A Guide to Merchant Credit Processing for Modern Businesses

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

At its core, merchant credit processing is simply the entire system that lets your business accept credit and debit card payments securely. It's a chain of services and technologies working together in the background to authorise, clear, and finally settle every transaction, making sure the money moves from your customer's bank account to yours.

Think of it as the digital plumbing for modern commerce.

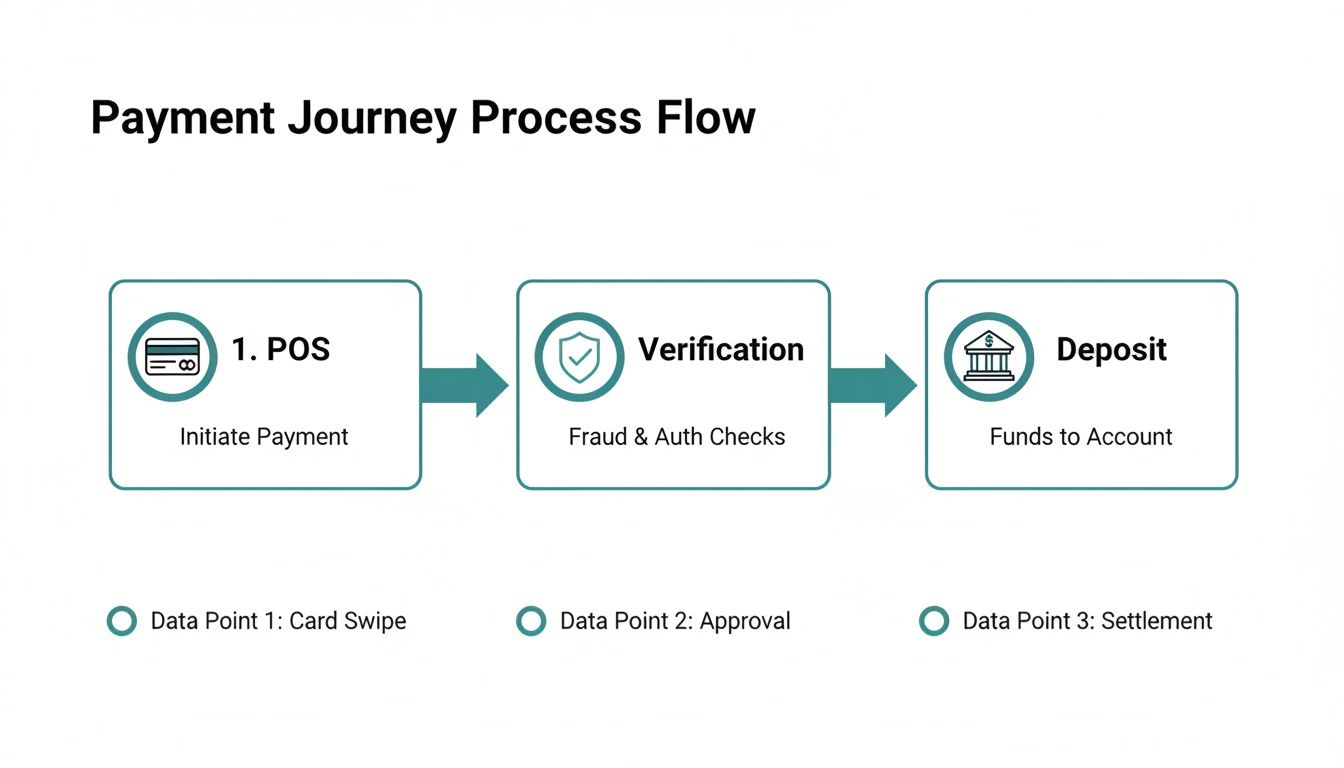

A Quick Look at the Payment Journey

Let’s imagine your business is a destination. When a customer wants to send a payment your way, merchant credit processing is the entire road network—the motorways, the junctions, and the traffic signals—that ensures their payment arrives safely and quickly. It’s not a single step, but a perfectly coordinated journey with several key players.

This process is the invisible engine powering every transaction, from a quick tap-to-pay in a shop to a complex payment taken over the phone in a contact centre. Getting to grips with how it all fits together is the first real step towards making your business's financial operations more secure and efficient.

Why Does This Matter to Your Business?

Understanding the nuts and bolts of merchant credit processing isn't just an academic exercise. It has a direct impact on your profits, your team's efficiency, and most critically, the trust your customers have in you. A poorly chosen or misunderstood system can easily lead to higher fees, glaring security holes, and a clunky customer experience.

