Hiring a PCI Compliance Auditor A Complete Guide for UK Businesses

Get Compliance Consultation

Ensure your payment processing meets UK regulations with Paytia's compliance experts.

A PCI compliance auditor is the independent expert who verifies that your business is handling credit card data according to the rulebook—the Payment Card Industry Data Security Standard (PCI DSS). It’s easy to think of them as an inspector looking for faults, but it’s more accurate to see them as a specialist who diagnoses your payment security to confirm it’s healthy and fit for purpose.

Understanding Your PCI Compliance Auditor

Bringing in a PCI compliance auditor is a massive step toward protecting customer trust and steering clear of eye-watering penalties. Their job isn’t just to find problems; it's to formally validate that your data protection practices are solid.

In the UK, this has become a central issue for any business taking card payments. According to the government's 2023 Cyber Security Breaches Survey, a staggering 59% of medium businesses and 69% of large firms suffered a cyber breach or attack in the last year. That's a stark reminder of why having robust, verified security is no longer a 'nice-to-have'. You can dig into the full findings on the GOV.UK website.

To get through the audit process, you first need to know who you're dealing with. There are a few different types of auditors, and choosing the right one depends entirely on your business needs and compliance level.

Comparing PCI Compliance Auditor Types

Let’s break down the key players you'll encounter on your compliance journey. Each has a distinct role, and knowing the difference is crucial.

| Auditor Type | Who They Are | Primary Role | Best For |

|---|---|---|---|

| Qualified Security Assessor (QSA) | An independent professional certified by the PCI Security Standards Council (PCI SSC). They work for a QSA company, not for you. | Conducting the official, external PCI DSS assessment and producing a Report on Compliance (ROC). | Level 1 merchants who need formal, third-party validation, or any business whose acquiring bank demands an external audit. |

| Internal Security Assessor (ISA) | An employee within your own organisation who has completed the same rigorous training and certification as a QSA. | Conducting internal PCI DSS assessments, helping maintain continuous compliance, and preparing the business for external audits. | Larger organisations wanting to build in-house expertise, manage ongoing compliance, and perform readiness assessments without constant external help. |

| Your Internal Audit Team | Your company's own internal audit or security staff who are familiar with PCI DSS but are not ISA-certified. | Performing informal gap analyses, checking controls, and gathering evidence ahead of an official assessment. | All businesses. They are the first line of defence in preparing for either an ISA or QSA assessment. |

Knowing these distinctions helps you plan your resources and approach the audit with the right team in place, whether they're internal champions or external experts.

Qualified Security Assessor (QSA)

A Qualified Security Assessor (QSA) is an independent expert certified by the PCI Security Standards Council to perform official, on-site PCI DSS assessments. Think of them as the external, board-certified specialist you bring in for a formal diagnosis. They work for a QSA company, ensuring complete impartiality.

You’ll need to hire a QSA if your business is a Level 1 merchant (meaning you process over six million card transactions a year) or if your acquiring bank specifically requires an external audit. Their work culminates in a formal Report on Compliance (ROC), which is the official verdict on your security posture.

To find out which category you fall into, have a look at our guide to the different PCI levels of compliance.

Internal Security Assessor (ISA)

An Internal Security Assessor (ISA), on the other hand, is your in-house expert. This is someone on your team who has gone through the same tough training and certification as a QSA but works directly for your organisation.

They are invaluable for larger companies that want to embed compliance expertise into their daily operations. An ISA can conduct internal assessments, help you stay compliant year-round, and get everything in order before a formal QSA audit might be needed. It’s about building capability from within rather than relying solely on outsiders.

The core distinction is simple: a QSA provides the independent, external validation required for the highest compliance levels, while an ISA provides internal expertise and assessment capabilities to keep you on track.

Getting your head around this difference is the first step toward a smooth and successful audit. For a wider view on regulatory demands and industry standards, you might find some useful insights in our compliance resources.

Unpacking the Five Stages of a PCI Audit

The road to PCI compliance can feel like a daunting expedition, but it’s actually a well-defined process with clear milestones. A formal PCI audit follows a logical, five-stage lifecycle, breaking down what seems like an overwhelming challenge into a manageable project. Each stage builds on the last, moving you from initial planning all the way to the final report.

