The Ultimate Payment Platform Definition Guide

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

So, what exactly is a payment platform?

In simple terms, a payment platform is the complete ecosystem that handles a company's financial transactions from start to finish. Think of it less as a single piece of software and more as the central nervous system for your payments. It brings together all the tools you need to accept, process, and manage customer payments across every channel—whether that's over the phone, on your website, or via live chat.

The Financial Air Traffic Control Tower

Let's move past the dry, technical definitions for a moment. The best way to understand a payment platform is to picture an air traffic control tower at a bustling airport. The tower's job isn't just to land one plane. It has to coordinate every single arrival, departure, and ground movement, making sure each aircraft follows a safe and efficient path.

A payment platform does the same thing for your business's money.

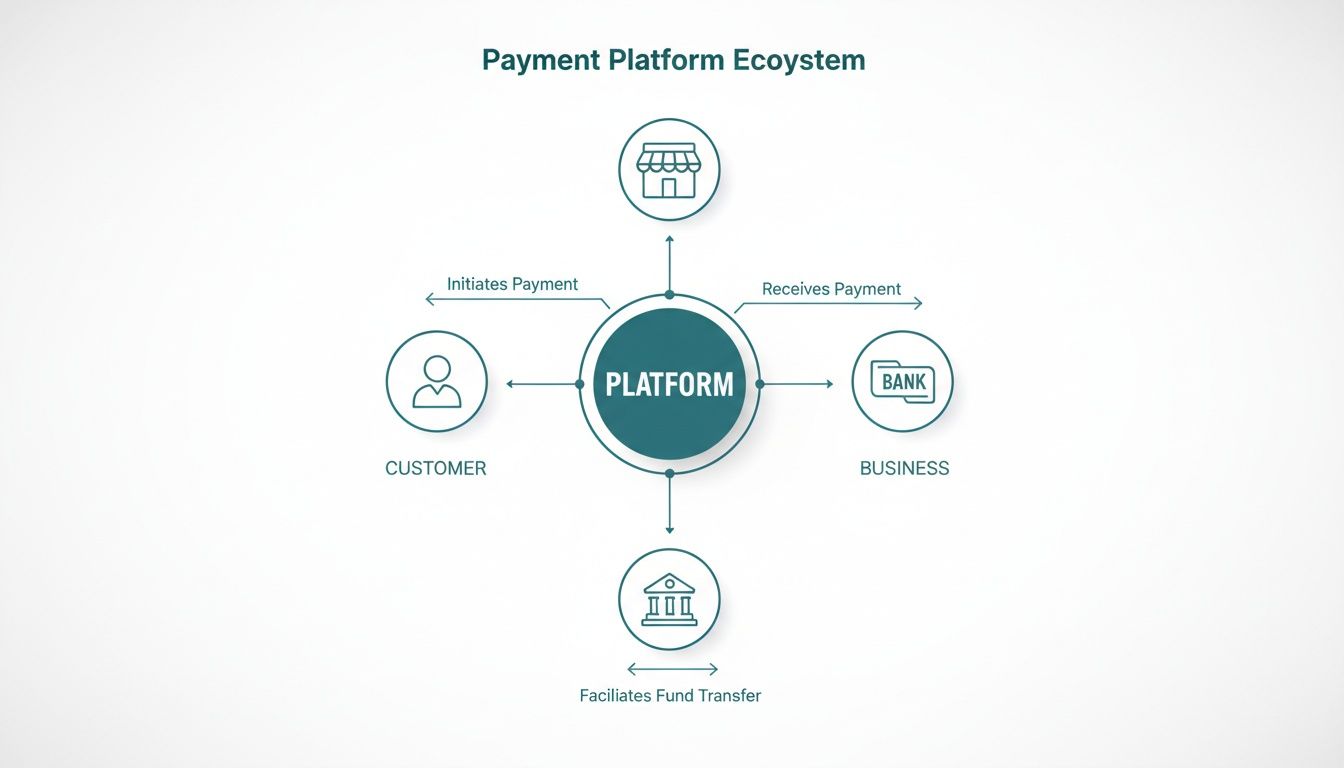

It doesn't just handle a single, isolated transaction. Instead, it oversees the entire payment journey, acting as the coordinator between:

- The Customer: The person initiating the payment.

- The Business: Your company, waiting to receive the funds.

- The Banks: Both the customer's bank and your business's bank account.

This platform is the central hub managing all the communication, verifying the information, and ensuring every piece of data is handled securely at every step. Without it, accepting payments would be like running an airport with no control tower—chaotic, risky, and painfully inefficient.