On the flip side, getting it right brings some serious advantages:

- Fewer Security Headaches: When you know how customer data flows, you can spot and fix weak points, protecting that sensitive information from fraudsters.

- A Smaller PCI DSS Footprint: By picking solutions that keep card details completely out of your environment, you can dramatically simplify compliance, saving a huge amount of time and money.

- Happier, More Trusting Customers: A smooth and secure payment process shows customers you take their security seriously. That builds confidence and keeps them coming back.

- Smarter Operations: Knowing how settlement works helps you predict cash flow. The right tools can also automate payment collection, freeing up your team for more important work.

For any business in a regulated industry or running a contact centre, mastering this process isn't optional. It’s the very foundation of a secure, compliant, and customer-friendly payment strategy. Get it right, and every transaction makes your business stronger, not more exposed.

The Key Players in Every Card Transaction

Every time a customer taps their card or enters their details, a complex ballet unfolds in just a few seconds. Think of it as a high-speed relay race, where a baton of financial data is passed between several key players. Understanding who does what is the first step to grasping how merchant credit processing works and, crucially, where the security risks lie.

This isn't just a two-way street between you and your customer. It’s a coordinated effort by a team of specialised financial organisations. Each has a specific job, from checking for available funds to moving money across the globe, all while playing by a very strict set of rules. Let’s meet the team that makes every card payment possible.

The Customer and Their Bank

The journey always starts with the two parties on the customer's side of the transaction.

- The Cardholder: This is your customer, the person kicking things off with their credit or debit card. They own the account where the funds will come from.

- The Issuing Bank: This is the cardholder's bank (think Barclays, Lloyds, HSBC). It's the institution that "issued" the card and is responsible for confirming whether the customer has enough money or credit to complete the purchase.

The Merchant and Their Bank

On your side of the counter, you and your financial partners are waiting to receive the payment.

- The Merchant: That’s you and your business, ready to accept payment for your goods or services.

- The Acquiring Bank (or Acquirer): This is your business bank, often called a merchant bank. It provides you with a merchant account, handles the incoming payment authorisations, and eventually deposits the customer's payment into your business account. You can explore the role of a merchant acquirer bank in our detailed guide to learn more about this vital partnership.

The Technical Intermediaries

A few critical technology players act as the secure bridge connecting the customer's bank with your bank.

- The Payment Gateway: Think of the gateway as a secure, digital version of a postbox. It grabs the sensitive card details from your point of sale—whether that's a website, phone call, or card terminal—and encrypts them for safe travel.

- The Payment Processor: The processor is the central communications hub. It takes that encrypted information from the gateway and routes it through the right channels to the card networks and banks, managing the entire authorisation and settlement process from start to finish.

These intermediaries are the real workhorses of secure merchant credit processing. They guard sensitive data, making sure things like the Primary Account Number (PAN) and CVC code stay protected as they zip across the payment ecosystem.

The Rule Makers

Overseeing this entire ecosystem are the card networks. They act like the governing bodies for the entire payment world.

- Card Networks: These are the big names everyone recognises, like Visa, Mastercard, and American Express. They don't issue cards or hold any funds themselves. Instead, they set the rules of the game, manage the communication networks connecting all the banks, and make sure everyone operates securely.

The diagram below shows how this entire journey plays out, from the moment a card is used to the funds landing safely in your account.

This map clearly shows how each player hands off the transaction data to the next, creating a secure chain of custody. This system is more important than ever. In the UK alone, consumers recently spent a staggering £249 billion on credit card transactions in a single year, with the total number of payments hitting a record 4.5 billion. This continued growth shows why having a robust and secure payment infrastructure is no longer just a nice-to-have—it's an absolute necessity.

Decoding Processing Fees and Settlement Times

So, you’ve just made a £100 sale. When you check your bank account, you might be surprised to see that the deposit isn't the full £100. Where did the rest of it go? That difference is the cost of doing business with credit cards, a world of processing fees that are essential to understand for protecting your profit margins.

Every single transaction fee is actually a blend of three separate charges. Think of it like a small pie where each slice is claimed by a different player in the payment journey. Once you know who gets paid and for what, your monthly statements start to make a lot more sense.

The Three Core Fee Components

The total fee you pay isn’t just one single charge from your provider. It’s always broken down into these three key parts:

- Interchange Fees: This is the biggest piece of the pie. It goes straight to the customer’s bank (like Lloyds or Barclays) to cover the risk and cost of approving the payment. The card networks set these rates, which change based on the card type, whether the payment was online or in-person, and your industry.

- Assessment Fees: This is a much smaller slice paid directly to the card networks themselves—Visa, Mastercard, and the like. It's their charge for letting you use their rails to move the money.

