What is a digital wallet? A Practical Guide to Secure Payments

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think about your physical wallet for a moment—the one with your cash and bank cards. Now, imagine that exact wallet living securely inside your smartphone. That’s pretty much what a digital wallet is. It’s an application that holds digital versions of your debit and credit cards, letting you make quick, secure payments without ever having to pull out the plastic.

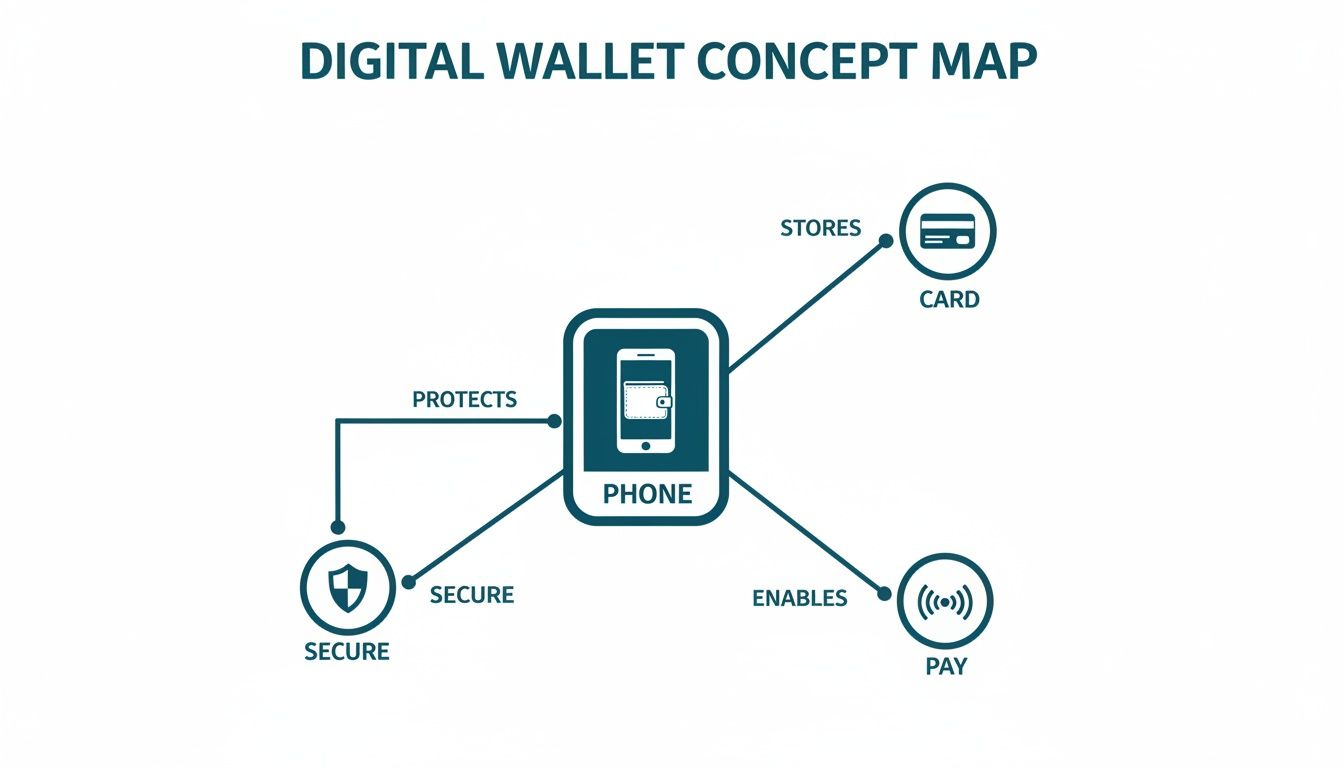

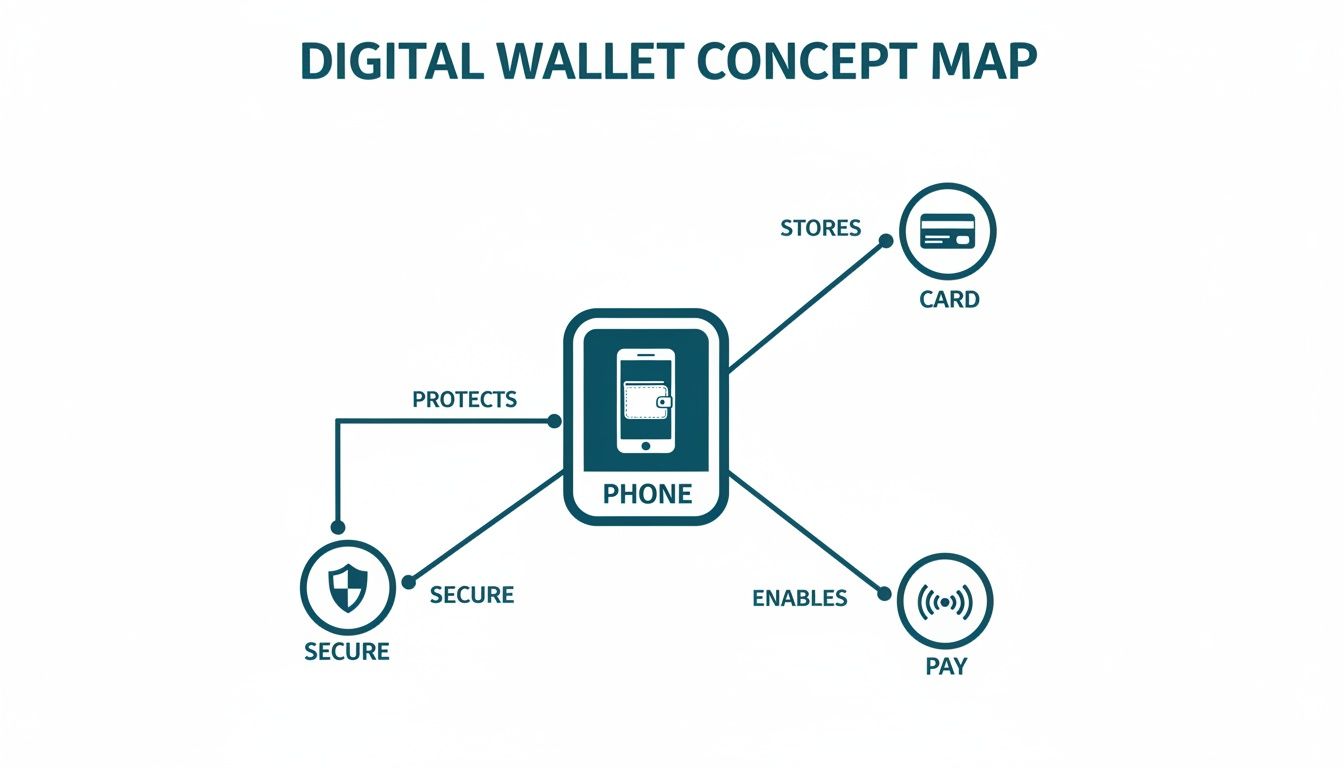

Getting to Grips with Digital Wallets

At its heart, a digital wallet is just a piece of software designed to securely store your payment information. It’s a virtual container for all the things you’d normally keep in a leather wallet, but with some clever tricks up its sleeve. Instead of rummaging for the right card at the till, you just tap your phone or smartwatch. Simple as that.

But this technology does more than just pay for your morning coffee. It’s also brilliant for online shopping, automatically filling in your card details and shipping address. What used to be a tedious chore becomes a single click. The whole point is to make buying things faster, safer, and a lot more convenient than the old ways.

The Basic Building Blocks

So, what’s actually inside this virtual container? While the features can differ between apps, most digital wallets are built on a few core components that work together to simplify your financial life. These are the foundations that make them so handy and secure.

