What Is the CVC on Cards and Why Does It Matter for Security

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Ever wondered about that little three or four-digit number on your credit card? That’s the CVC (Card Verification Code), and it’s one of the most important security features for online and over-the-phone payments.

The CVC is physically printed on your card, but crucially, it isn't stored on the magnetic stripe or embedded in the chip. Its sole job is to prove you have the actual card in your hand when you can't physically present it to a merchant. It’s a simple but powerful defence against fraud in what the industry calls Card-Not-Present (CNP) transactions.

Your Card's Secret Handshake Explained

Here’s a good way to think about it: your main 16-digit card number is like your home address. You share it fairly often with online shops and services. The CVC, on the other hand, is like a special, single-use key to your front door for a specific delivery.

It proves that the person placing the order isn't just someone who found your address written down somewhere. It confirms they have the actual key at that very moment.

In an age where huge data breaches can expose millions of card numbers, that little code is a surprisingly effective barrier. A criminal might get hold of your card number and expiry date, but without that CVC, their attempt to use it online will often fail.

The Alphabet Soup of Security Codes

You've probably seen a few different names for this code, and it can get a bit confusing. While the acronyms change depending on the card brand, they all do the exact same thing.

Here’s a quick breakdown to clear things up:

Comparing CVC, CVV, and CID Security Codes

| Acronym | Full Name | Card Scheme(s) | Location on Card |

|---|---|---|---|

| CVC | Card Verification Code | Mastercard | Three digits on the back signature strip |

| CVV | Card Verification Value | Visa | Three digits on the back signature strip |

| CID | Card Identification Number | American Express | Four digits on the front, above the card number |

Ultimately, whether it's called a CVC, CVV, or CID, it's just a brand name for the same fundamental security feature: a static code printed on the card to prove possession during a remote payment.

The core idea is brilliantly simple: if you can't swipe or dip the card, the CVC provides a way to prove you're holding it. It’s a low-tech solution to a high-tech problem.

A Brief History of the CVC

The concept of the CVC wasn't born in the internet era. Its roots go back to the days of mail-order and telephone shopping. The first version was actually developed in the UK in 1995 by Michael Stone, an employee at Equifax.

It started as an eleven-character alphanumeric code, trialled with partners like Littlewoods and NatWest bank to fight fraud. It was later simplified to the three-digit format we know today and was adopted across the industry by APACS (now part of UK Finance), setting a global standard. You can explore the history of card security codes on Wikipedia for a deeper dive.

This clever security measure creates a direct link between a digital transaction and the physical card—a principle that remains absolutely vital for securing payments today.

How to Find and Use the CVC on Your Card

Now that we've covered what a CVC is, let's get practical. Knowing where to find this little number is simple once you know what you’re looking for, but its location isn’t universal across all cards. That difference is actually a deliberate part of its security design.

For the vast majority of credit and debit cards, all you need to do is flip the card over and look at the signature strip.

Locating the CVC on Visa, Mastercard, and Discover

If you’re holding a Visa, Mastercard, or Discover card, your CVC is the three-digit number printed on the back. You'll spot it on the far right of the signature panel. Notice how it’s flat-printed, not embossed like the main card number? That makes it impossible to capture with an old-school carbon copy imprinter.

This specific placement was a clever move. It meant that even if a fraudster managed to get an imprint of the front of your card—a common tactic back in the day—they still wouldn't have the CVC. It's a subtle but important piece of physical security.

Finding the CID on American Express Cards

American Express does things a little differently. Instead of a three-digit code on the back, they use a four-digit code found on the front of the card.

This code, which Amex calls the Card Identification Number (CID), is printed just above the main card number, usually off to the right. It does the exact same job as a CVC, but its unique length and placement are a hallmark of their cards.

Key Takeaway: The CVC is intentionally kept separate from the embossed card number. This ensures that a criminal needs more than just the primary card details to make a purchase online; they need the physical card itself to get that all-important verification code.

