A Complete Guide to Modern Call Centre IVR Systems

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think of a call centre IVR as your business's digital front door. It’s a tireless system working 24/7 to greet and guide customers. Instead of a human operator picking up immediately, callers interact with an automated menu using their phone's keypad or voice, getting them to the right person or information efficiently.

This technology is the backbone of any operation managing high call volumes. It answers the routine questions so your human agents can focus on the complex, high-value conversations.

Understanding Your Digital Front Door

At its heart, a call centre IVR (Interactive Voice Response) system is a form of computer telephony integration (CTI) that automates the initial part of a phone call. It acts as the first point of contact, presenting a series of pre-recorded prompts to identify why someone is calling and route them correctly, all without human intervention.

For example, when a customer calls their bank, the IVR might greet them with:

- "For account balances, press 1."

- "To report a lost or stolen card, press 2."

- "To speak with an advisor, press 0."

This simple menu is the classic IVR experience, but modern systems go much further. They can plug directly into your company databases, like a Customer Relationship Management (CRM) system, to offer a truly personalised service. A well-designed IVR can recognise a caller's phone number, greet them by name, and provide specific details about their recent order.

This level of automation has become essential in the UK call centre industry, which has grown into a £3.2 billion market as of 2025. This steady demand is fuelled by sectors like finance, retail, and utilities, where IVR is critical for managing the massive volume of inbound calls, which now account for over half of all customer interactions. You can find out more about the UK call centre market trends from IBISWorld.

The Two Main IVR Interaction Methods

The way a customer "talks" to an IVR really boils down to two methods: the classic touch-tone keypad and modern speech recognition. Each has its own strengths and is suited for different jobs. Understanding the difference is the first step in designing a customer journey that actually works.

An effective IVR isn't about replacing humans; it's about making human interactions more valuable. By handling routine tasks, the system frees up agents to apply their expertise where it matters most.

Here’s a look at the two core technologies driving these interactions.

Comparing IVR Interaction Methods

To choose the right approach, it helps to see how the two methods stack up.

| Feature | DTMF (Touch-Tone) | Speech Recognition (Conversational IVR) |

|---|---|---|

| User Input | Pressing numbers on the phone keypad. | Speaking words and phrases naturally. |

| Best For | Simple, structured menus with limited options (e.g., "Press 1 for Sales"). | Complex queries or capturing data (e.g., "I need to check my order status"). |

| Complexity | Simple to design and highly reliable. | More complex to build; requires advanced Natural Language Processing (NLP). |

| Customer Experience | Can feel rigid and frustrating if menus are too long. | Offers a more intuitive, human-like experience that can be much faster. |

The first method, DTMF (Dual-Tone Multi-Frequency), is the technical name for the tones your keypad makes. It’s reliable and straightforward.

The second, Speech Recognition, powers what’s often called conversational IVR. This uses Natural Language Processing (NLP) to understand what a caller is saying, allowing for a much more natural, back-and-forth interaction. While touch-tone is great for simple choices, speech recognition opens the door to a much faster and more user-friendly experience.

The Real-World Benefits and Common Pitfalls of IVR

A well-designed call centre IVR is so much more than just a robotic menu. It's a strategic tool that can completely reshape your operational efficiency and the customer service you deliver. Get it right, and the benefits touch everything from your bottom line to agent morale. But a poorly planned system can quickly become a source of intense customer frustration.

The trick is to understand both sides of the coin: the incredible potential and the all-too-common mistakes. This balanced view is what allows you to build a system that actually helps, rather than alienates, the very people it's supposed to serve.

The Clear Advantages of a Well-Designed IVR

One of the first things you’ll notice is the potential for dramatic cost savings. Think about all the routine queries your team handles every day—checking an account balance, tracking a delivery, or confirming opening hours. By automating these simple, repetitive tasks, an IVR deflects a huge volume of calls that would otherwise need a human agent. This directly cuts down operational overheads and lets you handle more customer interactions without hiring more people.

Beyond cost, an IVR gives you unmatched service availability. It never sleeps, takes a holiday, or calls in sick. This means your customers can get answers and sort out simple issues 24/7, offering a level of convenience that would be financially impossible with human agents alone.

This frees up your team to be more productive. When the IVR handles the straightforward, transactional calls, your skilled agents can focus on the complex, high-value interactions that genuinely require empathy and critical thinking. This doesn't just improve their job satisfaction; it leads to better outcomes on the calls that really matter.

Key benefits include:

- Increased First-Call Resolution: A smart IVR can often solve a query on its own or, at the very least, gather enough information to route the caller to the perfect agent, boosting the chances of resolving the issue on the first try.