More Than Just a Single Tool

One of the biggest misconceptions is that a payment platform is just one thing. In reality, it’s a whole suite of technologies designed to work in perfect harmony. While you can get standalone tools like a payment gateway or a processor, a true platform bundles these components and then adds critical layers of security and functionality on top.

It's the difference between buying all the individual parts of a car versus owning a fully assembled, high-performance vehicle that's ready to hit the road.

A true payment platform is the complete infrastructure that connects various payment services, offering a unified system for transaction management, security, and reporting. It simplifies complexity by bringing disparate elements into a single, cohesive environment.

For example, a platform integrates the customer-facing checkout form, the secure data transmission (the gateway), and the communication with the banking networks (the processor). But it doesn't stop there. It also adds value with essential features like fraud detection, multi-currency support, detailed analytics, and the security protocols needed to protect sensitive data.

Understanding this integrated nature is key, as these platforms often incorporate services from a payment service provider to create a seamless experience. Ultimately, the goal is to give your business a single, reliable system that handles the entire payment lifecycle, allowing you to focus on what you do best rather than juggling multiple payment vendors.

Understanding the Core Components

To really get what a payment platform is, you need to lift the bonnet and see how all the engine parts work together. It isn't just one single thing; it’s an assembly of specialised components, each with a very specific job. Think of it like a perfectly organised restaurant kitchen during a busy dinner service.

Every part, from the server taking an order to the chef plating the final dish, must work in perfect sync to deliver a seamless experience. In the world of payments, this coordination is handled by several key players.

This diagram shows the platform right in the centre, acting as the hub that coordinates everything between customers, the business, and all the financial institutions involved.

The Payment Gateway: The Digital Courier

First up is the payment gateway. Picture this as a secure digital courier. Its job is to pick up a sensitive package—your customer's card details—from your website checkout or a phone call and transport it securely to the next destination.

The gateway’s main role is to encrypt this sensitive data, making it completely unreadable to fraudsters while it's in transit. It doesn't actually move any money; it's purely an information handler, making sure the payment request gets to the payment processor safely. This is your first line of defence in payment security.

The Payment Processor: The Backstage Coordinator

Once the gateway delivers its encrypted package, the payment processor takes over. The processor is the backstage coordinator for the whole transaction, acting as the go-between for the customer's bank (the issuing bank) and your business's bank (the acquiring bank).

It sends the authorisation request to the card networks (like Visa or Mastercard), who then check with the customer's bank for sufficient funds and any security red flags. The processor then relays the 'approved' or 'declined' message back through the chain.

A payment processor is the vital link between all the financial institutions involved in a transaction. It facilitates the authorisation, clearing, and settlement of funds, ensuring the money moves from the customer's account to the merchant's.

This entire back-and-forth happens in a matter of seconds. The sheer volume of these transactions is staggering. In fact, the UK's payment systems industry revenue is set to reach £11.0 billion in 2025. This growth is driven largely by card payments, which made up 64% of all UK transactions in 2024 and are expected to hit 67% by 2034. You can explore more data on the UK payments industry to see this trend for yourself.

The Merchant Account: The Business Till

So, where does the approved money actually go? It lands in your merchant account. This isn't your everyday business bank account; it's a special type of account that any business accepting card payments must have.

Think of it as a temporary holding area or a digital till for your business. Funds from all your approved card transactions are collected here first. Then, usually on a daily schedule, the total amount is transferred from your merchant account into your regular business bank account.

Foundational Technologies That Power the Platform

Beyond these main players, a couple of key technologies make everything possible and secure:

- Tokenization: This is an incredibly powerful security method. Instead of storing a customer's actual card number, the platform swaps it for a unique, non-sensitive string of characters called a "token." This token can be used for things like recurring billing without ever exposing the original card details, dramatically reducing your security and compliance risk.

- APIs (Application Programming Interfaces): APIs are the communication links that allow different software systems to talk to each other. A payment platform uses APIs to connect with your eCommerce website, CRM software, accounting tools, and contact centre telephony. This creates a unified and automated workflow across your entire business.

How Platforms Secure Transactions and Ensure Compliance

Trust is the currency of every transaction. If your customers don't feel their payment information is safe, they'll simply take their business elsewhere. This is why security isn't just another feature of a payment platform; it's the absolute foundation the entire system is built on. These platforms use a multi-layered defence strategy, protecting both businesses and their customers from ever-present threats.

At the heart of payment security is a set of rules known as the Payment Card Industry Data Security Standard (PCI DSS). Think of it as the universal safety code for handling payment card information. This isn't a friendly suggestion—it's a mandatory standard for any organisation that accepts, processes, stores, or transmits cardholder data. The goal is straightforward: create a secure environment that shuts down the risk of data breaches and fraud.

