What is a debit card security code: Protect online payments and fraud

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

You've probably noticed that little three-digit number on the back of your debit card. It's often called a CVC or CVV, and it’s one of the most important security features on your card. Think of it as a final checkpoint for any payment you make without your physical card, like when you're shopping online or paying for something over the phone.

This simple code is designed to prove you actually have the card in your hand, acting as a powerful, first-line defence against fraud.

Your Guide to the Debit Card Security Code

Picture this: you're about to buy a concert ticket online. You’ve punched in your long card number and the expiry date. But before you can confirm, you're asked for that short security code from the back. This number is essentially your digital bodyguard for any transaction where you can't physically slot your card into a machine or tap it on a reader.

Its main job is to confirm that the person making the payment genuinely holds the card. Even if a fraudster gets their hands on your main card number—say, from a data breach or a sneaky skimming device—they probably won't have the security code. That small but vital detail acts as a firewall, stopping unauthorised payments right where they start.

For a quick overview, here's a simple breakdown of what defines a debit card security code.

Debit Card Security Code at a Glance

| Attribute | Description |

|---|---|

| Common Names | CVV (Card Verification Value), CVC (Card Verification Code) |

| Length | Typically a three-digit number (four digits for American Express) |

| Location | Found on the back of most debit cards, near the signature strip |

| Primary Use | To verify "card-not-present" transactions (e.g., online, phone) |

| Security Role | Confirms the person making the payment has physical possession of the card |

This table neatly summarises why this little number plays such a big role in keeping your money safe during remote transactions.

The Importance for Remote Payments

In the UK, where contact centres process millions of payments every day, keeping this code secure is absolutely critical. As more of our shopping has moved online and over the phone, so have the attempts by criminals to get hold of this information. The boom in remote commerce has really put a spotlight on just how essential the security code has become.

To put it in perspective, UK Finance data shows that while overall debit card spending hit £76.5 billion in Q3 2025, the number of online transactions shot up by 6% to 971 million. This explosion in "card-not-present" activity is precisely why the security code is such a hot target for scams and why protecting it is non-negotiable for businesses.

A debit card security code is the primary line of defence in a card-not-present transaction. It separates legitimate cardholders from fraudsters who may have only obtained the main card number.

Ultimately, knowing what this code is and why it matters is the first step. For any business that takes payments, handling this number correctly isn't just good practice—it's a core requirement for earning customer trust and staying on the right side of regulations.

Decoding the Different Security Code Acronyms

When you’re asked for a debit card security code, you might come across a few different acronyms. It’s easy to get lost in this alphabet soup, but the good news is they all share the same fundamental goal: to prove you physically have the card in your hand.

These different names simply come from the various card networks. For most UK debit cards, which are typically issued by Visa or Mastercard, you'll be dealing with either a CVV (Card Verification Value) or a CVC (Card Verification Code). Both refer to the three-digit number on the back of your card, usually printed on the signature strip.

The Main Players: CVV and CVC

Although they have slightly different names, Visa's CVV and Mastercard's CVC are functionally identical. They’re created by the card issuer using a cryptographic key, which makes them incredibly difficult for fraudsters to guess or generate.

Their sole job is to add a layer of security to transactions where you can't physically present your card. For a deeper dive, you can learn what CVV means in our dedicated guide.

The image below shows the typical spot for these three-digit codes on the back of a card.

As you can see, the code is intentionally separated from the main card number and expiry date, making it much harder for criminals to capture all your details at once.

A Note on American Express

To round things out, it’s worth mentioning American Express. AMEX cards use a CID (Card Identification Number), which is a four-digit code found on the front of the card.

While the length and location differ, its role in verifying online or phone payments is exactly the same as the three-digit codes on Visa and Mastercard.

No matter what it's called—CVV, CVC, or CID—the security code is a non-negotiable verification step for 'card-not-present' transactions. Think of it as the digital equivalent of a shop assistant checking your signature.

Understanding these terms gives you the confidence to find the right number on any card, knowing it’s there to protect your money.

How Security Codes Act as Your Digital Bodyguard

Think of your debit card’s security code as its most trusted protector for any transaction made from a distance. Its one job is to prove that you physically have the card in your hand when you aren't there to tap it or use a Chip and PIN machine. This simple number acts as a powerful gatekeeper in the digital world.

When you're shopping in a physical store, the combination of your card’s microchip and your PIN creates a highly secure fortress around your money. But what about when you’re paying for a service over the phone or ordering something online? In these card-not-present scenarios, the security code steps up to become the primary line of defence against fraud.

