Meaning of descoped for PCI: What It Means for Security and Compliance

Get Compliance Consultation

Ensure your payment processing meets UK regulations with Paytia's compliance experts.

Put simply, descoping means strategically taking sensitive payment card data completely out of your business environment.

Imagine a high-security mailroom. Instead of your staff handling valuable packages (the card details) directly, a special robotic arm intercepts them. It places them straight into a secure vault, and your team never even touches them. This is the essence of descoping: it takes your operations out of scope for many of the strictest security rules.

Unpacking the Meaning of Descoped

At its heart, descoping is all about cutting risk and making compliance simpler. The term comes from the world of the Payment Card Industry Data Security Standard (PCI DSS), a mandatory set of security rules for any organisation that deals with credit or debit card information.

The "scope" of PCI DSS covers all the people, processes, and technology in your business that store, process, or send cardholder data. Any system that 'touches' this sensitive information falls inside this scope. That means it must follow a long and demanding list of security controls, which can be a massive headache to manage in terms of time, money, and resources.

Why Shrinking Your PCI Scope Matters

Descoping is the practice of shrinking that compliance footprint down to the bare minimum. By using specific technologies, you can stop sensitive card details from ever entering your systems.

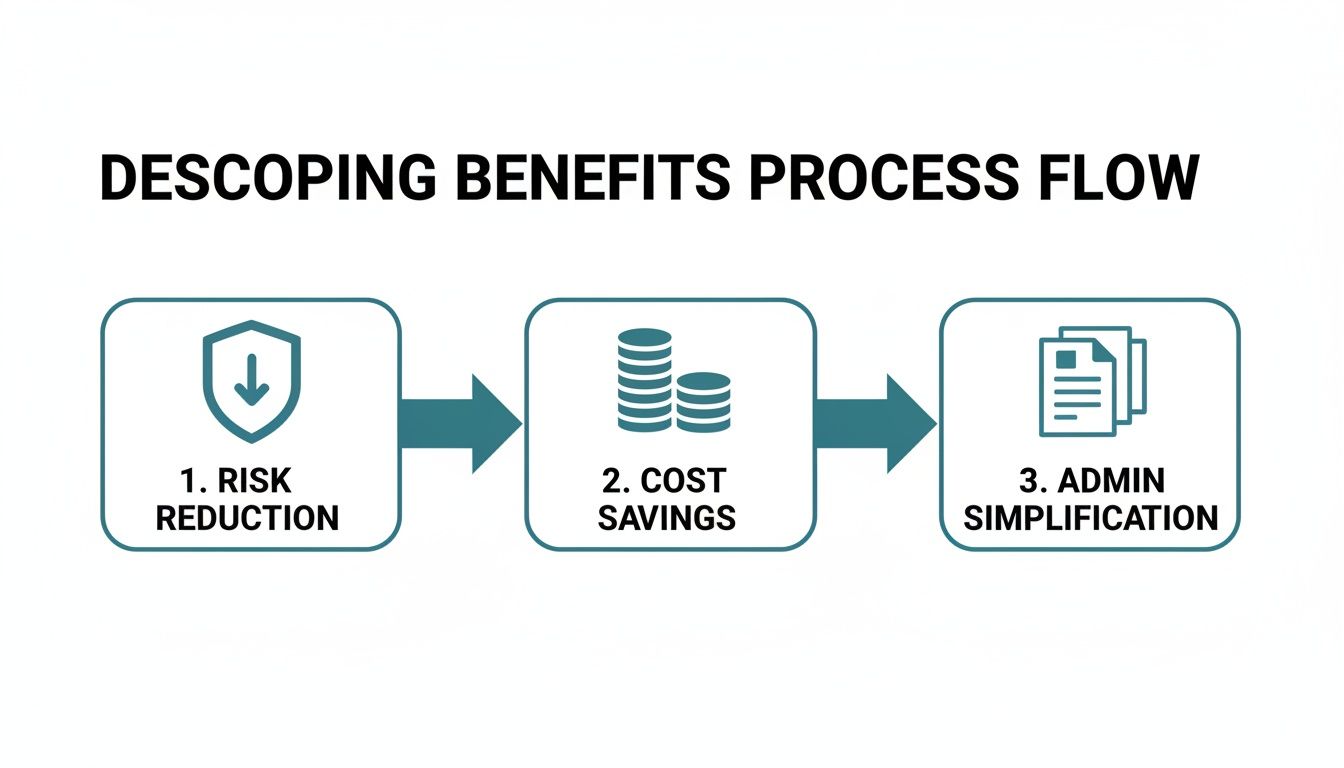

If the data never enters your environment, the systems it would have touched are no longer in scope. The benefits are immediate and significant:

- Simplified Audits: It makes your annual PCI DSS assessments drastically less complex and costly.

