What Is Tokenization And How It Secures Your Data

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

At its core, tokenization is a simple but powerful idea: it’s the process of swapping out sensitive data, like a full credit card number, for a unique, non-sensitive equivalent called a token. This token has no real value on its own; it just acts as a secure placeholder for the original, high-risk information. It has become a cornerstone of modern data security, especially for handling payments.

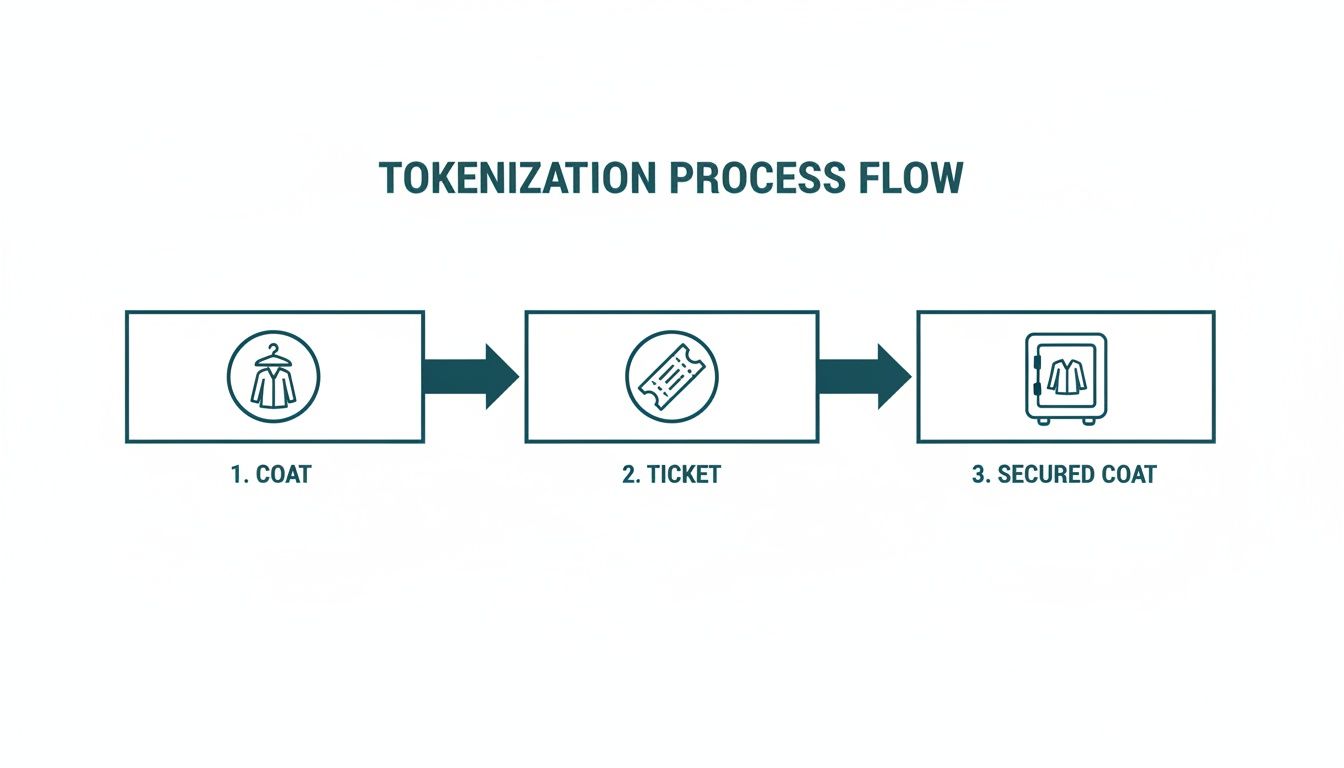

A Simple Analogy For Tokenization

Think of it like checking a valuable coat at a fancy restaurant. You hand over your coat, and in return, you get a small, numbered ticket. This ticket is your key to getting the coat back, but it means nothing to anyone else. If a thief stole that ticket, they wouldn't get your expensive coat—they'd just have a useless piece of paper. The coat itself stays locked away in a secure cloakroom, accessible only to staff who can match your ticket to it.