Putting Your CVC into Action

So, when will you actually be asked for this code? The CVC is almost exclusively used for Card-Not-Present (CNP) transactions. These are any payments where you aren't physically handing over your card to be swiped or inserted into a terminal.

Think about the last time you bought something online. The checkout process likely asked for four key pieces of information:

- Your full card number

- The card's expiry date

- Your name as it appears on the card

- And finally, the CVC (or CVV/CID)

That final field is the moment of truth. By entering the CVC, you're confirming to the seller's payment system that you have the card in your possession. It’s the digital equivalent of a shop assistant checking your signature. Whether you're finalising an online order or giving your details over the phone, the CVC is the handshake that seals the deal.

How the CVC Helps Stop Card-Not-Present Fraud

Think of the CVC as a digital bouncer for any transaction made online or over the phone. Let's say criminals get their hands on a huge list of stolen credit card numbers from a data breach. They've got the long 16-digit card number (the PAN) and the expiry date. That seems like enough to cause some serious damage, right?

But they're almost always missing one vital piece of the puzzle: that little three or four-digit CVC. This is because merchants are strictly forbidden from ever storing the CVC after a transaction is complete. So, when their servers are hacked, the CVC data simply isn't there to be stolen. This creates a surprisingly powerful security checkpoint.

A Simple Firewall Against Digital Theft

The CVC check is a simple but incredibly effective firewall. When a fraudster tries to use a stolen card number on a website, the payment gateway will inevitably ask for the CVC. Since they don’t have the physical card in their hand, they can't provide it. The transaction is stopped dead in its tracks.

This whole system was specifically designed to tackle Card-Not-Present (CNP) fraud—scenarios where the customer isn't physically at a till to swipe or tap their card. It’s a way of proving that the person making the payment likely has the genuine card with them at that very moment. Without this check, lists of stolen card numbers would be far more dangerous.

As e-commerce and phone payments have exploded, this little code has become more crucial than ever. The financial stakes for both businesses and their customers are massive, making CNP fraud a constant threat.

The Sheer Scale of Card-Not-Present Fraud

The numbers really put the problem into perspective. In the UK, CNP isn't just a minor issue; it's by far the biggest source of card-related crime.

In 2022, Card-Not-Present fraud made up a staggering 81% of all card fraud cases. This amounted to 2.21 million incidents and losses of £396 million.

This really drives home the risk involved any time a card isn't physically present. That year, the total value of all card fraud hit £556.3 million, a 6% jump from 2021, showing it's a persistent and growing challenge. You can discover more about these credit card statistics to get the full picture.

For any business taking payments over the phone, the danger is especially real. Just one breached call recording could expose a customer’s full card number and their CVC, handing a fraudster everything they need. This is exactly why modern security measures are no longer optional—they’re essential for protection and compliance.

How CVC Verification Works in Practice

So, what does this look like in a real-world scenario? Let's break it down.

- The Purchase: A customer calls your contact centre or visits your website to buy something. They provide their name, card number, and expiry date.

- The Checkpoint: Your payment system then asks for the CVC. This is the key moment where you verify they actually have the card.

- The Request: All this data—the PAN, expiry date, and CVC—is bundled up and sent securely to the payment processor, who then passes it to the customer’s bank.

- The Verdict: The bank checks if all three details match what they have on file. If the CVC is wrong or missing, the transaction is declined, even if the other details are perfect.

This whole process takes just a few seconds, but it’s a crucial defence that filters out criminals trying to use stolen data.

More Than Just a Number

While the CVC is a fantastic tool, it's not a silver bullet. It's important to remember that it's a static code; it doesn't change. If a fraudster manages to get hold of the card number, expiry date, and the CVC, they could potentially make fraudulent purchases until the card is cancelled.

That’s why the CVC should be seen as one important layer in a much bigger security strategy. It works best alongside other tools like the Address Verification System (AVS), 3D Secure authentication (you might know it as Verified by Visa or Mastercard SecureCode), and sophisticated fraud detection software that spots unusual spending patterns. You can learn more about the challenges of CNP fraud in our detailed guide.