- Lowered Risk: It hugely reduces the chance of a data breach and the financial and reputational fallout that comes with it.

- Reduced Burden: It cuts down on the day-to-day admin needed to maintain and prove you're compliant.

Technologies like DTMF suppression, which mask the tones a customer presses on their keypad, are key to this. For a contact centre, this means agents can stay on the line with a customer while they pay, but they never see or hear the card numbers. If you want to get into the weeds of the specific rules, you can learn more about PCI DSS requirements in our detailed guide.

The real goal of descoping isn't to sidestep security, but to build smarter security. By walling off sensitive data from your environment, you create a smaller, more manageable—and fundamentally more secure—area to protect.

Of course, descoping is just one piece of the puzzle. To build a truly secure payment environment, it's also vital to adopt modern practices like shift left security principles, which build security in from the very start. But understanding what 'descoped' really means is the first critical step toward a safer, more efficient way of handling payments.

Why Descoping Is a Game Changer for Businesses

Running a modern business means constantly juggling tight margins, tough competition, and a regulatory rulebook that seems to get thicker every year. For many, Payment Card Industry Data Security Standard (PCI DSS) compliance feels like a necessary evil—a resource-draining task that pulls focus away from what really matters, like serving customers and growing the business.

This is exactly why understanding the real-world impact of 'descoping' is so important.

Descoping isn’t just a technical tweak; it's a strategic move that directly helps your bottom line and makes your operations more agile. By taking sensitive card data completely out of your systems, you change your relationship with PCI DSS. The administrative headache shrinks, and the scope of those costly, time-consuming audits is cut down dramatically.

Turning Compliance Costs into Growth Capital

Imagine what you could do with the budget you currently spend on complex audits and compliance paperwork. For small and medium-sized businesses (SMEs), that shift can be a game-changer.

In the UK, 'descoping' means using technology to stop card details like the PAN and CVC from ever touching your business systems or call recordings. For the 99.2% of UK businesses that are SMEs with fewer than 50 employees, this can slash PCI compliance costs by up to 90-95%. It's a figure we regularly help our clients achieve with Paytia's Secureflow platform.

This financial breathing room lets you reinvest in what truly drives value:

- Improving the customer experience with better tools and training.

- Developing new products or services to get ahead of the market.

- Investing in marketing to attract and keep more customers.

Minimising Risk and Building Trust

Beyond the balance sheet, descoping massively lowers your risk profile. A data breach is a nightmare scenario, leading not just to eye-watering fines but also to reputational damage that can be hard, if not impossible, to repair.

But if sensitive card data never enters your environment, it can't be stolen from you. It's that simple.

Descoping turns compliance from a defensive cost into a proactive strategy. It gives you the confidence to tell customers their data is secure because it never even passes through your hands.

This approach doesn't just simplify things; it builds a more resilient business. A big part of this involves staying on top of the ever-changing regulatory landscape, which demands strong regulatory intelligence. By getting ahead of compliance demands, you free yourself up to focus on running your business, knowing your payment processes are secure by design.

How Key Descoping Technologies Actually Work

It's one thing to talk about the benefits of descoping, but it's another to see how the technology actually works in a busy contact centre. The real magic behind becoming 'descoped' comes down to two core technologies working behind the scenes: DTMF suppression and tokenization. They might sound technical, but their jobs are surprisingly simple.

Crucially, these systems are designed to be completely invisible to your customers and don't require any extra steps from your agents. The payment process feels natural and conversational, just without any of the risk.

DTMF Suppression: The Soundproof Box

Imagine your agent is on a call, helping a customer pay an invoice. When the time comes for the customer to provide their card number, the agent stays on the line to guide them, but a virtual "soundproof box" is placed around the sensitive part of the conversation.

This is exactly what DTMF (Dual-Tone Multi-Frequency) suppression does. As the customer enters their card details using their telephone keypad, the technology intercepts the tones before they can reach your agent or your call recording systems.

- The agent simply hears a flat, masked tone instead of the revealing beeps.

- The customer's card data is captured directly by a secure, PCI DSS-compliant platform.

- That sensitive information completely bypasses your network, your infrastructure, and your people.

Because the card numbers never even touch your environment, your systems are instantly taken out of PCI DSS scope for that transaction. The call continues without a hitch, but the risk has been completely neutralised.

DTMF suppression is like having a silent, invisible security guard on every call. It expertly handles the sensitive information without your team ever needing to touch it, ensuring both security and a seamless customer journey.

This process has a direct and immediate impact on your business by shrinking your compliance footprint.

