Contact centre ivr: Elevate Security, Cut Costs, Improve CX

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Ever dialled a company and been greeted by a recorded voice asking you to "press one for sales"? That's a contact centre IVR (Interactive Voice Response) system at work. But don't mistake it for a simple, robotic menu.

Think of a modern IVR as your business's digital front door—a smart, tireless virtual receptionist that greets every single customer and guides them exactly where they need to go, without making them wait.

What Is a Contact Centre IVR and Why Does It Matter?

At its heart, IVR technology lets a computer talk with people using voice commands and keypad tones. It acts as an intelligent first point of contact, often anticipating what a customer needs and offering immediate ways to help themselves. That first interaction shapes a customer's entire perception of your brand.

The journey of IVR has been pretty remarkable. Early systems were just basic touch-tone menus. Today, they've grown into sophisticated, AI-driven platforms that can understand natural spoken language, verify a caller's identity, and handle complex requests from start to finish.

The Modern Role of IVR

The importance of IVR has exploded. The UK call centre industry, which leans heavily on these systems, has ballooned into a massive £3.2 billion market. This isn't surprising when you see that in sectors like finance and retail, IVR often handles more than half of all incoming customer queries.

Since 2020, a staggering 61% of UK contact centre leaders have reported soaring call volumes, making efficient automation more critical than ever.

A well-designed IVR now plays two vital roles:

- It empowers your customers. They get 24/7 access for simple things like checking an account balance, tracking a delivery, or making a payment. This instant service is exactly what today's consumers expect.

- It supports your agents. By automating all the repetitive, straightforward questions, the IVR frees up your human agents to handle the more complex, high-value conversations that require real empathy and sharp problem-solving skills.

A great IVR doesn't replace human agents; it elevates them. By handling the routine, it allows people to handle the exceptional, turning a cost centre into a hub for customer loyalty.

Beyond Basic Call Routing

Today's advanced enterprise contact center solutions show us that an IVR is no longer just a switchboard. It's a central pillar of an integrated customer service strategy. It connects with your CRM, payment gateways, and other business software to deliver a truly personal and seamless experience.

As you build out your customer service ecosystem, think about how to handle payments securely and efficiently within that flow. Solutions like those offered by Paytia for contact centres integrate directly into this environment, making the modern IVR an indispensable asset for any organisation serious about boosting efficiency and customer satisfaction.

The Tangible Business Benefits of an Optimised IVR

Think of a well-designed IVR as more than just a call routing system. It's a strategic asset, an engine for growth that delivers clear, measurable returns across three key areas: serious cost reduction, happier customers, and a smoother, more efficient operation.

Once you move past the theory, the real-world advantages pop into focus when you look at the numbers. Every single time a customer sorts out their issue without needing to speak to a person, that’s a direct and significant cost saving. It’s a win for them and a win for your budget.

Drive Down Operational Costs

The most immediate financial win from a smart IVR is cost containment. This comes from resolving customer queries through automated self-service, meaning the call never needs to reach a human agent in the first place.

Let’s put that into perspective. An automated interaction might cost mere pence, whereas the average inbound call handled by an agent sits around a hefty £6.25. That makes a high containment rate an incredibly powerful lever for boosting profitability. Just look at the Alabama Department of Revenue—they overhauled their system with a new IVR, which freed up staff to recover an extra $1.5 million every single month by focusing on collections work instead of just answering the phone.

An optimised IVR doesn't just manage calls; it manages costs. Every customer who successfully self-serves through the IVR directly contributes to a healthier bottom line by reducing the need for more expensive agent-led interactions.

This kind of efficiency isn't just nice to have; it's essential. By automating the routine stuff, you free up both your budget and your people to focus on the complex, high-value work that actually drives revenue and builds lasting customer loyalty.