Getting your head around this process is key. It helps you work effectively with your PCI compliance auditor, anticipate what’s coming next, and put your resources where they’ll make the biggest impact. Let’s walk through the journey, step-by-step.

Stage 1: Scoping and Discovery

First things first, you need to define the battlefield. This initial stage is all about Scoping. Imagine you’re tasked with securing a castle; your first job is to map out the boundary walls. Here, your QSA works with you to identify every single system, person, and process that even touches cardholder data—whether it’s storing, processing, or transmitting it.

This defined area is your Cardholder Data Environment (CDE). Anything inside these walls is subject to the full rigour of the PCI DSS. The goal is to be meticulous. If you miss a component, you could fail the audit. On the flip side, including systems that don't need to be there will just inflate the cost and complexity of the whole exercise.

Stage 2: Readiness Assessment and Gap Analysis

Once the CDE is clearly mapped, it's time for a dress rehearsal. The Readiness Assessment is like a mock exam before the real test. Your PCI compliance auditor or an internal team will measure your current controls against the PCI DSS requirements to see where the gaps are.

This is a collaborative, blame-free process designed to uncover weaknesses early on. You'll typically get a detailed report that pinpoints areas of non-compliance and gives you a clear roadmap for fixing them. It's a golden opportunity to find and sort out problems without the pressure of a pass-or-fail verdict hanging over you.

Stage 3: Remediation

Armed with the findings from your gap analysis, you enter the Remediation phase. This is where your team rolls up their sleeves and gets to work closing those gaps. It could involve anything from simple configuration tweaks to much larger projects.

Common remediation tasks often include:

- Patching vulnerable systems: Applying the latest security updates to servers and software.

- Updating security policies: Making sure your documentation actually reflects compliant procedures.

- Implementing new technologies: Deploying tools like file integrity monitoring or multi-factor authentication.

- Training staff: Ensuring everyone understands their security responsibilities.

This stage usually demands the most time and resources, but it's absolutely vital for getting you over the compliance finish line.

The success of an audit is often decided during remediation. A thorough, well-documented effort shows a real commitment to security and makes the final validation much smoother.

