What Is a Customer Ref Number and Why Is It Key to Secure Payments

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Ever seen a strange jumble of letters and numbers on a bill? That’s likely a customer ref number, and it’s a crucial piece of the puzzle for any business you pay.

Think of it like a parcel tracking code. But instead of following a package, it tracks your financial interactions, making sure your payment lands in the right place, for the right reason. It’s a simple but vital tool for bringing order to the thousands of payments companies handle every day.

What Exactly Is a Customer Reference Number

At its heart, a customer reference number is the thread that connects you, your account, and your payment to an organisation. Without it, a business receiving a flood of payments would face an accounting nightmare, trying to match nameless funds to customer accounts. It's the go-to identifier for telling one transaction apart from another in a vast sea of financial data.

This unique code acts as a common language between you and the company. When you call up to ask about a bill or make a payment, giving them this number lets an agent instantly pull up your history. It saves you from having to share more personal details every time you get in touch.

The Role of a Unique Identifier

The main job of a customer ref number is to guarantee accuracy and efficiency. When you pay a bill, whether online or over the phone, this number tells the company’s systems exactly which account to credit and which outstanding invoice to clear.

It’s a straightforward system that prevents some very common—and costly—mistakes, such as:

- Crediting your payment to the wrong customer’s account.

- Misallocating funds and leaving your invoice incorrectly marked as unpaid.

- Causing delays in service activation or reconnection because a payment can’t be found.

A customer reference number transforms an anonymous payment into a specific, actionable event. It’s the key that unlocks precise financial reconciliation, turning potential chaos into organised accounting.

By creating this clear, unambiguous link, the reference number takes all the guesswork out of payment processing. It lays the groundwork for a reliable and trustworthy system—a concept closely related to the function of a general payment reference number, which also works to ensure funds are allocated correctly. It’s a foundational element for building smoother and more secure payment experiences.

Why Reference Numbers Are Crucial for UK Businesses

In the UK's fast-paced economy, a customer ref number is so much more than a random string of characters on an invoice. Think of it as the unique fingerprint for every single financial interaction a business has. It’s the simple tool that brings order and control to the otherwise chaotic world of payments, customer queries, and account management.

Let's paint a picture. A large energy supplier gets thousands of payments for exactly £50 every single day. Without a reference number, their accounts team would be lost in a sea of identical transactions, trying to guess which payment belongs to which customer. It would be a nightmare. The reference number cuts through that chaos, making sure every pound lands exactly where it should.

This precision keeps the entire operation running smoothly. When a customer rings up to ask about a bill, that number allows an agent to pull up their record in seconds. No more frustrating, time-wasting searches. This speeds up the whole process and leaves the customer feeling heard and helped, not ignored.

Making Payments and Disputes Simpler

As more and more business moves online or over the phone, the humble customer ref number becomes even more critical. With online sales soaring, the need for airtight tracking in contact centres has never been greater. Recent figures show that the proportion of online retail sales in the UK hit 28.3%, a clear sign of the sheer volume of remote payments that businesses have to get right. You can dive deeper into these trends in this report from the Office for National Statistics.

This little identifier is the secret to pain-free payment reconciliation. At the end of the day, finance teams can automatically match incoming payments to outstanding invoices using the reference number. This simple step slashes the need for manual work and dramatically reduces the risk of human error.

And in regulated industries like finance or utilities, this isn't just a nice-to-have; it's a must-have for compliance. If a dispute ever arises, the customer reference number provides a clear, undeniable audit trail, linking a specific payment directly to a specific invoice or account.

For any UK business, a solid customer reference number system is a direct route to lower operational costs, better compliance, and happier, more loyal customers. It transforms potential admin headaches into a slick, automated process.

Building Trust with Every Transaction

At the end of the day, using a customer ref number consistently and clearly builds trust. When customers see their payments are applied correctly and acknowledged promptly every time, their confidence in the company grows.

It sends a clear message: this business is organised, reliable, and cares about getting the details right. This simple tool prevents major financial headaches for everyone involved, making it a true cornerstone of modern business.

Common Formats and Where to Find Them

A customer ref number isn’t a universal standard; its format can look quite different from one company to the next. A good analogy is a car's registration plate. Every plate is unique to a vehicle, but the combination of letters and numbers follows different regional rules. It's the same idea here—the number is designed to be unique to you or a specific transaction, but its structure will vary.

You might see purely numeric codes, like an invoice number (e.g., INV-837492), or a mix of letters and numbers in an account ID (e.g., AC5591-B). The format often comes down to what works best for a company's internal systems. Some use simple sequential numbers, while others create more complex, randomised strings to keep them secure and hard to guess.

