What is click to pay: A Faster, Safer Online Checkout

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Ever tapped your contactless card in a shop? Think of Click to Pay as the online version of that same simple, secure experience. It’s a universal way to pay online, backed by the big names like Visa and Mastercard, that lets you skip manually typing in your card details every single time.

A Guide to Frictionless Online Payments

Picture your customers breezing through checkout without a single hiccup. No more scrambling for their wallet or trying to remember a password they set up months ago. Instead, they see a familiar, trusted icon, give it a click, and the payment is done. That’s the promise of Click to Pay.

This isn’t just some random new feature. It was created by the payment industry’s heavyweights—Visa, Mastercard, American Express, and Discover—to tackle two of the biggest headaches in e-commerce: abandoned carts and payment security. By creating one standardised button, they’ve gotten rid of the tedious task of punching in a 16-digit card number, expiry date, and CVC for every single purchase.

More Than Just a Button

It helps to think of Click to Pay as more than just another payment option. It’s the digital evolution of the EMV chip that’s in your physical card, bringing that same smart, trusted security to the online world.

It cleverly recognises you on your devices, letting you pay with any of your saved cards without needing to create a separate account for every merchant you buy from. This is a massive improvement over traditional methods. To see how it stacks up against other ways of storing card details, you can explore our detailed guide on what a digital wallet is and how they work.

This unified standard is arriving just in time. The UK's digital payments market, valued at USD 11.7 billion in 2025 and projected to hit USD 13.5 billion in 2026, shows just how quickly consumers are moving towards easier ways to pay.

Click to Pay is built on a technical standard called EMV® Secure Remote Commerce (SRC). This is the framework that keeps every transaction safe with layers of security, including network tokenization. It replaces sensitive card data with a unique digital identifier, keeping the real details under wraps.

To really grasp what Click to Pay is, you have to see its dual advantage. It gives customers the dead-simple checkout they crave while providing your business with the robust security it needs. It simplifies the whole transaction, directly addressing the main reasons people give up on their purchases, and builds trust right from the start.

This blend of speed and security is changing what people expect from online and over-the-phone payments.

To help you get a clearer picture, here’s a quick summary of what Click to Pay brings to the table.

Click to Pay At a Glance

| Feature | Description | Benefit for Your Business |

|---|---|---|

| Standardised Button | A single, recognisable icon across all participating websites and payment platforms. | Builds instant customer trust and familiarity, reducing hesitation at checkout. |

| Guest Checkout | Customers can pay without creating a new account or password for your site. | Lowers the barrier to purchase, which is a major driver in reducing cart abandonment. |

| Intelligent Recognition | Securely recognises returning customers on their trusted devices. | Delivers a fast, one-click payment experience that encourages repeat business. |

| EMV® SRC Security | Built on a global standard with multi-layered security, including network tokenization. | Dramatically enhances security and can help simplify your PCI DSS compliance requirements. |

| Major Network Backing | Supported by Visa, Mastercard, American Express, and Discover, ensuring wide acceptance and reliability. | Offers a credible, reliable payment method that appeals to a broad customer base. |

In short, Click to Pay isn't just another payment method; it's a smarter, safer, and much simpler way to handle transactions for everyone involved.

How a Click to Pay Transaction Works

So, what really happens when a customer clicks that little icon? Behind that simple button is a surprisingly elegant process, one that’s been fine-tuned for both speed and security. It’s a clever bit of coordination between your customer, your checkout, and the card networks, all wrapped up in a few seconds.

Let's pull back the curtain and look at how it works, first from the customer's point of view and then from the merchant's side of the counter.

The entire system is designed to get rid of the usual checkout headaches without cutting corners on security. It’s a balancing act: the customer wants to pay and get on with their day, and you need to know their payment data is safe.