Ultimately, the CVC’s main job is to forge a link between the digital transaction and the physical card, making life much, much harder for opportunistic criminals.

Understanding PCI DSS Compliance for CVC Handling

Handling the CVC on cards correctly isn't just a good security habit—it's a strict, non-negotiable requirement. The entire framework governing this is the Payment Card Industry Data Security Standard (PCI DSS). This set of rules, created by the major card brands, dictates exactly how businesses must protect customer card data.

When it comes to the CVC, the main rule is simple and absolute: you must never, ever store it after a transaction has been authorised. This is the cornerstone of its security value.

The CVC as a Self-Destructing Message

Think of the CVC as a self-destructing message in a spy film. Its whole purpose is to exist for a fleeting moment to verify a single mission—the payment authorisation—and then disappear forever. Once its job is done, it must be completely erased from your environment.

This means the CVC should never be found in any of these places after the transaction is complete:

- In a customer relationship management (CRM) database

- On a call recording from your contact centre

- Written down on a notepad or sticky note

- Saved in a spreadsheet or a text file

Storing the CVC, even accidentally, fundamentally breaks its security model and creates a massive compliance risk. You’re essentially turning a temporary key into a permanent one that fraudsters can steal and reuse.

The Heavy Price of Non-Compliance

Ignoring the PCI DSS rules for CVC handling just isn't an option. The penalties for non-compliance are severe and can have a devastating impact on your ability to do business.

The consequences aren't just theoretical. Failing a PCI DSS audit can lead to substantial monthly fines, often ranging from £5,000 to £100,000, until you fix the problem. In the most serious cases, a business can have its ability to process card payments revoked entirely.

Beyond the financial penalties, a compliance breach erodes customer trust, which can be far more costly in the long run. News of a data breach where sensitive authentication data like the CVC was exposed can cause irreparable damage to a company’s reputation.

Unique Risks for Contact Centres

Nowhere is the risk of accidentally storing a CVC greater than in a contact centre. When an agent takes a payment over the phone, they are on the front line of PCI DSS compliance, and the potential for a breach is incredibly high.

Just imagine an agent asking a customer to read out their CVC. That verbal confirmation instantly introduces several points of failure:

- Call Recordings: If the call is being recorded for training or quality purposes, the CVC is captured and stored directly in the audio file. This is a direct violation of PCI DSS.

- Keypad Tones (DTMF): If the customer enters their CVC using their telephone keypad, the tones (Dual-Tone Multi-Frequency or DTMF) can often be captured by call recording software, making it possible to reconstruct the numbers later.

- Human Error: An agent might jot down the CVC on a piece of paper just to make sure they heard it correctly. If that note isn't securely destroyed immediately, it becomes a physical security risk.

Each of these scenarios creates a compliance nightmare, turning a routine payment into a major liability. This is precisely why businesses need robust technology that removes the CVC from their environment altogether. You can explore the full scope of these regulations by reading our comprehensive guide on the key PCI DSS requirements your business needs to know.

How Modern Technology Secures CVC Data

The golden rule of payment security—never store the CVC—poses a real headache for any business that takes payments over the phone. How do you actually process a payment without that critical three-digit code ever touching your call recordings, your computer systems, or even an agent’s notepad?

This is where clever security technology steps in. It's designed to intercept and shield this sensitive data before it ever enters your environment, moving the entire process into a secure, isolated bubble. Think of it less as a manual process to be managed and more as an automated, protective shield built around the entire transaction.

Scrambling Keypad Tones with DTMF Masking

One of the smartest tools in the box is DTMF masking, sometimes called DTMF suppression. DTMF (Dual-Tone Multi-Frequency) is just the technical term for the unique sound each button on a phone’s keypad makes. When a customer taps in their CVC, those tones can be picked up by call recording software, instantly creating a serious PCI DSS compliance breach.

DTMF masking technology neatly sidesteps this problem. As the customer enters their CVC, the system intercepts the tones and replaces them with a flat, monotonous beep. All the agent and the call recording ever hear is a neutral sound, while the actual DTMF data is whisked away securely and directly to the payment processor.

