A Practical Guide to Cloud Contact Center Solutions

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Cloud contact centre solutions are, at their heart, sophisticated software suites that manage every way a customer can get in touch with you—calls, emails, live chat, social media, you name it. Hosted securely on the internet, they offer a flexible, subscription-based alternative to the old way of doing things: buying and maintaining bulky on-premise hardware.

This modern approach is the backbone for any business that needs to support a remote or hybrid workforce. It frees your agents from being tied to a specific office, letting them work effectively from anywhere.

What Are Cloud Contact Centre Solutions?

Let’s cut through the jargon. What does a "cloud contact centre" actually feel like in practice?

Think of a traditional, on-premise contact centre as a physical library. It's a powerful building, full of resources, but it's expensive to build and maintain, requires constant upkeep, and everyone has to physically be there to use it. It’s rigid.

A cloud solution, on the other hand, is like subscribing to a digital library service like Kindle Unlimited or Audible. It’s instantly accessible from any device with an internet connection, you can add or remove users on the fly, and the provider is constantly adding new features and updates behind the scenes.

From Capital Expense to Operational Flexibility

This shift fundamentally changes the economics of running a contact centre. You move away from a massive upfront capital investment (CapEx) for servers, software licences, and office space. Instead, you adopt a predictable, pay-as-you-go operational cost (OpEx) through a monthly or annual subscription.

This gives your business incredible agility. You can react to market changes, scale up for seasonal peaks, or downsize during quiet periods without being stuck with depreciating physical hardware you no longer need.

At its core, a cloud contact centre is simply a complete set of tools for managing customer conversations, hosted securely online instead of on servers humming away in your office. This model has become absolutely essential for supporting the remote and hybrid teams that UK businesses now rely on.

The move to the cloud isn't a new phenomenon, either. This trend was gaining serious momentum long before the massive shift to remote working, which just goes to show how compelling the benefits have always been.

In the UK, a staggering 39% of contact centres had already moved their operations to the cloud by 2018. Looking ahead, 57% of them planned to fully transition within the following three years, placing the UK firmly at the front of this digital shift in Europe. You can explore the full research about these market trends for more context.

On-Premise vs Cloud Contact Centre At a Glance

To make the differences crystal clear, it helps to see them side-by-side. Here’s a quick comparison of the old-school on-premise model versus a modern cloud contact centre solution.

| Aspect | On-Premise Contact Centre | Cloud Contact Centre Solution |

|---|---|---|

| Initial Cost | High upfront capital expenditure (CapEx) for hardware, software, and facilities. | Low to no upfront cost, with predictable monthly or annual subscription fees (OpEx). |

| Scalability | Rigid and slow. Adding or removing agents requires physical hardware changes. | Highly flexible and rapid. Scale agent numbers up or down instantly to meet demand. |

| Maintenance | Managed entirely by an in-house IT team, including updates, security, and repairs. | Handled by the provider, including all software updates, security patches, and maintenance. |

| Accessibility | Limited to a physical location, making remote work difficult and costly to implement. | Accessible from anywhere with an internet connection, ideal for remote and hybrid teams. |

| Updates | Requires manual updates and new software purchases to access new features. | Features are updated automatically and continuously by the provider at no extra cost. |

| Reliability | Dependent on in-house infrastructure, with business continuity resting on internal resources. | High uptime guaranteed by SLAs, with built-in redundancy and disaster recovery. |

Ultimately, choosing a cloud-based model is about future-proofing your operations. It’s about gaining resilience, financial predictability, and the technical agility you need to keep up with what modern customers expect.

Understanding Core Components and Deployment Models

To really get what makes cloud contact center solutions tick, you need to lift the bonnet and look at the engine inside. These platforms aren't just one piece of software; they're a collection of interconnected components, all working together to create a smooth experience for both your customers and your agents.

Think of it like a well-oiled machine. Each part has a crucial job to do.

At the very heart is the Automatic Call Distribution (ACD) system. This is the smart traffic controller for your entire operation. The ACD looks at every incoming query—whether it’s a call, a chat, or an email—and instantly routes it to the best-suited agent based on rules you define, like specific skills, language, or who's available.

