A Guide to Interactive Voice Response Systems

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

When you think of an automated phone system, what comes to mind? For many, it's the frustrating experience of repeatedly pressing buttons, trying to navigate a clunky, robotic menu. But that's a picture of the past. Today's interactive voice response (IVR) systems are something else entirely.

Think of a modern IVR less like a rigid switchboard and more like a sharp digital concierge for your phone lines. It’s designed to intelligently interact with callers, gather information, and often resolve their queries without ever needing a live agent.

Decoding Interactive Voice Response Systems

Imagine a customer calling your business and being greeted by a helpful, conversational assistant who understands exactly what they need from the get-go. That's the real power of a modern IVR. This technology is no longer just about "press one for sales, press two for support." It has become a sophisticated first point of contact, capable of managing huge call volumes and providing instant solutions.

A simple way to understand the evolution is to compare a basic IVR to a digital switchboard operator. It follows a very strict, pre-programmed script, routing calls based on keypad inputs (those DTMF tones we all know). An advanced, AI-powered IVR, on the other hand, is much more like a skilled problem-solver. It can understand natural, spoken language, tap into customer data in real-time, and offer immediate answers, completely changing the feel of the interaction.

The Role of IVR in Modern Business

As technology has advanced, IVR systems have become essential for businesses that need to operate efficiently. With sophisticated AI Receptionist solutions leading the charge, these systems are now central to automated customer service.

Their primary functions boil down to a few key areas:

- Automating Routine Queries: Simple questions like "what are your opening hours?" or "what's my account balance?" are handled instantly, freeing up your human agents to tackle more complex, high-value issues.

- Intelligent Call Routing: The system quickly figures out why someone is calling and sends them to the right person or department on the first try. No more frustrating transfers.

- Providing 24/7 Self-Service: Customers get the freedom to pay a bill, check an order status, or update their details whenever it suits them, day or night.

- Securing Sensitive Information: Crucially, a modern IVR is a vital tool for securely collecting payments and other sensitive data over the phone, protecting both the customer and your business.

A Cornerstone of UK Contact Centres

Here in the UK, IVR systems have become a non-negotiable part of contact centre operations, particularly for businesses that handle a high volume of interactions like payments. In fact, projections show that speech-based, conversational IVR technology is set to dominate the market by 2025. This signals a huge shift away from old-school touch-tone systems as UK businesses look for more natural, AI-driven customer conversations.

For any contact centre that takes payments over the phone, a secure IVR is a game-changer. By integrating with platforms like Paytia's Secureflow, the system can mask DTMF tones and tokenise sensitive card data. This simple step can reduce a company's PCI-DSS compliance scope by as much as 90-95%.

In essence, an IVR is not just about routing calls. It's about creating an efficient, secure, and responsive front door for your entire organisation, laying the groundwork for streamlined customer interactions.

How Modern IVR Technology Actually Works

To really get to grips with modern interactive voice response systems, it helps to pop the bonnet and see what’s inside. An IVR isn't a single bit of tech; it's a finely-tuned ecosystem of components working together to give customers a smooth, seamless experience.

Think of it like an orchestra. Each instrument plays its part, but it’s how they perform together that creates the music. An IVR is much the same, with each component handling a specific task to guide a caller from their first word to a final resolution.

The Telephony Interface: The Gateway

The customer's journey starts with the Telephony Interface. This is the system's front door, connecting the IVR to the outside world of telephone networks. It doesn't matter if a call comes from a landline, a mobile, or a VoIP line—this interface picks up the phone and creates a solid connection.

It acts as a translator, converting the analogue or digital signals from the phone network into data the IVR software can actually understand. Without this gateway, the IVR would be completely cut off, unable to take any calls at all.

The IVR Engine: The Brain

Once the call is connected, the IVR Engine takes over. This is the central processing unit, the 'brain' of the whole operation. It holds all the pre-programmed logic, business rules, and call flows that map out every possible interaction with a caller.

The engine executes the script. It plays the welcome message, offers menu options, and figures out what the caller wants, whether they’re pressing keys (DTMF tones) or speaking out loud. Every single step of the journey is managed right here. To see how these elements combine into a cohesive journey, our detailed guide on the IVR payment flow offers a practical walkthrough.