A Simple Analogy: Imagine it’s a soundproof tunnel. The customer’s CVC data goes in one end, travels through a secure path completely invisible and inaudible to your business, and comes out the other side directly at the bank. Your systems only ever know that a payment was approved.

Creating a Secure Path with Channel Separation

Another key technique is channel separation. This method carves out a completely separate, secure data channel just for the payment details, keeping it isolated from the voice conversation between your agent and the customer. Your agent can stay on the line to offer help, but they never see, hear, or touch the CVC.

What this does is ensure that no sensitive cardholder data—especially the CVC—ever enters your business's network. It stays locked within a certified, PCI DSS compliant pathway, straight from the customer's keypad to the payment gateway. By doing this, you effectively remove your entire organisation from the risk of handling sensitive data, which is a huge win for both security and compliance.

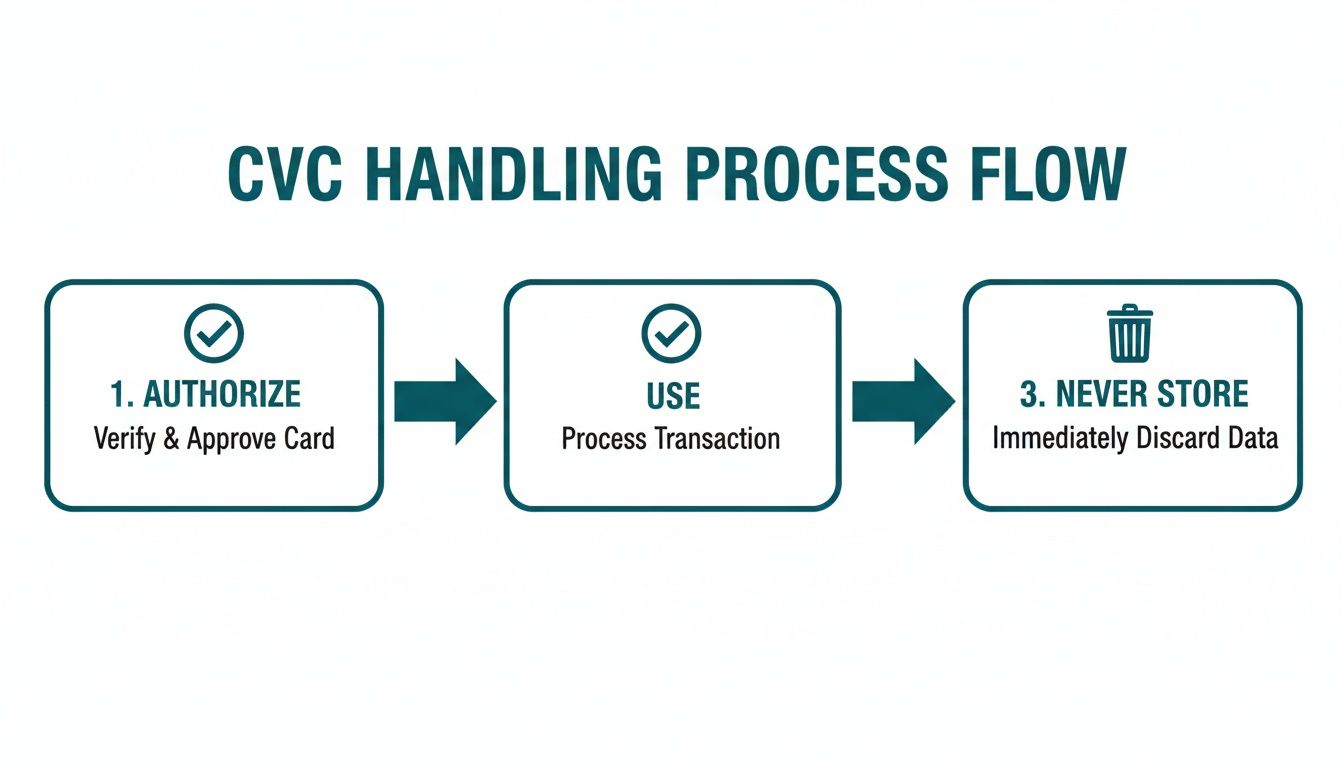

This diagram shows the simple, compliant lifecycle for handling a CVC.