This is exactly how tokenization protects your financial data. The credit card number is the valuable coat, and the token is the cloakroom ticket.

When you make a purchase, your actual payment details aren’t stored by the business you're paying. Instead, they're sent to a highly secure, centralised system known as a token vault—this is the restaurant's secure cloakroom. The vault safely stores your sensitive data and generates a unique, non-sensitive token, which it then sends back to the business for their records.

This token can then be used for things like recurring payments, refunds, or even for analytics, all without ever re-exposing your real card number. The business only ever interacts with the "ticket," while your actual Primary Account Number (PAN)—the "coat"—stays locked away and protected inside the vault. You can learn more about what a PAN is and why it's so critical to protect in our detailed guide.

What Makes a Token So Secure?

This whole process fundamentally changes the type of data a business has to manage. They go from handling high-risk, sensitive information to managing low-risk tokens, which has huge implications for their security and compliance obligations.

- Irreversibility: You can't mathematically reverse-engineer a token to figure out the original data. Unlike encrypted data, there's no "key" that can unlock it.

- Uniqueness: Every token is a randomly generated string of numbers and letters, completely unique to a specific piece of data for a specific merchant.

- Format Preservation: Tokens can be designed to mimic the format of the original data (like a 16-digit number that looks like a credit card). This clever feature allows businesses to use them in older, legacy systems without needing expensive and time-consuming software updates.

Sensitive Data vs Token At a Glance

Let's break down the key differences between the original sensitive data and its tokenized stand-in. The table below gives a quick snapshot of why this swap is so effective.

| Characteristic | Original Payment Data (PAN) | Token |

|---|---|---|

| Value | High intrinsic value to fraudsters. | No exploitable value on its own. |

| Security Risk | High. If stolen, can be used for fraud. | Very low. Useless to attackers. |

| PCI DSS Scope | In-scope. Requires strict security controls. | Out-of-scope. Reduces compliance burden. |

| Reversibility | N/A (It's the original data) | Cannot be mathematically reversed. |

| Use Case | Authorising initial transactions. | Recurring payments, refunds, analytics. |

| Storage | Heavily restricted and must be encrypted. | Can be stored in standard systems. |

As you can see, the token retains the practical usefulness of the original data for business operations but sheds all of the associated risk.

By swapping sensitive data for a token, an organisation effectively removes the value from the data it holds. A data breach becomes far less catastrophic because attackers would only steal the equivalent of cloakroom tickets, not the valuable assets themselves.

How The Tokenization Process Actually Works

To really get why tokenization is such a game-changer for security, you have to look under the bonnet. The cloakroom analogy is great for the big picture, but the real magic is in the technical steps that make the whole system so incredibly reliable for any business handling sensitive data.

The journey from a customer's raw credit card number to a secure token is a carefully choreographed dance between your business, a payment gateway, and a secure token vault. Every single step is designed to make sure the original, high-risk data never even touches your internal systems.

Think of it like this: the valuable "coat" (the card number) is swapped for a simple "ticket" (the token), and the coat itself is locked away in a high-security "vault".

This simple swap is the core of the process. You're replacing something a fraudster would love to get their hands on with a useless placeholder.

The Step-By-Step Tokenization Workflow

Let's walk through what happens during a typical payment, whether it's online, in an app, or a customer paying over the phone in your contact centre. The flow is remarkably consistent.

Data Capture: The customer gives you their payment details – the 16-digit Primary Account Number (PAN), expiry date, and CVC. This happens at the point of interaction, maybe through an encrypted web form or a secure phone payment system where the agent never sees or hears the numbers.

Secure Transmission: This is the crucial part. The sensitive data is immediately sent directly to the tokenization provider or payment gateway. It completely bypasses your own servers and applications, which is the single biggest move you can make to slash your PCI DSS compliance scope.

