What Is a Merchant Acquiring Bank and How Does It Work

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Think of a merchant acquiring bank as the backstage manager for your business's payments. When a customer taps their card or enters their details online, this is the bank that works behind the scenes to get the money from their account safely into yours.

Simply put, you can't accept card payments without one.

Understanding the Role of Your Acquiring Bank

An acquiring bank, often just called an ‘acquirer’, is a financial institution that’s been given the green light by card schemes like Visa and Mastercard to provide businesses with a merchant account. This special account is the vital link in the payment chain, allowing you to process credit and debit card transactions.

The acquirer’s job is crucial. It takes a customer’s payment request, talks to their bank (the ‘issuing bank’) to get the thumbs-up, and then makes sure the funds are settled into your account. For any UK business, a solid acquiring partner is a cornerstone of modern commerce.

The Core Functions of an Acquirer

At its heart, the acquirer acts as your representative in the complex world of payments. Its main responsibilities boil down to a few key areas:

- Providing a Merchant Account: This is the dedicated account where funds from your card sales land before they’re moved over to your main business bank account.

- Transaction Authorisation: The acquirer sends payment requests through the card networks to the customer’s bank to check if the funds are available and the transaction looks legitimate.

- Fund Settlement: Once a payment is approved, the acquirer collects the money from the issuing banks and deposits it into your merchant account. This is known as settlement.

- Risk Management: The acquirer vets your business for financial risk and keeps an eye on transactions for signs of fraud, protecting you, your customers, and the payment networks.

The UK's payment industry is booming, with revenue expected to hit £11 billion by 2025-26. This growth is driven by the sheer volume of card payments, which hit 31.4 billion transactions in 2024. This just goes to show how central acquiring banks are to the economy.

Some businesses might set up a direct relationship with an acquirer. Others prefer to work with a Payment Service Provider (PSP) that bundles acquiring services with other useful features. If you're wondering about the difference, check out our guide on what is a payment service provider.

To make things even clearer, here's a quick breakdown of what your acquiring bank handles every day.

Core Functions of a Merchant Acquiring Bank at a Glance

| Function | Description | Impact on Your Business |

|---|---|---|

| Merchant Account Provision | Establishes and maintains the special account needed to accept card payments. | Enables you to accept credit and debit card payments from customers. |

| Payment Authorisation | Manages the communication between your business, card networks, and the customer's bank to approve or decline transactions. | Ensures payments are legitimate and funds are available, reducing declined transactions. |

| Settlement of Funds | Collects approved funds from issuing banks and deposits them into your merchant account. | Guarantees you receive the money from your sales in a timely and organised manner. |

| Risk and Compliance | Monitors for fraudulent activity and ensures all transactions comply with card scheme rules and financial regulations. | Protects your business from fraud losses and ensures you meet industry security standards. |

In short, your acquirer does the heavy lifting to make sure every card payment is authorised, settled, and secure, letting you focus on running your business.

Tracing a Transaction From Tap to Settlement

Ever wondered what happens in the milliseconds after a customer taps their card? It seems instant, but behind the scenes, a rapid and highly organised sequence of events unfolds, with your merchant acquiring bank acting as the central coordinator.

Let's follow the journey of a single payment from start to finish to see exactly what role the acquirer plays.

