A Guide to Your Interactive Voice Response System IVRS

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think of an interactive voice response system (IVRS) as your business's tireless digital receptionist. It’s on the job 24/7, ready to greet every single caller and guide them exactly where they need to go, using pre-recorded messages, voice recognition, and keypad tones to automate the whole process.

Essentially, it’s the front door to your company's entire phone system.

What Is an Interactive Voice Response System?

We’ve all been there. You call your bank, and instead of a ringing tone, a calm, automated voice greets you with a menu: “Press 1 for account balances, Press 2 for our opening hours, or Press 0 to speak with an agent.” That automated gatekeeper is an IVRS in action. Its job is to figure out what a caller needs—without any human help—and point them towards the quickest solution.

This technology is a game-changer for businesses handling a high volume of inbound calls. It presents callers with a menu of options they can navigate using their phone's keypad (DTMF tones) or simply by speaking their choice. The system then routes them to the right person, provides automated info, or even lets them complete a task all by themselves.

The Evolution from Simple Menus to Smart Systems

Let’s be honest, early IVR systems could be frustrating. They were often rigid, tree-like menus that felt like a maze. But today's systems are a world apart. They’re much more intuitive, often integrating with a company’s customer relationship management (CRM) software to create a genuinely personal experience. Imagine it greeting a returning customer by name or guessing their reason for calling based on a recent order. That’s how an IVRS becomes an intelligent first point of contact, not just a call router.

The growth here is huge. In the UK alone, contact centres process over 1.2 billion calls every year, and IVR technology is becoming essential. Businesses are using it to slash wait times by an average of 30-40%, a massive boost for efficiency, especially in regulated sectors. You can dig deeper into the market trends for IVR systems to see just how quickly it’s expanding.

An effective IVRS doesn't just route calls; it resolves issues. By offering self-service for common queries like checking an order status or paying a bill, it frees up human agents to handle more complex, high-value conversations that require a personal touch.

To make this clearer, let's break down the main jobs an IVRS handles.

Core Functions of an IVRS at a Glance

This table sums up the primary roles an IVR system plays in day-to-day business operations.

| Function | Description | Business Impact |

|---|---|---|

| Initial Call Handling | Acts as the first point of contact, greeting callers professionally instead of letting the phone ring endlessly or hitting a busy signal. | Creates a professional first impression and ensures no call goes unanswered, improving customer perception. |

| Information Gathering | Collects and verifies key details like account numbers or order IDs before the caller even reaches a live agent. | Speeds up resolution time as agents have the necessary context right away, reducing repetitive questions. |

| Self-Service Portal | Empowers customers to find answers or complete tasks on their own, 24/7, like checking a balance or confirming an appointment. | Boosts customer satisfaction by providing instant solutions and reduces the number of routine calls agents have to handle. |

| Intelligent Call Routing | Analyses the caller's needs to direct them to the most qualified agent or department from the very start. | Improves first-call resolution, minimises frustrating transfers, and makes the entire support process more efficient. |

Ultimately, these functions work together to create a smoother, faster, and more satisfying experience for your customers while making your internal teams far more productive.