Token Generation: The gateway receives the raw card number. In an instant, it generates a unique, non-sensitive token. At the same time, it locks the original PAN and its new token partner away in a highly protected, isolated environment called a token vault.

A token vault isn't just any database. It's a purpose-built digital fortress, designed solely for storing sensitive data. These vaults are certified to the highest level of PCI DSS compliance, armed with heavy-duty encryption, ultra-strict access controls, and 24/7 monitoring.

Token Return: The brand-new token is sent back to your system. Now this is something you can safely store. You can link it to a customer's record in your CRM or billing platform without taking on massive security risks.

Transaction Processing: For that first payment, the gateway uses the original PAN it just received to get the transaction authorised by the bank. Once approved, the sale is complete.

Future Use: Here's the long-term win. For any future payments, like a recurring subscription or a refund, you just send the token to the gateway. The gateway looks it up in the vault, finds the real card number, and processes the new transaction. Your business never has to touch the raw PAN again.

Understanding Different Token Types

Not all tokens are built the same. The right one for you often depends on your existing software and how you operate. There are two main flavours you'll come across.

Random Alphanumeric Tokens: These are jumbled strings of letters and numbers that look nothing like the original card number. They offer fantastic security, but they can sometimes cause headaches for older, legacy systems that are hard-coded to expect a number in a specific format.

Format-Preserving Tokens (FPTs): These are a bit more sophisticated. An FPT is designed to mimic the format of the original data. For instance, a token for a 16-digit Visa card will also be a 16-digit number that starts with a '4' and passes basic format checks. This is a lifesaver for businesses with older systems, as it lets them adopt tokenization without a painful and expensive software overhaul.

Once you see the workflow, it's clear how tokenization acts as a powerful shield. It isolates the information that criminals want, letting you run your business efficiently without the constant risk and regulatory burden of storing raw payment data.

Tokenization vs Encryption: What’s the Difference?

People often talk about tokenization and encryption in the same breath, but they are fundamentally different ways to secure data. Getting them confused is easy to do, but it can leave serious gaps in your security. Both are designed to protect sensitive information, but how they do it and what they protect are worlds apart.

Think of encryption as locking your valuables in a high-tech safe. The original data is still there, but it's scrambled into an unreadable mess called ciphertext. To get it back, you need the right encryption key. The problem? If a thief gets hold of both the safe (the encrypted data) and the key, they can unlock it and see everything.

Tokenization works more like exchanging your valuables for a claim ticket. The original, sensitive data is completely removed from your systems and locked away in a secure, isolated vault. What you get back is a token—a placeholder that has no mathematical relationship to the original data. It's impossible to reverse-engineer the token to figure out the original details.

The Core Mechanical Distinction

The fundamental difference comes down to what happens to the data and how it’s protected.

- Encryption is a mathematical exercise. It uses a complex algorithm and a secret key to transform your data. The entire security of the system hangs on keeping that key safe.

- Tokenization is all about substitution. It yanks the sensitive data out of your environment entirely, swapping it for a non-sensitive stand-in. Its security comes from this complete removal.

Encryption modifies the data you hold, making it unreadable without a key. Tokenization removes the data you hold, replacing it with something that has no value to attackers. The risk is not just reduced; it is fundamentally relocated away from your business.

This distinction is massive when it comes to compliance. Encrypted data is still technically in your possession, meaning it remains within the scope of regulations like PCI DSS. But because tokenization removes the asset from your environment, your compliance burden shrinks dramatically.

When To Use Each Method

Neither approach is better than the other; they’re just built for different jobs. In fact, they often work best together as part of a layered security strategy. Understanding these differences is a core part of building a robust Data Loss Prevention (DLP) plan.

You’d use Encryption for:

- Data in Transit: When information is moving across a network (like a customer submitting a form on your website), encryption (TLS/SSL) is essential to stop anyone from snooping on the connection.

- Data at Rest: This is for securing large databases or file archives that you might need to decrypt later for analysis. It keeps the stored data safe from unauthorised access.

