How to Securely Take Pay Over Phone Payments A Complete Guide

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

To let customers pay over phone securely, you'll need specialised tech like DTMF masking and tokenisation. These tools are designed to shield customer card details from your agents and prevent them from being stored in call recordings, which is absolutely crucial for PCI DSS compliance.

Why Phone Payments Still Matter in a Digital-First World

It’s easy to think that online checkouts and digital wallets have taken over completely, but a huge amount of business is still done over the phone. Think about it. When it comes to critical transactions—settling an insurance premium, paying a late utility bill, or sorting out council tax—many people still prefer speaking to a real person.

This isn’t about being stuck in the past; it’s about trust, reassurance, and accessibility. A website just can't offer the same level of personal assurance.

This presents a real challenge. Customers want the convenience of sorting out their accounts with a quick phone call, but they rightly demand total security for their payment details. This leaves businesses walking a tightrope: how do you offer a great customer experience without getting tangled in the complex, unforgiving web of the Payment Card Industry Data Security Standard (PCI DSS)?

The Human Touch in High-Stakes Transactions

Some conversations just work better with a human. A customer trying to understand a confusing charge or set up a complex payment plan needs the empathy and quick thinking of a trained agent. A voice on the other end of the line can cut through the confusion, confirm details, and give immediate peace of mind that a payment has gone through correctly.

This is especially true for:

- Urgent or overdue payments: Stress levels are high, and people need absolute clarity.

- High-value transactions: Think booking a holiday or buying custom-made goods.

- Customers without easy digital access: It’s vital to be inclusive for everyone.

In the UK, phone payments remain a bedrock of contact centre operations. With over 88 million active mobile subscriptions, the potential customer base for voice transactions is enormous. And while we’re spending fewer minutes on personal mobile calls, off-net calls (often between businesses and customers for things like payment collection) still racked up 18.6 billion minutes. This just goes to show how much we still rely on the phone for high-trust interactions. You can find more UK mobile usage statistics to get a clearer picture of the landscape.

The real value in offering a pay-by-phone option is meeting customers where they are most comfortable. If you try to force everyone down a single digital path, you risk alienating a huge chunk of your customer base and missing out on revenue.

Navigating the Security and Compliance Minefield

Security has always been the biggest hurdle for phone payments. The old method—having an agent ask a customer to read out their card details—is now seen as incredibly risky. Those details could be overheard, scribbled down, or even captured in call recordings, creating a massive data breach risk and putting your entire operation in the full scope of PCI DSS.

This guide is your roadmap to getting it right. We'll walk through the modern technologies and processes that let you build a secure, compliant, and efficient system to pay over phone. The goal is to turn your contact centre from a compliance headache into a smooth and effective revenue channel.

