Your Essential Guide to Using a QSA for PCI Compliance

Get Compliance Consultation

Ensure your payment processing meets UK regulations with Paytia's compliance experts.

A Qualified Security Assessor, or QSA for PCI, is an independent security expert who has been certified by the PCI Security Standards Council to audit an organisation's security controls.

Think of them as a chartered accountant, but for your data security. Their entire job is to verify that you are correctly protecting sensitive payment card information according to the labyrinthine rules of the Payment Card Industry Data Security Standard (PCI DSS).

Understanding the Role of a QSA in PCI Compliance

Trying to navigate the complexities of PCI DSS can feel like solving an intricate puzzle where the stakes are incredibly high. This is precisely where a QSA becomes so much more than a simple auditor. They are your guide, your advisor, and the independent validator of your entire security posture.

QSAs work for QSA Companies (QSACs), which are the only firms authorised by the PCI Council to perform on-site assessments and issue a formal Report on Compliance (ROC).

For any business handling a large volume of transactions—especially contact centres taking payments over the phone—bringing in a QSA isn't optional; it's mandatory. But their real value goes far beyond just ticking a compliance box.

The QSA as a Strategic Security Partner

A good QSA brings a fresh, objective, and expert eye to your security framework. They don't just hunt for compliance gaps; they actively identify hidden vulnerabilities that could expose your business to catastrophic risk.

Just think about the fallout from a single data breach:

- Financial Penalties: Fines from the major card brands can quickly spiral into hundreds of thousands of pounds.

- Reputational Damage: Losing customer trust is a devastating blow that can take years to recover from, if ever.

- Operational Disruption: A breach triggers costly forensic investigations, system shutdowns, and endless headaches.

A QSA helps you shift from a reactive, "check-the-box" mentality to a proactive security strategy. Their assessment doesn't just validate your current controls—it gives you a clear roadmap for strengthening your defences against whatever threats are coming next.

More Than Just an Audit

Engaging a QSA is a direct investment in your company's resilience. One of their first, and most critical, tasks is to help you understand exactly which parts of your business fall under PCI DSS rules. This process, known as scoping, is everything.

By correctly defining your Cardholder Data Environment (CDE), a QSA helps you concentrate your security efforts where they'll have the biggest impact, saving you time, money, and stress.

Ultimately, working with the right QSA for PCI compliance is about building a rock-solid foundation of trust. It sends a powerful message to your customers, partners, and acquiring banks that you take data protection seriously. In a world where security is paramount, that external validation is priceless for protecting your brand.