Conversational Components: Speech and Text Engines

This is where today’s IVR systems really come into their own, thanks to two crucial components that enable natural, human-like conversations:

Speech Recognition (ASR): The Automatic Speech Recognition engine acts as the system’s 'ears'. It listens to what the caller says and turns it into text that the IVR engine can process. The success of any conversational IVR depends heavily on its speech to text accuracy.

Text-to-Speech (TTS): The TTS engine is the system's 'voice'. When the IVR needs to share dynamic information—like an account balance or an order update—it uses this engine to turn text data into natural-sounding speech. This makes every response feel personal and relevant.

Together, ASR and TTS free customers from the rigid "press 1 for sales" menus of the past. They can just say what they need, and the system understands and responds. It makes the whole process faster and a lot less frustrating.

Database Integration: The Memory

Of course, all this would be pretty useless without access to information. Database Integration is the bridge that connects the IVR to your business’s core systems, like your Customer Relationship Management (CRM) platform or payment gateways.

This connection is what gives the IVR its real power. It can identify a caller from their phone number, greet them by name, look up their recent orders, and even process a secure payment in real-time. This integration elevates the IVR from a simple call-routing tool to an intelligent, autonomous agent that can solve problems on the spot.

Keeping Phone Payments Secure with IVR and PCI DSS

Taking card payments over the phone throws up a whole host of security and compliance headaches. The moment a customer reads their card number to an agent, that sensitive data enters your world, and the responsibility to protect it lands squarely on your shoulders. Thankfully, modern interactive voice response (IVR) systems have evolved far beyond simple call routing; they are now essential security tools built to tackle this exact challenge.

When set up correctly, a secure IVR becomes your first line of defence. It effectively creates a secure bubble around the payment process, shielding your business from the intense scrutiny of the Payment Card Industry Data Security Standard (PCI DSS). The core idea is to make sure sensitive card details never even touch your internal systems, your agents' ears, or your call recordings.

This is all done using clever technology that works invisibly in the background. By completely isolating cardholder data, you can dramatically shrink your PCI DSS scope, which in turn cuts down on risk, cost, and complexity.

How DTMF Masking and Tokenization Work

Let's walk through a common scenario. A customer is on the phone with an agent and needs to settle an invoice. Instead of asking them to read out their card details, the agent directs them to a secure IVR payment channel. The agent can often stay on the line to help, but what they hear (and what gets recorded) is the secret sauce.

As the customer taps their card numbers into their phone's keypad, the agent doesn’t hear the familiar musical tones. All they hear are flat, single-note beeps. This is DTMF masking (sometimes called suppression) at work. It makes it impossible for the agent—or anyone listening to a call recording—to decipher the numbers being entered.

At the same time, the IVR is securely transmitting this information directly to your payment gateway for authorisation. As soon as the transaction is approved, the gateway sends back a unique, non-sensitive reference called a token.

Tokenization is the process of swapping highly sensitive data for a non-sensitive, randomly generated equivalent. You can safely store this token in your CRM to use for future payments or refunds, without ever having to handle the raw card details again.