Decoding Different Reference Number Types

Once you know what to look for, you’ll start spotting these numbers everywhere. The name might change from "Account Number" to "Order ID," but its job is always the same: to connect you to your account or payment.

Here are a few of the most common formats you'll come across:

- Numeric Only: Simple and straight to the point. You’ll often see these on invoices or order confirmations, like

48201993. - Alphanumeric: A blend of letters and numbers, typically used for broader account IDs, such as

CUS782B40P. - Prefixed: These start with a short code to explain what they are. Think

REF-PAYMNT-0051orACCT-9930-1.

This variety exists because different situations call for different identifiers. An online shop will give you a one-off order number, but your utility provider will issue a fixed account number that stays with you for years. To see how these compare with other payment identifiers, it's worth understanding the role of a bank reference number and its place in the system.

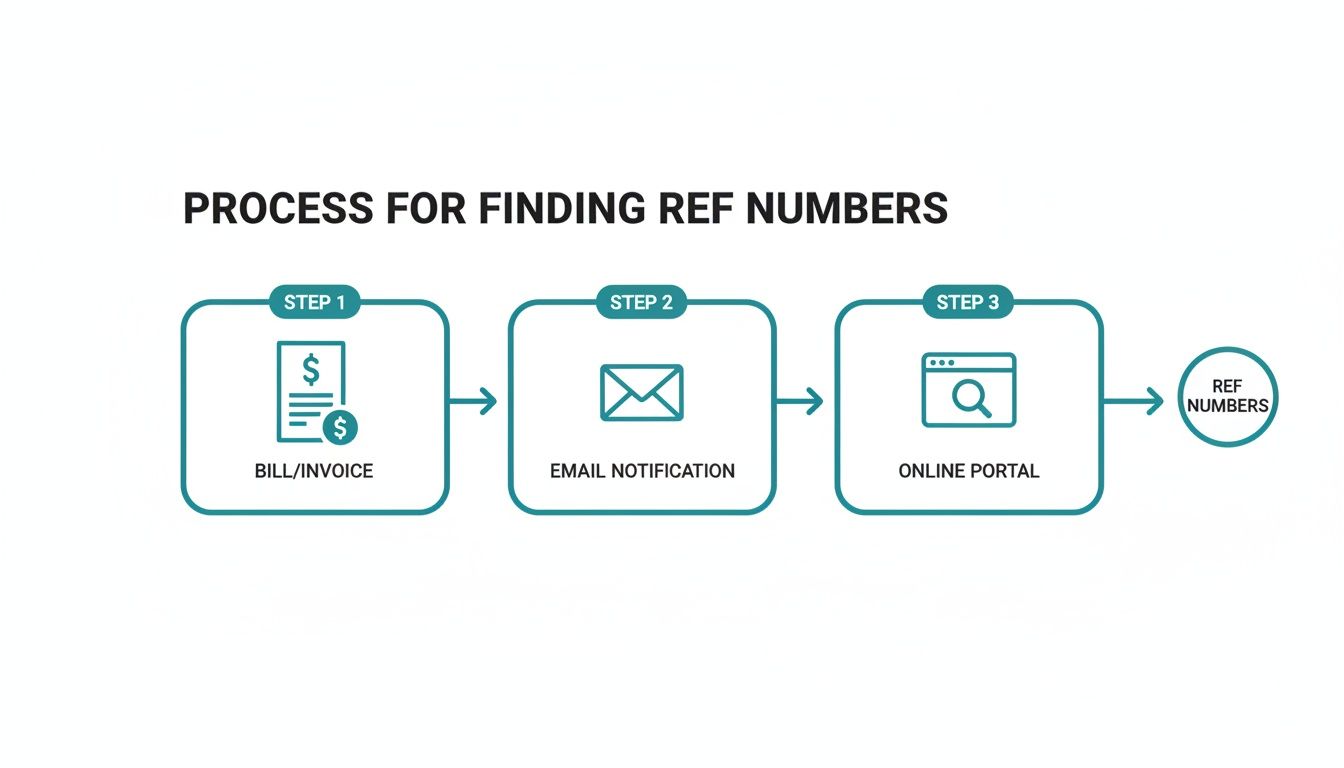

Quick Guide to Finding Your Customer Reference Number

Knowing where to look saves a lot of time and hassle. Luckily, companies want you to find your customer ref number—it's the key bit of information they need from you—so they usually place it in obvious spots.

Key Takeaway: Your customer reference number is almost always located near your personal details or the total amount due on any official document or digital communication from a company.

