, and cost.

The diagram below shows how these three core systems form the backbone of UK bank transfers.

This hierarchy shows that while all are types of bank transfers, they aren't interchangeable. Each is optimised for a specific job. To make it even clearer, here’s a quick comparison.

UK Bank Transfer Speeds at a Glance

| Payment System | Typical Speed | Transaction Limit | Best For |

|---|---|---|---|

| Faster Payments (FPS) | Seconds to 2 hours | Up to £1 million | Everyday personal and small business payments |

| CHAPS | Same-day (if sent by cut-off) | No limit | High-value, time-critical payments like house deposits |

| BACS | 3 working days | Up to £20 million | Bulk payments like payroll and Direct Debits |

As you can see, choosing the right rail is crucial. A business waiting on a large invoice payment would rely on the certainty of CHAPS, whereas an individual paying a friend for coffee will benefit from the instant feel of FPS.

The Engine Room of UK Payments Explained

To really get to the bottom of whether UK bank transfers are instant, you have to look under the bonnet at the system powering most of them: the Faster Payments Service (FPS).

It helps to think of the UK’s payment infrastructure as a delivery network. If high-value CHAPS transfers are the armoured trucks and slow-and-steady BACS payments are the reliable postal service, then FPS is the high-speed motorcycle courier. It’s built to zip millions of smaller payments between accounts, day or night, making it the true engine of the UK's real-time economy.

The Rise of Faster Payments

Launched back in 2008, FPS dragged UK banking into the digital age. Before it came along, most everyday electronic payments crawled along via BACS, taking a full three days to clear. FPS completely changed the game by creating a payment rail that runs 24 hours a day, 7 days a week – bank holidays included.

This ‘always-on’ design means that for most people and businesses, money can move from one account to another almost instantly. This isn't just a nice-to-have; it underpins modern financial life, from splitting a dinner bill with a mate to a small business paying a last-minute supplier. You can see how systems like this fit into the bigger picture in our guide to what is digital banking.

The impact has been massive. The sheer convenience of instant transfers has made FPS an indispensable part of daily life, driving huge growth and completely changing our expectations around payments.

The core idea behind Faster Payments is simple: make sending money as quick and easy as sending a text message. It's now the standard we all expect for everyday transactions.

The numbers tell the story. A recent UK Finance report showed that FPS volumes shot up by 15% to 4.9 billion payments last year, making it the UK's third most popular payment method. A huge driver of this growth was businesses, which now use FPS for 45% of all their payments. You can explore the full payment markets summary from UK Finance for all the details.

How FPS Works for Businesses

For any business, the benefits of Faster Payments are crystal clear. Predictable and rapid cash flow is everything, and getting customer payments in seconds instead of days makes a world of difference.

Here’s why it’s so vital for modern commerce:

- Improved Cash Flow: Money from sales hits your account almost immediately. It’s ready to be used for stock, payroll, or anything else you need, right away.

- Enhanced Customer Experience: Customers love the certainty of knowing their payment has landed instantly, especially for time-sensitive services or goods.

- Operational Efficiency: It gets rid of the headache of chasing payments or reconciling accounts while waiting for cheques or BACS transfers to clear.

While FPS does have a transaction limit, it’s currently set at £1 million per payment. That’s more than high enough to cover the vast majority of day-to-day business transactions. This blend of speed, 24/7 access, and a generous limit is precisely why Faster Payments has become the default engine for the UK's real-time payment world.

When Slower, Guaranteed Payments Make More Sense

While everyone loves the idea of an instant bank transfer, speed isn’t always the top priority in business finance. Sometimes, what you really need is an ironclad guarantee, the ability to move huge sums of money, or a super-efficient way to handle bulk payments.

That’s where the UK’s other trusted payment rails, CHAPS and BACS, come into their own. They aren’t built to compete with Faster Payments on speed; they’re designed to solve completely different business challenges. Understanding their unique strengths is key to building a smart, resilient payment strategy that balances speed with security and control.

The Armoured Truck: High-Value CHAPS Payments

Think of CHAPS (Clearing House Automated Payment System) as the financial world’s armoured truck. Its whole purpose is to move very large sums of money with absolute certainty on the same business day. For any mission-critical transaction that blows past the £1 million limit of Faster Payments, CHAPS is your only real choice.

You’ll typically see CHAPS used for things like:

- Property Transactions: Paying the deposit or final balance for a new office or warehouse.

- Major Supplier Invoices: Settling a seven-figure bill that’s crucial for your supply chain.

- Corporate Treasury Moves: Shifting significant funds between company accounts for investment or operational reasons.

The killer feature here isn't instant settlement, but its irrevocable, same-day guarantee. Once a CHAPS payment is sent and processed, that’s it—it cannot be reversed. This finality is vital when the stakes are high.

It's a heavyweight system. Bank of England data shows CHAPS can process over 4.5 million payments worth more than £8 trillion in a single month. But it operates on business days and takes time to clear, so it’s not ‘instant’ in the way we think of FPS.

