How Pay by Link Creates Secure and Seamless Payments

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Ever had to read your card details out over the phone? It’s not a great experience for anyone. Imagine instead sending your customer a secure, one-time-use digital invoice they can pay right there and then, straight from their own device. That’s the wonderfully simple idea behind pay by link.

It's a straightforward way for businesses to ask for and get paid by sending a unique URL through SMS, email, or even a web chat.

Understanding How Pay by Link Works

At its core, a payment link turns a clunky, multi-step chore into a single, satisfying click. Instead of asking customers to navigate a confusing checkout or give you their sensitive card details, you can generate a secure payment link for the exact amount and send it directly to them.

This is a win-win. Customers get a quick, easy way to pay, and businesses streamline how they get money in the bank. For example, a contact centre agent can wrap up a sale and ping a payment link over during the conversation. The customer then finishes the transaction on their own device – securely and privately.

The Shift to Digital-First Payments

This move towards methods like pay by link is part of a much bigger trend. Here in the UK, the switch to digital has been massive, with card payments now making up a huge 61% of all payments in 2023.

This surge makes secure, modern solutions absolutely vital. For contact centres, Paytia's payment links offer a simple, encrypted way to handle collections without the old security headaches. If you want to dive deeper, the latest UK payment markets report shows how cash usage is expected to plummet to just 4% by 2034.

Pay by link fundamentally changes the payment dynamic. It puts the control and security back into the customer's hands while de-scoping the business environment from sensitive PCI DSS data.

Core Benefits for Modern Businesses

Bringing this kind of payment method into your business solves some very common and very frustrating problems right away. It takes the whole process of collecting payment out of insecure channels and into a protected, digital space.

Here’s what that looks like in practice:

- Enhanced Security: When you use a platform like Paytia, sensitive card details never even touch your systems. This massively reduces your PCI DSS compliance burden and keeps customer data safe.

- Improved Customer Experience: Customers can pay how and when they want, on whichever device they prefer, without the usual friction of a traditional checkout.

- Faster Payments: Sending a direct link means you get paid faster. It drastically shortens the time between invoice and payment, which is great for cash flow.

- Operational Efficiency: Your team spends less time on manual data entry, which cuts down on human error and frees them up to focus on what they do best – talking to customers.

If you’re curious about the mechanics, looking into processes like creating a crypto payment link can offer a good practical insight into how these URLs are generated and used for different kinds of digital transactions.

The Anatomy of a Pay by Link Transaction

To really get to grips with just how simple pay by link is, let's walk through a single payment from start to finish. It’s a beautifully smooth workflow that gets rid of all the usual hassle of chasing payments manually, making it an obvious win for any business looking for efficiency.

It all kicks off when you need to take a payment. Maybe it's a contact centre agent closing a sale over the phone, your accounts team chasing an outstanding invoice, or even an automated reminder for an overdue utility bill.

Instead of the old, insecure way of asking for card details, the agent or system creates a unique, secure payment link for the exact amount needed. This is the critical first move. The link is tied to a single transaction, which tightens up security and drastically cuts down on human error.

The Customer Payment Journey

With the link ready, it’s sent directly to the customer through whatever channel they prefer—SMS, email, or even a direct message in a web chat. This flexibility is key; you meet the customer where they are, giving them an easy, immediate way to pay. All they have to do is click.

That click takes them to a secure payment page on their own phone or computer, often branded with your company's logo. Here, they can double-check the amount and enter their card details in a completely private, PCI DSS compliant environment. This is where services like Paytia shine, by ensuring your business systems never even see, let alone store, any sensitive card data.