- Processor's Markup: This final slice is what your payment processor or acquiring bank charges for their service. This is the only part of the fee that’s actually negotiable and where you’ll see the biggest differences between providers.

Understanding this breakdown is crucial. You can’t negotiate interchange and assessment fees, but the processor's markup is where you can find real savings by comparing providers and their pricing models.

Common Pricing Models Explained

How those three fees are bundled together and presented on your statement is what we call a pricing model. The structure you choose can have a big impact on your final costs, and the best one really depends on your business and sales volume.

Here's a quick comparison of the three most common models you'll encounter.

Comparing Merchant Account Pricing Models

| Pricing Model | How It Works | Best For | Pros | Cons |

|---|---|---|---|---|

| Interchange-Plus | Passes the true Interchange and Assessment fees to you, then adds a fixed, transparent markup. | High-volume businesses that want maximum transparency and potentially lower costs. | Very transparent; often the most cost-effective model for established businesses. | Statements can be complex and harder to read for newcomers. |

| Tiered Pricing | Groups transactions into tiers (e.g., Qualified, Mid-Qualified, Non-Qualified), each with a different rate. | Businesses looking for simplicity, though it's often less transparent and can be costly. | Simple to understand at a glance. | Lacks transparency; can be expensive as many transactions get "downgraded" to higher-cost tiers. |

| Flat-Rate | Charges a single, predictable percentage and a fixed fee for every transaction, regardless of card type. | New or low-volume businesses that prioritise simplicity and predictable costs over the lowest possible rate. | Extremely predictable and easy to forecast costs. | Almost always the most expensive option, especially as your volume grows. |

Choosing the right model is a critical decision in your merchant credit processing strategy. For a more detailed comparison, our guide to merchant payment processing offers deeper insights.

Understanding Settlement Times

Finally, there's the concept of "settlement." This is simply the term for when the money from your sales actually lands in your business bank account.

While a payment gets authorised in seconds, the funds don't move that fast. The process of batching and clearing payments between all the different banks usually takes 1-3 business days. Knowing this timeline is key to forecasting your cash flow accurately and managing your finances without any surprises.

Navigating PCI DSS Compliance and Security Risks

In the world of payments, security isn't just a nice-to-have feature; it’s the bedrock everything is built on. Any business that takes card payments must follow a set of rules known as the Payment Card Industry Data Security Standard (PCI DSS). This isn't just bureaucratic red tape—it's a critical framework designed to keep customer data safe, prevent disastrous breaches, and protect your company’s good name.

Think of PCI DSS as the highway code for handling financial data. It lays out the technical and operational rules of the road, ensuring any company that processes, stores, or sends credit card information does so in a secure environment. For businesses with contact centres or remote payment setups, getting this right is non-negotiable.

Dropping the ball on compliance can lead to serious consequences, including eye-watering fines and, in some cases, having your ability to accept card payments revoked entirely. The goal is simple: keep sensitive cardholder data away from fraudsters.

The Challenge of Remote Payments

When a customer pays in-store, their card never leaves their sight. The game changes completely when that payment is taken over the phone or via a web chat. Suddenly, sensitive card numbers are being spoken aloud, typed into systems, and potentially stored in call recordings or screen captures.

This creates a massive compliance headache. Every system, employee, and process that ‘touches’ that card data now falls under the scope of your PCI DSS audit. That means your phone systems, agent desktops, CRM software, and even your call recordings must all meet strict security standards, which can lead to complex and costly annual assessments.

Reducing Your PCI Scope with Technology

The smartest way to manage this risk isn’t to build ever-higher walls around your data. It’s to stop the data from ever entering your environment in the first place. This is where modern merchant credit processing technologies are a game-changer, especially for contact centres.

Two key technologies act as a digital shield for your business:

- Tokenization: Imagine a customer’s card number is a valuable package. Tokenization swaps this package for a unique, non-sensitive ticket—a ‘token’. You can safely store and use this token for future payments, but if it gets stolen, it’s worthless to a thief. The real card number stays locked away securely with the payment processor.

- DTMF Suppression (for phone payments): When a customer types their card details using their phone keypad, Dual-Tone Multi-Frequency (DTMF) suppression technology masks the tones. Your agent stays on the line to help, but they only hear a flat tone. The numbers are sent straight to the payment processor, completely bypassing your phone systems and call recordings.

By using these methods, you effectively "de-scope" your contact centre. Because your agents and systems never see, hear, or store the actual card data, they are no longer subject to the most stringent PCI DSS controls. This can reduce the scope of your compliance audit by as much as 90–95%.