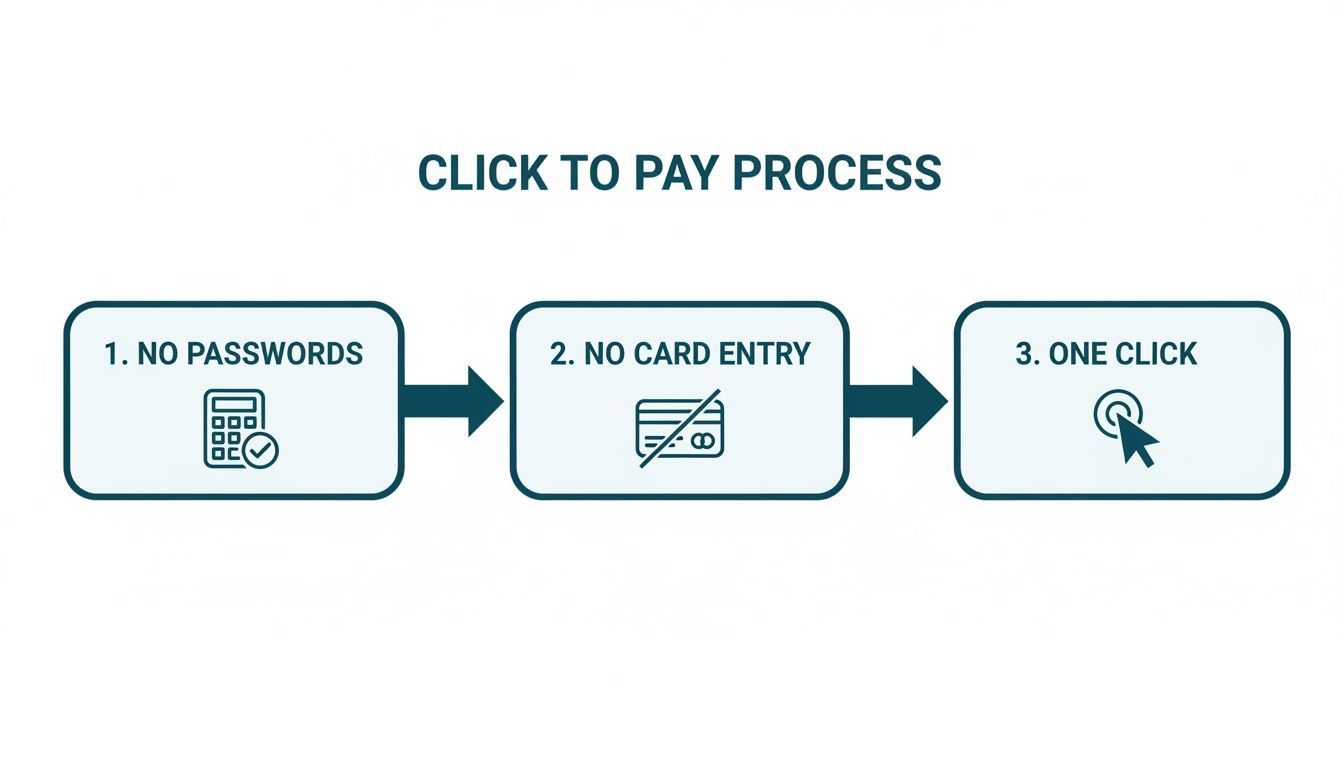

The flowchart below shows just how simple the journey is for the user. No more forgotten passwords or fumbling for a wallet. Just one click.

This visual really gets to the heart of what makes Click to Pay so appealing—it strips the checkout experience down to its absolute essentials.

The Customer Journey: A Seamless Experience

For your customer, the process is incredibly straightforward. The goal is to make paying feel almost invisible, letting them complete their purchase without the usual stops and starts.

Spot the Icon: The customer heads to checkout and sees the Click to Pay icon—that stylised logo with an arrow inside a circle—next to the other payment options. This is their cue for a faster, safer way to pay.

Get Recognised: As soon as they type their email address, the system smartly identifies them. If they’re on a device they’ve used before, it might recognise them automatically. First-timers are prompted to enrol by entering their card details just once. That info is then securely saved for any site that offers Click to Pay.

Quick Check: To make sure it’s really them, the system might send a one-time passcode to their phone or email. It’s a quick verification step that adds a solid layer of security without feeling like a major hurdle.

Confirm and Go: The customer sees their saved cards, picks one, and confirms the payment. That's it. No need to re-enter the long card number, expiry date, or CVC code. The transaction is done.

The real magic here is the "remember me" function. Once a customer is enrolled, the system can recognise them across any participating merchant’s website. What was once a chore becomes a simple, one-click action for returning shoppers.