Understanding When You Need a QSA for Your Business

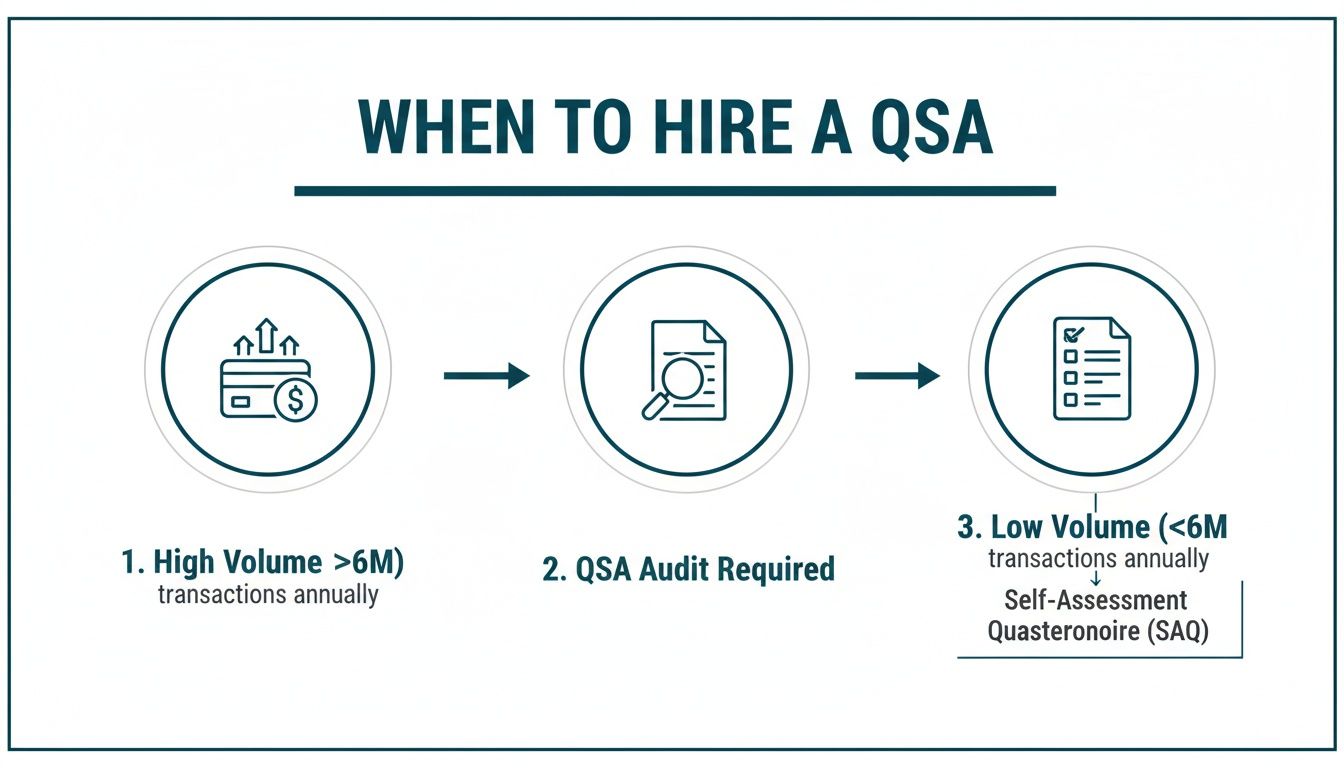

Figuring out if you need to bring in a Qualified Security Assessor isn't always straightforward. It's not a simple yes-or-no question for every business. The answer really boils down to one critical factor: your annual card transaction volume.

The PCI DSS framework sorts businesses into four different merchant levels, and the level you fall into dictates exactly how you have to prove your compliance.

For most small and medium-sized businesses, a full-blown, on-site audit by a QSA isn't on the cards. Instead, they can handle their annual compliance check-up using a Self-Assessment Questionnaire (SAQ). Think of it as a guided checklist that walks you through the PCI rules relevant to how you take payments, letting you certify your own compliance.

But the game changes completely once your transaction volume climbs into the top tier.

The Mandate for Level 1 Merchants

Businesses that process the highest volume of card payments are classed as Level 1 merchants. The exact number can differ slightly between card brands like Visa and Mastercard, but the general rule of thumb is processing more than six million card transactions a year.

Once you hit that number, a self-assessment is no longer an option. You’re required to have a formal, on-site audit every single year, carried out by a certified QSA. The end result of this audit is a Report on Compliance (ROC), which is the official, detailed proof that you’re meeting your PCI DSS obligations.

This strict process exists for a good reason. The sheer volume of payments at the Level 1 scale represents a massive risk. A data breach could affect millions of customers, so having an independent expert validate your security is non-negotiable. You can get a deeper look at the different PCI compliance levels and their requirements in our guide.

In the UK, QSAs are essential for these high-volume merchants. For businesses like contact centres taking phone payments, a QSA will closely examine whether systems like call recordings or agents' computers fall into PCI scope. They often recommend solutions that can slash this scope by up to 90-95% using clever tech like tokenisation.

A Quick Guide to Merchant Levels

Knowing your merchant level is the first step to building a smart compliance plan. The main difference between the levels is how you prove you're compliant—is it a self-managed questionnaire or a formal audit with a QSA?

Your transaction volume is the trigger. Crossing the Level 1 threshold changes your compliance journey from a self-guided process to a mandatory, externally validated audit.