The flow is crystal clear: the CVC is used for one thing only—authorisation—and then it must be wiped clean from all systems.

The Tangible Business Benefits

Bringing this kind of technology on board isn't just about ticking a compliance box. It delivers real, measurable benefits that make your entire operation stronger. The biggest advantage is a massive reduction in your PCI DSS scope. Because sensitive data no longer flows through your phone systems, CRMs, or agent desktops, the complexity and cost of your compliance audits can shrink by as much as 90-95%.

This has a fantastic knock-on effect:

- Lower Costs: Simpler audits mean smaller bills from Qualified Security Assessors (QSAs) and less time spent by your internal teams on compliance tasks.

- Zero In-house Fraud Risk: By stopping CVC data from ever entering your environment, you completely remove the risk of it being stolen from your systems during a data breach.

- Stronger Customer Trust: When customers feel confident their payment details are being handled securely, it builds loyalty and strengthens your brand reputation.

The old way of handling phone payments was full of risk. Now, modern solutions offer a much safer path.

Traditional Phone Payments vs Modern Secure Solutions

The table below highlights the night-and-day difference between outdated methods and a modern, secure approach. It's a clear illustration of how technology doesn't just improve security—it transforms the entire process.

| Security Feature | Traditional Phone Payment | Modern Secure Payment Solution |

|---|---|---|

| Data Exposure | CVC is spoken aloud, visible to agents, and captured on recordings. | CVC never enters the business environment; it's masked or sent via a separate channel. |

| PCI DSS Scope | Broad and complex. Includes telephony, agent desktops, CRMs, and call recordings. | Drastically reduced. The business's systems are taken out of scope. |

| Agent Access | Agents directly hear, see, and often write down CVC numbers. | Agents have zero access to CVCs, eliminating internal fraud risks. |

| Data Storage | High risk of accidental or malicious storage in call logs, notes, or recordings. | Prohibited by design. The CVC is used once for authorisation and then discarded. |

| Customer Trust | Relies entirely on trusting the agent and the company's internal processes. | Trust is built into the system, giving customers confidence their data is safe. |

Ultimately, these modern solutions take CVC handling from being a major liability and transform it into a seamless, secure, and trust-building part of the customer experience.

Another powerful technology that works hand-in-hand with these methods is payment tokenization, which swaps sensitive card numbers for non-sensitive "tokens." You can learn more about how this works by exploring our guide on what tokenization in payments is.

Best Practices for Handling CVC Data Securely

Protecting the CVC isn't just a job for the IT department; it demands a security-first culture that runs through the entire company. Every single touchpoint, from your contact centre agents to your back-end systems, has to be secure. The only way to handle this sensitive data responsibly is with a multi-layered approach that blends clear policies, smart technology, and ongoing staff training.

It all starts with a simple, ironclad rule: never ask a customer to send their CVC over email, text message, or web chat. These channels are fundamentally insecure, creating a digital paper trail of sensitive data that should never exist. A solid security strategy begins by defining exactly what not to do.

Establish a Foundation of Clear Policies

Your first step is to create and enforce unambiguous rules for everyone in the organisation. These policies shouldn't leave any room for misinterpretation; they need to become a core part of how you operate. Think of this policy framework as the bedrock of your entire security posture.

Your guidelines should explicitly ban any activity that puts the CVC at risk. This includes:

- Never Write It Down: Train agents that writing down a customer's CVC is completely off-limits, even on a temporary sticky note.

- Never Repeat It: It’s a common habit to repeat a CVC back to a customer for confirmation, but this practice must stop. It dramatically increases the risk of the number being overheard or captured on call recordings.

- Never Store It: Hammer home the PCI DSS rule that the CVC must never be stored anywhere after a transaction is authorised—not in databases, spreadsheets, or call logs.