- Enhanced Agent Focus: With fewer repetitive calls, agents can give their full attention to nuanced customer problems, which drives up the quality of support.

- Improved Call Routing: An intelligent IVR stops callers from being bounced between departments by connecting them to the right person from the very beginning.

The Common Pitfalls That Frustrate Customers

Despite all these benefits, many customers still dread hearing that familiar automated voice. This isn’t a failure of the technology itself, but a direct result of poor design and implementation. The most common pitfall is creating what customers bitterly refer to as "IVR jail."

This is what happens when a caller gets trapped in an endless loop of confusing menu options with no obvious way to reach a human. Overly long menus, vague choices, and a hidden or non-existent "speak to an agent" option are the main culprits here.

A frustrating IVR experience can single-handedly destroy customer loyalty. The goal is to make the customer's journey easier, not to build a fortress around your live agents.

Another major issue is the impersonal and outdated feel of many systems. A robotic voice, poor audio quality, and a complete lack of personalisation make customers feel like they're dealing with a machine that just doesn't care. When a system fails to recognise their needs or forces them down a rigid, irrelevant path, frustration builds fast. These aren't flaws in the idea of IVR; they are clear signs of a design that puts internal processes ahead of the customer's actual needs.

Designing an IVR That Customers Actually Want to Use

Building a powerful call centre IVR is one thing; designing one that doesn't send customers running for the hills is another challenge entirely. The difference between a genuinely helpful automated assistant and a frustrating digital brick wall often comes down to thoughtful, customer-first design choices. It’s all about striking that perfect balance between operational efficiency and a supportive user experience.

Think of your IVR menu as a digital map for your customer. If that map is cluttered with too many roads, confusing signs, and no clear destination, the traveller will get lost, frustrated, and give up. The goal is to create a clean, simple, and logical path that gets them where they need to go with minimal effort.

A poorly designed IVR doesn't just annoy callers; it actively harms your brand's reputation and leads to higher call abandonment rates. When customers feel trapped or misunderstood by a machine, their perception of your entire organisation takes a hit.

Laying the Foundation for a Better IVR Journey

The first and most important step is to simplify everything. Customers are calling because they have a problem to solve, and adding layers of complexity only pours fuel on the fire. A great rule of thumb is to keep your main menu options limited to no more than four clear choices. This prevents cognitive overload and helps callers quickly find the right path.

Beyond simplicity, clarity is king. Ditch the internal company jargon and ambiguous terms in your menu prompts. A phrase like "For account servicing" is vague and unhelpful. Instead, use direct, action-oriented language: "To check your account balance, press one."

And most importantly, every IVR needs a clearly marked escape hatch.

Always provide a straightforward option to connect with a live agent, typically by pressing '0'. Hiding this option might trim agent-handled calls in the short term, but the immense frustration it creates will erode customer trust for good.

Using Data to Refine and Optimise

Designing a great IVR isn't a one-and-done project; it’s an ongoing process of refinement fuelled by data. Your call analytics are a goldmine of insights into the customer experience, revealing exactly where your IVR is hitting the mark and where it’s falling short.

Keep an eye out for these key red flags in your reports:

- High Drop-Off Rates: If a significant number of callers hang up at a specific menu layer, it’s a clear sign that the options are confusing, irrelevant, or simply not what they were looking for.

- Frequent Mis-routes: Are calls about billing constantly landing in the technical support queue? This signals that your menu descriptions aren't clear enough to guide customers correctly.

- Repeat Callers: Customers calling back about the same issue shortly after an IVR interaction often means the system failed to resolve their problem the first time around.

This data-driven approach is becoming more common as UK contact centres grapple with divided consumer opinions. While 36% of customers report improved experiences with IVR, 32% feel it makes interactions worse. The frustrations are very specific: 22% point to too many steps to reach a human, and 20% note that AI lacks situational understanding. In response, the use of speech analytics to fine-tune IVR routing jumped from 28% to 37.5% in just one year. To get a closer look at these trends, you can discover more insights from contact centre benchmarks on Plivo.com.

Ultimately, building a better IVR means listening—not just to your customers' voices, but to the story their data tells. This is especially true for organisations using cloud-based contact centre solutions, which provide the advanced analytics and flexibility needed for continuous improvement. By marrying a simple, clear design with a solid commitment to data-driven optimisation, you can transform your call centre IVR from a necessary barrier into a valuable tool that genuinely helps your customers.

How to Securely Process Payments with IVR

When a customer rings up to pay a bill or make a purchase, the security of that transaction is everything. Using a standard call centre IVR to capture payment card details isn't just risky; it throws the door wide open to crippling financial penalties and brand damage if a breach occurs.

