What Does PCI Stand For: what does pci stand for

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Right, let's get straight to it. When you hear the acronym PCI, it stands for the Payment Card Industry. But in almost every business conversation, what people really mean is the Payment Card Industry Data Security Standard (PCI DSS). This is the master rulebook for any business that takes card payments.

What PCI Stands For And Why It Matters

Think of PCI DSS a bit like a restaurant's food hygiene rating. It's not a law passed by Parliament, but if you want to stay in business, you have to meet the standard. The major card brands—Visa, Mastercard, American Express, and others—make compliance a non-negotiable part of their contract with you. Fail to comply, and you can't accept their cards.

This is a massive deal for UK businesses, especially with the frightening levels of "card-not-present" fraud. UK Finance revealed that card fraud losses topped £0.5 billion in a single year. A staggering 80% of that came from online and phone payments where the physical card wasn't there. You can get the official details from the council that manages the standards at pcisecuritystandards.org.

Ignoring these rules is a recipe for disaster. The consequences aren't just a slap on the wrist; we're talking about hefty fines from your bank, jacked-up transaction fees, and—in the worst-case scenario—having your ability to take card payments shut down completely. For a deeper look at the basics, have a read of our guide on what is payment card industry compliance.

At its heart, PCI DSS is all about creating a secure environment for your customers' card details. It sets out the essential technical and operational rules to shield that data from thieves and fraudsters, keeping trust in the whole payment system intact.

Key PCI Acronyms At A Glance

To get your head around compliance, you first need to speak the language. The world of payment security is full of acronyms, and knowing what's what is the first step. This little table should help clear things up.

| Acronym | What It Stands For | What It Means For Your Business |

|---|---|---|

| PCI | Payment Card Industry | The collective term for the card brands and organisations involved in payments. |

| PCI DSS | Payment Card Industry Data Security Standard | This is the actual set of rules you must follow to protect customer card data. |

| PCI SSC | Payment Card Industry Security Standards Council | The global body that develops and manages the PCI DSS rules. |

Once you're comfortable with these terms, you're in a much better position to start building a secure foundation for your business.

Decoding The PCI Data Security Standard

While the Payment Card Industry Data Security Standard (PCI DSS) is built on 12 core requirements, trying to memorise them all is the wrong way to go about it. A much better approach is to see them for what they are: a logical set of security goals designed to keep sensitive payment information safe.

Think of it like building a fortress to protect treasure. You wouldn't just throw up a wall and call it a day. You'd need guards, secure vaults, and clear rules about who gets access. PCI DSS is no different, grouping its rules into common-sense principles. And since so many businesses now rely on the cloud, a good grasp of modern cloud data protection strategies is more important than ever.

The Core Goals of PCI DSS

Instead of getting bogged down in the fine print of all 12 requirements, let's look at the bigger picture. The standard really boils down to three main objectives:

- Build a Secure Network: This is your fortress wall. It’s all about installing and properly maintaining firewalls to control who and what comes in and out of your network. A big part of this is changing default, vendor-supplied passwords on hardware like routers.

- Protect Cardholder Data: This is about locking down the treasure itself. Any card data you store must be protected. Encryption is your best friend here, acting like a secret code. If thieves manage to steal encrypted data, they're left with a jumbled mess of characters that are completely useless without the decryption key.

- Maintain a Vulnerability Management Programme: Any fortress needs constant upkeep to stay secure. This goal covers everything from using and regularly updating anti-virus software to developing secure systems and applications that patch any potential weaknesses.

One of the most critical rules to remember is that you are strictly forbidden from storing sensitive authentication data after a transaction is authorised. This includes the three-digit CVC code from the back of a card, which is precisely why you're always asked to re-enter it for online purchases.

If you're ready for a deep dive, you can find a complete breakdown of all 12 rules in our detailed guide on the full list of PCI DSS requirements.

How Compliance Levels Affect Your Business

Thankfully, not every business is held to the same level of scrutiny. The PCI SSC has established different compliance levels based on how many card transactions your organisation handles each year.