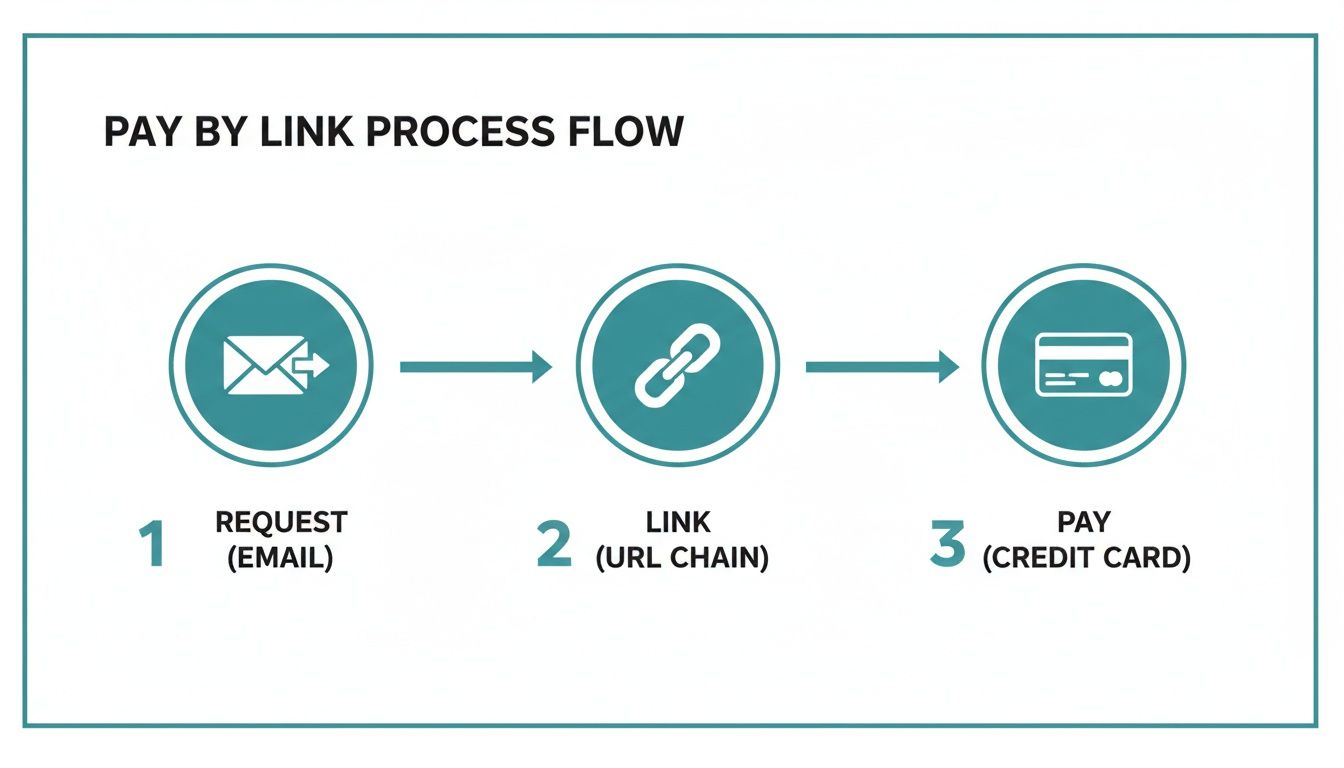

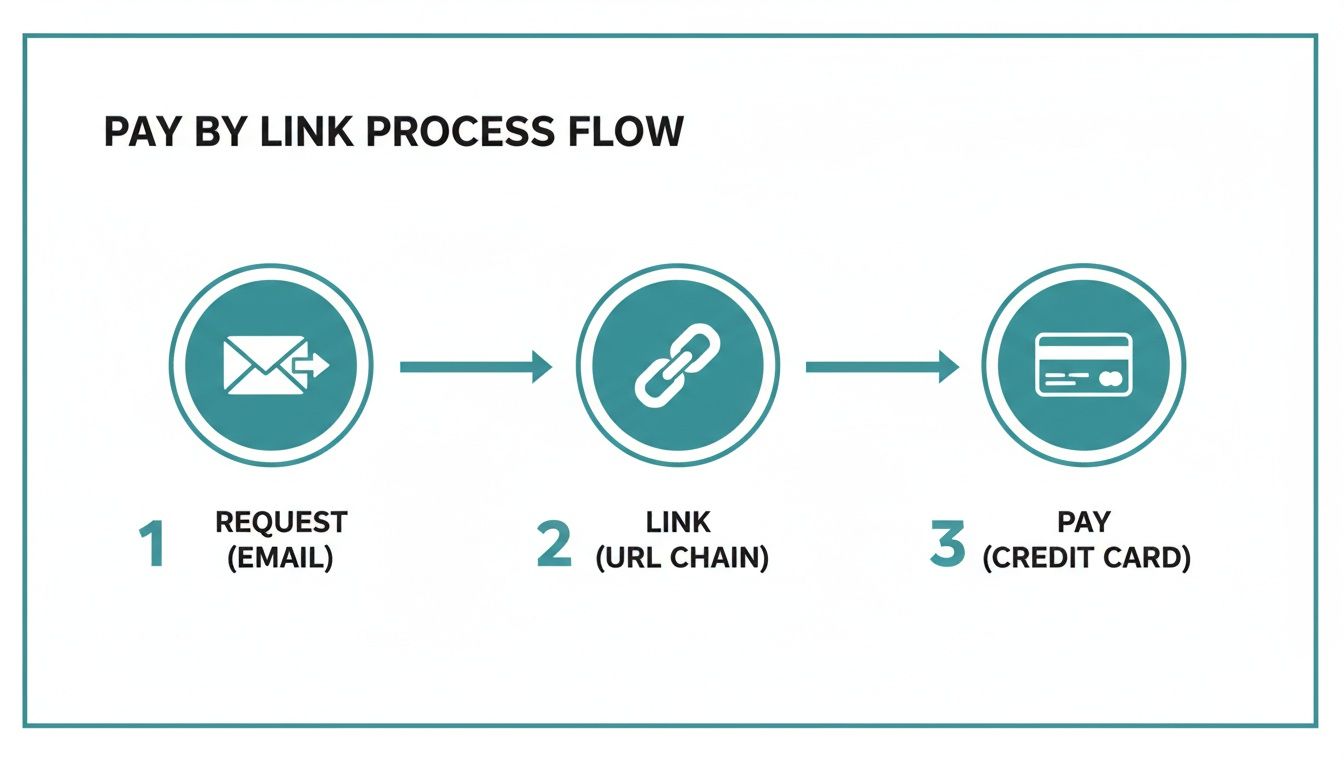

The flow is really that straightforward—request, link, and payment—as you can see below.

This diagram shows perfectly how the process takes your business out of the loop when it comes to handling sensitive data, shifting the whole interaction to a secure portal that the customer controls.

Behind the Scenes: Processing and Confirmation

Once the customer hits 'pay', their details are sent directly to the payment gateway for authorisation. This all happens in a matter of seconds. The gateway checks for sufficient funds and processes the payment, all without your business ever being exposed to the raw card numbers.

The best part? Everyone gets instant confirmation. The customer sees a success message on their screen, while your systems are updated in real-time to mark the invoice as paid. This immediate feedback loop is fantastic for keeping customers happy and your records clean.

By automating the journey from request to confirmation, pay by link doesn't just make payments easier; it fundamentally reduces agent handling time and eliminates the manual errors that often plague traditional payment methods.

So, let's break that end-to-end process down into a few clear stages:

- Link Generation: Your business creates a unique, single-use URL for a specific transaction amount.

- Secure Transmission: The link is sent to the customer via their preferred channel (email, SMS, chat).

- Customer Interaction: The customer opens the link on their device and types their card details into a secure, branded page.

- Gateway Authorisation: The payment processor securely handles the verification and transfer of funds.

- Instant Confirmation: Both you and your customer get an immediate notification that the payment went through successfully.

This entire flow is designed from the ground up for speed, security, and simplicity, creating a better, smoother experience for everyone involved.

How Pay by Link Fortifies Security and Compliance

In the world of payments, security isn't just a feature; it's the very foundation of customer trust. When someone gives you their card details, they’re trusting you to keep them safe. This is where pay by link solutions completely change the game, offering a fundamentally smarter way to handle sensitive data and navigate complex compliance rules.

The real magic behind its security is a simple but powerful idea: de-scoping. By sending a customer a secure link, the entire payment process is lifted out of your business environment. The customer enters their card numbers directly into a highly protected payment gateway. This means their sensitive information never even touches your systems, networks, or call recordings.