Elevate Customer Satisfaction and Retention

In a world where everyone wants instant answers, a modern IVR is your frontline soldier. It offers 24/7 self-service, empowering customers to get information or complete tasks whenever it suits them, not just during business hours. This immediate access cuts down on frustration and massively improves their overall experience.

The stakes for getting this right are sky-high. UK customers, in particular, don't mess around. A staggering 42% will switch providers after just one bad service experience, and another 38% will seriously think about it. With 55% of callers giving up entirely because of long wait times, a capable IVR isn't a luxury—it's a critical tool for retention. You can read more about what UK customers really want from contact centres in 2025 and discover how to meet their rising expectations.

By offering a quick and efficient automated path, you're showing you respect your customer's time. And that’s the bedrock of loyalty.

Boost Operational Efficiency and Agent Performance

A truly intelligent contact centre IVR is the ultimate organisational tool. It acts as a super-efficient triage system, making sure that when a call does need a human touch, it gets to the right person, with the right skills, on the very first try. This smart routing has a massive knock-on effect on your most important metrics.

A well-oiled IVR machine can transform your key contact centre metrics. The table below breaks down exactly how it moves the needle on performance indicators that matter most, leading to better business outcomes across the board.

How an Optimised IVR Impacts Key Contact Centre Metrics

| Metric | Impact of Optimised IVR | Business Outcome |

|---|---|---|

| First Call Resolution (FCR) | Gathers key information upfront and routes calls based on skill or need, increasing the chance of a one-touch resolution. | Higher customer satisfaction and reduced repeat call volume. |

| Average Handling Time (AHT) | Delivers pre-qualified calls to agents, so they spend less time on discovery and more time solving the actual problem. | Lower handling times, reduced operational costs, and improved agent capacity. |

| Agent Productivity | Filters out simple, repetitive queries, allowing agents to focus on more complex and engaging customer issues. | Increased job satisfaction, better agent performance, and lower staff turnover. |

This process doesn't just make your contact centre run more smoothly; it creates a less stressful, more productive environment for your most valuable asset: your people. By handling the grunt work, the IVR lets your agents shine where they’re needed most.

The Architecture of a Modern IVR System

To really get what a modern contact centre IVR can do, you need to look under the bonnet. This isn't some standalone box sitting in a server room. Today’s IVR is an intricate, interconnected system—think of it less like a single instrument and more like an orchestra conductor, coordinating multiple sections to create a seamless customer experience.

At its heart, the architecture is all about bridging the gap between old-school telephony and your digital business systems. Every component has a job, and they all work together to figure out who is calling, what they need, and how to get them the right help, fast.

The Core Architectural Components

A modern IVR is built on a few key pillars that handle everything from the moment the call connects to processing complex requests. Understanding how these pieces fit together takes the mystery out of the technology and shows you what’s really possible.

Telephony Gateway: This is your IVR's front door. It’s what connects the system to the outside world’s telephone network, whether that’s a traditional phone line or a modern VoIP (Voice over IP) setup. It answers the call and translates the audio into digital data the rest of the system can actually work with.

IVR Application Server: This is the brains of the whole operation. It runs the software that holds all the logic, menus, and workflows—what we often call "call flows." When a customer presses a key or speaks a command, this server processes that input and decides what to do next.

Web and Database Servers: Think of these as the system's memory and knowledge base. They connect to your backend databases that store all the important stuff: customer details, order histories, account balances, and more. The IVR pings these servers to pull the information it needs to answer a caller's question.

These parts work in perfect concert, creating a functional system that can be shaped to fit your specific business needs.

Critical Integrations: The Symphony of Systems

An IVR's real power isn’t just in its own components, but in how it hooks into your other technology. These integrations are what turn it from a simple menu into an intelligent platform that understands context.

The most advanced systems now incorporate conversational AI to make these interactions even more natural. To see how these technologies are changing the game, it's worth reading up on the capabilities of an AI Customer Service Agent.