As the diagram shows, once you remove sensitive data from your environment, you automatically strengthen security, unlock cost savings, and drastically simplify your compliance overhead.

Tokenization: The Secure Valet Key

While DTMF suppression stops card data from ever entering your systems, tokenization is what protects it for any future use, such as handling recurring payments or processing a refund. Think of it as a secure valet key for your customer's payment details.

A valet key can start the car and move it around the car park, but it can't open the boot or the glove compartment where the valuables are kept. A payment token works in the same way—it's a randomly generated, non-sensitive placeholder that stands in for the actual card number.

This token can be stored safely in your systems to trigger future payments. But if a fraudster ever managed to steal it, it would be completely useless to them because it contains none of the original, valuable card details. If you'd like to dive a bit deeper, you can learn more about what tokenization is in payments in our dedicated guide.

Combining these technologies creates a powerful, layered defence that secures your phone payments from end to end.

Seeing Descoping in Real-World Scenarios

It’s one thing to understand the theory behind what descoped means, but the concept really clicks when you see it solving genuine business problems. Let’s move away from the abstract and look at how descoping technology works in everyday situations, turning high-risk interactions into secure, compliant, and smooth experiences.

These scenarios show how a smart approach to payments simply removes sensitive data from the equation altogether.

Securing an Insurance Premium Payment

Picture an insurance company’s contact centre. An agent is on the phone with a policyholder, ready to take their annual premium payment. In a traditional setup, this is fraught with risk: the agent hears the card details, and those same numbers could be captured by the call recording system. That’s a massive compliance headache waiting to happen.

With a descoped solution, the whole process is different. The agent stays on the line to help, but when it’s time to pay, the customer uses their telephone keypad to enter their card details.

- DTMF suppression technology masks the tones, so neither the agent nor the recording ever captures the card number.

- The payment data travels directly to a secure, PCI DSS Level 1 certified platform.

- Once the transaction is processed, both the agent and the customer get an immediate confirmation.

The result? A successful payment, a fully compliant call recording, and absolutely zero exposure of sensitive data within the insurance company’s environment. The business has been completely descoped from that part of the transaction.

By removing card data at the point of capture, you're not just securing a single payment. You are fundamentally redesigning the interaction to be secure by default, protecting your customer, your agent, and your brand's reputation all at once.

Taking a Rent Payment for a Housing Association

Now, let's think about a housing association. A tenant calls to pay their monthly rent but feels uneasy about reading their card details out over the phone. For organisations like this, building and maintaining trust is everything.

A descoped payment process offers peace of mind to both the tenant and the housing association. The agent can still guide the tenant through the payment, but the technology takes care of the security. After confirming the amount owed, the agent simply initiates the secure payment capture.

This straightforward, secure flow prevents accidental data leaks and protects against internal fraud. It’s a clear signal to tenants that their data security is taken seriously, strengthening that all-important trust while slashing the administrative burden of managing PCI DSS compliance. The conversation stays personal and helpful, while the payment itself remains completely private and secure—all thanks to a system working silently in the background.

Debunking Common Myths About PCI Descoping

Bad information can stop a good idea in its tracks, especially when it comes to adopting smarter, more secure ways to handle payments. There are a few persistent myths floating around about what it really means to descope a payment environment, and they cause a lot of unnecessary hesitation.

Let’s clear the air and separate fact from fiction.

Myth 1: Descoping Means We Can Completely Ignore PCI DSS

This is by far the most common—and most dangerous—misconception. While descoping dramatically shrinks your compliance footprint, it doesn't make it vanish entirely. You’re still responsible for ensuring the third-party provider handling your payments is fully compliant, and you’ll still need to complete a much-simplified Self-Assessment Questionnaire (SAQ).

Think of it like hiring a professional security firm to transport your cash. You no longer need to worry about reinforcing your own vehicles or training drivers for high-speed chases, but you absolutely have to verify that the security firm is licensed, insured, and legitimate.

Descoping strips away the most complex and costly requirements, but it is a scope reduction, not a total elimination.

Myth 2: The Implementation Is Too Complex and Disruptive

Another big worry is that overhauling payment systems will bring the business to a grinding halt. Years ago, that might have been a valid concern, but modern descoping solutions are specifically designed for seamless, quiet integration.

Platforms like Paytia are built from the ground up to work with your existing telephony (PBX/VoIP) and CRM systems. The rollout is typically a straightforward, low-impact process managed by experts. It requires very little from your IT team and causes no disruption to your daily operations or customer conversations.

The goal of today’s descoping technology is integration, not interruption. The process is designed to fit into your workflow, not force you to build a new one from scratch.