Core Security Technologies Explained

To meet (and often exceed) PCI DSS requirements, payment platforms deploy several powerful technologies. These tools work in concert, building a fortress around sensitive data and making it incredibly difficult for unauthorised parties to get anywhere near it.

End-to-End Encryption (E2EE): This is the first line of defence. From the moment a customer enters their card details, E2EE scrambles that information into unreadable code. It stays encrypted throughout its entire journey across networks, only becoming readable once it reaches its secure, authorised destination at the payment processor.

Tokenization: As we touched on earlier, tokenization is a genuine game-changer for security. Instead of your systems handling raw card numbers, the platform swaps this "toxic" data for a unique, non-sensitive placeholder called a token. This token can then be safely used for things like repeat payments or refunds without ever exposing the actual card details. For businesses, this is a massive win, as it removes sensitive data from their environment entirely.

Of course, security needs to adapt. Taking a payment over the phone in a busy contact centre requires a different approach than a standard online checkout.

A key function of a secure payment platform is to descope your business from the most stringent PCI DSS requirements. By ensuring sensitive cardholder data never enters your systems, the platform can reduce your compliance burden by up to 95%.

This massive reduction in scope not only saves a huge amount of time and money on audits but also drastically minimises the risk and potential financial fallout that comes with a data breach.

Advanced Security and Compliance Measures

Modern platforms go even further to protect data, especially in high-risk environments like voice communications. One of the most effective techniques used in contact centres is DTMF (Dual-Tone Multi-Frequency) Masking.

When a customer enters their card numbers using their telephone keypad, this technology intercepts the tones. The contact centre agent simply hears a flat, unrecognisable tone, and the digits are masked on their screen, often appearing as asterisks (****). The sensitive data is routed directly to the payment processor, completely bypassing the agent and the business's call recording systems.

This achieves two critical things:

- Your agents are never exposed to sensitive financial information.

- Your call recordings remain compliant, as no card data is ever captured.

As threats evolve, so do security measures. Beyond the basics, platforms are adopting advanced strategies like biometric-first approaches to fraud reduction to bolster security even further. Understanding your specific PCI DSS obligations is crucial, and you can learn more about the different requirements in our detailed guide on the PCI levels of compliance.

Ultimately, a robust platform handles these complex security layers for you. This allows you to focus on serving your customers with confidence, knowing every single transaction is protected.

Platform vs Gateway vs Processor Explained

In the world of payments, it’s easy to get tangled up in the terminology. Words like ‘platform’, ‘gateway’, and ‘processor’ often get thrown around as if they mean the same thing. But that’s like saying a car, its engine, and its transmission are all identical.

Each component plays a unique and vital part in the journey of a transaction. Getting a handle on these differences is the first step to choosing the right payment infrastructure for your business.

Let’s use a simple analogy to clear things up: think of it all as a high-security courier service for money.

The payment gateway is your armoured van. Its one and only job is to securely collect the customer’s sensitive card details—whether from your website or a phone keypad—and get them safely to the next stop. It encrypts the data, acting as the frontline security guard for every single transaction.

Unpacking the Roles of Each Component

From there, the armoured van arrives at the payment processor, which is like the central sorting facility. This is where the real back-and-forth happens. The processor takes the encrypted data from the gateway and communicates with the card networks (like Visa or Mastercard) and the customer’s bank.

It’s the financial middleman asking, "Does this person have the funds?" and then relaying the 'yes' or 'no' back down the line.

So, where does a payment platform fit in? It's not just one piece of this puzzle; it's the entire operation. A platform bundles the gateway and processor into one seamless system and then builds a whole suite of essential business tools on top.

A payment platform is the complete ecosystem that gives you a single, feature-rich environment to manage every part of the payment lifecycle. It combines the core machinery (gateway, processor) and enhances it with tools for security, compliance, reporting, and multi-channel support.

This integrated approach is far more powerful than trying to stitch together separate services on your own. For a closer look at how these components are wired together, our guide on payment gateway API integration offers some great technical insights.

Why an Integrated Platform Offers More Value

Choosing a platform is a strategic move. It's the difference between buying individual computer parts and hoping they work together versus getting a high-performance machine that’s ready to go right out of the box—complete with the operating system, security software, and customer support. A platform is a complete solution.

To make this crystal clear, let's compare them side-by-side.