For instance, a huge enterprise processing over six million card transactions annually falls into Level 1. This top tier demands a formal, on-site audit conducted by a Qualified Security Assessor (QSA).

On the other end of the scale, a small charity processing fewer than 20,000 transactions might only need to complete an annual Self-Assessment Questionnaire (SAQ). This tiered approach makes compliance a much more manageable and achievable goal for businesses of all shapes and sizes.

The Real World Impact On Your Business

Knowing the textbook definition of PCI is one thing, but seeing how those rules play out in your day-to-day operations is where it really hits home. If you take payments over the phone or via web chat, the requirements of PCI DSS aren't just abstract concepts—they have a direct, and often costly, impact on how you do business.

The moment a customer reads their card number out loud to an agent, your business is instantly exposed to risk. Think about common practices like call recording. A standard system will capture and store those sensitive card details, creating a goldmine for fraudsters and a massive compliance headache for you.

Understanding Your PCI Scope

To get a handle on the problem, you first need to understand the idea of PCI scope. The easiest way to picture it is as a contamination zone.

Any person, system, or process that comes into contact with—or even just transmits or stores—sensitive cardholder data is inside this zone. That includes the agent on the phone, their desktop computer, your call recording software, and even your network infrastructure. Everything within this zone is considered "in scope" and has to meet the strict (and often expensive) controls mandated by PCI DSS.

The larger your contamination zone, the more complex and costly your compliance becomes. Your goal should always be to make this zone as small as possible.

The Hidden Risks In Your Contact Centre

Let's trace the journey of a customer's payment details to see exactly where these risks are hiding. When a customer gives their card number over the phone, that information weaves its way through multiple systems, each one a potential weak link in the chain.

Consider these common vulnerabilities:

- Agent Desktops: An agent might scribble down card details on a notepad or key them into an unsecured app. In an instant, that device and everything connected to it is pulled into scope.

- Call Recordings: Standard recording platforms capture the whole conversation, including the card number, CVC, and expiry date, often storing it without any encryption.

- Network Equipment: Because the data travels across your internal network, all the routers and switches it passes through also fall into scope.

Every single one of these touchpoints expands your PCI scope. This inflates the burden of audits, drives up the cost of security, and magnifies the potential financial damage from a data breach. The key isn't just knowing what PCI stands for; it's about actively controlling where that sensitive data goes.

How To Reduce Your PCI Scope And Risk

Trying to meet every single PCI DSS requirement can feel like fortifying an entire castle. A much smarter approach is to shrink the area you need to protect in the first place. The most effective way to stay compliant is to reduce your PCI scope—that is, the zone where sensitive card data is handled or stored.