You’d use Tokenization for:

- Payment Processing: This is its bread and butter. By tokenizing card numbers, you can process payments, handle refunds, and manage subscriptions without ever letting sensitive cardholder data touch your systems.

- Protecting PII: It’s perfect for securing personally identifiable information like national insurance or driving licence numbers in your internal systems where you don’t need the original value for day-to-day work.

Comparing Tokenization and Encryption

Let's put them side-by-side to make the differences crystal clear. This table breaks down how these two powerful security tools function.

| Feature | Tokenization | Encryption |

|---|---|---|

| Core Process | Substitutes sensitive data with a non-sensitive token. | Scrambles data into an unreadable format (ciphertext). |

| Data Location | Original data is removed and stored in a secure vault. | Original data remains, just in a modified, unreadable state. |

| Reversibility | Not mathematically reversible; requires vault access. | Reversible with the correct decryption key. |

| Data Format | Can preserve the format of the original data (FPT). | Results in a random-looking string of characters. |

| PCI DSS Impact | Drastically reduces compliance scope. | Data remains in-scope, requiring strict key management. |

| Primary Use | Securing payment card data and PII in business systems. | Securing data in transit and at rest. |

In the end, it’s not about choosing one over the other. A truly solid security posture uses both. You'll use encryption to protect data on its way to the token vault, and then tokenization takes over to make sure the sensitive parts are removed from your environment for good.

The Business Case For Adopting Tokenization

While the technical side of tokenization is impressive, the real question for any business leader is simple: what does this actually do for my bottom line? The truth is, adopting tokenization isn’t just a security upgrade. It’s a strategic business decision that delivers tangible financial and operational wins by completely changing how you manage risk.

The single biggest advantage is a dramatic reduction in your Payment Card Industry Data Security Standard (PCI DSS) compliance scope. When sensitive cardholder data never enters or rests within your systems, you effectively ‘de-scope’ those parts of your business from many of the standard's toughest—and most expensive—requirements. This is a complete game-changer.

This de-scoping translates directly into cost savings. You’ll deal with less complex and less frequent audits, spend less on specialised security infrastructure, and free up your IT and compliance teams from soul-crushing admin. Instead of managing a high-risk data environment, they can get back to focusing on what actually grows the business.

Slashing Compliance Costs and Complexity

For many businesses, the primary driver for adopting tokenization is the sheer relief it provides from PCI DSS obligations. As long as raw card data is present in your environment—even if it's encrypted—you are on the hook for protecting it under a strict and unforgiving set of rules. Tokenization removes the data, and with it, much of the responsibility.

Here’s how it immediately impacts your operations:

- Reduced Audit Scope: Auditors can certify that your systems are out of scope, which massively simplifies the assessment process and lowers the associated costs.

- Lowered Risk of Penalties: A data breach is incredibly costly, with fines for non-compliance running into tens of thousands of pounds per month. By minimising the data you hold, you minimise this huge financial risk.

- Simplified Operations: Your teams no longer need to wrestle with complex encryption key rotations or tightly restricted databases for payment information. Your entire IT infrastructure becomes simpler and easier to manage.

By removing the very asset that criminals are after—the actual card number—you drastically lower your profile as a target. Tokenization isn't just about passing an audit; it's about making your business fundamentally less attractive to attackers, which is the ultimate form of risk management.

Navigating these requirements can be tricky, so understanding the specifics is key. You can see how this works in practice by exploring a deeper dive into how Paytia helps with PCI DSS compliance.

Building Customer Trust and Enabling Growth

In an age where data breach headlines are a near-daily occurrence, customer trust has become an incredibly valuable currency. When customers know you are taking advanced steps to protect their information, their confidence in your brand grows. This is especially true in places like contact centres, where payments are often taken over the phone.

Tokenization gives you a powerful story to tell about security. You can confidently state that your agents never see, hear, or handle sensitive card details, and that this data is never stored on your systems. That kind of assurance can boost conversion rates and build real, long-term loyalty.

This strong security foundation also unlocks safer omnichannel experiences. A token generated from a phone payment can be safely used for a future online purchase, or vice versa. This creates a seamless and secure customer journey across all your sales channels without ever re-exposing sensitive data.