To make it even easier, we've put together a little cheat sheet. Use this to quickly locate your reference number on various documents and digital platforms.

| Document or Platform | Typical Location | Example Format |

|---|---|---|

| Physical Bills/Invoices | Usually at the top right, near your name and address or the payment slip. | Account No: 74839201 |

| Email Confirmations | Often in the subject line or highlighted in the body of the email. | Your Order #UK58392 |

| Online Customer Portal | Displayed prominently on the main dashboard or under "My Account." | Ref: CUST-AB12345 |

| Direct Debit Mandates | Listed as the reference for the payment instruction with your bank. | DD Ref: UTIL44928 |

Hopefully, this table helps you find what you need without having to dig around. Just remember to check the top of your documents or the main sections of your online accounts first.

How Reference Numbers Underpin Secure Payments

A customer reference number is far more than a simple admin tool; it's the key that unlocks a truly secure and compliant payment process. It acts like a coat-check ticket at a fancy restaurant. You hand over your valuable coat (your payment card details) to the attendant (a secure payment system), and you get a simple, non-valuable ticket in return.

That ticket—the customer reference number—allows the business to identify your account and manage your payment without ever having to handle your expensive coat themselves. This simple piece of information lets them process payments without ever touching the sensitive stuff: the card number, expiry date, and CVC.

When a customer provides their customer ref number, it kicks off a secure workflow that keeps all sensitive details completely separate from the company's own environment. This is a game-changer for payments made over the phone, through web chat, or any other channel where an agent is involved.

The Magic of Tokenization and Isolation

The real wizardry behind this process is a technology called tokenization. When a payment is started using a reference number, the customer is guided to enter their card details into a completely separate, secure system. This could be a protected keypad on their phone (using DTMF suppression technology) or a secure online payment link.

Once the payment gateway processes the transaction, it doesn't send the actual card details back to the business. Instead, it sends a unique "token".

This token is just a randomly generated string of characters that acts as a secure stand-in for the actual card number.

- It has no real-world value: If a fraudster got hold of the token, it's completely useless to them.

- It's tied to the transaction: The business can use this token for things like refunds or setting up recurring payments without ever needing the original card details again.

- It keeps customer data safe: The actual card information never enters the business's systems, call recordings, or even appears on an agent's screen.

This separation is the bedrock of modern payment security. By using the customer ref number to initiate the process, the business effectively outsources the risk associated with handling card data. You can get a much deeper look into the mechanics by reading our in-depth article on payment tokenization.

Slashing PCI DSS Scope and Building Trust

Perhaps the biggest win here is the massive reduction in PCI DSS (Payment Card Industry Data Security Standard) scope. Your PCI DSS scope includes all the people, processes, and technology that store, process, or transmit cardholder data. By making sure that data never even touches your systems, you can shrink your compliance footprint by as much as 90-95%.

By isolating payment card data, the customer ref number becomes a powerful compliance tool. It allows a business to accept payments confidently, knowing they are operating within a secure framework that protects both their customers and themselves from data breaches.

This infographic shows the simple, common places where customers can find their reference number to begin this secure payment journey.

As you can see, these numbers are always within easy reach, making it simple for customers to kick off a secure payment using documents they already have to hand.

This level of security is crucial, especially in the UK. With an incredible 88.4 million mobile connections and an average of 37,660 scam calls happening every day, consumers are rightly wary. They need to feel confident that paying over the phone is safe.

A secure payment flow that starts with a customer reference number gives them exactly that peace of mind. It doesn't just cut compliance costs; in an age of constant security threats, it builds the one thing that matters most: customer trust.

Using Reference Numbers to Drive Efficiency and Automation

Sure, the security gains are huge, but the real magic of a customer ref number happens when you use it to supercharge your operations. It’s less of a label and more of the central gear in your financial machinery.

Once every payment, query, and record is tied to this single identifier, you can start automating all those manual processes that used to eat up so much time. This is where the reference number stops being passive and becomes an active player in your workflow. It becomes the trigger for a whole chain of automated actions, completely overhauling your accounts receivable and letting your team get back to more important work. The result? A quicker, smarter, and far more cost-effective operation.

Automating the Customer Payment Journey

One of the best places to see this in action is with self-service payment systems. Think about automated Interactive Voice Response (IVR) systems. They let customers make payments 24/7 without ever needing to speak to a person. The customer just calls up, punches in their reference number, and the system takes care of the rest securely.

This isn't just a nice-to-have for your customers; it’s a massive win for your contact centre. Every single payment the IVR handles is one less call clogging up your phone lines. Queue times drop, and so do your operational costs.