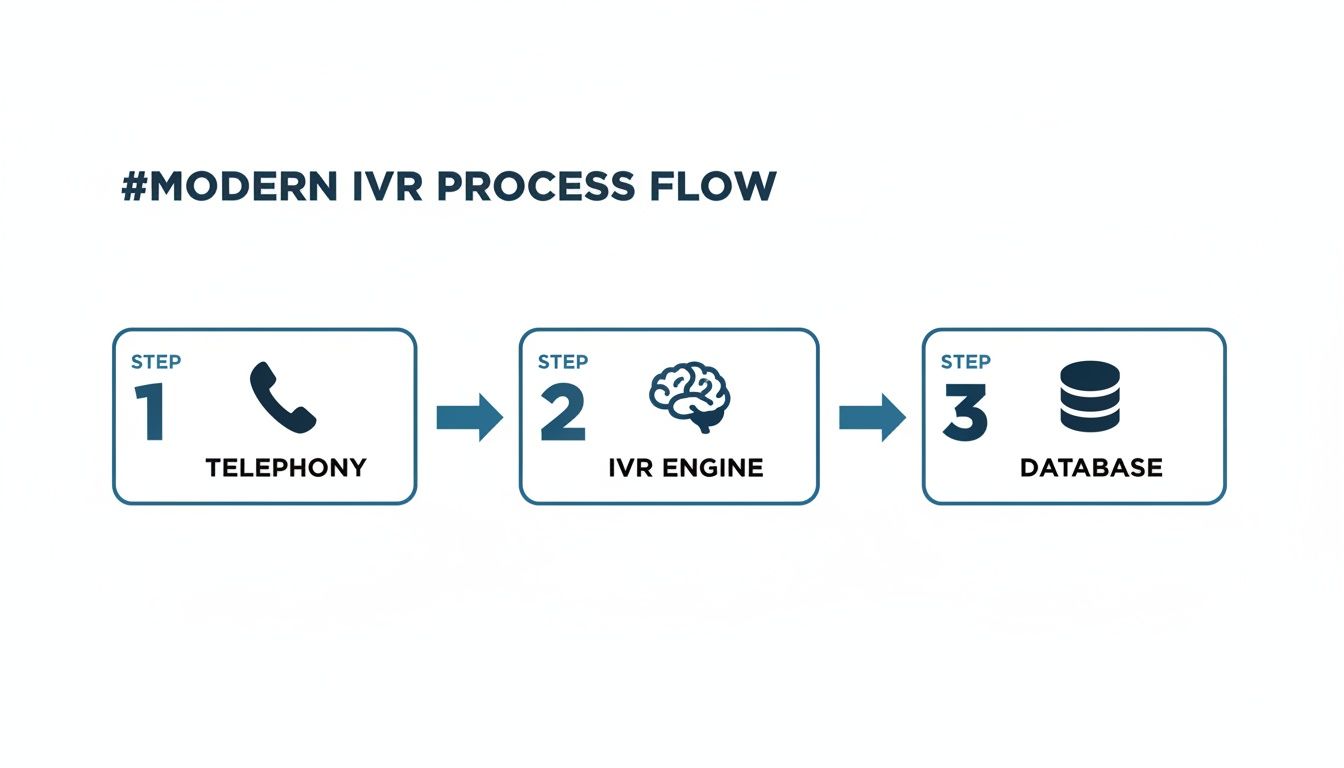

This flow diagram gives you a clearer picture of how these pieces fit together in a modern, secure IVR setup.

As you can see, the call comes in, hits the IVR engine, and is then securely processed by interacting with the necessary back-end databases, all without exposing sensitive information.

Slashing Your PCI DSS Scope

Using DTMF masking and tokenization together is the key to effectively "de-scoping" your contact centre. Because the actual cardholder data completely bypasses your people, your computers, and your network, the number of PCI DSS rules you have to follow drops dramatically. For any business that wants to accept card payments over the phone without the massive overhead, this is a game-changer.

The table below breaks down the difference between a standard approach and a secure, compliant one.

IVR Security Features for PCI DSS Compliance

| Security Feature | Standard IVR Approach (High Risk) | Secure IVR Approach (Low Risk) | Impact on PCI DSS Scope |

|---|---|---|---|

| Data Input | Customer reads card details aloud to an agent. | Customer enters details via keypad; DTMF tones are masked. | Drastically Reduced: No verbal data means agents and call recordings are out of scope. |

| Data Storage | Card details may be captured in call recordings or written down. | Raw card data is never stored; only a secure token is retained. | Significantly Reduced: Removes the need for complex secure storage and encryption controls. |

| Agent Access | Agents hear and handle raw cardholder data. | Agents never hear or see card details, only transaction status. | Eliminated: Takes the human element of risk completely out of the equation. |

| System Interaction | Card data traverses internal networks, PCs, and CRM systems. | Data goes directly from IVR to the payment gateway, bypassing internal systems. | Massively Reduced: Your entire network and infrastructure can be de-scoped. |

This comparison highlights how a secure IVR doesn't just add a layer of security—it fundamentally changes your compliance posture by removing the risk at its source.

The benefits are clear and immediate:

- Lower Compliance Costs: Fewer controls mean simpler, cheaper audits and less paperwork.

- Zero Internal Fraud Risk: If agents can't hear or see card numbers, they can't misuse them.