To make things crystal clear, we've put together a simple summary of the merchant levels and what each one requires. This table will help you quickly see where your business fits and whether hiring a QSA is a must.

PCI DSS Merchant Levels and QSA Validation Requirements

| Merchant Level | Annual Transaction Volume (Per Card Brand) | Required Validation |

|---|---|---|

| Level 1 | Over 6 million transactions | Annual Report on Compliance (ROC) by a QSA |

| Level 2 | 1 million to 6 million transactions | Annual Self-Assessment Questionnaire (SAQ) |

| Level 3 | 20,000 to 1 million e-commerce transactions | Annual Self-Assessment Questionnaire (SAQ) |

| Level 4 | Fewer than 20,000 e-commerce transactions | Annual Self-Assessment Questionnaire (SAQ) |

As the table shows, the absolute requirement for a QSA is tied exclusively to being a Level 1 merchant. If your business is processing fewer than six million transactions a year, your compliance path will almost certainly involve completing the right SAQ for your setup.

That said, even if you aren't Level 1, bringing in a QSA for a gap analysis or some strategic advice can be a brilliant investment in your security posture.

Navigating the QSA Assessment Process Step by Step

Getting into a formal audit with a QSA for PCI compliance can feel like cramming for a final exam. It's an intense process, no doubt, but it’s not some big mystery. A typical assessment follows a clear, predictable path designed to check every box without turning your business upside down.

Think of it as a joint project between your team and the assessor. Once you understand the phases, you can prepare properly, put the right people on the job, and make sure the whole thing runs as smoothly as possible. This roadmap breaks the journey down into manageable chunks, from the first handshake to the final sign-off.

Let's be clear: the first step is always the most important. It sets the tone for everything else.

Phase 1: Initial Scoping and Kick-off

The whole process kicks off with a meeting where you’ll meet your QSA team. This first phase is all about defining the battlefield—in other words, getting an exact picture of your Cardholder Data Environment (CDE). Honestly, this is the single most critical step in the entire audit.

Your QSA will work with you to map out every system, process, and person that touches or could possibly affect the security of cardholder data. They’ll want to see network diagrams, data flow charts, and a full inventory of all the tech involved. The goal is to draw a very precise line around your CDE.

Get ready for some detailed questions, like:

- How does card data first enter your network?

- Where is it stored, processed, or sent?

- Which parts of your network are completely separate from the CDE?

- Who can access these environments, and how do you control it?

If you get the scope wrong, you’ll end up with "scope creep," where the audit suddenly gets bigger, more expensive, and takes way longer. Nailing this at the start is absolutely essential for an efficient assessment.

Phase 2: Evidence Gathering and Documentation Review

Once the scope is locked in, the QSA moves on to collecting evidence. This is where all your prep work really starts to pay off. The assessor will ask for a mountain of documents to review before they even consider setting foot on-site.

This isn’t just about having policies written down; it's about proving you actually follow them. You'll need to provide solid proof for hundreds of individual PCI DSS requirements.

Think of your QSA as a detective following a trail of evidence. Your job is to hand them a clean, organised case file that proves your security story, leaving no room for doubt.

To make the data collection and evidence submission less of a headache, you might want to look into automating security questionnaire responses. This can cut down on the manual work for your team, letting you focus on the actual security controls instead of just the audit admin.

Phase 3: On-site Assessment and Interviews

With the paperwork reviewed, the QSA will then conduct on-site (or sometimes remote) checks to see if the evidence holds up. This means technical testing, looking at system configurations, and talking to key people across your company.

They’ll chat with everyone from system admins and network engineers to developers and even HR staff to confirm your documented processes are what’s happening in the real world. They will watch procedures, check log files, and verify physical security. This is where the rubber meets the road.

This flowchart shows how your transaction volume dictates whether you need a full QSA audit or if you can get by with a Self-Assessment Questionnaire (SAQ).

As you can see, businesses processing a high volume of transactions have no choice—they must go through a formal QSA audit, making all these steps mandatory.