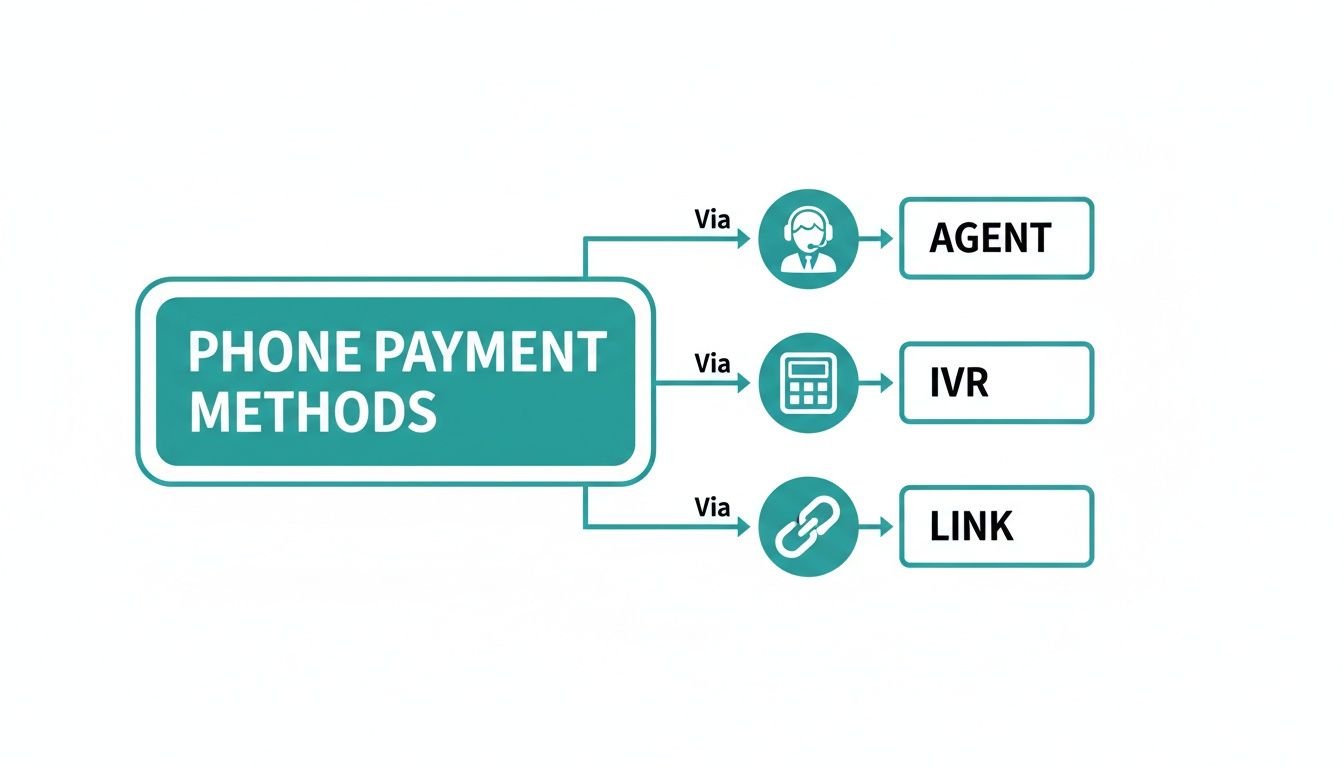

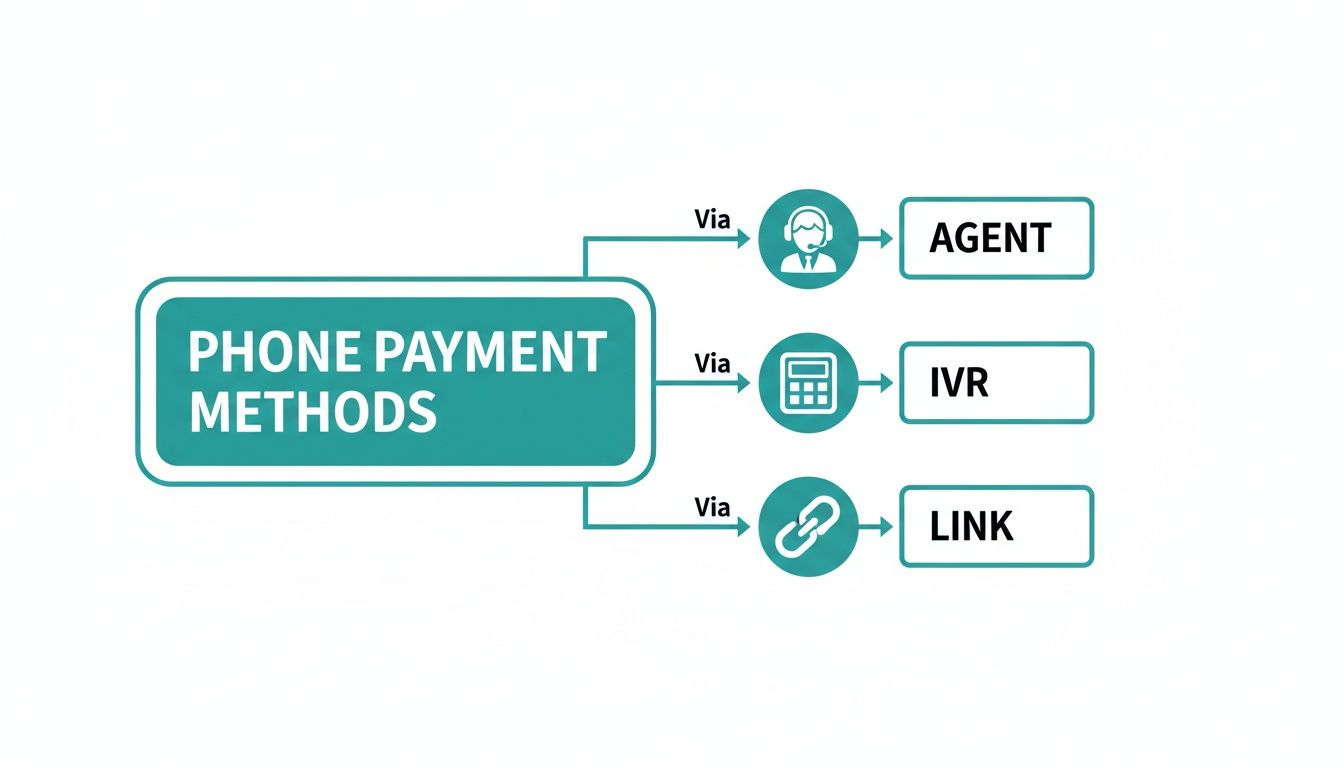

Choosing the Right Method for Capturing Phone Payments

Deciding how a customer will pay you over the phone is one of the most critical choices you'll make. This isn't just a technical decision; it's a careful balancing act between watertight security, a smooth customer experience, and your own team's efficiency.

There’s no single "best" way to do it. The right approach depends entirely on your business, your customers, and the kind of conversations you're having. Let's cut through the jargon and look at the three main options from a real-world perspective.

Agent-Assisted Payments: The Human Touch

This is the classic phone payment scenario, but with a crucial modern twist. An agent stays on the line to guide the customer, but secure technology ensures they never actually hear or see the sensitive card details. It’s perfect for those moments that demand a personal connection or a bit of hand-holding.

Imagine a travel agent finalising a complex, multi-part holiday booking. The customer is about to make a significant payment but has last-minute questions. An agent can provide that final piece of reassurance, answer their queries, and then seamlessly guide them through the payment process, staying on the line to confirm everything went through.

This method really shines for:

- High-value or complex sales: Where customers need to feel confident before committing to a large payment.

- Customer support calls: Like sorting out a billing issue and then taking the corrected payment on the same call.

- Less tech-savvy customers: Who often feel more comfortable and secure when a person is there to help.

The real magic here is blending personal service with robust security. The customer feels looked after, yet their data is completely shielded from human error or potential misuse.

Automated IVR Payments: The Efficiency Engine

