A Guide to Secure Over The Phone Card Payments

Get Secure Payment Solutions

Learn how Paytia can help secure your payment processing.

Even with all the slick online checkouts and tap-to-pay options out there, taking card payments over the phone is still a massive part of doing business. For many customers, it’s actually their preferred way to pay. It’s that blend of remote convenience and a real human conversation that you just can't replicate on a website, especially in service-focused industries.

Sometimes, talking to a person is what seals the deal and builds the trust needed to hand over payment details.

Why Phone Payments Still Matter in a Digital World

It’s easy to think that phone payments are a relic of the past, but the data and our experience tell a different story. For thousands of businesses—think insurance brokers, hotels, healthcare clinics, and law firms—the phone is the central hub for handling complex bookings, settling invoices, and sorting out detailed enquiries. For high-value purchases or sensitive matters, customers want the reassurance of speaking with someone directly.

This creates a real headache for businesses today. How do you give customers the voice channel they want while protecting their financial data from ever-present threats? The old way of doing things, where an agent just types in the card numbers a customer reads out, is riddled with security holes. That method puts sensitive details like the Primary Account Number (PAN) and CVC code right into your systems, your call recordings, and potentially into the hands of a dishonest employee.

The Escalating Risks of Outdated Methods

The stakes are higher than ever. As more payments move online, fraudsters are getting smarter and more determined to find weak spots. Back in 2022, the UK saw a staggering 45.7 billion payments processed, and card transactions accounted for 57% of that total. This explosion in digital payments has thrown a harsh spotlight on the security gaps in traditional contact centres, where taking over the phone card payments manually sends PCI DSS compliance costs through the roof. You can dig into the full payment trends analysis from UK Finance for a closer look.

This direct exposure to card data puts you on a collision course with data protection laws like GDPR and creates a huge compliance burden. The cost and effort of achieving and maintaining PCI DSS compliance for an environment that handles raw card data are enormous, covering everything from network security to intense staff background checks.

The core dilemma is this: Customers value the personal connection of a phone call, but businesses can no longer afford the financial and reputational risk of handling their card data directly. This is the gap that modern, secure payment technologies are designed to fill.

Thankfully, today’s solutions tackle this problem head-on. They work by completely removing your agents and your internal systems from the flow of sensitive card data, all without disrupting the customer's experience. By bringing in this kind of technology, you can keep offering that personal touch your customers love while massively cutting down your security risks and compliance nightmares. To get a better sense of the landscape, it’s worth exploring the wider world of alternative payment methods.

Choosing Your Secure Payment Solution

Picking the right way to take card payments over the phone is a huge decision. It's a real balancing act between keeping your customers happy, making life easy for your team, and locking down your security. There’s no single "best" answer; what works for a high-end travel agent won't be the right fit for a local council. It all comes down to your business, your customers, and the kind of transactions you handle day-to-day.

You've got three main routes to go down: agent-assisted payments, automated Interactive Voice Response (IVR), or sending out secure payment links. Each one does a brilliant job of taking sensitive card data out of your hands (and out of PCI scope), but they get there in very different ways.

The pandemic really pushed phone and remote payments into the spotlight. As we all know, online sales went through the roof, but so did the need for secure phone channels for those times when a web checkout just doesn't cut it. This boom, however, also shone a light on the vulnerabilities, leading to more fraud and higher compliance headaches for businesses. A Mastercard report dives deeper into these payment trends and what they mean for businesses today.