A standalone IVR is just a menu. An integrated IVR is a conversation. It knows who the customer is, anticipates their needs, and connects them to the right information or person without friction.

These connections are especially vital in the UK's contact centre outsourcing sector, which supports 280,000 jobs. With hybrid working expected to hit 92% adoption, the need for seamless links between the IVR and telephony systems is more critical than ever. For regulated industries, this extends to secure payment solutions that can slash PCI DSS scope by 90-95% using techniques like tokenization, ensuring you stay on the right side of GDPR and Cyber Essentials.

Here are the key integration points that make all the difference:

Customer Relationship Management (CRM): By linking to your CRM, the IVR can identify callers by their phone number. This unlocks personalised greetings ("Hello Sarah, are you calling about your recent order?") and lets you offer proactive help based on their history.

Payment Gateways: If you take payments over the phone, this is non-negotiable. A direct, secure connection to a payment gateway lets the IVR process transactions automatically and safely, ensuring sensitive card data never even touches your internal systems.

Backend Databases and APIs: This is how your IVR provides real-time, dynamic information. It can look up an order status, check stock levels, confirm an appointment, or pull any other data stored in your business systems to serve it directly to the customer.

By tying these separate systems together, the architecture of a modern contact centre IVR transforms a simple phone call into a rich, data-driven interaction.

Securing IVR Payments and Ensuring Compliance

Taking payments over the phone is a huge win for efficiency, but it also brings some serious security responsibilities. A single breach can lead to catastrophic financial penalties and, worse, a permanent loss of customer trust. For any modern contact centre IVR, handling payments isn't just another feature—it's a high-stakes process that demands bulletproof security and strict compliance.

The moment a customer starts punching in their card details, your systems become a target. The biggest risks are that this sensitive data gets accidentally captured in call recordings, stored in system logs, or intercepted by fraudsters. This is where compliance frameworks like the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR) become non-negotiable.

These regulations aren't just bureaucratic hoops to jump through; they are essential safeguards built to protect consumers. Getting it wrong can result in crippling fines, legal action, and a PR nightmare. That's why building your IVR payment process with security at its core is a fundamental business necessity.

De-Scoping Your Contact Centre from Risk

The smartest strategy for securing IVR payments is to make sure sensitive card data never even touches your environment. This concept is known as "de-scoping." By preventing Primary Account Numbers (PAN) and Card Verification Codes (CVC) from being seen, heard, or stored by your agents and systems, you massively reduce your compliance burden.

Two key technologies make this possible:

DTMF Masking: When a customer uses their telephone keypad, each press creates a distinct sound called a DTMF (Dual-Tone Multi-Frequency) tone. DTMF masking, or suppression, intercepts these tones and swaps them for a flat, monotonous sound before they reach the agent or your call recording software. The data still gets sent securely to the payment gateway, but anyone listening—including your own recordings—hears nothing useful.

Tokenization: This is the process of replacing sensitive card data with a non-sensitive equivalent called a "token." Once the customer enters their details, the payment gateway processes the transaction and sends back a unique, single-use token. This token can be safely stored in your systems for things like processing refunds without ever exposing the actual card number. It’s like giving your system a secure locker key instead of the cash itself.

These methods create a powerful shield, protecting both your customers and your business. To get the full picture of the security standards involved, it’s worth exploring the core PCI DSS requirements in detail.

By adopting DTMF masking and tokenization, you shift the security responsibility from your contact centre to a certified payment provider. This dramatically simplifies your path to compliance and lets you focus on what you do best: serving your customers.

The Role of Secure Payment Platforms

Trying to implement these security measures from scratch is a complex and expensive headache. That's why many organisations turn to specialised secure payment platforms. These providers offer ready-made solutions that plug directly into your existing telephony and contact centre software, delivering top-tier security without a massive internal development project.

These platforms handle the entire secure part of the transaction. They create a separate, encrypted channel for the payment data to travel through, completely isolating it from your agents and infrastructure. For your team, the process feels seamless; for your compliance officer, it's a huge weight off their shoulders.