The UK tokenization market has seen incredible growth, reflecting this rising demand for secure payment tech. The market was valued at around USD 284.1 million and is projected to hit USD 929.0 million by 2030, growing at a blistering 22.5% annually. This trend shows just how vital the technology has become for UK businesses.

Of course, tokenization protects live data, but a complete security strategy considers the entire data lifecycle. Understanding robust practices for secure data destruction is crucial for properly disposing of old hardware that might contain residual information. Ultimately, tokenization is an investment in resilience, trust, and efficiency—providing a clear and compelling business case.

How To Implement Tokenization In Your Business

Understanding the power of tokenization is one thing; actually bringing it into your organisation is another. The good news is that implementing this technology has never been more accessible. For most, the journey starts with a simple question: should you build your own solution or partner with a specialist?

Each path has its trade-offs. Building an in-house tokenization system gives you ultimate control, but it's a monumental undertaking. This route demands deep expertise in cryptography and data security, a substantial upfront investment in infrastructure, and ongoing resources to manage maintenance, updates, and the all-important PCI DSS Level 1 certification.

For the vast majority of businesses, partnering with a dedicated tokenization provider is the far more practical and secure choice. These providers have already poured millions into building and certifying their platforms, allowing you to tap into enterprise-grade security without the enormous cost and operational headache. It's a faster, safer way to get to market while staying aligned with the latest security standards.

Choosing Your Implementation Path

When you team up with a third-party provider, the most common and flexible method of integration is through an Application Programming Interface (API). An API is the modern standard for connecting different software systems, letting your existing applications—like your CRM, billing software, or contact centre platform—talk directly and securely with the tokenization service.

API-based tokenization offers a seamless way to weave security directly into your workflows without ripping out and replacing your current technology. For instance, when a customer gives you their payment details, your system makes a simple API call to the provider. The provider handles the token generation and vaulting, then sends the secure token back to your application for storage and future use.

This isn't just a trend; it's the dominant force in the market. Within the UK tokenization landscape, API-based solutions represent the largest market segment, pulling in revenues of USD 148.86 million. More importantly, this approach is also the fastest-growing, projected to expand at an impressive rate of 26.33%. This rapid growth points to a clear preference for flexible, developer-friendly integrations that don't disrupt the business.

An API acts as a secure messenger between your systems and the token vault. It lets you request a token or use an existing one to process a payment, all without sensitive data ever touching your own infrastructure. This is the key to drastically reducing your PCI DSS compliance scope.

Key Integration Considerations

Successfully plugging a tokenization solution into your business requires careful planning. It’s not just about the tech, but how it fits into your unique processes, especially across different customer channels.

Before you start, think about the following:

- Existing Systems: Map out every application that currently handles or stores sensitive data. This includes your e-commerce platform, accounting software, and any customer management tools. An API solution needs to play nicely with this ecosystem.

- Customer Channels: How do you take payments? Your tokenization strategy must cover every touchpoint—online, in-person, and especially over the phone in a contact centre. A single, unified token can create a secure and consistent omnichannel experience.

- Payment Gateway Compatibility: Check that the tokenization provider works with your current payment gateway or offers a solution that meets your needs. Smooth integration here is vital for uninterrupted payment processing. Our guide on payment gateway API integration offers more insights into this critical relationship.

- Developer Resources: While APIs are designed to be straightforward, you’ll still need some technical resources to manage the implementation. Look at the provider’s documentation, support, and developer tools to make sure the rollout will be smooth.

By carefully considering these factors and choosing a flexible, API-driven partner, you can roll out a tokenization project that secures your data, slashes your compliance burden, and builds lasting trust with your customers.

Answering Your Questions About Tokenization

As you start to explore what tokenization could mean for your business, it’s only natural to have a few questions. This technology fundamentally changes how you handle sensitive data, so getting crystal clear on the details is a must. To help you move forward with confidence, we’ve put together answers to some of the most common questions we hear from decision-makers.