But it doesn't stop with inbound calls. The customer ref number can also power up your outbound communications, for instance:

- Automated Payment Reminders: Fire off an SMS or email with the reference number and a direct payment link already included.

- Scheduled Follow-ups: Automatically trigger calls or messages for overdue accounts, all tied back to that one unique code.

- Payment Confirmation: Instantly send a receipt the moment a payment linked to a reference number goes through successfully.

By making the reference number the key to self-service, you empower customers and simultaneously reduce the manual workload on your team. It’s a classic win-win for efficiency and customer experience.

Creating a Single Source of Truth

The final piece of the puzzle is integration. When the customer ref number is used consistently across your entire business, it builds a powerful, unified view of every customer's financial journey.

By connecting your payment platform to your Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems, that reference number becomes the universal translator between them. This seamless link means that when a payment is made, it’s automatically recorded against the right customer and the right invoice in every system. No more manual data entry, no more painful reconciliation errors, just a single, reliable source of truth for every transaction. That level of accuracy is exactly what you need for spot-on financial reports and smart business decisions.

Best Practices for Managing Reference Numbers Securely

To get the most out of your customer reference number system, you need a solid framework. It’s not just about generating a string of characters; it’s about creating a secure and efficient process from start to finish.

The absolute first rule? Every single number must be unique. Think of it like a National Insurance number—if two people shared the same one, you’d have chaos. The same logic applies here; a duplicate number could lead to payments being applied to the wrong account, which is a headache no one needs.

Just as critical is making sure your customers are in the loop. You need to clearly communicate what the number is for and where they can easily find it. This simple bit of guidance cuts down on confusion and helps them feel confident in the payment process, which is especially important in sensitive areas like debt collection or healthcare billing.

Compliance and Data Minimisation

When you’re designing a customer ref number, there’s one golden rule you can’t break: it must never contain sensitive personal data.

Baking in details like a date of birth or a snippet of an address is a huge compliance red flag, especially under regulations like GDPR. The number should be a completely random, anonymous identifier—not a secret key that unlocks someone's personal information.

This boils down to the principle of data minimisation. The real power of a reference number lies in what it isn't. It's a secure pointer to an account that doesn't expose any of the customer’s private details along the way.

A well-managed reference number system creates an unbreakable audit trail. It gives you a clean, chronological history of every transaction and conversation, which is invaluable for sorting out disputes and proving compliance.

This is particularly true in the UK insolvency sector, where keeping track of payments is absolutely essential. With financial distress on the rise—government statistics point to 126,240 individual insolvencies in 2025, a 7% increase from 2024—the need for precision has never been greater.

For banks and payment handlers, a customer ref number securely links a payment to a specific insolvency case, allowing for secure, tokenised payment capture that keeps sensitive financial data out of harm's way. You can dig deeper into these insolvency statistics and trends on GOV.UK.

Frequently Asked Questions

Even when you've got the basics down, a few practical questions always seem to pop up about customer reference numbers. Here are some quick, clear answers to the ones we hear most often.

What Is the Difference Between a Customer Ref Number and an Order Number?

It's a common point of confusion, but the distinction is pretty straightforward. Think of a customer reference number as your unique account ID with a business – like your council tax account number, which covers your entire relationship. An order number, on the other hand, is for a single transaction, like the one you get when you buy a new laptop.

For any ongoing service, your customer reference number is permanent. You’ll get a new order number with every separate purchase. That said, many payment systems are flexible and will let you use either number to track down the specific bill you need to pay.

Should a Customer Reference Number Be Kept Private?

A customer ref number isn't sensitive in the same way as your password or credit card details. It’s an operational tool, designed to help companies route your payment correctly or pull up your account information quickly.

While you wouldn't shout it from the rooftops, it's perfectly safe to share with a company's agent or type into a secure payment portal. In fact, its real security power lies in letting you kick off a payment without having to share any of your truly sensitive financial data first.

A customer reference number is a key, not the treasure itself. It unlocks a secure process but has no intrinsic value if intercepted, which is why it's a cornerstone of modern, compliant payment capture methods.

To properly protect the systems that handle these identifiers, organisations should look at advanced cybersecurity measures like 24/7 SOC monitoring. This kind of proactive oversight helps safeguard the entire data ecosystem where these numbers live.

Ready to tighten up your payment security and make your operations run smoother? With Paytia, you can completely rethink how you handle payments, cutting your PCI DSS scope by up to 95% and building huge trust with your customers. See our secure agent-assisted and self-service payment solutions for yourself by visiting https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.