Working in lockstep with the ACD is the Interactive Voice Response (IVR) system. A modern IVR is so much more than a clunky "press one for sales" menu. It’s your automated front-line agent, capable of handling simple, everyday tasks like checking an account balance or confirming a delivery. This frees up your human agents to tackle the complex, high-value conversations that need a real person's touch. We dive much deeper into how these systems work in our guide to modern IVR.

Optimising Your Most Valuable Asset

Beyond just routing calls and messages, the best solutions come packed with Workforce Optimisation (WFO) tools. This is a suite of features designed specifically to manage, coach, and get the best out of your team. It typically includes:

- Quality Management: Tools that let you record calls and agent screens. This is essential for reviewing performance, providing targeted feedback, and ensuring you’re meeting compliance standards.

- Workforce Management (WFM): Clever software that helps with forecasting and scheduling. It ensures you have exactly the right number of agents logged in at the right times, preventing long queues and agent burnout.

- Performance Analytics: Dashboards that give you a bird's-eye view of key metrics like average handle time, first-call resolution, and customer satisfaction scores. This is where you spot trends and find opportunities to improve.

Choosing Your Cloud Deployment Model

Just as important as what is in your solution is how it's deployed. "The cloud" isn't a one-size-fits-all concept. The right model for you depends entirely on your needs for security, control, and scalability.