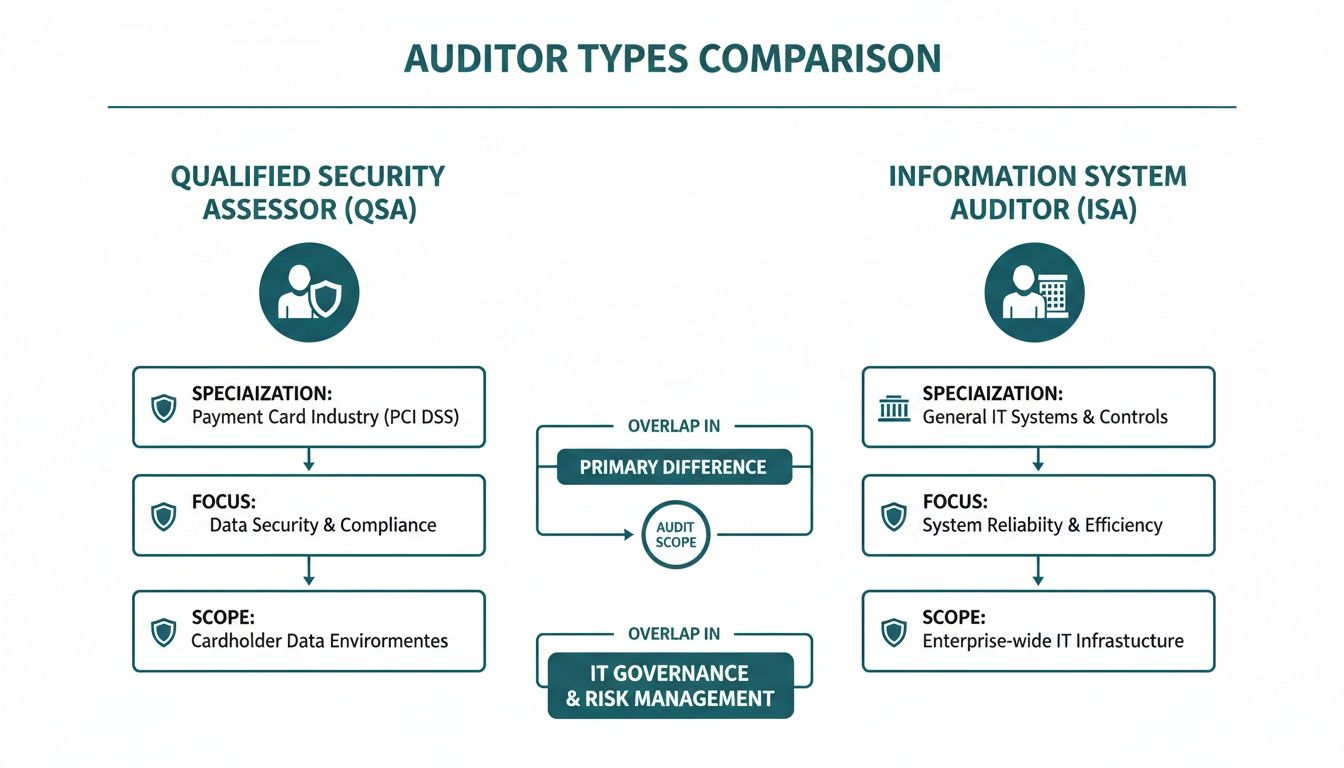

The infographic below offers a simple comparison of the two main types of auditors you might work with during your PCI compliance journey.

As you can see, while a QSA is your external validator, an ISA often plays a crucial role in the internal readiness and remediation stages.

Stage 4: Validation and Evidence Gathering

With remediation complete, the formal Validation kicks off. This is the official audit, where your QSA rigorously tests and verifies that every applicable control is not just in place, but also working as it should. The auditor’s job is to gather concrete evidence to back up their findings.

This involves a bit of everything:

- Reviewing documentation: Poring over policies, procedures, and network diagrams.

- Interviewing personnel: Chatting with system administrators, developers, and executives.

- Observing processes: Watching how your team actually handles sensitive data day-to-day.

- Testing systems: Running scans and checking system configurations to make sure they’re secure.

For a deep dive into exactly what auditors are looking for, check out our guide on the 12 requirements for PCI compliance.

Stage 5: Reporting

Finally, once the assessment is complete, the PCI compliance auditor produces the official Reporting deliverables. The main document is the Report on Compliance (ROC), an exhaustive report detailing the scope, the evidence reviewed, and a formal verdict for each PCI DSS requirement.

If your organisation has successfully met every requirement, the auditor will also issue an Attestation of Compliance (AOC). Think of this as your certificate of achievement—it's the summary document you provide to your acquiring bank and the card brands to prove you're compliant.

Decoding the True Cost of a PCI Audit

The price tag for a PCI audit goes far beyond the auditor's daily rate. Too many businesses get fixated on the initial quote from a QSA company, completely overlooking the huge hidden costs that make up the real investment in compliance. This tunnel vision can lead to some nasty budget shocks and seriously strained resources down the line.

Think of it like buying a house. The agreed purchase price is just the starting point, isn't it? You’ve still got solicitor fees, surveys, stamp duty, and maybe even a few unexpected renovation jobs to factor in. A PCI audit works in much the same way; the auditor's fee is only one piece of a much larger financial puzzle.

Uncovering the Hidden Financial Layers

The total cost of compliance is always a mix of direct and indirect expenses. While the fee you pay your PCI compliance auditor is the most obvious one, it's the indirect costs that often spiral and become far more significant. These are all the resources you have to pour in internally just to support the audit.

These hidden costs usually fall into a few key buckets:

- Internal Staff Time: Your IT, security, and operations teams will spend countless hours getting ready for the audit, digging up evidence, sitting in interviews, and managing any cleanup projects. Their time isn't free—it's a direct cost to your business.

- Technology Upgrades: The audit will almost certainly shine a light on security gaps that need investment. This could mean buying new firewalls, rolling out encryption solutions, or deploying a security information and event management (SIEM) system.

- Remediation and Re-testing: If your auditor finds things that aren't compliant, you'll have to pay to fix them. On top of that, you might have to pay the auditor for extra time to come back and re-test those controls once you've sorted them out.

- Ongoing Maintenance: Compliance isn’t a one-and-done project. It demands constant monitoring, patching, and management, all of which come with their own ongoing operational costs.