- Protection from Data Breaches: Even if your systems were compromised, there’s no valuable card data for criminals to find.

Here in the UK, regulations like PCI DSS and GDPR are huge drivers for secure IVR adoption. Solutions like Paytia's Secureflow are designed specifically for this, enabling secure, agent-assisted payments by keeping the voice and payment channels separate. The financial services sector, in particular, relies heavily on this technology for everything from identity verification to processing claims payouts.

And while traditional touch-tone IVRs have been the norm, we're seeing a massive shift towards speech-based systems. They're not just more user-friendly; they've been shown to cut operational costs by 30% and reduce the number of people who hang up in frustration.

Putting Your IVR System to Work

So, we've covered the nuts and bolts of what an IVR is. But how do these systems actually solve real-world business problems? The true value of interactive voice response comes to life when it’s put to work automating processes, locking down security, and giving customers simpler, more convenient ways to get things done.

We typically see these systems deployed in two main ways, each tackling a different but equally important business need.

The first is what most people think of when they hear "IVR": complete self-service automation. Here, the IVR is the entire show, a fully independent digital agent that can handle a customer's journey from start to finish without a human ever getting involved. It's the ultimate efficiency play, offering a reliable service channel that never sleeps.

The second, and arguably more sophisticated, application is agent-assisted automation. In this setup, the IVR is a trusted partner to your human agent. It steps in to handle specific, sensitive parts of a conversation, ensuring security and compliance are watertight. This hybrid model gives you the best of both worlds—the slick efficiency of automation paired with the empathy and problem-solving of a real person.

Driving Efficiency with Self-Service Automation

Think about a customer who realises late on a Sunday night that they forgot to pay their utility bill. Without a self-service IVR, they're stuck. They have to wait until your contact centre opens on Monday, all while worrying about late fees. It’s a frustrating experience.

But with an automated system? They can simply call in, verify their identity, and securely pay the bill in a matter of minutes. Problem solved.

This 24/7 availability is a massive win for both customer satisfaction and your bottom line. It gives customers the power to sort things out on their own schedule, which in turn takes a huge chunk of routine, repetitive calls off your agents' plates.

Here are a few common examples of self-service in action:

- Retail: A customer can check their order status, track a delivery, or find the nearest store just by following the prompts.

- Finance: Callers can instantly check their account balance, hear their last few transactions, or move money between accounts.

- Charities: Donors have the freedom to make a one-off or recurring contribution over the phone, whenever inspiration strikes.

- Insurance: A policyholder could renew their policy, get a quick quote, or log the first notice of a claim through a guided, automated flow.

By letting the IVR handle these high-volume, low-complexity interactions, you free up your skilled agents to focus on the tricky customer issues that genuinely need a human brain. It's a double win: you cut operational costs and your agents get to do more interesting, satisfying work.

Enhancing Security with Agent-Assisted Payments

Now, let's look at a more complex situation. Imagine a patient calling a healthcare provider to sort out a confusing bill. A friendly agent talks them through the charges and resolves the query. The last step is for the patient to pay the outstanding balance. This is where agent-assisted IVR really proves its worth.

Instead of the old, insecure method of asking the patient to read their card details out loud, the agent initiates a secure handover. With a click, the customer is seamlessly passed to the IVR payment system. Crucially, the agent stays on the line to provide reassurance and confirm the payment goes through, but they are completely firewalled from the sensitive payment data.

The customer simply taps their card numbers into their phone's keypad. Thanks to technology like DTMF suppression (or masking), the agent hears nothing but flat, monotonous beeps. This process, which is the cornerstone of platforms like Paytia, ensures sensitive cardholder data never enters your contact centre environment. That makes demonstrating PCI DSS compliance a whole lot simpler.

This model is the perfect fit for any scenario where a human conversation is essential, but security can't be compromised. You maintain that personal connection while guaranteeing that your customers' payment information is protected by the highest standards. This intelligent, dual approach—automating where you can and assisting where you must—is how modern interactive voice response systems deliver real, measurable value every single day.