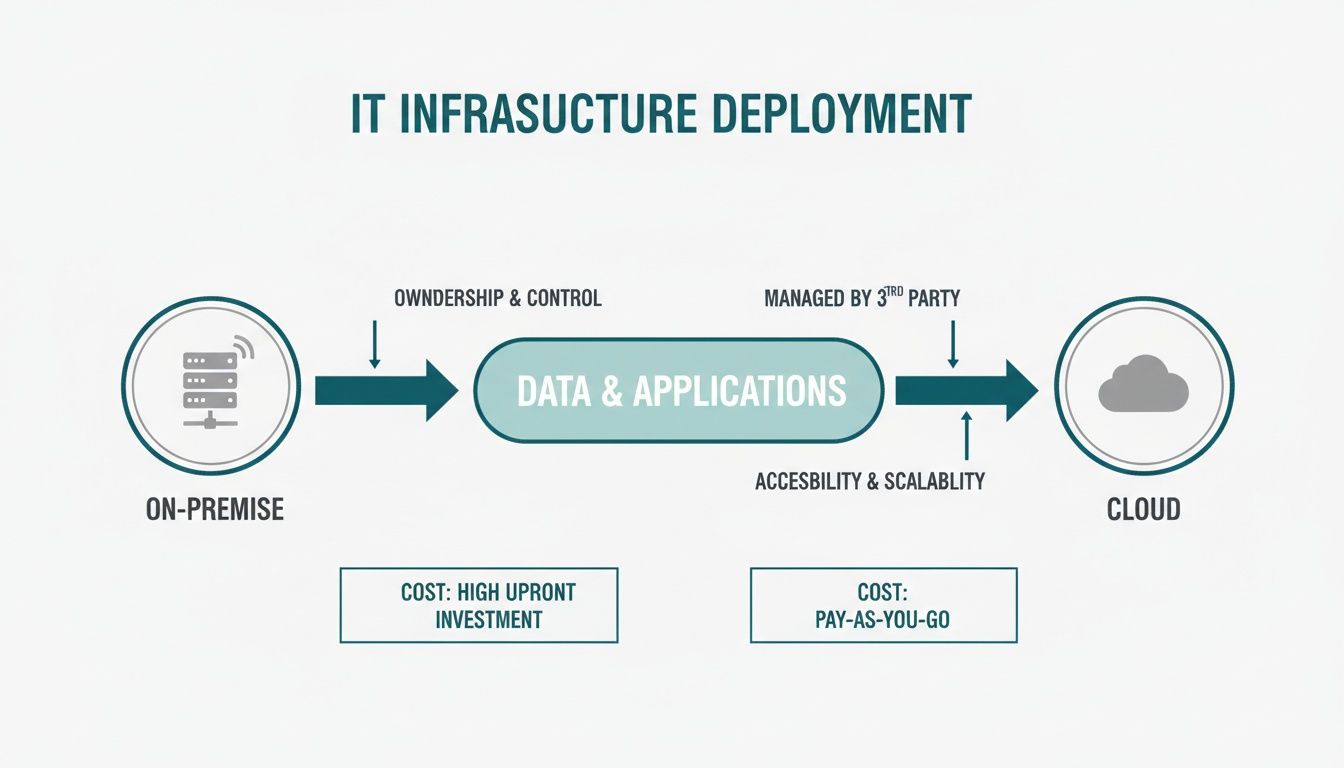

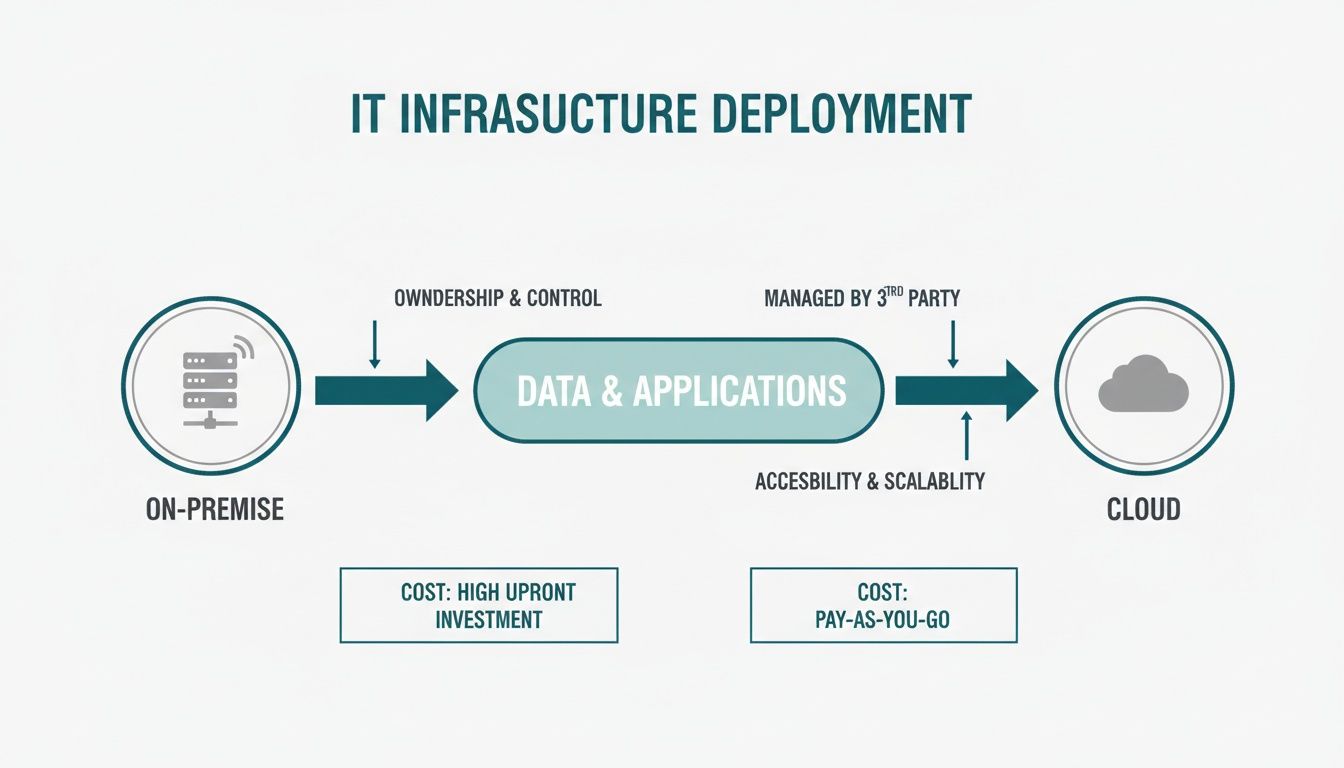

This diagram breaks down the fundamental difference between sticking with old-school on-premise hardware and moving to the cloud.

You can see the clear shift from buying and managing expensive hardware yourself to a more flexible, service-based approach.

Public Cloud: A Shared, Scalable Resource

Think of the public cloud as renting a flat in a modern, professionally managed building. You get access to all the top-tier amenities—security, maintenance, utilities—without the colossal expense and hassle of owning the building. It’s cost-effective, incredibly scalable, and run by experts like AWS or Microsoft Azure. A fast-growing e-commerce company, for example, would find this agility invaluable.

