Global Pay Solutions: global pay solutions for seamless payments

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think of global pay solutions as a combination of a universal travel adapter and a Fort Knox-level security detail for every payment you take. They are technology platforms built to securely handle all the different ways customers want to pay—whether that’s over the phone, via web chat, or through a mobile app—without your business ever having to touch the toxic, sensitive card data itself.

Why Are Secure Payment Solutions Even a Thing?

Let’s paint a picture. A customer calls your contact centre to pay their bill. Without a proper system in place, your agent has to ask for the full 16-digit card number, the expiry date, and the CVC code right there on the call. That conversation could be overheard, the details jotted down on a sticky note, or worse, captured forever in a call recording. It’s a massive security hole and a compliance disaster waiting to happen.

This one scenario gets right to the heart of the problem that global pay solutions were designed to fix.

These platforms create a secure buffer, completely isolating your business environment from raw payment data. For any organisation with a contact centre, a team of remote workers, or any channel where the customer isn't physically present, this isn't just a tech upgrade. It's a fundamental business necessity.

The Real-World Pressures Pushing for Change

The shift towards these solutions isn't just happening on a whim. It’s a direct response to some very real and pressing challenges that businesses can no longer afford to ignore. Trying to navigate the minefield of PCI DSS compliance, avoiding the crippling cost of a data breach, and simply earning customer trust are top of the list. One slip-up can lead to eye-watering fines and reputational damage that takes years to repair.

A secure, compliant payment infrastructure is no longer just a technical 'nice-to-have'; it has become a strategic foundation for business growth, customer loyalty, and long-term resilience in an increasingly digital economy.

The way we pay has also changed for good. In the UK, card payments already make up 64% of all transactions. That figure is projected to climb to 67% by 2034, thanks in large part to the explosion of contactless payments. As cards become the default, the pressure to protect that data properly only intensifies. For a closer look, the details are laid out in this UK Finance report on payment markets.

So, What Do These Solutions Actually Do?

At their core, global pay solutions tackle these problems with a toolkit designed to create a completely secure payment environment. They offer features that:

- Isolate Sensitive Data: They stop credit card numbers from ever touching your network or systems. This alone dramatically shrinks your PCI DSS compliance scope and headache.

- Support Multiple Channels: They give you the flexibility to take secure payments over the phone, through web chat, with payment links, and more, all while delivering a smooth and consistent customer journey.

- Build Customer Confidence: When people know their payment details are safe with you, their trust in your brand deepens. That’s how you earn repeat business.

To get a better feel for the capabilities out there, this complete guide on digital payment solutions for businesses is a great resource that breaks down different payment types and security measures. The modern https://www.paytia.com/resources/blog/payment-platform-definition has evolved far beyond just processing transactions; it’s now a vital blend of security, compliance, and customer experience.

The Core Technologies That Make Payments Secure

To build unbreakable trust with customers, global pay solutions use a powerful combination of technologies working behind the scenes. These aren’t just technical buzzwords. Think of them as the digital equivalent of a bank vault, a secure courier, and a soundproof room, all working together to protect sensitive payment data from the moment a customer shares it. Let's peel back the layers on the core components that make this level of security a reality.

These technologies all share one primary goal: PCI scope reduction. Imagine your PCI DSS scope as the total area of your business exposed to sensitive card data. The larger that area, the more complex, expensive, and stressful your compliance becomes. Using these tools, a business can shrink that exposure by up to 90-95%, because the card data never actually touches its environment.

End-to-End Encryption: The Locked Steel Box

The first line of defence is end-to-end encryption. Picture this: you write down a customer's card details, place them in a solid steel box, and snap a unique padlock on it. Only the payment gateway at the final destination has the key. Even if that box were intercepted on its journey, the contents would be nothing but unreadable gibberish to anyone else.

This all happens in an instant. From the moment data is captured, it’s scrambled into an indecipherable format. This ensures that as it travels from the customer, through the secure platform, and on to the payment processor, the actual card number and CVC code are completely hidden from view.