- Payment Information Storage: This is the core of the wallet. It’s where tokenised (not the real numbers!) versions of your credit cards, debit cards, and bank details are safely stored.

- User Interface (UI): This is the app on your screen. It’s how you add or remove cards, check your transaction history, and tweak your settings.

- Transaction Technology: This covers the tech that makes the payment happen, like Near Field Communication (NFC) for contactless payments in shops or QR codes for paying specific merchants.

- Security and Authentication: This is the protective layer. It uses powerful encryption to guard your data and demands proof it’s you—usually with a fingerprint, face scan, or PIN—before any money changes hands.

A digital wallet’s main job is to be a secure go-between. Instead of sending your actual card number to the merchant, it sends a unique, one-time code for that single transaction. This keeps your real financial data shielded from prying eyes.

These pieces all click together to create a smooth payment experience. To get a clearer picture of how they work in practice, let's break them down in a quick table.

Key Components of a Digital Wallet

Here's a simple breakdown of the essential parts of a digital wallet and what they do.

| Component | Function | Example |

|---|---|---|

| Software Application | Provides the user interface to manage cards and view history. | The Apple Pay interface on an iPhone or the Google Wallet app on an Android device. |

| Payment Data Storage | Securely holds digitised versions of your payment cards and bank details. | Adding your Visa debit card to your phone for contactless payments. |

| Security Layer | Protects your information with encryption and authentication. | Using your fingerprint or Face ID to approve an in-store purchase. |

It's clear that digital wallets are a massive part of the shift towards financial tools that are both easier to use and far more secure.

They’re a key player in the wider world of alternative payment methods, which are completely changing how we all transact. This move away from physical cash and cards isn’t just a fad; it’s a fundamental trend towards making every single payment more efficient and better protected.

How Digital Wallets Keep Your Money Safe

Ever tapped your phone to pay and had a fleeting thought about how secure it really is? It’s a fair question. The reality is, the tech working behind the scenes in a digital wallet builds a security fortress far stronger than any old-school magnetic stripe card.

This isn’t about a single lock and key. Instead, digital wallets rely on multiple, powerful layers of defence to shield your financial information at every stage of a transaction. Let’s pull back the curtain on the two most important security pillars that make it all work.

As you can see, security isn’t just bolted on at the end; it's woven into the very fabric of the wallet, working hand-in-hand with your cards and payment functions to create a system you can trust.

Tokenization: The Secret Code for Your Card

The real powerhouse security feature inside a digital wallet is tokenization. Think of it like using casino chips instead of cash. At the gaming table, you hand over your money for chips. Those chips have value inside the casino, but they're completely useless anywhere else.

Tokenization does something very similar for your payment card.

When you add a credit or debit card to your wallet, the wallet service talks to your bank and generates a unique, randomised string of numbers called a token. This token is what gets stored on your device—not your actual card number.

So, when you make a purchase, it's this single-use token that's sent to the merchant's terminal. Your real card details—that 16-digit number, expiry date, and CVC—are never shared with the merchant or kept on their systems.

This process is a genuine game-changer for security. If a merchant's system is ever breached, all the hackers will find is a list of useless, one-time tokens, not your actual financial data. This dramatically cuts down the risk of card fraud.

For businesses, particularly in regulated environments like contact centres, this is a massive win. It means sensitive payment information never even enters your business environment, which is a crucial step towards maintaining Payment Card Industry Data Security Standard (PCI DSS) compliance.

Encryption: Your Digital Bodyguard

While tokenization protects your stored card data, encryption acts like a bodyguard during the transaction itself. Encryption is simply the process of scrambling your data into a complex, unreadable code while it's travelling from your phone to the payment terminal.

Imagine writing a secret message using a code that only you and the recipient have the key to decipher. If someone intercepts it, all they'll see is gibberish. That’s exactly what encryption does for your payment information.