The Reliable Workhorse: BACS for Bulk Payments

If CHAPS is the armoured truck, then BACS (Bankers' Automated Clearing System) is the reliable, scheduled delivery fleet. It works on a predictable three-day cycle and is built from the ground up to handle massive volumes of non-urgent payments in a highly cost-effective way.

BACS is the engine room for predictable, recurring payments. Its real value is in automating thousands of transactions at once, saving a huge amount of administrative time and money.

This system is perfect for any situation where you know payments need to be made on a specific date, but they don't need to arrive in seconds. Imagine trying to process payroll for hundreds of employees using individual Faster Payments—it would be an administrative nightmare. BACS turns this into a single, automated file submission.

Its main uses are BACS Direct Credit for making payments (like salaries and supplier runs) and BACS Direct Debit for collecting them (like subscriptions and membership fees). If your business model depends on recurring revenue, you might find our guide on the differences between Direct Debits and other recurring payments useful.

Common Roadblocks That Can Delay Your Bank Transfer

Even when you're using a system designed for speed, like the UK's Faster Payments, you might find a transfer doesn't land in seconds. While the payment rails themselves are lightning-fast, the journey from one account to another isn't a straight line—it has several checkpoints that can add time.

These delays aren't usually system failures. More often than not, they are deliberate safeguards designed to protect both you and the person you're paying. Understanding these friction points helps you manage expectations and figure out what’s happening when a payment seems to have gone missing.

Nine times out of ten, the culprit is simple human error.

An incorrect sort code or account number will stop a transfer in its tracks. The payment might bounce back to the sender, but that process alone can take hours or even days. In the same way, entering the wrong payment reference can cause a real headache for a business's finance team, making it a nightmare to match the incoming cash to the right customer account. Knowing how to use a bank reference number correctly is a small but crucial step for smooth processing.

Security and Fraud Prevention Checks

Beyond simple typos, the biggest reason for a delay comes down to the security checks banks are legally required to run. These automated systems are the unsung heroes of digital banking, working silently behind the scenes to spot and stop fraud.

A bank's anti-fraud algorithms analyse transactions in real-time, looking for anything out of the ordinary. A payment might get flagged and held for a manual review if it ticks certain boxes:

- Unusually Large Amount: A payment that’s much bigger than the sender's typical transactions.

- New Payee: Sending a large sum to a brand-new beneficiary for the first time.

- Atypical Timing or Location: A transfer made late at night or one that appears to come from an unusual location.

When a payment is held for a security check, it’s a necessary pause. It can be frustrating, for sure. But this automated review is what stops thousands of fraudulent transactions every day, protecting businesses and individuals from serious financial loss.

It's a constant balancing act for banks. They need to get legitimate payments through as quickly as possible while slamming the door on criminal activity. If a payment is held, it’s usually released within a few hours once the bank is satisfied it’s genuine.

The Confirmation of Payee Safety Net

Another intentional "delay" built into the system is Confirmation of Payee (CoP). Introduced to fight the rise in authorised push payment (APP) fraud, CoP is the quick check that happens before you even hit send.

When a payer types in the recipient's name, sort code, and account number, their bank pings the recipient's bank to see if the details match up. The system then gives one of three answers: a perfect match, a partial match (e.g., you typed "J Smith" but the account is "John Smith"), or no match at all.

This momentary check forces the sender to pause and double-check they're paying the right person or business. It adds a few seconds to the process, but it has proven incredibly effective at stopping costly, misdirected payments and gives customers confidence their money is going exactly where it's meant to.

Why International Bank Transfers Are Rarely Instant

Sending money across borders isn't quite like sending it down the street. While a bank transfer in the UK often feels immediate, international payments are playing a totally different game, one that’s traditionally been much, much slower. The simple truth is that genuine, real-time cross-border payments are still the exception, not the rule.

So, what’s the hold-up? It all comes down to the old-school architecture of global finance. Most international transfers hop between a network of correspondent banks—think of them as intermediary institutions passing your money along like a parcel from one courier to the next. Every single stop on that journey adds time, complexity, and cost.

The Journey of a SWIFT Payment

The messaging system that directs most of this traffic is called SWIFT (Society for Worldwide Interbank Financial Telecommunication). It’s important to realise SWIFT isn't a payment system itself. Instead, it’s a highly secure messaging service—almost like a specialised email for banks—that sends payment instructions from one institution to another.

A standard international transfer looks something like this:

- Your bank sends a SWIFT message to a correspondent bank it works with.

- That bank processes the instruction and might forward it to another intermediary bank, especially if the currencies are obscure.

- Eventually, the message makes its way to the recipient's bank in their country.

- Only then does the final bank credit the money to the beneficiary’s account.

When you factor in different currencies, time zones, and separate compliance checks at each stage, it's easy to see why a typical international payment can take 3-5 business days to land.