The Scope-Cost Connection

The single biggest factor driving all these costs is the size of your Cardholder Data Environment (CDE). A larger CDE—meaning more systems, applications, and people touching card data—directly inflates every single aspect of the audit. More systems mean more interviews for the auditor, more evidence to gather and review, and a much bigger attack surface with more potential holes to plug.

This is where the financial case for scope reduction becomes crystal clear. The economics of PCI compliance auditing in the UK are pushing businesses to find smarter ways to protect data. Major UK consulting firms quote day-rates for PCI services anywhere from £500 to £3,500. For a large contact centre, a Level 1 assessment can swallow dozens of consulting days, pushing the total cost well into six-figure territory over a three-year cycle when you add in internal resources, penetration testing, and infrastructure changes. You can see more details on these services on the UK Government's Digital Marketplace.

By proactively reducing your audit scope, you aren't just making a technical tweak. You're making a powerful financial decision that dramatically lowers both your direct and indirect compliance costs.

While the specific costs for a PCI audit can vary, the core factors that influence the price are pretty universal across different compliance frameworks. For another angle on this, it's worth understanding the true cost of a SOC 2 Type 2 audit, which follows similar principles of scope and complexity driving the final bill. Without a doubt, proactively shrinking your CDE is the most effective strategy you have for controlling the total cost of your compliance programme.

How to Dramatically Reduce Your Audit Scope

This is where you find out the secret to making PCI audits simpler, faster, and cheaper. The single most effective strategy is scope reduction.

Think of it like this: your PCI compliance auditor has been tasked with assessing the security of an enormous mansion. They’d have to check every single door, window, and room—a massive undertaking.

Now, imagine that instead of trying to secure the whole mansion, you move all your valuables into a single, high-tech, locked safe. The auditor’s job just became infinitely easier. They only need to inspect that one safe.

This is exactly what modern payment technologies do for your business. Solutions like tokenisation and DTMF suppression act as that digital safe, preventing sensitive card data from ever entering your main business environment in the first place.

This image perfectly captures the idea. The entire ornate room is your business environment, but the auditor can ignore it and focus solely on the secure safe where card data is actually handled.

Why Scope Reduction Is a Game Changer

When you reduce your PCI scope, you are shrinking your Cardholder Data Environment (CDE). That means fewer systems, networks, and applications are subject to the demanding requirements of PCI DSS. The benefits are immediate and substantial.

By using a solution that isolates card data, you can effectively de-scope huge parts of your operations from the audit. This includes:

- Call Recordings: Sensitive audio containing card numbers is never captured, so your call recording system falls out of scope.

- Agent Desktops: Agents never see or type full card numbers, removing their workstations from the CDE.

- CRM and Back-Office Systems: Since payment data doesn't pass through these applications, they are no longer in scope.

- Your Entire Network: By isolating the payment process, you protect your wider network infrastructure from being dragged into the audit.

This approach is especially critical in the UK contact centre world, where phone payments remain a high-risk area for fraud. A recent industry guide noted that many UK contact centres still use outdated 'pause-and-resume' recording systems. Auditors increasingly see these as fragile and difficult to prove effective, so their reports now commonly recommend moving to DTMF masking and channel separation.

The goal is to ensure agents never hear or see a customer's full card number. You can find more detail in the UK Contact Centre Decision-Makers’ Guide 2023.

The Paytia Approach to De-Scoping

Platforms like Paytia are designed specifically for this kind of radical scope reduction. By separating the payment channel from your business environment, you can shrink your CDE by up to 95%.

This means giving the PCI compliance auditor a much smaller, simpler, and more secure area to assess. It directly translates into lower audit fees, less internal disruption, and a faster path to compliance.

Let’s look at how the audit process changes when you bring in a scope-reduction solution.

Traditional Audit vs Scope-Reduced Audit

The table below shows just how different the experience can be. A traditional audit is an exhaustive, system-wide examination, whereas a modern, scope-reduced audit is a targeted and efficient review.

| Audit Aspect | Traditional Approach (High Scope) | Modern Approach (Reduced Scope with Paytia) |

|---|---|---|

| Systems Audited | Entire telephony platform, CRM, agent desktops, call recorders, network segments. | Only the secure, third-party Paytia platform and its integration points. |

| Evidence Required | Hundreds of data points from dozens of systems and staff members. | A pre-packaged set of compliance documents from Paytia and evidence from a few key personnel. |

| Auditor Time | Weeks of on-site interviews, system testing, and documentation review. | Days of focused review, primarily assessing the vendor's compliance and your minimal touchpoints. |

| Remediation Effort | Often requires complex network segmentation, costly software updates, and extensive staff training. | Minimal, as the technology handles the complex security controls on your behalf. |

| Annual Cost | High, reflecting the significant time and complexity involved for the PCI compliance auditor. | Significantly lower, reflecting a drastically simplified and faster audit process. |

Ultimately, a smaller audit scope isn't just about saving money. It transforms the entire process from a painful, expensive necessity into a manageable, predictable part of your security strategy—one that actually strengthens your defences without derailing your business.