By using a dedicated secure payment solution within your contact centre IVR, you can:

- Reduce PCI DSS scope by up to 95%, saving significant time and money on audits.

- Protect call recordings from ever capturing sensitive card information.

- Empower agents to help with payments without being exposed to card data.

- Build customer trust by showing a clear commitment to data security.

Ultimately, securing IVR payments isn’t about adding barriers. It’s about building a trustworthy and frictionless process. With the right technology, you can turn a compliance headache into a competitive advantage, making every transaction as safe as it is simple.

Best Practices for a Customer-Centric IVR Design

A powerful contact centre IVR is only as good as the experience it creates. If the design is clunky, impersonal, or leads customers down a dead end, it quickly becomes a source of frustration that can seriously damage your brand. The real secret is to stop thinking about what suits your internal departments and start focusing on what creates the smoothest journey for your caller.

This means designing an experience that feels intuitive, efficient, and respectful of their time. A well-built IVR isn't a robotic barrier; it's a helpful guide, connecting people to the right information or support as quickly as possible.

Design for your customer, not your departments. The best IVR anticipates a caller’s needs and provides the fastest, most logical path to a solution, whether that's self-service or speaking to a skilled agent.

Keep It Simple and Intuitive

When someone calls your business, they're usually looking for a fast answer. Hit them with a long, complicated laundry list of options, and you’re paving a fast track to irritation and abandoned calls. When it comes to IVR design, simplicity is your best friend.

A great guiding principle is the "rule of four." Try to present no more than four main options at any single menu level. This keeps the choices easy to remember and process, so callers don't have to listen to the whole list all over again.

And critically, every interaction needs a clear and easy escape hatch to a human. Offering phrases like "To speak with a member of our team, press zero" early and often provides a vital safety net. It reassures customers they aren't trapped in an automated loop, which goes a long way in reducing frustration.

Personalise the Caller Journey

A generic, one-size-fits-all IVR menu just feels dated and cold. By plugging your IVR into your CRM system, you can build a much smarter, more tailored experience that recognises the customer as an individual.

Personalisation can change the entire tone of the interaction from the very first second.

- Proactive Assistance: Use the caller's phone number to identify them and greet them by name. You can then offer clever shortcuts based on their recent activity. Think: "Hello, Sarah. Are you calling about your delivery scheduled for today?"

- Intelligent Routing: Skip unnecessary steps for customers you already know. If a high-value client calls, for instance, your IVR can route them straight to a senior support agent, bypassing the main menu completely.

- Contextual Information: Offer relevant self-service options based on their account. A customer with an overdue bill could be immediately presented with a secure option to make a payment.

Continuously Monitor and Improve

An IVR is not a "set it and forget it" tool. Your customers' needs will change over time, and your IVR has to evolve right alongside them. The only way to know if it's still doing its job is to constantly track its performance and listen to what the data is telling you.

To build a truly effective system, you must understand how your customers are using it. For a deeper dive into the foundations of IVR technology, check out our complete guide on the call centre IVR.

Key metrics offer priceless insights into the friction points in your call flows. Get into the habit of analysing these KPIs to spot areas for improvement:

- IVR Containment Rate: What percentage of calls are fully resolved within the IVR without ever needing an agent? A high rate is generally good, but you need to know why people are dropping out.

- Misrouted Calls: How often do callers pick an option, only for an agent to transfer them to another department? This is a classic sign of confusing menu labels or flawed logic.

- Average Time in IVR: If customers are spending ages navigating menus, it’s a clear signal that your call flows are too complex or just plain inefficient.

Real-World Scenarios for Secure IVR Payments

Abstract concepts like tokenization and DTMF masking are great on paper, but seeing them in action is where it all clicks. Let's walk through two very common payment situations to show how a secure contact centre IVR turns a compliance headache into a smooth, safe transaction.