This smooth, frictionless flow is a powerful weapon against abandoned carts. In fact, research shows that 28% of online shoppers in the UK will ditch their purchase if the checkout process is too long or complicated. By removing those roadblocks, Click to Pay directly tackles one of the biggest conversion killers.

The Merchant Process: Secure and Simplified

While the customer is enjoying that breezy checkout, a robust security operation is happening behind the scenes to protect everyone involved. Crucially, your business never has to handle or store raw card data, which massively reduces your security and compliance burden.

Here’s a look at what’s going on in the background:

Requesting a Token: When the customer confirms their payment, your payment gateway pings the correct card network (Visa, Mastercard, etc.) through the EMV® SRC system.

Secure Data Swap: The card network verifies the customer's identity. But instead of sending back the actual 16-digit card number, it generates a unique, one-time-use network token along with a dynamic cryptogram.

Authorising the Transaction: This secure token is what gets sent back to your payment gateway. Your gateway then uses this token—not the actual card number—to authorise the payment with your acquiring bank. The real card details stay safely locked away in the card network’s vault.

This process, known as tokenisation, is the bedrock of Click to Pay’s security. Because your systems only ever handle a token, your PCI DSS compliance scope is dramatically reduced. Even in the unlikely event of a data breach, any intercepted tokens would be completely useless to fraudsters. It’s a win-win, protecting both your business and your customers' trust.

The Tech Powering Click to Pay: EMV SRC

When a customer clicks that simple Click to Pay button, there's some seriously clever technology working behind the scenes. The whole system is built on an industry standard called EMV® Secure Remote Commerce (SRC). If that EMV part sounds familiar, it should – it comes from EMVCo, the same group that gave us the secure chip on our physical bank cards.

Think of EMV SRC as the master blueprint for taking that chip-level security and applying it to the world of online payments. It’s what ensures every Click to Pay transaction is consistent, secure, and works smoothly across different websites and card brands.

Before this standard came along, online checkouts were a bit of a mess. You had Visa Checkout, Masterpass, Amex Express Checkout, and others, all doing similar things but in slightly different ways. It was confusing for customers and a headache for merchants to manage. EMV SRC brought them all together under one unified, reliable framework.

This standardisation is what makes the whole "recognise me anywhere" magic happen. But its most important job is defining the security protocols that keep payment data locked down tight.

The Twin Pillars of EMV SRC Security

At its heart, the EMV SRC standard is built on two key security technologies that work together to protect every single transaction: network tokenisation and dynamic cryptograms. Getting your head around these two concepts really shows why Click to Pay is such a massive leap forward from typing card numbers into a web form.

First up is network tokenisation, which is a fancy way of saying we swap sensitive data for a non-sensitive stand-in.

This approach completely changes how card details are handled, taking them out of your business environment entirely. To get a deeper understanding of this crucial security layer, check out our guide on what tokenisation is in payments and how it works.

In a nutshell, instead of your customer's 16-digit card number (known as the Primary Account Number or PAN) flying around the internet, EMV SRC replaces it with a unique string of characters called a network token.

This isn't just a random code. The token is specific to the customer, the merchant, and their device. It's a secure substitute, while the real card details stay safely vaulted with the card network, like Visa or Mastercard. Even if a fraudster somehow got their hands on the token, it would be completely useless to them.

For your business, this is a game-changer. It dramatically shrinks your PCI DSS compliance scope because you never actually see, handle, or store the raw card number. A massive security risk and liability is lifted from your shoulders.

Adding Another Layer with Dynamic Cryptograms

Network tokenisation is incredibly robust on its own, but EMV SRC doesn't stop there. It pairs it with a second line of defence: a dynamic cryptogram. This is the digital cousin of the unique code your chip card generates every time you tap to pay in a shop.

Think of the token as the key to a secure vault. The dynamic cryptogram is like a one-time-use PIN that changes for every single transaction.

Here’s how it works in practice with Click to Pay:

- When a customer finalises their purchase, the system generates both the network token and a unique, single-use cryptogram.

- This cryptogram acts like a digital signature, proving the transaction request is authentic and coming from the right place.