Tokenization: The Secure Valet Ticket

Once the encrypted data reaches its destination and is processed, another clever bit of tech comes into play: tokenization. It’s a lot like a valet service for your car. You hand your keys to the attendant and get a ticket—a token—in return. You can use that ticket to get your car back, but the ticket itself is worthless to a thief; they can't use it to start the engine.

In the payments world, tokenization works the same way:

- The actual card number (the car keys) is stored securely in the payment processor's vault.

- Your business receives a unique, non-sensitive token (the valet ticket) in its place.

- This token can be used for future transactions like recurring billing or refunds, without ever re-exposing the original card details.

This is a game-changer for both security and convenience. If you want to dig deeper into the mechanics, you can discover more about how payment tokenization works in our detailed guide.

By combining encryption and tokenization, global pay solutions create a dual-layered defence. Encryption protects the data in transit, while tokenization protects it at rest, ensuring that raw card details are never stored on your systems.

DTMF Suppression: The Soundproof Booth

For any business taking payments over the phone, there’s another critical vulnerability: the sound of a customer tapping their card details into their telephone keypad. Those tones, known as Dual-Tone Multi-Frequency (DTMF), can be easily picked up by call recordings or screen-recording software on an agent's desktop.

DTMF suppression (or masking) solves this problem elegantly. It acts like a soundproof booth around the keypad tones. As a customer enters their card number, the technology intercepts and masks these tones before they ever reach the agent or the call recording system. The agent stays on the line to help, but all they hear is a flat, monotonous tone or complete silence instead of the sensitive numbers. This simple but powerful feature is essential for de-scoping call recordings from PCI DSS requirements, protecting both your customers and your business.

How to Navigate the Complex World of PCI Compliance

Let’s be honest, compliance can feel like a maze of confusing acronyms and red tape. When you're handling payments, two big ones always come up: the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR). While they’re both vital, they do different jobs. GDPR is all about protecting personal data, whereas PCI DSS zooms in specifically on keeping cardholder data safe.

Getting your head around these standards isn’t about memorising the rulebook. It’s about understanding how they affect your business day-to-day. Get it wrong, and you’re looking at hefty fines, major operational headaches, and a serious dent in customer trust. This is exactly where the right global pay solutions shift from being just another tool to a core part of your business strategy.

The Power of PCI Scope Reduction

If there's one game-changing benefit to using a certified payment solution, it's PCI scope reduction.

Imagine your PCI scope is a map of every single part of your business that touches cardholder data—your phone lines, call recordings, agent computers, and all the network gear in between.

Auditing that entire map yourself is a massive, expensive undertaking. It means endless checks, penetration tests, and constant monitoring to make sure every nook and cranny is secure. But a certified global pay solution acts as a security guard, stopping sensitive data at the door before it even sets foot in your environment.

Using clever tech like DTMF suppression and tokenization, the solution intercepts and isolates cardholder information, keeping it completely separate from your systems.

This simple but powerful separation can slash your PCI scope by as much as 95%. All of a sudden, you're not auditing an entire city; you’re just securing a single, well-protected room. The savings in time, money, and compliance-related stress are huge.