Practical Steps to Secure Your Payments

Achieving and maintaining compliance is a continuous journey, not a one-off task. It’s a mix of the right technology, solid processes, and well-trained people. A strong security posture is built on a few core principles that protect both your business and your customers.

To make things simpler, you can start by understanding the foundational pillars of compliance. For a detailed breakdown of what's required, you might find our guide explaining the 12 key PCI DSS requirements every business should know helpful.

Ultimately, navigating the security risks in merchant credit processing comes down to making smart choices. By adopting solutions that put a barrier between your business and sensitive data, you don't just simplify compliance—you build a foundation of trust, showing customers their information is always safe with you.

Choosing the Right Payment Capture Method

How your business takes a card payment is every bit as important as the transaction itself. The method you choose has a direct impact on the customer's experience, your team's efficiency, and most importantly, your security and compliance. Get it right, and you’ll find your workflow becomes smoother while wrapping every transaction in a solid layer of protection.

Effective merchant credit processing isn't just about having the ability to take payments. It’s about picking a capture method that genuinely fits how you operate. For a contact centre, that means finding a way to securely handle payments over the phone or through digital channels without ever letting sensitive data touch your systems.

Agent-Assisted Phone Payments

This is the classic scenario: a customer reads their card details to an agent over the phone. You might know it as a Mail Order/Telephone Order (MOTO) transaction. Historically, this created a massive headache for PCI DSS compliance, as card numbers could be overheard, jotted down on a notepad, or even captured in call recordings.

Thankfully, modern solutions have completely changed the game. Using technology like DTMF masking, an agent can stay on the line to guide a customer through the payment, but when the customer types their card numbers on their telephone keypad, the agent only hears flat, single tones. The sensitive details go straight to the payment processor, completely bypassing your staff and systems. This protects the data without losing that personal, supportive customer experience.

Automated IVR Payments

For businesses that handle a high volume of routine payments — think utility bills, subscription renewals, or account top-ups — an automated Interactive Voice Response (IVR) system is a game-changer. It lets customers make payments 24/7 without ever needing to speak to a person.

This self-service route offers some major advantages:

- Lower Operational Costs: It frees up your agents to focus on more complex or sensitive customer issues, which is a much better use of their time.

- Tighter Security: The entire transaction is handled by a machine, ensuring no human inside your organisation ever sees, hears, or handles sensitive card data.

- Customer Convenience: It’s a fast, simple way for people to pay whenever it suits them, day or night.

Secure Payment Links

Another method that's become incredibly popular is the use of secure payment links. During a conversation on the phone, via web chat, or even SMS, an agent can generate a unique link and send it straight to the customer. They simply click the link, which opens a secure, branded payment page where they can enter their details privately.

This method neatly shifts the responsibility for data entry to the customer within a secure, isolated environment. Because the payment is completed outside of your business systems, it dramatically reduces your PCI scope while still offering a slick, modern digital experience. It’s the best of both worlds: the convenience of online checkout combined with the real-time support of an agent.

Payment Capture Methods Feature Comparison

Choosing the right tool for the job is crucial. The table below breaks down the most common remote payment methods, comparing their security implications, the kind of customer experience they offer, and where they fit best. For contact centres in regulated fields, making the right choice isn't just about convenience—it's about compliance.

| Capture Method | Security Level (PCI Scope) | Customer Experience | Best Use Case | Paytia Solution |

|---|---|---|---|---|

| Agent-Assisted (DTMF) | High (Minimal PCI Scope) | High-touch, guided, and secure. Builds confidence. | Complex sales, first-time payments, or supporting vulnerable customers. | Secure Virtual Terminal |

| Automated IVR | Highest (No PCI Scope) | Fast, convenient self-service, available 24/7. | High-volume, routine payments like bills, fines, or subscription renewals. | Pay by Phone IVR |

| Secure Payment Links | Highest (No PCI Scope) | Modern, mobile-friendly, and gives customer control. | Omnichannel support (phone, chat, SMS) and follow-up payments. | Pay by Link |

Each method offers a distinct set of benefits. The key is to match the technology to your specific operational needs and customer expectations, ensuring every transaction is both seamless and secure.

It’s also helpful to look at how different professions are adapting. For instance, a growing number of professional services are now accepting credit cards to streamline their billing and make life easier for clients. This wider trend shows the shift towards more flexible and secure payment solutions across every industry, underlining why it's so important to choose a method that serves your business and your customers equally well.