Comparing Payment Platform, Gateway, and Processor

The table below breaks down the distinct roles and responsibilities of each component, showing why a platform offers a much broader scope.

| Aspect | Payment Platform | Payment Gateway | Payment Processor |

|---|---|---|---|

| Primary Role | A complete, integrated ecosystem for managing all payment operations. | A secure courier that encrypts and transmits card data from the point of sale. | The financial intermediary that communicates between banks and card networks. |

| Functionality | Broad: Includes analytics, user management, security, multi-channel support, and reporting. | Narrow: Focused solely on secure data transmission and encryption. | Narrow: Focused on authorisation, clearing, and settlement of funds. |

| Business Scope | Strategic: Manages the entire payment lifecycle and customer experience. | Technical: A crucial but singular step in the payment process. | Operational: The behind-the-scenes financial communication link. |

| Example | A system like Paytia that lets you securely take payments via phone, web, and chat with full compliance and reporting. | The technology that powers the online checkout form on an e-commerce site. | The service that connects an online store's gateway to the banking system. |

Ultimately, a gateway and processor are essential cogs. But a platform is the entire, intelligent machine. It delivers the control, visibility, and security that modern businesses need to handle payments safely and efficiently across every part of their organisation.

How Businesses Use Payment Platforms in the Real World

Understanding the theory behind payment platforms is one thing, but seeing how they solve real business problems is where it all clicks. These platforms aren't just abstract tech; they're the practical tools that tackle specific operational headaches in a huge range of industries, every single day.

From busy contact centres to healthcare providers and insurance firms, payment platforms provide the secure plumbing needed to handle money efficiently and safely. Let's look at a few real-world scenarios to see how this technology goes from a definition to a dynamic business solution.

Securing Payments in Contact Centres

Picture a customer calling their insurance company to pay a monthly premium. In the old days, the agent would ask for the full 16-digit card number, expiry date, and CVC code over the phone. This immediately throws up huge security and compliance red flags.

That conversation is probably being recorded for quality assurance, which means sensitive card data is now sitting in your call recording system. The agent themselves heard and saw the data, creating a potential point for internal fraud. This entire process puts the business squarely in scope for tough PCI DSS regulations.

A modern payment platform completely transforms this workflow.

When it’s time to pay, the platform takes over. The agent can trigger a secure payment process where the customer enters their card details using their telephone keypad. DTMF masking technology ensures the agent only hears flat tones, and the numbers never appear on their screen. The agent and the call recording are kept completely clean.

The sensitive data travels directly to the payment processor, completely bypassing the business's own environment. This one simple change solves a whole host of problems:

- It protects the customer’s confidential information.

- It removes the agent from any exposure to card details.

- It keeps call recordings compliant without needing to be paused or clumsily edited.

- It massively reduces the business's PCI DSS scope, saving a ton of time and money.

Streamlining Collections in Healthcare

Now, let's think about a dental clinic that needs to collect payment for a scheduled appointment. Chasing down payments after the fact is a drain on resources and hurts cash flow. A payment platform offers a simple, automated fix.

The clinic can use the platform to generate a secure payment link and send it straight to the patient via SMS or email before their visit. The patient just clicks the link, enters their details on a secure, branded page, and pays on their own device. Easy.

This approach is especially powerful when you look at the explosive growth in mobile transactions. The UK's mobile payment market hit USD 4,745.2 million in 2024 and is projected to soar to USD 31,921.0 million by 2030. With mobile web payments alone making up over 31% of that revenue, it's crystal clear that businesses need to offer dead-simple, mobile-friendly ways to pay. You can dig deeper into the UK's rapid shift to mobile payments to see just how vital this channel has become.

Automating Insurance Premium Collections

Finally, let’s look at an insurance provider juggling thousands of recurring premium payments. Manually processing these every month would be an administrative nightmare, riddled with errors and delays.

A payment platform automates the whole thing. During the initial sign-up, the customer’s payment details are captured once and instantly converted into a secure token. The platform then uses that token to automatically charge the premium on the scheduled date each month. If a payment fails, the system can be set to retry automatically or trigger a notification to the customer, freeing up staff to focus on more complex issues.

In each of these examples, the payment platform stops being technical jargon. It becomes a strategic asset that tightens security, boosts operational efficiency, and builds the kind of customer trust that's essential for long-term success.

Choosing the Right Payment Platform for Your Business

Picking a payment platform is far more than a simple IT task. It's a strategic decision that has a direct line to your security posture, how smoothly your business runs, and the trust you build with customers. With so many choices out there, you need to move beyond a simple payment platform definition and start a proper evaluation. The right platform will feel like a natural extension of your workflow, while the wrong one can quickly become a tangled mess of compliance headaches and operational friction.