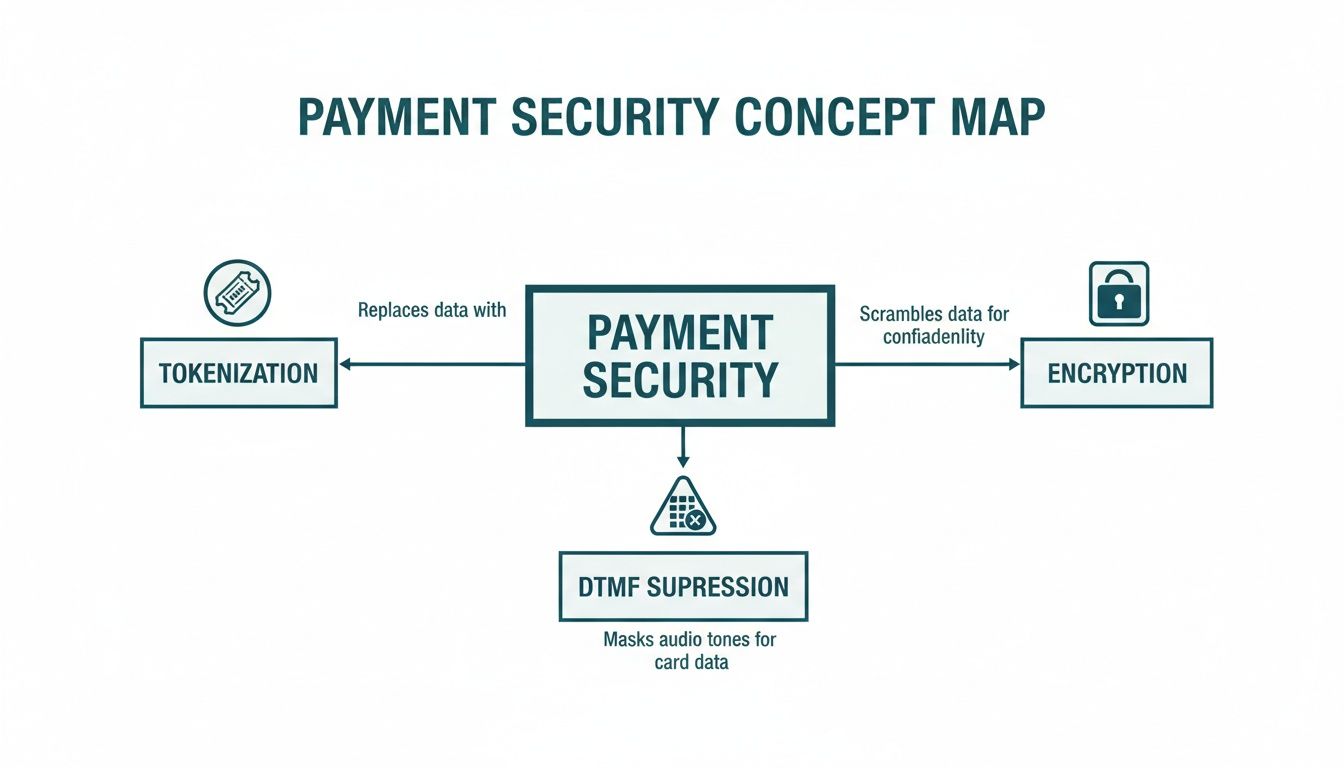

This diagram shows how these security technologies team up to lock down payment data.

As you can see, each piece of the puzzle—tokenization, encryption, and DTMF suppression—creates another layer of defence, walling off sensitive information from your internal infrastructure.

The table below gives you a clearer picture of just how dramatic the difference is.

PCI DSS Compliance Before and After a Secure Payment Solution

| Compliance Area | Without a Secure Solution (High Scope) | With a Secure Solution (Reduced Scope) |

|---|---|---|

| Call Recordings | All call recordings containing cardholder data must be secured, encrypted, and stored according to strict PCI DSS rules. | Call recordings contain no cardholder data due to DTMF masking, removing them from PCI scope. |

| Agent Desktops | Every agent's computer must be hardened, monitored, and regularly audited as it processes card data. | Agent desktops never see or handle card data, significantly simplifying security requirements. |

| Network Infrastructure | The entire network segment (firewalls, routers, switches) handling payments must be PCI compliant. | Only the connection to the secure provider needs monitoring; the internal network is out of scope. |

| Annual Audits | Requires a comprehensive, costly Report on Compliance (ROC) or Self-Assessment Questionnaire (SAQ-D) covering hundreds of controls. | A much simpler and less expensive Self-Assessment Questionnaire (SAQ-A) is typically all that's needed. |

| Data Storage | Cardholder data stored locally must be encrypted and protected with robust access controls. | No sensitive cardholder data is ever stored, eliminating storage-related compliance risks. |

By offloading the heavy lifting to a certified provider, you essentially transform your compliance burden from a complex, sprawling audit into a simple, manageable checklist.

