A Guide to Accepting Card Payments Over the Phone Securely

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Taking card payments over the phone securely isn't just a box-ticking exercise; it's about protecting your customers' data with robust, PCI-compliant methods. Today, that means looking at technologies like DTMF suppression and tokenization. These clever solutions stop sensitive card details from ever reaching your business environment, which dramatically cuts down your risk and compliance headaches.

Why Secure Phone Payments Are No longer Optional

We live in a world of one-click checkouts, and that expectation for quick, safe transactions now extends to every customer interaction—phone calls included. When someone chooses to pay you over the phone, they're placing a huge amount of trust in your hands. It's a critical moment. They are verbally giving you their financial details, and they absolutely expect you to handle that information with the highest level of care.

Get this wrong, and the consequences can be devastating, going far beyond a single lost sale. A data breach can lead to a catastrophic fallout, from eye-watering regulatory fines and legal bills to the immense cost of putting things right for your customers. According to recent industry reports, the average cost of a data breach has now climbed to over £3.4 million.

The High Stakes of Insecure Phone Payments

The risk is especially acute for call centres in industries like insurance, healthcare, and retail, where agents are constantly handling card details. An old-fashioned, insecure process—like asking customers to read their card number out loud—puts your entire operation on the line.

Think about it. That sensitive data can be easily overheard by others, jotted down on a notepad, or even stored in your call recordings. Each of these is a potential point of failure waiting to be exploited.

This direct exposure has a massive impact on your PCI DSS (Payment Card Industry Data Security Standard) compliance. If your agents, their computers, and your network "touch" raw card data, they all fall within the scope of PCI DSS, which means you're on the hook for implementing and maintaining rigorous—and expensive—security controls.

A single security lapse can demolish years of hard-won customer trust. Often, the damage to your brand's reputation far outweighs the immediate financial penalties, leading to customer churn that can cripple a business long-term.

Shifting From 'Nice-to-Have' to Essential

This is precisely why modern security measures have moved from being a 'nice-to-have' feature to an absolute business essential. Technologies like DTMF (Dual-Tone Multi-Frequency) masking or tokenization are designed to take your business completely out of the loop when sensitive data is being shared.

Here’s what that looks like in the real world:

- Massively Reduced Risk: Card numbers are never spoken by the customer or heard by your agent. They aren't stored in your systems, which practically eliminates the threat of both internal and external fraud.

- Simplified Compliance: By stopping card data from ever entering your environment, you can slash your PCI DSS scope by as much as 95%. The savings in time, money, and audit-related stress are enormous.

- Stronger Customer Trust: Your customers will feel far more secure when they can enter their payment details using their phone's keypad, knowing that the information is being protected by an automated, secure process.

Adopting these technologies is a smart, proactive move. It sends a clear message that you value your customers' security as much as they do. For a more detailed breakdown, you can learn more about the hidden risks of taking card payments over the phone and see why updating your process is so critical.

What Are My Options for Taking Card Payments by Phone?

When it comes to taking card payments over the phone, it’s not a one-size-fits-all situation. The method you choose has a direct impact on your workflow, your security posture, and just how much of a headache PCI DSS compliance becomes.

Let's walk through the main choices available, starting with the old, high-risk ways and moving towards modern, secure solutions that actually protect your business and your customers.

We're seeing a massive shift in consumer behaviour. The UK mobile payments market was valued at USD 2.65 billion in 2024, and it's expected to surge to USD 14.4 billion by 2033. This isn't just a trend; it's a fundamental change in how people expect to pay. They want quick, secure, and seamless transactions, and that expectation now extends to every phone call they have with a business. The old ways just don't cut it anymore.

The Old Way: Agent-Assisted Payments (And Why It's So Risky)

This is the classic method most people picture. A customer reads their full card number, expiry date, and three-digit CVC code out loud to a live agent, who then manually keys everything into a virtual terminal.

Simple? Yes. Secure? Absolutely not.

The second an agent hears or sees that sensitive card data, your entire contact centre environment is pulled into PCI DSS scope. This includes the agent, their computer, your network, and any call recordings. The compliance burden and associated costs skyrocket almost instantly.

Just think about it: a charity volunteer takes a generous donation over the phone and jots the card details down on a sticky note to enter later. That little piece of paper is now what we call a 'toxic asset'. It's a huge security risk that needs to be tracked, managed, and securely destroyed. It’s a compliance nightmare waiting to happen.