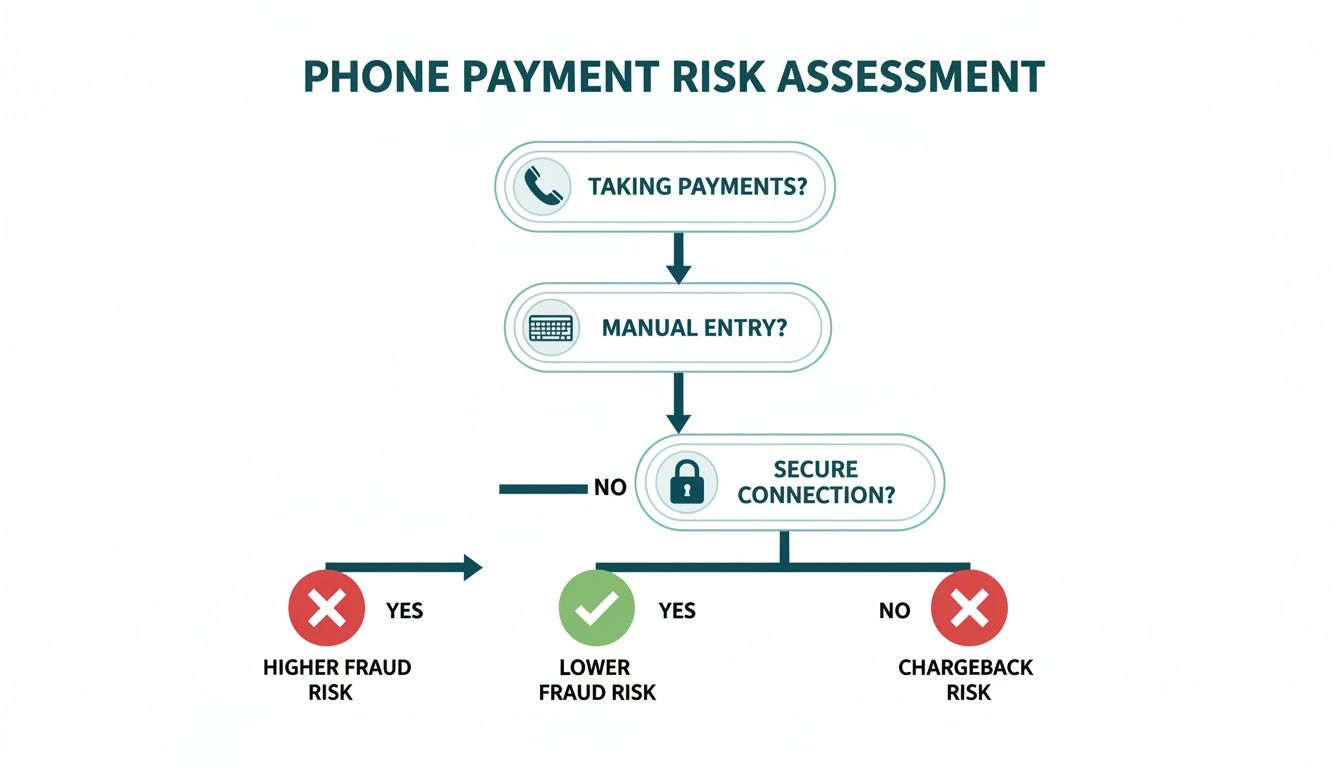

This decision tree gives you a clear picture of the risks involved from the get-go.

As the flowchart shows, the second your team starts manually keying in card numbers, you're opening the door to massive security and compliance risks. A secure, automated solution is simply the safer, smarter way forward.

H3: Agent-Assisted Secure Payments

When the human touch is non-negotiable, agent-assisted solutions are the gold standard. This approach lets your agent stay on the call, guiding the customer and keeping that personal connection alive right through to the end of the transaction.

Here’s how it works: when it's time to pay, the agent kicks off the secure payment process. The customer then taps their card details into their telephone keypad. The clever bit is that tech like DTMF (Dual-Tone Multi-Frequency) masking completely silences and hides these tones. Your agent hears nothing, and more importantly, your call recordings capture nothing. It’s completely secure.

This is a perfect match for:

- High-value or complex sales: Think of a travel consultant putting the final touches on a bespoke holiday package.

- Customer service scenarios: A support agent who has just solved a problem and needs to take payment for a replacement part.

- Relationship-focused businesses: A financial advisor taking payment for a consultation.

The biggest win here is the seamless experience. The conversation doesn't just stop; the agent is right there to handle any last-minute questions, which is fantastic for building trust and stopping people from backing out at the last second.

People often think this process must be clunky or awkward, but it’s anything but. The agent just says something like, "Okay, I'm now passing you to our secure payment system to pop in your card details. I'll stay on the line with you," and the customer carries on without breaking the flow.

H3: Automated IVR Payments

For routine, high-volume payments, an automated IVR is an efficiency powerhouse. It lets customers pay their bills 24/7 without ever needing to speak to a person, which frees up your team to deal with more complex or urgent enquiries.

Imagine a customer for a utility company. They can ring up at 10 pm, punch in their account number, and follow the voice prompts to pay their gas bill with their phone. The whole thing is self-service, secure, and done in a couple of minutes.