Our goal here is to iron out any lingering uncertainties and reinforce the core concepts, giving you a solid picture of how this technology really works in the wild.

Can a Token Be Reversed to Get the Original Card Number?

This is one of the most important questions, and the answer gets right to the heart of why tokenization is so secure. In short, no, a token cannot be mathematically reversed to reveal the original card number, or Primary Account Number (PAN). This is a crucial difference between tokenization and its cousin, encryption.

With encryption, there’s a direct mathematical link between the original data and the scrambled ciphertext. If an attacker somehow gets their hands on both the encrypted data and the decryption key, they can unlock it.

Tokenization doesn't rely on a reversible formula. Instead, it’s a system of pure substitution. The original card number is sent to an incredibly secure, isolated environment called a token vault. The vault then generates a completely random, unrelated token and sends that back to your system. The only connection between that token and the original PAN exists inside that heavily fortified vault, managed entirely by the tokenization provider.

Think of it this way: there isn't a "key" that can unlock a token. To get the original data, an attacker would have to breach a PCI DSS Level 1 certified vault—one of the most secure digital fortresses on the planet. This makes the data you hold practically useless to them.

Is Tokenization the Same as End-to-End Encryption?

While they both protect data, they aren't the same thing. Tokenization and encryption are two distinct tools that solve different security challenges. As we touched on earlier, they work best when used together as part of a layered defence.

Here’s a quick reminder of their different jobs:

- Encryption is like a temporary bodyguard for data on the move. It scrambles data while it's in transit (say, from a customer's browser to the payment gateway) and can protect it while it's at rest in a database. Crucially, though, the original data is still there—it’s just in disguise.

- Tokenization is about permanent removal. It takes the sensitive data completely out of your environment and swaps it for a secure placeholder. Your systems never have to store, process, or transmit the actual card number after that first transaction.

A rock-solid security setup uses both. Encryption protects the card number on its initial journey to the token vault. Once it arrives safely, tokenization takes over, removing that risky data from your systems for good.

How Does Tokenization Secure Payments in a Contact Centre?

Contact centres are a perfect example of where tokenization really shines. Traditionally, agents taking payments over the phone created a massive security and compliance headache. They would hear or write down card numbers, and this sensitive audio could easily be captured in call recordings.

Tokenization gets rid of these risks completely. When a customer is ready to pay, modern systems use one of two secure methods:

- DTMF Suppression: The customer types their card details using their telephone keypad. The agent stays on the line to help, but the tones (DTMF signals) are masked. The agent only hears flat beeps, and nothing sensitive is captured in the call recording.

- Secure Payment Links: The agent sends a payment link to the customer via SMS or email. The customer can then complete the transaction on their own device through a secure, tokenized portal.

In both cases, the sensitive card data goes directly from the customer to the payment processor, completely bypassing the agent and all your internal business systems. The contact centre only gets a token back confirming the payment was successful. This simple switch de-scopes the entire interaction from PCI DSS, protects agents from handling toxic data, and builds huge trust with customers.

What Is the First Step to Start Using Tokenization?

Taking that first step can feel like the hardest part, but it doesn't have to be a huge ordeal. Your journey toward adopting tokenization should kick off with a straightforward look at your current data environment and business processes.

Start by doing a quick internal audit. Map out every single touchpoint where your business currently interacts with sensitive payment data. Ask yourself:

- Where do we collect card details (website, over the phone, in-person)?

- Which systems store this information (our CRM, accounting software, random spreadsheets)?

- Who in our organisation actually has access to this data?

Once you have a clear map of your data flow, you can start looking into third-party tokenization providers. Find a partner with a flexible API, proven experience in your industry, and a platform that can secure all your different payment channels. This initial assessment will give you the clarity you need to choose a solution that fits your unique operational needs and security goals.

Ready to secure your payments and simplify compliance? Paytia's Secureflow platform uses advanced tokenization to remove sensitive data from your business environment, protecting every transaction across phone, chat, and digital channels. Discover how you can reduce risk and build customer trust with Paytia.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.