Myth 3: It Creates a Poor Customer Experience

Some people fear that secure payment systems will feel clunky or robotic, creating friction for customers who just want to pay and be done. In reality, it's the complete opposite. A well-designed descoping solution makes the customer journey both smoother and safer.

Take DTMF suppression, for example. The customer stays on the line with the agent the entire time. There are no awkward hand-offs to an automated IVR, and nobody is ever asked to read their sensitive card numbers out loud.

The experience for the customer is actually better:

- A continuous conversation: The agent remains on the line to help, maintaining that personal connection.

- Enhanced security and trust: Customers can tell their data is being handled with the highest level of care, which builds confidence.

- Simplicity and speed: The payment process is fast, intuitive, and feels like a natural part of the call.

Ultimately, a descoped environment shows your customers you take their security seriously without ever sacrificing service quality. It’s a powerful way to build trust.

Your Next Steps Toward a Descoped Environment

Okay, so you understand what descoping means. That's the first hurdle cleared. Now, it's time to put that knowledge into action. Shifting to a more secure, compliant payment environment isn't some far-off dream; it’s a tangible goal, and the journey starts with a frank look at where you are right now.

The first step is to map out your current processes. Think like a detective following the trail of sensitive data. Where does it touch your business? This includes phone calls, web chats, and any of your back-office systems.

Get specific. Ask the tough questions: Who has access to card data? Where is it being stored, even for a second? Are your call recordings capturing those sensitive payment details? This initial audit will give you a clear picture of your current PCI DSS scope and shine a spotlight on the areas crying out for improvement.

Charting Your Path Forward

Once you have a clear lay of the land, you can start planning your move. The real key here is to find a solution that slots neatly into your existing setup—like your telephony (PBX/VoIP) and CRM platforms—without causing a major headache for your team or your customers.

Your action plan should cover a few key points:

- Identify Key Risks: Pinpoint the exact processes that are exposing your organisation to the biggest compliance and security threats.

- Define Integration Needs: Figure out precisely how a new secure payment platform needs to talk to your current systems. You're aiming for a seamless workflow for both agents and customers.

- Consult with Experts: Don't go it alone. Bring in specialists who can guide you through the entire process, from the initial look-see to full implementation and support afterwards.

Reaching a descoped state isn't about tearing down your entire operation and starting from scratch. It's about making smart, strategic changes that tackle risk right at the source. This frees you up to focus on what you do best—running your business—with genuine peace of mind.

To make this whole process smoother, it's often a smart move to work with a Qualified Security Assessor (QSA). They live and breathe this stuff. You can learn more about the role of a QSA for PCI compliance in our detailed guide.

Unpacking the Practical Side of Descoping

When businesses start exploring how to descope their payment channels, a few practical questions always come up. It's one thing to understand the concept, but another to see how it fits into your day-to-day operations. Let's clear up some of the most common queries we hear.

Does Descoping Mean I Can Forget About PCI DSS?

No, and that’s a really important distinction to make. Descoping dramatically shrinks the scope of your PCI DSS obligations, but it doesn't make them vanish completely. You'll still need to fill out a much-simplified Self-Assessment Questionnaire (SAQ) to confirm your compliance.

Think of it like this: installing a state-of-the-art vault for your valuables (that’s your card data) means you no longer need to post guards in every single room. You’ve isolated the risk. But you still have to lock the front door of the house.

Will This Disrupt Our Business Operations?

This is a big one for many operations managers, but the answer is a reassuring no. Modern descoping solutions are built to be plug-and-play. They're designed to integrate seamlessly with the telephony (PBX/VoIP) and CRM systems you already use, working quietly in the background.

A well-implemented descoping solution should cause zero friction for your team. The whole point is to bolster security without your agents—or your customers—noticing any difference in the payment conversation, other than the added peace of mind.

Is Descoping Just for Big Contact Centres?

Absolutely not. While it's true that large contact centres see massive benefits, descoping is arguably even more valuable for small and medium-sized businesses (SMEs). For a smaller organisation, the savings from simpler compliance and the protection from a potentially devastating data breach can make a huge difference. The technology is completely scalable and financially accessible for businesses of all sizes.

Can We Still Handle Recurring Payments?

Yes, you can. In fact, descoping technologies like tokenization are purpose-built for this. Once the first payment is securely processed, a non-sensitive token is generated and stored in your system. This token is just a placeholder—a secure stand-in for the actual card details. You can use it to process all future payments without ever having to see, hear, or store the real card number again.

Ready to see what a descoped environment could look like for your business? Discover how Paytia can remove sensitive payment data from your operations, simplify compliance, and build customer trust. Learn more at https://www.paytia.com.

Ready to Simplify Compliance?

Get expert guidance on UK payment regulations and PCI DSS compliance. Contact us today.