Crucial Takeaway: The goal here is to minimise the CVC's exposure. The less time it spends in your environment, and the fewer people who handle it, the smaller your risk becomes. A zero-tolerance policy for improper handling is non-negotiable.

Implement Technical and Human Safeguards

While policies lay down the law, it's the combination of technology and training that ensures the rules are actually followed. Your payment systems and your people have to work together to create a genuinely secure environment.

On the technology side, this means making sure every component that touches payment data is fully PCI DSS compliant. Your payment gateway, CRM, and phone systems should all be designed to prevent CVC data from being stored. This is where solutions like DTMF masking (where keypad tones are concealed) become so valuable, as they stop sensitive data from ever entering your call recordings in the first place.

But technology is only half the battle. The human safeguards are just as important. You should be running regular, mandatory training sessions for any staff member who handles payments.

These sessions need to cover:

- Understanding the 'Why': Don’t just tell them the rules; explain why the CVC is so critical for preventing fraud. Make sure they understand the severe consequences of a data breach, both for the customer and for the business.

- Recognising Social Engineering: Train agents to spot the red flags when fraudsters try to trick them into mishandling card information.

- Secure Procedures in Practice: Run through role-playing scenarios that reinforce the correct, compliant way to process a payment without ever seeing, hearing, or writing down the CVC.

By combining strict rules with smart technology and well-educated staff, you build multiple layers of defence that protect your customers, your reputation, and your business.

Got Questions About CVC Security? We’ve Got Answers

To wrap things up, let's tackle some of the most common questions people have about the CVC. We'll give you clear, no-nonsense answers to help clear up any confusion and make sure you have the full picture.

Can a Business Ever Store the CVC from a Card?

Absolutely not. This is one of the golden rules of payment security.

The Payment Card Industry Data Security Standard (PCI DSS) is crystal clear on this: storing the CVC after a transaction is authorised is strictly forbidden. It doesn't matter if it's in a database, a spreadsheet, a call recording, or even scribbled on a piece of paper—it’s a major compliance breach. Breaking this rule can lead to hefty fines and, in serious cases, you could even lose your ability to accept card payments altogether.

The whole point of the CVC is that it's temporary; storing it defeats its purpose.

What Happens If Only My CVC Is Stolen?

On its own, a stolen CVC is pretty much useless to a criminal. Think of it as one piece of a three-part puzzle.

A CVC is only valuable when it’s used alongside your main card number (the PAN) and the expiry date. It’s the final check to prove you physically have the card during an online or phone payment. Without the other details, a fraudster can't do anything with it. Its strength lies in being the one detail that legitimate merchants are banned from keeping, making it much harder to steal in a data breach.

Why Do Some Payments Not Ask for a CVC?

You’ve probably noticed this with subscriptions or recurring payments. After you’ve paid the first time, companies like Netflix or Spotify don't ask for your CVC again. That's because they aren't using your raw card details for every charge.

Instead, after the first successful payment (which did use the CVC), they use a secure ‘token’—a unique, randomised code that stands in for your actual card information. It's a secure and compliant way to handle repeat billing.

However, a word of caution: if a website asks for all your card details for a one-off purchase but doesn’t ask for the CVC, that’s a potential red flag. It could signal poor security, so it’s wise to be extra careful before you proceed.

Is the CVC the Same as My Card’s PIN?

No, they are two completely different things, designed for completely different situations.

- The CVC (or CVV) is that 3 or 4-digit code used for verification when your card isn’t physically present—think online shopping or phone orders.

- A PIN (Personal Identification Number) is your private password, used when your card is physically present, like at an ATM or a chip-and-PIN machine in a shop.

You should never, ever share your PIN with anyone, and you'll never be asked for it when paying online. Mixing them up is a serious security risk.

Secure every payment and build unbreakable customer trust with Paytia. Our platform ensures CVCs and other sensitive data never enter your systems, dramatically reducing your PCI DSS scope and protecting you from fraud. Discover how Paytia can safeguard your payments.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.