Think of it like choosing an engine for a vehicle you’re building. You wouldn't just look at its raw power. You’d need to know how it fits the chassis (your existing software), its fuel efficiency (cost), and its safety features (security and compliance). A mismatched engine can ruin the entire vehicle's performance, and a payment platform is no different.

Define Your Core Requirements

Before you even glance at a vendor’s website, you need a crystal-clear picture of what your business actually needs. Every organisation is different, so the first step is to map out your specific payment scenarios. This internal audit is the single most important part of the entire process.

Start by asking a few critical questions:

- What payment channels do we use? Are you just taking payments on your website, or do you also handle transactions over the phone, through live chat, or via an automated IVR system?

- What systems must it connect with? Make a list of your absolute must-haves, like your CRM, accounting package, and any contact centre software. If it can't talk to your other tools, it’s a non-starter.

- What are our biggest security concerns? If you run a contact centre, for instance, keeping sensitive card details out of your call recordings is probably at the top of your list.

Key Evaluation Criteria

Once you’ve got your requirements nailed down, you can start weighing up potential platforms against a consistent checklist. This keeps you focused on what truly matters, rather than being distracted by shiny features you'll never touch. Zero in on these mission-critical areas.

- Security and Compliance: Does the platform hold a PCI DSS Level 1 certification? That's the highest level of validation available. Get specific and ask how it reduces your PCI DSS scope. You want to hear them talk confidently about tokenization and end-to-end encryption.

- Integration Capabilities: Does it offer pre-built connectors for your key systems? If not, how good are its APIs? A platform with poorly documented or inflexible APIs is a dead end waiting to happen.

- Scalability and Future-Proofing: Will this platform grow alongside your business? Don't just think about your transaction volume today; think about where you'll be in a few years. The UK's digital payments market is projected to hit USD 43.7 billion by 2034, growing at 15.2% a year, thanks to new tech like pay-by-bank. Your platform has to be ready for what's next. To grasp the importance of this, you can learn more about the rapid expansion of the UK digital payments market.

A platform's real value isn't just what it does today, but its ability to adapt to the payment methods your customers will be demanding tomorrow. Make sure it has a clear roadmap for supporting emerging payment technologies.

In the end, choosing the right platform is about finding a partner who understands your unique operational challenges. By starting with a clear definition of your needs and using a structured evaluation, you can confidently pick a solution that delivers security, efficiency, and a solid foundation for the future.

Frequently Asked Questions

When you start digging into payment technology, a few common questions always pop up. Let's tackle them head-on to clear things up and give you a solid understanding of how these platforms really work.

Can a Payment Platform Work with My Existing Bank and Software?

Absolutely. In fact, this is one of the biggest strengths of a modern payment platform. The best ones are designed to be ‘gateway agnostic,’ meaning they can plug into a wide range of payment gateways and acquiring banks—including the ones you already have a relationship with.

This avoids the painful process of ripping out and replacing the financial partners you trust. They also come with robust APIs (Application Programming Interfaces) that allow for a smooth connection to your existing CRM, ERP, and even your contact centre's telephony system. You get to add a powerful layer of payment security and efficiency without having to rebuild your entire tech stack from the ground up.

How Does a Payment Platform Actually Reduce Our PCI DSS Scope?

Think of a payment platform as a shield that stands between your business and any sensitive cardholder data. By using clever technologies like tokenization and DTMF masking for phone payments, the platform makes sure that raw card numbers never even touch your systems.

Here's the key takeaway: by stopping sensitive data from ever being stored, processed, or transmitted within your environment, your PCI compliance burden can shrink by as much as 95%. This makes audits dramatically simpler and massively reduces the risk of a data breach.

Since your agents, their desktops, and your call recordings are never exposed to the card details, the most stringent PCI DSS rules no longer apply to those parts of your business. This is easily one of the most significant operational and financial wins a platform can deliver.

Are Payment Platforms Only for Large Enterprises?

Not at all. While these platforms certainly offer the rock-solid security and scale that large enterprises need, they bring just as much value to small and medium-sized businesses (SMBs). After all, the need for airtight compliance is universal, no matter how big your company is.

Plus, features like automated payment links and recurring billing can be a game-changer for an SMB’s cash flow and cut down on tedious admin work. Most modern platforms are offered as a scalable Software-as-a-Service (SaaS) solution, which makes enterprise-grade payment tech both accessible and affordable for any business, without needing a huge upfront investment.

Ready to secure your payments and simplify compliance? With Paytia, you can effortlessly take secure payments across phone, web, and chat, reducing your PCI DSS scope and building customer trust. Learn more about how Paytia can transform your payment operations.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.