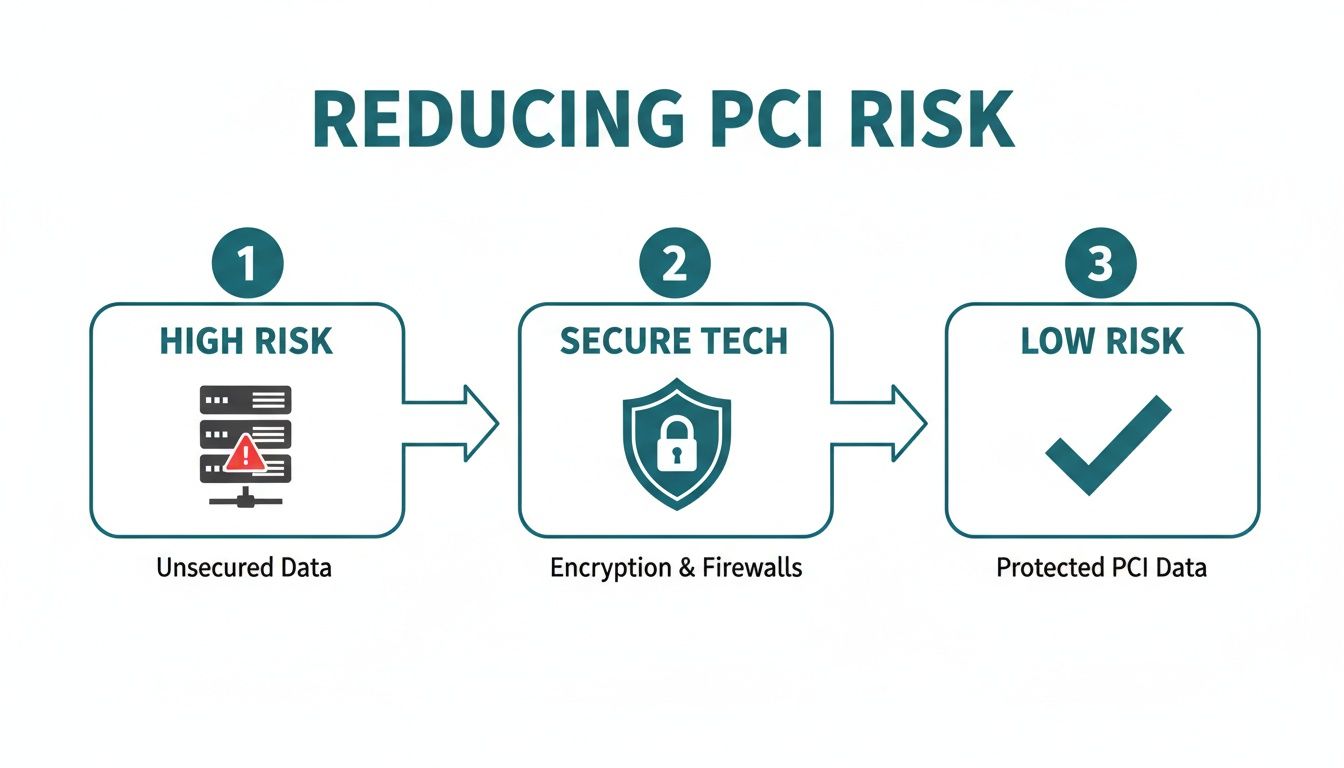

This is where clever technology can completely change the game. By preventing sensitive card details from ever entering your business environment, you effectively remove entire systems, processes, and even teams from the scope of a PCI audit. The result? Dramatically simpler compliance and lower costs.

Key Scope Reduction Technologies

Two of the most powerful tools for pulling this off are tokenisation and DTMF suppression. They work together, creating a layered defence that keeps cardholder data far away from your systems.

- Tokenisation: Think of this like a secure coat-check ticket. Instead of holding onto a customer’s valuable coat (their card number), you're given a unique, non-sensitive ticket (a token). This token can be used for future payments, but it’s completely useless to a fraudster if it’s ever stolen.

- DTMF Suppression: This technology works by muffling the tones a customer makes when they type their card number into their telephone keypad. The sensitive tones are captured securely before they ever reach your agent, your network, or your call recordings.

When you combine these methods, you create a secure payment process where your business never actually touches the card data. This simple but powerful idea is the cornerstone of modern, efficient PCI compliance.

It's no surprise that many UK businesses now rely on these tools. Recent survey data shows that 74% of organisations now use tokenisation as a primary PCI control, with 57% adding other methods to build a stronger, layered defence. This investment significantly reduces the amount of data in scope and, in turn, the cost of annual audits. You can check out more insights on the growth of the PCI compliance services market on datainsightsmarket.com.

These technologies make staying compliant far more manageable, no matter the size of your business. To understand how your own transaction volume affects what’s required of you, it’s worth exploring the different PCI levels of compliance.

A Smarter Path to PCI DSS Compliance

When it comes to PCI DSS, the smartest move is often the simplest: reduce your scope. Trying to secure every system that touches card data is a complex, expensive, and never-ending battle. A better approach is to stop sensitive data from entering your environment in the first place.