IVR really shines for:

- Bill payments: Utilities, council tax, or subscription renewals.

- Donations: Charities can collect vital funds around the clock.

- Account top-ups: Think prepaid mobile phones or topping up an Oyster card.

You do lose the personal touch of an agent, of course. But what you gain is massive scalability and cost savings. An IVR can handle thousands of calls at once, slashing queue times and cutting down your operational overheads.

H3: Secure Payment Links

The third powerful option in your toolkit is the secure payment link. During the call, your agent can send a link straight to the customer's mobile phone via SMS. They stay on the line, offering support while the customer taps the link and is taken to a secure, branded payment page on their own device.

This method is a fantastic hybrid, mixing the slick convenience of an online checkout with the reassurance of having a real person on the phone. A retail advisor, for instance, could be discussing a product, confirm the order, and then ping over a link for immediate payment. The customer enters their details on their smartphone – an interface they already know and trust.

It's also great when a visual confirmation helps. The customer can see a full summary of their order right there on the payment page before they hit "pay", which adds another layer of confidence to the whole process.

To help you weigh up these options, we’ve put together a table comparing their key features side-by-side.

Feature Breakdown of Secure Payment Solutions

| Feature | Agent-Assisted Solutions | Automated IVR | Payment Links |

|---|---|---|---|

| Human Interaction | High – Agent stays on the call throughout. | None – Fully automated self-service. | High – Agent on call, payment on separate device. |

| Best For | Complex sales, high-value orders, customer service. | Routine bills, donations, high-volume transactions. | Retail, order confirmation, tech-savvy customers. |

| Operating Hours | Limited to agent availability/working hours. | 24/7/365 | Limited to agent availability/working hours. |

| PCI Scope Reduction | Maximum – DTMF masking removes agents/systems from scope. | Maximum – No human interaction with card data. | Maximum – Payment handled on a separate, secure channel. |

| Customer Experience | Personalised, reassuring, high-touch. | Fast, efficient, convenient for simple tasks. | Modern, familiar, combines conversation with digital. |

| Implementation | Integrates with contact centre and CRM systems. | Integrates with telephony (PBX/VoIP) systems. | Integrates with CRM and communication platforms. |

Ultimately, whether you choose the personal touch of an agent-assisted solution, the 24/7 efficiency of an IVR, or the modern convenience of a payment link depends entirely on your operational needs and, most importantly, your customers' preferences. Many businesses even find that a blended approach, using two or more of these methods, gives them the flexibility to handle any scenario.

How Modern Technology Secures Phone Payments

To really get your head around the security behind modern over the phone card payments, you need to look under the bonnet. We're not talking about small tweaks to old systems here; these are fundamental changes to how payment data is handled, designed from the ground up to stop risk in its tracks.

The core principle is simple: sensitive cardholder data—like the long card number (PAN) and the CVC—should never enter your business environment. That means it's never heard by your agents, saved in your call recordings, or passed through your internal servers. This is achieved through a few clever, overlapping techniques that work together to create a fortress around that data.

Hiding the Tones with DTMF Suppression

Picture the classic phone payment scenario: a customer taps their card number into the keypad. Every keypress creates a distinct sound, a Dual-Tone Multi-Frequency (DTMF) signal. In an old-school, unsecured setup, these tones can be recorded and easily decoded, basically giving away the card details to anyone with access to the recording.

This is where DTMF suppression (sometimes called masking) steps in. It's a brilliantly simple yet powerful solution.

- As the customer keys in their card number, a secure payment platform intercepts the DTMF tones before they ever reach your agent or recording system.

- The platform reads the numbers directly from the signals.

- It then replaces those distinct tones with a single, flat, monotonous sound for your agent to hear. The agent knows the customer is entering information but has no way of telling which numbers are being pressed.

This neat trick means the actual card data never even touches your infrastructure. Your agent can stay on the line, guiding the customer and providing support, but they remain completely walled off from the sensitive details.

Replacing Data with Tokens

Of course, even if you stop the data from being heard or recorded, you still need to process the payment and handle things like refunds or repeat billing down the line. That's where tokenization comes in, and it's a real game-changer.

Think of a casino chip. It has value and can be used for transactions inside the casino, but take it outside, and it's just a worthless bit of plastic. A payment token works on the same principle.