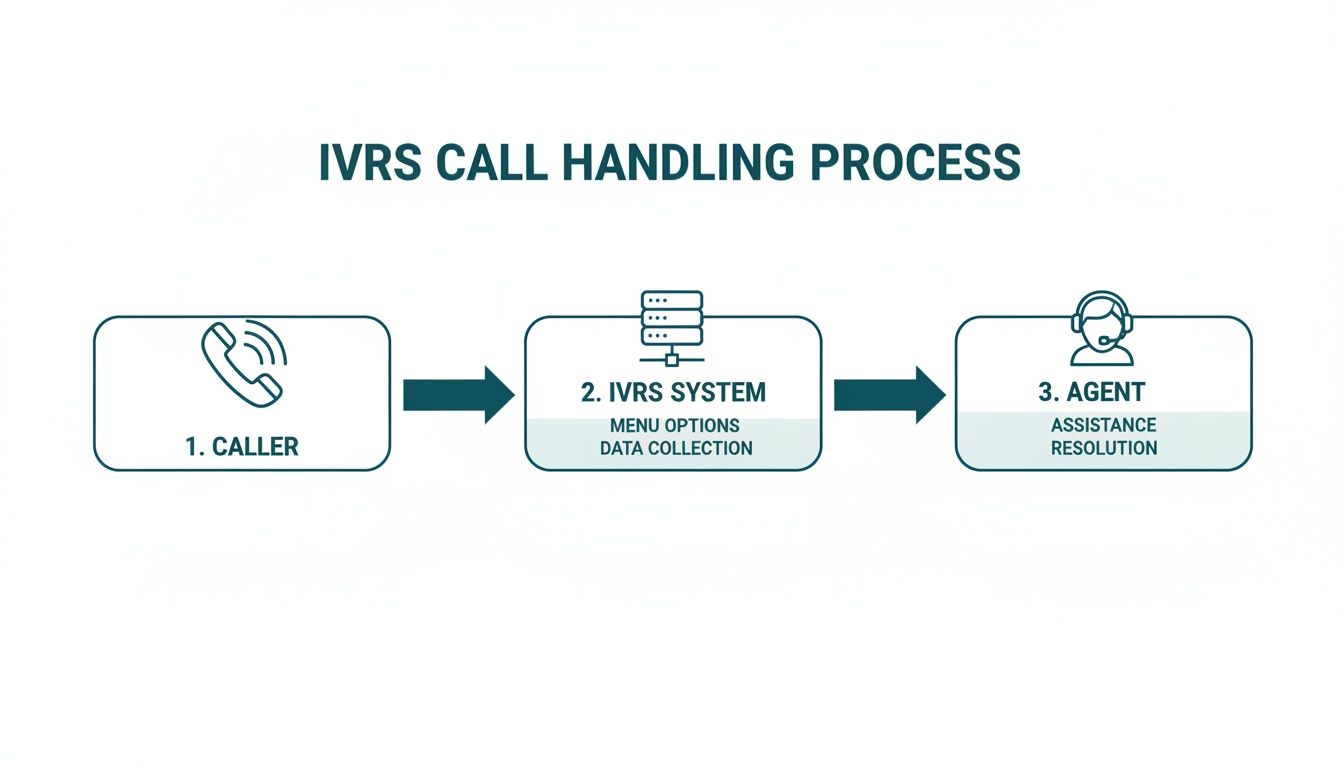

How an IVRS Works Behind the Scenes

To really get to grips with an interactive voice response system IVRS, let’s walk through what happens from the moment a customer dials your number. For the caller, it seems simple enough, but there's a lot of clever tech working in the background to connect them to the right person or information.

The magic starts the instant a call connects. Instead of ringing out, the call is picked up immediately by a telephony interface, which is like the digital front door to your business. This interface is hooked into your company's phone system, whether you're using a modern VoIP setup or a more traditional landline network.

Next, the call is handed off to an application server. Think of this as the brain of the operation. It runs the software that dictates the call flow you've designed, playing your welcome message and presenting the first set of menu options based on a pre-written script.

Capturing and Interpreting Caller Input

So, the caller hears the classic "Press 1 for Sales, Press 2 for Support..." and makes their choice. They can do this in one of two ways:

- Dual-Tone Multi-Frequency (DTMF) Signalling: This is the more technical term for the beeps you hear when you press a key on your phone's keypad. The IVRS is built to recognise these distinct tones and translate them into commands.

- Speech Recognition: More sophisticated systems now use speech recognition, allowing for a much more natural, conversational experience. A caller can simply say, "I need help with a recent order," and the system understands what they mean.

This flowchart below maps out the journey, showing how a call moves from the customer, through the IVRS, and on to a final resolution.

As you can see, the real strength of a good IVRS lies in that seamless handoff between the automated system and, when needed, a human agent.

Connecting to Business Systems

Once the IVRS registers the caller's choice, it gets to work. This is where tying into your other business systems really pays off. For example, if a customer wants to check their order status, the IVRS application server can connect directly to your company's database or CRM.

It fires off a query using the information the caller provided, like an account number. The database then shoots back the relevant data—say, a delivery date or tracking number—which the IVRS converts into a spoken message and plays for the customer.

This ability to pull in real-time information is what turns an IVRS from a simple call router into a seriously powerful self-service tool. It handles the routine stuff instantly, freeing up your agents for more complex issues.

Finally, if the caller's problem does need a human touch, the system does its last, most important job: intelligent routing. Based on the menu choices, the IVRS sends the call to the best-suited agent or department. This makes sure the customer is put straight through to an expert who can actually solve their problem, which is a massive boost for first-call resolution.

The entire sequence happens in just a few seconds, creating a smooth and efficient journey for your customer. To see this in action, take a look at our detailed guide on the IVR payment flow.

The Real Business Benefits of Implementing IVRS

Think of a well-designed interactive voice response system (IVRS) as more than just a call-routing tool. It’s a workhorse, an engine for genuine business growth that delivers tangible results. The advantages go way beyond a polished welcome message, creating a ripple effect that touches your bottom line, agent workload, and customer relationships.