This makes sure that even if a criminal somehow managed to intercept the payment signal as it travels through the air, they wouldn't be able to make any sense of it.

These core technologies are then beefed up with your device's own security features, creating even more layers of protection.

- Biometric Authentication: Your wallet needs proof it's really you authorising the payment. This is usually done through something unique to you, like your fingerprint (Touch ID) or your face (Face ID).

- Device-Specific PINs: On top of biometrics, you typically set a unique PIN or passcode for your device, adding another hurdle for anyone trying to get in.

- Secure Elements: Most modern smartphones have a dedicated, tamper-resistant chip called a Secure Element. This is a physical piece of hardware where your payment tokens are stored, totally isolated from the phone's main operating system and apps.

A cornerstone of modern digital wallet security is multi-factor authentication (MFA), adding crucial layers of protection against unauthorised access. This blend of what you have (your phone), what you are (your fingerprint), and what you know (your PIN) makes digital wallets incredibly secure. Additional protocols, like those used in 3-D Secure authentication, can also be layered on top to verify online transactions, creating an even more robust defence against fraud.

Exploring the Different Types of Digital Wallets

Just as you might have a simple cardholder or a bulky billfold in your pocket, the digital world offers its own range of wallets. It's a mistake to think they're all the same. Understanding the differences is vital for any business trying to keep up with how customers prefer to manage and spend their money.

Each type of digital wallet is built with a different purpose, security model, and user experience in mind. For businesses, knowing which ones your customers favour is the first step toward building a payment process that feels both seamless and secure.

Let's break down the main categories you'll come across.

Mobile Wallets

This is what most people picture when they hear “digital wallet.” Mobile wallets are the apps built directly into our smartphones or wearables, like an Apple Watch. They use Near Field Communication (NFC) technology to make contactless payments a reality at checkout counters.

Wallets like Apple Pay, Google Pay, and Samsung Pay are all about convenience. You load digital versions of your existing credit and debit cards, and suddenly, paying in-store or online is as simple as a tap or a glance. The tight integration with the device's own security makes the experience feel incredibly slick and safe.

This ease of use has kick-started a huge shift in customer habits. In fact, over half of UK adults have now adopted mobile wallets as a go-to payment method. A staggering 57 percent of the adult population is registered and actively using these services. And it's not slowing down; recent UK finance reports show a 16 percent jump in monthly usage from 2023 alone. You can read more about the rise of mobile payments in the UK for the full picture.

Hosted or Custodial Wallets

Next up are hosted wallets, sometimes called custodial wallets. The idea here is that a third-party company holds and manages your digital funds or assets on your behalf. Think of it like a traditional bank account, but for the digital realm. The company is the custodian, taking on the responsibility for securing what’s inside.

A perfect example is your account on a cryptocurrency exchange. When you buy Bitcoin on a platform like Coinbase or Kraken, it usually sits in a hosted wallet managed by them. You get easy access by logging in, and they handle the complicated business of securing the digital keys.

While it's convenient, it does involve a trade-off: you're trusting that third party to protect your assets. This model is very common for:

- Cryptocurrency exchanges.

- Online payment platforms where you hold a balance, like PayPal.

- Certain investment and trading apps.

Non-Custodial Wallets

On the opposite end of the spectrum are non-custodial wallets. The philosophy here is self-sovereignty—you, and only you, have full control over your private keys and your funds. There’s no third party holding the reins.

With this setup, the user bears total responsibility for security. If you lose your private keys or your recovery phrase, there's no customer support to call for a password reset. Your assets could be gone for good. But the upside is that no company or authority can freeze or seize your funds.

Non-custodial wallets are the digital equivalent of keeping cash in a safe at home. You have full control and responsibility, but you also bear all the risk if you forget the combination.

These wallets are a mainstay in the world of cryptocurrency and decentralised finance (DeFi), with popular examples including MetaMask and Trust Wallet. They offer users the ultimate control over their digital assets.