Once the secure platform has captured the card details, it sends them straight to the payment gateway. The gateway processes the transaction and sends back a unique, non-sensitive substitute: the token. This is just a string of random characters.

This token acts as a secure stand-in for the actual card data. It's useless to fraudsters because it contains none of the original card information, but you can safely store it in your CRM to use for future, authorised transactions like refunds or subscription renewals.

Suddenly, you can manage customer billing and relationships without holding onto toxic, high-risk card data in your own systems. If you're curious about the mechanics behind this, our guide exploring what tokenization is in payments is a great place to start.

Securing the Data in Transit

The final piece of this security puzzle is making sure the data is protected while it's travelling from the customer's phone to the payment gateway. This is handled by End-to-End Encryption (E2EE).

You can think of E2EE as creating a sealed, armoured tunnel between the customer's phone and the payment processor's secure servers.

- The moment the customer starts entering their details, the data is instantly scrambled using a complex cryptographic key.

- This encrypted data then travels across the network, completely unreadable to anyone who might try to intercept it.

- Only when it arrives safely at the payment gateway can it be unlocked with a corresponding private key.

What this means in practice is that even in the highly unlikely event a criminal managed to grab the data packet in transit, they'd just see a meaningless jumble of characters.

When you bring DTMF suppression, tokenization, and end-to-end encryption together, you get a layered defence that makes modern phone payments exceptionally secure.

Dramatically Reduce Your PCI DSS Scope

One of the biggest wins you’ll get from adopting secure technology for over the phone card payments is a drastically smaller Payment Card Industry Data Security Standard (PCI DSS) scope. For many businesses, grappling with PCI compliance feels like a constant, expensive battle. The first step to winning that fight is understanding what your 'scope' actually is.

Put simply, your PCI scope covers every person, process, and piece of technology that stores, processes, or transmits cardholder data. The wider the scope, the bigger your compliance headache.

The Burden of a Large PCI Scope

Picture a typical contact centre that hasn't modernised its payment security. A customer calls to pay, reads out their card number, and the agent types it directly into a system. In this all-too-common scenario, your PCI scope balloons to an enormous size.

Suddenly, everything that ‘touches’ that sensitive data is included:

- Your People: Every agent handling card details needs rigorous background checks and continuous security training.

- Your Technology: The agent’s desktop, the CRM, your internal network, and especially the call recording platform are all dragged into scope.

- Your Processes: You need strict, documented procedures for everything from how data is handled to the physical security of your office.

This sprawling scope creates a huge operational overhead. It means costly annual audits, penetration testing, and constant monitoring to prove you’re compliant. And it only takes one weak link—an unpatched server or a simple human error—to cause a data breach, leading to devastating fines and lasting damage to your brand.

A Radically Simpler Path to Compliance

Now, let's revisit that same contact centre after implementing a secure payment solution. When the customer is ready to pay, the agent triggers a secure process. The customer taps their card details into their phone keypad, but technologies like DTMF masking and tokenization make sure that data never actually enters your environment.

Instead, the sensitive information travels straight from the customer to the payment gateway through a fully encrypted channel. All your systems ever see is a secure, non-sensitive token.

The change is immediate and profound. By stopping cardholder data from ever entering your infrastructure, you effectively take that infrastructure out of your PCI scope. This isn’t a small adjustment; it’s a fundamental shift in your security posture.

The result? A radically smaller compliance burden. All at once, your call recordings, agent desktops, and huge parts of your network are no longer subject to the strictest PCI DSS controls. For many organisations, this can slash the scope by up to 95%.

The Tangible Business Impact

Shrinking your PCI scope delivers powerful, real-world benefits that go way beyond just ticking a compliance box. It translates into direct savings in both time and money, freeing up your team to focus on growing the business.

Here’s what that looks like in practice:

- Reduced Audit Costs: The time and money spent on annual PCI audits plummet. Your Qualified Security Assessor (QSA) has far less ground to cover.

- Simplified Operations: Your IT team is freed from the burden of managing a complex cardholder data environment (CDE), reducing the need for constant network segmentation and monitoring.

- Lowered Risk Profile: With no sensitive data to steal, you become a much less appealing target for cybercriminals, significantly lowering the chance of a costly breach.