For any business, but especially those in regulated industries, this is massive. De-scoping can slash your PCI DSS (Payment Card Industry Data Security Standard) compliance burden by as much as 95%. Think of the time, cost, and headaches saved on audits.

Key Security Technologies at Play

This security model isn't just a clever workaround; it's powered by some serious tech. One of the cornerstones is tokenization. Instead of storing a customer's actual 16-digit card number, the system swaps it for a unique, non-sensitive string of characters—a 'token'. This token can be safely stored and used for future payments without ever exposing the real card details again.

On top of that, robust end-to-end encryption scrambles the data from the moment it leaves the customer’s device until it safely reaches the payment processor, making it completely unreadable to anyone in between.

These layers work together to create an ironclad payment channel, protecting both you and your customer. To get a better handle on what this means for your specific obligations, our guide on achieving PCI DSS compliance is a great place to start.

Comparing Security in Pay by Link vs Traditional Phone Payments

It's one thing to talk about security features, but seeing them side-by-side with old-school methods really highlights the difference.

| Security Feature | Pay by Link Solution | Traditional Phone Payment (MOTO) |

|---|---|---|

| Data Handling | Customer enters details directly into a secure portal. Sensitive data never touches the merchant's system. | Agent hears, repeats, and often manually types card details into a system. High risk of exposure. |

| PCI DSS Scope | Dramatically reduced. The merchant's environment is 'de-scoped' from handling cardholder data. | Full scope applies. The entire contact centre environment, including agents and systems, must be compliant. |

| Call Recordings | Card details are never spoken, so recordings remain clean and compliant without complex pause/resume tech. | Requires 'pause and resume' software, which is prone to human error and can still capture sensitive data. |

| Tokenization | Standard practice. A secure token is generated and used for repeat billing, protecting the original card number. | Not inherent. Often requires separate, costly integrations or manual processes, if used at all. |

| Fraud Prevention | Built-in controls like single-use links, expiry timers, and real-time validation are common. | Relies heavily on agent training and manual checks (e.g., CVV), which can be inconsistent. |

The takeaway is clear: pay by link shifts the security burden from your team to a purpose-built, secure platform, massively reducing your risk profile.

Built-In Fraud Controls

Good pay by link solutions go beyond just meeting compliance standards; they actively fight fraud. For example, payment links can be set to be single-use only, stopping them from being passed around or used by bad actors. You can also set expiry times, so a link automatically becomes inactive after a few hours or days, closing another potential window for misuse.

These controls are more important than ever. With the UK's digital payments market projected to hit an incredible USD 43.7 billion by 2034, the move away from cash is undeniable. This explosive growth makes robust security an absolute must. Solutions like Paytia's channel separation and tokenization are crucial for staying aligned with GDPR and achieving certifications like Cyber Essentials Plus.

Ultimately, adopting a secure pay by link provider doesn't just tick a box. It strengthens your defences, builds lasting customer confidence, and frees you up from the immense responsibility of safeguarding payment data yourself.

Real-World Applications Across Industries

It’s all well and good talking theory, but what really matters is seeing how pay by link solves real, tangible problems out in the wild. This isn't just some niche tech; it’s a seriously versatile tool that makes a massive difference across a whole host of sectors, each with its own payment headaches.

From buzzing contact centres to your local council, the power to send a simple, secure payment request is a game-changer for both customer experience and operational efficiency. Let's dig into some of the most common places you'll see it in action.

Empowering Contact Centre Agents

If you've ever worked in a contact centre, you know the constant pressure to be quick, helpful, and completely secure. Taking card payments over the phone used to be a nightmare—a clunky, high-risk process that put both agents and customers in an awkward spot. Think of all those clumsy 'pause and resume' call recording systems.

Now, an agent can wrap up a sale or settle an account right in the middle of a conversation, simply by sending a payment link to the customer's phone. The customer handles the transaction on their own device, which means no sensitive card details are ever spoken aloud or keyed into the contact centre’s system. It’s an instant security and compliance win that makes the whole interaction feel much more modern and smooth.