For routine, high-volume payments, having an agent handle every single one is a massive bottleneck. This is where an Interactive Voice Response (IVR) system is a game-changer. An IVR lets customers pay their bills 24/7 without ever speaking to a person, freeing up your team to handle more valuable, complex queries.

Think of a local council or a utility company. Thousands of people need to pay their monthly bill. An automated IVR handles this relentless volume without breaking a sweat. A customer calls, enters their account number, hears their balance, and uses their phone's keypad to securely key in their card details. Job done.

An IVR system is like the perfect employee for repetitive work. It never calls in sick, works around the clock, and processes standard payments with 100% accuracy, driving down your operational costs.

This self-service model is ideal for straightforward, recurring payments like council tax, subscription renewals, or clearing an outstanding invoice. It gives customers a quick, convenient way to pay whenever it suits them. If you want to dive deeper into this, our guide on secure telephone payment solutions covers these methods in much more detail.

Secure Payment Links: The Best of Both Worlds

So, what happens when a conversation starts with an agent, but the customer would rather enter their details privately on their own device? Secure payment links, sent by SMS or email during a live call, offer a brilliant hybrid solution.

Picture an insurance agent discussing a policy renewal. After agreeing on the terms, the agent can instantly text a unique, secure link to the customer's smartphone. The customer taps the link, enters their card information on a secure web page, and the agent’s screen immediately shows a confirmation once the payment is successful.

This approach gives you the personal guidance of an agent combined with the privacy and familiarity of a self-service checkout. It keeps sensitive data away from the voice channel entirely and lets customers use a payment method they already know and trust.