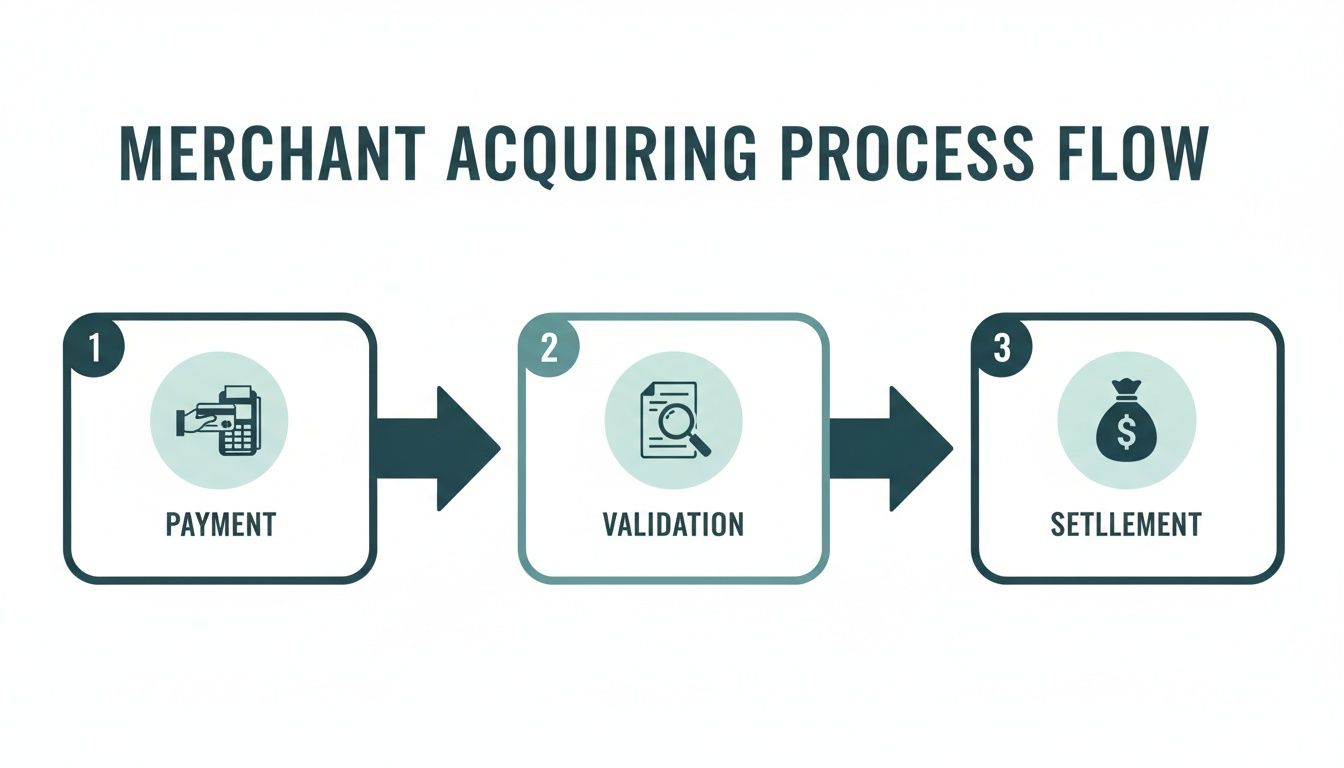

This visual breaks down the three core stages managed by the merchant acquirer: payment, validation, and finally, settlement.

It’s a great illustration of how the acquirer acts as the crucial intermediary, translating a simple customer action into a secure, settled payment for your business.

The Initial Request

It all begins the moment your customer presents their card at a terminal or enters their details on your website.

- Payment Information is Captured: Your point-of-sale (POS) terminal or online payment gateway securely grabs the customer's card details. This information is immediately encrypted.

- Request Sent to Card Scheme: This encrypted package is then sent to your merchant acquiring bank. The acquirer immediately forwards the transaction request to the relevant card scheme—think Visa, Mastercard, or American Express—which acts as a central messaging hub.

The Authorisation Loop

Next, the card scheme routes the request over to the customer's own bank, known as the issuing bank. This is where the crucial "approve" or "decline" decision is made.

The issuing bank performs several lightning-fast checks:

- Does the customer have sufficient funds or available credit?

- Has the card been reported lost or stolen?

- Are there any red flags for unusual or fraudulent activity?

If everything checks out, the issuing bank sends an authorisation code back through the card scheme to your acquiring bank. This approval message is then relayed to your payment terminal or gateway, and voilà—the transaction is approved. The whole round trip takes just a few seconds.