Simply having an agent jot down card numbers or capturing them in a call log creates a massive security hole. This is where specialist, secure IVR payment solutions come in. They are built from the ground up to shield sensitive data, giving customers peace of mind and keeping your business compliant.

Agent-Assisted Secure Payments

One of the best ways to handle payments securely is with an agent-assisted model. It keeps that crucial human touch while completely neutralising the security risk. The customer stays on the line with the agent, who can answer questions and walk them through the process right up until it's time to pay.

When the customer is ready to enter their card details, the agent triggers a secure payment mode. The customer then uses their telephone keypad to key in their card number, expiry date, and CVC. This is where the clever part happens.

- DTMF Masking: The keypad tones are masked or silenced through DTMF suppression. Your agent hears nothing but a flat tone, so they never hear or see the card numbers.

- Recording Suppression: The technology also stops these tones from ever being captured in call recordings, keeping your audio logs clean, safe, and compliant.

- Continuous Support: The agent is there the whole time, ready to help if the customer runs into trouble. It's a supportive experience, but one where your team never has to handle toxic payment data.

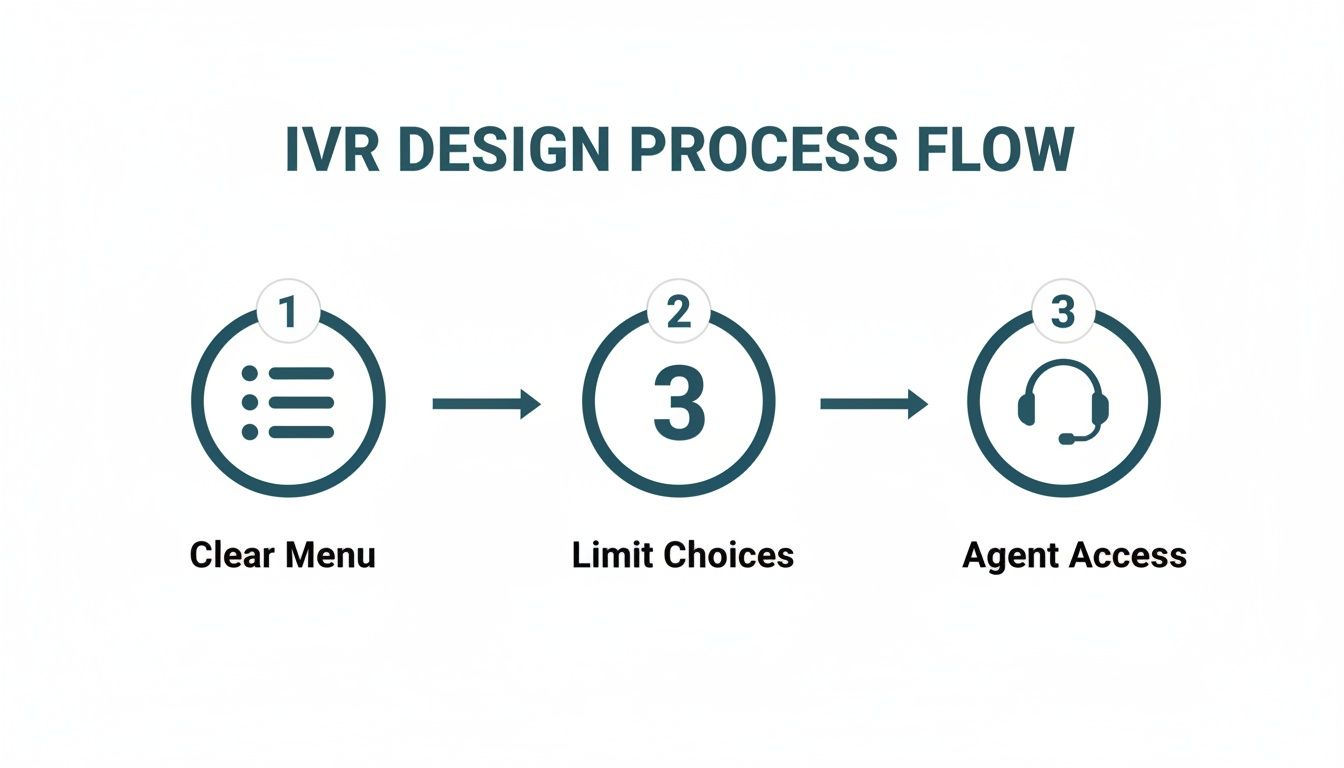

This infographic shows a typical design flow for a customer-friendly IVR, which is the foundation for any smooth payment journey.