- The payment processor then checks both the token and the cryptogram. If they match up and are valid, the payment is approved. If anything is amiss, it’s instantly declined.

This powerful combination makes it exceptionally difficult for criminals to pull off "replay attacks," where they steal old transaction data and try to use it again. Each payment is protected by its own unique, non-reusable security code, guaranteeing its integrity. This multi-layered security is exactly what makes Click to Pay such a trustworthy standard for modern commerce.

Weighing Up the Pros and Cons for Your Business

When a new payment technology comes along, it's easy to get swept up in the hype. But for any business, especially one with a busy contact centre where every second counts, you need a clear-headed look at what it really offers. Click to Pay has some serious advantages, but it's not a silver bullet. Let's get into the good, the bad, and what it all means for your operations.

The Upside: Better Conversions and Watertight Security

The biggest win with Click to Pay is how it smooths out the checkout process. We all know that a clunky, frustrating payment page is the number one reason customers give up and leave. By making it quick and simple, you directly attack the problem of abandoned baskets, which means more completed sales and a healthier bottom line.

Security is the other massive plus point.

- Less Fraud, Fewer Chargebacks: Because Click to Pay uses network tokenization and one-time-use codes, the actual card details are never exposed. This makes the transaction data almost useless to fraudsters, leading to a real drop in fraudulent payments and the costly chargebacks that follow.

- A Lighter PCI DSS Burden: Since you're not handling or storing sensitive card numbers yourself, your PCI DSS compliance scope can shrink dramatically. This is a huge relief, saving you time, money, and a lot of administrative headaches.

- Building Customer Confidence: Seeing that familiar Click to Pay logo tells customers you’re serious about protecting their data. It’s a small but powerful signal of trust that can make them feel more comfortable buying from you again.

Think about it in a contact centre context. Faster, more secure payments mean shorter call times. Your agents aren't stuck laboriously reading out and typing in card numbers, which frees them up and improves everyone's experience.

The Downsides: Awareness and Integration Realities

For all its strengths, Click to Pay isn't perfect. The single biggest hurdle right now is simply consumer awareness. It’s still the new kid on the block, and many shoppers don't yet recognise the icon or understand what it does. This can mean a slower uptake when you first add it to your website or payment flow.

Then there are the practical bits of getting it set up.

- Gateway Compatibility: First things first, your payment gateway has to support the EMV® SRC standard. Most of the big players do, but it's the first thing you need to confirm before you go any further.

- The Integration Itself: Even with modern tools, adding the Click to Pay button isn't a one-click job. It will take some developer time to implement it correctly within your e-commerce site or payment system and test it thoroughly.

This shift towards effortless payments is happening everywhere. Just look at the explosion of contactless in the UK. In a recent 12-month period, contactless payments hit a staggering 18.9 billion transactions, now accounting for over 60% of all card payments. People clearly want fast and easy ways to pay, and Click to Pay is built to meet that demand once it becomes more familiar. You can dig into more data on UK payment trends to see just how strong this movement is.

So, is Click to Pay right for you? It’s a balancing act. The boost to your conversion rates and the iron-clad security are incredibly persuasive. The challenges around public awareness and technical setup are real, but they are also hurdles that will shrink over time.

Click to Pay vs Traditional Payment Methods

To put it all into perspective, let's see how Click to Pay stacks up against the other methods you might be using to take payments remotely.

| Feature | Click to Pay | Payment Links | Manual Card Entry (MOTO) |

|---|---|---|---|

| Security | Very High (Tokenization, device binding, 3DS) | High (Hosted page, tokenization) | Low (Verbal data, manual entry) |

| PCI Scope | Reduced (SAQ A) | Reduced (SAQ A) | High (SAQ C/D) |

| Customer Effort | Very Low (One-time setup, then single click) | Low (Click link, enter card details) | High (Must read out details) |

| Conversion Rate | Highest | High | Lowest |

| Agent Effort | Very Low (Customer self-serves) | Low (Generate & send link) | High (Listen, type, verify) |

| Setup | Moderate (Gateway integration) | Simple (Platform configuration) | N/A (Standard terminal feature) |

This comparison makes it pretty clear. While sending a payment link is a solid step up from taking card details over the phone, Click to Pay offers the best all-around experience for security, customer convenience, and conversion potential.