A Better Way: Agent-Assisted Payments with DTMF Masking

A far more secure and intelligent approach uses what's known as DTMF (Dual-Tone Multi-Frequency) masking. In this scenario, your agent stays on the line to guide the customer, but when it's time to pay, the customer uses their phone's keypad to punch in their card details.

The DTMF tones are intercepted and masked by a secure platform, so the agent only hears flat, unrecognisable beeps or complete silence. The sensitive card data completely bypasses your systems and goes straight to the payment processor.

This approach really does offer the best of both worlds:

- You keep the human touch. The agent is there to help, answer last-minute questions, and confirm the payment went through. This is invaluable for complex sales or for reassuring customers who might be less comfortable with technology.

- You drastically reduce your PCI scope. Because card data never enters your environment, you can effectively de-scope your agents, their workstations, and your network from many of the toughest PCI DSS requirements.

My Takeaway: DTMF masking is a game-changer. It allows you to maintain that crucial personal interaction while completely removing the security risk of handling verbal card payments. You protect customer data without sacrificing the customer experience.

For Ultimate Efficiency: Fully Automated IVR Payments

For more routine, high-volume payments, a Payment IVR (Interactive Voice Response) system is incredibly efficient. This is a fully automated, 24/7 service where customers can pay a bill or top up an account without ever speaking to a person.

A great real-world example is a utility company. A customer can call late at night, follow a few simple voice prompts ("Press 1 to pay your bill"), and use their keypad to enter their account and card numbers. The system handles everything and provides a confirmation number. To support this, many businesses are adopting high-performance VoIP solutions that integrate seamlessly with these automated platforms.

You can learn more about how https://www.paytia.com/solutions/payment-ivr can streamline your collections and keep security tight.

The Modern Approach: Secure Payment Links Sent Mid-Call

Another fantastic option is to send a secure payment link via SMS or email while the agent is still on the phone with the customer. The customer simply taps the link on their smartphone, which opens a secure, branded payment page where they can enter their details themselves.

This method is perfect when a visual confirmation is needed. Imagine an insurance agent taking a payment for a new policy. They can send a link that summarises the policy details and cost right on the payment page, so the customer knows exactly what they’re paying for before they hit 'confirm'.

The agent can see on their screen, in real-time, the moment the payment is completed and can then wrap up the call. And, just like with DTMF, no card data ever comes near your systems, keeping your PCI scope minimal.

Comparison of Phone Payment Methods

To help you decide, here’s a quick breakdown of how these methods stack up against each other. Choosing the right one really comes down to your specific business needs, the types of customer conversations you have, and your call volume.

| Method | Security Level | PCI Scope Impact | Customer Experience | Best For |

|---|---|---|---|---|

| Verbal Agent-Assisted | Very Low | Very High | Simple but insecure; can cause customer anxiety. | Not Recommended. A high-risk legacy process. |

| DTMF Masking | High | Very Low | Secure and reassuring, with live agent support. | Complex sales, technical support payments, donations. |

| Automated IVR | High | Very Low | Fast and convenient for self-service 24/7. | Routine bill payments, account top-ups, renewals. |

| Secure Payment Links | High | Very Low | Modern and mobile-friendly, with visual confirmation. | Insurance premiums, retail orders, service deposits. |

Ultimately, the goal should always be to move away from any process where your team can hear, see, or handle raw cardholder data. By adopting technologies like DTMF masking, IVR, or secure links, you're not just ticking a compliance box. You're fundamentally improving your security and providing a smoother, more trustworthy experience that your customers will appreciate.

How to Handle PCI DSS Compliance for Phone Payments

PCI DSS compliance can feel like trying to navigate a maze in the dark, particularly when you bring voice channels into the mix. Let's switch the lights on. Think of this as your practical map for keeping phone payments secure and compliant, without all the usual headaches.

The Payment Card Industry Data Security Standard (PCI DSS) is the rulebook for protecting cardholder data. For a contact centre, these rules have traditionally been a massive operational challenge. Why? Because if your agents can hear, see, or record sensitive card details, your entire operation—from the agents themselves to your network and call recordings—falls under its strict regulations. This is what's known as being 'in scope'.