Pay by link turns a point of friction into a moment of trust. Instead of asking for sensitive data, agents empower customers to pay securely on their own terms, improving first-call resolution rates and overall satisfaction.

Recovering eCommerce Revenue

Every online retailer feels the sting of the abandoned shopping basket. A customer fills it up, heads to the checkout... and vanishes. A pay by link strategy gives you a direct and surprisingly effective way to bring those potential buyers back.

Forget sending another generic "You left something behind!" email. Instead, you can ping them a targeted message with a direct link to their pre-filled checkout. This simple step cuts out all the friction, making it ridiculously easy for the customer to pick up exactly where they left off and finish the purchase in a couple of taps. It's a proactive move that can give your conversion rates a serious boost.

Simplifying Billing and Collections

Think about industries like utilities, insurance, or housing associations. They're constantly juggling a mix of recurring bills and one-off payments. Chasing overdue invoices or processing odd fees can be a huge administrative drain.

Payment links bring incredible flexibility to these scenarios:

- Utility Bills: A customer can clear an outstanding balance instantly via a link sent by SMS while they’re on the phone.

- Insurance Claims: An insurer can quickly take an excess payment or even send a secure link to disburse a payout.

- Donations: Charities and schools can accept one-off or recurring donations effortlessly, making it easier for supporters to give.

This adaptability is more important than ever as payment habits in the UK continue to shift. Innovations like Faster Payments are projected to handle a staggering 7.2 billion transactions by 2033, quickly becoming the go-to for business-to-individual transfers. As more people demand digital options, using secure payment links via platforms like Paytia allows regulated firms to slash their PCI scope by 90-95% and cut compliance costs.

You can learn more about how remote banking is reshaping UK payments and why it matters for your business. This is a trend that makes instant, secure collections an absolute necessity.

How to Integrate a Pay by Link Solution

Bringing a new payment technology into your business should feel like a genuine step up, not a technical headache. Getting a pay by link system up and running is often surprisingly straightforward, with a few different routes you can take depending on your team's technical know-how and how you plan to use it. The whole point is to get you taking secure payments faster, without turning your existing operations upside down.

For many businesses, the quickest win is a no-code solution. Think of it as a simple web portal your team can log into. From there, they can create payment links on the fly and send them out to customers. This approach needs zero development work and can be live in minutes, making it a perfect fit for smaller teams or anyone who needs to solve a payment problem right now.

You get immediate value by shifting payments into a secure, compliant channel without ever needing to pull in an IT resource. All the core benefits of top-notch security and compliance are there from day one.

Deeper Integration with APIs

For businesses aiming for a slicker, more automated workflow, an Application Programming Interface (API) is the way to go. An API is essentially a bridge that lets your own business software—like your CRM or accounting platform—talk directly to the pay by link service.

This means you can build the payment link feature right into the tools your team already lives in. Imagine an agent clicking a button inside your customer management software to instantly generate and send a link. Once the customer pays, the status automatically updates in their record. No more manual tracking. If you want to dive deeper, you can learn more about the mechanics of a payment gateway API integration and how it puts financial workflows on autopilot.

Connecting with Telephony and Contact Centre Platforms

A huge piece of the puzzle for any contact centre is how a new tool plays with your existing phone system (PBX/VoIP). It’s a critical question. Leading providers, like Paytia, offer ready-made integrations that connect the payment service directly with your call-handling platform.

This creates one unified space where agents can manage both calls and payments without having to jump between different apps. It makes for a much smoother, more professional experience for the customer and keeps your agents' workflows clean and efficient.

The right integration path really comes down to what you want to achieve. A simple portal gets you started immediately, while an API integration unlocks powerful automation and embeds secure payments deep within your core business processes.

Whichever path you take, the rollout typically follows a few common-sense stages:

- Provider Selection: Find a partner who offers the integration options you need, has the right security credentials, and can give you the support to make it work.

- Account Setup: This is where you configure your account, add your company branding to the payment pages, and give your team members access.

- Integration (If Applicable): If you're going the API route, your developers will use the provided documentation to connect your systems to the payment platform.