How to Implement Click to Pay

So, you’re ready to bring Click to Pay into your payment operations? Good move. Getting it set up is a straightforward process, and while there’s a bit of technical work involved, the payoff in security and customer experience is more than worth it. This isn't just about sticking another button on your website; it's about upgrading your entire payment ecosystem, especially in places like a contact centre where speed and security are paramount.

Let’s walk through the practical steps. The journey starts with your payment gateway and ends with a slick, integrated payment tool that works seamlessly whether a customer is online or talking to one of your agents. The end goal is simple: make payments faster, safer, and easier for everyone.

Step 1: Verify Gateway and PSP Support

First things first, you need to confirm that your current payment service provider (PSP) and payment gateway can actually handle Click to Pay. The whole system is built on the EMV® Secure Remote Commerce (SRC) standard, so support for that is non-negotiable.

Most of the big players like Stripe, Braintree, and Adyen are already on board, but don't just assume. The best thing to do is get in touch with your provider's support team and ask them directly if they facilitate Click to Pay. This is the crucial first hurdle that will shape your entire implementation plan.

Step 2: Plan Your Integration Points

Once you've got the green light from your PSP, it's time to think about where you’re going to offer Click to Pay. The obvious answer is your e-commerce checkout page, but that’s just scratching the surface. To get the most value, you should consider every place a customer might pay you.

Think about all your different customer touchpoints:

- Website Checkout: This is the classic use case. The Click to Pay button sits right there next to the "Pay with Card" or PayPal options.

- Mobile App: Integrating it into your app's payment flow offers a beautifully seamless, one-tap experience for your mobile users.

- Contact Centre Chat: Imagine an agent generating a payment request and sending it straight into the chat window. The customer clicks, authenticates, and pays securely on their own device without ever reading out their card details.

- Email or SMS Invoices: You can embed payment links with the Click to Pay button into invoices sent via email or text, giving customers a super-fast way to settle up.

This kind of flexibility is essential today. According to Statista, the number of UK users paying with their smartphone is expected to grow by nearly three million between 2022 and 2026. You can read more about UK mobile payment adoption on Statista.com. Meeting your customers on their preferred device isn't just a nice-to-have; it's a necessity.

Step 3: Execute the Technical Integration

With a solid plan in hand, it's time to get technical. This part usually falls to your development team, who will work with your payment provider’s API and SDKs (Software Development Kits). The exact process will depend on your provider, but it generally follows these steps:

- Obtain API Keys: Your developer will need the right credentials from your PSP to connect your system to their Click to Pay service.

- Add the Button: The official Click to Pay button (often called a 'mark') needs to be added to your checkout page's front-end code. Most providers have libraries that make this pretty simple.

- Configure the Payment Flow: Your back-end system needs to be set up to kick off a Click to Pay session, correctly handle the tokenised payment data that comes back from the card network, and then process the transaction.

- Test Thoroughly: Before going live, you must run end-to-end tests in a sandbox environment. This ensures everything works perfectly, from recognising the customer to authorising the payment and handling any potential errors.

For businesses that use a dedicated secure payment platform, this whole process gets a lot easier. A system like Paytia can handle the heavy lifting of the integration, letting you simply switch on Click to Pay as a feature without needing a major in-house development project.

By following these key steps—verifying support, planning your touchpoints, and handling the technical setup—you can create a clear roadmap for adoption. This strategic approach ensures you get the full power of Click to Pay, boosting security and streamlining payments across your entire business. You can learn more about how Paytia solutions simplify Click to Pay implementation for various business needs.

The Future of Secure Online Payments

Click to Pay isn’t just another button on the checkout page. It’s shaping up to be a fundamental shift in how we handle online payments, much like contactless completely changed the game for in-person shopping. It's on track to become the new default for how we buy things online.

The real strength here is its foundation: the EMV® Secure Remote Commerce standard. This isn’t some proprietary tech from a single company; it's a unified framework backed by the biggest names in payments. This collaborative approach creates a consistent, secure experience that benefits everyone involved, from the customer to the merchant.

This isn't a passing fad. It’s a serious building block for the future of e-commerce, designed to give customers the speed they crave without cutting corners on security. As technology evolves, you can bet Click to Pay will evolve with it, making payment journeys even smoother.