Getting Your IVR Implementation Right

Rolling out an interactive voice response system isn't a one-and-done job. A truly great IVR is planned with painstaking detail and fine-tuned over its entire lifespan. The goal is to make it feel less like a robotic gatekeeper and more like a helpful concierge, guiding your customers exactly where they need to go with zero fuss.

This journey starts well before you flip the switch. It begins by mapping out your customer's experience and digging into the most common reasons they phone you. What are their biggest headaches? Which simple, repetitive questions are eating up your agents' valuable time? The answers you find become the blueprint for your IVR call flows.

A well-designed flow feels natural, logical, and most importantly, quick. Nobody wants to be trapped in an endless maze of menus. They want clear, simple choices that anticipate their needs and offer an easy escape route to a real person if things get tricky.

Designing Call Flows That Don't Frustrate

The whole point of a call flow is to get a caller's query sorted as fast as possible. This means designing menus that are no more than two or three levels deep and using plain, jargon-free English for every prompt. And a simple but crucial tip: always put the most popular options right at the start of the menu.

Think about the customer's journey at every single touchpoint:

- A Solid Welcome: The first thing they hear should be professional, welcoming, and instantly confirm they've reached the right company.

- Keep Menu Choices Simple: Stick to a maximum of four or five options per menu. Any more than that and people just can't remember them all.

- The 'Escape Hatch': Always, always provide a clear and easy way to speak to a human agent. Burying this option just leads to angry customers and sky-high call abandonment rates.

Integration and a Smooth Launch

Once your core flows are mapped out, the next critical step is integration. A modern IVR doesn't work in isolation; its real power comes from connecting to your other business systems. This means creating seamless links to your CRM, payment gateways, and your existing phone setup, whether that’s a PBX or VoIP network.

Proper integration is what turns a basic IVR into a powerhouse. It allows the system to identify callers, pull up their account history for a personalised experience, and securely handle tasks like processing a payment or updating a customer record.

A successful launch absolutely depends on rigorous testing. Before a single customer ever hears your IVR, your team needs to run through every possible scenario. Listen for clunky phrasing, hunt for dead ends, and check that every routing path works flawlessly. A phased rollout, maybe starting with a small group of customers, is a great way to catch any last-minute snags before going fully live.

Measuring What Matters: How to Optimise Your IVR

Launching your IVR is just the starting line. The real work is in monitoring its performance and constantly tweaking it based on what the data tells you. Without tracking the right metrics, you’re essentially flying blind.

Key Performance Indicators (KPIs) give you the insight you need to spot friction points in the customer journey and make smart, targeted improvements.

Here are the essential metrics you should be tracking:

- Call Containment Rate: What percentage of calls are fully sorted out within the IVR, without ever needing an agent? A high containment rate is a sure sign your IVR is doing its job well.

- Abandonment Rate: This shows you how many callers hang up while they're still in the IVR menu. If this number is high, it’s a red flag that your call flow is probably too long or confusing.

- Misrouted Calls: How often does the IVR send a caller to the wrong person or department? This points directly to unclear menu options or a flaw in your routing logic.

- Average Time in IVR: You want the IVR to be efficient, but if the time is incredibly short, it could mean callers are just pressing '0' immediately to bypass your self-service options entirely.

In the UK, the shift towards AI-driven, conversational IVRs is all about improving these very metrics. Performance data reveals these advanced systems can resolve 14% more issues per hour and cut the average handling time by 9%. This has also helped boost patient and customer engagement in sectors like healthcare by 33% for tasks like paying a bill. By using these systems, UK contact centres gain audit-ready controls, much like those you’d find with Paytia’s Cyber Essentials Plus certification. You can discover insights on UK call centre statistics to learn more about these trends.

By regularly analysing this data, you can transform your IVR from a simple call-routing tool into a powerful, data-driven engine that improves customer satisfaction and delivers a serious return on your investment.

How to Choose the Right IVR Vendor

Picking an IVR vendor isn't just a transaction; it's a long-term partnership. The right provider will become an extension of your team, helping you boost security, sharpen your efficiency, and keep customers happy. But choose poorly, and you could be facing a world of customer frustration and operational nightmares.

Your evaluation needs to be thorough. Don't just get dazzled by a long list of features on a spec sheet. You need to get under the bonnet and really understand how committed a vendor is to security, flexibility, and genuine support. Getting this right from the start means you'll have a solution that doesn't just solve today's problems but grows with you.