One of the most immediate impacts is on your operational costs. An IVR automates all those routine, repetitive queries that clog up your phone lines—things like checking an order status or confirming an account balance. By deflecting these simple calls away from live agents, you need fewer people to handle basic tasks, which translates directly into savings on staffing and training.

This newfound efficiency frees your experienced agents to do what they do best: navigate the complex, high-value conversations that require a human touch. Instead of just resetting another password, they can focus their energy on retaining a key customer or closing a major sale.

Enhancing Customer Satisfaction and Availability

We live in an on-demand world, and customers expect answers now. An IVR system meets that expectation head-on by offering 24/7 self-service options. It empowers customers to find information or complete tasks whenever it suits them, long after your office has closed for the day. That kind of instant accessibility is a huge win for customer satisfaction.

A smart IVR also tackles one of the biggest customer frustrations: sitting in a queue. When designed properly, it engages callers immediately and gives them a clear path forward. It's a world away from the silent, endless hold music of the past.

By providing immediate, automated solutions for common issues, an IVRS not only reduces call volume but also demonstrates respect for the customer's time, building trust and loyalty with every successful interaction.

This blend of constant availability and efficient service makes your customers feel heard and valued, which is the cornerstone of long-term loyalty.

Boosting Agent Productivity and Performance

Intelligent call routing is where an IVR really shines, acting as a an expert triage nurse for your contact centre. It gathers key details from the caller at the start and uses that information to send them to the perfect agent or department on the very first try.

The knock-on effect on your team’s performance is massive:

- Improved First-Contact Resolution (FCR): When a caller gets to the right person straight away, their issue is far more likely to be solved in one go. This is one of the most important metrics for customer happiness.

- Reduced Call Handling Time: Agents waste less time transferring calls or asking for basic details because the IVR has already done the legwork. They can get straight to the heart of the problem.

- More Meaningful Work: By filtering out the simple stuff, an IVR ensures your agents are tackling interesting, challenging problems. This leads to higher job satisfaction and helps reduce staff turnover.

It all adds up to a more efficient and effective contact centre. For a deeper look at how this technology fits into the bigger picture, you can learn more about the role of IVR in a contact centre environment. The end result? A more productive team, happier customers, and a healthier bottom line.

Securing Payments with IVR and PCI Compliance

Taking payments over the phone is convenient for customers, but for a business, it's a security minefield. It throws you straight into the complex world of the Payment Card Industry Data Security Standard (PCI DSS). The moment a customer reads their card number to one of your agents, that sensitive data enters your world, and with it comes a massive risk of fraud and a heavy compliance burden.

This is a huge headache. The old-school way means your agents hear, and often repeat, sensitive card information. This data can easily end up in call recordings or scribbled on a notepad, turning your business into a prime target for data thieves. A breach doesn't just cost money; it can shatter the trust you've built with your customers for good.

Thankfully, a modern interactive voice response system (IVRS) offers a genuinely elegant solution. It builds a digital fortress around your customer's payment details, securing the entire process from start to finish.

How Secure IVR Payments Work

Picture this: your agent guides a customer through a payment, offering help and reassurance the whole time, but they never hear or see the card details. That’s exactly what a secure IVR payment system makes possible. You get to keep the human touch, but the risky part is handled entirely by technology.

When it’s time to pay, the agent simply triggers the secure payment process. The IVR then prompts the customer to punch in their card number using their telephone keypad.

This is where the clever bit comes in. The system uses DTMF (Dual-Tone Multi-Frequency) masking or suppression. As the customer enters their details, the tones they generate are either completely silenced or replaced by flat, monotone beeps. This makes it impossible for the agent to figure out the numbers, and critically, ensures the sensitive tones are never stored in your call recordings.

The customer's payment data bypasses your business systems completely. It travels directly from their keypad to your payment gateway through a secure, encrypted channel. This one move drastically shrinks your PCI DSS scope, as the cardholder data never even touches your network.

By taking the human element out of the data capture equation—often the weakest link in the security chain—you practically eliminate the risk of internal fraud or an accidental data leak.

The Impact on PCI DSS Compliance

Getting and staying PCI DSS compliant is a difficult and expensive job. It involves deep-dive audits, constant network scans, and tight controls on any system that handles cardholder data. For any business taking phone payments the traditional way, this puts the entire contact centre—desktops, call recording software, network gear, everything—in scope.

When you switch to a secure IVR payment solution, you can take huge chunks of your operation out of that compliance spotlight.