Bank and ACH Wallets

Finally, we have the growing category of bank or ACH wallets. These are payment solutions offered directly by banks or powered by direct bank transfer networks like the Automated Clearing House (ACH). Instead of linking to a card, they connect straight to a user's bank account.

This approach powers secure account-to-account (A2A) payments, often building on Open Banking initiatives. For businesses, this can translate to lower transaction fees compared to card networks and a reduced risk of chargebacks. For customers, it’s a secure way to pay from their bank balance without ever revealing their card details. A well-known example is Zelle in the US, which enables instant bank transfers between people.

Comparison of Digital Wallet Types

To pull all this together, the table below offers a quick snapshot comparing the key differences between these wallet types.

| Wallet Type | Primary Use Case | Security Control | Examples |

|---|---|---|---|

| Mobile Wallets | In-store and online contactless payments with traditional cards. | Device biometrics and hardware-level security. | Apple Pay, Google Pay |

| Hosted Wallets | Storing and managing cryptocurrencies or online balances. | Controlled by a third-party company (custodian). | PayPal, Coinbase |

| Non-Custodial Wallets | Full personal control over digital assets and crypto keys. | Controlled exclusively by the user (self-custody). | MetaMask, Trust Wallet |

| Bank/ACH Wallets | Direct bank-to-bank payments and transfers. | Bank-level security and authentication protocols. | Zelle, Bank Apps |

Each wallet serves a different need, from the daily convenience of a mobile wallet to the absolute control of a non-custodial one. Understanding this landscape is the first step to meeting your customers where they are.

The Business Impact of the Digital Wallet Boom

The explosion of digital wallets is much more than a fleeting consumer trend. It’s a seismic shift in how people expect to pay, and it’s one that businesses simply can’t afford to ignore. This isn't just about adding another payment button to your checkout page; it's about fundamentally rethinking the customer experience around speed, simplicity, and rock-solid security.

Customers today expect to glide through payments on any channel—whether they're online, in-store, or speaking to an agent in your contact centre. Any friction in that process doesn't just cause frustration; it erodes trust and can kill a sale on the spot. For any business serious about growth, getting digital wallet payments right is now a cornerstone of a competitive strategy.

Why Adaptation Is No Longer Optional

The forces pushing this change are powerful. The rise of e-commerce has trained us all to love one-click checkouts, while in-store contactless has made tapping a phone second nature. These habits don't just vanish when a customer picks up the phone to place an order. They bring those same expectations with them.

The market data tells the same story. Take the United Kingdom's digital wallet market, for example. It's not just growing; it's accelerating. Valued at USD 177.52 billion in 2025, it’s on track to hit a staggering USD 381.11 billion by 2030, powered by a compound annual growth rate of 16.5%. This isn't just a blip; it reflects a deep change in how British consumers and businesses manage money, a shift kicked into high gear by the pandemic's drive for contactless everything. You can dig deeper into the UK's digital payment expansion to see the full picture.

For businesses, the takeaway is clear: the digital wallet isn't just another payment method to add to a list. It's the centrepiece of a modern, secure, and customer-centric payment strategy that spans every interaction point.

The Strategic Advantages for Businesses

Getting on board with digital wallets isn't just about playing catch-up; it's about unlocking real, tangible benefits for your business. When you integrate these payment methods, you'll start seeing improvements in some critical areas.

- A Better Customer Experience: Let's be honest, nobody enjoys reading a 16-digit card number over the phone. Digital wallets eliminate that hassle, making payments faster and smoother. That efficiency leads directly to happier, more loyal customers.

- Stronger Security and Trust: As we've covered, technologies like tokenization mean a customer's actual card details are never exposed during a transaction. This robust security model gives consumers peace of mind and shields your business from the nightmare of a data breach.

- Simplified PCI DSS Compliance: This is a huge one for contact centres. When you accept digital wallet payments through secure links, sensitive card data never even touches your systems. This dramatically shrinks your PCI DSS scope, saving you a small fortune in time, money, and administrative headaches.