The Secret Weapon: PCI Scope Reduction

By far the most effective strategy for managing compliance is scope reduction. This isn't about cutting corners; it's about smartly engineering sensitive data out of your environment. The aim is to create a secure bubble around the payment process so that raw card details never even touch your systems.

Imagine your contact centre is a large building. In a traditional setup, the whole building has to be secured to PCI standards—a costly and complex undertaking. With scope reduction, you're essentially building a small, ultra-secure vault just outside the main building to handle the payments. Now, only that vault needs to meet the highest security standards, freeing the rest of your operations from that heavy compliance burden.

This is where modern payment technology really shines.

De-Scoping Your Contact Centre with Technology

Solutions that use DTMF suppression (often called DTMF masking) and tokenization are the key to making this happen. They're designed to intercept and secure card data before it ever gets a chance to enter your world.

Here’s how it works in a real-world call:

- Your agent is on the phone and it’s time for the customer to pay.

- The agent guides the customer to enter their card number using their telephone keypad.

- As the customer types, the DTMF tones are captured by a secure third-party platform, completely bypassing your phone system. Your agent simply hears flat beeps or silence, and the tones never reach your call recordings.

- The card data is sent directly to your payment gateway, and a non-sensitive token (a randomised string of characters) is sent back to your system.

This token can be safely stored in your CRM or other business apps for things like recurring billing or refunds, but it contains none of the original, toxic card details. You've just processed a payment without ever touching the sensitive data.

This method is incredibly powerful. By preventing card data from entering your call recordings, agent desktops, and network logs, you can effectively shrink your PCI DSS scope by 90-95%. It's a direct path to slashing audit costs, reducing complexity, and minimising risk.

This approach also fits perfectly with current consumer habits. While contactless payments are booming in the UK—hitting 17 billion transactions in 2022—phone payments remain a vital channel for many businesses. But they come with unique risks. Fraud losses on UK cards reached a staggering £609 million in 2022, a stark reminder that secure technologies are essential for building and maintaining customer trust. You can dig into these trends in the latest UK Finance payment markets report.

Your PCI Compliance Checklist for Phone Payments

Getting compliant—and staying that way—is about more than just technology. It requires a clear framework that covers your people, processes, and systems.

Here’s a straightforward checklist of the key areas to focus on when you're taking card payments over the phone:

Secure Your Call Recordings

This is your number one priority. Make absolutely sure that card numbers (the PAN) and security codes (the CVC) are never stored in call recordings. A basic 'pause and resume' system is a start, but for true security, adopting DTMF suppression automatically prevents this data from ever being captured in the first place.Implement Robust Agent Training

Your agents are your first line of defence. They need regular, ongoing training on security best practices, including:- How to handle customer payment information securely.

- The importance of a 'clean desk' policy—never writing down card details.

- How to spot and report suspicious activity.

Control Access to Systems

Always apply the principle of least privilege. This simply means agents should only have access to the data and systems they absolutely need to do their jobs. Enforce strong, unique passwords and use multi-factor authentication wherever you can.Secure Your Network and Workstations

Ensure all computers and network devices are protected with up-to-date firewalls and anti-virus software. This is non-negotiable, especially in remote or hybrid work environments where agents might be using less-secure home networks.Develop Clear Policies and Procedures

Document everything. Create clear, accessible policies for handling cardholder data, responding to security incidents, and managing compliance. Everyone on your team needs to know the rules and what to do if something goes wrong.

By focusing on scope reduction and following this framework, you can turn PCI DSS compliance from a daunting obstacle into a manageable, integrated part of your operations. It’s about working smarter, not harder, to protect your customers and your business. For a deeper dive, check out our comprehensive guide on achieving and maintaining PCI DSS compliance.

Right, you know the theory behind secure phone payments. Now for the practical part: getting a system up and running that actually works for your business, your team, and your customers. This is where we move from concepts to a concrete plan of action.

The goal here is a methodical transition from your current setup to a fully operational, PCI-compliant payment process. It's a project that means taking a hard look at your existing tech, like your phone system and CRM, to figure out the smartest way to slot in new, secure payment tools.