Your Practical Pre-Audit Checklist

Facing an audit can feel daunting, but a bit of solid preparation can turn a stressful ordeal into a smooth, professional process. A PCI compliance auditor can do their job far more efficiently when your house is already in order. This isn't about hiding problems—it's about organising everything so the auditor can validate your controls quickly and accurately.

Think of this checklist as a strategic roadmap, not just a to-do list. When you tackle these items proactively, you’re not just ticking boxes. You’re showing a mature security posture and a respect for the auditor's time, which sets a positive tone right from the start.

Organise Your Documentation

Long before your auditor is scheduled to arrive, start pulling together a central library of all your key documents. Auditors run on evidence. Making it easy for them to find what they need is the single best thing you can do for a smooth audit. A last-minute scramble for a missing policy document wastes everyone’s time.

Your documentation library should include:

- Network and Data Flow Diagrams: Make sure these are up-to-date. They need to accurately map out every system inside your Cardholder Data Environment (CDE), showing exactly how data comes in, moves around, and leaves your network.

- Security Policies and Procedures: Gather all your information security policies, incident response plans, data retention schedules, and procedures for role-based access control.

- Previous Audit Reports: Have your last Report on Compliance (ROC) or Self-Assessment Questionnaire (SAQ) handy. Be ready to show evidence of how you fixed any issues found last time.

- Vendor Compliance Documents: Get the Attestations of Compliance (AOCs) for all your third-party service providers who touch cardholder data—think payment gateways or hosting providers.

Why it matters: Tidy, organised documentation proves your compliance programme is a managed, year-round process, not just a chaotic annual fire drill. It builds instant credibility.

Validate Your Scope

Your audit scope is the bedrock of the entire assessment. If you get it wrong, everything else that follows is built on shaky ground. Before the auditor even starts, you need to do your own internal review to double-check the boundaries of your CDE.

Follow the journey of cardholder data through your systems. Are there any forgotten databases, old applications, or overlooked network segments where data might be hiding? Finding an undiscovered pocket of card data mid-audit can derail the whole project, leading to expensive delays and a potential failed assessment.

Prepare Your People

A PCI audit is more than just a technical check-up. It involves interviewing your team to see how policies work in the real world. Your PCI compliance auditor will want to chat with system administrators, network engineers, software developers, and maybe even your contact centre agents.

Get your team ready by:

- Briefing them on the audit process: Let them know who the auditor is, why they are there, and what to expect during the interviews. No surprises.

- Reviewing key procedures: Make sure staff can clearly explain their specific security duties, like how they handle physical media, respond to security alerts, or manage user access.

- Encouraging honesty: Tell your team to be truthful and direct. If they don’t know an answer, it’s far better to say so than to guess. The auditor’s goal is to verify controls, not to play "gotcha."

This is precisely why our comprehensive PCI DSS compliance checklist is such a valuable tool for getting your people and systems aligned before the formal audit kicks off. By following these steps, you’re not just preparing evidence—you’re fostering a culture of security awareness that will impress any auditor.

Choosing the Right Auditor for Your Business

Picking the right PCI compliance auditor is one of the most critical decisions you'll make for your security programme. This isn't just about hiring a technician to tick boxes off a list. You're bringing in a strategic partner whose experience and approach will directly shape the cost, complexity, and real-world value of your compliance journey.

The best auditors don't just inspect; they advise. They've seen how countless other companies—including your direct competitors—navigate the very same security hurdles you're facing. This insight is invaluable, helping you find practical, cost-effective solutions instead of just a list of problems. A bad fit, on the other hand, can drag you into a rigid, frustrating process that gets bogged down in trivial details while completely missing the bigger security picture.