By making this change, you’re not just buying a piece of technology; you’re adopting a smarter, safer, and more sustainable way of operating. To get a deeper understanding of the specific controls involved, you can learn more about the core PCI DSS requirements and how they apply in different situations. This strategic move makes accepting over the phone card payments a secure, streamlined part of your business, not a source of constant risk and expense.

Integrating Secure Payments into Your Workflow

Bringing secure over-the-phone card payments into your business shouldn't mean tearing down your existing setup. The best solutions aren't designed to replace your systems, but to slot right into the workflows your team already knows. Think of it as a secure bridge that connects your essential tools, not another island for your team to manage.

A well-integrated system lets data flow seamlessly and securely from your phone system, through the payment process, and straight into your customer records. It’s not about adding another layer of complexity; it's about making your existing processes safer and a whole lot smoother.

Connecting with Your Existing Tech Stack

The real magic happens when a modern payment solution can talk to the software you already depend on. This is usually handled through APIs (Application Programming Interfaces), which let different systems share information automatically and securely. The result is a single, cohesive environment where everything just works.

Most businesses will need to connect a few key systems:

- Telephony Systems (PBX/VoIP): This is your foundation. The payment platform has to play nicely with your phone system, whether it’s a traditional on-premise PBX or a modern cloud-based VoIP service like RingCentral. This is what allows the secure payment flow to be managed correctly during a call.

- Contact Centre Platforms: If you’re running a larger contact centre, direct integration with platforms like Genesys or Avaya is a must. This allows agents to kick off a secure payment right from their main dashboard, keeping their workflow consistent and efficient.

- CRM Systems: Linking to your CRM is a game-changer. Imagine a payment being processed and a secure token (never the full card details) being automatically logged against the customer's record in Salesforce or HubSpot. It eliminates manual entry and creates a perfect audit trail.

- Payment Gateways: Your chosen solution should work with a wide variety of payment gateways, from giants like Stripe and Worldpay to more specialised providers. This flexibility means you can keep your existing merchant relationships and aren't forced into a bundled, one-size-fits-all deal.

Get this right, and an agent can take a call, pull up the customer's details in the CRM, start the secure payment process, and see the transaction confirmation pop up in the CRM moments later. All of this happens on a single screen, without the agent ever seeing, hearing, or touching sensitive card data.

Planning a Successful Rollout

Dropping a new payment system into your business needs a solid plan. A well-thought-out rollout ensures everyone is prepared and the switch is painless for both your team and your customers.

I’ve seen companies treat this as a purely IT or security project, and that’s a mistake. This is a business improvement project. You need to get your IT, finance, and operations teams in a room together from day one. Getting their buy-in and addressing their concerns early will save you countless headaches down the line.

Your finance team, for instance, will have questions about reporting and how reconciliation will work. IT will be focused on the technical integration and security. Aligning these departments from the start makes everything that follows run much more smoothly.

A Phased Approach to Minimise Disruption

Once you have internal agreement, avoid a ‘big bang’ launch. A phased deployment is always the smarter move.

- Run a Pilot with a Small Group: Never roll this out to everyone at once. Pick a handful of your best agents to be the test group. They can try the new system in a live environment, which is the only way to spot any unexpected quirks and gather real-world feedback.

- Listen to Your Agents: The people on the front line know best. Ask them how it feels. Is initiating the payment intuitive? Does the script for explaining the process to customers sound natural? Their insights are gold for refining your training materials.

- Keep Training Simple: The great thing about these systems is that the agent's core job doesn't really change. Training should be light and focused. A simple one-pager or a quick huddle is often all that's needed to show them how to start the process and what to say.

- Communicate and Scale: With a successful pilot under your belt, you can roll it out to the rest of the team with confidence. Be sure to explain why you're making the change—it reduces risk for the business, simplifies their job, and protects customer data. When people understand the benefits, they get on board much faster.

Fraud Prevention and Staff Training: Your Human Firewall

Putting the right technology in place for over the phone card payments is a huge win, but it’s not the whole story. Even the most sophisticated systems can be sidestepped by human error or a convincing fraudster. To really lock down your payment process, you need to back up your tech with smart operational habits and a well-briefed team.

This doesn't mean your agents need to become security analysts. Quite the opposite, actually. Modern secure payment solutions are designed to take agents completely out of the loop, so they never touch sensitive card data. The goal is to build awareness around the new process, establish clear procedures, and make the most of the security tools at your fingertips.