Comparison of Phone Payment Capture Methods

Choosing the right method means weighing up these different factors. The table below offers a simple breakdown to help you see which approach fits your business best.

| Method | Best For | Customer Experience | PCI-DSS Scope | Implementation Effort |

|---|---|---|---|---|

| Agent-Assisted | Complex sales, high-touch support, high-value transactions | Personalised and reassuring, guided by a human expert | Minimal (with DTMF suppression) | Low to Moderate |

| Automated IVR | Routine bill payments, high-volume, 24/7 service | Fast and efficient for simple, predictable transactions | Minimal | Moderate to High |

| Secure Payment Links | Blending agent support with self-service, mobile-first customers | Modern and flexible, empowers customer self-entry | Minimal | Low |

Ultimately, the smartest strategy might not be to pick just one. Many businesses find success by using a blend of all three. You could funnel routine payments to an IVR, empower your sales team with agent-assisted tools, and offer secure links as a convenient alternative for anyone who asks. By matching the method to the moment, you create a seamless and secure experience that works for everyone.

The Core Technologies That Make Phone Payments Secure

When you take a payment over the phone, security isn't just a feature; it's the entire foundation of the process. Get it wrong, and you're not just risking a data breach. You're looking at eroded customer trust and the full, daunting scope of PCI DSS compliance.

Thankfully, there's a suite of powerful technologies working behind the scenes to lock down modern phone payments. You don't need to be a security engineer, but understanding these core components helps you ask the right questions when choosing a provider. It's about knowing what to look for to ensure sensitive cardholder data never even touches your business environment.

The main ways payments are captured over the phone all rely on the security tech we're about to break down.

Whether an agent is guiding a customer or an automated system is handling the transaction, the goal is always the same: isolate and protect the payment data.

DTMF Suppression and Masking

You know those distinct beeps your phone keypad makes? Those are Dual-Tone Multi-Frequency (DTMF) tones. Each number has a unique sound, which means if your call recording system picks them up, you're effectively storing a customer's card number in an audio file. That’s a massive security risk.

This is where DTMF suppression and masking comes in. Think of it as a digital muffler. When a customer keys in their card details, this technology intercepts the tones before they can reach your agent or get captured by your call recording system. The agent might hear a flat, monotonous tone or just silence, while the sensitive DTMF signals are routed directly and securely to the payment gateway.

This simple but incredibly effective control is your first line of defence. It ensures no one in your organisation—and no audio recording—ever has access to the raw card number. You can find a more technical deep-dive in our guide to understanding DTMF masking technology.

Channel Separation for Data Isolation

Next up is a concept called Channel Separation. Picture a phone call as a single highway where your conversation (voice data) and the customer's payment details (card data) are travelling together. If they stay in the same lane, there's always a risk of a data collision or interception.

Channel Separation solves this by creating a completely separate, secure tunnel just for the payment information. You continue talking to the customer on the main voice channel, but the moment they start entering their card details, that data is cleverly diverted into its own encrypted, isolated path.

This technical segregation is crucial for reducing your PCI DSS scope. It provides clear proof that cardholder data never gets mixed with your standard call traffic and never enters your network, systems, or agent's desktop environment.

Splitting the voice and payment data streams creates a verifiable barrier that auditors love to see. It’s a clear signal that your business processes are designed from the ground up to keep sensitive information out.

Tokenization: The Digital Safe Deposit Box

Even with the data safely separated, you still need a way to reference a transaction for things like refunds or recurring billing. This is where Tokenization plays a vital role.

Tokenization is simply the process of swapping a customer's actual 16-digit card number (the Primary Account Number or PAN) for a unique, non-sensitive placeholder called a "token." This token is generated by your payment gateway and can be safely stored in your systems.

Here's a quick look at how it works:

- A customer enters their card details, which are sent directly to the payment gateway via a secure channel.

- The gateway processes the payment and stores the real card details in its ultra-secure, PCI-compliant vault.

- It then creates a random token (something like

tok_1a2b3c4d5e) and sends it back to your system.