Key Takeaway: The acquiring bank doesn't approve the transaction itself; it manages the communication flow that allows the issuing bank to make the final decision. The acquirer ensures all messages are sent securely and arrive at the right destination.

Settlement: The Final Step

While authorisation feels instant, the actual money doesn't move until later, in a process called settlement.

At the end of each business day, your acquirer bundles all your approved transactions into a single batch. It sends this batch to the card schemes to formally request the funds from the various issuing banks involved in your day's sales.

The card schemes facilitate the transfer of money from those issuing banks over to your merchant acquiring bank.

Finally, the acquirer deposits these funds—minus any agreed-upon fees—into your merchant account. From there, the money is moved to your main business bank account. This entire cycle, from authorisation to settlement, is powered by the infrastructure your acquiring bank provides, which works within the broader payment platform definition to create a seamless experience.

Decoding Your Merchant Account Fees and Risks

Think of your relationship with a merchant acquiring bank as a financial partnership. It's not just about moving money from A to B; it’s a two-way street built on shared risk and reward. Understanding the costs and responsibilities involved is crucial for the health of your business.

Your acquirer is essentially your financial gatekeeper. They take on the financial liability of every transaction you process. In return, you pay for that service through a structure of fees that directly impacts your bottom line.

Breaking Down the Core Payment Fees

The fee you’ll see most often is the Merchant Service Charge (MSC). It looks like a single percentage deducted from your transactions, but it’s actually a blend of three separate costs.

Interchange Fees: This is the biggest slice of the pie. It’s a fee your acquiring bank pays to your customer's issuing bank for every single transaction. Think of it as compensation to the cardholder's bank for taking on the risk and cost of approving the payment. The rates aren't random; they're set by card schemes like Visa and Mastercard and change based on card type, how the transaction was made (online vs. in-person), and even your industry.

Scheme Fees: A much smaller piece, this fee goes directly to the card schemes themselves. It’s what you pay for them running and maintaining the secure network that connects all the banks and makes the whole system work.

Acquirer's Mark-up: This is the part your acquiring bank keeps. It’s their profit for giving you a merchant account, handling the transaction, and managing all the risks that come with it.

Knowing this breakdown is your secret weapon when it comes to negotiation, as the only part that's really up for discussion is the acquirer's mark-up. For a deeper dive into the numbers, check out our full guide on merchant payment processing.

The Acquirer as Your Risk Partner

An acquiring bank does more than just process payments—it underwrites your business. Before they’ll even give you a merchant account, they perform a deep assessment of your financial stability, business model, and the likelihood of chargebacks. Why? Because if your business goes under, the acquirer is often left holding the bag for refunds and disputed charges.

Your acquirer is your first line of defence in the payment ecosystem. They are responsible for monitoring your transactions for fraud, managing chargeback disputes, and ensuring your business adheres to the stringent Payment Card Industry Data Security Standard (PCI DSS).

This risk management role is absolutely vital. The UK payments ecosystem is projected to hit £11 billion by 2025-26, and card payments are on track to make up 66% of all payments by 2033. For businesses like contact centres, this means securely handling enormous transaction volumes—jumping from 24.5 billion debit payments in 2023 to an estimated 31.4 billion in 2024.

This explosive growth shines a spotlight on the need for rock-solid security. It's a huge concern for banks, which already spend 20% of their IT budget on compliance alone. This is exactly where Paytia’s PCI DSS Level 1 certification makes a real difference, helping to reduce a business’s compliance scope by up to 95%.

How to Choose the Right Acquiring Bank for Your Business

Picking a merchant acquiring bank is a serious business decision, one that goes way beyond just comparing a few percentage points on a fee schedule. You aren't just hiring a supplier; you're bringing on a financial partner who needs to get how your business actually works and be able to keep up as you grow.

Get it right, and your payments will hum along smoothly. Get it wrong, and you’ll create constant friction for your team and, even worse, your customers.

To make a smart choice, you have to look past the headline rates. Think about how the acquirer’s services will actually plug into your existing setup. A cheap service that can’t talk to your phone system or CRM will quickly turn into an expensive operational nightmare.