These examples show how modern tech carves out a separate, secure channel just for payment data. It's like building a protective bubble around your contact centre.

Scenario 1: The Fully Automated Self-Service Payment

Imagine a customer, David, needing to pay his utility bill after hours. He rings the company's main number and the IVR picks up.

- Authentication: The IVR greets him and asks for his 10-digit account number using the phone's keypad. The system checks this against the billing database in a split second.

- Payment Intent: It sees he has an outstanding bill and proactively offers, "I see you have a balance of £54.20. Would you like to pay this now?" David simply presses '1' for yes.

- Secure Data Capture: Now for the critical part. The IVR prompts him to enter his 16-digit card number, expiry date, and the three-digit CVC. As he types, DTMF masking technology kicks in. His keypresses are captured directly by the secure payment platform, but the tones are completely silenced from the company’s systems and any call recordings.

- Tokenization and Confirmation: The payment platform sends the details securely to the payment gateway, which gives the green light. It then sends a unique token—not the actual card details—back to the utility company's system. The IVR confirms to David, "Thank you, your payment has been successful. Your confirmation number is..."

Throughout that entire process, the sensitive card details never once touched the utility company's network, completely removing them from that slice of PCI DSS compliance.

Scenario 2: The Agent-Assisted Secure Handoff

Now let's think about Sarah. She’s on the phone with a contact centre agent, Alex, sorting out a complex order. Mid-conversation, she decides to add an item and pay for it.

Asking her to read out her card details is a huge security no-go. Instead, Alex triggers a secure handoff.

- Initiating the Payment: Alex tells her, "I can take that payment for you now. For your security, I'm going to pass you to our secure automated system to enter your card details. I'll stay on the line with you, but I won't be able to see or hear any of your information."

- Secure IVR Capture: With a click in his software, Alex transfers Sarah to the payment IVR. She hears the familiar prompts asking for her card number, expiry, and CVC. Just like in the first scenario, DTMF masking means Alex hears only flat, muted beeps, and the call recording captures nothing of value.

- Real-Time Agent View: On his screen, Alex doesn't see the numbers. Instead, he sees real-time progress updates like "Card Number Entered" and "Expiry Date Entered."

- Confirmation and Continuation: As soon as the payment goes through, his screen flashes a "Payment Successful" message, along with a secure token for their records. He can then jump straight back into the conversation with Sarah to confirm the payment and finalise her order.