Private Cloud: Your Dedicated Environment

A private cloud is like owning your own detached house. You have total control. You can customise it exactly how you want, and you're solely responsible for its security and upkeep. This model offers the ultimate level of control and security, making it the go-to choice for large financial institutions or government bodies with strict data residency rules.

Hybrid Cloud: The Best of Both Worlds

The hybrid model is like owning your house but still connecting to the grid for electricity and water. You keep your most sensitive data and critical applications on your private cloud (your house) while tapping into the public cloud's power for less sensitive tasks, like development work or handling massive seasonal spikes in traffic.

This strategic mix of control and flexibility is precisely why hybrid models are becoming so popular, particularly in regulated UK sectors. While public cloud adoption is still strong, the hybrid approach is growing at over 20% CAGR, driven by the need to balance data sovereignty with commercial agility.

This trend is a direct response to ever-changing data laws. In fact, many businesses report that adopting the right cloud strategy has cut their compliance-related costs by up to 45%. It's all about finding the perfect balance for your specific needs.

Essential Features That Improve Customer Experience

While the technical architecture of cloud contact centre solutions is impressive stuff, it’s the features built on top that really shape your customer conversations. These are the tools that empower your agents, iron out clunky workflows, and ultimately create the kind of smooth experience people now expect. Moving to the cloud unlocks a whole suite of capabilities that are incredibly difficult, if not impossible, to pull off with old-school on-premise systems.

These features all work together to build a single, unified view of the customer. This allows conversations to flow naturally across different channels without any friction or annoying repetition. For your customers, it means they don't have to tell their story over and over again every time they talk to someone new or switch from a web chat to a phone call. For your business, it means better efficiency and happier customers.

Unifying the Journey with Omnichannel Routing

The days of siloed communication are long gone. Omnichannel routing is arguably the most powerful feature of modern cloud platforms. It weaves all your touchpoints—voice, email, SMS, social media, and web chat—into a single, continuous conversation.

Imagine a customer starts a query on your website’s chatbot. When things get a bit too complex, they can click a button to escalate to a live agent. That agent instantly gets the full chat history, letting them pick up the conversation exactly where it left off. No more "Can you please explain the problem from the beginning?"

This kind of continuity is everything. Research shows customers will jump ship after just one bad experience, and a disjointed, repetitive journey is a fast track to frustration.

Intelligent IVR and Self-Service

Modern Interactive Voice Response (IVR) systems are a world away from the infuriating, robotic menus we all used to hate. Powered by AI, today’s intelligent IVRs can actually understand what a customer wants and handle a whole range of tasks on their own, acting as your first line of support.

These systems can take care of common queries entirely, such as:

- Processing Payments: Securely taking card details to settle a bill.

- Booking Appointments: Checking calendars and scheduling services.

- Checking Order Status: Giving real-time delivery updates.

- Answering FAQs: Pulling answers straight from a knowledge base.

This automation frees up your human agents to focus on the more complex, emotionally charged conversations where their expertise makes a real difference.

Recordings for Quality and Compliance

Call and screen recording is a cornerstone for any serious contact centre. Its main job is quality assurance (QA) and agent training. Managers can review interactions to give targeted feedback, spot coaching opportunities, and make sure service standards are being met across the board.

Beyond training, recordings are a vital tool for compliance and sorting out disputes. They provide an undeniable record of what was said, which is absolutely essential in regulated industries like finance and insurance to prove you're following the rules.

A robust cloud contact centre doesn't just store data; it makes it useful. The ability to easily access, analyse, and learn from every customer interaction is what separates a good service operation from a great one.

Actionable Analytics and Reporting

You can't fix what you don't measure. Cloud contact centre solutions come with powerful analytics dashboards that turn raw operational data into clear, actionable insights. These platforms track hundreds of metrics in real-time, giving you a live view of performance.

Key performance indicators (KPIs) often include:

- First Contact Resolution (FCR): The percentage of queries solved in one go.

- Average Handle Time (AHT): How long an average customer interaction takes.

- Customer Satisfaction (CSAT): Direct feedback scores from customers after an interaction.