Modern secure payment platforms do exactly this. They create a clean separation between your business and the raw cardholder data, like the full card number (PAN) and the CVC. Your agents never see or hear it, your call recordings never capture it, and your internal networks never touch it. By using agent-assisted secure payment channels or automated self-service options, businesses can slash their PCI scope by a massive 90-95%. It completely changes the game.

The Benefits of Scope Reduction

Shrinking your PCI scope isn’t just about ticking a box for an auditor. It delivers real, tangible results that strengthen your business from the inside out.

- Drastically Lower Costs: Fewer systems in scope means the bills for audits, penetration testing, and ongoing security controls drop dramatically.

- Minimised Breach Risk: This is the most powerful benefit. If you don't store or handle sensitive data, you can't lose it in a breach. It’s the ultimate security posture.

- Enhanced Customer Trust: When you show customers you’re serious about protecting their data, you’re not just being compliant; you’re building loyalty and a stronger brand.

The process is straightforward but incredibly effective, shifting your operations from a high-risk to a low-risk environment.

By placing secure technology between your business and the payment data, you effectively de-risk your entire operation.

When choosing a technology partner, look for one with the highest level of validation: Level 1 PCI DSS certification. This is crucial. It guarantees the provider’s own systems are rigorously audited to the most stringent standards available, giving you confidence that your outsourced payment processes are in safe hands. Seamless integration is just as important to ensure the solution works perfectly with your existing setup.

Your Top Questions About PCI Answered

Diving into payment security can feel like opening a can of worms. You get a handle on the acronyms, but then the real-world questions start piling up. What are my legal duties? What happens if we slip up? Can't I just outsource this whole headache? Let's tackle the most common questions we hear from business owners, with straight-talking answers.

Is PCI DSS Actually a Law in the UK?

This is a great question, and the short answer is no – PCI DSS isn't a law passed by Parliament. But don't let that fool you.

It's a contractual requirement baked into your agreement with the major card schemes (think Visa, Mastercard) and your acquiring bank. If you want to accept card payments, you have to play by their rules, and their rules say you must be PCI DSS compliant.

So, while it’s not technically a law, the consequences of ignoring it are serious enough that you should treat it as mandatory. Failing to comply can lead to painful fines, higher transaction fees, or the worst-case scenario: having your ability to take card payments shut down entirely.

What’s the Real Risk if My Business Isn’t Compliant?

Ignoring compliance is a gamble with pretty high stakes. First off, you can expect monthly penalties from your acquiring bank. These aren't just slaps on the wrist; they can range from tens to thousands of pounds, depending on the size of your business and how far off the mark you are.

But that’s just the start. If you suffer a data breach, the financial fallout gets much, much worse. You’ll be on the hook for forensic investigation costs, the fees for re-issuing all the compromised cards, and eye-watering fines directly from the card schemes. Beyond the money, a breach can shatter customer trust, something that’s incredibly difficult to win back. This is why getting ahead of compliance is always the cheaper, smarter move.

Despite the clear dangers, getting it right is tough. A recent study found that only about 32% of organisations around the world were fully compliant with every single PCI DSS requirement. In the UK, it’s all enforced through contracts with acquirers, unlike regulations such as GDPR which are set in stone by law. You can read more about the PCI compliance enforcement study.

Does Using a Third-Party Provider Make This Problem Go Away?

Partnering with a PCI-validated service provider is one of the smartest things you can do. It drastically cuts down your workload, but it doesn't completely absolve you of responsibility. The right partner, however, can change the game.

By using a solution that prevents sensitive card data from ever touching your systems, you can shrink your PCI scope by as much as 95%. A reduction that big means you can often use the simplest Self-Assessment Questionnaire (SAQ-A) and have far fewer security controls to worry about yourself.

You're still responsible for making sure your end of the bargain is secure, but you’ve effectively and safely handed off the most complex, expensive, and high-risk technical parts to an expert.

Ready to shrink your PCI scope and simplify compliance? Paytia provides secure payment solutions that keep sensitive card data out of your environment, reducing risk and building customer trust. Discover how we can help at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.