- Testing: Always run a few test transactions. This ensures everything is working perfectly before you start taking real customer payments.

- Team Training: A quick walkthrough is usually all that’s needed to show your team how to create and manage links in the new system.

When you map it out like this, you can see that bringing a pay by link solution on board is a very manageable project—one that delivers a big return, fast.

Best Practices for Using Payment Links

Getting a pay by link system up and running is a brilliant first step. But to really make it work for your business, you need to go beyond just sending out links. The secret lies in optimising the entire experience to drive up completion rates and build stronger customer trust.

It all starts with trust and clarity. When a customer clicks your link, the payment page they land on must feel familiar. Seeing your company logo and consistent branding instantly tells them they're in the right place, which is a huge factor in preventing them from dropping off. Just as vital is crystal-clear communication—make sure the payment amount and what it’s for are impossible to misunderstand.

Measuring and Optimising Performance

You can’t improve what you don’t measure. To sharpen your process, you need to be tracking a few key performance indicators (KPIs) to get a clear picture of what's working and what isn’t.

Start by focusing on these core metrics:

- Payment Completion Rate: Out of all the links you send, what percentage actually get paid? This is your North Star metric for success.

- Time-to-Payment: On average, how long does it take for a customer to pay after you send the link? A shorter timeframe is great news for your cash flow.

- Channel Performance: Do links sent by SMS get paid faster than those sent via email? Knowing this helps you pick the right tool for the job.

A high completion rate is a direct reflection of a frictionless customer journey. If your rate is low, it’s a clear signal to re-examine the clarity of your communication or the simplicity of your payment page.

Keeping an eye on these numbers helps you pinpoint any friction. For example, if the time-to-payment is dragging on, it might mean your follow-up process needs a bit of a nudge. This is exactly where automation comes in. Solutions like Paytia’s Payment Chase can automatically send friendly reminders for unpaid links, taking that manual, repetitive task off your team’s plate.

This frees up your staff to handle more meaningful customer conversations instead of chasing down payments. For a deeper dive into how this tech improves the whole experience, have a look at the benefits of using secure payment links in our detailed guide. By blending a slick, branded journey with data-driven tweaks and smart automation, you can turn a simple pay by link tool into a real strategic advantage.

Common Questions About Pay by Link

It's smart to have questions before you jump into any new payment method. Getting the right answers is the first step to feeling confident. Let’s run through some of the most common queries we hear about pay by link, clearing up how it works and where it can fit into your business.

How Secure Is Pay by Link for Customer Data?

This is usually the first question, and for good reason. The entire point of a secure pay by link system is to completely remove your business from the flow of sensitive payment information.

When a customer clicks to pay, their details are sent straight to a PCI DSS compliant payment gateway through a fully encrypted connection. Your systems never touch the raw card data. Modern solutions also use tokenization, which swaps actual card numbers for a secure, meaningless token. This immediately slashes your security and compliance burden.

Can Payment Links Be Used for Subscriptions?

They absolutely can. While they're a natural fit for one-off payments, a good platform is built for more. You can easily use pay by link to kick off recurring payments or subscription plans.

The customer simply authorises the first payment through the link. The system then securely tokenizes their card details, allowing you to automatically handle all future collections without needing them to enter their information again.

How Does This Fit with My Existing Business Software?

Flexibility is key here. You can get started almost instantly with a simple, no-code web portal that your team can access from anywhere. No technical setup required.

But if you want to go deeper, powerful APIs let you embed pay by link features directly into your CRM, accounting software, or other core business tools. This creates a completely seamless workflow for your staff and automates the entire payment request process.

What Happens if a Customer Does Not Pay?

We've all been there—an email gets buried or life just gets in the way. Proper pay by link solutions have tools to handle this without adding to your team's workload.

You can set expiry dates on links to add a little urgency. Better yet, you can set up automated follow-up emails or texts to send polite reminders for any unpaid links. It saves your team from having to manually chase down every late payment.

Ready to see how a secure, convenient payment process can transform your operations? Find out how Paytia can help you implement a secure pay by link solution that protects your customers and makes getting paid simpler than ever. Learn more at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.