- Agent Utilisation: The amount of time agents are actively helping customers.

These insights help managers spot trends, predict call volumes, and make data-driven decisions to fine-tune team performance and the overall customer experience.

APIs: The Universal Connectors

Finally, Application Programming Interfaces (APIs) are the secret sauce that lets your contact centre plug into the rest of your business software. Think of APIs as universal adapters that allow different systems to talk to each other seamlessly.

For example, an API can connect your contact centre to your Customer Relationship Management (CRM) system. When a call comes in, the agent’s screen can automatically pop up with the caller's entire history, past purchases, and recent support tickets. This 360-degree view is vital for providing personalised and efficient service. To deliver consistently excellent service and empower agents, understanding and implementing effective knowledge management best practices is key for cloud contact center solutions.

Navigating Security and Compliance in the Cloud

Moving your customer conversations to the cloud naturally puts security under the microscope. When you’re handling sensitive information like payment details or personal data, robust security isn’t just a nice-to-have—it’s the bedrock of your operation. Trust is the currency of customer relationships, and a single breach can shatter it in an instant.

The good news is that modern cloud contact centre solutions are built with security at their core. Reputable providers offer enterprise-grade protection that often goes far beyond what most businesses could manage on their own. They pour millions into infrastructure, threat detection, and certifications to keep your data locked down.

Demystifying PCI DSS and Data Protection

For any organisation that takes card payments, the Payment Card Industry Data Security Standard (PCI DSS) is the rulebook. It sets out exactly how you must handle, process, and store cardholder data to prevent fraud. On top of that, regulations like GDPR govern how you manage personal data, adding another layer of responsibility.

Trying to manage this data directly within your contact centre—where calls are recorded and agent screens might be captured—creates a massive compliance headache. This is where specialised payment security technology becomes absolutely essential.

By pulling sensitive payment data out of your contact centre's environment entirely, you can slash your PCI DSS scope. This approach can shrink your compliance obligations by up to 95%, saving an enormous amount of time, money, and stress.

This process is known as "de-scoping," and frankly, it's the smartest way to tackle payment security in a contact centre.

To help you understand the key technologies involved, here’s a quick breakdown of what they are and why they matter.

| Technology/Standard | Primary Purpose | How It Protects Your Business |

|---|---|---|

| PCI DSS | Fraud Prevention | A mandatory set of rules for handling cardholder data securely. |

| Tokenization | Data Obfuscation | Replaces real card numbers with a non-sensitive "token," making stolen data useless. |

| DTMF Suppression | Data Isolation | Masks the tones customers enter on their keypad, so card numbers never enter your systems. |

| Secure Payment Links | Channel Separation | Moves the entire payment process to a secure, separate portal on the customer's device. |

These tools work together to create a secure bubble around your operations, keeping sensitive data far away from your agents and recordings.

How Tokenization Secures Customer Payments

One of the most powerful tools for de-scoping is tokenization. It’s a simple idea with huge security implications.

Think of it like a casino chip. Inside the casino, that chip represents real money and you can use it to play. But if you walk outside with it, it's just a worthless piece of plastic. Tokenization does the same thing for payment data.

When a customer gives you their card details, the system instantly swaps the actual card number for a unique, non-sensitive placeholder—a token. This token can be safely stored and used for future payments, but the real card number is never exposed in your systems.

Practical Ways to Keep Sensitive Data Out

Beyond tokenization, leading solutions use clever methods to stop sensitive data from ever touching your contact centre infrastructure. This ensures your call recordings and agent desktops stay clean and completely out of scope for PCI DSS.

Two common techniques are:

- DTMF Suppression: When a customer keys in their card number on their phone, the agent hears only flat, muted tones. The sensitive DTMF (Dual-Tone Multi-Frequency) signals are captured by the secure payment platform, never reaching your contact centre systems or recordings.

- Secure Digital Payment Links: An agent can generate and send a one-time, secure payment link to the customer via SMS or email. The customer then completes the transaction on their own device in a secure portal, totally separate from the agent's environment.

By adopting these technologies, you build a protective wall around your core operations. It allows your agents to help customers with payments in real-time without ever seeing, hearing, or touching the card information themselves. For a more detailed look, you can learn more about how to meet specific PCI DSS requirements in our guide. This proactive approach doesn't just simplify compliance—it builds a foundation of trust with every customer you serve.