Key Factors for Your Selection Checklist

Before you sign on the dotted line, run through a checklist of make-or-break questions. This is all about making sure a potential partner is truly aligned with where you're heading. Think of this process as finding an extension of your own team.

Here are the essential areas to dig into:

- Industry Specialisation: Do they actually have experience in your world? A bank that understands the compliance headaches in regulated industries like insurance, or the specific payment flows of a busy contact centre, is going to provide far better support and risk management.

- Integration Capabilities: How well do their systems play with your core tools? You need to ask pointed questions about compatibility with your CRM, accounting software, and—this is a big one—your telephony platforms. Smooth integration is the secret to efficiency and a good customer experience.

- Payment Channel Support: Your customers expect to pay you in all sorts of ways. Make sure the acquirer can handle every channel you use, whether that’s taking payments over the phone, through your website, via secure payment links, or even with automated IVR systems.

A great acquiring partner does more than just move money around. They give you the flexible tools you need to take payments securely and efficiently, no matter how a customer gets in touch. For any modern business that cares about its customers, this is non-negotiable.

Traditional Banks vs Modern Payment Providers

The world of acquiring has changed a lot. You're no longer stuck with the big high-street banks. Today, modern, tech-first payment providers often bring more agility and specialised features to the table. Knowing the difference is crucial for picking the right fit.

To help you see the contrast, here's a quick comparison of what to expect from each.

Traditional Acquirers vs Modern Payment Providers

A comparison of key features to help businesses choose the right type of acquiring partner for their needs.

| Feature | Traditional High-Street Acquirer | Modern Payment Provider |

|---|---|---|

| Technology Focus | Often relies on established, sometimes legacy, systems. Integrations can be more rigid. | Built on modern APIs, designed for flexible and straightforward integration with other software. |

| Onboarding Process | Can be slower, with more paperwork and a longer underwriting process. | Typically faster and more streamlined, with digital onboarding and quicker approval times. |

| Support Model | Generalised support through large call centres, may lack deep technical expertise. | Often provides specialised technical support with a deeper understanding of payment integrations. |

| Flexibility | Less adaptable to bespoke business needs or niche payment flows. | More likely to offer customised solutions and support for innovative business models. |

Ultimately, the choice depends on your priorities. If you need rock-solid stability and have simple needs, a traditional bank might suffice. But if your business relies on seamless software integration, speed, and the flexibility to adapt, a modern provider is almost always the better choice.

Integrating Payments and Reducing PCI DSS Scope

Alright, let's move from theory to practice. The technical integration with your chosen merchant acquiring bank is where your payment strategy really comes alive. This isn't just about plugging one system into another; it's a huge opportunity to strengthen your security and slash your compliance workload.

A typical integration follows a clear checklist. You'll start by digging into the acquirer's API documentation, run a bunch of transactions in a test (or sandbox) environment, and then map out a careful go-live plan. But today, modern payment platforms have turned this from a heavy technical lift into a real strategic advantage.

How Modern Integrations Protect Your Business

The main goal here is simple: keep sensitive payment data out of your environment completely. Technologies like tokenization and DTMF suppression are the heroes of this story, acting as a protective shield between your business and raw card details.

Think of it like this: instead of handling a live grenade (the customer's card number), you're given a harmless, unique token that simply represents it. You can use this token to process payments, but if a fraudster ever got their hands on it, it would be completely useless to them.

This approach has massive implications for your Payment Card Industry Data Security Standard (PCI DSS) obligations. If card data never even touches your systems, your compliance scope can shrink by as much as 90-95%. From your acquiring bank's perspective, this makes you a much more attractive, lower-risk client because it drastically reduces the chance of a costly data breach starting with you.

Reducing PCI DSS scope isn't just a technical footnote; it's a core business strategy. It directly translates to lower compliance costs, reduced administrative overhead, and enhanced customer trust, freeing up resources to focus on growth.