Integration with Emerging Technologies

The really exciting part is seeing how Click to Pay will weave itself into other new technologies. Think about a checkout that’s not just one-click, but practically zero-click, where authentication happens instantly and invisibly in the background. That's where this is all heading.

Biometric Authentication: Imagine this: instead of waiting for a one-time passcode via text, you just use your fingerprint or Face ID to approve a payment. This blends top-notch security with incredible ease, making transactions instantaneous and fraud incredibly difficult.

Open Banking Synergy: The possibilities get even more interesting when you combine Click to Pay with Open Banking APIs. A customer could see their saved cards, and right alongside them, the system could offer an instant bank transfer as another easy option—all within the same secure, familiar interface.

This forward-looking design means the standard won't become outdated. It's built to adapt as new security protocols and consumer habits emerge.

The core principle is clear: to make paying online as simple and secure as paying in person. By removing friction and bolstering trust, Click to Pay is not just improving the checkout; it's building the foundation for a more connected and secure digital economy.

A Strategic Imperative for Modern Business

For any business today, adopting payment methods like Click to Pay is less of an option and more of a necessity. This isn't just about keeping pace with competitors; it's about future-proofing your operations and showing customers you take their security and convenience seriously.

Meeting customer expectations is everything. A shopper who has a fast, simple, and secure checkout experience is far more likely to come back. When you offer a payment standard backed by the world's largest card networks, you’re sending a clear signal: you value their time and you’ve earned their trust.

Ultimately, bringing Click to Pay into your business is an investment in a better customer journey and a more secure bottom line. It gets you ready for the next wave of payment innovation, making sure every transaction is built on a bedrock of confidence and efficiency.

Frequently Asked Questions

Getting to grips with new payment technology always throws up a few questions. We've put together some straightforward answers to the most common things businesses and customers ask about Click to Pay, covering security, cost, and how it all works.

Is Click to Pay Secure for My Business and Customers?

Absolutely. It’s built on the EMV® Secure Remote Commerce (SRC) standard, which is the same global standard that powers the chip in your physical card. It uses advanced security like network tokenization, meaning your customer’s real card number is never actually sent during the payment or stored on your systems.

Instead, a unique, single-use token is created for that specific purchase. This massively cuts down your risk of a data breach and can really help simplify your PCI DSS compliance headaches. For your customers, it’s peace of mind – they're getting the same powerful security they already trust every time they tap or insert their card in a shop.

What Card Networks Support Click to Pay?

Click to Pay is a big-team effort, backed by the world's major card networks, including Visa, Mastercard, American Express, and Discover.

This collaboration is what makes it so powerful. It creates a single, reliable checkout experience for almost every online shopper out there. When someone sees that Click to Pay icon, they know it’s a secure, easy option, no matter which of these cards is in their wallet.

Think of it this way: the goal was to create one trusted button for online payments. It replaces the old, confusing mix of different options like Visa Checkout or Masterpass, which often left customers scratching their heads. This unified approach builds confidence and just makes life simpler for everyone.

How Is Click to Pay Different from Storing a Card on File?

They both aim to make repeat payments easier, but how they handle security couldn't be more different. When you store a 'Card-on-File', you are literally storing the customer's actual card details yourself. This places the security responsibility squarely on your shoulders and significantly expands your PCI DSS scope.

Click to Pay, on the other hand, relies on network tokenization. The card details are kept in a secure vault managed by the card network itself, not by you. All your system ever sees is a low-risk token. This setup not only lessens your security burden but also gives your customers more control over their own payment information.

Does It Cost Extra to Offer Click to Pay?

For your customers, using Click to Pay is completely free. No hidden charges.

For your business, the card networks don't add any extra fees for providing it as an option. Your normal transaction processing fees from your payment provider will apply, just like any other card payment. The only real cost is the initial technical effort to get the Click to Pay button integrated into your checkout flow. Many modern payment gateways and platforms have made this much easier by building the support right in.

Ready to offer your customers the future of fast, secure payments? Paytia makes it simple to implement Click to Pay across all your channels, from your website to your contact centre. Discover how you can reduce PCI scope, shorten call times, and boost customer trust by visiting the Paytia website.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.