This distinction is crucial because it highlights a common tactic used by criminals.

A Firewall Against Data Breaches

Imagine a large online retailer suffers a data breach. Hackers might steal a massive database of customer names, addresses, and debit card numbers. While this is a serious security failure, the thieves are often still missing one vital piece of the puzzle: the three-digit security code.

Because of strict security rules, legitimate businesses are forbidden from storing this code after a transaction is authorised. This means that even if the worst happens and a company's data is compromised, the stolen card numbers are often useless for making new online purchases without their corresponding security codes.

This small but mighty number effectively acts as a firewall, stopping fraudsters in their tracks. It transforms a stolen card number from an open gateway into a locked door, protecting your funds.

The Evolving Role in UK Payments

The debit card security code has been a cornerstone of remote payment security for decades. It became a standard feature in the UK during the transition from magnetic stripes to the more secure Chip and PIN system between 2003 and 2005, specifically to protect mail-order and telephone transactions.

As card-not-present fraud continues to rise, its importance has only grown. Even with total UK card transactions holding steady, reliance on the CVC for non-contactless payments remains high, as you can explore in more depth through current payment technology trends.

The security code's power lies in its simplicity. It’s a piece of information that should only be known by the person holding the card at the moment of payment, making it an effective authenticator.

For any business that handles payments remotely, especially contact centres, understanding this protective role is fundamental. It underscores the immense responsibility they have to safeguard this data, not just for compliance but to maintain customer trust and prevent significant financial loss. The security code isn't just a random number; it's a digital bodyguard on duty 24/7.

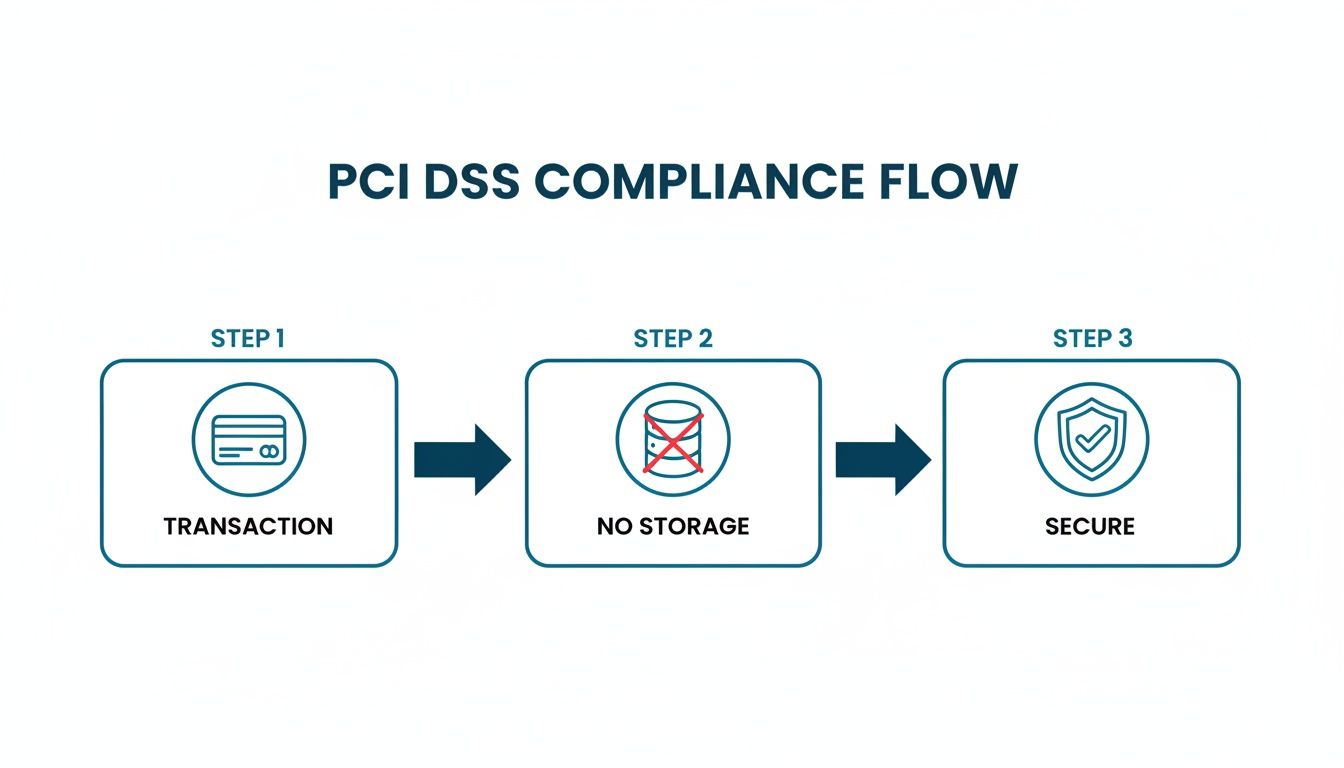

Navigating the Strict Rules of PCI DSS Compliance

When your business starts taking debit card payments, you step into a world governed by a very specific set of rules: the Payment Card Industry Data Security Standard (PCI DSS). Think of it as the ultimate rulebook for protecting sensitive payment information. When it comes to the debit card security code, its instructions are non-negotiable.