Phase 4: Reporting, Remediation, and Attestation

After finishing their analysis, the QSA will pull all their findings together into a draft Report on Compliance (ROC). If they found any gaps or controls that aren’t up to scratch, this is your chance to fix them. The QSA will give you a detailed list of what needs to be addressed.

Your team then gets to work closing those gaps, providing new evidence to the QSA to prove the problems have been solved. This back-and-forth continues until every single requirement is met.

Once the QSA is satisfied you're fully compliant, they will finalise the ROC and issue an Attestation of Compliance (AOC). The AOC is the official one-page summary you send to your bank and the card brands. It’s your certificate of PCI DSS compliance for the year.

Avoiding Common Pitfalls in Your QSA Audit

Getting through a PCI DSS audit successfully isn't always about having flawless security. More often, it's about sidestepping common, avoidable mistakes. Even organisations that feel well-prepared can get tripped up by details that seem minor at first glance. Knowing where these hidden traps lie is the secret to a smoother, faster, and much less painful assessment.

Most of the time, the biggest headaches come from a handful of core areas that can completely derail a solid compliance effort. By getting a handle on these potential pitfalls beforehand, you can sort them out long before your QSA arrives, saving yourself a world of time and trouble.

Let's walk through the most common challenges we see and, more importantly, what you can actually do to avoid them.

Inaccurate or Incomplete Scope Definition

This is, hands down, the biggest reason QSA audits go sideways. Scope creep is what happens when systems you were sure were separate from cardholder data turn out to be connected, instantly ballooning the audit's size, complexity, and cost. That forgotten legacy server, a developer's messy test environment, or an old call recording archive can have massive consequences.

For example, a contact centre might think their PCI scope is neatly contained within their payment IVR system. But if their call recordings happen to capture sensitive card details, or if agents' computers can access systems inside the Cardholder Data Environment (CDE), that tidy little scope just exploded.

To stop this from happening, you have to:

- Map Every Single Data Flow: Sit down with your QSA and meticulously trace the journey of cardholder data from the second it enters your business to the moment it's securely deleted. No shortcuts.

- Challenge Your Assumptions: Don't just assume a system is out of scope. You need to prove it's isolated with proper network segmentation and clear firewall rules.

- Talk to Everyone: Get your IT, development, and customer service teams in a room. You need their help to uncover any hidden processes or shadow IT systems that might be touching payment data.

Getting this wrong can be devastating. The recent wave of UK retail cyber-attacks is a powerful reminder of why QSA-led assessments are so vital. Breaches at major brands exposed millions of customer records, revealing huge gaps in compliance. Many of these incidents were tied directly to failures in defining the PCI scope for phone and digital payments—the exact challenge faced by contact centres in healthcare, housing, and other sectors. You can read a detailed breakdown of these events and see why PCI compliance is so critical for any modern business.

Poor Documentation and Evidence Management

Your QSA works on a very simple premise: if you can't show me the paperwork, it didn't happen. You could have the most sophisticated security controls on the planet, but if you don't have clear, consistent, and easy-to-find documentation to back it up, you will fail the audit.

Too many businesses treat documentation as a last-minute chore, frantically trying to assemble policies and procedures just weeks before the assessment. This always ends in a scramble, leading to missing evidence, stressed-out teams, and a very unimpressed auditor.

"Your documentation tells the story of your compliance. If it’s a jumbled, inconsistent mess, your QSA will assume your security practices are, too. A well-organised evidence folder is the hallmark of a mature security programme."

Get ahead of this by creating a single, organised library for all your compliance documents. This should hold everything—network diagrams, firewall rule sets, security policies, staff training logs, you name it. Crucially, make sure someone is responsible for reviewing and updating these documents regularly, especially after any changes to your systems.

Lack of a Dedicated Internal Champion

PCI compliance is not an IT project; it's an ongoing business responsibility. A classic pitfall is having no single person who owns the compliance process internally. When there's no dedicated champion, accountability gets fuzzy, tasks fall through the cracks, and communicating with the QSA for PCI audit becomes chaotic and inefficient.