- Higher Conversion Rates: Friction is the ultimate conversion killer. By eliminating the need to manually punch in card numbers and CVC codes, you streamline the payment process and slash the chances of a customer giving up, whether they're on your website or on a call with an agent.

Ultimately, the digital wallet boom is reshaping the payments world. Businesses that get ahead of the curve and adapt their infrastructure won't just be meeting customer expectations—they'll be building a more secure, efficient, and profitable operation for years to come.

Accepting Digital Payout Payments in Your Contact Centre

The rise of digital wallets has thrown a curveball at many contact centres. How do you take a payment from a customer's Apple Pay or Google Pay over the phone without getting tangled up in PCI DSS compliance? Let's face it, asking someone to read out their card details feels increasingly old-fashioned and risky, and your customers know it.

The solution is actually quite elegant: take your contact centre completely out of the payment flow. Instead of your agents hearing, seeing, or storing sensitive card data, they simply facilitate the payment. This move fundamentally rewrites the security equation, transforming a compliance nightmare into a smooth, modern customer experience.

This isn't just about bolstering security; it's about meeting your customers where they are, giving them the quick, self-service interactions they now expect.

The Secure Payment Link Workflow

The most effective way to do this is by sending a secure payment link straight to the customer's device while they're on the call. It’s a simple process that sidesteps the risks of verbal payments and puts the customer back in the driver's seat.

Here’s how it works in practice:

- Initiation: While talking to the customer, your agent generates a unique, single-use payment link through a secure platform.

- Delivery: That link is instantly sent to the customer via SMS or email.

- Authentication: The customer taps the link on their smartphone, which opens a secure, branded payment page.

- Authorisation: Here, they choose their preferred digital wallet (like Apple Pay or Google Pay) and authorise the payment using their phone's built-in security—Face ID, fingerprint scan, you name it.

- Confirmation: The payment is processed using tokenization, and both the agent and the customer get an immediate confirmation that everything went through.

The critical part? At no point did the customer's financial data ever touch the contact centre's systems. The entire transaction is a secure conversation between the customer's device, their wallet provider, and the payment gateway.

This method of "de-scoping" your contact centre from PCI DSS requirements is a game-changer. By making sure sensitive authentication data never even enters your environment, you can slash your PCI scope by as much as 90-95%. Think of the reduction in compliance costs and administrative headaches.

Turning Compliance into a Competitive Advantage

Putting a secure, digital-wallet-friendly payment process in place does far more than just tick a compliance box. It delivers real business benefits that can give you a serious edge. To see how different businesses are tackling this, it's helpful to look at examples of participating merchant partners who have already integrated these methods.

Adopting modern payment solutions has a direct, positive impact on key business metrics.

- Enhanced Customer Trust: When you offer a familiar, secure option like Apple Pay, you're sending a clear message: "We take your security seriously." That builds incredible trust and loyalty.

- Improved Agent Efficiency: Agents are no longer bogged down keying in card details, fixing typos, or handling sensitive data. This frees them up to do what they do best—solve customer problems and improve first-call resolution.

- Reduced Fraud and Chargebacks: The multi-factor authentication built into digital wallets (like a fingerprint or face scan) is a powerful tool for customer authentication, drastically cutting the risk of fraud.

- Increased Payment Success Rates: This clean, simple process cuts out common failure points like mistyped card numbers or expired dates, which means more payments go through successfully the first time.

Solutions like Paytia’s Click to Pay are built for precisely this scenario. They offer a robust platform that slots neatly into existing contact centre workflows, letting businesses offer the convenience of digital wallets without a massive technical overhaul. By embracing this technology, you can create a customer journey that’s faster, easier, and fundamentally more secure.

The Future of Your Wallet Is Digital

Looking ahead, the digital wallet is set to become much more than just a tool for tapping to pay. It’s quickly evolving into a central hub for your entire digital life—a secure container for not just your money but also your identity.