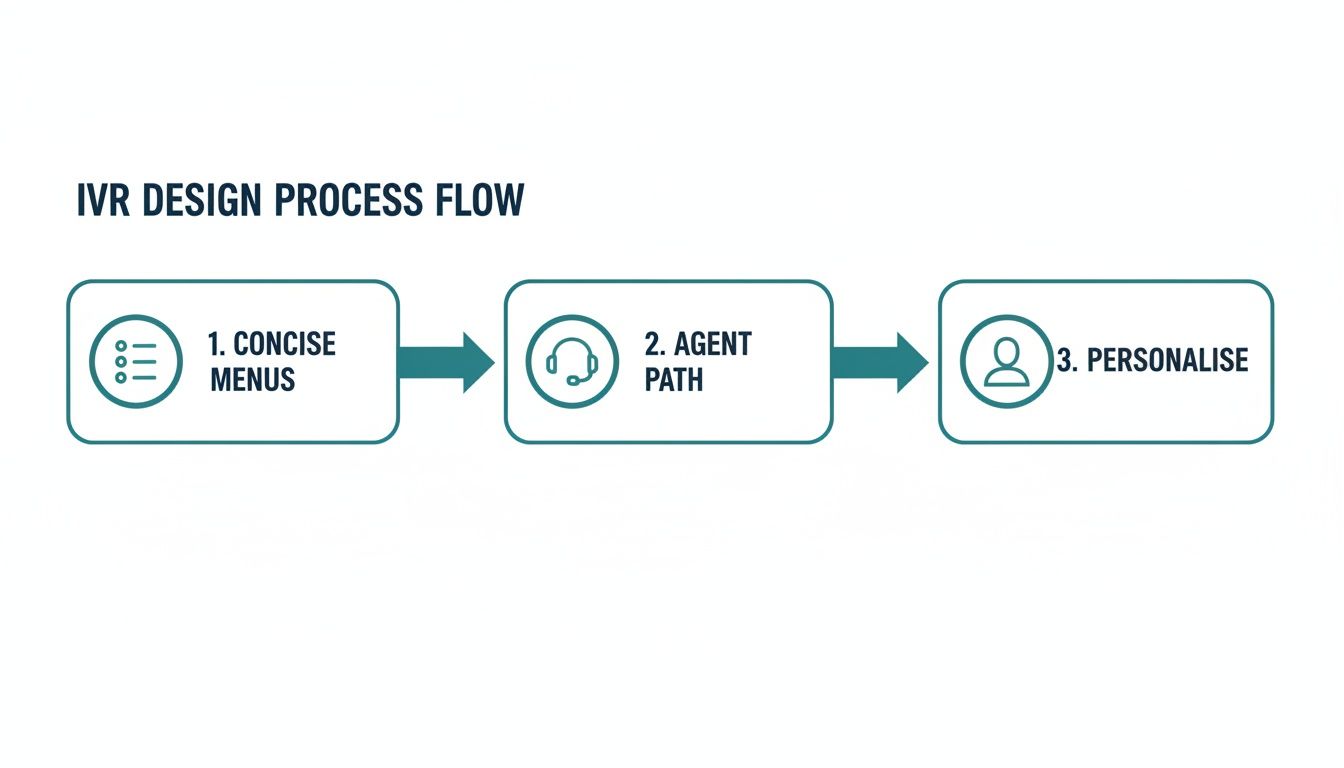

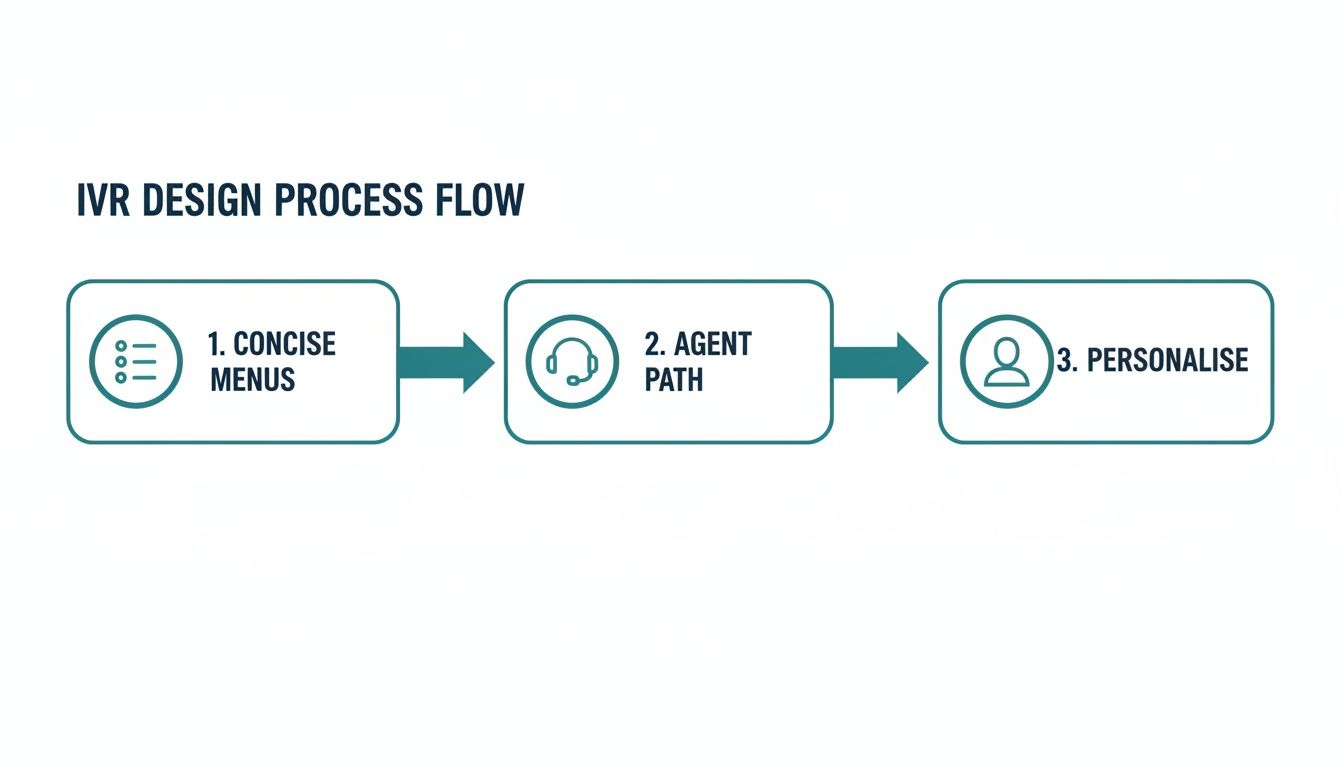

This flow, which is crucial for making these secure journeys user-friendly, relies on a few core design principles.

When you keep menus concise, give agents a clear path, and personalise the journey where you can, you build the trust customers need to feel comfortable using these secure payment options.

Your IVR Questions, Answered

Stepping into the world of contact centre IVR can feel a little overwhelming. How do you make sure customers love it? What’s the real difference between all the jargon? Getting straight answers is the first step to making a smart decision.

Let's cut through the noise. Here are a few of the most common questions we hear, with practical answers to help you get the most from your IVR.

How Can I Stop My IVR From Frustrating Customers?

The secret to an IVR that people don’t hate is simple: design it for them, not for you. That means keeping your menus short and sweet—stick to three or four options per level, max. Nobody wants to listen to a novel just to pay a bill.

Always give callers an easy way out. A clear, consistent "press 0 to speak with an agent" option at every step is non-negotiable. It’s a safety net that builds trust. Finally, use a professional, human-sounding voice for your prompts and constantly look at your IVR data. Find where people are getting stuck or hanging up, and fix it.

What Is the Difference Between an IVR and a Phone Tree?

Think of a phone tree as a simple signpost. It just points callers in a basic direction: "Press 1 for Sales, Press 2 for Support." It’s a one-way street of basic commands and doesn't really do anything.

A modern contact centre IVR, however, is more like a fully-trained member of your team. It’s an intelligent platform that connects to your other business systems. It can handle entire tasks on its own—like paying a bill, checking an order status, or booking an appointment—without ever needing a human. Some can even understand natural speech, making the whole experience feel less like a robot and more like a conversation.

A phone tree just points you to a department. An IVR can solve your problem right then and there, becoming an active part of your customer service team.

Can I Take Secure IVR Payments Without Full PCI DSS Compliance?

Yes, absolutely—and it’s how most smart businesses handle it. The key is to partner with a specialised, secure payment provider. These platforms use clever tech like DTMF masking and tokenization to make sure sensitive card details never actually touch your contact centre’s environment.

The provider handles the sensitive data directly, which can slash your PCI DSS compliance scope by 90-95%. Your systems and agents only ever see a secure, useless token instead of the real card number. This dramatically lowers your risk, your costs, and the headaches that come with compliance.

Ready to secure your IVR payments and reduce your compliance burden? Paytia provides a seamless, secure payment platform that integrates with your existing contact centre technology. Discover how Paytia can protect your customer data and simplify your operations.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.