How to Implement a Secure Processing System

Getting a secure and efficient payment system up and running is the final, crucial step in mastering **merchant credit processing**. Think of this as your roadmap for setting up a new system or upgrading your current one. Our goal isn't just to make it work, but to ensure it's scalable, compliant, and a perfect fit for your business.Before you even start looking at vendors, you need to take a hard look at your own operations. This isn't a step you can skip. You'll need to get a handle on your transaction volume, pin down your main sales channels—like phone, web, or automated IVR—and get crystal clear on your security requirements. Ask yourself: what does a genuinely smooth payment experience look like for both my customers and my team?

Your Practical Implementation Checklist

Once you have a solid understanding of what you need, it's time to start thinking about vendors and integration. This checklist breaks down the critical stages to make sure the whole process goes off without a hitch.

Define Your Core Requirements: Get everything down on paper. Document your expected daily transaction counts, the specific currencies you need to handle, and any other must-haves. A clear brief makes comparing vendors a whole lot easier.

Prioritise Seamless Integration: How will this new system play with your existing tools? Make sure any solution you're considering can connect cleanly with your CRM, accounting software, and telephony systems. The last thing you want is to create data silos or clunky manual workarounds.

Scrutinise Vendor Credentials: Your payment vendor is your partner in security. PCI DSS Level 1 certification is absolutely non-negotiable. It's the highest level of validation and proves they operate a secure environment for handling cardholder data.

Evaluate Features and Support: Look for features that solve your actual problems, like automated payment reminders or robust reporting that gives you real insight. Just as important is the quality of their technical support. Will they be there to help when you need them most?

Choosing the Right Partner

Picking a vendor is about more than just comparing price lists; it's about finding a partner who is genuinely committed to your security and success. Don't just ask what a platform does—ask how it does it. Does it use tokenisation to protect stored card data? Can it provide DTMF suppression to pull your contact centre out of the scope of PCI DSS audits?

The right partner empowers you to build a payment system that minimises risk from day one. Their expertise becomes an extension of your own, providing the tools and assurance needed to handle payments securely and build lasting customer trust in your merchant credit processing operations.

Frequently Asked questions

Getting to grips with merchant credit processing can feel like learning a new language. But once you break down the jargon, it all starts to click. Here are some plain-English answers to the questions we hear most often.

Gateway vs. Processor: What’s the Difference?

It’s easiest to think about this with an analogy. A payment gateway is like the secure card machine on a shop counter—only it’s for your website, app, or phone system. Its one job is to securely grab the customer's payment details, encrypt them, and pass them along.

The payment processor is the entire back-office operation that the gateway talks to. It’s the engine that takes the encrypted info, sends it to the right banks and card networks (like Visa or Mastercard) to get the 'yes' or 'no' on the transaction, and actually gets the money moving.

So, the gateway is the secure front door, while the processor is the entire financial network making it all happen.

How Can I Reduce My PCI DSS Scope?

In simple terms, reducing your PCI DSS scope means shrinking the parts of your business that come into contact with sensitive card data. The smaller that footprint, the less you have to worry about during a compliance audit. The absolute best way to do this is to use a third-party solution that walls off your systems from that information entirely.

For businesses taking payments over the phone, this is a game-changer. Technologies like DTMF masking let a customer type their card numbers into their phone keypad. The data goes straight to the processor, completely bypassing your agent’s ears and your call recordings. A simple move like this can take your entire contact centre out of PCI scope, slashing the cost and headache of compliance.

Why Does Settlement Take a Few Days?

While a customer gets an "approved" message in seconds, the actual cash doesn't land in your account instantly. This final step is called settlement.

Here’s what happens: at the end of each day, all your approved transactions are bundled together into a "batch." This batch is sent to your processor, who then has to do the work of collecting the funds from all the different customer banks involved. This clearing process between multiple banks is why it typically takes 1-3 business days for the money to show up in your account.

Are All Processing Fees the Same?

Not at all. Processing fees can vary wildly, and it pays to know what you’re looking at. Every single transaction fee is actually made up of three distinct parts:

- Interchange Fee: This is a non-negotiable slice that goes to the customer's bank (the card issuer).

- Assessment Fee: A tiny fee that goes directly to the card brand, like Visa or Mastercard.

- Processor Markup: This is the part your payment processor charges for their service. It’s their margin.

How these fees are bundled is what really matters. An "Interchange-Plus" pricing model is transparent, showing you exactly what goes where. A "Flat-Rate" model is simpler to understand but can often hide higher costs. Make sure you understand your provider’s model so you know you’re getting a fair deal.

Ready to simplify your payment security and reduce PCI scope? Paytia provides secure, compliant payment solutions for contact centres and businesses worldwide. Learn how Paytia can protect your transactions and build customer trust.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.