As the flow shows, a secure payment process must also be simple and clear, with an easy path to agent assistance always available.

Fully Automated Self-Service IVR Payments

For businesses wanting round-the-clock payment capabilities, a self-service payment IVR is the perfect answer. It lets customers call in and pay anytime, day or night, without speaking to anyone. The IVR securely authenticates the caller and guides them through the payment steps.

By taking your agents, systems, and call recordings out of the path of sensitive card data, you dramatically shrink the scope of your PCI DSS audit. This isn't just a security feature—it’s a major business advantage that saves a huge amount of time and money on compliance.

This automated approach works by combining two core technologies. First, DTMF suppression makes sure the keypad tones are never exposed. Second, tokenization converts the card details into a unique, non-sensitive token. This token can be stored safely for things like recurring payments, meaning you never hold the actual card number. It’s the key to learning how to securely accept card payments over the phone while building trust.

As IVR systems get smarter and incorporate AI, it's also vital to understand the new security challenges they might introduce. For a deeper dive into lessons learned from analyzing AI security failures, it's worth reading up on external research from security experts. By blending agent-assisted support with automated self-service, your call centre can offer flexible and secure payment options that work for everyone.

Navigating PCI DSS Compliance in Your IVR System

If your business takes card payments over the phone, the Payment Card Industry Data Security Standard (PCI DSS) isn't just a suggestion—it's a mandatory set of rules. Getting it wrong can lead to crippling fines, losing your ability to process cards, and doing lasting damage to your brand's reputation.

For a call centre IVR, compliance brings its own unique set of headaches. Traditional setups, where agents hear or key in card details, are a massive liability. This approach puts your entire infrastructure—from agent desktops to call recordings—under the intense microscope of a PCI DSS audit. A modern, secure strategy is non-negotiable.

The smartest way to manage this complexity is through 'descoping'. Think of it as drawing a secure perimeter around your payment process. The goal is simple: make sure sensitive cardholder data, like the long card number and CVC, never even touches your agents, networks, or call recording systems.

The Power of Descoping Your Call Centre

When you successfully keep sensitive data separate from your business environment, the scope of your PCI DSS audit shrinks dramatically. Why? Because you no longer have to prove that every single piece of your infrastructure is secure enough to handle card information.

This strategic move is made possible by technologies designed to intercept and shield payment data right at the point of entry. By removing your systems from the flow of this "toxic" data, you slash your risk and simplify your compliance burden.

Descoping is the most effective strategy for achieving PCI DSS compliance in a call centre. It shifts the security responsibility from your entire operation to a specialist, certified solution, saving enormous amounts of time, effort, and money on audits.

Key Technologies for a Compliant IVR

To achieve true descoping, your IVR needs the right tools in its arsenal. Certain technologies work together to create a secure payment environment where sensitive information is completely shielded from your business. The two most crucial components are DTMF masking and payment tokenisation.

These technologies are the bedrock of a secure system. You can dive deeper into the specific PCI DSS requirements in our detailed guide, which breaks down the standards into clear, actionable steps.

To help illustrate how these technologies work together to secure your IVR payment process, here is a summary of their roles and benefits.

Key Technologies for PCI DSS Compliant IVR Payments

A summary of the essential technologies that enable secure payments within a call centre IVR and their role in achieving PCI DSS compliance.

| Technology | How It Works | Primary Compliance Benefit |

|---|---|---|

| DTMF Masking/Suppression | Intercepts the keypad tones (DTMF) as a customer enters their card details. It replaces them with a flat, single tone or silence, so neither the agent nor the call recording captures the sensitive data. | Keeps card numbers out of the agent's earshot and prevents them from being stored in call recordings, directly addressing Requirement 3 (Protect stored cardholder data). |

| Payment Tokenisation | Once card details are securely captured, they are sent directly to a payment gateway. The gateway processes the transaction and returns a non-sensitive, unique identifier called a 'token'. | The token can be safely stored in your CRM for future billing without exposing the actual card number. This massively reduces the scope of Requirement 3 by removing the need to store raw card data. |

By combining these methods, you build a payment process where your call centre never sees, hears, or stores vulnerable card information. This makes achieving and maintaining PCI DSS compliance a far more manageable and cost-effective process, letting you focus on what really matters—delivering a great customer experience.

Measuring the Success of Your IVR Performance

Putting a call centre IVR in place is one thing, but proving it’s actually working is another challenge entirely. To justify the investment and see a real impact, you have to look beyond basic call counts and dig into the key performance indicators (KPIs) that tell the true story of your customer experience.