This person doesn't need to be a deep security expert, but they do need the authority to work across different departments, get the resources they need, and keep the project moving. They become the main point of contact for the QSA, making sure requests are handled quickly and that everyone on your team knows what’s expected of them. Appointing this leader is one of the single most effective things you can do to ensure a focused, organised, and successful audit.

How to Reduce PCI Scope and Lower QSA Costs

The cost, time, and sheer headache of a QSA for PCI audit comes down to one critical factor: the size of your Cardholder Data Environment (CDE).

Think of your CDE as the "blast radius" for compliance. Every single server, application, network device, and even employee inside this environment has to be audited against hundreds of demanding security controls. A bigger CDE means more systems for your QSA to inspect, more logs to comb through, more staff to interview, and a much, much higher final invoice.

It’s a simple equation: the smaller the scope, the smaller the audit. The most powerful way to get a grip on your compliance overhead is to shrink this CDE as much as humanly possible. This isn't about cutting corners; it's about strategically isolating sensitive payment data so fewer of your systems ever have to touch it.

The Power of Descoping Technologies

The real secret to shrinking your scope is to stop raw cardholder data from ever entering your business systems in the first place. Technologies like tokenisation and secure, third-party payment platforms are built to do exactly that. They act as a protective barrier, handling the sensitive information so you don’t have to.

Here’s a quick rundown of how they work:

- Tokenisation: This process swaps out sensitive card details (like the 16-digit PAN) for a unique, non-sensitive equivalent called a token. You can safely store and use this token for things like recurring billing, but it’s completely worthless to a criminal if it’s ever stolen.

- Secure Payment Platforms: Solutions like Paytia’s Secureflow create a completely separate, secure channel for capturing payments. When a customer pays over the phone, for example, the data is handled securely by the platform and never touches your agent's computer, your call recordings, or your internal network.

By putting these tools in place, you can literally remove entire departments and systems from your CDE. You can dive deeper into how this works by exploring the fundamental PCI DSS requirements and seeing how they apply to different systems.

A Tale of Two Contact Centres

Let’s make this real. Imagine a contact centre that takes payments over the phone the old-fashioned way, without any descoping solution.

Before Scope Reduction:

- Agent Desktops: In scope. The agents hear and type card details.

- Telephony System: In scope. It carries the sensitive conversation.

- Call Recording System: Definitely in scope, as it stores recordings containing card data.

- Internal Network: The whole network the agents use is now in scope.

- CRM System: Potentially in scope if it connects to any of the above.

This sprawling environment means the QSA has to audit every last one of these components. The process becomes long, eye-wateringly expensive, and incredibly disruptive to your business.

Now, let's see what happens when that same contact centre implements a secure payment solution that uses DTMF suppression to mask the customer’s keypad tones.

After Scope Reduction:

- Agent Desktops: Out of scope.

- Telephony System: Out of scope.

- Call Recording System: Out of scope.

- Internal Network: Almost entirely out of scope.

- The Secure Payment Platform: The only system that remains in scope.

By simply stopping sensitive data from ever touching their environment, the contact centre has slashed its PCI scope by up to 95%. The QSA’s audit now focuses on the third-party provider’s compliance, not the contact centre's entire infrastructure.

This isn't just about cutting the QSA's final bill. It dramatically reduces the workload for your own IT and security teams, minimises the risk of a costly data breach, and simplifies your compliance management for years to come. It is, without a doubt, the most powerful strategy for turning a daunting compliance headache into a manageable, cost-effective process.

Choosing the Right QSA Partner for Your Business

Picking a Qualified Security Assessor isn't just about hiring someone to tick boxes on a compliance checklist. You're bringing in a long-term security partner who will get to know your systems and processes intimately.

The right firm acts as a pragmatic advisor, but the wrong one can turn your compliance journey into a frustrating and expensive nightmare. A great QSA for PCI compliance should feel like an extension of your own team, offering guidance that genuinely strengthens your security, not just gets you a pass certificate. Their approach, industry experience, and even their communication style can make all the difference.