Beyond the Minimum Requirements

Ticking the compliance box is one thing, but building a truly secure and trustworthy business is another. The best providers go above and beyond, proving their commitment with multiple, tough-to-get certifications.

PCI DSS Level 1: This is the gold standard. It requires a gruelling annual audit by a Qualified Security Assessor (QSA) and proves the provider's systems can withstand hundreds of strict security tests.

Cyber Essentials Plus: A UK government-backed scheme, this isn't just a paper exercise. It involves hands-on technical checks to prove a provider is properly defended against common cyber attacks. It's a real badge of honour for security.

This dedication to security is more critical than ever. The UK’s Payment Systems sector is projected to hit £11 billion in revenue by 2026, fuelled by the explosion in digital payments. As this report on the UK payments industry highlights, this growth means the need for secure, compliant solutions is no longer a 'nice-to-have'—it's essential.

When you partner with a provider holding these top-tier certifications, you're not just buying software; you're outsourcing the most complex and high-stakes part of payment security. This frees you up to focus on what you do best, confident that your payments are not just compliant, but genuinely secure. That kind of trust is what turns a one-off buyer into a long-term customer.

Integrating Secure Payments into Your Current Systems

The best technology never asks you to tear down your entire setup and start over. It should simply slot into the tools your team already depends on. A modern global pay solution is designed to do just that, connecting smoothly with your existing business systems without forcing a massive operational headache.

The whole point is to add a powerful, secure payment layer on top of your current infrastructure, not replace it. This way, you enhance your workflows instead of reinventing them, making your teams more efficient and your payment processes far more secure from day one.

Connecting with Your Telephony and CRM

Your telephony and Customer Relationship Management (CRM) systems are the very heart of your customer conversations. A proper global pay solution must integrate directly with these core platforms, creating one unified and secure environment for your agents.

It shouldn't matter if you're using an on-premise PBX, a modern VoIP system, or a cloud platform like Zoom—the integration should feel invisible. The payment technology hums along in the background, letting agents kick off a payment process right from their call screen without ever seeing or hearing sensitive card details.

Deep CRM integration is just as critical. It unlocks huge benefits:

- Automated Record Keeping: Payment results, transaction IDs, and even tokenised card details for recurring billing can be automatically logged against the customer’s record. No more manual data entry.

- Better Agent Efficiency: Agents can process a payment without juggling multiple screens or apps. This saves time and dramatically cuts down the risk of human error.

- A Complete Customer Picture: Your team gets a full, audit-ready history of every interaction and transaction in one central place, which is brilliant for both service quality and compliance.

The key is making secure payments a natural extension of the tools your team already knows. It’s about weaving security directly into your workflow, not clumsily bolting on a separate, clunky process.

The Power of APIs and Gateway Flexibility

So, how does all this seamless connection actually work? The secret sauce is the Application Programming Interface, or API.

Think of an API as a universal adapter plug. Each system—your CRM, your telephony platform, your payment solution—has its own unique socket. The API is the bridge that allows them to connect perfectly, letting them talk to each other and share information in a secure, pre-agreed way.

This gives you incredible flexibility. With a well-documented API, your developers can embed secure payment functions directly into your own apps or build custom workflows that are a perfect fit for your business. For anyone wanting to dig a bit deeper, you can find out more about payment gateway API integration and how it creates such adaptable payment processing.

This API-first approach also applies to payment gateways. The best global pay solutions are gateway-agnostic, meaning they aren’t tied to one specific payment processor. You're not locked in. This freedom allows you to shop around for the best transaction rates and pick the gateway that makes the most sense for your business, all while keeping a single, consistent, and secure method for taking payments.

How Different Industries Use Global Pay Solutions

The real power of global pay solutions clicks into place when you see them solving real, high-stakes problems out in the wild. While the technology itself is flexible, its application is always laser-focused on a core mission: slashing risk, making things run smoother, and giving customers a better experience.

From the constant buzz of a contact centre to the critical services of a healthcare provider, the need to handle payments securely is universal. But the specific hurdles and compliance headaches look very different from one industry to the next. Let's dig into how four very different sectors put this technology to work to solve their unique challenges.