Integrating Your Contact Centre for Maximum ROI

A cloud contact centre rarely works in isolation. Its real power isn't just in the flashy features, but in how deeply it connects with the other systems that run your business. Without these crucial links, you end up with information silos, forcing agents to constantly juggle screens. That’s a recipe for frustrated staff and slow service.

Think of your contact centre as the brain of your customer service operation. It’s intelligent on its own, but it can’t act effectively without a central nervous system. Integrations are that nervous system, carrying vital information back and forth between the brain and the rest of the body—your other business tools. This seamless data flow is what truly unlocks the highest possible return on your investment.

When these systems work in harmony, agents get a complete, real-time picture of every customer. This unified view leads directly to faster resolutions, more personalised conversations, and a massive boost in overall efficiency.

Core Integration Categories

To build a truly connected operation, your integrations will typically fall into three critical categories. Each one plays a unique role in creating a frictionless experience for both your team and your customers. Getting these right is fundamental to maximising the value of your cloud contact centre solutions.

These three pillars are:

- Telephony Systems: This is the foundational link. Integrating with your Voice over IP (VoIP) or existing phone system ensures crystal-clear call quality, reliable connections, and the ability to manage voice channels right from the contact centre platform.

- Business Applications: This is where you connect your contact centre to the software that runs your operations. The most common and vital integration is with your Customer Relationship Management (CRM) platform, but this also includes helpdesk software, ERP systems, and internal knowledge bases.

- Payment Gateways: For any business that takes payments over the phone, this integration is non-negotiable. It connects your contact centre to your payment processor, allowing for secure, compliant, and efficient transaction handling directly within the customer interaction.

The Power of a Connected CRM

Let’s focus on the single most impactful integration: the CRM. When your contact centre and CRM are properly linked, magic happens. An incoming call can automatically trigger a "screen pop," presenting the agent with the customer's entire history before they even say hello.

The agent instantly sees:

- Past purchases and order history

- Previous support tickets and their outcomes

- Notes from prior conversations with other agents

- Customer loyalty status or value

This context is a game-changer. It eliminates the dreaded, "Can you tell me your account number again?" and transforms a generic interaction into a highly personal and efficient one. In fact, agents can resolve issues on the first contact 30-40% more often when they have this kind of unified view.

Securely Integrating Payments

Integrating with a secure payment platform is just as crucial. It allows an agent to take a payment mid-conversation without ever handling sensitive card data themselves. Instead of asking a customer to read their card number aloud, the agent can use a secure method like sending a payment link or using DTMF masking to capture the details.

This separation is vital for compliance. By keeping payment details out of your core contact centre environment, you drastically reduce your PCI DSS scope, protecting your business from risk and your customers from fraud.

For a deeper dive into how this all works behind the scenes, learn more about the specifics of payment gateway API integration in our detailed guide. It’s the key to building trust while streamlining how you collect revenue.

Ultimately, thoughtful integration turns your contact centre from a simple communication tool into the intelligent hub of your entire customer experience strategy.

How to Plan Your Migration and Avoid Common Pitfalls

Moving to the cloud is a big step, but it doesn't have to be a painful one. With a clear plan, what seems like a massive project becomes a manageable, step-by-step transition. A solid migration roadmap is your best defence against blown budgets and missed deadlines, making sure you get the full value of your new cloud contact centre solutions from day one.

This isn't just a tech project; it's a people project. Success starts long before you even look at a contract.

The first phase is all about discovery. You need to set clear, measurable goals. What specific headaches are you trying to cure? Are you trying to cut operational costs, finally enable a fully remote team, or boost your First Contact Resolution rates? Nailing these objectives down gives the entire project a clear direction.

This is also the time to get your team together. Critically, this can't just be an IT-led initiative. You need people from every key department in the room—customer service, operations, finance, and compliance. This ensures everyone's needs are heard and builds buy-in across the business right from the start.

Creating a Phased Migration Plan

Trying to switch everything over at once—a "big bang" approach—is just asking for trouble. A phased rollout gives you control, letting your team learn and adapt without bringing operations to a standstill. A sensible migration follows a logical sequence that keeps disruption to a minimum.