This token is completely useless to a fraudster. It has no mathematical link to the original card number and can't be reverse-engineered. But for you, it's gold. You can use it to safely initiate future transactions for that customer without ever having to handle their real card details again.

End-to-End Encryption: The Armoured Truck

Finally, End-to-End Encryption (E2EE) is the digital armoured truck that protects the data during its journey. From the instant a customer enters their first digit on the keypad until that data is safely received by the payment gateway, E2EE scrambles it into an unreadable format.

Only the payment gateway holds the "key" to unlock and read this information. This means that even in the incredibly unlikely event that a fraudster managed to intercept the data in transit, all they would see is a meaningless jumble of characters. This powerful layer of security shields every single pay over phone transaction from eavesdropping and man-in-the-middle attacks, giving you and your customers total peace of mind.

Making Payments a Seamless Part of Your Workflow

Let’s be honest, a powerful payment solution is pretty useless if it forces your team to constantly jump between different applications or manually copy and paste customer details. A truly effective system should feel like a natural part of your existing setup, not another clunky hurdle to get over.

When you embed secure phone payments directly into your workflow, you’re making the entire process smarter, faster, and far less prone to human error. The real goal here is to create a unified experience where taking a payment is just another seamless part of the customer conversation.

The Three Pillars of Smart Integration

To get this right, your secure payment platform needs to talk effortlessly with the tools your team already relies on every day. I like to think of it as building bridges between three key islands in your business ecosystem.

Your Telephony Platform: This is your contact centre software, VoIP system, or even a platform like Zoom. A solid integration means your payment solution knows when a call is happening and can be launched straight from the agent’s call control panel.

Your Payment Gateway: Whether you use Stripe, Worldpay, or Adyen, the system has to pass transaction data to them securely for authorisation. This is the fundamental connection that actually gets the money processed.

Your Business Systems (CRM/ERP): This is your Customer Relationship Management software or Enterprise Resource Planning tool. This link is absolutely vital for automating your record-keeping and making sure you have one single source of truth for every customer interaction.

When these three pillars are properly connected, that's when the magic happens.

Picture an insurance agent taking a premium payment. The second the transaction is approved, a record is automatically created and logged against the customer's profile in the CRM, complete with the transaction ID and payment status. No manual data entry. No risk of typos. No wasted time. This is what separates a basic tool from a genuine business asset.

Choosing Your Integration Path: APIs vs. Pre-Built Connectors

When it comes to actually making these connections, you generally have two paths to choose from. The right one for you will come down to your technical resources, your timeline, and just how complex you need the workflow to be.

A pre-built integration or connector is the fastest way to get up and running. These are essentially ready-made links between your payment platform and popular systems like Salesforce, HubSpot, or major telephony providers. They offer a plug-and-play experience that can often be configured in minutes, not weeks, making them perfect for businesses that need a quick, reliable solution without a big development project.

On the other hand, an Application Programming Interface (API) gives you complete creative control. An API is a toolkit that lets your developers build completely custom workflows tailored to your exact business processes. You could, for example, build a workflow where a successful payment automatically triggers a fulfilment order in your ERP and sends a personalised thank-you email from your marketing platform.

Think of it like this: a pre-built connector is like buying a high-quality, ready-made suit that fits well straight off the rack. An API is like hiring a master tailor to create a bespoke suit, designed to fit you and you alone, perfectly.

There's no single right or wrong answer here; it all boils down to what your business needs. We often see companies start with pre-built connectors for speed and then explore API projects later to add more advanced automation as they grow.

Creating a Unified Agent Experience

At the end of the day, all the technical details of the integration should be completely invisible to your agents. Their focus needs to be on the customer, not on juggling multiple screens or trying to remember a complicated procedure for taking a payment.

A well-integrated system makes an agent's life easier by bringing everything they need into a single view. When a customer wants to pay over the phone, the agent shouldn't have to open a separate terminal or website. Instead, they should be able to trigger the secure payment process with a single click from within the application they are already using, whether that's your CRM or contact centre dashboard.

This unified approach has some serious benefits:

- Fewer Errors: Automating data transfer between systems gets rid of the manual copy-pasting that leads to costly mistakes.