Secure Payments in Contact Centres

Picture a customer service agent handling dozens, if not hundreds, of calls every day. Without the right tools, every single call that involves a payment becomes a massive liability. The agent has to ask for sensitive card details over the phone, which almost always get captured on call recordings—a huge red flag for PCI DSS compliance.

A global pay solution flips this scenario on its head. When it's time to pay, the agent simply triggers a secure payment flow without ever dropping the call. The customer punches in their card details on their telephone keypad, and DTMF suppression technology cleverly masks the tones. The agent only sees a simple "payment successful" confirmation on their screen; they never see, hear, or touch the raw card data.

The payoff is immediate and significant:

- Zero Data Exposure: The risk of internal fraud or an agent accidentally leaking sensitive data is completely wiped out.

- Simplified Compliance: Call recordings are instantly removed from the scope of PCI DSS, which saves a phenomenal amount of time and money on audits.

- Improved Efficiency: Agents can process payments faster and with more confidence, bringing down average call times and boosting the quality of service.

Streamlining Insurance Premium Collections

Insurance companies are constantly juggling a high volume of recurring premiums and one-off payments. The old way of manually chasing late payments is a drain on resources and often leads to a frustrating experience for the customer. Not to mention, taking card details over the phone for renewals carries all the same risks we just talked about.

For insurers, automation and security are the name of the game. Global pay solutions let them set up automated, recurring payment plans using tokenization. A secure, non-sensitive token replaces the customer’s actual card details for all future billing, keeping the real data safe. For one-off payments, they can ping a secure payment link over by SMS or email, letting customers pay when it suits them on a secure, branded page.

This move away from manual chasing to automated, secure processing doesn't just tighten security. It directly improves cash flow and lifts the administrative weight off collections teams, freeing them up to focus on more important work.

Compliant Billing in Healthcare

Healthcare providers have a double-edged sword to deal with: they must protect highly sensitive patient health information while also managing billing and co-pays. Taking a payment in a busy clinic or over the phone demands a system that is both rock-solid secure and respects patient privacy, staying in line with regulations like GDPR.

Global pay solutions give administrative staff a secure pathway to take payments for appointments, procedures, or outstanding balances. Whether an agent is on the phone sorting out a follow-up or a patient is using a self-service portal, the payment is handled completely separately from the healthcare provider’s internal systems. That separation is absolutely vital for reducing PCI scope and proving a real commitment to protecting every bit of patient data.

Boosting Donor Confidence for Charities

For charities and non-profits, trust is the currency they run on. Donors must feel completely confident that their financial details are safe when they decide to give. A data breach could be utterly devastating, shattering a charity's reputation and its ability to raise crucial funds.

These organisations use global pay solutions to securely process both one-time and recurring donations—whether over the phone, on their website, or through links shared in fundraising campaigns. An agent can have a meaningful conversation with a potential donor, explain the incredible impact of their contribution, and then seamlessly guide them through a secure payment. This keeps the donation experience personal and reassuring, encouraging generosity while holding up the highest security standards to protect the charity’s integrity.

Choosing the Right Global Pay Solutions Partner

Picking a provider for your global pay solutions isn’t like buying off-the-shelf software. It’s about finding a long-term partner you can trust with your customers' most sensitive data. The market is crowded, and it's easy to get lost trying to separate the genuine security experts from the simple tech resellers.

Making the right choice will do more than just protect your business; it will fold neatly into your daily operations and build customer confidence. This means you need to look past the slick marketing and get to the heart of what they offer: their core technology, security credentials, and the quality of their support. After all, you’re handing over a huge part of your compliance and customer relationships.

Core Technology and Security Credentials

First things first: let's talk about security. This isn't just a feature on a list; it's the entire foundation of a reliable payment solution. You need verifiable, audited proof that they take security as seriously as you do. Your reputation depends on it.