First things first: security. If you're handling payments over the phone, a vendor's security credentials should be your absolute top priority. Don't be afraid to ask for proof.

A vendor without a PCI DSS Level 1 certification is an immediate red flag. This is the gold standard, proving they have the rock-solid controls required to handle sensitive card data safely.

Core Capabilities to Evaluate

Beyond top-tier security, a great IVR vendor needs to bring serious technical know-how and a real understanding of how your business actually works. A powerful IVR is one that slots neatly into your existing tech stack, so you need to dig into their API capabilities. Ask to see case studies of how they've integrated with platforms like the ones you use.

Here are the key things to look for:

- Integration Power: How easily can their system talk to your CRM, payment gateways, and current phone system? Seamless API connections are the secret to creating those smooth, personalised customer journeys.

- Scalability and Reliability: What happens when you have a sudden surge in calls? You need a partner whose infrastructure can handle the pressure without dropping calls or sacrificing quality.

- Omnichannel Support: Customer service is more than just phone calls these days. Can the vendor help you unify the experience across other channels, like web chat or messaging?

- Industry Expertise: A vendor who has already worked in your sector—whether that's finance, healthcare, or retail—will just get it. They'll understand the specific regulations and customer service quirks you deal with every day.

Support and Commercials

Finally, don't forget the human side of things. How good is their support team when you really need them? A fantastic product with terrible support is a recipe for disaster. Ask about their service level agreements (SLAs) and clarify exactly what kind of technical help is included.

You also need to take a close look at the pricing. Is it clear and predictable? Or are there hidden costs for support, extra transactions, or scaling up? Understanding the total cost of ownership is vital. By carefully weighing up all these areas, you can explore the full suite of secure payment features and find a partner who truly gets what you're trying to achieve.

Frequently Asked Questions About IVR Systems

When you start looking at new phone systems for your business, a few key questions always pop up. Getting straight answers is the first step to figuring out how a modern interactive voice response system can actually help your company and your customers. Let's tackle the most common ones.

What Is the Difference Between a Basic and a Conversational IVR?

Imagine a basic IVR as an old-fashioned phone tree. It's a rigid, one-way street where callers have to navigate a maze by pressing buttons on their keypad: "Press 1 for sales, Press 2 for support." It gets the job done, but it can feel slow, robotic, and a bit impersonal.

A conversational IVR, on the other hand, is more like a genuine dialogue. It uses artificial intelligence and Natural Language Processing (NLP) to understand what people are saying in their own words. Instead of punching in numbers, a customer can simply say, “I need to check my account balance,” and the system gets it. This makes the whole experience faster, more natural, and a lot more human.

How Does a Secure IVR Reduce PCI DSS Scope?

Think of a secure IVR as a protective bubble. It drastically shrinks your PCI DSS compliance headache by making sure sensitive payment card data never even touches your business environment. It uses clever technology to completely isolate that information from your team and your systems.

When a customer keys in their payment details, technology like DTMF masking intercepts the tones. Your agent just hears flat, anonymous beeps, and more importantly, your call recording captures nothing sensitive. The IVR sends the data directly and securely to the payment processor.

Your business gets back a secure, non-sensitive token instead of the raw card details. Because the actual card data completely bypasses your agents, call recordings, and internal networks, you can slash your compliance burden by over 90%.

Can IVR Systems Integrate with Our Existing CRM?

Yes, they certainly can. Modern interactive voice response systems are designed from the ground up to connect with the other tools you rely on. They use APIs (Application Programming Interfaces) to create a smooth link between your VoIP phone system, your CRM software like Salesforce, and your payment gateways.

This integration is what transforms an IVR from a simple tool into a powerhouse. It allows the system to pull customer data to personalise the call—for example, greeting a caller by name or referencing their last order. It also automates tasks like instantly logging a payment confirmation into the customer’s CRM record, which keeps your data clean and saves a huge amount of admin work. Good integration capabilities should be high on your list when picking a provider.

Ready to enhance security and streamline your payment processes? With Paytia, you can implement a PCI DSS-compliant IVR system that protects your customers and your business. Explore our secure payment solutions.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.