Imagine a single, powerful app on your phone that holds it all. Your payment cards, loyalty points, concert tickets, boarding passes, and even your driving licence, all living together in one convenient place. The lines between payments, identity, and access are blurring fast.

From Payments to Digital Identity

The next logical step in this evolution is the integration of verifiable digital credentials. This technology lets you prove who you are without ever handing over physical documents. Soon, your digital wallet might hold your official ID, professional certifications, or proof of age, all cryptographically secured and ready to present with a tap.

This shift promises a world of convenience and control. Instead of showing your entire driving licence just to prove you’re over 18, your wallet could share only that single piece of information. This move towards a unified digital identity will completely redefine how we interact with businesses and services.

The Impact of Open Banking

Powering much of this change is Open Banking. This framework allows trusted third-party applications, including digital wallets, to securely connect directly to your bank account. Instead of relying solely on card networks, payments can happen directly from your account—often with better security and lower costs for businesses.

This deeper integration transforms the wallet from a simple card holder into a genuine financial control centre, offering richer insights and more direct transactions.

The convergence of payments, loyalty, and identity into a single digital wallet isn't just a convenience—it's the new standard for customer interaction. Businesses must prepare for this unified experience or risk being left behind.

The entire UK digital payments market, which includes mobile wallets and bank-based solutions, is a testament to this rapid growth. Valued at USD 11.7 billion in 2025, it’s projected to reach a staggering USD 43.7 billion by 2034. While contactless cards currently lead the pack, mobile wallet payments are set for the fastest expansion, with an expected growth rate of 17.56 percent during this period. You can explore more data on the UK’s digital payment forecast on straitsresearch.com.

For businesses, this forward-looking perspective highlights a clear directive: adopt flexible, modern payment solutions now. Preparing for this next wave of innovation is essential to staying ahead of customer expectations and building a secure, future-proof operation.

Got Questions About Digital Wallets? We've Got Answers

Even after getting the hang of what digital wallets are, it's natural for businesses to have lingering questions, especially around security and day-to-day use. Let's tackle some of the most common queries that come up for contact centre managers weighing up their payment options.

Are Digital Wallets Actually More Secure Than a Physical Card?

Yes, by a significant margin. Digital wallets rely on seriously advanced security, like tokenization, which cleverly masks your real card number so it’s never shared during a transaction.

On top of that, they almost always require biometric authentication—think fingerprint or face scan—just to open the wallet. This multi-layered defence means even if someone gets their hands on your phone, your payment details are locked down tight. You can't say the same for a lost or stolen physical card.

How Can Our Contact Centre Start Accepting Digital Wallet Payments?

The best way for a contact centre to take digital wallet payments is through a secure payment platform. Instead of the old-school (and risky) method of asking for card details over the phone, your agent simply sends a secure payment link to the customer's smartphone.

From there, the customer uses their own device to pay with their preferred wallet, like Apple Pay or Google Pay. This whole process cleverly keeps sensitive data from ever touching your systems or call recordings, making PCI DSS compliance a whole lot simpler.

"Shifting to secure payment links for digital wallets isn't just about modernising your contact centre. It's about meeting your customers where they are—expecting speed and security—while making your own compliance posture much stronger."

Won't Supporting Digital Wallets Just Complicate Our PCI DSS Compliance?

Quite the opposite, actually. When you use a modern payment solution designed for this, supporting digital wallets can dramatically simplify your PCI DSS compliance.

Because the payment data is handled entirely on the customer's device and is tokenized from the start, it never enters your environment. This move drastically shrinks your PCI scope, which in turn reduces the complexity, headache, and cost of staying compliant.

Ready to bring your contact centre payments into the modern era with a solution built for security and simplicity? Paytia offers a secure platform that lets your team accept digital wallet payments without ever having to handle sensitive data. Find out how you can modernise your payment process and protect your business today.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.