Training That Makes Sense

One of the best things about modern secure payment systems is how much they simplify staff training. You can forget about the long, complicated sessions on what to do (and what not to do) with raw card details. Why? Because your agents will never see or hear them again.

Instead, your training can focus on two simple, practical things:

- Explaining the 'Why': Help your team understand that the new system is there to protect them as much as it protects the customer and the business. When they realise the weight of handling sensitive information has been lifted from their shoulders, they’ll quickly get on board.

- Guiding the Customer: Give them a simple, confidence-inspiring script for when it’s time to take payment. Something as easy as, "To keep your details secure, I'm now passing you to our automated system. Just pop your card details in using your phone's keypad, and I'll be right here with you the whole time," is perfect. It's reassuring, professional, and makes the process seamless for the customer.

This approach not only builds agent confidence but also guarantees every caller gets the same professional, secure experience.

Smart, Proactive Fraud Prevention

Beyond training, a few operational controls can add powerful layers of defence against fraud. We're not talking about complex technical configurations, but rather practical rules you can easily set up within your payment gateway.

A good place to start is by looking at your own data. What does a typical, legitimate transaction look like for your business? Once you have a clear picture of 'normal', you can set up rules to flag anything that looks out of place.

Consider putting these effective measures in place:

- Sensible Transaction Limits: Cap the maximum value for a single phone payment. Any amount above that threshold could automatically trigger a manual review or require an alternative payment method.

- Velocity Checks: This is a fancy term for a simple idea: monitoring how many times a card is used in a short window. For example, you could flag any card used more than three times in an hour, which is a classic sign of an automated bot attack.

- Address Verification Service (AVS): AVS is a must. It checks the numbers in the customer's billing address against the details the card issuer has on file. A mismatch is often a red flag for fraud.

It's easy to think fraud prevention is purely the payment gateway's responsibility. While their tools are essential, you hold the most valuable piece of the puzzle: context. You know what a normal purchase looks like for your business, making your insight the first and most important line of defence.

Keeping an Ironclad Audit Trail

Finally, let's talk about audit trails. Having a detailed, easily searchable record of every transaction is fundamental to both security and compliance. When a customer disputes a chargeback weeks or even months down the line, you need to be able to find the complete transaction history in seconds.

A secure payment platform does this for you automatically. It logs every key detail: the time of the call, the agent involved, the transaction amount, the gateway's response, and the unique token that was generated for the payment. This creates a rock-solid, unimpeachable record proving a legitimate transaction occurred—all without ever storing the risky card number itself. In a chargeback dispute, this log is your best evidence, and for auditors, it's clear proof of your PCI DSS compliance.

Answering Your Questions

How Does DTMF Masking Actually Keep Card Details Safe?

You know those beeps you hear when you type numbers on your phone? Those are DTMF tones. DTMF masking technology works by intercepting these tones as your customer enters their card details.

Instead of the tones travelling to your agent's ears or getting stored on your call recordings, our secure platform grabs them mid-stream. It then sends the card data directly to the payment gateway for processing. To your agent, it just sounds like a series of flat, identical beeps – they never hear or see the actual card numbers. This simple but powerful step means sensitive data never even touches your systems.

Will My Team Need a Lot of Retraining?

This is a common worry, but the answer is no. One of the best things about a well-designed secure payment system is how little it changes the agent's day-to-day work.

Your team stays on the line with the customer, guiding them just as they always have. The only difference is that when it's time to enter card details, they won't hear or see them. The whole process feels completely natural and is designed to slot right into your existing scripts with minimal fuss.

Can This System Connect With Our Existing CRM?

Yes, absolutely. Modern secure payment platforms are designed to play nicely with the tools you already use.

Through APIs, they can integrate seamlessly with all the major CRMs, contact centre software, and payment gateways. This means payment data flows exactly where it needs to, all without disrupting the established workflows your business depends on.

Ready to modernise how you handle over the phone card payments? Paytia provides a PCI DSS Level 1 certified platform to secure every transaction, slash your compliance scope, and build customer trust. Discover a smarter, safer way to get paid by visiting https://www.paytia.com.

Ready to Get Started?

Contact Paytia to learn how we can help secure your payment processing.