Measuring IVR performance isn't about proving a machine can answer a call; it's about proving it can solve a problem. The right metrics will show you exactly where your system shines and, more critically, where it’s creating friction for your customers. This is how you move from a "set and forget" mentality to one of continuous improvement.

Core Metrics for IVR Effectiveness

Think of these KPIs as the vital signs of your automated front door. They give you a clear, immediate snapshot of your IVR's health, helping you spot problems, celebrate wins, and make smart decisions to refine the customer journey.

Start by getting a firm grip on these essential indicators:

IVR Containment Rate: This is the big one. It measures the percentage of calls that are fully resolved within the IVR, with no need for a human agent. A high containment rate is a clear sign your IVR is doing its main job: handling routine queries efficiently.

First Call Resolution (FCR): While we often link FCR to live agents, it’s a vital metric for your IVR too. When a customer sorts their issue on their first try using only the IVR, that's a huge win for both your bottom line and their satisfaction.

Call Abandonment Rate: This tracks how many callers hang up while navigating your IVR menu. A high rate is a massive red flag. It usually points to a confusing menu, painfully long wait times, or the frustrating inability to find a simple "speak to an agent" option.

Together, these metrics give you a powerful, at-a-glance view of how well your IVR is serving customers and deflecting calls from your agents.

An effective IVR doesn't just route calls—it resolves them. The goal is to build a system so efficient and intuitive that customers prefer using it for simple tasks, freeing up your expert agents for the conversations that truly need a human touch.

Deeper Dives into IVR Data

Beyond those core numbers, other data points can give you a much richer picture of how people are actually using your system. Analysing this data helps you understand the 'why' behind the numbers, showing you precisely which parts of your IVR flow need a rethink.

The role of the IVR in UK contact centres has grown significantly, especially after 61% of leaders reported a surge in call volumes since 2020. With centres now fielding thousands of calls every month, AI-powered conversational IVR is making a real difference. Centres using this tech see 14% more issues resolved per hour and a 9% drop in Average Handling Time (AHT).

To get deeper insights into how your IVR contributes to overall performance, it’s worth exploring what a good call center reporting software can do. By consistently measuring these KPIs, you can transform your IVR from a static, rigid menu into a dynamic tool that adapts to what your customers really need, proving its immense value to your entire operation.

Your IVR Questions Answered

Even after getting to grips with how a call centre IVR works, you probably still have a few specific questions floating around. Let's tackle some of the most common ones we hear about implementation, security, and making sure the customer experience is top-notch.

How Can I Stop My IVR Annoying Customers?

The single best way to prevent a frustrating IVR is to design it with the customer, not the business, in mind. Keep your menus short, use plain language everyone understands, and stick to a logical flow. A good rule of thumb is to offer no more than four clear choices per menu layer.

Most importantly, always give people an easy way out. A clearly signposted option to speak to a human agent, usually by pressing '0', is non-negotiable. You should also regularly dive into your call analytics to see where people are getting stuck or dropping off—that data is gold for refining your IVR flow.

Is DTMF Masking Good Enough for PCI DSS Compliance?

While DTMF masking is a crucial piece of the puzzle, it’s just one piece. On its own, it’s not enough. For real, robust PCI DSS compliance, you need to pair it with other security measures like payment tokenisation and certified, secure payment gateways.

This layered approach is what keeps sensitive card data from ever touching your business environment in the first place—that includes your agents' desktops and your call recordings. This is the strategy that genuinely shrinks your compliance scope, risk, and audit headaches.

Can I Connect an IVR to My Existing CRM?

Yes, absolutely. Modern, secure IVR payment platforms are built specifically to integrate smoothly with the tools you already use. The best providers offer APIs and pre-built connectors for all the major CRM systems, contact centre platforms, and a huge range of payment gateways.

This kind of connectivity is what creates a seamless flow of information. It unlocks powerful features like automated payment reconciliation right inside your CRM and gives you the freedom to work with your preferred payment processor without any disruption.

What’s the Real Difference Between IVR and Conversational AI?

Think of it like this: a traditional IVR is a structured, button-pushing system. Users navigate a rigid, pre-set menu by pressing keys on their phone (DTMF). It’s a series of "if this, then that" commands.

Conversational AI is the next evolution. It uses Natural Language Processing (NLP) to actually understand what a person is saying in full sentences. Instead of being forced to "Press 2 for billing," a customer can just say, "I've got a question about my last invoice." The AI gets the intent, making the whole conversation feel more natural and a lot more efficient.

Ready to build a secure, compliant, and customer-friendly payment experience? Paytia provides the tools you need to securely process payments across any channel, simplifying PCI DSS compliance and protecting your customers' valuable data. Discover how our solutions can transform your call centre at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.