- No Data Storage: Because card details are never stored on your systems or in call logs, you remove the single biggest compliance risk.

- Reduced Scope: Your PCI DSS audit becomes far simpler and cheaper. Your contact centre infrastructure no longer handles raw card data, which can slash your compliance scope by as much as 90-95%.

- Enhanced Security: It gives you a rock-solid, auditable process that proves you're doing everything possible to protect your customers' information.

To see just how different the two approaches are, take a look at the comparison below. For a deeper dive into how it all works, you can also check out our complete guide to IVR payment processing.

Traditional vs Secure IVR Phone Payments

The table below breaks down the fundamental differences between the old, risky method of taking phone payments and the modern, secure IVR approach.

| Feature | Traditional Phone Payment | Secure IVR Payment |

|---|---|---|

| Data Exposure | Agent hears and sees card details, creating high risk. | Agent never hears or sees card details, ensuring zero exposure. |

| Call Recordings | Sensitive data is often captured, posing a major security risk. | DTMF tones are masked, keeping recordings clean and compliant. |

| PCI DSS Scope | Entire contact centre environment is in scope, increasing complexity and cost. | Scope is dramatically reduced, simplifying audits and lowering costs. |

| Customer Trust | Customers may feel hesitant sharing sensitive information verbally. | Builds confidence by demonstrating a clear commitment to data security. |

In the end, using an interactive voice response system for payments isn't just about ticking a compliance box. It’s about forging unbreakable trust with your customers. It’s a clear signal that you value their security, turning a potential vulnerability into a powerful demonstration of your business's integrity.

Common IVRS Use Cases Across Industries

The real magic of an interactive voice response system (IVRS) is just how flexible it is. It's not some off-the-shelf, one-size-fits-all solution. Instead, you can mould it to tackle specific problems in almost any industry you can think of. Think of it as your business’s digital front door, expertly handling all the routine stuff so your team can focus on the conversations that really matter.

From the high-stakes world of finance to the fast-paced environment of healthcare, the applications are incredibly diverse. Each one shows how a well-implemented IVRS can tighten up operations, slash costs, and make the customer's life a whole lot easier.

Financial and Banking Services

In banking, everything comes down to security and efficiency. An IVRS nails both, giving customers a secure and instant way to handle their day-to-day banking without having to queue for an agent. It’s all about giving them 24/7 access to what they need.

You'll commonly see it used for:

- Automated Balance Enquiries: Lets customers get a quick snapshot of their account balance or check on recent transactions.

- Secure Fund Transfers: Walks users through moving money between their accounts, with all the necessary security checks built-in.

- Card Services: Allows customers to activate a new card or, more importantly, report a lost or stolen one immediately. When time is critical, this is a lifesaver.

Healthcare and Appointment Management

For a doctor's surgery or hospital, administrative logjams can get in the way of patient care. An IVRS cuts through the noise by automating appointment booking and routine information requests. This frees up clinic staff and means patients spend less time on hold.

Just think about these scenarios:

- Appointment Scheduling: Patients can book, change, or confirm their appointments whenever it suits them, even if the clinic is closed.

- Prescription Refills: The system can handle repeat prescription requests, firing them straight over to the pharmacy and letting the patient know when it's ready for collection.

- Test Result Notifications: For non-critical results, an IVRS can provide the information securely, saving both the patient and the clinic a phone call.

When you let an IVRS handle these predictable, high-volume jobs, it gives healthcare professionals more time for what they're trained for: direct patient care.

These systems also pave the way for more sophisticated customer support. For instance, many businesses now integrate their IVRS with modern AI-powered support applications to take their customer interactions to the next level.

Utilities and Public Services

Utility companies are constantly fielding calls, whether it's about a bill or a service outage. An IVRS acts as a reliable first line of defence, capable of handling a massive surge in calls during peak times, like when a storm causes a power cut.

The technology lets customers help themselves with common tasks:

- Bill Payments: Customers can securely pay their bill over the phone using their keypad, often tying into the same secure payment tech we've discussed.

- Outage Reporting: An IVRS can log outage reports, pinpoint the customer's location, and even give an estimated time for when services will be back up, all without needing a human agent.

- Meter Reading Submissions: Taking meter readings is a perfect task to automate, saving heaps of time for everyone involved.

And it’s not just big corporations. Charities and non-profits get huge value from IVRS too. They use it to securely process donations over the phone, handle event sign-ups, and share information with supporters, which means more of their precious resources can be spent on their actual mission. Each of these examples proves that an IVRS is far more than just a call routing tool—it’s a powerful asset for any organisation.