Here are the absolute must-haves:

- PCI DSS Level 1 Certification: This is the gold standard and it's non-negotiable. It means the provider undergoes a painstaking annual audit by an independent Qualified Security Assessor (QSA). Don't just take their word for it—ask to see their Attestation of Compliance (AOC).

- Multi-Channel Support: Your customers interact with you everywhere. Can the solution handle secure payments over the phone (using DTMF suppression), through web chat, via SMS payment links, and even on video calls?

- Enterprise-Grade Audit Trails: When a payment dispute arises, you need answers. The platform must provide detailed, unchangeable logs of every single action. This is vital for resolving issues, proving compliance, and keeping an eye on things internally.

Think of it this way: choosing a partner is all about risk transference. You're essentially moving the heavy burden of securing payment data from your shoulders to theirs. Make absolutely sure they have the certified infrastructure and proven history to handle that responsibility.

Integration and Operational Flexibility

Even the most secure payment solution is worthless if it causes chaos for your team. The best partners offer flexible integration that enhances your existing workflows, not upends them. A robust API (Application Programming Interface) is a great sign.

An API lets your developers weave secure payment functions directly into your own applications, creating a seamless experience for agents and customers alike. It's also worth checking for pre-built integrations with popular CRM systems and major payment gateways. A gateway-agnostic platform is a huge plus, as it gives you the freedom to shop around for the best transaction rates without being tied to one processor.

Beyond the Technology Itself

Finally, you need to look at the people behind the platform. The quality of support and their business transparency often reveal the true nature of a vendor. When you’re vetting potential partners, don't be afraid to ask the tough questions:

- What does your customer support actually look like? Get specifics on their service level agreements (SLAs), support hours, and the technical know-how of their team. When a payment goes wrong, you need expert help, fast.

- Is your pricing model completely transparent? Steer clear of partners who bury costs in complex contracts. You want clear, upfront pricing with no nasty surprises like hidden implementation fees or long-term lock-ins.

- Can you provide references from our industry? There’s no substitute for hearing from a current customer. It’s the best way to get honest insight into a provider’s reliability and how much they actually care about their clients' success.

Frequently Asked Questions

Getting your head around secure payments can throw up a lot of questions. We get it. Here are some of the most common queries we hear from businesses looking into global pay solutions, with straight-talking answers to help you move forward with confidence.

What Is the Difference Between a Payment Gateway and a Global Pay Solution?

It's a great question, and the distinction is crucial.

Think of a payment gateway as the digital version of a shop's card machine. Its one job is to get the thumbs-up for a transaction by connecting you, your customer, and the banks. It’s an essential link in the chain, but it's just one link.

A global pay solution is the entire secure framework around that transaction. Its role is to safely capture payment details from all your channels—be it over the phone, via a payment link, or through a web chat—before they ever reach the gateway or your own systems. The whole point is to take your business out of the path of sensitive card data, which massively shrinks your PCI DSS responsibilities and risk.

How Do These Systems Affect the Customer Experience?

Many business owners worry that more security means more hassle for the customer. In reality, it’s quite the opposite. A well-designed system actually makes the process smoother and more professional.

Imagine a customer paying over the phone. Instead of nervously reading their card number out loud, they can simply tap the digits into their telephone keypad while still talking to your agent. It’s faster, it feels far more secure, and it shows them you take their data protection seriously.

The best global pay solutions don’t add friction; they build trust. By making payments feel safer and more convenient, you actually strengthen customer confidence and loyalty.

What Does a Typical Implementation Timeline Look Like?

This is another common worry, but getting started is often much quicker than you might think. For a straightforward phone payment setup, you could be up and running in a few days, not weeks.

Of course, if you’re looking for a more tailored integration with your existing CRM or telephony platforms, that will take a bit longer. A good provider will map out a clear plan with you, making sure the whole process is smooth and causes minimal disruption. The end goal is always the same: to get you taking secure payments as quickly and painlessly as possible.

Ready to eliminate payment security risks and simplify your compliance? Paytia provides a suite of secure, multi-channel payment solutions designed to protect your business and your customers. Explore how Paytia can transform your payment processes.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.