The single most important rule is crystal clear: the security code must never be stored after a transaction has been authorised. This isn't a suggestion. It means you can't keep it anywhere—not on a piece of paper, not in a digital file, and certainly not in a call recording. Once that payment gets the green light, the CVV data must be gone for good.

The High Stakes of Getting It Wrong

This rule creates a massive headache for businesses with contact centres, where agents are taking payments over the phone all day long. A single slip-up, like an agent jotting down a CVV on a sticky note "just in case," is a major compliance breach. Even something as common as a call recording that captures a customer reading out their security code creates a toxic data trail, putting the entire company at risk.

The consequences for failing to follow PCI DSS are serious enough to sink a business.

- Crippling Fines: We're not talking small change. Financial penalties can run from thousands to hundreds of thousands of pounds every month, depending on the size of your business and the mistake.

- Reputational Damage: A data breach involving card details is a fast way to lose customer trust. Once that trust is gone, it's incredibly difficult to win back, and your brand's reputation will suffer.

- Loss of Payment Processing: In the worst-case scenario, the major card networks can simply revoke your ability to accept card payments. For many businesses, that's like turning off the lights for good.

PCI DSS isn't just a set of best-practice guidelines; it's a mandatory standard for any organisation that stores, processes, or transmits cardholder data. The ban on storing security codes is one of its most fundamental and fiercely enforced rules.

These seemingly small habits—a note here, a recording there—create huge security holes and compliance nightmares. This is exactly why secure payment solutions were created. They solve the problem by making sure sensitive data, like the security code, never even touches your business environment. By getting to grips with these rules, you can see why modern payment technology is so crucial. To dive deeper into the specific controls, you can explore the core PCI DSS requirements in more detail.

How Modern Technology Protects Your Payment Data

The strict PCI DSS rules, especially the ban on storing a debit card security code, create a real headache for businesses. If you take payments over the phone, how do you handle that sensitive data without it ever touching your systems, your agents, or your call recordings?

The answer is found in modern payment technologies specifically designed to build a secure bubble around the transaction. These solutions act as a shield, stopping sensitive data in its tracks before it can ever enter your business environment. This dramatically cuts down your security risks and, just as importantly, shrinks the scope of your PCI DSS obligations.

The Soundproof Box Analogy for DTMF Suppression

One of the cleverest pieces of tech for this is Dual-Tone Multi-Frequency (DTMF) suppression. Let's paint a picture: a customer is on the phone with one of your agents and needs to key in their three-digit security code using their phone's keypad.

Ordinarily, the tones each keypress makes—those familiar beeps—would travel down the line. Your agent would hear them, and your call recording software would capture them. That's an instant and serious PCI DSS violation.

DTMF suppression essentially puts a "soundproof box" around this part of the call. As the customer types their security code, the technology intercepts the tones and masks them with a flat, monotonous sound. The agent hears nothing, the recording captures nothing, and those all-important digits are passed directly and securely to the payment processor. The security code is never seen or heard by your business.

This diagram shows how keeping card data out of your environment in the first place is the key to simple, secure compliance.

The fundamental principle here is simple: if you don't store sensitive card details, you create a much safer payment process from start to finish.

The Casino Chip Analogy for Tokenization

Another vital technology is tokenization. The best way to think about it is like swapping your cash for casino chips. Inside the casino, those chips are valuable and you can use them to play. But if a thief steals them and tries to use them at the local supermarket, they're just worthless bits of plastic. Tokenization does exactly that for your debit card details.

When a payment goes through, the real card number and security code are swapped out for a unique, non-sensitive "token." This token is safe to store in your systems and can be used for things like setting up a recurring payment or looking up a customer's history. It might look a bit like card data, but it's completely useless to a fraudster outside of that specific payment environment.

By combining technologies like DTMF suppression and tokenization, platforms like Paytia's Secureflow create a completely sealed-off payment environment. Your agents can talk a customer through a payment in real-time without ever seeing, hearing, or handling the actual card details themselves.