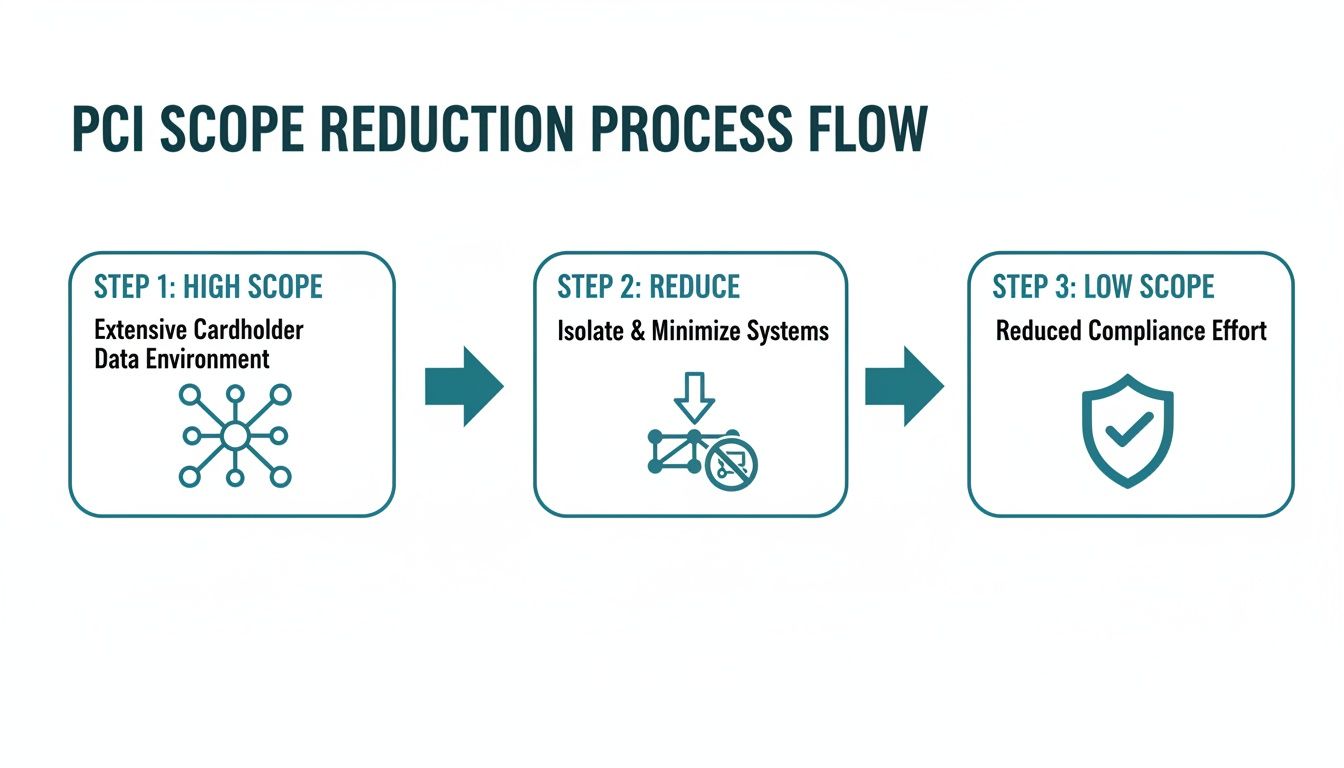

This whole process is about shrinking your PCI DSS scope. As you can see below, implementing the right solutions takes your operations from a high-risk environment, where card data is everywhere, to a much safer, low-risk one.

By getting sensitive card data out of your systems, you're not just ticking a compliance box—you're making your entire operation more secure.

Assessing Your Current Technology Stack

Before you can build anything new, you need a solid understanding of what you’re working with right now. Start by mapping out your key systems and how they talk to each other. This isn't just a job for the IT department; it’s about tracing the journey a customer's call takes through your business.

You’ll want to evaluate a few key pieces of your setup:

- Telephony System: What are you using for calls? Is it a classic PBX, a more modern VoIP solution, or a full-blown Contact Centre as a Service (CCaaS) platform? Your phone system is the backbone, and any payment solution has to play nicely with it.

- CRM Software: This is where your customer data lives. A slick integration means payment transaction details (but crucially, not the card numbers) are automatically logged against a customer’s record. Think of the time that saves your agents.