Verifying Credentials and Industry Expertise

Before you even book a meeting, your first job is to check a potential QSA company's credentials. The PCI Security Standards Council keeps an official public list of all authorised QSA Companies (QSACs). If a firm isn’t on that list, they simply aren’t qualified to perform your assessment. End of story.

Beyond the official certification, their industry experience is critical. A QSA who has only ever audited e-commerce websites might not grasp the unique complexities of a contact centre, where call recordings and agent desktops are massive scope considerations.

Look for a partner with proven, hands-on expertise in your specific sector, whether that’s healthcare, housing, or financial services. This specialisation means they’ll understand your day-to-day operational realities and provide relevant, practical advice instead of generic, one-size-fits-all recommendations.

Key Questions to Ask a Potential QSA

Finding the right fit means asking the right questions. When you interview potential QSAs, dig deeper than their technical skills—probe their assessment philosophy and how they handle support. This is how you find out if they'll be a true partner when challenges pop up.

To help you make an informed choice, here’s a checklist of essential questions to ask:

- What is your approach to scoping? A good QSA will be meticulous and collaborative, working with you to define the CDE accurately from day one.

- How do you handle disagreements on scope or findings? Their answer will tell you if they're a rigid auditor or a collaborative partner who is open to discussing compensating controls.

- What kind of support do you provide after the audit is complete? The relationship shouldn't just stop the moment the report is delivered.

- Can you provide references from clients in our industry? Speaking to their existing customers is one of the best ways to get a real sense of what it's like to work with them.

Choosing a QSA is a strategic decision. Your goal is to find a firm that aligns with your business objectives, communicates clearly, and provides practical, risk-based advice that improves your security posture for the long term.

For more detailed guidance, check out our complete article on what to look for when selecting a PCI compliance auditor. Ultimately, the right QSA won't just validate your compliance; they'll empower your organisation to become more secure and resilient.

Burning Questions About PCI QSA Assessments

Even with the best preparation, a few common questions always seem to crop up. Let's tackle them head-on.

How Much Does a QSA Assessment Cost in the UK?

This is the big one, and the honest answer is: it depends. The cost of a QSA-led Report on Compliance (ROC) is directly tied to the complexity of your Cardholder Data Environment (CDE).

For a medium-sized Level 1 merchant, you're likely looking at a range of £15,000 to £50,000. For large, complex enterprises, that figure can easily push past £100,000. The price is driven by the time and effort a QSA needs to invest, which is dictated by things like the number of systems, how tangled your network is, and how many physical sites are in scope. This is exactly why scope reduction is your most powerful tool—it directly cuts down the QSA’s workload and, therefore, your costs.

How Long Does a Typical QSA Audit Take?

Patience is a virtue here. A standard assessment for a Level 1 merchant usually takes somewhere between three to six months from the first kickoff meeting to the final report.

That timeline covers everything: the initial scoping workshops, the long slog of evidence gathering, on-site interviews, the actual report writing, and then fixing anything that was flagged. It's worth noting that well-prepared organisations, especially those who have aggressively reduced their compliance scope, can often get through the process much faster.

What Happens if We Fail a QSA Assessment?

First off, don't panic. Failing an assessment isn't the end of the world; it’s actually the beginning of the remediation phase. It’s a common part of the process.

Your QSA will document every area of non-compliance and work with you to agree on a reasonable timeline for fixing the issues. Once your team has addressed the problems, the QSA comes back to re-validate only those specific controls. A final, clean report is only issued once every single gap has been closed.

Can a QSA Help if We Are Not Level 1?

Absolutely. While only Level 1 merchants are required to use a QSA for their annual audit, many other businesses bring them in for their expertise. A QSA can perform a gap analysis to see where you stand, help you navigate your Self-Assessment Questionnaire (SAQ), and provide invaluable strategic advice on your security posture.

Ready to dramatically reduce your PCI scope and simplify your next audit? With Paytia, you can remove your contact centre and business systems from the scope of a QSA audit, saving time and money. Discover how at https://www.paytia.com.

Ready to Simplify Compliance?

Get expert guidance on UK payment regulations and PCI DSS compliance. Contact us today.