The real goal is to find a QSA who gets your commercial reality. Someone who provides advice that genuinely makes you more secure and ensures your investment in compliance delivers tangible business value.

Key Questions for Your Potential QSA

When you sit down with a potential PCI compliance auditor or QSA firm, you need to go beyond their certifications and price list. The questions you ask should get to the heart of their experience, their methods, and their philosophy on security. Think of it as an interview for a true partner.

"What's your experience in our specific industry?"

An auditor who intimately understands the pressures of a busy UK contact centre, for instance, will be far more effective than one whose primary experience is with e-commerce sites. Don't be shy about asking for case studies or references from businesses that look and feel like yours."How do you approach scope reduction?"

This is the question that separates the pragmatists from the box-tickers. A great auditor will be actively looking for ways to help you shrink your cardholder data environment (CDE) with clever solutions like tokenisation. Their answer will tell you immediately if they see scope reduction as a core strategy or just an afterthought."Can you tell me about a time you helped a client with a tricky compensating control?"

PCI DSS allows for ‘compensating controls’ when a requirement can't be met exactly as written. An experienced auditor should have stories of helping clients find creative but secure alternatives. This demonstrates flexibility and a genuine problem-solving mindset."How do you and your team keep up with new threats?"

The threat landscape changes constantly. You want an auditor who is proactive about their own education—someone who attends industry conferences, contributes to security research, and is always learning. Their expertise directly benefits your own security posture.

Choosing an auditor is a long-term investment. The right QSA won't just get you through the annual audit; they'll become a trusted advisor, helping you mature your security posture year after year and turning compliance from a burden into a business advantage.

Your PCI Audit Questions Answered

Even with the best preparation, a few questions always come up when you're staring down the barrel of a PCI DSS audit. Let's tackle some of the most common ones to give you a clearer path forward.

What's the Difference Between a ROC and an SAQ?

A Report on Compliance (ROC) and a Self-Assessment Questionnaire (SAQ) are both tools for validating compliance, but they're worlds apart in terms of rigour.

Think of the ROC as a full, formal audit report, like a detailed financial statement prepared by an external chartered accountant. It’s a comprehensive document put together by a Qualified Security Assessor (QSA) after a thorough on-site assessment. This is non-negotiable for Level 1 merchants—those processing over six million card transactions a year.

The SAQ, on the other hand, is more like filling out a detailed tax return yourself. It’s a tool that lets merchants with smaller transaction volumes report on their own compliance. The real difference is the level of outside scrutiny; a ROC is an independent, expert validation, while an SAQ is a self-declaration.

How Often Do We Actually Need a PCI Audit?

For any organisation that qualifies as Level 1, a formal audit by a QSA is a strict annual requirement. You have to go through the entire validation process every single year to keep your compliance status. No shortcuts.

For Levels 2, 3, and 4, an annual SAQ typically takes the place of a full-blown audit. But here’s the crucial bit: PCI compliance is an ongoing, continuous effort, not just a once-a-year scramble. Every business must maintain its security posture day in, day out. This includes running regular network scans with an Approved Scanning Vendor (ASV) and sticking to all your security protocols year-round.

PCI DSS compliance isn't a finish line you cross once a year; it's a security standard you must uphold continuously. The annual audit or SAQ is simply the formal moment of validation.

Can a Tool Like Paytia Make Us Fully PCI Compliant?

No, and it's important to be clear about this. No single product can ever make a business 100% PCI compliant all by itself. The PCI DSS standard is a holistic framework that covers your people, your processes, and your technology. A tool can't write your internal security policies or train your team for you.

What a platform like Paytia can do, however, is dramatically simplify your path to compliance by massively reducing your audit scope. By making sure sensitive cardholder data never even touches your environment—including your phone systems, call recordings, and agent desktops—Paytia takes huge chunks of your infrastructure completely off the auditor's checklist.

This means you have far fewer requirements to worry about, manage, and prove. It makes achieving and maintaining compliance significantly easier, faster, and cheaper.

At Paytia, we specialise in taking the complexity and risk out of payment card security. Our secure payment platform can reduce your PCI DSS audit scope by up to 95%, saving you time, money, and stress. Learn how we can help you at https://www.paytia.com.

Ready to Simplify Compliance?

Get expert guidance on UK payment regulations and PCI DSS compliance. Contact us today.