Designing an IVR System Customers Actually Like

An interactive voice response system (IVRS) is a bit like a digital receptionist. A bad one sends your customers down a rabbit hole of confusing options, leading to sheer frustration. But a great one? It’s a smooth, helpful, and effortless experience. The secret is all in the design, with a laser focus on the caller’s journey.

The golden rule is simplicity. Keep your menus short and use plain, everyday language. Cut out the jargon. Nobody wants to listen to a long list of options just to find the one they need. A good rule of thumb is to stick to no more than four or five choices per menu.

And here’s the big one: always give people an easy out. A clear, easily found path to a real human being is non-negotiable. Mention the "press 0 to speak to someone" option early and often. Trapping callers in an automated loop when they really need to talk to a person is the quickest way to sour their experience.

Crafting an Intuitive Call Flow

Your IVR script isn’t just a list of commands; it’s a conversation. It needs a professional yet warm tone, delivered through crystal-clear, high-quality audio. If the recordings are fuzzy or hard to understand, you're just setting your callers up for mistakes and annoyance.

The best call flows anticipate what the caller wants before they even have to search for it. Look at your data. If 80% of your calls are about checking account balances, make that the very first option. This simple tweak shows you respect your customer's time and makes the whole process faster for the vast majority of people calling in.

Ultimately, a truly effective IVRS doesn't exist in a vacuum. It must be seamlessly woven into a wider omni-channel customer experience, ensuring every customer interaction feels consistent and connected.

Measuring Success and Optimising Performance

Building a great IVR isn't a one-and-done project. It needs constant attention to stay effective. By tracking the right metrics, you can get a clear picture of what’s working and, more importantly, what isn’t.

Here are a few key performance indicators (KPIs) you should have your eye on:

- Call Containment Rate: This is the percentage of calls that are completely handled by the IVR, without ever needing a human agent. A high rate here means your self-service is hitting the mark.

- Abandonment Rate: This tells you how many people hang up while they're still in the IVR menu. If this number is high, it’s a massive red flag that your system is too confusing or long-winded.

- First-Contact Resolution (FCR): For calls that do get passed to an agent, does the issue get solved on that first try? A well-built IVR gets people to the right department from the start, which gives FCR a huge boost.

By keeping a close watch on these numbers, you can spot the exact points of friction in your IVR. Maybe one particular menu option has a crazy-high abandonment rate, or a self-service function just isn’t working as intended. This data-driven approach lets you make smart, targeted tweaks that genuinely improve the customer experience, turning your IVR from a simple call-routing tool into a real strategic asset.

Frequently Asked Questions About IVR Systems

When you start digging into the world of interactive voice response (IVR), a few practical questions always come up around cost, compatibility, and how the tech actually works. Let’s tackle some of the most common ones to give you the clarity you need.

How Much Does an IVR System Cost?

There's no single price tag for an IVR. The cost can range from a simple, affordable monthly subscription for a cloud-based service to a much larger, one-off investment for a complex system you host yourself.

But the sticker price isn't the whole story. The real question is about the return on investment (ROI). By taking routine, repetitive tasks off your agents' plates, an IVR frees them up for more valuable work and cuts down operational costs. It often pays for itself surprisingly quickly.

Can an IVR Integrate with My Current CRM?

Yes, absolutely. Modern IVR platforms are built to play nicely with other business tools. They use something called Application Programming Interfaces (APIs) to connect to your Customer Relationship Management (CRM) system, payment gateways, and other software you rely on.

This connection creates a much smarter, more unified workflow. For instance, when a known customer calls, the IVR can instantly pull up their record from your CRM. It can then greet them by name or offer personalised menu options based on their history, making the whole experience feel seamless.

What Is the Difference Between IVR and Conversational AI?

Think of a traditional IVR as a clear, structured phone menu. It guides callers down a set path using their keypad—the classic "Press 1 for sales, Press 2 for support." It's predictable and efficient for straightforward tasks.

Conversational AI is the next step up. It uses Natural Language Processing (NLP) to actually understand what a person is saying, allowing for a proper back-and-forth dialogue. Instead of pressing buttons, a customer can just say, "I need to check on my last order," and the system gets it.

Today, many of the best IVR systems are actually a hybrid. They use the simple menu structure for clarity but weave in conversational AI to handle more complex queries. It's the best of both worlds.

Ready to enhance security and streamline your customer payments? Discover how Paytia's secure IVR solutions can reduce your PCI DSS scope and build unbreakable customer trust. Learn more at Paytia.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.