You can think of an international bank transfer less like a direct flight and more like a series of connecting flights. Each layover at a correspondent bank adds time, cost, and the potential for frustrating delays.

Closing the International Speed Gap

Thankfully, things are starting to change. New technologies are chipping away at the old delays. For instance, SWIFT gpi (Global Payments Innovation) is a massive step forward, giving businesses something akin to Amazon-style tracking to see exactly where their payment is at any given moment.

Even more significant is the global shift to ISO 20022, a new financial messaging standard that creates a common language for banks everywhere. This allows for far more data to travel with each payment, which helps to automate compliance checks and seriously speed up processing.

Here in the UK, the push for faster global payments is undeniable. A recent study found that 79% of consumers now expect international payments to arrive within an hour, a standard that traditional methods just can't meet. The Bank of England is responding by upgrading its own RTGS system to ISO 20022, which is set to improve how quickly global payments are cleared. You can find more details in these insights on cross-border payment trends. This, along with European regulations mandating 10-second euro transfers, is dragging the whole industry towards a faster and more transparent future.

How Businesses Can Make Payments Faster and More Secure

For any UK business, the goal isn't just to get paid quickly. It's about doing so in a way that feels safe for the customer and builds their trust in you. The old method of asking customers to manually type in bank details is painfully slow and riddled with potential for typos, which completely defeats the purpose of having an instant payment network in the first place.

Thankfully, there’s a much smarter way to handle this. Open Banking, and the Pay-by-Bank solutions built on top of it, let you create a secure, pre-filled payment request straight from your customer’s own bank account. This simple step cuts out all the friction and risk that comes with manual entry.

Putting Pay-by-Bank into Practice

Let's imagine a customer calls your contact centre to settle a bill. Instead of asking them to read out card numbers or go through the hassle of logging into their online banking portal, you can simply send a secure link to their mobile.

From there, it’s just a couple of taps. They use their fingerprint or face ID to approve the payment directly within their own trusted banking app. The funds are then sent via Faster Payments and land in your account moments later.

This modern approach delivers some serious advantages:

- Dramatically Lower Fraud Risk: Because the payment is authenticated inside the customer's secure banking app, the opportunity for payment fraud is virtually eliminated.

- No More Manual Errors: Your account details are pre-populated, so you can say goodbye to failed payments caused by a slip of the finger when typing a sort code or account number.

- A Genuinely Better Customer Experience: The entire process is smooth, fast, and feels incredibly secure, giving customers total confidence in how their payment is being handled.

With Pay-by-Bank, businesses can harness the full speed of the Faster Payments network without ever having to see, hear, or handle sensitive bank details themselves. It’s a game-changer for simplifying compliance and creating a more trustworthy payment journey.

And this efficiency isn't just for customer interactions. By automating accounts receivable processes, businesses can dramatically speed up incoming payments and cut down on administrative costs.

Platforms like Paytia's Secureflow are designed to weave these technologies right into your existing operations, whether your team is taking payments over the phone, through web chat, or via an automated phone system. By partnering with a secure, compliant provider, you effectively de-scope your business from the headache and expense of PCI DSS requirements, as sensitive data never touches your environment. This lets you offer a payment experience that is truly instant and secure, boosting both your cash flow and your customers' trust.

Frequently Asked Questions

Even when you know how the payment rails work, it’s easy to have questions when a specific transaction doesn’t go exactly as planned. Let's tackle some of the most common queries we hear about bank transfers.

Why Did My Faster Payment Take Longer Than a Few Seconds?

Most Faster Payments land almost instantly, but occasionally, you'll see a delay. More often than not, this is down to a routine security check by either the sending or receiving bank, especially if the payment looks unusual for your account.

Sometimes, a bank might have a brief technical hiccup, which can slow things down for up to two hours. It’s rarely something to worry about, but it’s a good reminder that even "instant" systems aren't always guaranteed to the second.

Are There Charges for Using Faster Payments?

For you and me sending money from our personal accounts, or for most small businesses, using the Faster Payments Service via online or mobile banking is usually free. Things can change for business customers, as some banks do charge for certain types of FPS transactions.

It's always smart to check your bank's specific business tariff. Remember that CHAPS payments, the system for very high-value transfers, almost always carry a fee, typically somewhere between £20-£30 per transaction.

How Can I Be Sure My Payment Was Received Instantly?

The simplest way is the most direct: just ask the person you paid to check their bank account. If you've used the Faster Payments Service, the money should be sitting there within moments.

For businesses, getting this confirmation is a critical part of customer service. A modern payment solution that gives you real-time status updates can handle this automatically. It improves your team's efficiency and gives both you and your customer immediate peace of mind that the job is done.

At Paytia, we help your business offer fast, secure, and fully compliant payment options without the headache. Our solutions use Open Banking to create a smooth Pay-by-Bank experience that keeps your customers happy and your cash flow healthy. Learn more about how Paytia can transform your payment processes.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.