- Payment Gateway: Who actually processes your card payments today? Your new phone payment solution will need to connect directly to your chosen gateway to get transactions authorised and settled.

Imagine a housing association that uses a VoIP phone system and a popular CRM. They’d be looking for a DTMF suppression provider that already has pre-built connectors for both. That kind of shortcut dramatically simplifies the technical work and gets them live much faster.

Choosing Your Technology Partner and Gateway

Once you have a clear picture of your tech stack, you can start shopping for partners. Remember, you're not just buying a piece of software. You're bringing on a partner to help you protect your customers' data and, by extension, your reputation.

As you compare providers, keep these factors front and centre:

- PCI DSS Level 1 Certification: This is an absolute must-have. It’s the highest level of validation and proves the provider meets the industry’s toughest security standards. No certificate, no deal.

- Integration Capabilities: Do they have flexible APIs or, even better, pre-built integrations for your specific telephony and CRM systems? Ask for real-world case studies or to speak with businesses that have a similar setup to yours.

- Support and Onboarding: What’s their process for getting you started? A good partner will give you dedicated support to walk you through the setup, testing, and team training.

The best technology is only as good as the support behind it. A partner who takes the time to understand your business and is there for you during the setup phase will make the whole project less stressful and far more likely to succeed.

Crafting Workflows and Agent Scripts

The technology is just one piece of the puzzle. Your agents on the front line are the ones who will make or break this new system. That means you need to design clear, logical workflows and give them scripts that inspire confidence in your customers.

A well-designed workflow should feel completely natural. For an agent-assisted payment, the script could guide the agent to say something like:

"To finish your payment securely, I’m now going to ask you to type your card details using your telephone keypad. I won't be able to hear the tones, and your details will be processed securely."

This simple bit of dialogue does two critical things: it tells the customer exactly what to do and reassures them that their information is safe. The best way to get this right is to practise these scripts through role-playing during training sessions, so agents feel completely comfortable when they're on a live call.

The Final Steps: Testing, Training, and Monitoring

Before you flick the switch, rigorous testing is non-negotiable. This isn’t just about checking if the payment goes through. You need to test every single part of the journey for both the customer and the agent.

- End-to-End Testing: Run test transactions from start to finish. Does the call go to the right place? Does the DTMF masking work perfectly? Does the transaction record pop up correctly in your CRM?

- User Acceptance Testing (UAT): Get a small group of your agents to run through realistic payment scenarios. They are the best people to spot any clunky phrasing in the scripts or confusing steps in the workflow.

Once testing is done and you’re happy it all works, it's time for some solid agent training. Every single agent who will be accepting card payments over the phone needs to understand not just how to use the new system, but why it's so vital for security and compliance.

Finally, put a monitoring plan in place. Keep a close eye on metrics like transaction success rates, how long payment calls are taking, and any feedback from your agents. This ongoing oversight helps you spot small issues before they become big problems and allows you to constantly refine your process for the long haul.

Daily Best Practices for Your Agents and Operations Teams

Even the most sophisticated payment technology is only as good as the people using it. When you're taking card payments over the phone, your agents and operations teams are your first and most important line of defence. It’s the consistent, everyday habits that transform a decent system into a genuinely secure, well-oiled machine.

This isn't about watching over your team's shoulder. It's about giving them the right tools and knowledge to handle every payment call with confidence. An agent who feels prepared doesn't just process a payment; they provide a smooth, reassuring experience that builds customer trust and protects your reputation.

Setting Your Agents Up for Success

Your frontline agents need more than a script; they need a clear process for navigating payments, answering customer questions, and handling the inevitable hiccup. The goal is to weave security into their daily workflow so it feels like a natural part of the conversation, not a clunky interruption.

A great place to start is with standardised, reassuring language. When it's time to take payment, agents should have a simple, go-to phrase ready. Something like this works wonders:

"To finish this up securely, I’m going to ask you to type your card details into your keypad. For your protection, our system masks the tones, so I can't hear them, and your details go straight to our secure payment gateway."

This simple explanation does two crucial things: it clearly tells the customer what to do next and, more importantly, why it's safe for them to do it.

Beyond the script, agents need to really understand the process. I recommend running regular, short training sessions that cover:

- The 'Why' Behind the Tech: Briefly explain how DTMF masking actually works to protect customer data. When your team understands the logic, they buy into the process and can explain it with more authority.