Your plan should break the journey into clear stages:

- Vendor Evaluation and Selection: Use the goals you defined earlier to build a shortlist of vendors. Ask for demos that focus on your specific challenges, not just a tour of their flashy, generic features.

- Data Preparation and Cleansing: Your existing data, like customer records and call logs, is gold. Before moving it, take the time to clean it up. Get rid of duplicates, standardise the formatting, and archive anything that's out of date.

- Pilot Programme: Start small. Pick a controlled group of agents to test the new system. This is your chance to iron out workflow kinks, spot integration problems, and get real-world feedback in a low-risk environment.

- Training and Onboarding: Whatever you do, don't skimp on this step. Great training is the difference between a tool people love and one they ignore. Go beyond just showing them which buttons to press; focus on how the new platform will make their jobs easier and more effective.

- Full Rollout and Go-Live: Armed with the lessons from your pilot, you’re ready for the company-wide migration. Make sure you have dedicated support from your vendor locked in for this critical period.

Avoiding the Most Common Pitfalls

Even the best-laid plans can go sideways. Knowing where the common traps lie is the first step to avoiding them. Most migration failures aren't about the technology itself; they’re about oversights in planning and communication.

A successful migration is 20% technology and 80% change management. If you fail to prepare your people for the new way of working, you’re setting your project up for a stall and a poor return on investment.

Keep an eye out for these classic mistakes:

- Poor Stakeholder Engagement: If you don't involve key teams from the beginning, you'll face resistance and end up with a solution that doesn't actually solve the business's problems.

- Underestimating Training Needs: Assuming your agents will just "figure it out" is a recipe for frustration, low adoption, and wasted potential.

- Neglecting Data Cleanup: Migrating messy data is the definition of "garbage in, garbage out." It clutters your shiny new system and undermines its value from the get-go.

- Ignoring Integration Complexity: Failing to properly map out how the new platform will talk to your CRM or payment systems can cause major operational headaches after you go live.

By following a structured plan and actively sidestepping these traps, you can navigate your migration with confidence. The result is a smooth transition that starts delivering real value right away.

Still Have Questions About Cloud Contact Centres?

Making the switch to a cloud contact centre is a big decision. It’s bound to stir up plenty of questions, affecting everything from budgets and project timelines to the way your teams work day-to-day. Getting straight answers is the only way to move forward with confidence.

One of the first questions that always comes up is about the real cost. Unlike old-school on-premise systems that demand a massive upfront investment in hardware, cloud contact centre solutions run on a simple, predictable subscription. This pay-as-you-go model makes budgeting far easier and lets you scale your costs up or down as your business changes.

Another hot topic is how long it all takes. While every project has its own unique wrinkles, moving to the cloud is almost always faster than a traditional hardware deployment. By taking a phased approach—maybe starting with a small pilot group—you can get a team live in a matter of weeks, not months, which keeps disruption to a minimum.

Data Security and Future Growth

Concerns around data security are, of course, completely valid. But here’s the thing: reputable cloud providers pour enormous resources into security. They often provide a level of enterprise-grade protection that most individual businesses simply can't match on their own. They take on the heavy lifting of staying compliant with standards like PCI DSS and GDPR, which significantly reduces your own risk profile.

Scalability is another conversation we have all the time. How easily can the system actually grow with you? With a cloud solution, adding or removing agents is as simple as tweaking your subscription plan. You can instantly ramp up for seasonal peaks or expand into new territories without worrying about physical servers or phone lines. That kind of agility is one of the biggest wins.

It's no surprise that the market for these solutions is booming. The UK contact centre software market, which is dominated by cloud contact centre solutions, pulled in USD 2,097.5 million in 2024. Projections show it rocketing to an incredible USD 14,362.2 million by 2033. This explosion is largely driven by the permanent shift to hybrid work, with 70% of contact centres globally now planning for long-term remote capabilities. You can dig into more of these numbers and UK contact centre market trends on grandviewresearch.com.

At Paytia, our focus is securing customer payments, no matter what contact centre environment you use. Our platform is designed to lift sensitive card data completely out of your agents' hands and away from your systems, dramatically shrinking your PCI DSS scope and building vital customer trust. Learn how Paytia can secure your operations.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.