- Faster Calls: Agents can handle payment requests much more efficiently, which cuts down average handling time and makes the whole contact centre more productive.

- More Confident Agents: A simple, intuitive process makes agents feel more comfortable and professional when handling sensitive financial details.

By focusing on seamless integration, you're doing more than just adding a new payment method. You’re refining your entire operational process, making it more secure, efficient, and ultimately, a much better experience for your customers.

Making PCI DSS Compliance Manageable by Shrinking Your Scope

For any business handling card payments, the Payment Card Industry Data Security Standard (PCI DSS) can feel like a mountain to climb. It’s a dense set of rules designed to stop fraud, but getting and staying compliant often means expensive audits, tricky system changes, and a whole lot of paperwork.

The heart of this challenge lies in a concept called PCI scope. Put simply, your scope covers every person, process, and piece of technology in your business that stores, processes, or transmits cardholder data. The wider your scope, the bigger—and more expensive—your compliance headache.

This is where the technologies we've been talking about, like DTMF suppression and tokenisation, really come into their own. Their entire purpose is to shrink that scope as much as possible. By putting smart controls in place that stop sensitive card data from ever touching your business environment, you make your compliance journey dramatically simpler.

How Technology Puts a Fence Around Your Business

Think about a traditional call centre. An agent takes card details over the phone, reading them out and typing them in. In that scenario, your PCI scope is enormous. It includes the agent themselves, their computer, the phone network, call recording systems—the lot. Every single one of those components has to be locked down according to strict PCI DSS rules.

Now, picture a modern, secure pay over phone system. When a customer taps their card details into their keypad, that sensitive data is completely isolated. It goes straight to the payment gateway, never crossing the agent's screen, never getting saved in call recordings, and never entering your internal network.

That’s scope reduction in a nutshell. You’re effectively building a secure fence that card data cannot cross to get into your environment.

For contact centres, this is a game-changer. Adopting a PCI DSS Level 1 certified platform can slash the costs and effort of compliance by reducing scope by up to 90-95%. This is typically done using tokenisation to keep payment data out of systems like Zoom, web chat, or VoIP recordings. This is more relevant than ever as payment habits shift. UK Finance reports that 12% of consumers are now using Buy Now Pay Later services, many of which start with a phone call. At the same time, high-value CHAPS transfers totalling £98.6 trillion often need some form of verbal verification. You can dig into more UK payment trends to get the full picture.

Once these elements are taken out of scope, they no longer need to go through rigorous and costly PCI DSS audits.

What to Look for in a Secure Payment Provider

Choosing the right partner to help you do this is critical. Not all solutions are built the same, and you absolutely need a provider that can give you the audit-ready controls and paperwork to prove you’re compliant.

Here's a straightforward checklist of what you should be asking for.

Your Essential Provider Checklist:

- PCI DSS Level 1 Certification: This is the highest level of security validation. It's a non-negotiable. Always ask to see their Attestation of Compliance (AOC).

- A Full Toolkit for De-Scoping: The provider must offer technologies like DTMF masking, channel separation, and tokenisation to properly isolate your systems.

- Audit-Ready Documentation: They need to provide you with clear reports and evidence that shows exactly how their solution keeps card data out of your environment.

- Gateway Agnostic: Ideally, the platform should integrate with your existing payment gateway. This avoids getting locked into one vendor and gives you more flexibility down the line.

The true value of a great provider isn’t just the tech they sell you—it’s the compliance weight they take off your shoulders. They should be an expert partner who can guide you through the complexities of PCI DSS.

This all translates into real, tangible benefits for your business. By shrinking your PCI scope, you aren't just ticking a compliance box. You’re directly lowering your operational costs, drastically reducing the risk of a damaging data breach, and freeing up your team from hours of painful admin. You can learn more about how to put these strategies into action with our in-depth guide on PCI DSS compliance.

Ultimately, simplifying compliance lets you spend less time worrying about security admin and more time on what actually matters: giving your customers a brilliant, trustworthy experience.

Ensuring a Smooth Rollout and Agent Adoption

Getting the tech right is one thing, but the real test is getting your team to actually use it. A smooth switch from old habits to a new, secure workflow is absolutely vital when you change how customers pay over the phone. The human side of this project is every bit as important as the technical one.