- Navigating Customer Scepticism: Run through a few role-playing scenarios. What do you say when a customer is hesitant? Teach agents to respond with empathy while gently reinforcing the security measures you've put in place.

- Common Glitches: What's the plan if a customer says their keypad isn't responding? Give agents a simple troubleshooting checklist, like reminding the customer to make sure their phone is on the main call screen, not another app.

A Playbook for Managers and Operations Leaders

For team leaders and ops managers, the mission is a bit different. Your job is to cultivate a security-first culture while keeping a close eye on performance. You’re building the framework that enables your agents to do their best work securely.

One of the most effective things you can implement is a 'clean desk' policy, and yes, this applies to remote workers too. It's a simple but powerful rule: no pens, paper, or personal mobile phones near the workstation when taking calls. This simple step physically removes the opportunity to jot down sensitive card details.

Operationally, your payment platform's data is a goldmine for process refinement. Make a habit of regularly reviewing key metrics, looking specifically at:

- Transaction Success Rates: A sudden dip in successful payments could flag an issue with the customer journey or a problem with a specific payment gateway you're using.

- Call Handling Times: Are payment calls taking noticeably longer? This might point to a need for clearer scripting or a bit more agent training.

- Feedback from the Floor: Create an easy way for agents to report problems or suggest improvements. They’re using the system all day, every day, and their insights are invaluable.

Finally, make time for regular, informal check-ins. This isn't about auditing their every move; it's about seeing how things are going from their perspective. Ask agents if they feel confident using the payment system and what would make their lives easier. This continuous feedback loop is what will keep your operation secure and efficient in the long run.

Common Questions About Phone Card Payments

Whenever you're thinking about changing how you take card payments over the phone, a few common questions always pop up. It’s only natural. Let's walk through some of the things businesses are often curious about, so you can feel confident about making the right choice.

A big concern for many is how new security measures will fit in with their day-to-day operations, especially things like call monitoring for training purposes.

Can We Still Record Calls for Training and Quality?

Yes, absolutely. This is a classic problem that modern secure payment platforms were built to solve. They use a technology called DTMF suppression.

What this means is that when your customer taps their card numbers into their telephone keypad, those tones are either masked or completely diverted away from your systems. The sensitive data never even touches your call recording software. The recording will just have a patch of silence where the numbers were entered, so you can keep recording the rest of the call for quality checks and training without breaking any PCI DSS rules.

How Does This Affect Our PCI DSS Scope?

The method you choose to take payments has a huge impact on your PCI DSS scope. If your agents can hear or see cardholder data, then your entire contact centre—your agents, their computers, the network, and all your call recordings—is considered ‘in-scope’. That’s a massive compliance headache and can get very expensive, very quickly.

By using a solution that stops that data from ever entering your environment in the first place, you can effectively de-scope your contact centre almost entirely.

For many organisations, this is the single biggest benefit. It can slash the scope of a PCI DSS audit by up to 95%, saving an enormous amount of time, money, and stress on compliance management.

What Is the Difference Between IVR and Agent-Assisted Payments?

An IVR (Interactive Voice Response) system is completely automated. The customer calls in, follows a series of voice prompts, and enters their payment details without ever speaking to a person. It's brilliant for straightforward, high-volume payments, like settling a utility bill or topping up an account.

On the other hand, an agent-assisted secure payment keeps a real person on the line. The agent is there to guide the customer, but when it’s time to pay, the customer enters their details privately on their keypad. The agent can't hear or see the sensitive data but stays on the call to provide that human touch. This approach is much better for more complex sales or for customers who simply prefer talking to a person.

How Difficult Is Integration with Our Current Systems?

This is another common worry, but leading platforms are designed with integration in mind. They're built to plug into your existing phone systems (PBX/VoIP), contact centre software (CCaaS), and CRM using APIs or ready-made connectors.

Typically, the process involves a simple call diversion to the secure payment platform just for the payment part of the conversation, before handing the call straight back to the agent. Better still, the transaction outcome can be automatically sent back to your CRM, keeping your customer records updated in real-time without you ever having to handle the card details yourself.

Ready to simplify compliance and build customer trust? Paytia provides a suite of secure, flexible solutions for accepting card payments over the phone. Discover how Paytia can de-scope your contact centre today.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.