This approach takes your business systems right out of the flow of sensitive data. The impact is huge—it can reduce your PCI DSS compliance scope by as much as 90-95%. It's a powerful way to shut down the risk of internal fraud, stop data leaks from call recordings, and build genuine trust with your customers. You can dive deeper into this topic by reading our guide on what is tokenization in payments and how it works.

Best Practices for Handling Payments Securely

Knowing the theory behind protecting a debit card security code is one thing. Putting it into practice every single day is another challenge entirely.

If your business takes payments over the phone or through other remote channels, setting up clear, secure processes isn't just about dodging fines. It's about earning and keeping your customers' trust. The core objective is simple: create a payment environment where sensitive card data, especially the CVV, never even touches your organisation’s systems.

This all starts with a shift in mindset. Your entire team needs to understand that security is a shared responsibility, not just an IT problem. This means training staff to never ask a customer to read out their full card details over the phone, send them in an email, or type them into a web chat. These old-school methods are incredibly risky and blow a huge hole in your PCI DSS compliance efforts.

The smart move is to adopt automated, secure payment platforms that handle the heavy lifting for you. These tools let your agents guide customers through a transaction without ever seeing or hearing the sensitive information themselves.

Adopting Secure Payment Channels

To properly protect your customers and your business, you have to get away from manually handling card data. Modern payment solutions offer several secure channels that completely isolate your systems from the flow of sensitive information like the security code.

Here are the most effective methods you can use:

Secure Payment Links: Your agent can generate a unique payment link and send it straight to the customer via SMS or email. The customer clicks the link, lands on a secure, branded payment page, and enters their details to complete the purchase. The agent gets a real-time confirmation once it's done, but never sees the card numbers.

Automated Phone Systems (IVR): For customers who prefer the phone, an Interactive Voice Response (IVR) system can take over. The customer is transferred to a secure line where they can key in their card number and security code using their phone’s keypad. DTMF masking ensures the tones are suppressed, so they're never audible or recorded.

Agent-Assisted Solutions: These tools are the best of both worlds. An agent can stay on the line to help a customer, but technologies like those in Paytia's Secureflow make sure the agent can't hear the keypad tones or see the card details being entered. It’s a seamless, supportive, and completely secure experience.

By implementing these technologies, you fundamentally change your security posture. You stop reacting to risk and start actively designing it out of your payment processes from the ground up.

This shift does more than just lock down the debit card security code. It makes your operations more efficient and gives you a real edge over the competition. When customers feel confident that their data is safe with you, their trust in your brand deepens, paving the way for stronger relationships and repeat business. Security stops being a compliance chore and becomes a key part of your customer experience.

A Few Common Questions About Debit Card Security Codes

So, you’ve got a handle on what a debit card security code is. But what happens in the real world? Here are some straight answers to the questions we hear all the time, helping you use your CVV with confidence.

What Should I Do If My Card Is Lost or Stolen?

The moment you realise your card is missing, you need to act fast. Don't wait. The first thing you must do is contact your bank immediately to report it lost or stolen. They’ll instantly cancel the card to block any fraudulent payments and send a new one out to you, complete with a fresh card number and security code.

As a quick first step, check your mobile banking app. Most banks now let you freeze your card with a single tap, which is perfect for those "did I leave it at the shop?" moments while you retrace your steps.

Can I Share My Security Code with Anyone?

Absolutely not. Think of your CVV in the same way you think of your PIN – it’s a secret. You should never, ever share it over email, in a text message, or on social media. A legitimate company will never ask you to send your full card details through an insecure channel like that.

The only time it’s safe to provide your security code is when you are actively making a payment on a secure website or through a properly secured, automated phone payment system.

Just remember: your security code is the final key needed for online and phone purchases. Keeping it private is your single best defence against card-not-present fraud.

Is It Safe to Save My Card Details Online?

It's tempting, isn't it? Saving your details with your favourite online shops makes checkout a breeze. But while it's convenient, it does carry some risk. PCI DSS rules mean retailers are forbidden from storing your security code, but they do hold on to your main card number. If they ever suffer a data breach, that number could be stolen.

For the highest level of security, the best practice is to enter your details manually for every single purchase. It takes a few extra seconds, but it guarantees your security code is only ever used for that one, authorised transaction.

Protecting payment data is a complicated business, but Paytia makes it simple. Our secure payment platform ensures sensitive details like the CVC never even touch your systems, dramatically reducing your compliance burden and building unbreakable trust with your customers. Find out how we can secure your remote payments at https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.