I've seen it time and time again: rushing into a company-wide launch is a recipe for disaster. It creates confusion, resistance, and ultimately, a failed project. A phased rollout is a much smarter play.

Start small. Carve out a dedicated pilot team to take the new system for a spin. This gives you a safe space to find all the unexpected quirks, get honest feedback, and polish your process before everyone else gets their hands on it. Think of this trial run as your chance to iron out all the kinks, whether it’s a small software bug or a big misunderstanding in the new workflow.

Preparing Your Team for Success

Solid training is the bedrock of agent adoption. You have to remember you’re not just showing them a new tool; you’re fundamentally changing how they handle payments. They are no longer touching sensitive data themselves, but are now guides for a secure, automated transaction.

Your training needs to hit these points hard:

- The ‘Why’ Behind the Change: Don’t just show them the ‘how’. Explain exactly how this new system protects the customer, the business, and even them. Once agents grasp the security benefits, they’ll become your biggest champions.

- Walk Through Real Scenarios: Role-play is your best friend here. How do they actually send a secure payment link? What’s the script for guiding a nervous customer through an IVR payment? Practice makes perfect.

- Prep for Customer Questions: Customers will ask why things have changed. Arm your agents with simple, confident answers. A well-prepared agent creates a reassured customer.

The real goal of training isn't just about teaching which buttons to press. It’s about building confidence. You're shifting their mindset from being a data handler to a process facilitator, which dramatically reduces risk and empowers your team.

Communicating the Change Clearly

You can’t over-communicate. Internally, make sure your team knows the timeline, when their training is, and who their point person is for questions. This heads off any gossip and makes everyone feel like they’re part of the process, not just having it forced on them.

Externally, you should frame this as a win for your customers. For businesses in banking or insurance, it’s a powerful message to say you’re using channel separation and encryption to better protect their payments. For these sectors, managing voice payments alongside the 4.7 billion Direct Debits processed each year is a massive operational challenge. And while card payments account for 57% of all transactions, a smooth and secure phone payment experience is still critical for earning and keeping customer trust. You can find more data on this in the UK mobile payments market report.

A simple heads-up on your website or a quick line from an agent—"Just to let you know, we’re using a new, more secure system to protect your details"—is all it takes. It shows customers you’re actively investing in their safety.

By carefully managing the people side of this change, you can ensure your new system doesn't just work on paper—it actually thrives in the real world.

Got Questions About Phone Payments? We've Got Answers

When businesses start exploring how to take payments over the phone, a few key questions always come up. Let's tackle some of the most common ones I hear from people just like you.

Are Phone Payments Actually Secure These Days?

Absolutely, but only if you're using modern, purpose-built technology. It's not about just taking down card numbers anymore.

Real security comes from a layered approach. Think of it as a combination lock: you need DTMF suppression, tokenisation, and end-to-end encryption all working together. This is a game-changer because it means sensitive card data never even touches your business environment.

Essentially, these controls make the payment details invisible to your agents, your call recordings, and your entire internal network. This not only makes it an incredibly secure way to pay but also dramatically shrinks your risk and your PCI DSS compliance headache.

Will My Team Need a Lot of Training?

You'd be surprised. One of the best things about a good secure phone payment platform is how it simplifies everything for your agents. They no longer have the stress of hearing, seeing, or manually handling card numbers.

Training is usually very straightforward. It's less about handling sensitive data and more about learning the simple workflow for kicking off the secure payment process. It's a world away from the old, high-risk way of doing things.

How Does This Fit With Our CRM?

Modern platforms are designed to slot right into your existing setup. They use APIs and ready-made connectors to talk to the major telephony systems, CRMs, and a huge range of payment gateways.

The real magic is what happens after the payment is complete. The transaction data can automatically flow back and update the right customer record in your CRM. This cuts out the manual admin, gets rid of expensive data entry mistakes, and gives you a single, reliable record for every payment.

Ready to secure your phone payments and make compliance simpler? At Paytia, we provide the tools to protect your customers and your business. Explore our secure payment solutions and see how we can help.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.