For contact centres in regulated sectors like healthcare and utilities, this is non-negotiable. Secure solutions allow agents to assist with payments using end-to-end encryption, ensuring card numbers and CVCs are never exposed to your internal systems. This lines up perfectly with how customers behave now, with 75% of consumers using remote banking regularly. This shift is pushing acquiring banks to support secure, integrated solutions that dramatically cut down on fraud risk.

For a deeper dive into the technical side of payment system connectivity, you might find some useful insights on integrating with various payment tools. By prioritising a secure integration, you're not just setting up a way to get paid; you're building a safer, more efficient foundation for your entire business.

Got Questions About Merchant Acquiring Banks?

Even after you get the hang of the payment flow, a few practical questions always pop up about the relationship with your merchant acquiring bank. Let's tackle some of the most common ones and give you some straightforward answers to help you manage these crucial partnerships.

We'll clear up the confusion between gateways and acquirers, walk through what it takes to switch providers, and explain how disputes are handled. Think of this as your go-to guide for the day-to-day realities of working with an acquirer.

What's the Difference Between a Gateway and an Acquirer?

It’s incredibly easy to mix these two up, but they have completely different jobs. The simplest way to put it is that one is the messenger, and the other is the bank.

The Payment Gateway is the technology that securely captures your customer’s card details and encrypts them for the journey. It's the digital version of a card machine, acting as a secure messenger that hands the payment request over to the acquirer.

The Merchant Acquiring Bank is the financial institution that actually receives that message. It's the one that gives you a merchant account, talks to the card schemes and the customer's bank, and ultimately moves the money and settles it into your account.

So, the gateway is the secure front door collecting the payment info. The acquirer is the entire banking engine behind that door, making sure the money actually gets where it’s supposed to go.

How Do I Switch My Acquiring Bank?

Thinking about switching your merchant acquirer can feel like a huge task, but it can be a really smart move if you're looking for better fees, modern technology, or just better support. The process usually breaks down into a few key steps.

First, you'll need to do your homework and find a new partner that’s a better fit for your business, paying close attention to how they integrate with your existing systems and if they have experience in your industry. Once you’ve made a choice, you’ll go through their application and underwriting process, where you'll provide details about your business, transaction history, and financial standing.

Heads up: Before you make the leap, dig out your existing contract. You need to be aware of any early termination fees or required notice periods to avoid any nasty surprises or unexpected costs. A smooth switch is all in the planning.

Once your new merchant account is approved, the last part is technical. You’ll need to update the settings in your payment gateway or e-commerce platform to send transactions to your new acquirer. A good partner will give you clear instructions to make this changeover as painless as possible.

How Does My Acquirer Handle Chargebacks?

When a customer disputes a transaction, it kicks off a formal process called a chargeback. Your acquiring bank plays the role of coordinator in all of this, but remember, the final decision always rests with the customer's own bank (the issuer).

Here’s how a typical chargeback plays out:

- Dispute Kicks Off: The cardholder calls their bank to question a charge on their statement.

- You Get Notified: The issuer flags this with the acquirer through the card scheme, and the acquirer then lets you know. The disputed amount is usually held back from your account temporarily.

- Time to Show Your Proof: You have a limited time to provide compelling evidence that the transaction was legitimate. This could be anything from proof of delivery and signed receipts to customer emails.

- The Final Verdict: Your acquirer sends this evidence back to the issuer, who makes the final call. If you win, the money is returned. If you lose, the chargeback stands.

Your job is to provide clear, timely evidence. Your acquirer's role is to manage this back-and-forth and argue your case based on the card scheme rules.

At Paytia, we know that secure and reliable payment processing is the lifeblood of your business. Our platform is built to integrate seamlessly with your chosen merchant acquiring bank, which dramatically reduces your PCI DSS scope and keeps your customers' sensitive data safe, no matter how they pay. By handling the payment capture securely, we free you up to focus on growth while we take care of the compliance headaches.

Discover how Paytia can level up your payment security and simplify your operations.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.